What is the Returnable Packaging Market Size?

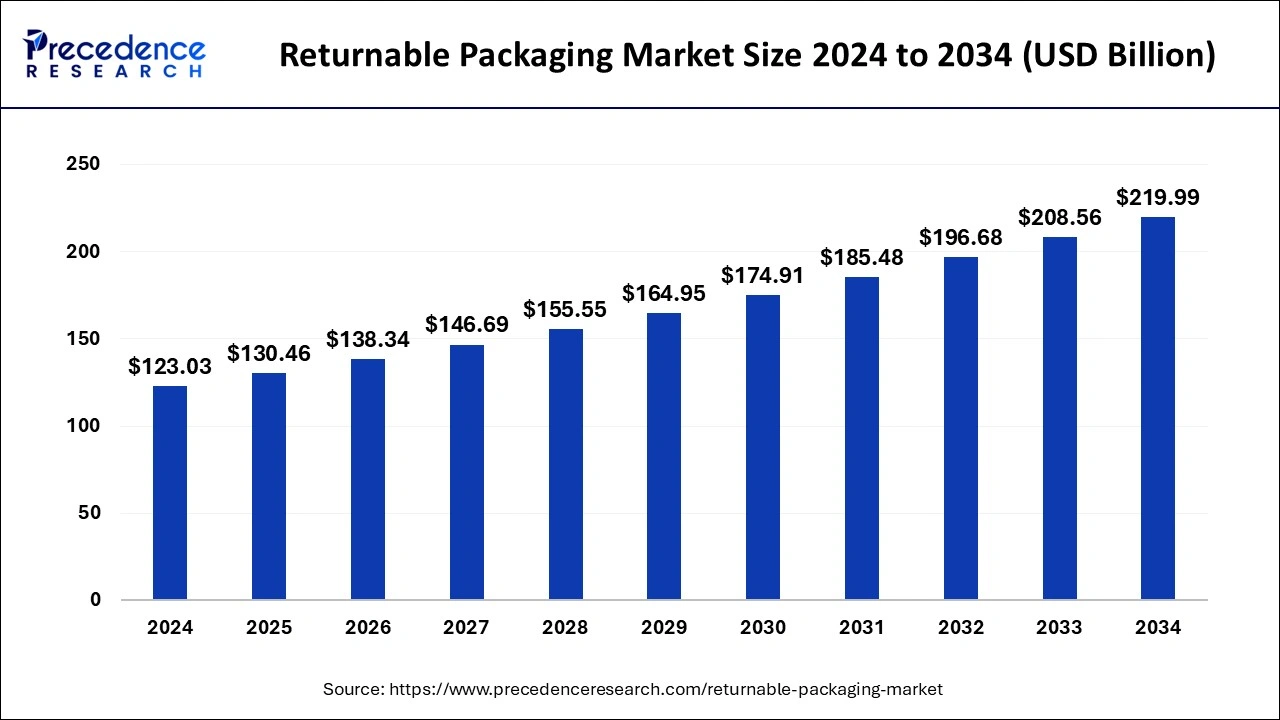

The global returnable packaging market size is calculated at USD 130.46 billion in 2025 and is predicted to increase from USD 138.34 billion in 2026 to approximately USD 219.99 billion by 2034, expanding at a CAGR of 5.98% from 2025 to 2034.The growth of the returnable packaging market is driven by the rising demand for sustainable packaging solutions and the growing focus on reducing packaging waste.

