What is the Oral Solid Dose Oncology CDMO Market Size?

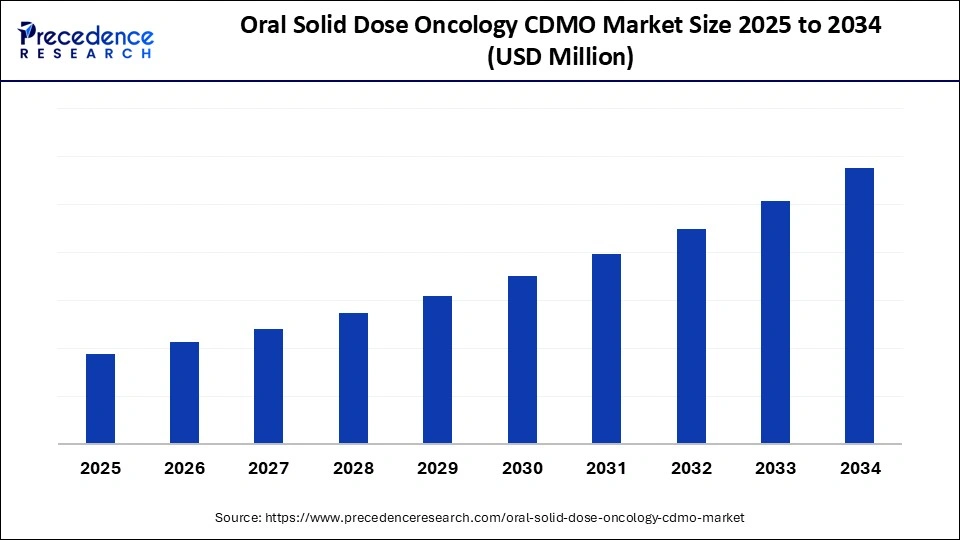

The global oral solid dose oncology CDMO market is driven by growing demand for efficient, scalable cancer drug manufacturing and formulation support.The market is experiencing significant growth, driven by the rising demand for effective cancer treatments in solid dosage forms. With an increasing number of oncology therapies being developed and launched, contract development and manufacturing organizations (CDMOs) play a crucial role in supporting pharmaceutical companies. This dynamic market is anticipated to expand from its current valuation, reaching impressive figures over the next decade.

Oral Solid Dose Oncology CDMO Market Key Takeaways

- By region, North America dominated the market, holding the largest market share in 2024.

- By region, Asia Pacific is expected to expand at the fastest CAGR in the oral solid dose oncology CDMO market between 2025 and 2034.

- By service type, the commercial manufacturing & formulation/process development segment held the largest market share in 2024.

- By service type, high-potency is expected to grow at a remarkable CAGR between 2025 and 2034.

- By process type, the wet granulation & direct compression segments held the largest market share in 2024.

- By process type, advanced coating/modified-release tech and containment technologies for HPAPIs is expected to grow at a remarkable CAGR between 2025 and 2034.

- By product type, the small-molecule targeted oncology agents segment held the largest share in the oral solid dose oncology CDMO market during 2024.

- By product type, HPAPI handling and cytotoxic oral formulations are expected to grow at a remarkable CAGR between 2025 and 2034.

- By dosage form type, the immediate-release tablets segment held the largest market share in 2024.

- By dosage form type, modified release and multiarticulate systems are expected to grow at a remarkable CAGR between 2025 and 2034.

- By API potency type, the Non-HPAPI and standard small molecules segment held the largest market share in 2024.

- By API potency type, HPAPIs & cytotoxic containment services grow at a remarkable CAGR in the oral solid dose oncology CDMO market between 2025 and 2034.

- By customer type, the biotech & mid-sized pharma segment held the largest market share in 2024.

- By customer type, specialty/HPAPI-focused biotech is at a remarkable CAGR between 2025 and 2034.

- By contract type, the fee-for-service & turnkey contracts segment held the largest market share in 2024.

