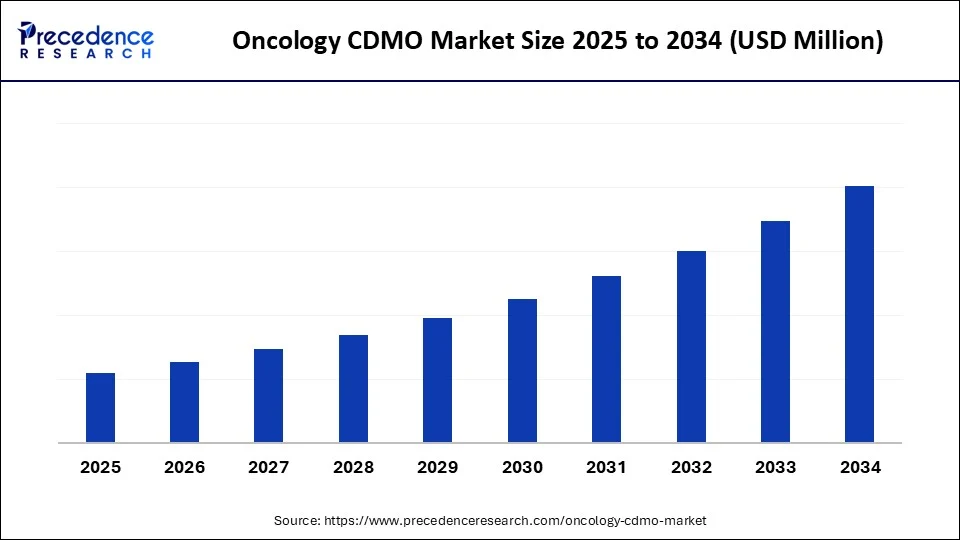

The oncology CDMO market is expanding rapidly, fueled by rising cancer prevalence, growing demand for advanced therapies like ADCs and cell & gene therapies, and the increasing need for specialized outsourcing services. The oncology market is witnessing growth due to increasing awareness and quick diagnosis of cancer, which is enabling patients to treat themselves early.

Key Market Takeaways

- North America dominated the oncology CDMO market in 2024.

- Asia Pacific is anticipated to grow at the fastest CAGR during the forecast period.

- By service type, the drug product manufacturing segment held the largest market share in 2024.

- By service type, the cell & gene therapy CDMO services segment is expected to grow at the fastest CAGR during the forecast period.

- By drug type, the monoclonal antibodies segment accounted for a considerable share in 2024.

- By drug type, the antibody-drug conjugates (ADCs) segment is projected to experience the highest growth CAGR between 2025 and 2034.

- By phrase, the clinical (phase I, II, III) segment captured the biggest market share in 2024.

- By phase, the commercial segment is expected to experience the fastest market growth CAGR from 2025 to 2034.

- By end-user type, the large pharmaceutical companies segment contributed highest market share in 2024.

- By end-user type, the biotechnology companies' segment is projected to expand rapidly in the coming years.

- By oncology therapy area type, the solid tumor biologics segment maintained a leading position in 2024.

- By oncology therapy area type, the hematologic malignancies (CAR-T, cell therapies) and targeted ADCs segment is projected to expand rapidly in the coming years.

Market Overview

The oncology CDMO market comprises companies that provide outsourcing services for the development, manufacturing, and packaging of oncology drugs. These services span preclinical development, clinical trial material production, commercial-scale manufacturing, formulation development, analytical testing, regulatory support, and packaging. The oncology segment is highly specialized due to the complexity of cancer drugs, including small molecules, biologics, antibody-drug conjugates, cell & gene therapies, and highly potent APIs (HPAPIs). CDMOs enable pharmaceutical and biotech companies to accelerate time-to-market, ensure regulatory compliance, and reduce infrastructure investment risks.