Returnable Packaging Market Key Takeaways

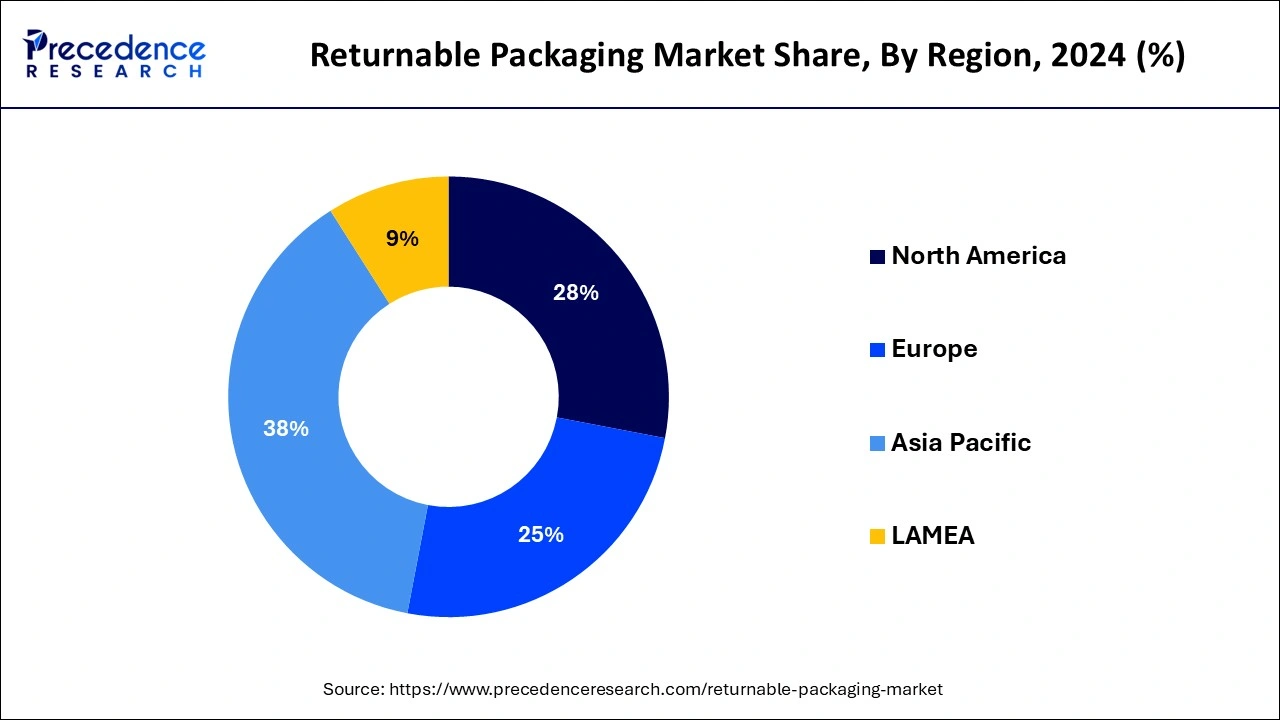

- Asia Pacific dominated the returnable packaging market with the largest revenue share of 38% in 2024.

- By material, the plastic segment has contributed more than 64% of the revenue share in 2024.

- By material, the metal segment is expected to grow at the highest CAGR of 6.71% during the forecast period.

- By product, the pallets segment accounted for the major revenue share of 58% in 2024.

- By product, the IBC segment is projected to grow at the highest CAGR of 7.15% during the forecast period.

- By end-use, the food & beverage segment has held the biggest revenue share of 36% in 2024.

- By end-use, the healthcare segment is expected to expand at a solid CAGR of 6.92% during the forecast period.

Market Overview

The returnable packaging market refers to the sector of reusable packaging, which is a term used to describe packing materials intended to be reused several times before being discarded or recycled. The materials used to make these kinds of packaging are usually strong enough to endure handling and frequent usage.

The reusable packaging is frequently utilized in a variety of sectors to save waste, minimize packaging expenses, and enhance environmental sustainability. The returnable packaging is a popular choice for many sectors looking for environmentally friendly packaging solutions since it has several benefits, including operational, economic, and environmental ones.

The returnable packaging market is fragmented with multiple small-scale and large-scale players, such as ORBIS Corporation, NEFAB GROUP, PPS Midlands Limited, Tri-pack Packaging Systems Ltd., Amatech, Inc., CHEP, Celina, UBEECO Packaging Solutions, RPR Inc., RPP Containers, IPL, Inc., Schoeller Allibert.

