Power MOSFET Market Size to Rise USD 40.92 Billion By 2032

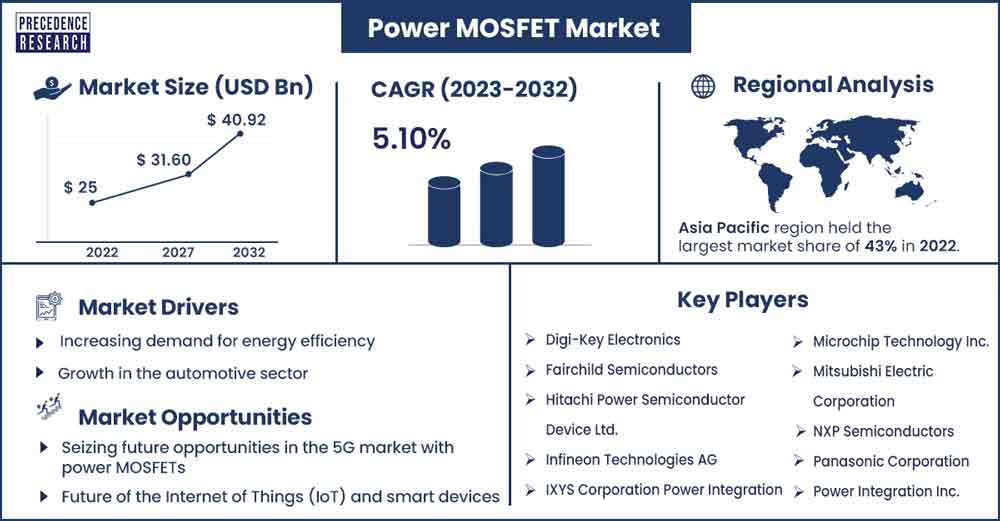

The global power MOSFET market size surpassed USD 25 billion in 2022 and is expected to rake around USD 40.92 billion by 2032, poised to grow at a CAGR of 5.10% from 2023 to 2032.

Market Overview

A power MOSFET, or metal-oxide-semiconductor field-effect transistor, is a crucial electronic component widely used in various applications, particularly in power electronics. This semiconductor device plays a pivotal role in controlling and amplifying electrical signals. Its fundamental structure comprises a metal gate insulated from the semiconductor material by a thin oxide layer. The voltage applied to the gate terminal modulates the conductivity of the semiconductor, allowing the MOSFET to function as a switch or an amplifier.

In power electronics, power MOSFETs are employed for their ability to handle high voltage and current levels efficiently. The unique advantage lies in their fast-switching speed and low on-resistance, enabling them to manage power with minimal losses. This characteristic makes power MOSFETs invaluable in applications such as voltage regulators, motor control, inverters, and power supplies. Their prevalence in these systems stems from the MOSFET's ability to efficiently control the flow of electrical power, making it an essential component in modern electronic devices and industrial equipment. The activities related to the power MOSFET market involve continuous innovation and development to meet the ever-evolving demands of various industries.

Industrial trends also influence the activities surrounding the power MOSFET market. As the demand for energy-efficient electronic systems grows, the market witnesses a surge in the adoption of power MOSFETs in electric vehicles, renewable energy systems, and smart grids. Manufacturers engage in strategic collaborations and partnerships to expand their product portfolios and cater to emerging markets. Moreover, regulatory initiatives promoting energy efficiency and environmental sustainability drive the development of power MOSFETs with improved performance metrics.

Regional Snapshot

The dominance of Asia-Pacific in the power MOSFET market is driven by robust industrialization, increasing consumer electronics demand, and a growing focus on energy-efficient technologies. Key players contributing to this dominance include semiconductor giants like Infineon Technologies AG, STMicroelectronics, and Mitsubishi Electric Corporation. These companies leverage advanced manufacturing processes and innovative design techniques to produce power MOSFETs with high efficiency and reliability.

China, as a key player in the Asia-Pacific power MOSFET market, plays a pivotal role in driving growth. Its manufacturing prowess and the expansive consumer electronics market contribute significantly to the increasing demand for power MOSFETs. Moreover, the region is involved in extensive research and development efforts focused on enhancing the efficiency, reliability, and performance of power MOSFETs. Engineers and scientists work on refining fabrication processes, exploring new materials, and optimizing designs to push the boundaries of what these devices can achieve.

Europe, with strong nations like the U.K., Germany, and France, is expected to witness significant growth. This can be attributed to factors such as market saturation, economic fluctuations, and stringent regulatory frameworks. The region’s historical emphasis on traditional industries might contribute to a more gradual adoption of cutting-edge technologies.

North America represented by key players like U.S. and Canada demonstrating a strong foothold in the power MOSFET market. The region benefits from a mature electronics industry, robust research and development activities, and a high adoption rate of advanced technologies. The U.S., in particular, serves as a technological hub, fostering innovation and creating a conducive environment for the proliferation of power MOSFETs. Efforts are made to reduce production costs, making power MOSFETs more accessible to a broader range of applications. Ongoing research, development activities, and market trends contribute to the evolution of these devices, ensuring they meet the dynamic requirements of modern electronic applications while promoting energy efficiency and sustainability.

Power MOSFET Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 26.15 Billion |

| Projected Forecast Revenue by 2032 | USD 40.92 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 5.10% |

| Largest Market | Asia-Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing demand for energy efficiency

The increasing demand for energy efficiency propels the power MOSFET market as industries and consumers prioritize sustainable solutions. With their prowess in enhancing power management and reducing energy consumption, power MOSFETs play a pivotal role in meeting this demand. In the automotive sector, the adoption of electric vehicles relies heavily on power MOSFETs for efficient power conversion, contributing to the overall energy efficiency of the transportation industry. Similarly, in smart manufacturing, these components facilitate precise control, minimizing energy wastage. This surge in demand for energy-efficient solutions significantly drives the market, positioning power MOSFETs as crucial components across diverse industries.

Growth in the automotive sector

The automotive sector's transition to electric vehicles and the integration of advanced electronic systems are pivotal drivers for the escalating demand for the power MOSFET market. With electric vehicles becoming mainstream, power MOSFETs play a crucial role in motor drives, managing power distribution, and enhancing overall energy efficiency. Additionally, advanced electronic systems within vehicles, ranging from infotainment to safety features, necessitate efficient power management, further propelling the adoption of power MOSFETs. As automakers continue to prioritize electrification and smart technologies, the demand for power MOSFETs is poised to persist and expand, solidifying their integral role in shaping the automotive industry's future.

Restraint

Complex manufacturing process

The complexity of manufacturing power MOSFETs stems from intricate processes like semiconductor wafer fabrication, multiple layers of metal interconnects, and precise doping techniques. These intricacies contribute to elevated production costs, encompassing specialized equipment and skilled labor.

As a result, the overall cost of power MOSFETs remains relatively high, potentially limiting their widespread adoption, especially in cost-sensitive markets. Manufacturers continually seek innovations to streamline production processes and reduce costs, aiming to make power MOSFET technology more economically viable for a broader range of applications and industries, fostering increased accessibility and market penetration.

Opportunities

Seizing future opportunities in the 5G market with power MOSFETs

The surge in 5G infrastructure deployment unfolds substantial prospects for the power MOSFET market. As 5G networks evolve, the demand for advanced power management solutions intensifies, and power MOSFETs stand at the forefront of this transformation. These devices, pivotal for efficient power amplification and signal processing in communication infrastructure, become linchpins in enhancing 5G network performance.

Manufacturers and innovators can capitalize on this opportunity by developing cutting-edge power MOSFET technologies that cater to the specific demands of 5G applications, ensuring energy efficiency and reliability. This forward-looking approach positions businesses to play a key role in shaping the future of 5G connectivity.

Future of the Internet of Things (IoT) and smart devices

In the ever-expanding landscape of IoT and smart devices, power MOSFETs emerge as fundamental components driving efficiency and miniaturization. As the demand for compact and energy-efficient solutions intensifies, the power MOSFET market plays a pivotal role in enhancing power management across diverse applications.

Future market opportunities lie in the continuous innovation of MOSFET technologies tailored for IoT, smart homes, and wearables. Optimizing for lower power consumption, smaller form factors, and reliable performance positions businesses to meet the evolving demands of the smart device ecosystem, ensuring that power MOSFETs remain integral in shaping the future of connected and intelligent technologies.

- In February 2022, Infineon Technologies unveiled the OptiMOS Power MOSFETs in the PQFN 2x2 mm² package.

Recent Developments

- In October 2023, Littelfuse introduced the IXTY2P50PA, the inaugural automotive-grade PolarP P-Channel Enhancement Mode Power MOSFET. Designed for high-voltage automotive and industrial applications, this -500 V, -2 A MOSFET boasts a low on-state resistance of 4.2 Ω, 11.9 nC gate charge, and AEC-Q101 qualification.

- In November 2023, Toshiba introduced the SSM10N961L MOSFET, designed for USB devices and lithium-ion battery protection in laptops and tablets. This 30V N-channel common-drain MOSFET boasts low on-resistance, ideal for applications above 12V. Enclosed in the TCSPAG-341501 package, it offers a compact footprint. Toshiba also unveiled a power multiplexer circuit reference design based on this innovation.

- In November 2023, Nexperia introduced its first silicon carbide MOSFETs, the NSF040120L3A0 and NSF080120L3A0. These 1200V devices, available in 3-pin TO-247 packaging, feature RDS(on) values of 40mΩ and 80mΩ. This launch marks the beginning of Nexperia’s SiC MOSFET portfolio, with plans for various devices in various packages.

Major Key Players

- Digi-Key Electronics

- Fairchild Semiconductors

- Hitachi Power Semiconductor Device Ltd.

- Infineon Technologies AG

- IXYS Corporation Power Integration

- Microchip Technology Inc.

- Mitsubishi Electric Corporation

- NXP Semiconductors

- Panasonic Corporation

- Power Integration Inc.

- Renesas Electronics Corporation

- STMicroelectronics

- Sumitomo Electric Industries Ltd.

- Texas Instruments.

- Toshiba Electronic Devices

- Vishay Siliconix

Market Segmentation

By Type

- Depletion Mode

- Enhancement Mode

By Power Rate

- High power

- Medium power

- Low power

By Application

- Energy & Power

- Inverter & UPS

- Consumer Electronics

- Automotive

- Industrial

- Others

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1998

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308