- By contract type, risk-sharing / milestone deals are at a remarkable CAGR between 2025 and 2034.

Key Technological Shift in the Oral Solid Dose Oncology CDMO Market

The oral solid dose oncology CDMO market is witnessing a profound technological metamorphosis, with formulation science and digital innovation converging to redefine therapeutic precision. The advent of amorphous solid dispersions, hot melt extrusion, and nano-milling is enabling higher solubility and stability for poorly bioavailable anticancer drugs. 3D printing technologies are being explored to customize dose profiles and release kinetics for individual patients. The integration of real-time data monitoring and digital twins in manufacturing ensures enhanced quality control and process reproducibility. Furthermore, the transition to high-potency containment systems and automated capsule filling has revolutionized safety and efficiency. As technology pervades every stage from molecule to medicine, the oral oncology sector stands on the cusp of an unprecedented transformation.

What Is the Oral Solid Dose Oncology CDMO Market?

The oral solid dose oncology CDMO market services are focused on developing, scaling, manufacturing, testing, and packaging oral solid dose oncology products, including tablets, capsules, and oral thin films for small-molecule oncological drugs, targeted therapies, and cytotoxic/high-potency compounds. This market covers formulation & process development, analytical and regulatory support, clinical and commercial manufacturing, including handling of HPAPIs, and secondary packaging tailored to oncology product requirements.

Market growth in the oral solid dose oncology CDMO market has accelerated in recent years, underpinned by the global shift toward patient-centric cancer care. The convenience, stability, and cost-effectiveness of oral formulations have positioned them as a preferred route over parenteral administration for chronic oncology therapies. With advancements in formulation technologies, bioavailability challenges are being surmounted, allowing for sustained release and targeted drug delivery. Moreover, the rising incidence of cancer and the increasing focus on outpatient and home-based treatment regimens are propelling demand. Pharmaceutical companies are intensifying R&D in oral targeted therapies, kinase inhibitors, and immunomodulators. As healthcare systems evolve toward personalization and accessibility, oral oncology drugs are becoming a cornerstone of modern cancer therapeutics.

Oral Solid Dose Oncology CDMO Market Outlook

- Industry Growth Overview: The industry's growth trajectory is being buoyed by the confluence of technological progress, regulatory support, and expanding patient awareness. The global shift toward home-based care, driven by pandemic-era learnings, has accelerated the adoption of oral dosage forms in oncology. Regulatory agencies are increasingly receptive to accelerated approvals for oral targeted therapies that show significant improvements in efficacy. Contract manufacturing organizations (CMOs) specializing in high-potency active pharmaceutical ingredients (HPAPIs) have seen exponential growth in demand. In addition, the expansion of companion diagnostics and precision medicine frameworks is complementing the development of oral oncology. Together, these dynamics are ushering in a more decentralized and personalized model of oncology care.

- Sustainability Trends: Sustainability in oral oncology manufacturing is transcending token efforts and becoming an intrinsic business imperative. The industry is embracing green chemistry practices to minimize solvent waste and reduce carbon footprints in synthesis and formulation. Packaging sustainability, particularly through biodegradable blister packs and recyclable HDPE bottles, is gaining prominence. Energy-efficient continuous manufacturing systems are replacing batch processes in large-scale OSD production. Additionally, ethical sourcing of excipients and traceability of raw materials are being prioritized. These initiatives are not only reducing environmental burden but also aligning with the ethical expectations of modern healthcare consumers and investors.

- Major Investors: Major investment inflows are being channeled from both established pharmaceutical giants and forward-looking venture capital firms. Companies such as Pfizer, Novartis, and Bristol Myers Squibb are scaling their oral oncology portfolios, while investors like Flagship Pioneering and Arch Ventures are backing next-generation formulation startups. Institutional investors are showing growing interest in CDMOs with strong oncology OSD capabilities. The market's resilience, recurring revenue potential, and alignment with value-based care models make it a preferred destination for long-term capital.

- Startup Economy: A vibrant startup ecosystem is emerging around oral solid dose innovation, focusing on bioavailability enhancement, nanocarrier delivery, and personalized dosing platforms. Startups are leveraging AI-driven predictive modeling to optimize pharmacokinetics and formulation design. Many are also adopting modular and continuous manufacturing models that lower production costs and shorten development timelines. Academic spin-offs are partnering with oncology centers to advance novel oral therapies for niche cancers. This confluence of agility, innovation, and collaboration is reshaping the oncology OSD landscape.

Market Key Trends

- Increasing adoption of targeted oral therapies and immunomodulatory agents.

- Surge in personalized and companion-diagnostic-linked formulations.

- Growth in high-potency API (HPAPI) manufacturing capabilities.

- Integration of digital adherence monitoring tools for home-based therapy.

- Expansion of contract manufacturing partnerships.

- Growing regulatory support for novel OSD oncology drug approvals.

Market Scope

| Report Coverage | Details |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Service type, process / Technology, product type / Molecule Class, dosage form / Release Profile, API Potency / Safety Classification, Customer type, Contract / Commercial Model, Scale / Capacity, Analytical & Regulatory Support, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market dynamics

Drivers

The Pill That Empowers: Patient-Centric Oncology

The greatest driver of the oral solid dose oncology CDMO market is its ability to empower patients through autonomy and convenience. Oral therapies eliminate the need for frequent hospital visits, offering dignity and comfort in long-term cancer care. As healthcare moves toward decentralization, the patient-centric nature of OSD therapies becomes a formidable advantage. Moreover, oral formulations improve treatment adherence by reducing procedural complexity and improving accessibility. Pharmaceutical companies are responding with a pipeline rich in kinase inhibitors and checkpoint modulators designed for oral delivery. This democratization of therapy, allowing patients to manage cancer from home, is the true force propelling the market forward.

Restraint

The Bioavailability Bottleneck

Despite its promise, the oral solid dose oncology CDMO market remains constrained by significant pharmacokinetic challenges. Many anticancer molecules exhibit poor solubility and low permeability, undermining their efficacy when administered orally. High first-pass metabolism further complicates dose optimization. Formulation scientists are grappling with the delicate balance between potency and safety in the oral delivery of cytotoxic agents. The regulatory complexity surrounding high-potency containment and cross-contamination risks adds another layer of difficulty. Until these barriers are systematically addressed through technological and regulatory alignment, the market's full potential will remain partially unrealized.

Opportunity

Nanotech and Personalization: The Next Frontier

An extraordinary opportunity lies at the intersection of nanotechnology and personalized medicine in oncology OSDs. Nanocarriers such as liposomes, micelles, and polymeric nanoparticles are revolutionizing the delivery of insoluble molecules. The ability to design patient-specific release profiles based on genetic and metabolic data heralds a new age of individualized therapy. Advances in digital therapeutics and adherence tracking will further optimize real-world outcomes. Emerging markets, with their expanding middle class and rising cancer burden, offer fertile ground for affordable oral therapies. Thus, the convergence of nanoscale engineering and personalization defines the next chapter of opportunity.

Oral Solid Dose Oncology CDMO Market Value Chain Analysis

- Raw Material Sources: Key raw materials include high-potency active ingredients, polymers for controlled release, and pharmaceutical excipients like microcrystalline cellulose and lactose. Sourcing strategies are evolving toward sustainable, traceable, and GMP-certified suppliers to ensure purity and consistency.

- Technology Used: Advanced technologies such as hot melt extrusion, fluid bed coating, and nanocrystal engineering are at the forefront of formulation innovation. Automation, robotics, and continuous manufacturing are enhancing precision and scalability.

- Investment by Investors: Investors are prioritizing companies with strong oncology pipelines and robust high-potency manufacturing capabilities. Strategic partnerships and mergers are increasingly targeting innovation-driven startups with niche expertise in solid oral formulations.

