Polypropylene Corrugated Packaging Market Poised for Global Growth

Polypropylene Corrugated Packaging Market

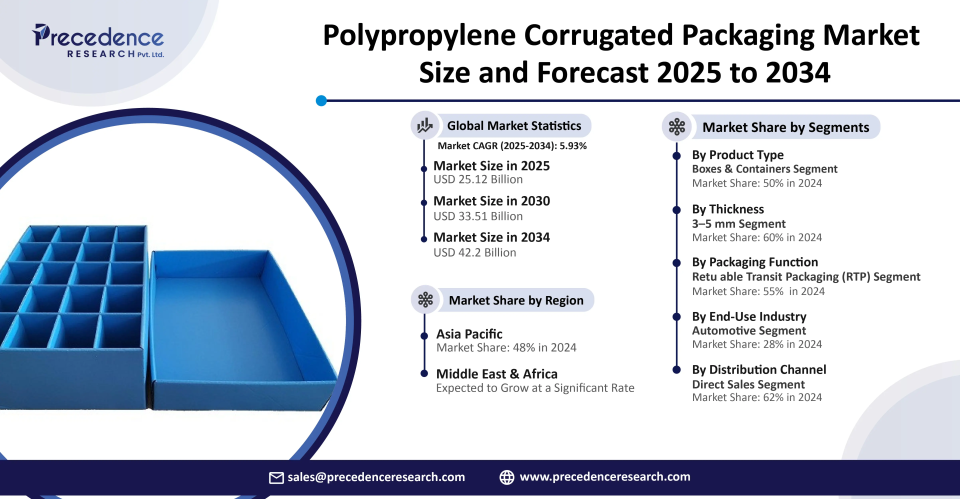

The global polypropylene corrugated packaging market size was estimated at USD 23.72 billion in 2024 and is anticipated to reach around USD 5.93 billion by 2034, growing at a CAGR of 5.93% from 2025 to 2034. The core advantages of these packaging materials in terms of durability, reusability, and cost-effectiveness drive their remarkable growth in the global market.

Global Outlook

The polypropylene corrugated packaging market is driven by the rapid shift from traditional to modern packaging materials and the numerous benefits of corrugated plastic packaging. These packaging materials are durable, cost-effective, and lightweight in nature while delivering longevity and versatility. They provide customized solutions, reduce environmental impact, and achieve sustainability. The corrugated plastic materials are applicable in various industries such as retail, e-commerce, agriculture, food, automotive, and electronics.

Market Opportunity

In March 2025, Procter & Gamble, the global leader in innovating sustainable packaging materials, celebrated global recycling day 2025 by recognizing award-winning sustainable packaging innovations. The major market players, like Procter & Gamble, focus on reducing, reusing, replacing, and recycling plastic. They also make efforts to deliver a better experience through product packaging for people with reduced environmental impact. The innovative solutions and services in packaging help industries to reduce their carbon footprint through scalable and sustainable solutions.

Key Growth Factors

The industries are launching fully recyclable alternatives to packaging materials and products.

The new inventions of clarified polypropylene (PP) bottles for healthcare applications are ideal for the packaging of various products like nutraceuticals, vitamins, beauty supplements, dietary supplements, and OTC treatments.

Market Restraint

The polypropylene corrugated packaging market revolves around economic, supply chain, environmental, regulatory, and competitive challenges. The volatile costs and the increasing competitive pressure from alternative packaging materials like paper present certain challenges in the global market. The consumers are highly preferring sustainable materials to meet their needs.

Segmental Outlook

Product Type Insights

The boxes & containers segment dominated the polypropylene corrugated packaging market in 2024 owing to their superior strength, chemical and moisture resistance, and insulation properties. These materials deliver cost efficiency and operational savings. They offer a reduced carbon footprint and reduced waste and recyclability.

The dividers & partitions segment is expected to grow at the fastest CAGR in the polypropylene corrugated packaging market during the forecast period due to enhanced protection of products, cost efficiency, and sustainability. The innovative packaging materials improve logistics and operational efficiency. They support the growth of e-commerce, address market demands, and facilitate branding.

Thickness Insights

The 3–5 mm segment dominated the polypropylene corrugated packaging market in 2024 owing to the superior durability and protection of packaged products. The packaged materials with 3-5 mm strength enable competitive pricing and deliver cost efficiency. They also provide easy customization and superior printability.

The >5 mm segment is expected to grow at the fastest CAGR in the polypropylene corrugated packaging market during the forecast period due to greater longevity and reusability. The materials of >5 mm strength offer enhanced protection against external elements. They have wide applications in logistics, warehousing, automotive, electronics, agriculture, and construction.

Packaging Function Insights

The retu able packaging (RTP) segment dominated the polypropylene corrugated packaging market in 2024 owing to the economic benefits of these materials in terms of reduced long-term costs, superior protection of products, and lower waste disposal fees. They offer compatibility with automation and optimized transport and storage. They contribute to a circular economy and have a lower carbon footprint.

The protective packaging segment is expected to grow at the fastest CAGR in the polypropylene corrugated packaging market during the forecast period due to superior moisture and chemical resistance provided by these materials. They support reusable and returnable packaging systems and provide customized and branding solutions. They enable the growth of e-commerce and AI-driven optimization.

End-Use Industry Insights

The automotive segment dominated the polypropylene corrugated packaging market in 2024 owing to reduced logistics costs and space-saving design. Certain materials used in the automotive industry are highly recyclable and offer a lower carbon footprint. They exhibit specialized properties and enable smart tracking and supply chain transparency.

The agriculture segment is expected to grow at the fastest CAGR in the polypropylene corrugated packaging market during the forecast period due to improved airflow, reduced shipping costs, and easy cleaning applications of agricultural products. They contribute to a greener supply chain and enable fresh produce. They are used in the packaging of seeds, fertilizers, and feeds.

Distribution Channel Insights

The direct sales segment dominated the polypropylene corrugated packaging market in 2024 owing to the increased profit margins and direct control over sales. They strengthen client relationships and provide tailored solutions. They offer enhanced technical support and lower costs per unit.

The online retail segment is expected to grow at the fastest CAGR in the polypropylene corrugated packaging market during the forecast period due to reduced shipping costs, improved shipping efficiency, customization options, and fewer returns. The online retail channels allow a lower carbon footprint and strong brand perception. These distribution channels help to achieve sustainability and high recyclability.

Geographical Outlook

Asia Pacific

Asia Pacific dominated the polypropylene corrugated packaging market in 2024 due to the e-commerce boom, rapid industrialization, and urbanization. The National Environment Agency, in partnership with the Singapore Manufacturing Federation (SMF), launched an industry-led initiative named the packaging partnership program (PPP) for the development of industrial capabilities in sustainable packaging waste management. The Asia Pacific Economic Cooperation is dedicated to promoting recyclable materials policies in the Asia Pacific region. It also makes efforts to promote clearer materials quality standards for paper, plastics, and organics. This contribution improves the financial sustainability and public expenditure.

The World Bank Group made efforts towards a national single-use plastics roadmap in Vietnam and provides strategic options to reduce single-use plastics.

India

The Government of India and the Ministry of Health and Family Welfare reported the importance of eco-friendly packaging solutions and the potential of India to drive sustainability. The Minister of State organized an open consultation with stakeholders to offer them favorable opportunities for future growth and improvement. This session united around 1500 stakeholders, leading food businesses, recycling associations, packaging industries, regulatory bodies, consumer groups, environmental organizations, farmer groups, and government departments.

- In April 2025, Shri Prataprao Ganpatrao Jadhav, Union Minister of State for Health and Family Welfare, opened the National Stakeholder Consultation on sustainable packaging for food business and emerging global trends and regulatory framework which was held by the Food Safety and Standards Authority of India (FSSAI) at Mumbai in April 2025.

The Middle East and Africa

The Middle East and Africa is expected to grow at the fastest CAGR in the polypropylene corrugated packaging market during the forecast period. This regional growth is attributed to the policy shifts by the governments of Africa and the Middle East that accelerate the need for sustainable packaging in this region. The policies encompass stricter plastic labeling rules, Nigeria’s national ban on single-use plastics, and many other aspects.

South Africa

South Africa led the plastics action towards trade and circular economy. It focuses on improving recycling rates to create strong domestic and regional recycling markets. It also focuses on aligning domestic policy to boost circularity. The regional government efforts are enhancing the management of plastic and plastic waste at the border.

- In May 2025, the Plastics Recycling Awards Middle East and Africa was launched that provides an exclusive and a brand-new platform to recognize success in plastic recycling across the region.

Strategic Moves by Key Players

- In October 2024, Berry, the packaging solutions provider, launched several clarified polypropylene (PP) bottles for their applications in healthcare.

- In January 2024, WestRock planned to establish a new corrugated box plant in Wisconsin to meet the growing demands of customers in the Great Lakes region.

Polypropylene Corrugated Packaging Market Companies

- International Paper

- Smurfit Kappa Group

- WestRock

- TGI Packaging Pvt. Ltd.

- Flexituff Ventures International Ltd.

- Time Technoplast Ltd.

- Pioneer Enterprises (I) Pvt. Ltd.

- Aakanksha Packaging

- Protech

- Jaayo Plast

- Golden Pack

- DS Smith Plc

- Nefab Group

- Sohner Kunststofftechnik GmbH

- Inteplast Group

Polypropylene Corrugated Packaging Market Segments

By Product Type

- Boxes & Containers

- Sheets & Rolls

- Totes & Bins

- Dividers & Partitions

By Thickness

- <3 mm

- 3–5 mm

- 5 mm

By the Packaging Function

- Retu able Transit Packaging (RTP)

- Protective Packaging

- Display & Promotional Packaging

By End-Use Industry

- Automotive

- Agriculture

- Food & Beverage

- Pharmaceutical & Healthcare

- Electronics

- Retail & E-commerce

- Logistics & Warehousing

By Distribution Channel

- Direct Sales

- Distributors/Wholesalers

- Online Retail

By Region

- North America

- U.S.

- Canada

- Mexico

- Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Source: https://www.towardspackaging.com/insights/polypropylene-corrugated-packaging-market-sizing