The oncology CDMO (Contract Development and Manufacturing Organization) market is experiencing robust growth, driven by surging demand for cancer therapies and the rise of innovative treatment modalities, including antibody drug conjugates, immunotherapies, and cell therapies. Increasing complexities in oncology drug development have made outsourcing to CDMOs both a strategic and economic necessity. Pharmaceutical firms are relying on CDMOs for scalable solutions, ranging from preclinical research and development to commercial manufacturing. Stringent regulatory frameworks further elevate the importance of CDMOs, as they offer compliance expertise that mitigates risks. The industry is also seeing consolidation, with CDMOs expanding global footprints to serve diverse markets. Overall, the oncology CDMO market is poised to catalyze faster, safer, and more cost-effective cancer drug development.

How Is AI Transforming the Oncology CDMO Market?

Artificial Intelligence (AI) is redefining how oncology CDMOs approach drug development and manufacturing. AI-powered algorithms are being leveraged to analyze vast datasets from genomics, clinical trials, and patient outcomes, enabling faster identification of drug targets. Machine learning models are helping to optimize formulations, predict toxicity, and enhance clinical trial designs. In manufacturing, AI-driven predictive maintenance and process optimization improve efficiency and reduce downtime. Moreover, AI is enabling CDMOs to forecast supply chain needs and manage regulatory submissions with greater accuracy. By merging AI with traditional drug development workflows, oncology CDMOs are achieving unprecedented speed, precision, and scalability, ultimately accelerating the journey of life-saving cancer therapies from lab to patient.

Market Key Trends

- Rising demand for personalized oncology drugs and precision medicine.

- Increasing adoption of advanced therapies like cell and gene therapies.

- Growth of antibody drug conjugates as a leading oncology segment.

- Strategic mergers and acquisitions to expand global reach.

- Investment in flexible manufacturing and modular facilities.

- Expansion of AI and digitalization in oncology drug pipelines.

Market Scope

| Report Coverage | Details |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service Type, Drug Type, Phase, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

The Ultimate Catalyst

The escalating prevalence of cancer worldwide serves as the primary driver for the oncology CDMO market. With millions of new cases reported annually, there is an urgent need for effective and innovative therapies. Pharmaceutical companies are under immense pressure to deliver breakthrough treatments quickly, and CDMOs provide the infrastructure and expertise to meet these demands. The increasing shift toward biologics and targeted therapies amplifies the need for specialized CDMO capabilities. Furthermore, regulatory bodies encourage collaboration with CDMOs that maintain stringent quality standards. Ultimately, the growing global cancer burden continues to fuel investment, innovation, and expansion in the oncology CDMO sector.

Restraint

Regulatory Complexity and Cost Challenges

Despite strong growth potential, the oncology CDMO market faces hurdles that can impede progress. Navigating stringent regulatory frameworks across multiple regions is a complex and resource-intensive process. The high cost of oncology drug development and manufacturing infrastructure poses another barrier, especially for smaller biotech firms. Supply chain vulnerabilities, particularly for critical raw materials, can disrupt production timelines. Additionally, ensuring the safe handling of highly potent oncology compounds requires sophisticated containment facilities and skilled personnel, which in turn raises operational costs. These challenges, though significant, drive CDMOs to innovate and differentiate themselves with compliance excellence and cost optimization strategies.

Opportunity

Unlocking Growth Through Innovation

Opportunities in the oncology CDMO market lie in the expanding pipeline of next-generation therapeutics. Breakthroughs in immuno-oncology, gene editing, and personalized medicine are creating significant opportunities for outsourcing. The demand for flexible, small-batch manufacturing of personalized treatments opens new avenues for specialized CDMOs. Emerging markets also offer untapped potential, with increasing healthcare investments and a rising incidence of cancer. The surge in oncology clinical trials further amplifies the need for CDMOs with integrated research and development services. By embracing digitalization and establishing advanced manufacturing hubs, CDMOs can capitalize on significant opportunities to reshape oncology care.

Regional Insights

Why is North America Leading the Oncology CDMO Market?

North America dominated the global oncology CDMO market in 2024, fuelled by its advanced healthcare infrastructure, robust research and development ecosystem, and presence of leading pharmaceutical companies. The U.S. serves as the hub for oncology innovation, with a high concentration of clinical trials and research collaborations. Strong regulatory oversight by the FDA ensures quality and accelerates adoption of CDMO partnerships. Investment in biologics, immunotherapies, and targeted therapies continues to surge in the region, providing CDMOs with a steady flow of opportunities. Moreover, the integration of digital tools and AI-driven drug development positions North America at the forefront of oncology outsourcing.

