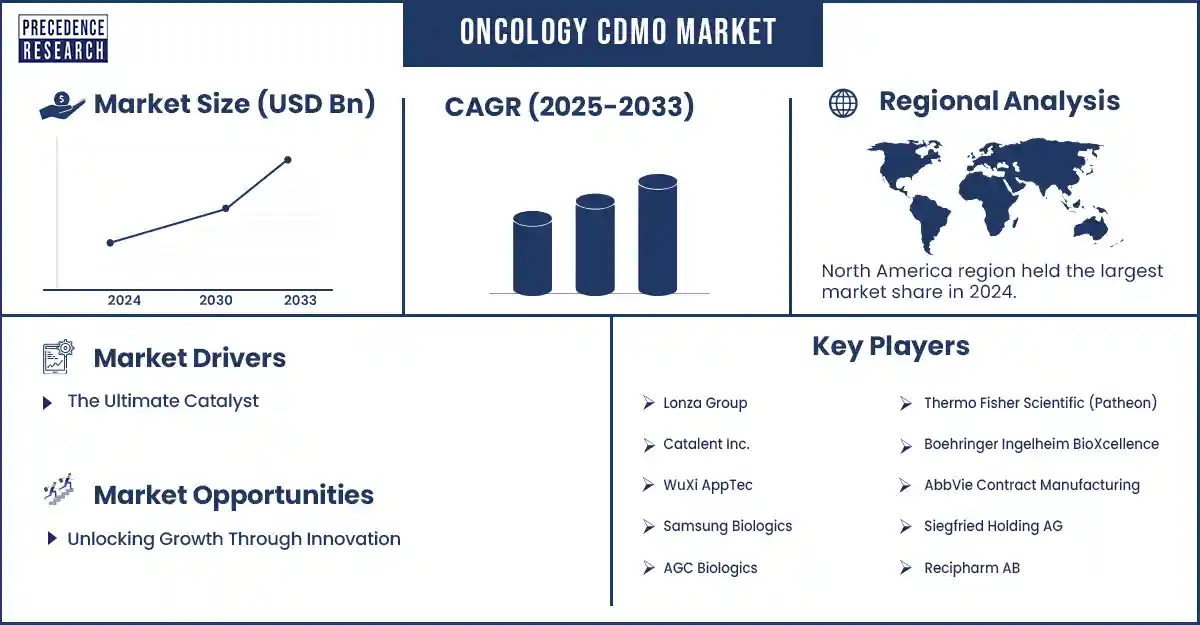

Oncology CDMO Market Revenue and Forecast by 2033

Oncology CDMO Market Revenue and Trends 2025 to 2033

The oncology CDMO market growth is driven by the surging global cancer burden, increasing demand for advanced biologics and personalized therapies, and growing reliance on specialized outsourcing for cost-efficient, scalable manufacturing.

What are the Key Factors Boosting the Growth of the Oncology CDMO Market?

The market is experiencing rapid growth due to several reasons. Firstly, the global increase in cancer cases is propelling the demand for next-generation therapies, including biologics, cell and gene therapies, and traditional APIs. Secondly, pharmaceutical companies are increasingly outsourcing drug manufacturing and testing activities to CDMOs to cut costs, accelerate time-to-market, and leverage specialized expertise. Thirdly, the trend toward personalized and targeted cancer treatments necessitates flexible, scalable manufacturing solutions, supporting market expansion. Finally, the willingness of regulatory agencies to collaborate with CDMOs on accelerated approvals for breakthrough therapies further enhances their importance.

Ongoing technological advancements and innovations, such as continuous manufacturing and AI-driven process optimization, will continue to propel the CDMO landscape, making partnerships essential for the future of oncology drug discovery and development. Moreover, rising demand for personalized medicine and expansion into emerging markets are creating immense opportunities in the market.

Segment Insights:

- By service type, the drug product manufacturing segment dominated the market in 2024. This is due to the rising global demand for innovative drug product formulations, injectable oncology therapies, and specialized capabilities to ensure quality and scalability in drug product manufacturing.

- By drug type, the monoclonal antibodies segment led the market while holding a significant share in 2024 due to their effectiveness in targeted cancer therapies, increasing approvals, and the rising demand for specialized, large-scale manufacturing of these biologics.

- By phase, the clinical (Phase I, II, III) segment dominated the oncology CDMO market in 2024, as pharmaceutical and biotech companies increasingly outsourced clinical-stage development to CDMOs to reduce costs, accelerate timelines, and access specialized expertise in oncology. The increasing demand for oncology trials necessitates specialized development, flexible capacity, and accelerated pathways for innovative therapies, supporting segmental growth.

- By end-user, the large pharmaceutical companies segment held the largest market share in 2024. This is due to their robust R&D pipelines and strategic outsourcing models. These companies often collaborate with CDMOs to develop and accelerate their oncology drug pipelines and enhance manufacturing efficiency.

- By oncology therapy area type, the solid tumor biologics segment captured the largest share of the market in 2024, driven by the high global prevalence of solid tumors and the increasing shift toward biologic-based treatments, along with the increasing trend of utilizing CDMOs for advanced biologics manufacturing.

Oncology CDMO Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD billion/trillion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Insights:

North America registered dominance in the oncology CDMO market by capturing the largest share in 2024. The region's dominance is attributed to its high cancer rates, robust healthcare infrastructure, and presence of leading pharmaceutical and biotech companies. The region benefits from a well-defined regulatory framework, rapid adoption of advanced manufacturing technologies, and growing investment in biologics and personalized cancer therapies. The increasing number of oncology clinical trials, along with strategic partnerships between pharmaceutical companies and CDMOs, further bolsters the market in the region.

Asia Pacific is expected to grow at the fastest rate during the forecast period due to rising cancer prevalence, increased healthcare spending, and the expansion of the pharmaceutical sector. Outsourcing cancer drug development to countries like China, India, and South Korea is gaining traction, driven by cost benefits, the availability of skilled talent, and government support for biotech. The growing adoption and production of biologics and cell & gene therapies are further likely to support regional market growth.

Recent Development:

- In March 2025, Shilpa Medicare launched a full-service hybrid CDMO focused on oncology, serving both small and large molecule clients, including peptides. The model combines end-to-end discovery, clinical, and commercial services with ready-to-license, off-the-shelf novel formulations. This dual approach allows pharma companies to access Shilpa’s oncology expertise while minimizing development risks and timelines.

( Source: https://www.contractpharma.com)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6681

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344