Complex Rehab Technology Market Size and Forecast 2025 to 2034

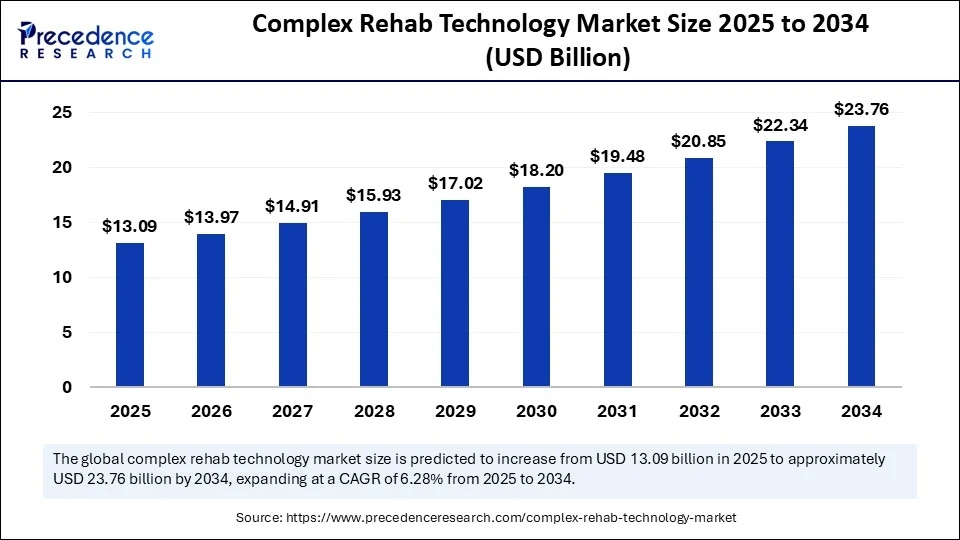

The global complex rehab technology market size accounted for USD 12.28 billion in 2024 and is predicted to increase from USD 13.09 billion in 2025 to approximately USD 23.76 billion by 2034, expanding at a CAGR of 6.82% from 2025 to 2034. The complex rehab technology market is growing rapidly due to the increasing need for customized mobility and assistive solutions for individuals with complex medical needs.

Complex Rehab Technology Market Key Takeaways

- In terms of revenue, the global fluoroalkyl-based coatings market was valued at USD 12.28 billion in 2024.

- It is projected to reach USD 23.76 billion by 2034.

- The market is expected to grow at a CAGR of 6.82% from 2025 to 2034.

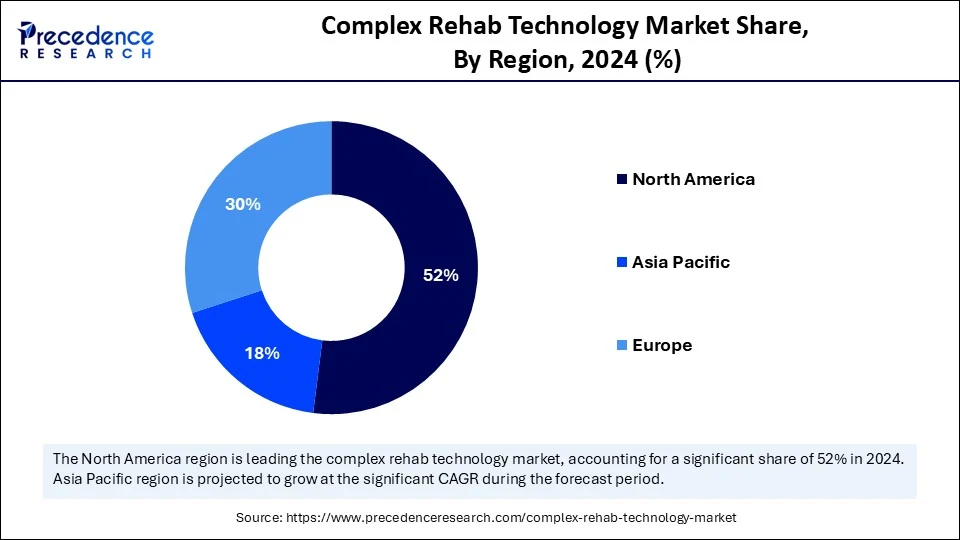

- North America accounted for the largest market share of 52% in 2024.