How Is Asia Pacific Emerging As The Fastest-Growing Oncology CDMO Market?

Asia Pacific is the fastest-growing region in the oncology CDMO sector, driven by rising cancer prevalence and expanding access to healthcare. Countries like China, India, and South Korea are investing heavily in pharmaceutical infrastructure and clinical research. Cost-efficient manufacturing capabilities combined with a large patient population make the region attractive for outsourcing. Government initiatives supporting biotech innovation and international collaborations are further propelling growth. CDMOs in the Asia-Pacific are increasingly focusing on oncology biologics and biosimilars, tapping into global demand. With its combination of affordability, expertise, and growing capacity, the Asia-Pacific region is poised to become a major force in the global oncology CDMO landscape.

Service Type Insights

Why Did Drug Product Manufacturing Dominate the Global Oncology CDMO Market in 2024?

Drug product manufacturing has become a dominant force in the oncology CDMO sector, providing the critical link between drug discovery and patient delivery. These services encompass formulation development, sterile fill-finish operations, packaging, and quality assurance, all of which are indispensable for oncology therapeutics. With cancer drugs requiring precise dosing, sterile environments, and stringent regulatory adherence, pharmaceutical companies heavily rely on CDMOs with proven track records in product manufacturing. The rising demand for parenteral oncology drugs, particularly injectables, further underscores the importance of this segment. The need for scalability, from clinical batches to commercial supply, ensures its enduring dominance. Ultimately, drug product manufacturing forms the cornerstone of oncology CDMO services by bridging innovation with patient care

Drug product manufacturing also plays a pivotal role in accelerating market access for new therapies. Oncology developers, facing time-sensitive demands, benefit from CDMOs' ability to rapidly scale production while ensuring global compliance. Advanced manufacturing capabilities, such as isolator-based fill-finish and lyophilization, strengthen their dominance in this sector. As personalized and precision oncology therapies expand, the need for specialized manufacturing only intensifies. Additionally, with increasing regulatory oversight on sterility and quality, CDMOs that excel in this space gain a significant competitive advantage. This dominance is likely to persist, as drug product manufacturing remains the most sought-after service within the oncology outsourcing sector.

The cell & gene therapy CDMO services are the fastest-growing segment in the oncology CDMO market, because of the revolutionary shift toward personalized and curative treatments. These services encompass vector production, cell processing, gene editing, and specialized analytics, all of which require advanced infrastructure and expertise. With oncology being the leading therapeutic area for cell and gene therapies, CDMOs are experiencing surging demand to support early-stage clinical trials and eventual commercialization. Their ability to provide end-to-end solutions, from plasmid production to GMP-compliant viral vector manufacturing, makes them indispensable in this rapidly advancing sector. The promise of long-term remission and potential cures in oncology underpins their exponential growth trajectory.

Moreover, the complexity and cost of establishing in-house capabilities push pharmaceutical and biotech companies to partner with CDMOs specializing in cell and gene therapies. These organizations provide the expertise, regulatory knowledge, and scalable facilities needed to navigate this intricate therapeutic space. The growth is further reinforced by global approvals of CAR-T therapies and the expansion of novel gene-modified approaches targeting cancers. Unlike traditional manufacturing, this segment requires highly personalized processes, aligning with the broader trend of precision medicine. As such, cell and gene therapy CDMO services are evolving into the most dynamic and transformative segment of the oncology CDMO market.

Drug Type Insights

Why Did Monoclonal Antibodies Account for the Largest Share in the Global Oncology CDMO Market?

The monoclonal antibodies segment accounted for a considerable share of the market in 2024, followed by small molecules, recombinant proteins, and other biologics engineered to modulate disease at the molecular level. With oncology research deeply rooted in molecular pathways, these therapies remain the largest contributor to outsourced CDMO services. The breadth of applications across solid tumors, hematologic cancers, and rare oncology indications reinforces their prominence. CDMOs specializing in molecular biology provide not only production capabilities but also analytical support for characterization, stability, and quality control. This dominance highlights the central role of molecular biology in shaping the oncology drug landscape.

The reliance on molecular biology is further strengthened by its versatility in drug discovery and clinical translation. Advances in bioinformatics and high-throughput screening have enabled the design of highly specific molecules with fewer off-target effects. Oncology CDMOs continue to expand infrastructure to support these drugs, offering integrated solutions from synthesis to clinical supply. Moreover, molecular biology therapeutics often demand sophisticated delivery systems, an area where CDMOs provide critical expertise. Given their wide applicability and established regulatory pathways, these therapies maintain a dominant presence in the oncology outsourcing market. Their continued success lies in their ability to balance innovation with scalable production.

The antibody-drug conjugates are the fastest-growing in the oncology CDMO sector, owing to their unique ability to combine targeted therapy with potent cytotoxic agents. Antibody-drug conjugates deliver precise treatment by binding selectively to cancer cells while sparing healthy tissue, significantly improving therapeutic outcomes. The growing number of ADCs in clinical pipelines reflects the immense investment and confidence in this modality. CDMOs are experiencing a surge in demand for specialized services, including conjugation chemistry, bioconjugation analytics, and high-containment manufacturing. Their role is indispensable, given the intricate processes and stringent safety measures required for the development of antibody-drug conjugates.

Recent regulatory approvals and the robust oncology pipeline of ADC candidates also fuel this segment's rapid growth. Biopharma companies increasingly turn to CDMOs with expertise in complex biologics to ensure timely clinical and commercial supply. The manufacturing of antibody-drug conjugates requires not only biologic and chemical expertise but also containment infrastructure to handle highly potent APIs. This dual requirement creates a unique niche for specialized CDMOs. With advancements in linker technologies and payload innovation, ADCs are poised to revolutionize oncology therapeutics, cementing their status as the fastest-expanding drug class in this space.

Phase Insights

Why the Clinical (Phase I, II, III) Led the Global Oncology CDMO Market in 2024?

The clinical (phase I, II, III) led the oncology CDMO sector industry in 2024. CDMOs play a vital role in this phase, providing flexible and small-batch manufacturing capabilities, as well as regulatory support. Given the complexity of oncology trials, which often involve adaptive designs and biomarker-driven approaches, outsourcing ensures both agility and cost efficiency. The ability to scale production across multiple trial phases while maintaining quality and compliance gives CDMOs a significant advantage. This dominance reflects the high volume of oncology drugs progressing through clinical pipelines worldwide.

The commercial sector is expected to grow at the fastest rate in the oncology CDMO sector, driven by the increasing approval of novel oncology drugs. Once clinical success is achieved, pharmaceutical companies rely on CDMOs for large-scale, GMP-compliant production to meet global market demand. This phase demands advanced infrastructure, capacity expansion, and supply chain excellence, areas where specialized CDMOs excel. The shift toward personalized oncology therapies adds another layer of complexity, requiring tailored commercial manufacturing solutions. As the number of approved oncology drugs rises, the demand for commercial outsourcing grows exponentially.

Additionally, CDMOs supporting commercial supply gain long-term partnerships with sponsors, ensuring sustained revenue growth. Regulatory scrutiny is particularly stringent at this stage, which increases the reliance on CDMOs with proven compliance records and global certifications. With the oncology market expanding rapidly, CDMOs that successfully transition products from clinical to commercial scale establish themselves as essential strategic partners. The focus on speed-to-market and reliable global distribution makes this the fastest-accelerating phase in the oncology outsourcing ecosystem.

End User Insights

Why Do Large Pharmaceutical Companies Maintain the Top Position in the Global Oncology CDMO Market?

The large pharmaceutical companies maintained a leading position in the oncology CDMO sector industry, due to their expansive pipelines, financial resources, and global reach. These organizations often outsource manufacturing to streamline operations and focus on research and innovation. The need for scalability, cost-efficiency, and adherence to stringent regulatory standards drives their reliance on CDMOs. Oncology drugs, particularly biologics, demand sophisticated infrastructure, which CDMOs are well-positioned to provide. Consequently, large pharmaceutical companies remain the primary drivers of outsourcing in this sector.

The biotechnology companies segment is the fastest-growing in the oncology CDMO sector, driven by their innovation-driven pipelines and focus on next-generation therapies. Many biotech's lack in-house infrastructure, making outsourcing a necessity for development and manufacturing. Their heavy involvement in cutting-edge oncology modalities such as cell and gene therapies, ADCs, and RNA-based treatments drives significant demand for CDMO expertise. Biotechs rely on CDMOs not only for production but also for regulatory navigation and technical know-how. This strong dependency fuels the rapid expansion of biotech-driven outsourcing.

Oncology Therapy Area Insights

Why Did Solid Tumor Biologics Capture So Much of the Oncology CDMO Market?

The solid tumor biologics segment captured a significant portion of the market in 2024, due to the prevalence of solid cancers such as breast, lung, and colorectal cancers. These biologics, including monoclonal antibodies, checkpoint inhibitors, and targeted therapies, represent the majority of clinical and commercial pipelines. Their dominance stems from their proven efficacy and broad applicability across high-burden cancers. CDMOs supporting this segment offer specialized biologics manufacturing, analytical development, and regulatory compliance services. The scale and consistency required for solid tumor therapies ensure their central role in oncology outsourcing.

Hematologic malignancies and targeted ADCs are the fastest-growing segments in the oncology CDMO sector. This rapid growth is fueled by breakthroughs in cell and gene therapies, CAR-T treatments, and antibody-based modalities specifically designed for blood cancers. These therapies offer transformative potential, driving significant demand for specialized CDMO services. The complexity of producing autologous and allogeneic cell therapies highlights the essential role of outsourcing partners.

Recent Developments

- In August 2025, Nucleus RadioPharma, a radiopharmaceutical-focused contract development and manufacturing organization established by Eclipse and the Mayo Clinic, appointed Dr. Stephen Hahn, former FDA commissioner under the first trump administration, as its new chief executive officer.(source: https://pharmaphorum.com/)

- In June 2025, Mabion, a Poland-based CDMO, launched a €500,000 oncology services contest at the BIO International Convention aimed at accelerating the development of recombinant protein-based cancer therapies. The contest will see its final leg at the CPHI Worldwide in Frankfurt during October 2025. CPHI aims to spotlight upcoming biotechs ready to scale their innovation. The initiative provides a simplified entry process via QR code at Mabion's booth and on a dedicated landing page. Selected entrants will be guided through pre-qualification, NDAs, and proposal shaping with Mabion's business development team. (Source:https://www.genengnews.com)

Oncology CDMO Market Companies

- Lonza Group

- Catalent Inc.

- WuXi AppTec

- Samsung Biologics

- Fujifilm Diosynth Biotechnologies

- Thermo Fisher Scientific (Patheon)

- Boehringer Ingelheim BioXcellence

- AbbVie Contract Manufacturing

- Siegfried Holding AG

- Recipharm AB

- AGC Biologics

- Jubilant Biosys Ltd

- Asymchem Laboratories

- Samsung Biopis

- Piramal Pharma Solutions

Segments Covered in the Report

By Service Type

- Process Development & Optimization

- Active Pharmaceutical Ingredient (API) Manufacturing

- Drug Product Manufacturing (Formulation & Fill-Finish)

- Analytical & Quality Testing

- Packaging & Labeling

- Regulatory & Compliance Support

- Cell & Gene Therapy CDMO Services

By Drug Type

- Small Molecules

- Biologics

- Monoclonal Antibodies

- Antibody-Drug Conjugates (ADCs)

- Cell & Gene Therapies

- Vaccines

By Phase

- Preclinical

- Clinical (Phase I, II, III)

- Commercial

By End User

- Large Pharmaceutical Companies

- Biotechnology Companies

- Research Institutes

By The Oncology Therapy Area

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Prostate Cancer

- Leukemia & Lymphoma

- Solid Tumor Biologics

- Hematologic Malignancies (Car-T, Cell Therapies) And Targeted ADCs.

Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting