Pharmaceutical and Biotechnology Analytics Market Revenue and Forecast by 2035

Pharmaceutical and Biotechnology Analytics Market Revenue and Trends 2026 to 2035

The global pharmaceutical and biotechnology analytics market is poised for strong growth as pharma and biotech firms increasingly leverage advanced analytics, AI, and big data to accelerate drug discovery, optimize clinical trials, enhance regulatory compliance, and improve operational efficiency through data-driven decision making. This market is experiencing unprecedented growth, driven by the increasing need for data-driven insights in the drug discovery and development process.

What are the Factors That Have a Significant Contribution to the Growth of the Pharmaceutical and biotechnology analytics market?

The increasing prevalence of chronic diseases and growing demand for personalized medicine are the major drivers, accelerating the market revenue during the forecast period. The rising prevalence of chronic diseases drives demand for effective treatments and data-driven targeted therapies. Advanced analytics assists in tailoring treatments to individual patient genetics. Moreover, the integration of AI, Machine Learning, and big data analytics is expected to fuel the expansion of the pharmaceutical and biotechnology analytics market.

Pharmaceutical and Biotechnology Analytics Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2025 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa |

Segment Insights

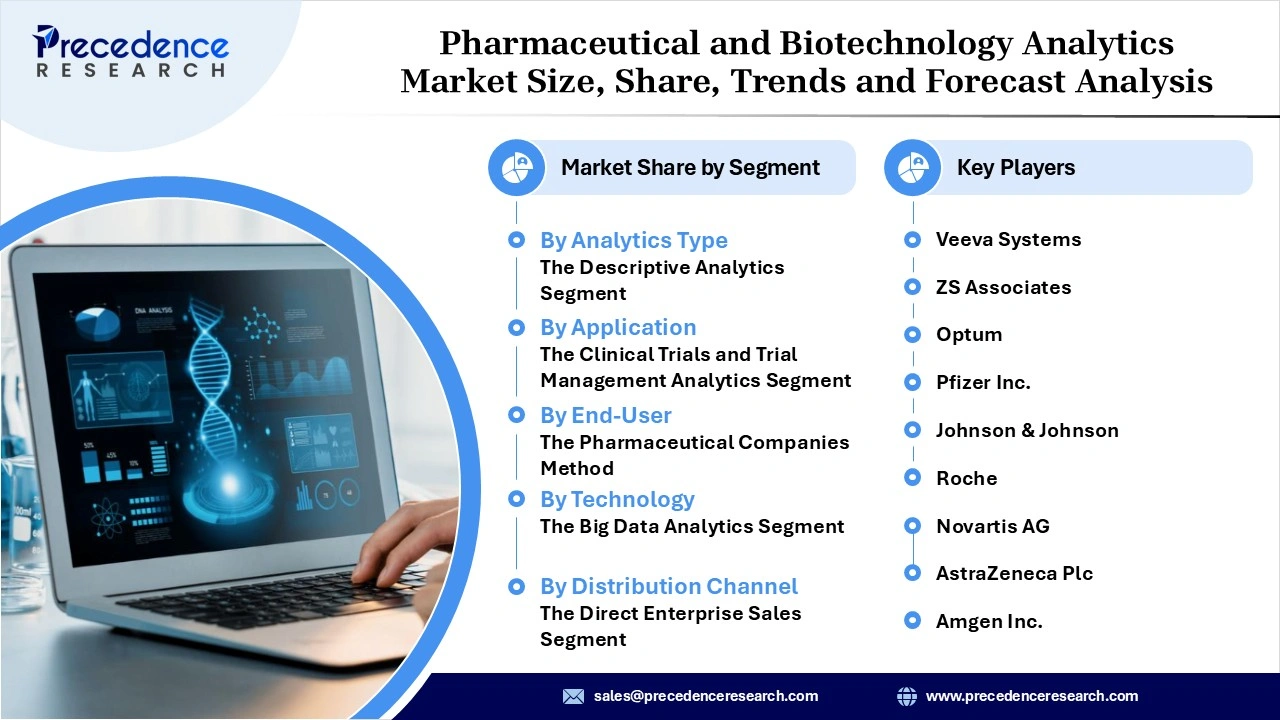

- By analytics type, the descriptive analytics segment held the largest market share in 2024, owing to the growing need to analyze large volumes of data from various sources to identify trends, evaluate performance, and meet regulatory requirements.

- By application, the clinical trials and trial management analytics segment accounted for the majority of the share in the pharmaceutical and biotechnology analytics market during 2024. The segment is experiencing significant growth driven by rapid technological advancements, including Artificial Intelligence (AI), Machine Learning (ML), and cloud computing, as well as the increasing trend towards personalized medicine and decentralized clinical trials.

- By end-user, the pharmaceutical companies segment held a dominant share in 2024, with increased investment in R&D for advanced therapies, drug discovery, and trial optimization. Pharmaceutical companies are increasingly investing in developing new drugs and treatments, which drives demand for analytics to process large volumes of data.

- By technology, the big data analytics segment led the market in 2024, driven by the growing need for faster drug discovery, clinical trial optimization, and improved treatment outcomes.

By distribution channel, the direct enterprise sales segment held a significant share in the pharmaceutical and biotechnology analytics market during 2024. Direct sales enable the building of strong, long-term partnerships and allow companies to ensure that the implementation and use of analytics platforms adhere to regulations.

Regional Insights

North America holds the dominant share in the global pharmaceutical and biotechnology analytics market, supported by the region’s concentration of major pharmaceutical and biotechnology companies and its long-standing leadership in data-intensive drug development. The rising incidence of chronic and life-threatening diseases such as cancer, cardiovascular disease, and diabetes continues to intensify demand for advanced analytics in clinical research and therapeutic decision-making. According to the Centers for Disease Control and Prevention (CDC) 2023 report, chronic diseases account for roughly six in ten adult deaths in the United States, underscoring the need for analytics platforms that can process clinical trial data, genomic information, and real-world evidence at scale.

The NIH All of Us Research Program, which has generated one of the world’s largest genomic datasets since its launch in 2018, continues to support analytics companies by expanding access to structured multi-omic and clinical datasets. The regulatory environment also plays a critical role. The U.S. Food and Drug Administration (FDA) has introduced guidance on the use of AI and machine learning in drug development, most notably through its 2023 framework for AI-enabled clinical decision-support tools, which encourages responsible integration of computational technologies into regulated workflows.

Canada contributes to regional strength through national genomic initiatives such as Genome Canada’s 2022–2025 Strategic Plan, which funds multi-sector collaborations in precision medicine and bioinformatics. These programs increase demand for cloud-based analytics platforms and high-throughput computational tools that support drug discovery, biomarker validation, and population-level disease modeling.

On the other hand, the Asia Pacific region is anticipated to grow at the fastest rate during the forecast period. The expansion of major pharmaceutical companies drives growth, the rising burden of chronic diseases, and substantial increases in R&D investment across China, India, South Korea, Japan, and Singapore. Many of these countries are scaling precision medicine infrastructures. For instance, Japan’s Moonshot Research and Development Program (launched 2020) supports large-scale biomedical data integration, while China’s 14th Five-Year Plan (2021–2025) prioritizes AI-enabled drug discovery and computational biology.

Recent Developments:

- In April 2025, Caris Life Sciences, a leading next-generation AI TechBio company and precision medicine pioneer, announced a collaboration with MiBA, an innovative healthcare technology company, to provide physician education and insights to accelerate research, identify, and personalize treatment plans. This partnership aims to help improve patient care and advance precision medicine.

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/7188

You can place an order or ask any questions, please feel free to contact us at sales@precedenceresearch.com |+1 804 441 9344