Robotic Surgery Market Size, Trends, Shares and Top Companies

Robotic Surgery Market Size, Recent Developments and Segment Analysis

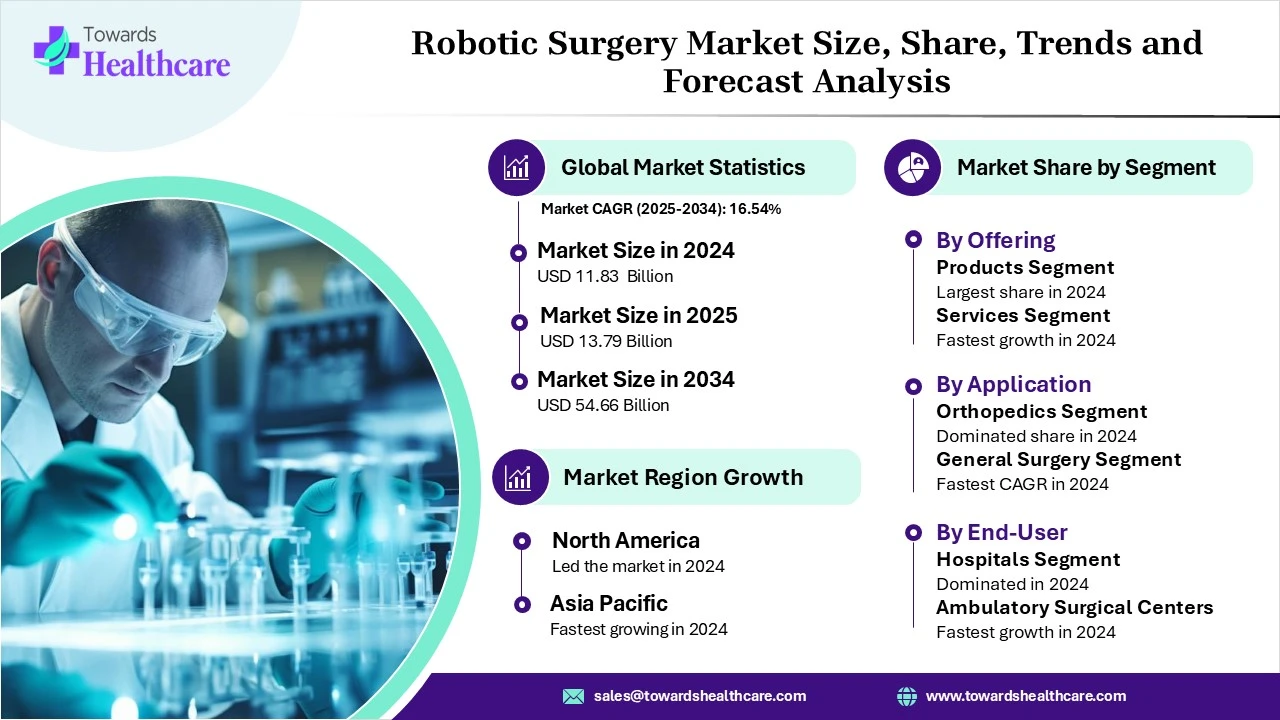

The global robotic surgery market size was estimated at USD 11.83 billion in 2024 and is anticipated to reach around USD 54.66 billion by 2034, growing at a CAGR of 16.54% from 2025 to 2034. The improvements and advantages of robotic operations over conventional minimally invasive surgery drive their significant demand in the global market.

Global Outlook

The integration of robotics and AI in surgery has led to advancements in modern healthcare. The robotic surgery market is mainly driven by promising and enhanced precision, improved patient outcomes, and efficiency. Research studies introduced a rapid adoption of AI-assisted robotic surgery across various medical procedures, such as surgeries. These advanced medical operations have reduced complication rates and have been driven by improved accuracy.

Market Opportunity

The future of robotic surgical procedures and the robotic surgery market depend on the emerging trends in robotics for surgeons. These major trends include miniaturized robotic systems, artificial intelligence, machine learning, and telesurgery. The rising use of technologies revolves around AI-guided 3D augmented reality (AR) in kidney transplantation and patient-specific implant positioning in knee/hip arthroplasty.

Key Growth Factors

- The huge adoption of common robotic surgical procedures, such as gynecologic surgery, urologic surgery, cardiac surgery, and orthopedic surgery, allows better medical procedures with the robotic system.

- The better efficiency of robotic surgeries over traditional surgery provides robotic assistance with lowered costs, improved patient outcomes, and reduced hospitalization duration.

Market Restraint

The future of robotic surgical procedures is uncertain due to their dependency on human surgeons and experts to operate robotic systems. Though the use of robots for performing surgery is rapidly growing, they do not work for every specialty. The risk and safety of robotics vary depending on the procedures. Certain technologies, like telesurgery may introduce more risk.

Segmental Outlook

Offering Insights

How does the Products Segment Dominate the Robotic Surgery Market in 2024?

The products segment dominated the market in 2024, owing to intelligent assistance, enhanced visualization, preoperative planning, prediction, and intraoperative decision support. The rising trend of micro-robotics, single-port systems, modular and portable designs introduced miniaturization and enhanced mobility. The novel products provide advanced sensory feedback and improved utilization.

The services segment is expected to grow at the fastest CAGR in the market during the forecast period due to a critical role played by services in simple equipment sales and the entire lifecycle of robotic platforms. The key services in robotic operations focus on providing virtual and remote training and enabling structured curricula for education. They prioritize maintenance and technical support through on-site technicians, system upgrades, and predictive maintenance.

Application Insights

What made Orthopedics the Dominant Segment in the Robotic Surgery Market in 2024?

The orthopedics segment dominated the market in 2024, owing to the enhanced surgical precision and accuracy. The improved patient outcomes and patient recovery are driven by minimally invasive techniques, faster recovery, and a personalized approach. Robotics is expanding in new orthopedic subspecialties like shoulder and spine surgery, trauma, and oncology.

The general surgery segment is estimated to grow at the fastest rate in the market during the predicted timeframe due to the rapid adoption of robotics in both routine and complex operations. The robotic-assisted surgery is notably beneficial in causing less pain, shorter recovery times, and reduced complications than traditional methods. Robotics has advanced minimally invasive techniques for complex procedures.

End-User Insights

How did the Hospitals Segment Dominate the Robotic Surgery Market in 2024?

The hospitals segment dominated the market in 2024, owing to better resource management, enhanced surgical capabilities, faster recovery, and improved patient outcomes through the adoption of robotic-assisted surgery. Robotics is applicable in various specialties like general surgery, urology, gynecology, cardiothoracic surgery, etc. Moreover, robotics is utilized across orthopedics, neurosurgery, and pediatrics.

The ambulatory surgical centers segment is anticipated to grow at a notable rate in the market during the upcoming period due to improved patient outcomes through less pain, less blood loss, smaller incisions, and quicker recovery times. They deliver increased efficiency, enhanced capabilities, increased reputation, and ergonomic benefits for surgeons. They support the integration of robotics into general surgery, gynecology, and spine surgery.

Geographical Outlook

North America

How does North America Dominate the Robotic Surgery Market in 2024?

North America dominated the robotic surgery market in 2024, owing to the increased demand for minimally invasive surgery, the growing patient population, technological advancements, and innovation. In August 2025, the World Health Organization (WHO) and the Society of Robotic Surgery launched a health innovation initiative to expand access to telesurgery and virtual care. The American Hospital Association (AHA) proclaimed that robotic surgery is changing healthcare in 2025 through rising competition, increased focus on expanded use of surgical robots in ambulatory surgery centers, and the huge role of AI in surgical robots. According to AHA, Tampa General Hospital and the University of South Florida expanded their partnership with Medical Microinstruments Inc. (MMI) to introduce the company’s Symani Surgical System to the academic medical center. With the FDA clearance, da Vinci robots are widely used in many laparoscopic soft-tissue procedures, including general, urologic, cardiac, and gynecologic surgery.

U.S. Robotic Surgery Market Trends

In May 2025, the Washington Hospital Healthcare System reported that robotic surgery sets a new standard in patient care and precision. There is a wide utilization of robotic systems in healthcare by New York University, the Cleveland Clinic, the University of Pennsylvania, and Cedars-Sinai Medical Center in Los Angeles. The leading global companies across the U.S., like Stryker, Johnson & Johnson, and Medtronic, are expanding their capabilities in operating rooms.

Asia Pacific

What is the Potential of the Robotic Surgery Market in the Asia Pacific?

Asia Pacific is expected to grow at the fastest CAGR in the robotic surgery market during the forecast period due to increased healthcare investments and robust healthcare infrastructure. Apollo Hospitals Group of the Asia Pacific launched the most advanced CyberKnife® Robotic Radio Surgery System in this region at Apollo Specialty Cancer Hospital. The major rationales behind this regional growth are subsidies, expansion of access, and the launch of new initiatives in Asian Pacific countries like Malaysia, Taiwan, India, and South Korea. The expansion of the national health insurance coverage (NHI), along with the AI and robotics initiative, drives the growth of Taiwan. The other Asian Pacific countries, like Singapore, focus on policies and industrial collaborations, while Malaysia keeps an eye on system deployment and Japanese system adoption.

India Robotic Surgery Market Trends

In September 2025, the All-India Institute of Medical Sciences (AIIMS), Raipur, launched the first state-of-the-art robotic surgery facility, Devhast of central India. In the same period of the year 2025, Chief Minister Sukhvinder Singh Sukhu virtually opened the robotic surgery facility at a cost of ₹30 crore at Dr Rajendra Prasad Government Medical College, Tanda. The major Indian government initiatives by AIIMS Delhi, AIIMS Raipur, the National Institute of Tuberculosis and Respiratory Diseases (NITRD) and state government programs by Himachal Pradesh, Punjab, and Maharashtra supported the integration of robotic surgery into public healthcare.

Strategic Moves by Key Players

- In March 2025, Stryker showcased the latest advancements in Mako SmartRobotics™ across knee, hip, shoulder, and spine procedures at the 2025 annual meeting of the American Academy of Orthopaedic Surgeons (AAOS), which also highlighted over 1.5 million Mako procedures performed globally across 45 countries.

- In September 2025, Medtronic announced its plan to expand its London-based center for AI and robotic surgery to align with some goals of the National Health Service (NHS).

Market Companies

- Stryker

- Medtronic

- Zimmer Biomet

- CMR Surgical

- Smith & Nephew

- Johnson & Johnson

- Hansen Medical

- Globus Medical

- Titan Medical

- Auris Health, Inc.

- AiM Medical Robots

- Accuray

Segments Covered in the Report

By Offering

- Products

- Robotics System

- Laparoscopic Robotic System

- Orthopedic Robotic System

- Neurosurgical Robotic System

- Other Robotic systems

- Services

By Application

- Orthopedics

- Neurology

- Urology

- Gynecology

- General Surgery

- Others

By End-User

- Hospitals

- Ambulatory Surgical Centers

- Other

By Region

- North America

- U.S.

- Canada

- Mexico

- Asia Pacific

- China

- Singapore

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa

- South Africa

- UAE

- Saudi Arabia

- Kuwait