- Asia Pacific is expected to grow at a solid CAGR of 9.28% 2025 and 2034.

- By product type, the seating and positioning systems segment led the market while holding a major share in 2024.

- By product type, the environmental control devices segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By application, the neurological conditions segment led the market while holding he largest share in 2024.

- By application insight, the musculoskeletal conditions segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By age group, the geriatric segment led the market in 2024.

- By age group, the pediatric segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By end-user, the hospitals & clinics segment led the market while holding a major share in 2024.

- By end-user, the sports and fitness centers segment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By distribution channel, the direct sales segment led the market in 2024.

- By distribution channel, the online retailers segment is expected to grow at a remarkable CAGR between 2025 and 2034.

How is AI Revolutionizing the Complex Rehab Technology Market?

Artificial intelligence is revolutionizing the market for complex rehab technology by enabling smarter, adaptive, and highly personalized assistive devices. AI-driven wheelchairs can now learn user behaviors, navigate complex environments, and adjust controls to user intent. Predictive analytics enable clinicians to fine-tune equipment settings and anticipate maintenance needs, thereby improving user safety and comfort. AI is also being used in virtual assessments, streamlining customization for individual users. Machine learning enhances data interpretation from sensors, giving therapies better insights into posture, usage, and pressure management. Overall, AI is transforming CRT from static devices into intelligent, responsive systems that grow with the user.

U.S. Complex Rehab Technology Market Size and Growth 2025 to 2034

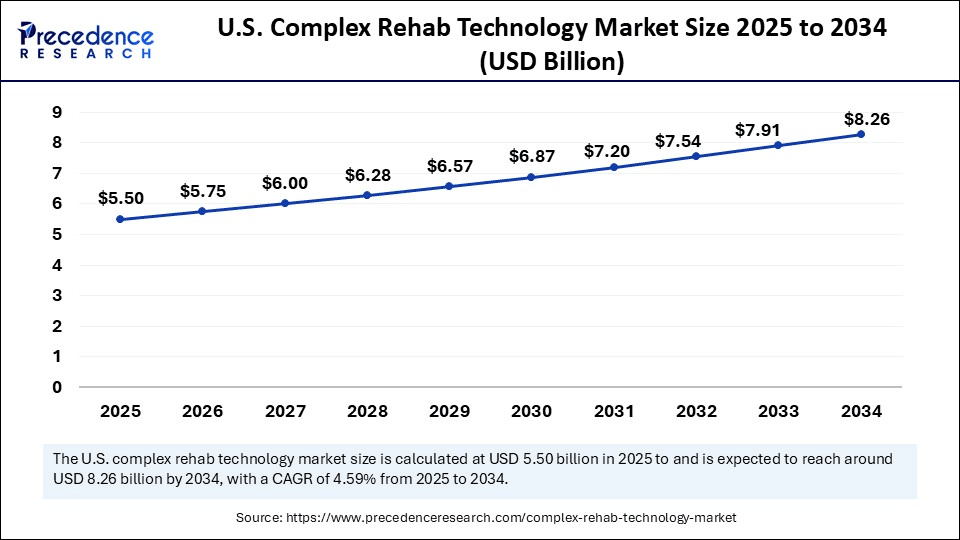

The U.S. complex rehab technology market size was exhibited at USD 5.27 billion in 2024 and is projected to be worth around USD 8.26 billion by 2034, growing at a CAGR of 4.59% from 2025 to 2034.

What Factors Contribute to North America's Leading Position in the Market?

North America dominated the complex rehab technology market by capturing the largest market share of 52% in 2024, driven by robust healthcare infrastructure, advanced R&D, and strong insurance reimbursement systems. The U.S., in particular, benefits from a large base of certified ATPs (Assertive technology professionals) and specialized clinics. Medicare and private insurers are increasingly recognizing the long-term value of CRT, which aids in its adoption. Top manufacturers and innovation hubs are also headquartered in the region, accelerating product development and distribution. The strong advocacy and support network for people with disabilities further fuels demand. With a high focus on quality of life and medical outcomes, North America remains the benchmark for CRT adoption.

Moreover, North America continues to invest heavily in healthcare technology, fostering an environment conducive to innovation in CRT. The region's regulatory landscape is also favorable, facilitating quicker approval processes for new devices. Additionally, extensive training programs for healthcare professionals ensure optimal utilization of CRT technologies. Community awareness initiatives further promote acceptance and understanding of CRT benefits among patients.

Asia Pacific: The Fastest-Growing Region

Asia Pacific is expected to grow at the fastest CAGR in the coming years, driven by several key factors. The region's rising healthcare investments are enabling broader access to advanced assistive devices. Governments are launching public health initiatives to enhance disability care, further increasing demand. Urbanization and demographic shifts, such as aging populations, are creating new needs for mobility and rehabilitation solutions. International companies are actively forming partnerships and establishing local manufacturing facilities to better serve this expanding market. Despite some infrastructure challenges, the overall trend remains positive, and with ongoing improvements in affordability and awareness, Asia Pacific is poised to become a major player in the market.

Market Overview

The complex rehab technology market is experiencing robust growth as the demand for advanced, user-specific solutions increases worldwide. Rising rates of neurological conditions, spinal cord injuries, and pediatric mobility needs are driving adoption. North America and Europe lead the market, while Asia-Pacific is emerging as a key growth zone. Innovations in powered mobility, environmental control units, and pressure relief systems are expanding the capabilities of products. Regulatory support and funding programs are also helping more patients access high-end CRT solutions. As personalized healthcare gains traction, CRT is becoming a vital part of modern rehabilitative care.

Key Market Trends

- Integration of Advanced Technologies: Increasing adoption of automation and AI-driven controls to enhance device functionality, optimize performance, and improve user outcomes.

- Focus on Patient-Centric Designs: Emphasizing the development of customized, comfortable, and minimally invasive devices that cater to individual patient needs, thereby improving quality of life.

- Growing Use of Smart and Connected Devices: Expansion of smart rehab equipment with sensors and internet of things (IoT) connectivity to enable real-time monitoring, data collection, and personalized therapy adjustments.

- Market Expansion in Emerging Regions: Rising investment and infrastructure development in developing countries, broadening access to complex rehab solutions across diverse populations.

- Emphasis on Cost-Effective and Sustainable Solutions: Development of more affordable, energy-efficient, and environmentally friendly rehab technologies to increase accessibility and reduce long-term costs.

- Increased Focus on Tele-rehabilitation: Adoption of remote therapy options to complement in-clinic treatments, especially intensified by global health scenarios.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 23.76 Billion |

| Market Size in 2025 | USD 13.09 Billion |

| Market Size in 2024 | USD 12.28 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.82% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type, Application, Age Group, End User, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Prevalence of Disabilities

The increasing prevalence of disabilities and chronic conditions such as cerebral palsy, muscular dystrophy, and spinal cord injuries is a major driver of the complex rehab technology market. Patients require personalized, medically necessary equipment to regain mobility and live independently. Healthcare systems and insurers are increasingly recognizing CRT as essential, boosting funding and reimbursement options. Advances in engineering and digital customization are enabling the development of better-fitting, more effective equipment tailored to the unique needs of individual users. Demand is especially high among aging populations and pediatric users with lifelong mobility challenges. This combination of medical needs and technological advancement is propelling the market forward.

Restraint

Is Cost Still a Barrier to Better Mobility?

Yes, the high cost of CRT devices remains a significant restraint in the market. These solutions often involve complex assessments, customization, and skilled labor, which drive up prices. Insurance coverage can be inconsistent across regions, leaving many patients underfunded or excluded altogether. Additionally, procurement processes for government and healthcare providers are often slow and bureaucratic. Small clinics and care centers may also struggle to invest in expensive technology without guaranteed reimbursement. This financial barrier limits accessibility and slows adoption, especially in lower-income and rural areas.

Opportunity

Technological Innovation

The complex rehab technology market is brimming with opportunity, especially as technologies like AI, 3D printing, and smart sensors reshape what is possible in personalized care. Custom seating, posture monitoring, and intelligent control systems are now more accessible and scalable. Emerging markets present untapped potential, where access to advanced assistive devices remains limited. Digital health integration presents another frontier, enabling CRT devices to integrate into broader health monitoring ecosystems. Collaborations among tech companies, rehabilitation specialists, and healthcare providers are driving innovation at a rapid pace. With an increasing focus on patient-centric care, CRT is becoming a cornerstone in next-gen rehabilitation.

Product Type Insights

Why Did the Seating and Positioning Systems Dominate the Market in 2024?

The seating and positioning systems dominated the complex rehab technology market in 2024 due to their critical role in supporting posture, function, and skin integrity. These systems are essential for individuals with severe mobility impairments, offering both comfort and clinical benefits. Customized seating can prevent pressure sores, enhance respiration, and improve overall quality of life. Therapists and clinicians consistently prioritize these components during CRT assessments. Their widespread use across neurological, musculoskeletal, and pediatric conditions drives consistent demand. As innovation continues in pressure mapping and materials, these systems remain the core of most CRT solutions.

On the other hand, the environmental control devices segment is expected to grow at the fastest rate during the projection period. These devices offer users the ability to manage lighting, temperature, doors, and entertainment systems independently. As homes become smarter, CRT devices are integrating with IoT and AI to enhance autonomy. These systems are especially empowering for users with limited mobility in their upper limbs. Voice-controlled, eye-tracking, and switch-based inputs are making them more accessible than ever. The shift toward home-based care and independent living is accelerating adoption. With a growing focus on digital inclusion, environmental control is becoming a cornerstone of modern assistive technology.

Application Insights

What Made Neurological Conditions the Dominant Segment in the Complex Rehab Technology Market?

Neurological conditions, such as cerebral palsy, multiple sclerosis, ALS, and spinal cord injuries, are the dominant application areas for CRT. These conditions often result in complex mobility and postural needs that require personalized, high-tech solutions. CRT provides functional mobility, environmental interaction, and physical support to patients managing progressive or lifelong neurological disorders. Long-term dependency on these devices ensures steady market demand. Clinical guidelines also prioritize early and customized intervention in neurological cases. As awareness and diagnosis improve, CRT adoption also increases.

Meanwhile, the musculoskeletal conditions segment is expected to grow at the fastest rate over the forecast period, driven by rising cases of arthritis, orthopedic injuries, and age-related degeneration. Patients recovering from trauma or surgery are turning to CRT devices for temporary or long-term mobility support. Innovations in adaptable supports and modular wheelchairs are making CRT more accessible for this segment. Rehabilitation-focused interventions often involve CRT for enhancing functional outcomes. As fitness-related injuries and skeletal disorders increase globally, demand is surging. The musculoskeletal segment is benefiting from both medical necessity and lifestyle-related factors.

Age Group Insights

How Does the Geriatric Segment Dominate the Market in 2024?

The geriatric segment dominated the complex rehab technology market in 2024 due to the higher prevalence of age-related conditions affecting mobility and independence. Conditions like Parkinson's, stroke, and degenerative joint diseases often require long-term assistive solutions. Older adults benefit significantly from powered mobility, pressure relief systems, and customized seating. As global populations age, especially in developed nations, demand for CRT in elder care is surging. Family caregivers and assisted living facilities increasingly rely on CRT to improve safety and daily function. This demographic remains the largest and most consistent user base for CRT devices.

On the other hand, pediatric is the fastest-growing segment in the market due to rising diagnoses of developmental disabilities and improved early intervention. Children with conditions like cerebral palsy or spinal muscular atrophy require customized, adaptive equipment that grows with them. Technological advances now enable the development of lighter, modular, and adjustable devices specifically designed for children. Education systems and pediatric rehab programs are also expanding access to CRT in schools. Early mobility and posture management are crucial to developmental success, underscoring the need for CRT solutions. As pediatric care becomes increasingly specialized, this segment is experiencing exponential growth.

End User Insights

Why Did the Hospitals and Clinics Segment Lead the Market?

The hospitals and clinics segment led the market in 2024. They are major end users of CRT due to their role in diagnostics, rehabilitation, and long-term care planning. CRT is often prescribed and fitted through multidisciplinary rehab teams in clinical settings. These institutions are equipped with skilled staff and assessment tools necessary for customizing devices. Public and private funding often flows through clinical providers, boosting their share in device distribution. Hospitals also serve as central points for training and patient education in CRT usage. Their infrastructure and regulatory alignment make them the strongest market contributors.