- AI Advancements: AI is revolutionizing every stage from predictive pharmacokinetic modeling to formulation optimization and patient adherence monitoring. Machine learning algorithms are accelerating candidate screening and enabling adaptive clinical trial designs for oral oncology drugs.

Segment Insights

Service Type Insights

Why Commercial Manufacturing & Formulation/Process Development is Dominating the Oral Solid Dose Oncology CDMO Market?

The dominant segment in the oral solid dose oncology CDMO industry is commercial manufacturing and formulation/process development. This area focuses on the comprehensive support of drug products, covering everything from initial formulation to large-scale production. The expertise in this segment ensures that oncology drugs are not only effective but also manufactured following stringent regulatory standards.

Meanwhile, the fastest-growing segment is high-potency/cytotoxic handling services and analytical development for complex oncology molecules. There is a notable increase in the demand for handling High-Potency Active Pharmaceutical Ingredients (HPAPIs) due to their critical role in developing innovative cancer therapies. As pharmaceutical companies continue to evolve their offerings, the emphasis on analytical development is essential for ensuring the safety and efficacy of these complex therapeutics.

Process / Technology Insights

Why are wet granulation & direct compression dominating the Oral Solid Dose Oncology CDMO Market?

In the process and technology category, the wet granulation and direct compression techniques stand out as the dominant segment. These traditional tablet core processes are favored for their reliability and effectiveness in producing high-quality solid dosage forms. They facilitate the manufacturing of various formulations, ensuring uniformity and desired release characteristics.

However, the fastest-growing area here includes advanced coating/modified-release technology and containment technologies for HPAPIs. These innovations address the need for precision in drug delivery and safety, particularly when working with high-potency compounds. As the demand for more sophisticated oncology therapies increases, investing in these technologies is crucial for CDMOs looking to remain competitive.

Product Type / Molecule Class Insights

Why are small-molecule targeted oncology agents dominating the Oral Solid Dose Oncology CDMO Market?

Small-molecule targeted oncology agents represent the dominant segment under product type or molecule class. These agents are essential in the landscape of cancer treatments, providing specificity in targeting cancer cells while minimizing effects on healthy tissues. Their popularity has surged due to advancements in molecular biology, enabling more effective cancer regulations.

In contrast, the fastest-growing segment encompasses HPAPI handling and cytotoxic oral formulations, attributed to the expanding pipeline of oral chemotherapy options. This growth reflects the industry's shift toward more patient-friendly drug administration routes, enhancing adherence and improving patient outcomes. As more oncology drugs transition to this format, CDMOs must enhance their capabilities to manage these complex compounds effectively.

Dosage Form / Release Profile Insights

Why are immediate-release tablets/capsules dominating the Oral Solid Dose Oncology CDMO Market?

Immediate-release tablets and capsules dominate the dosage form segment in the oral solid dose oncology CDMO market, appealing to patients and healthcare providers for their quick action and ease of administration. These forms are often preferred in oncology treatments where a rapid therapeutic effect is desired. They are also integral in clinical settings, where timely intervention can correlate with improved patient outcomes.

Conversely, the fastest-growing area is in modified release and multiarticulate systems. These systems are increasingly important as they offer better patient adherence and optimized pharmacokinetic control. By adjusting the release profile of the drug, manufacturers can enhance therapeutic efficacy and minimize side effects. As the industry focuses more on personalized medicine, demand for these advanced dosage forms is expected to rise significantly.

API Potency / Safety Classification Insights

Why are Non-HPAPI and standard small molecules dominating the Oral Solid Dose Oncology CDMO Market?

Non-HPAPI and standard small molecules are the dominant segments in API potency and safety classification, primarily due to their broader applications and established manufacturing processes. This segment covers a wide range of oncology medications that are generally less complex to handle. They form a substantial part of the market by volume, catering to various treatment regimens.

On the other hand, the fastest-growing segment includes HPAPIs and cytotoxic containment services. The high revenue per batch and substantial investment needs associated with these APIs highlight their importance in the market. As the industry shifts towards more targeted therapies, the capabilities to handle such high-potency substances become critical for CDMOs. Enhanced safety protocols and specialized containment technologies will attract more investment into this segment.

Customer Type Insights

Why are biotech & mid-sized pharma dominating the Oral Solid Dose Oncology CDMO Market?

Biotech and mid-sized pharmaceutical companies represent the dominant customer type segment in the oral solid dose oncology CDMO market. These companies often rely heavily on end-to-end CDMO services to navigate the complexities of drug development and scale-up. They benefit from the flexibility and expertise offered by CDMOs, enabling them to bring innovative therapies to market efficiently.

By contrast, the fastest-growing customer type segment is specialty/HPAPI-focused biotech firms. These companies are experiencing a surge in their pipeline of oral oncology candidates, driving demand for specialized manufacturing services. As the complexities of these drugs increase, the need for dedicated service providers who can manage high-potency compounds becomes crucial. CDMOs that can successfully cater to this niche market will likely see substantial growth opportunities.

Contract / Commercial Model Insights

Why is are clinical scale dominating the Oral Solid Dose Oncology CDMO Market?

In the contract/commercial model landscape, fee-for-service & turnkey contracts are the dominant segment, primarily due to their straightforward structure and predictable costs. These contracts allow clients to obtain specific services without lengthy negotiations, streamlining the partnership process. This model is appealing for many organizations, especially those seeking agility in product development.

However, the fastest-growing segment is risk-sharing/milestone deals, which reflect a shift in how CDMOs and pharmaceutical companies collaborate. These agreements incentivize CDMOs to invest in promising oncology assets earlier in development, aligning interests and mitigating risks for both parties. This evolving approach is fostering stronger partnerships and enabling faster rollout of innovative therapies to market.

Scale / Capacity Insights

Why is are clinical scale dominating the Oral Solid Dose Oncology CDMO Market?

The clinical scale segment is currently the dominant category in terms of scale and capacity in the oral solid dose oncology CDMO market, reflecting the greatest number of ongoing projects in the oncology field. Clinical-scale manufacturing serves as a vital step in validating formulations, supporting clinical trials, and confirming market readiness. CDMOs operating at this level often have extensive experience in managing the complexities of early-phase development.

Conversely, commercial scale expansion is emerging as the fastest-growing segment, particularly for manufacturers enhancing their capabilities with HPAPI containment suites. As patients increasingly prefer oral therapies, the transition from clinical to commercial scale is crucial for meeting market demands. This shift enables CDMOs to support the entire product lifecycle, from initial trials to large-scale manufacturing. Increased investment in commercial capabilities ensures that organizations can effectively respond to the growing need for oncology medications.

Analytical & Regulatory Support Insights

Why is stability & method development dominating the Oral Solid Dose Oncology CDMO Market?

In the analytical and regulatory support category, stability and method development services dominate as they are integral to any oral solid dosage (OSD) program. These services ensure that products remain effective throughout their shelf life while meeting regulatory requirements. The emphasis on robust analytical support is critical to instill confidence in both regulators and consumers.

Meanwhile, the fastest-growing segment comprises regulatory filing support and method transfer services. As companies strive for global approvals, many outsource these functions to streamline the process and ensure compliance with various international standards. The demand for expert guidance in navigating regulatory landscapes is likely to accelerate as oncology products evolve. CDMOs that can provide comprehensive regulatory support will position themselves as valuable partners in drug development.

Regional Insights

Will North America Continue to Rule the oral solid dose oncology CDMO market?

North America dominates the oral solid dose oncology CDMO sector, driven by its robust pharmaceutical infrastructure, extensive R&D funding, and regulatory agility. The U.S. leads in targeted oral therapies, particularly kinase inhibitors and PARP inhibitors. A culture of rapid innovation and adoption, supported by strong patent protection and reimbursement frameworks, fosters consistent growth. Major CDMOs in the region specialize in high-potency manufacturing, aligning with the growing demand for oral oncology APIs. Moreover, increasing patient preference for home-based treatments is fuelling market expansion. The convergence of technology, investment, and patient empowerment ensures the region's continued leadership.

In Canada, healthcare modernization initiatives and growing clinical trials in precision oncology are bolstering the adoption of oral therapeutics. Canadian biotech firms are investing in nanotechnology-enabled OSD platforms, bridging innovation with affordability. Cross-border collaborations with U.S. firms are expediting market access.

Why is Asia Pacific Fastest Growing in the Oral Solid Dose Oncology CDMO Market?

Asia-Pacific represents the fastest-growing frontier of the OSD oncology market, propelled by demographic shifts and healthcare transformation. Rapid urbanization, expanding middle-class populations, and rising cancer prevalence are accelerating demand for accessible oral therapies. Governments in India, China, and Japan are prioritizing local drug manufacturing and affordable oncology solutions. The region's CDMOs are becoming global leaders in cost-efficient production and high-potency handling. Moreover, increasing collaboration between academic institutions and biopharma companies is spurring local innovation. Both speed and scale characterize the market's trajectory, positioning Asia-Pacific as the nex t growth epicenter.

Top oral solid dose oncology CDMO market Companies

- Lonza: Lonza is a leading global CDMO offering end-to-end services for high-potency oral oncology drugs, from early-stage development to commercial-scale manufacturing. With advanced HPAPI containment technologies, specialized solid dose facilities, and integrated analytical and regulatory support, Lonza enables seamless production of complex oncology formulations.

- Catalent: Catalent is a pioneer in oral oncology formulation and delivery, specializing in softgels, capsules, and controlled-release systems for potent therapeutics. The company's global network of high-containment facilities supports the full lifecycle of oncology drugs, emphasizing bioavailability enhancement and rapid scale-up.

- Thermo Fisher Scientific / Patheon: Thermo Fisher's Patheon division provides comprehensive oncology CDMO services, combining HPAPI manufacturing, solid dose formulation, and clinical-to-commercial production. Its expertise in handling cytotoxic compounds and global supply chain integration ensures speed, safety, and quality in oncology drug development and distribution.

- PCI Pharma Services: PCI Pharma is renowned for its specialized oncology handling and packaging capabilities, with advanced containment technologies for high-potency OSD products. The company offers an integrated solution, spanning development, manufacturing, and clinical logistics, designed for the precise, safe delivery of oral oncology therapies to global markets.

- Recipharm: Recipharm delivers tailored oncology OSD development and manufacturing services through its high-containment facilities across Europe. The company focuses on formulation optimization, scale-up, and commercial manufacturing of cytotoxic and highly potent oral drugs, ensuring GMP compliance and rapid time-to-market.

Other Companies in the Market

- Cambrex: Offers comprehensive OSD oncology services, including process development, solid-state chemistry, and containment manufacturing for high-potency APIs and finished forms.

- Fareva: Manufactures high-potency oral oncology products through specialized containment facilities, offering formulation development and large-scale solid dose production.

- Siegfried Group: Delivers HPAPI synthesis and OSD formulation services for oncology therapies, leveraging advanced containment technology and global GMP facilities.

- Aenova: Provides full-service oncology OSD manufacturing under high-containment conditions, offering tablets, capsules, and controlled-release systems for potent oncology drugs.

- Alcami: Specializes in oncology OSD formulation, analytical development, and small-to-mid-scale GMP manufacturing, with expertise in cytotoxic handling and solid dosage scale-up.

- Evonik: Offers pharmaceutical excipient innovation and HPAPI formulation for oncology OSDs, focusing on advanced oral delivery systems and controlled-release technologies.

- PCI Pharma Services (Specialized Oncology Division): Delivers targeted oncology solutions with end-to-end CDMO support from early-phase formulation to commercial-scale packaging and distribution of oral cytotoxic drugs.

Recent Developments

- In September 2025, Oral liquid dosage forms play a crucial role in the pharmaceutical sector, particularly for patients who struggle with swallowing solid tablets, including children and the elderly. These liquid formulations facilitate more accurate dosing, which is especially advantageous in therapeutic areas like oncology. They also allow healthcare providers to modify dosages more easily to meet individual patient needs, thereby improving treatment effectiveness and adherence.(Source: https://www.pharmaceutical-technology.com)

Segments Covered in the Report

By Service type

- Formulation & Process Development

- Pre-formulation studies

- Lead formulation selection (IR, MR, delayed-release, ODT, chewable)

- Process optimization / scale-up (lab → pilot → commercial)

- Analytical Development & Testing

- Method development & validation (HPLC, LC-MS/MS)

- Stability studies (ICH-compliant)

- Impurity profiling / forced degradation

- Clinical Manufacturing (GMP)

- Phase I clinical batches (small-scale)

- Phase II clinical batches (scale-up)

- Phase III clinical/comparability batches

- Commercial Manufacturing (GMP)

- Dedicated / multipurpose lines for tablets & capsules

- High-Potency & Cytotoxic Handling Services

- Isolators & contained manufacturing suites

- Dedicated containment packaging

- Packaging & Secondary Operations

- Blistering, bottle filling, serialization, unit-dose packaging

- Regulatory & Quality Services

- CMC dossiers, regulatory filing support, stability protocol design

- Supply Chain & Logistics

- Cold chain (if required for certain formulations), controlled distribution

By process / Technology

- Granulation Technologies

- Wet granulation (top-spray, fluid-bed)

- Dry granulation (roller compaction / slugging)

- Direct Compression

- Roller Compaction / Dry Granulation

- Coating Technologie

- Film coating, enteric coating, functional coating for modified release

- Encapsulation & Fill Technologies

- Hard-gelatin / HPMC capsule filling, controlled-release pellets

- Oral Thin Film / ODT / Chewable Technologies

- Containment & HPAPI Technologies

- Isolators, RABS, negative pressure suites, dust control

By product type / Molecule Class

- Small-molecule targeted oncology agents (oral TKIs, kinase inhibitors)

- Cytotoxic / Cytostatic agents (oral chemotherapeutics)

- Hormonal & supportive oncology small molecules

- Orally-administered ADC precursors / prodrugs

- High-Potency Active Pharmaceutical Ingredients (HPAPIs)

By dosage form / Release Profile

- Immediate Release (IR) tablets & capsules

- Modified / Controlled Release (MR/CR)

- Delayed / Enteric Release

- Orally Disintegrating Tablets (ODT) / Orally Thin Films

- Multiparticulate systems (pellets, granules in capsules)

By API Potency / Safety Classification

- Non-HPAPI (standard small molecules)

- Low-to-moderate potency oncology APIs

- High-Potency APIs (HPAPIs) / Cytotoxics

- Highly cytotoxic / controlled substances

By customer type

- Large pharma (in-house programs outsourced for scale/compliance)

- Biotech / small & mid-size pharma (core CDMO customers for end-to-end development)

- Generic manufacturers (ANDAs for oncology generics)

- Specialty companies (HPAPI-focused, orphan oncology players)

By Contract / Commercial Model

- Fee-for-service / time & materials

- Fixed-price / turnkey (end-to-end) contracts

- Risk-sharing / milestone-based agreements

- Toll manufacturing / dedicated long-term agreements

By Scale / Capacity

- Laboratory / R&D scale (mg → g)

- Pilot scale (100s g → kg)

- Clinical scale (kg-level for Ph I–III)

- Commercial scale (multi-tonne capability for blockbuster needs)

By Analytical & Regulatory Support

- Bioanalytical assays, PK/PD support

- Stability program design & ICH studies

- Regulatory filing support (CMC for IND/CTA/MAA/NDA/ANDA)

- Method transfer & validation

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content