Ophthalmic Packaging Market Size To Attain USD 13.83 Bn By 2032

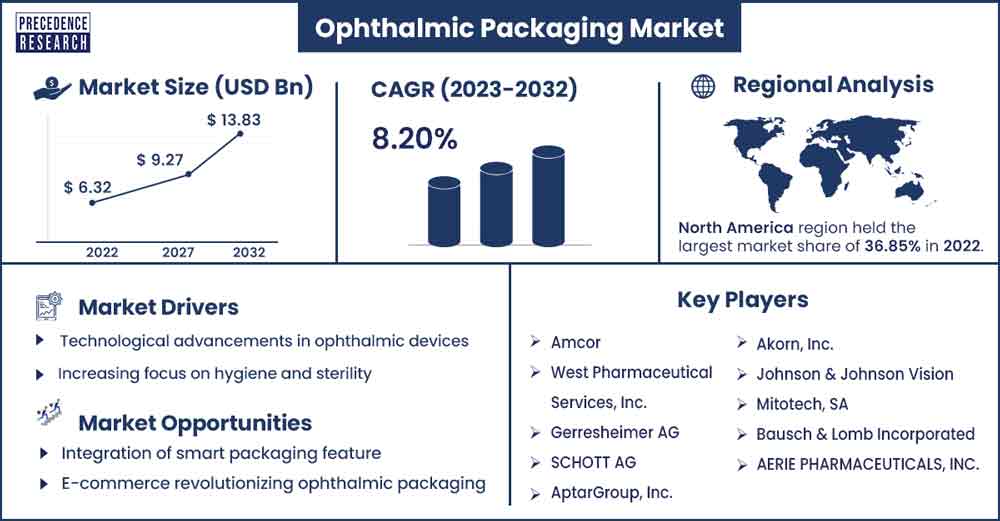

The global ophthalmic packaging market size surpassed USD 6.81 billion in 2023 and is projected to attain around USD 13.83 billion by 2032, growing at a CAGR of 8.2% from 2023 to 2032.

Market Overview

Considering the fragility of ophthalmic equipment, the packaging format must prioritize shock resistance and secure containment. Utilizing materials that shield against external impacts is imperative, safeguarding lenses and sensitive components from any potential damage during transit. Furthermore, the packaging design should facilitate easy retrieval and minimize the risk of accidental damage when accessing the product. This ensures that the end-user receives an ophthalmic device in optimal condition, ready for immediate use.

Packaging for ophthalmic devices must embody a fusion of protective design, user-friendly accessibility, and adaptability to diverse product types. Prioritizing these elements ensures that the packaging not only shields delicate optical products but also aligns with evolving industry trends, meeting the expectations of both manufacturers and end-users alike. The design and material choices for packaging must align with the delicate nature of optical products, ensuring that they reach end-users in pristine condition.

Beyond physical protection, the packaging format should address hygiene concerns associated with ophthalmic products. A sterile and sealed environment is crucial to maintaining the integrity of lenses and avoiding contamination. Incorporating features such as tamper-evident seals and sterile packaging materials enhances ophthalmic products' overall safety and reliability, instilling confidence in both practitioners and end-users.

In the dynamic landscape of ophthalmic technology, the packaging format should also adapt to the diverse range of devices, from prescription eyewear to cutting-edge diagnostic tools. Customizable packaging solutions that cater to different sizes and shapes of ophthalmic products ensure a tailored fit, optimizing space and minimizing excess material. This adaptability enhances the aesthetic appeal of the packaging and reflects a commitment to sustainability by minimizing waste. Incorporating this awareness, the packaging for ophthalmic devices must strike a balance between safeguarding the product and presenting a user-friendly experience.

Regional Snapshot

This regional hierarchy reflects the global distribution of demand and manufacturing capabilities in the ophthalmic packaging industry. While North America leads with its technological prowess, Asia Pacific’s growth potential is fueled by demographic factors and expanding healthcare access. With its commitment to quality and sustainability, Europe maintains a robust presence, contributing to the overall advancement of ophthalmic packaging on the global stage.

The ophthalmic packaging market underscores a clear dominance in North America, followed closely by Asia Pacific. North America’s stronghold in this sector can be attributed to its robust healthcare infrastructure, technological advancements, and a significant presence of key industry players. The demand for precision-engineered and sterile ophthalmic packaging aligns with the region’s focus on healthcare excellence and cutting-edge medical solutions.

In Asia Pacific, the ophthalmic packaging market emerges as a formidable player, driven by the region’s expanding healthcare sector, burgeoning population, and increasing awareness of eye care. Adopting ophthalmic devices in countries like China and India propels the demand for specialized packaging solutions. Moreover, the thriving manufacturing capabilities in Asia Pacific contribute to a diverse range of packaging options, meeting the unique needs of the ophthalmic industry.

Europe remains a significant player in the ophthalmic packaging landscape. The region’s emphasis on quality standards, innovation, and sustainability aligns with the evolving requirements of ophthalmic product packaging. European countries boast a well-established healthcare system and a discerning consumer base, driving the demand for sophisticated and reliable packaging solutions in the ophthalmic sector.

Ophthalmic Packaging Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 6.81 Billion |

| Projected Forecast Revenue by 2032 | USD 13.83 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 8.2% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Technological advancements in ophthalmic devices

Ophthalmic devices are undergoing a transformative evolution marked by cutting-edge technologies. Smart lenses, precision instruments, and diagnostic tools are at the forefront, demanding packaging solutions that mirror their sophistication. The packaging landscape is adapting to ensure secure containment and protection against external elements. Smart packaging, integrating features that complement device functionality, becomes imperative.

As devices incorporate connectivity and advanced sensors, packaging must facilitate these capabilities while safeguarding the delicate technological components. This alignment between device innovation and packaging ingenuity ensures that end-users receive ophthalmic products in optimal condition, ready to deliver the intended technological benefits. Thus, driving the ophthalmic packaging market.

Increasing focus on hygiene and sterility

In the realm of ophthalmic products, the paramount importance of hygiene and sterility is steering packaging advancements. The demand for a sterile environment to preserve product efficacy and ensure user safety propels the development of packaging solutions with meticulous attention to detail. Sealed sterile compartments are crafted to maintain the pristine condition of lenses and instruments, guarding against potential contaminants.

Tamper-evident features add an extra layer of assurance, instilling confidence in practitioners and end-users alike. The packaging, designed with precision, not only safeguards the product but also contributes to the overall hygiene protocols associated with ophthalmic care. The focus on sterility and commitment to the highest quality and safety standards helps the growth of the ophthalmic packaging market.

Restraint

Environmental concern and sustainability

The growing emphasis on environmental sustainability challenges the ophthalmic packaging industry. While there is a push for eco-friendly materials and reduced environmental impact, achieving sustainability goals without compromising the protective and functional aspects of packaging can be challenging.

Developing packaging solutions that meet both sustainability criteria and the stringent requirements for protecting delicate ophthalmic products requires innovation and investment in research and development. Striking a balance between sustainability and product integrity is an ongoing challenge that the ophthalmic packaging market must address to align with broader environmental goals.

Opportunities

Integration of smart packaging feature

In the ophthalmic packaging market, there is a promising opportunity to elevate packaging through the integration of smart features. For instance, RFID technology can be employed for precise tracking and authentication, ensuring the authenticity of ophthalmic products from manufacturer to end-user. Temperature-sensitive indicators offer a practical solution, allowing real-time monitoring of product conditions during storage and transportation and safeguarding the integrity of sensitive devices.

Interactive packaging that provides users with pertinent information, such as usage instructions or expiration dates, enhances user engagement and contributes to overall product safety. These smart packaging features not only improve traceability but also enhance the user experience, reinforcing the value of ophthalmic products.

- In February 2023, LF of America introduced an innovative ophthalmic packaging solution addressing common challenges. Utilizing patented multi-layer technology and a 100% preservative-free formula, their unit dose packaging for eye drops ensures ease, comfort, and precise dosing for both eyes.

E-commerce revolutionizing ophthalmic packaging

The surge in e-commerce presents unprecedented opportunities for the ophthalmic packaging market. Online platforms offer a direct channel to consumers, allowing manufacturers to tailor packaging solutions to meet individual preferences. Customization options, such as personalized lens prescriptions and packaging aesthetics, become feasible, enhancing user experience.

The digital space facilitates the integration of smart packaging features, providing real-time tracking and ensuring product authenticity. With the growing trend of virtual consultations, packaging could incorporate interactive elements for instructional purposes. E-commerce not only streamlines distribution but also opens avenues for innovative packaging designs, creating a dynamic landscape where user convenience and technological advancements converge for optimal customer satisfaction.

Recent Developments

- In June 2023, the Drugs Consultative Committee (DCC) proposed the use of opaque plastic bottles to prevent microbial contamination while also suggesting transparent bottles to ensure contamination-free packaging. The DCC may discuss the feasibility with pharmaceutical companies before making a final decision on this matter.

- In April 2023, Bausch + Lomb introduced StableVisc and TotalVisc Ophthalmic Viscosurgical Devices (OVDs) in the U.S., enhancing cataract surgery with dual-action protection. StableVisc maintains anterior chamber space, while TotalVisc combines StableVisc and ClearVisc™ for comprehensive ocular tissue protection.

- In March 2023, Berry Global and Pylote joined forces for innovative antimicrobial packaging, unveiling a groundbreaking ophthalmic multidose dropper. Effectively combating Adenovirus type 3, E. Coli, and Staphylococcus aureus, the dropper minimizes plastic waste by 16 times compared to monodose alternatives.

Prepared Flour Mixes Market Players:

- Amcor

- West Pharmaceutical Services, Inc.

- Gerresheimer AG

- SCHOTT AG

- AptarGroup, Inc.

- Akorn, Inc.

- Johnson & Johnson Vision

- Mitotech, SA

- Bausch & Lomb Incorporated

- AERIE PHARMACEUTICALS, INC.

- Novartis AG

- Merck Sharp & Dohme Corp.

- Bayer AG

- F. Hoffmann-La Roche Ltd.

- ALLERGAN

- Santen Pharmaceutical Co.

- Teva Pharmaceutical Industries Ltd.

Segments Covered in the Report:

By Material

- Plastic

- Metal

- Glass

By Product Type

- Bottles & Vials

- Blister Packs

- Ampoules

- Squeezable Tubes

By Application

- Prescription Medication

- OTC Products

- Medical Devices

Buy this Research Report@ https://www.precedenceresearch.com/checkout/3072

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308