On the other hand, the sports and fitness centers segment is expected to expand at the highest CAGR in the upcoming period. These facilities are increasingly serving individuals with disabilities who seek strength training, movement therapy, or recovery from injuries. Specialized CRT equipment is being designed for high-performance and exercise use. Paralympic programs and inclusive recreation initiatives are driving this trend globally. More fitness centers are integrating CRT for both therapeutic and performance-based applications. As wellness becomes more inclusive, these centers are becoming unexpected yet major adopters of CRT.

Distribution Channel Insights

What Made Direct Sales the Dominant Distribution Channel for CRT?

The direct sales segment dominated the complex rehab technology market in 2024, as it provides tailored consultation and after-sales support. Complex products, such as CRTs, require close coordination among clinicians, suppliers, and patients. Direct interactions ensure proper customization, training, and ongoing support, all of which are critical for user success. Manufacturers and specialized distributors rely on direct engagement to meet strict clinical and regulatory standards. This model also supports ongoing upgrades and warranty support, which is critical for high-investment devices. Trust, quality control, and expertise make direct sales the preferred choice for most CRT users.

Meanwhile, the online retail segment is likely to grow at the fastest rate, driven by convenience, broader product access, and digital-first purchasing habits. Users and caregivers can now compare features, pricing, and reviews to make informed decisions. E-commerce platforms are beginning to offer basic CRT products, accessories, and even virtual consultations. With telehealth and remote assessments growing, online channels are becoming more viable for select CRT needs. Subscription-based models and home delivery are making maintenance and upgrades easier.

Complex Rehab Technology Market Companies

- Invacare Corporation

- Medline Industries, Inc.

- Dynatronics Corporation

- Drive Devilbiss Healthcare

- Ekso Bionics

- Caremax Rehabilitation Equipment Ltd

- GF Health Products, Inc

- Hospital Equipment Mfg. Co

- Maddak, Inc.

- India Medico Instruments.

Recent Developments

- In March 2025, Healing Innovations, Inc. partnered with Barrett Medical to bring best-of-class full-body neurorehabilitation to facilities nationwide. The partnership aims to expand access to cutting-edge rehabilitation technology, offering a complete end-effector solution for rehabilitation clinics.

(Source: https://www.healinginnovations.com) - In July 2024, KIMSHEALTH deployed an advanced robotic gait trainer, G-Gaiter, which will help patients recover rapidly from paraplegic disabilities. The custom-made G-Gaiter assists patients with stroke-triggered paraplegic conditions, traumatic spinal cord injury, cerebral palsy, accidents and Parkinson's disease by increasing their mobility as well as consistency.

(Source: https://pinkerala.com)

Segments Covered in the Report

By Product Type

- Mobility Devices

- Manual Wheelchairs

- Power Wheelchairs

- Scooters

- Seating and Positioning Systems

- Cushions

- Back Supports

- Headrests

- Standing Devices

- Standing Frames

- Standing Wheelchairs

- Bath Safety and Daily Living Aids

- Shower Chairs

- Commodes

- Environmental Control Devices

- Communication Devices

- Control Systems for Home Automation

- Accessories

- Batteries and Chargers

- Ramps and Lifts

By Application

- Neurological Conditions

- Spinal Cord Injury

- Cerebral Palsy

- Multiple Sclerosis

- Musculoskeletal Conditions

- Muscular Dystrophy

- Osteogenesis Imperfecta

By Age Group

- Pediatric

- Congenital Disorders

- Developmental Disabilities

- Geriatric

- Age-related Mobility Issues

- Stroke Rehabilitation

By End User

- Hospitals and Clinics

- Inpatient Facilities

- Outpatient Rehabilitation Centers

- Home Care Settings

- Specialty Care Centers

- Long-term Care Facilities

- Assisted Living Facilities

- Sports and Fitness Centers

By Distribution Channel

- Direct Sales

- Retail

- Specialty Rehab Stores

- Medical Supply Stores

- Online Retailers

- Distributors and Dealers

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting