Polylactic Acid Market Will Grow at CAGR of 16% By 2032

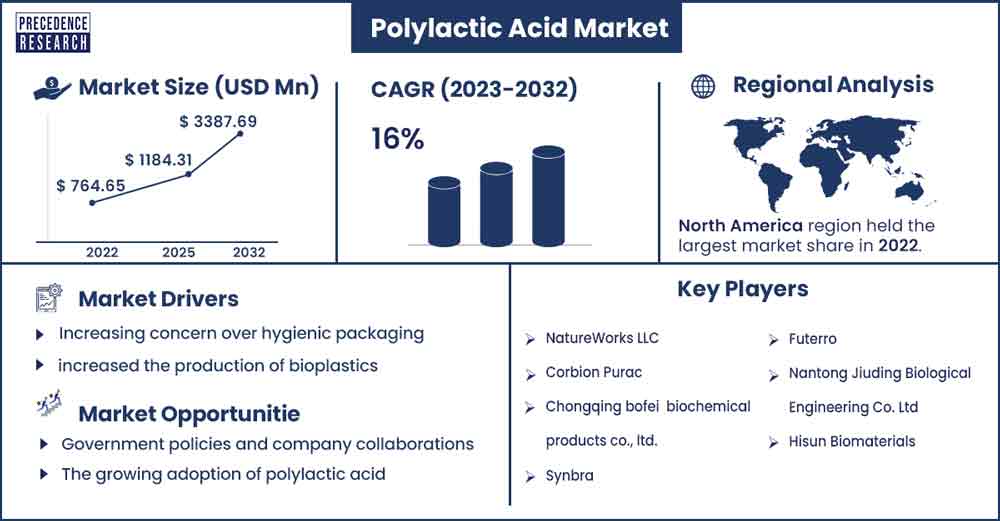

The global polylactic acid market size was exhibited at USD 764.65 million in 2022 and is anticipated to touch around USD 3,387.69 million by 2032, expanding at a CAGR of 16% from 2023 to 2032.

Market Overview

Polylactic acids are versatile materials with readily available raw ingredients in developed and emerging countries. Thus, factors such as rapid industrialization, increased use in the packaging industry, growing demand for PLA in additive manufacturing, and government initiatives support the market growth. The compound is known to exhibit high transparency, excellent processing characteristics, and strong mechanical.

Therefore, the expanding polylactic acid market is driven by the increasing need for flexible packaging, propelled by the rising demand for ready-to-eat meals, snacks, packaged foods, and other products. PLA's eco-friendly nature, emitting less CO2 than traditional plastics, has led to a substantial surge in global demand. The market's growth is thus fueled by rising demand from diverse industries such as agriculture, transportation, textiles, and packaging.

PLA, a bio-based and biodegradable polymer, finds ideal use in the packaging industry due to its excellent clarity, barrier properties, and printability. It is a sustainable alternative to traditional plastics, particularly in applications like food packaging, including trays, pouches, wraps, and labels. Moreover, its excellent clarity, barrier properties, and printability make it suitable for flexible packaging solutions, addressing the growing concerns about hygiene and food safety, particularly during the pandemic.

For instance, Indian packaging consumption has doubled over the past decade, reaching 8.6 kg per person per year, reflecting a significant market trend. PLA's renewable and compostable nature aligns with regulatory bodies and consumers' growing emphasis on sustainability and waste reduction. This is expected to drive increased adoption of PLA in various packaging solutions.

Certain notable companies are exploring the use of polylactic acid (PLA) in the healthcare sector, intending its application in implants, screws, stitching materials, and medical equipment. Additionally, PLA is expected to find utility in the automotive industry, particularly in producing tires using starch-based materials to reduce fuel consumption. For instance, in October 2021, Total Corbion PLA, a technology leader from the Netherlands, introduced Luminy PLA, made from chemically recycled post-consumer and post-industrial waste, claiming it to be the world's first commercially available bioplastic product.

The expanding polylactic acid market is driven by the increasing need for flexible packaging, propelled by the rising demand for ready-to-eat meals, snacks, packaged foods., and other products. PLA's eco-friendly nature, emitting less CO2 than traditional plastics, has led to a substantial surge in global demand. The growth of the polylactic acid market is fueled by rising demand from diverse industries such as agriculture, transportation, textiles, and packaging.

Regional Snapshot

North America took the lead in the global market, holding a significant market share. The region's growth is fueled by the rising demand for bioplastics, particularly in Europe, where PLA is a significant player, closely followed by the Asia Pacific. The market is poised for further expansion, driven by the increasing preference for environmentally friendly products, supported by initiatives promoting bioplastics. Notably, the region is witnessing heightened demand for PLA across critical automotive, electronics, textile, packaging, appliances, and medical industries.

