Medical Cannabis Market 2025 Trends with Rising Adoption in Pain and Neurological Health Management

Medical Cannabis Market Size, Trends and Top Key Players

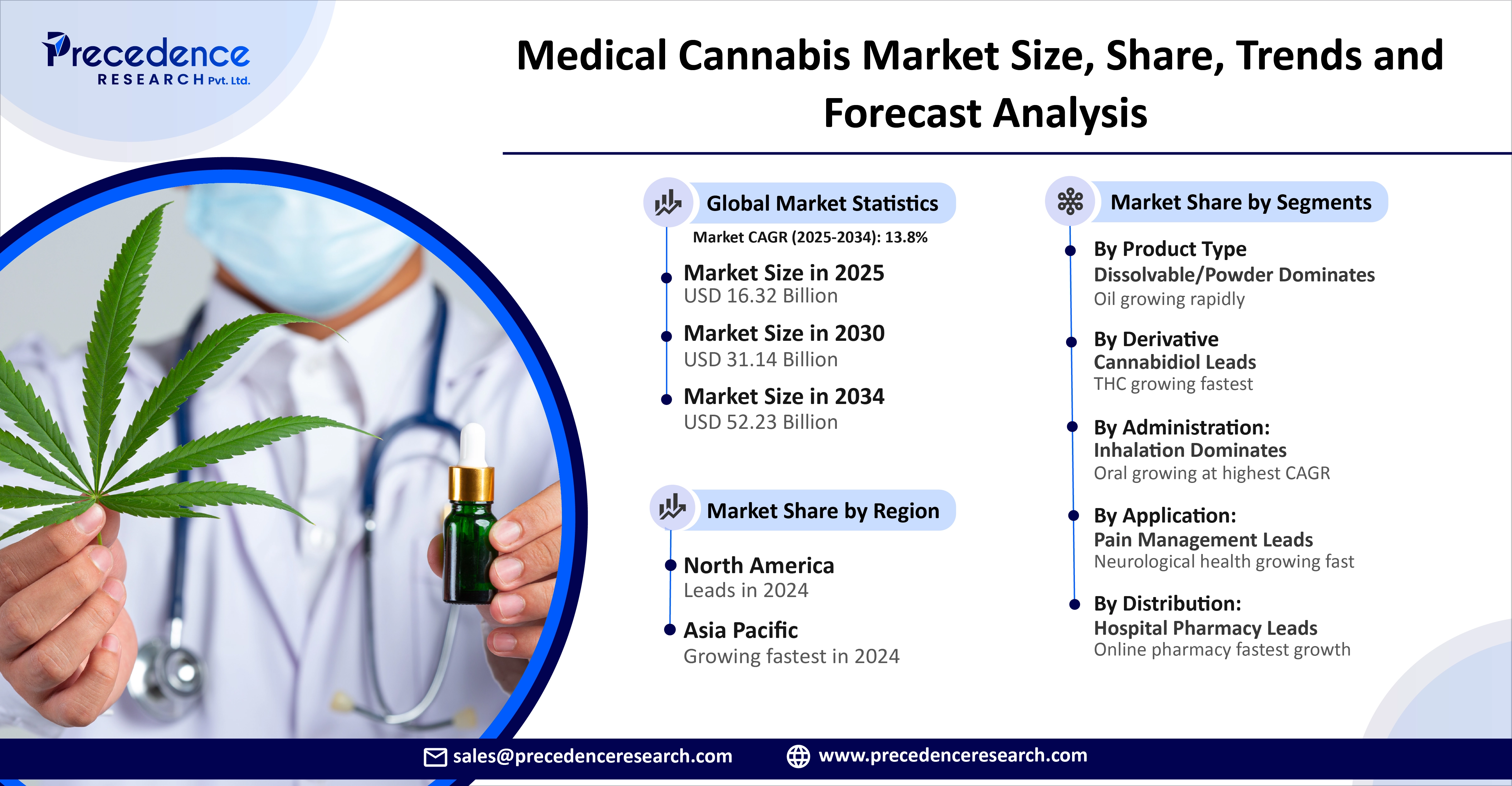

According to Towards Healthcare, the global medical cannabis market size was estimated at USD 14.34 billion in 2024 and is anticipated to reach around USD 52.23 billion by 2034, growing at a CAGR of 13.8% from 2025 to 2034. The rising need for medical cannabis is driven by the increased focus on chronic pain management and research on mental health and neurological conditions.

Global Outlook

The medical cannabis market deals with different forms of medicinal cannabis, such as pharmaceutical cannabis, controlled and standardized herbal cannabis, and unregulated and illegal herbal cannabis that can treat the symptoms of a medical condition called epilepsy. A wide range of products, including synthetic cannabinoids such as Dronabinol. Sativex and plant products produced in the USA and Netherlands drive the growth of medicinal cannabis.

One of the organizations, called the Therapeutic Goods Administration, introduced its TGA special access scheme for medical practitioners to easily access and prescribe cannabis-based medicines to patients in need under certain conditions. In August 2024, Ukraine officially announced the launch of its medical cannabis program, while in September 2024, Ukraine approved the new policy for qualifying medical cannabis. There will be strict regulations in European nations regarding the production, development, and distribution of medical cannabis therapies and products.

Market Opportunity

Cannabis is gaining traction for its medical benefits due to major research breakthroughs. Scientific advancements, public perceptions, and legal regulations have recognized cannabis as a safe medicine. These factors play an important role in impacting the future of medical cannabis use and patient acceptance. Researchers are exploring the numerous effects of medical cannabis on people with different health conditions such as brain aging, anxiety, chronic pain, menstrual pain, endometriosis, sleep, etc.

Key Growth Factors

In October 2024, University College London and Great Ormond Street Hospital planned to conduct the first double-blind randomized controlled trials to evaluate the combined use of tetrahydrocannabinol and cannabidiol in epilepsy in adults and children under the National Health Service.

The successful clinical trials and research findings allow the approvals for cannabis- associated chemical compounds by regulatory bodies that will expand access to cannabis-based treatments on the National Health Service.

Market Restraint

There are certain limitations associated with the safety and efficacy of medicinal cannabis based on clinical research studies. Publicly funded trials find logistical challenges, funding shortages, and regulatory hurdles for many researchers. Clinicians have certain limitations in prescribing cannabis-based medical products due to the emerging need for its evaluation as a medicine.

Segmental Outlook

By Product Type

The dissolvable/powder segment dominated the medical cannabis market in 2024 owing to the improved absorption and enhanced bioavailability of dissolvable or powder forms. These forms are easier to consume and exhibit properties like dosage flexibility, versatility, and convenience. There are fewer additives in these products, which also offer increased hydration to potential consumers.

The oil segment is expected to grow at the fastest CAGR in the market during the forecast period due to the importance of oil products as potential energy sources. The oil products offer various industrial applications in chemical industries or as lubricants. The other potential uses of oil are related to pharmaceuticals, cosmetics, agriculture, and household products.

By Derivative

The cannabidiol segment dominated the medical cannabis market in 2024 owing to the promising therapeutic applications of cannabidiol and its derivatives. It is widely applicable in treating neurological disorders, managing pain, mental health, and delivering anti-inflammatory and antioxidant effects. They hold improved potency and efficacy along with enhanced pharmacokinetic properties.

The tetrahydrocannabinol segment is expected to grow at the fastest CAGR in the market during the predicted timeframe due to FDA-approved uses of tetrahydrocannabinol and its derivatives in chemotherapy-induced nausea, vomiting, and appetite stimulation in AIDS-related anorexia. They are potentially beneficial in chronic pain relief and treatment of sleep disorders, anxiety, depression, etc. They are ideally used in treating neurological disorders, weight loss, multiple sclerosis, etc.

By Route of Administration Type

The inhalation segment dominated the medical cannabis market in 2024 owing to the targeted delivery and the rapid onset of action. The inhalation route of administration offers convenience and ease of use. They are potentially helpful for lower doses that can achieve the desired therapeutic effect than systemic administration.

The oral segment is expected to grow at the fastest CAGR in the market during the forecast period due to the cost-effectiveness of oral medications and variety of dosage forms. Oral medications offer sustained release formulations and reliable absorption. They avoid the use of any special medical equipment or medical monitoring.

By Application

The pain management segment dominated the medical cannabis market in 2024 owing to the advantages of medical cannabis in managing neuropathic pain, musculoskeletal pain, cancer pain, and other medical conditions. Medicinal cannabis plays a significant role in mood regulation, inflammation management, and pain regulation. Cannabis is also used for medical treatments of back pain, arthritis pain, and trauma-related pain.

The neurological health management segment is expected to grow at the fastest CAGR in the market during the predicted timeframe due to the medical benefits of cannabis in Parkinson's disease symptom relief and multiple sclerosis symptom management. Cannabis is also beneficial in seizure control, epilepsy, neuroprotection, and functional neurological disorder symptom relief. It is advantageous in pain management and treating conditions like migraines and fibromyalgia.

By Distribution Channel

The hospital pharmacy segment dominated the medical cannabis market in 2024 owing to the expanded treatment options for several medical conditions. The hospital pharmacy is rapidly growing due to the expertise of pharmacists, improved patient care, and cost-effective treatment options. Medical cannabis reduces the use of opioids in pain management and makes it a potential solution for opioid reduction.

The online pharmacy segment is expected to grow at the fastest CAGR in the market during the forecast period due to increased accessibility of online pharmacies and improved patient care in remote areas. The various factors like telemedicine consultation, patient portals, dosage tracking tools, etc. facilitate patient engagement and patient adherence. The online pharmacy platforms allow easy access to regulated products through e-commerce platforms.

Geographical Outlook

North America

North America dominated the medical cannabis market owing to regulatory advancements and the increased focus on patient access and safety. In June 2025, the National Conference of State Legislatures situated in Washington, D.C. introduced the state medical cannabis laws. Based on these laws, three territories, 40 states, and the District of Columbia allowed the medical use of cannabis products. Utah in the Western United States conducts new programs to increase access to medical cannabis to qualifying patients. Furthermore, the California Department of Fish and Wildlife launched the cannabis restoration grant program, which has also expanded new funding opportunities for research and innovation. In November 2024, the Cannabis Regulatory Agency situated in the state of Michigan, the U.S. announced applications for the social equity grant program for FY 2025, through which about 62 Michigan social equity licensees received over $16,000 each.

In May 2024, the U.S. Department of Justice reported the submission of a proposed regulation to reschedule cannabis or marijuana from a schedule I to schedule III drug under the Controlled Substances Act, recognizing its huge adoption for medical use and medical treatment in the U.S.

Canada

The Government of Canada and Health Canada play a significant role in the collection and publishing of data on cannabis for medical purposes under the Cannabis Tracking System Order, Cannabis Act, and the Cannabis Regulations. Veterans Affairs Canada developed a reimbursement policy on cannabis for medical purposes. The Government of Canada also contributes to making cannabis accessible for medical purposes. It presents the process for applying to be a licensed producer of cannabis through strict regulations and laws.

Asia Pacific

Asia Pacific is expected to emerge at the fastest CAGR in the medical cannabis market during the forecast period of 2025 to 2034, owing to significant government support and legalization of medical cannabis. The Central Drugs Standard Control Organization of India introduced a new process to apply to import products that have nonmedical and medical uses. In January 2025, Somai Pharmaceuticals made a partnership with Pacific Cannovation Company Limited to revolutionize Thailand into a global hub for high-quality medicinal cannabis. It also aims to transform medicinal cannabis in Asia and beyond. There is a strong presence of cannabis HealthTech companies in India, which includes key companies like BOHECO, BabyBerry, Health Horizons, CBD Store India, and ChloroHemp. About seven funded companies in the cannabis health tech sector in India have raised $16.4M in private equity and venture capital money.

Strategic Moves by Key Players

- In May 2025, Canopy Growth Corporation declared a series of product innovations, including high-demand products such as high-THC flower, vapes, edibles, and pre-rolls by targeting Canada’s rapidly-growing adult-use market.

- In August 2025, Green Thumb Industries reported its revenue of $293.3 million in the second quarter of 2025 which is based on U.S. generally accepted accounting principles.

Medical Cannabis Market Companies

- Canopy Growth Corporation

- Aurora Cannabis Inc.

- Tilray Brands

- Cronos Group Inc.

- Green Thumb Industries

- Trulieve Cannabis Corp.

- Innovative Ind Props

- Cresco Labs

- Glass House Brands

- Curaleaf Holdings

- Jazz Pharmaceuticals plc

- GW Pharmaceuticals plc

- OrganiGram Holding Inc.

- HEXO Corp.

- Medical Marijuana, Inc

- Verano Holdings Corp

- TerrAscend Corp.

Segments Covered in the Report

By Product Type

- Dissolvable/Powder

- Oil

- Solids

- Ointments & Creams

By Derivative

- Cannabidiol

- Tetrahydrocannabinol

By Route of Administration

- Inhalation

- Oral

- Topical

By Application

- Pain Management

- Neuropathic Pain

- Cancer

- Inflammatory Pain

- Neurological Health Management

- Mental Health Management

By Distribution Channel

- Hospital Pharmacy

- Online Pharmacy

- Retail Pharmacy

By Region

- North America

- U.S.

- Canada

- Mexico

- Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Source: https://www.towardshealthcare.com/insights/medical-cannabis-market-size