Medical Aesthetic Devices Market Size to Attain USD 43.23 Billion by 2032

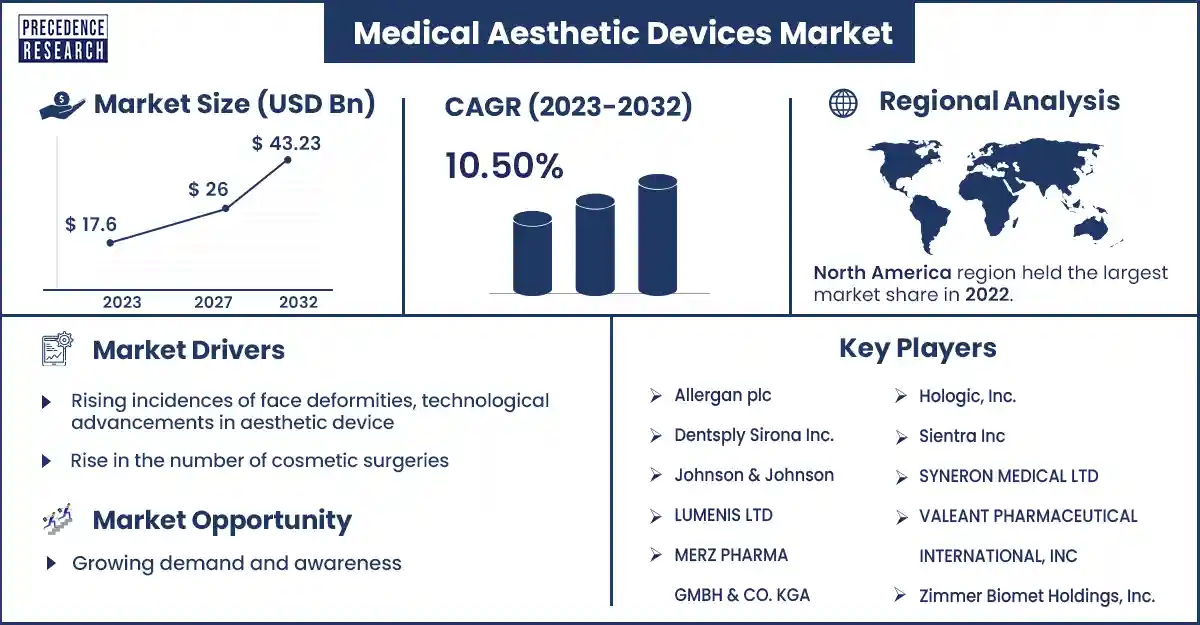

The global medical aesthetic devices market size surpassed USD 17.6 billion in 2023 and is estimated to attain around USD 43.23 billion by 2032, growing at a CAGR of 10.50% from 2023 to 2032.

Market Overview

In the medical aesthetic devices market, medical aesthetics devices serve both cosmetic and medical purposes. They enhance aesthetics, repair skin, manage pain, repair tissues, and achieve various other medical goals. The medical aesthetics devices sector encompasses a range of products, from medical instruments and supplies to implants, fillers, and injectables for aesthetic enhancement. It is an intersection of the cosmetic and pharmaceutical industries. Aesthetic Devices provides a detailed guide to different medical and specialized tools and equipment used for cosmetic and aesthetic treatments. These devices are used in non-invasive and minimally invasive techniques to improve a person's physical appearance, address cosmetic concerns, and enhance overall health.

Medical aesthetic devices can enhance physical and psychological health through various treatments and solutions catering to diverse individual preferences and needs. These devices influence the market and extend beyond the surface-level appearance, impacting many individuals' overall quality of life. Factors contributing to the growth of the medical aesthetic devices market include increased awareness of minimally invasive techniques, a growing number of older adults, and a surge in demand for cosmetic procedures.

Regional Snapshot

North America was the dominating region in the market in 2023. This was due to several factors, including a well-developed healthcare infrastructure, increasing healthcare costs, and a strong economy that allows a broader range of customers to access aesthetic devices and treatments. Additionally, a growing focus on physical appearance, anti-aging solutions, and wellness drove the demand for aesthetic procedures. Strict regulatory criteria and FDA support also helped to improve customer trust in the security of these devices. Furthermore, the culture of valuing beauty ideals and the presence of top aesthetic device manufactories in North America solidified the region's dominance in the medical aesthetic devices market.

Asia Pacific is currently the fastest-growing medical aesthetic device market. This can be attributed to several factors, including a rising demand for aesthetic procedures driven by the increasing disposable income of the expanding middle class. In addition, changing beauty standards and a solid cultural influence have also contributed to the adoption of aesthetic devices. The availability of cutting-edge technologies and a growing number of aesthetic clinics and practitioners, particularly in countries like India and South Korea, have also contributed to expanding the medical aesthetic devices market. The Asia-Pacific region's large and diverse population remains a lucrative aesthetic device and treatment market.

- For instance, China’s medical beauty market has emerged as a standout sector amid global economic challenges, exhibiting remarkable growth and resilience. Fueled by the capital influx and a well-defined value chain, the industry has become a focal point for consumption growth within the broader beauty and healthcare sectors, offering various opportunities for foreign businesses and investors.

Medical Aesthetic Devices Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 17.6 Billion |

| Projected Forecast Revenue by 2032 | USD 43.23 Billion |

| Growth Rate from 2023 to 20320 | CAGR of 10.50% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Transforming beauty standards

In the medical aesthetic devices market, the development of aesthetic devices is strongly influenced by the desire to change beauty standards. People are increasingly seeking aesthetic enhancements to conform to societal beauty standards. The influence of social media and celebrities often leads people to consider various cosmetic procedures to achieve present beauty standards. Beauty standards vary across cultures and regions, leading to the growth of specific aesthetic devices catering to these preferences.

Regulatory support

The market benefits from favorable regulatory environments that support the development and adoption of medical aesthetic devices. Policies encouraging non-surgical aesthetic treatments and approving new devices contribute to the market's growth. Additionally, the increasing recognition of the role of medical aesthetics in promoting overall health and well-being is likely to support the market.

Restraint

The insurance coverage is limited

The growth of the medical aesthetic devices market is hampered by limited insurance coverage. Many aesthetic treatments are elective and cosmetic, meaning health insurance plans don't cover them. People who want these treatments must pay for them without financial assistance. The high cost of these procedures can be a significant obstacle for people considering them. This economic barrier may discourage potential patients since the out-of-pocket expenses associated with aesthetic procedures can be costly. Limited insurance coverage creates a significant accessibility gap, especially for lower-income people. The absence of insurance coverage hinders the market's growth for aesthetic enhancements. It may also lead to unequal access to such procedures, which could marginalize a significant portion of the population. To overcome this issue, it is necessary to advocate for broader insurance coverage or establish alternative financing options that promote inclusivity and make it easier for people to access aesthetic treatments.

Opportunities

Growing demand and awareness

The medical aesthetic devices market is experiencing a surge in demand for medical aesthetic devices, driven by a growing awareness of the importance of aesthetic appearance and the benefits of aesthetic treatments. This increased awareness is reflected in the surge of awareness programs, such as breast reconstructive awareness campaigns to educate patients about various aesthetic options. The rising incidence of congenital face and tooth deformities, along with the increasing preference for minimally invasive and noninvasive reconstruction surgeries, are further fueling the market's growth.

Technological innovations

The medical aesthetic devices market is at the forefront of technological innovation, developing new devices and treatments that offer minimally invasive alternatives to traditional surgical procedures. This includes advancements in non-invasive treatments, such as laser and light therapies, microneedling, and dermal fillers, enhancing aesthetic procedures' effectiveness and safety. Introducing new technologies, such as injectable exosomes and intradermally delivered for collagen replacement therapy, presents significant opportunities for market growth and innovation.

Recent Developments

- In March 2024, L'Oréal Canada announced the launch of an American medical aesthetic brand named Skinbetter Science. The brand used a biotechnological approach for clinical validation and technological innovations to provide better efficacy and safety.

- In January 2024, RecensMedical, a medical device developer, said that it had signed a business agreement with LG Chem to market TargetCool, a rapid cooling medical device, in China.

- In January 2023. Apyx Medical Corp. follows in the footsteps of aesthetic drug makers Allergan/AbbVie, Evolus, and Revance as it launches a new, dedicated marketing campaign for its latest product, Renuvion.

Key Market Players

- Allergan plc

- Dentsply Sirona Inc.

- Johnson & Johnson

- LUMENIS LTD

- MERZ PHARMA GMBH & CO. KGAA

- Hologic, Inc.

- Sientra Inc

- SYNERON MEDICAL LTD

- VALEANT PHARMACEUTICAL INTERNATIONAL, INC

- Zimmer Biomet Holdings, Inc.

Market Segmentation

By Type

- Devices

- Energy-based Aesthetic Device

- Laser-based Aesthetic Device

- Radiofrequency (RF)-based Aesthetic Device

- Light-based Aesthetic Device

- Ultrasound Aesthetic Device

- Non-energy-based Aesthetic Device

- Botulinum Toxin

- Dermal Fillers and Aesthetic Threads

- Microdermabrasion

- Other

- Energy-based Aesthetic Device

- Aesthetic Implants

- Facial Implants

- Breast Implants

- Others

By Application

- Surgical

- Non Surgical

By End User

- Hospitals and Clinics

- Medical Spas and Beauty Centers

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1773

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308