According to FMI, North America is expected to contribute approximately 29.5% of the market share in the forecast period, driven by a growing number of research and development activities in the USA to explore new application areas for polylactic acid. Moreover, it is anticipated to dominate the packaging market in the forecast period, propelled by the burgeoning food and beverage sector, especially in India and China.

The United States holds promising growth prospects in the polylactic acid market, driven by various factors. The country enjoys ample access to raw materials and hosts major PLA manufacturers. The growing consumer inclination towards packaged food and ready-to-eat meals has spurred the expansion of the food processing market in the United States. Supportive laws and regulations implemented by the U.S. government regarding PLA production further contribute to market growth. Additionally, the convenient availability of raw materials for synthesizing PLA within the country is a significant factor in its market expansion.

- In October 2023, NatureWorks made notable advancements in building its new all-in-one Ingeo PLA biopolymer production facility in Nakhon Sawan Province, Thailand.

- In May 2023, DuPont completed the acquisition of Spectrum Plastics. This will add the company's existing bio-pharma packaging solutions to the medical devices.

Polylactic Acid Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 883.94 Million |

| Projected Forecast Revenue by 2032 | USD 3,387.69 Million |

| Growth Rate from 2023 to 2032 | CAGR of 16% |

| Largest Market | North America |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing concern over hygienic packaging

The heightened hygiene awareness during the pandemic has compelled packaging companies to innovate for a competitive edge. Polylactic acid, known for its excellent chemical properties, is extensively used as a raw material in various applications. Both primary and emerging industry companies prioritize adding PLA production capacity. This trend is anticipated to persist, contributing to the growth of the polylactic acid industry over the next decade.

Environmental aspects

The global polylactic acid market is anticipated to grow due to the rising preference for bio-based, biodegradable plastics across various industries. Companies worldwide, in both developed and developing economies, have increased the production of bioplastics in response to this trend. Additionally, the demand for polylactic acid is increasing in the medical sector, particularly in manufacturing sutures and stents, driven by advancements in medical technology globally.

Restraint

The high expense involved during production

Their high production cost hinders the growth of bio-polylactic acid films in the market. While these films offer sustainable, biodegradable, and environmentally friendly packaging solutions, their elevated production expenses make them more costly than synthetic or fossil fuel-based alternatives.

Opportunities

Government policies and company collaborations

Government authorities are implementing policies favoring sustainable and eco-friendly products in response to climate change and environmental degradation concerns. Polylactic acid films align with these policies, making them ideal choices across industries. The market is ready for growth as stringent regulations encourage the widespread adoption of polylactic acid films during the forecast period. Researchers at Michigan State University's School of Packaging have developed a sustainable alternative to enhance the biodegradability of petroleum-based plastics. In their ACS Sustainable Chemistry & Engineering journal study, Rafael Auras's team created a bio-based polymer blend utilizing polylactic acid derived from plant sugars rather than petroleum. PLA, used in packaging for over a decade, produces natural waste byproducts—water, carbon dioxide, and lactic acid—when properly managed. The study shows that PLA can biodegrade in industrial composters, providing a more environmentally friendly solution.

Multi-domain application

The growing adoption of polylactic acid in diverse applications, including coated cellophane, non-woven fibers, active packaging, and agricultural mulching, presents promising opportunities across various industries such as agriculture, electronics, food and beverage packaging, biomedical, and textiles. Additionally, the rise in genetically modified corn production and the increasing use of Bio-PLA in 3D printing contribute to the growth potential in the PLA market.

Recent Developments

- In August 2022, LG Chem, a well-known chemical company, entered into two joint ventures with ADM, a leading nutrition and bio-solutions brand, to produce polylactic acid and lactic acid in the USA. The collaboration aims to address the growing demand for various plant-based products, including bioplastics, and contribute to fulfilling market needs.

- In December 2023, Swiss technology company Sulzer will broaden its bioplastics offerings by introducing a new comprehensive licensed technology called CAPSULTM. This technology facilitates the continuous production of polycaprolactone (PCL), a biodegradable polyester widely employed in packaging, textiles, and the agricultural and horticultural sectors.

Major Key Players

- NatureWorks LLC

- Corbion Purac

- Chongqing bofei biochemical products co., ltd.

- Synbra

- Futerro

- Nantong Jiuding Biological Engineering Co. Ltd

- Hisun Biomaterials

Market Segmentation

By Raw Material

- Corn starch

- Sugarcane & sugar beet

- Cassava

- Others

By Application

- Packaging

- Agriculture

- Transport

- Electronics

- Textiles

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1244

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308