Microbiology Testing Market is Likely to Rise at 9.2% CAGR By 2032

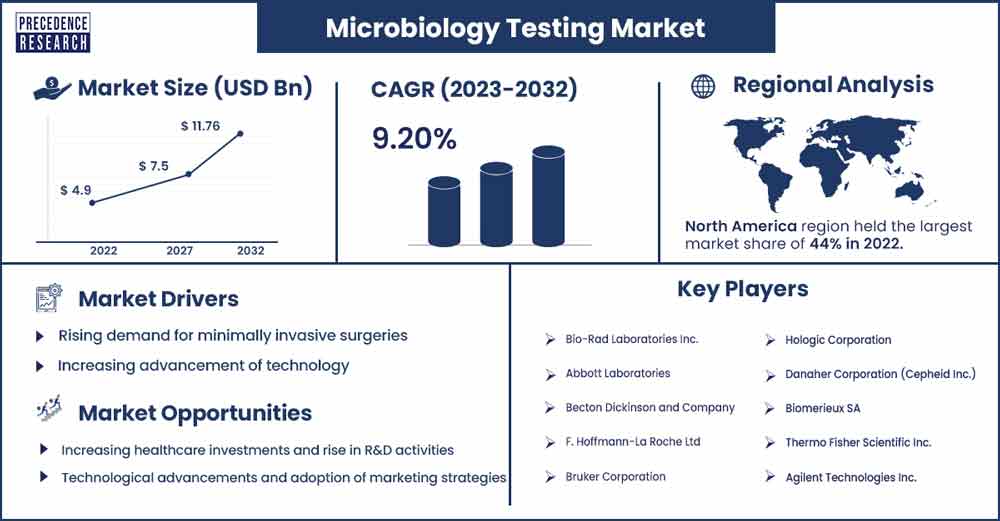

The global microbiology testing market size was exhibited at USD 5.33 billion in 2023 and is projected to attain around USD 11.76 billion by 2032, growing at a CAGR of 9.2% during the forecast period 2023 to 2032.

Market Overview

Microbiology testing plays a crucial role in public health, scientific research, and clinical diagnostics. This field highly focuses on the study of microorganisms such as viruses, algae, fungi, bacteria, and parasites, as well as their impact on the environment and human health. Microorganisms are ubiquitous in the environment, and they are employed in food production, such as cheese, beer, wine, bread, and other dairy products. At the same time, certain microorganisms are pathogens, including E. coli, Salmonella, Listeria, Norovirus, and Staphylococcus aureus, which can cause harm to the human body. Therefore, microbiology testing and microbial detection assist in ensuring quality control to provide product safety in the pharmaceutical manufacturing, food and beverage, and cosmetics sectors.

The cases of infection are increasing globally. The most common types of infections in the human body are blood infections, respiratory tract infections, digestive tract infections, hepatitis B infections, and skin infections. Microbiological testing helps to find the cause of the disease. Early detection and timely treatment using the right antibiotics are important steps to destroy the cause of the disease completely. The most common methods used for microbiology testing analysis include the spread plate method, pour plate method, multiple-tube fermentation (MPN) method, and membrane filtration method.

The microbiology testing market is driven by several factors, including technological advancements in microbiology testing, growing health concerns among individuals, increasing incidence of infection, growing healthcare expenditure, an increase in pharmaceutical production, growing demand for point-of-care testing, and rising investment in research and development activities. Additionally, the market is growing as a result of increasing global awareness of foodborne illnesses and robust demand for safe quality food items, which has increased the need for microbiology testing in the food and beverage industry.

- In November 2023, a specialist contract development and manufacturing organization, Symbiosis Pharmaceutical Services, launched their in-house analytical and microbiological capabilities to enable the testing of biological products, small molecules, and advanced therapeutic medicinal biopharmaceuticals following an investment of £1 million.

- In October 2023, Quotient Sciences announced the investment in the sterile fill-to-finish processes at its Alnwick facility in the U.K. The investment is expected to build on the current capacity of the Annex 1 compliant facility to meet the growing industry demand for fully integrated drug development programs.

- In October 2022, The PPD clinical research business of Thermo Fisher Scientific Inc. announced an investment plan worth USD 59 million to expand its laboratory operations in Highland Heights, Kentucky, United States, to assist customers in delivering life-changing medicines to patients. The facility is to grow from a 71,600-square-foot operation to 114,000 square feet, and it is estimated to be completed in stages by the end of 2024, which is likely to create 200 new jobs in the next five years.

- In November 2022, the U.S. and Canada-based life science business of Merck KGaA, MilliporeSigma, announced its investment of more than USD 286 million in its biosafety testing capabilities at the company's Rockville site in Maryland, USA. This will substantially expand the company's ability to conduct biosafety analysis and analytical development services.

- In July 2022, Merck announced the opening of its first microbiology application and training lab in the Jigani region of Bengaluru. An investment of €200,000 was poured into the MAT center, spanning over an area of 1,100 square feet. The services offered in the laboratory include rapid bioburden testing, advanced membrane filtration, pyrogen testing, sterility testing, and other pharma quality control microbiology applications.

Microbiology Testing Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 5.33 Billion |

| Projected Forecast Revenue by 2032 | USD 11.76 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 9.2% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Insights

North America is expected to dominate the market due to several factors. The region's growth is driven by the presence of advanced healthcare infrastructure, rising private and public funding for research on infectious diseases, implementation of stringent regulatory policies, strong emphasis on food safety, rising incidence of infectious diseases, and advancement in technology. Diseases such as respiratory diseases, bloodstream infections, sexually transmitted diseases, and urinary tract infections also fuel the market growth. A report published by the Centers for Disease Control and Prevention (CDC) showed that flu has resulted in 9.4 million to 41 million illnesses, 100,000 to 710,000 hospitalizations, and 4,900 to 52,000 deaths each year between 2010 and 2022.

The United States held the largest revenue share in the region due to the presence of key market players, an increasing number of pharmaceutical and biotechnology companies, innovation in testing technologies, an increasing number of aerobic and anaerobic tests, and sophisticated medical infrastructures, such as hospitals and clinical labs. Furthermore, the growing prevalence of diseases requiring these microbiological services drives the industry. According to the data published by the Centers for Disease Control and Prevention in June 2022, it is estimated that in the last five years, nearly 14,000 to 25,000 cases of invasive group A strep disease occurred annually in the US. For instance, Gonorrhea is the second most commonly reported bacterial sexually transmitted infection in the US. A significant rise in the presence of prominent market players in the Canadian market is likely to influence the market's growth positively.

- In March 2022, Bureau Veritas, a global leader in testing, inspection, and certification services, announced the opening of its fifth Canadian Microbiology Laboratory located in Winnipeg, Manitoba. The new facility will deliver rapid Pathogen testing and Indicators. The expansion of its food testing and certification business in Canada also enhances Bureau Veritas' market-leading food safety and quality laboratory testing capabilities across the North American region.

Market Dynamics

Drivers

Increasing cases of foodborne diseases

The robust growth in the cases of foodborne illnesses is anticipated to boost the growth of the microbiology testing market. It is estimated that around 48 million people get sick from a foodborne- illness, with nearly 128,000 hospitalizations and 3,000 deaths each year in the United States, according to the Centers for Disease Control and Prevention (CDC). In addition, implementing stringent food safety standards, increasing consumer awareness about food safety among individuals, and growing consumer demand for packaged food products are all expected to drive market expansion in the coming years.

Rising prevalence of sexually transmitted diseases

Several sexually transmitted infections, including human immunodeficiency virus (HIV), human papillomavirus (HPV), HBV, and HCV, are rising rapidly, which increases the demand for microbiology testing. For instance, according to an article published by the World Health Organization in July 2023, it is estimated more than 1 million sexually transmitted infections are acquired every day globally, and most of the cases are asymptomatic. There are an estimated that every year 374 million new infections with 1 of 4 curable sexually transmitted infections (STIs) such as chlamydia, trichomoniasis, syphilis, and gonorrhea. Therefore, increasing cases of STI augment the growth of the microbiology testing market during the forecast period.

Restraints

Rising issues laboratory reimbursement

The microbiology testing market's expansion is anticipated to be constrained by laboratory reimbursement issues. The reimbursement for microbiology testing is kind of a complex process. Several undeveloped and developing countries lack standardized reimbursement policies, which is anticipated to hamper the market expansion during the forecast period.

High cost

The high cost of microbiology instruments is expected to hamper the market growth over the forecast period. The high initial and maintenance cost of microbiology instruments may result in less adoption in lower and middle-income countries. Thus, it may impede market growth in the coming years.

Opportunities

Increasing healthcare investments and rise in R&D activities

The rapid rise in healthcare investments coupled with the rise in R&D activities are the leading drivers to fight against infectious diseases and live a healthy life and are projected to offer a lucrative opportunity for market growth during the forecast period. For instance, according to the data by the NIH in January 2023, from 2008 to 2022, the National Institute of Health (NIH) supported funding of 4.5 billion USD to tackle AMR. Such increasing investment in research by the government is boosting the expansion of the microbiology testing market.

Technological advancements and adoption of marketing strategies

The market is witnessing significant advancements in microbiology testing due to the adoption of advanced technology for various diagnostic purposes. In addition, the key market players are adopting various strategies such as product launches, acquisitions, and collaborations to gain competitive advantages, which are projected to create significant growth opportunities for the market during the forecast period.

- In August 2022, IDEXX Laboratories announced the acquisition of the water testing company TECTA-PDS. TECTA-PDS is a company specializing in portable instruments that automatically test for microorganisms like coliforms, Escherichia coli, and Enterococci. The TECTA B16 and B4 instruments provide rapid results to laboratories. The acquisition is expected to help IDEXX in expanding its microbiology testing options for lab-based and in-field testing.

- In April 2023, two firms bioMérieux and JMI Laboratories announced six partnerships to undertake collaborative projects evaluating the performance and increasing potential of rapid and innovative microbiology diagnostics as important tools in the battle against AMR.

Recent Developments

- In June 2022, STEMart, a provider of integrated medical device contract research organization, launched microbiology and sterility testing for sterile and non-pyrogenic medical devices. The company has expertise in microbiology and sterility testing and a dedicated workforce that supports manufacturers in meeting regulatory goals and reduces compliance risk.

- In November 2022, ADM announced the opening of its new North America Microbiology Laboratory at the ADM Specialty Manufacturing Facility in Decatur, Illinois. The new facility is anticipated to double ADM's current microbiology laboratory footprint and enhance the expansion of its testing capabilities in the Decatur community.

Key Market Players

- Bio-Rad Laboratories Inc.

- Abbott Laboratories

- Becton Dickinson and Company

- F. Hoffmann-La Roche Ltd

- Bruker Corporation

- Hologic Corporation

- Danaher Corporation (Cepheid Inc.)

- Biomerieux SA

- Thermo Fisher Scientific Inc.

- Agilent Technologies Inc.

- Merck KGaA

- Shimadzu Corporation

- NEOGEN Corporation

Market Segmentation

By Product

- Instruments

- Reagents

By Test Type

- Bacterial

- Viral

- Fungal

By Application

- Respiratory Diseases

- Bloodstream Infection

- Gastrointestinal Diseases

- Sexually Transmitted Diseases

- Urinary Tract Infections

- Periodontal Diseases

- Others

By End User

- Hospitals

- Diagnostic Centers

- Academic and Research Institutes

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3406

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308