Impact of AI on the Returnable Packaging Market

The use of artificial intelligence (AI) in returnable packaging businesses helps optimize delivery processes while managing stock better and using materials more effectively. AI technologies help companies create better packaging designs while using less material and resources. Advanced technologies like AI and ML help manufacturers create reusable packaging solutions that meet strict environmental regulations while working well for multiple usage types. Moreover, integrating AI technologies in the production processes of returnable packaging automates processes and reduces waste generation, thereby enhancing production efficiency.

Regulations & Compliance

The Packaging and Packaging Waste Regulation (PPWR), which is a regulation of the European Union, focuses on the reduction of packaging waste, as well as the promotion of the circular economy. Starting from February 12, 2025, and becoming binding as of August 12, 2026, it requires that by 2030, packaging materials should be fully recyclable and by 2038, at least 80% of packaging should be recyclable. It has set a target of having at least 35% of the packaging material made up of recycled materials by the year 2030.

Returnable Packaging Market Outlook

- Industry Growth Overview: The returnable packaging market is expected to experience robust growth between 2025 and 2034, driven by increasing demand for sustainable supply chain solutions and cost-effective, reusable packaging systems. Rising environmental regulations, corporate sustainability initiatives, and the adoption of circular economy practices further accelerate market growth.

- Sustainability Trends: Sustainability has become the main force driving market because of corporate ESG requirements, circular economy laws, and rising consumer demands to reduce packaging waste. Recyclable packaging vendors are investing heavily in high-strength recyclable polymers, new molding technologies, and reusable systems that produce less carbon throughout their lifecycle. Additionally, RFID-enabled asset tracking is also enhancing sustainability by reducing losses, increasing recovery rates, and extending asset lifespan.

- Global Expansion:Major manufacturers of returnable packaging are expanding globally to serve high-growth industrial regions and enhance regional supply chain efficiency. Southeast Asia, Eastern Europe, Latin America, and the Middle East are emerging as strategic expansion zones driven by rapid industrialization and rising manufacturing investments. Additionally, multinational brands are adopting standardized returnable systems in these markets to ensure consistent quality and global conformity.

- Major Investors: Major investors in the market include packaging solution providers, logistics companies, and venture capital firms that fund innovations in reusable, durable, and sustainable packaging systems. Their investments drive market growth by supporting R&D, expanding manufacturing capacities, and enabling the adoption of standardized, cost-effective, and environmentally friendly packaging solutions across global supply chains.

Returnable Packaging Market Growth Factors

- Growing Emphasis on Sustainability: As people become aware of the negative impact of packaging waste on the environment, they are shifting toward sustainable practices. This, in turn, boosts the demand for returnable packaging.

- Technological Advancements: Rising advancements in packaging technologies enhance the durability and efficiency of returnable packaging.

- Regulatory Measures by Government: Governments of various nations are implementing strict regulations regarding packaging waste management. Thus, businesses are adopting returnable packaging to comply with these regulations.

- Cost-efficiency: Customers can save money in the long run through reusable packaging because it reduces throwaway products and waste disposal expenses.

- Expanding E-commerce Businesses: As e-commerce businesses increase, the need for returnable packaging to meet shipping demands further increases.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 130.46 Billion |

| Market Size in 2026 | USD 138.34 Billion |

| Market Size in 2034 | USD 219.99 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.98% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Material, Product, End-use, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing retail and e-commerce sectors

The growing retail and e-commerce sectors boost the returnable packaging market. The need for effective and affordable packaging solutions has grown due to the retail and e-commerce sectors' explosive expansion. In these quick-paced industries, returnable packaging contributes to increased logistical efficiency, decreased packaging waste, and cheaper shipping expenses.

Restraint

Costs of the initial investment

A few organizations in the returnable packaging market may find it prohibitive to incur the upfront expenditures of installing returnable packaging solutions, which include buying sturdy containers and establishing reverse logistics procedures. Budgetary restrictions or concerns about return on investment (ROI) may cause businesses to pause.

Opportunity

Sensitive product protection and superior quality

The sensitive product production and superior quality can boost the returnable packaging market. Reliable and secure packaging solutions are necessary for industries that deal with high-value and delicate items, such as electronics, chemicals, and medicines. High-quality protection against contamination and damage during transit is offered by returnable packing.

Technological Advancement

New technologies, including smart packages with RFID tags, IoT sensors, and GPS tracking, are making it possible to track shipments, manage assets, and minimize losses. Automation and robotics are influencing the cleaning, handling, and sorting of returned merchandise, improving reverse logistics and its cost-effectiveness. In addition, there is a growing trend in the use of online tools that allow firms to track their packaging fleets, plan their usage cycle, and even provide information for maintenance planning.

Segmental Insights

Material Insights

The plastic segment dominated the returnable packaging market in 2024. Returnable plastic packaging, such as crates, pallets, and containers, is incredibly strong and can endure repeated usage without suffering from severe damage. Because of its durability, firms wishing to invest in reusable packaging solutions may do so at a reasonable price. Compared to other materials like metal or glass, plastic is substantially lighter. These lightweight characteristics ease handling and lower transportation costs, which improves operational efficiency.

Plastic is versatile and can be molded into a broad range of sizes and forms, meeting the needs of many industries and applications. Because of its adaptability, it may be tailored to certain industries, such as the food and beverage, automotive, electronics, or retail sectors. Plastic returnable packaging can have a high initial cost, but because of its reusability, decreased damage rates, and lessened shipping, there are long-term cost advantages.

The metal segment is expected to grow at the highest CAGR in the returnable packaging market during the forecast period. Metal packaging is incredibly strong and resilient, able to handle challenging circumstances and large weights. This makes it perfect for sectors like heavy machinery, industrial products, and automobiles that need robust packaging solutions. Steel racks, aluminum containers, and metal pallets are examples of returnable packaging made of metal that usually lasts longer than other materials.

Over time, this long-term use increases productivity and reduces costs. Metals are good for moving big, heavy objects because they can support large weight loads without fracturing or deforming. This is especially crucial for industries like aerospace and automotive. Packaging made of metal is resistant to corrosive conditions, impacts, and high temperatures. Because of its robustness, it may be used in industries with demanding standards and challenging operating environments.

Product Insights

The pallets segment dominated the returnable packaging market in 2024. Pallets are an essential part of supply chain logistics in a number of sectors, such as manufacturing, food and beverage, retail, and pharmaceuticals. Because of their adaptability, they are essential for moving a variety of goods. Pallets help transport items with forklifts, pallet jacks, and automated warehouse systems more easily and efficiently. This increases the efficiency of logistics overall, lowers labor costs, and speeds up loading and unloading times.

Pallets are available in standard sizes, which facilitates operations, maximizes storage capacity, and guarantees interoperability with international shipping containers and transit networks. The smooth incorporation of these standards into supply chains is essential. Returnable pallets are built to be strong and resilient, especially if they are composed of plastic and metal. Their sturdy design lessens the need for frequent replacements, which raises the price.

The IBC segment is expected to grow at the highest CAGR in the returnable packaging market during the forecast period. IBCs are extremely adaptable and found in many different industries, including agriculture, food & beverage, chemicals, and pharmaceuticals. Their versatility in storing and moving both liquids and solids makes them essential in many industries.

IBCs are significantly less expensive than conventional packaging options. Because of its huge capacity, fewer smaller containers are required, which results in less money spent on handling, storing, and shipping. IBCs are made of sturdy materials that are meant to last and be reused, such as metal or high-density polyethylene (HDPE). When compared to solutions for single-use packaging, this longevity guarantees a superior return on investment. Because of their stackable shape, IBCs maximize storage capacity both during transit and in warehouses. This effective use of space is especially advantageous for companies trying to get the most out of their storage capacity.

End-use Insights

The food & beverage segment dominated the returnable packaging market in 2024. The food and beverage sector handles a lot of products every day; thus, effective and dependable packaging solutions are needed to guarantee secure storage and transit. Strict safety and sanitary regulations apply to the sector. Plastic crates, pallets, and bins are examples of returnable packing options that are readily sterilized and reused while adhering to health laws.

Packaging that may be returned lowers the costs of single-use packaging, including ongoing purchases and disposal charges. This cost-effectiveness is essential in a sector where profit margins are narrow. In an effort to lessen its influence on the environment, the food and beverage sector is placing a greater emphasis on sustainability. Returnable packaging helps these efforts by cutting down on waste and the requirement for raw materials.

The healthcare segment is expected to grow at the highest CAGR in the returnable packaging market during the forecast period. Medical supply and prescription drug packing and delivery are governed by stringent laws that apply to the healthcare business. In order to guarantee compliance and safety, returnable packaging solutions may be created to match these strict requirements. Healthcare goods such as medications and medical gadgets are frequently expensive and environmentally sensitive.

Delivered in returnable packing, there is less chance of damage and contamination since it offers better stability and protection. Reducing its environmental impact is driving the healthcare business to embrace more sustainable methods. Because it reduces waste and encourages the reuse of packaging materials, returnable packaging supports these efforts.

Regional Insights

Asia Pacific Returnable Packaging Market Size and Growth 2025 to 2034

The Asia Pacific returnable packaging market size is exhibited at USD 49.57 billion in 2025 and is projected to be worth around USD 84.69 billion by 2034, poised to grow at a CAGR of 6.12% from 2025 to 2034.

What Made Asia Pacific the Dominant Region in the Market?

Asia Pacific dominated the returnable packaging market in 2024. Asia Pacific has seen tremendous urbanization and industrial expansion, which has raised demand for effective packaging solutions in a number of sectors, including manufacturing, electronics, and the automobile industry. Due to increased internet usage and consumer spending,e-commerce has flourished in the area. In this rapidly expanding industry, returnable packaging is crucial for the economical and efficient transportation of goods.

Major hubs for export and manufacturing include China, India, Japan, and South Korea. Reusable and dependable packaging solutions are essential for the economical and secure transportation of products. In Asia Pacific, environmental impact reduction and sustainability are becoming more and more important. The returnable packaging market is being embraced by businesses and governments as a way to reduce waste and encourage the circular economy.

China Returnable Packaging Market Trends

China is a major contributor to the market in Asia Pacific. The market in the country is driven by its massive manufacturing base across electronics, automotive, and FMCG sectors, which is increasingly adopting returnable crates, pallets, and component trays to improve high-volume production efficiency. Government-led sustainability initiatives promoting material circularity further support the transition to reusable systems within industrial clusters.

What Makes North America a Significantly Growing Area?

North America is expected to witness significant growth in the returnable packaging market during the forecast period. The automotive, aerospace, pharmaceutical, and consumer goods sectors are just a few of the well-established businesses found in North America, especially in the United States and Canada. The market for returnable packaging is expanding as a result of these sectors' need for robust and effective packaging solutions.

In North America, there is a considerable emphasis on environmental effect reduction and sustainability. The returnable packaging market is becoming more and more popular among businesses as a way to reduce waste and encourage environmentally friendly behaviors that also comply with legal requirements and corporate social responsibility objectives. The area has a well-established logistics and supply chain, which facilitates the effective use of returnable packaging technologies. The modern logistics networks make it easier to organize, trace, and return recyclable packaging.

U.S. Returnable Packaging Market Trends

The U.S. is considered a major player in the North American returnable packaging market due to its large manufacturing and logistics sectors, which drive high demand for reusable pallets, crates, and bulk containers. The rising adoption of technologies such as RFID tracking, along with significant investments in washing, refurbishment, and repair facilities, enhances supply chain efficiency and supports the widespread implementation of returnable packaging systems across industries.

What Potentiates the Growth of the European Returnable Packaging Market?

Europe is projected to experience the fastest growth in the coming years, driven by stringent environmental regulations that limit single-use plastics and promote circular logistics. Reusable totes, foldable bulk containers, and dunnage systems are increasingly adopted across the automotive, chemical, and food sectors, aligning with strict ESG compliance standards. Additionally, long-term circular economy directives by EU member states are expected to further boost demand for reusable materials over disposable alternatives.

Germany Returnable Packaging Market Trends

In Germany, the market is driven by its strong industrial base, particularly in automotive, chemical, and manufacturing sectors, which rely heavily on reusable pallets, crates, and bulk containers. The country's strict environmental regulations, focus on sustainability, and adoption of circular economy practices drive the widespread use of returnable packaging, while German manufacturers lead in innovation, quality, and efficient asset management systems.

What Opportunities Exist in Latin America for the Returnable Packaging Market?

Latin America presents significant opportunities in the market due to rapid industrialization, growing manufacturing investments, and increasing adoption of sustainable supply chain practices. Brazil is a major contributor to the region, driven by its large automotive, FMCG, and electronics sectors, which increasingly use reusable pallets, crates, and bulk containers to improve efficiency. Additionally, emerging markets across Mexico, Argentina, and Chile are witnessing growth as multinational companies standardize returnable systems to ensure quality and reduce operational costs. The rising focus on circular economy initiatives and environmental sustainability further supports the expansion of returnable packaging solutions across the region.

What Drives the Growth of the Market in the Middle East & Africa?

The growth of the returnable packaging market in the Middle East & Africa (MEA) is driven by increasing industrialization, the expansion of manufacturing sectors, and rising adoption of sustainable supply chain practices. Saudi Arabia is a major contributor to the region, supported by its large automotive, chemical, and food industries, which rely on reusable pallets, crates, and bulk containers to enhance operational efficiency. Additionally, government initiatives promoting environmental sustainability and circular-economy practices are encouraging the shift from disposable to returnable packaging. Investments in logistics infrastructure, refurbishment facilities, and technology-enabled tracking systems further boost the market's growth across MEA countries.

Returnable Packaging Market – Value Chain Analysis

Raw Material Sourcing

Returnable packaging products are primarily made from plastics (HDPE, PP), metals (steel, aluminum), wood, textiles, and composite materials. This stage involves sourcing durable, reusable, and cost-efficient raw materials that withstand repeated handling cycles.

- Key Players: SABIC, ExxonMobil, ArcelorMittal, UPM Timber.

Component Fabrication

In this stage, sourced materials are converted into components such as plastic sheets, molded parts, metal frames, wooden structures, fabrics, and protective inserts. These components serve as building blocks for reusable crates, pallets, totes, and bulk containers.

- Key Players: DS Smith, Sonoco Products Company, Pregis, Sealed Air.

Packaging Product Manufacturing

Fabricated components are assembled or molded into finished returnable packaging units, including pallets, foldable bulk containers, RPCs (Reusable Plastic Crates), IBCs, dunnage, totes, racks, and customized solutions.

- Key Players: ORBIS Corporation, Schoeller Allibert, NEFAB Group, RPP Containers, IPL Inc.

Pooling, Tracking & Service Operations

After manufacturing, packaging enters service models that include rental, pooling, washing, refurbishment, RFID tracking, and lifecycle management. This stage is essential for optimizing asset utilization and maintaining quality across supply chains

- Key Players: CHEP, Tosca, PPS Midlands Limited, Tri-Pack Packaging Systems, RPR Inc.

Distribution to End-Use Industries

Returnable packaging solutions are delivered to industries such as automotive, food & beverage, e-commerce, pharmaceuticals, and retail chains. This stage focuses on integrating reusable packaging into logistics processes to reduce waste and enhance supply-chain efficiency.

- Key Players: UBEECO Packaging Solutions, Celina, Amatech Inc., Tri-Wall, Loscam.

Top Companies in the Returnable Packaging Market & Their Offerings

- ORBIS Corporation (U.S.): A leading provider of reusable plastic containers, pallets, and dunnage systems designed to improve supply-chain efficiency across automotive, retail, and food industries.

- NEFAB Group (Sweden):Specializes in durable returnable packaging solutions—including thermoformed trays and customized logistics systems focused on reducing total cost and environmental impact.

- PPS Midlands Limited (UK): Offers a full-service returnable transit packaging program with reusable crates, pallets, and IBCs enhanced by washing, rental, and tracking services.

- Tri-Pack Packaging Systems Ltd. (UK):Provides recyclable and returnable polypropylene packaging such as totes and trays tailored for fresh food, pharmaceutical, and industrial applications.

- Amatech, Inc. (U.S.): Manufactures custom reusable packaging made from corrugated plastic, including totes, partitions, and protective dunnage for automotive and aerospace supply chains.

- CHEP (Australia): A global leader in pallet and container pooling services, offering reusable pallets and crates that streamline logistics and support circular supply-chain models.

- Celina (U.S.):Produces custom returnable textile-based packaging solutions such as industrial fabric containers, covers, and protective sleeves for heavy-duty manufacturing environments.

- UBEECO Packaging Solutions (Australia):Delivers reusable timber, plastic, and hybrid packaging systems engineered for industrial transport, export logistics, and material-handling durability.

- RPR Inc. (U.S.): Designs robust reusable packaging systems including molded plastic pallets, totes, and custom material-handling units optimized for high-cycle industrial operations.

- RPP Containers (U.S.): Supplies reusable plastic bulk containers, totes, and bins widely used in food processing, manufacturing, and distribution networks.

- IPL, Inc. (Canada): Provides sustainable reusable plastic containers, bins, and bulk packaging engineered for retail, agriculture, and industrial applications.

- Schoeller Allibert (Netherlands):One of the world's largest manufacturers of reusable plastic packaging, offering foldable large containers, stackable crates, pallets, and intermediate bulk containers for global supply chains.

Industry Leader Announcement

- In October 2024, Tri-Wall Circular introduced its reusable packaging solution, the YOYOBin Adjustable, which is lightweight compared to conventional metal and plastic containers and aims to increase efficiency in the automotive industry. Rodney Salmon, automotive director at Tri-Wall Circular, said, "the automotive industry's focus on lightweighting doesn't just apply to the vehicle itself, but it extends to every part of the supply chain. The YOYOBin Adjustable addresses this by offering a packaging solution that reduces weight while maintaining strength and durability.”

Recent Developments

- In April 2024, Uber Eats started provided takeout with food in reusable, returnable packaging, while also expanding its partnership to Los Angeles, San Francisco, and other cities on the West Coast of the United States.

- In March 2024, French beauty brand Yves Rocher announced the launch of Bain de Nature eco refill packs, which contains bath and shower gels, and is made of up to 90% recycled plastic, This initiative, as reported includes packaging that uses four times less plastic than a conventional 400ml bottle, with this initiative aimed at delivering against consumer demand for sustainable alternatives, and fulfilling national and European objectives related to plastic usage.

- In February 2024, Glow Recipe, a well-known brand specializing in skincare products, launched a refillable unit for its Watermelon Glow Pink Juice Oil-Free Moisturizer. As reported, the new packaging is made from 95% post-consumer recycled plastic, which represents approximately 59% less carbon emissions and 51% less waste compared to their single-use products.

- In November 2024, Cummins introduced a returnable packaging initiative utilizing RFID tracking to minimize packaging waste, enhance asset movement, and lower labor expenses throughout its operations.

Segment Covered in the Report

By Material

- Plastic

- Metal

- Wood

By Product

- Pallets

- Crates

- IBCs

- Drums & Barrels

- Dunnage

- Others

By End-use

- Food & Beverage

- Automotive

- Consumer Durables

- Healthcare

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting