Rare Disease Small-Batch CDMO Market Revenue and Forecast by 2033

Rare Disease Small-Batch CDMO Market Revenue and Trends 2025 to 2033

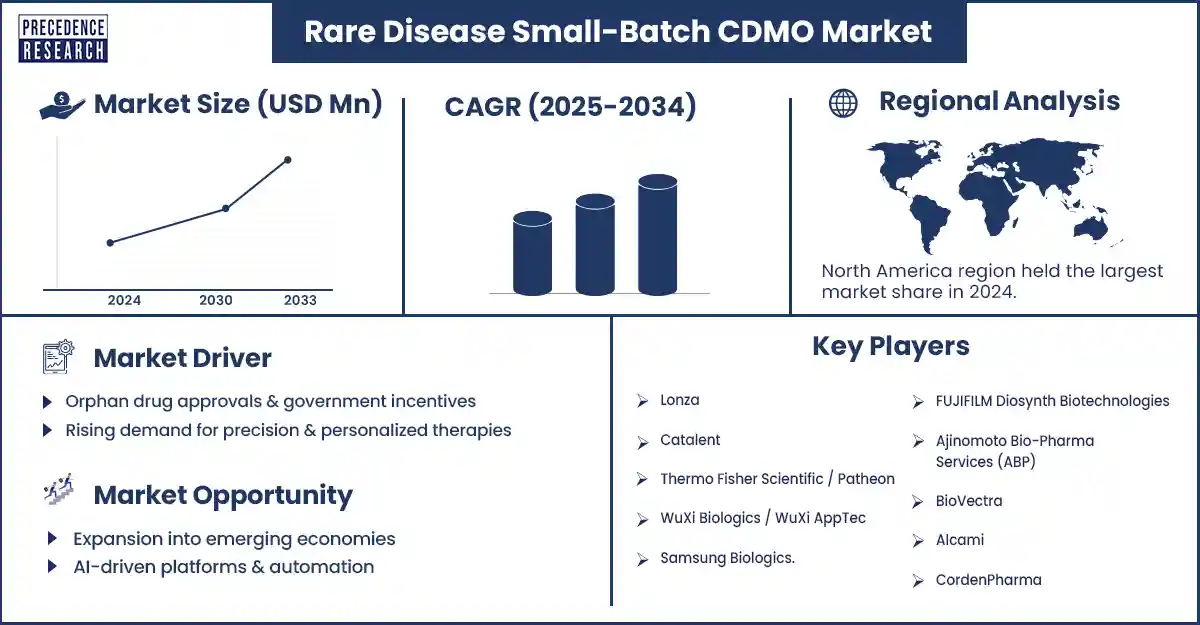

The rare disease small-batch CDMO market is gaining momentum as orphan drug development accelerates, supported by regulatory incentives and advances in precision medicine. With flexible modular facilities and strong biotech partnerships, CDMOs are enabling faster time-to-market and shaping the future of ultra-rare therapeutics. The growth of the market is driven by increasing demand for personalized therapies for rare diseases.

Exploring the Growth Potential of the Market

The rare disease small-batch CDMO market is experiencing significant growth due to an increase in orphan drug development and contracts. This is due to strong regulatory incentives like orphan drug designation, tax credits, and market exclusivity. Progress in genomic medicine and precision biotherapeutics has accelerated the development of new drug pipelines targeting ultra-rare conditions. This requires specialized manufacturing processes suitable for very small batch sizes. To meet these needs, CDMOs are developing new, flexible, modular facilities. These facilities can handle both API and drug product manufacturing while adhering to stringent regulatory guidelines. CDMO partnerships with biotech startups are proving beneficial, offering significant time-to-market advantages and capital efficiency. This benefits sponsors and helps in outsourcing high-risk investigational drug products.

Segment Insights

- By service type, the clinical-scale API / drug substance manufacturing (GMP) segment dominated the market in 2024 due to the specialized nature of rare disease treatments, which often require small-batch production and strict adherence to GMP.

- By modality/technology, the small molecules segment accounted for the largest market share in 2024 due to their established processes, regulatory landscape, and high usage in the treatment of rare diseases.

- By batch/scale type, the clinical small-scale batch (phase I/II) segment dominated the market in 2024 due to the critical nature of early-stage clinical trials in rare disease drug development.

- By development stage, the clinical supply (phases I/III) segment led the rare diseases small-batch CDMO market in 2024, as these phases are essential for assessing the safety, efficacy, and dosage of treatments, especially in rare diseases where patient populations are limited and treatment regimens must be highly customized.

- By therapeutic area/indication, the genetic/neurodegenerative rare disease segment contributed the largest market share in 2024. This is mainly due to the growing pipeline of rare disease therapeutics and high unmet medical needs.

- By customer type, the small biotech/orphan-drug startups segment held the largest share of the market in 2024, as these startups typically require specialized, small-scale manufacturing capabilities to produce their drug candidates in limited volumes, often for early-phase clinical trials.

- By contracting model, the fee-for-service segment led the market in 2024 due to its flexibility and cost-effectiveness, particularly for companies with limited resources developing therapies for rare diseases.

Rare Disease Small-Batch CDMO Market Coverage

| Report Attribute | Key Statistics |

| Quantitative Units | Revenue in USD million/billion, Volume in units |

| Largest Market | North America |

| Base Year | 2024 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Regional Insights

North America dominated the rare diseases small-batch CDMO market with the largest share in 2024, driven by a robust biotech ecosystem, a large pipeline of rare disease products, and strong regulatory incentives. U.S. orphan drug regulations and venture capital support market growth. Leading CDMOs in North America possess advanced capabilities, enabling both scalability and commercial production.

The market in Asia Pacific is expected to grow at the fastest rate in the upcoming period, driven by the development of biotech hubs in China, India, and South Korea. Cost-competitive small batch services are available in these countries, and governments are offering incentives to expedite drug approvals for rare diseases. Collaborations between biotech companies and CDMOs are expected to drive the regional market expansion further.

Recent Development

- In February 2025, Recipharm, a leading global contract development and manufacturing organisation (CDMO), launched a new modular sterile filling system at its facility in Wasserburg, Germany, designed for process development, pilot scale, and clinical supply. The system, compliant with GMP standards, supports a range of products like syringes and vials, with a new pre-filled syringe module expanding its capabilities. Capable of handling batches from 500 to 50,000 units, it offers efficiency, flexibility, and cost savings by minimizing product loss during clinical trials. (Source: https://www.recipharm.com)

Orphan Disease Biomarkers Market Key Players

- Lonza.

- Catalent.

- Thermo Fisher Scientific / Patheon.

- WuXi Biologics / WuXi AppTec.

- Samsung Biologics.

- FUJIFILM Diosynth Biotechnologies.

- Ajinomoto Bio-Pharma Services (ABP).

- BioVectra (Agilent/Biovectra).

- Alcami.

- CordenPharma.

- Charles River Laboratories (clinical supply & biologics services).

- Novasep / Combi-blocks (specialty small-batch for complex APIs).

- Aenova / Vetter (sterile fill-finish & packaging).

- PCI Pharma Services (clinical supply & packaging).

- Jubilant Biosys / Jubilant HollisterStier (specialty CDMO).

Get this report to explore global market size, share, CAGR, and trends, featuring detailed segmental analysis and an insightful competitive landscape overview @ https://www.precedenceresearch.com/sample/6767

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com |+1 804 441 9344