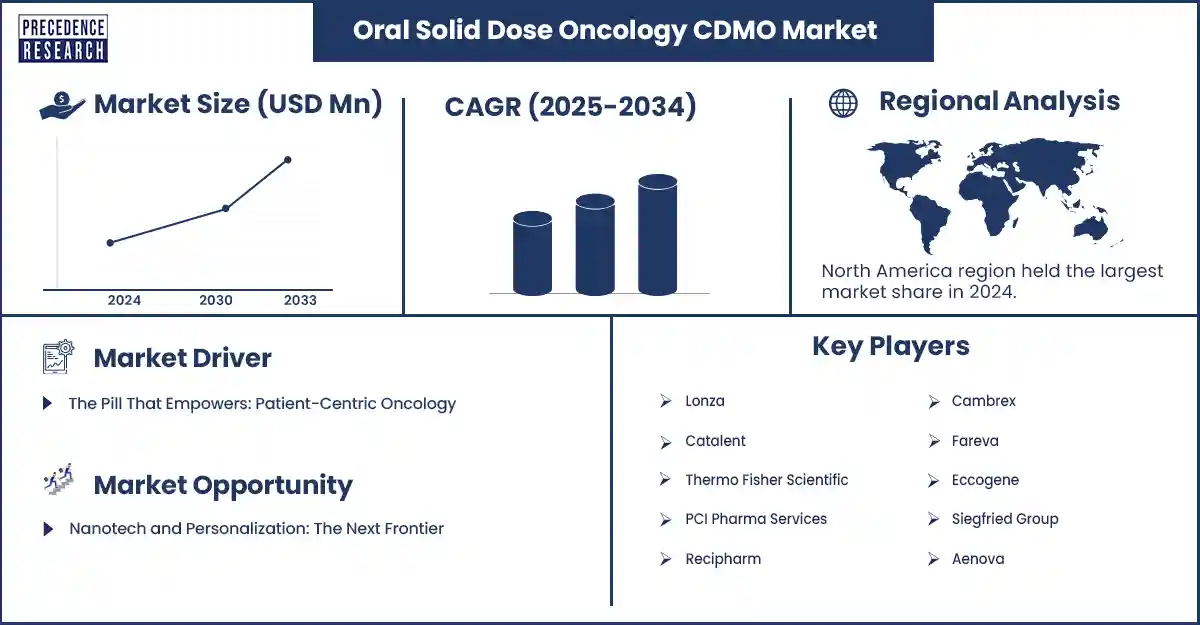

Oral Solid Dose Oncology CDMO Market Revenue and Forecast by 2033

Oral Solid Dose Oncology CDMO Market Revenue and Trends 2025 to 2033

The global oral solid dose oncology CDMO market explores the growing demand for outsourced manufacturing of oral cancer therapies—tablets/capsules, small molecules and high-potency agents. The oral solid dose oncology CDMO market is witnessing steady growth driven by rising cancer prevalence, demand for targeted therapies, and increasing outsourcing of complex oncology formulations.

Oral Solid Dose Oncology CDMO Market Overview

Market growth can be attributed to an increase in cancer cases and targeted oral cancer therapies that increase convenience and adherence. The market for contract development and manufacturing organizations (CDMO) that make oral solid dose oncology drugs consists of companies that provide end-to-end development and manufacturing services for oral cancer drugs including tablets and capsules.

CDMOs collaborate with pharmaceutical companies to advance the development, scaling, and commercialization of cancer therapeutics while maintaining quality and regulatory compliance. Drives for outsourcing, advancements in drug formulation technologies, and the cost efficiency of producing therapeutics are facilitating further growth in the market, whereby CDMOs will become essential partners in the global supply chain for oncology drugs.

Segmental Analysis

- By Service Type- commercial manufacturing and formulation/process development represent the most dominant service type segment for scale-up, process optimization, and consistent production of complex oral solid oncology therapies.

- By Process / Technology- Wet granulation and direct compression remains the dominant Process/Technology segment dominate as both conventional processes that ensure product uniformity, stability and cost-effective large scale production for solid oral oncology formulations.

- By Product Type / Molecule Class- Small-molecule targeted oncology agents dominate as the segment due to their therapeutic precision, oral bioavailability and continued industry preference for targeted chemotherapy formulations within a solid dose form.

- By Dosage Form / Release Profile- Immediate-release tablets and capsules dominate within the segment due to the straightforward formulation design, prompt drug absorption and patient acceptance for use within oncology therapeutic regimens.

- By API Potency / Safety Classification- Non-HPAPI and standard small molecules dominate production volume as the majority of solid dose oncology drugs involve moderately-potent compounds that require standard containment facilities.

- By Customer Type- Biotech and mid-size pharmaceutical companies continue to dominate as they look to outsource end-to-end development and manufacturing to CDMOs for more agility and fast-tracking of commercial production.

- By Contract / Commercial Model- Fee-for-service and turnkey contracts dominate as the sponsors prefer predictable cost structures and standard project scopes for their oncology drug manufacturing partnerships.

- By Scale / Capacity- Clinical-scale production is the major share driven mainly by the sheer number of oncology molecules being developed, and the need for pilot-scale batches before commercialization.

- By Analytical & Regulatory Support- Stability and method development dominate as these are the main areas of analytical and regulatory work ensuring drug quality, consistency and regulatory compliance at all stages of oncology product development.

Regional Analysis

North America dominated the oral solid dose oncology CDMO market because large pharma sponsors have concentrated their late-stage oncology formulation and commercial scale-up work there, relying on deep specialty capacity for high-potency handling, complex quality systems, and regulatory preparedness. Stringent FDA oversight, coupled with an expanding domestic manufacturing push, has raised demand for audited CDMOs to establish CGMP compliance, inspection readiness, and rapid supply chain response for oncology launches and shortages.

Asia pacific is the fastest growing as clinical trial activity and local R&D has increased, labouring sponsors to localize their oral solid dose manufacturing and scale formulation partnerships. Governments and regulators are accelerating priority review/approval pathways, while CDMOs expand on tablet/capsule capabilities and tech transfer capacity, to capture the ongoing/to continually increase cost-sensitive commercial launches and regional exports a blend of efforts that is rapidly elevating volumes of contract manufacturing.

Oral Solid Dose Oncology CDMO Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Recent Developments

- In April 2025, Cyprumed and MSD signed a nonexclusive license and option agreement to develop oral formulations of MSD’s peptides using Cyprumed’s innovative drug delivery technology.

Key Players in Oral Solid Dose Oncology CDMO

- Lonza

- Catalent

- Thermo Fisher Scientific / Patheon

- Recipharm

- PCI Pharma Services

- Cambrex

- Fareva

- Siegfried (now part of Siegfried Group)

- Aenova (part of the Rottendorf / Aenova group)

- Alcami

- Evonik (pharmaceutical contract manufacturing & excipient solutions)

- PCI / PCI’s specialized oncology services (listed for emphasis)

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7007

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344