Variable Frequency Drive Market Size to Attain USD 30.61 Bn by 2032

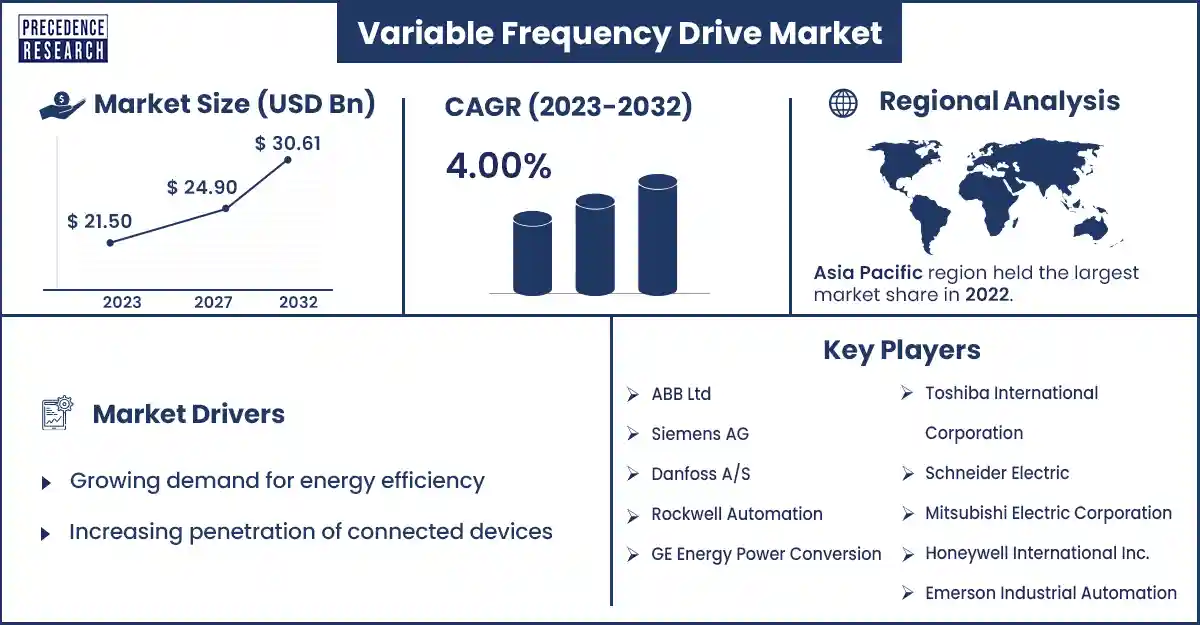

The global variable frequency drive market size surpassed USD 21.5 billion in 2023 and is estimated to attain around USD 30.61 billion by 2032, growing at a CAGR of 4% from 2023 to 2032 The increasing demand for variable frequency drives by several end users drives the VFD market growth.

Market Overview

The variable frequency drive market deals with market share, value chain optimization, production analysis, import-export analysis, trade regulations, and new recent developments of VFD. The variable frequency drives are electrifying appliances used with electric motors, which are supplied to the motor and change the applied voltage. VFD helps monitor the working speed to decrease energy consumption and improve efficiency. The major role of the variable frequency drive is to increase the life of machines, improve operational frequency, and decrease mechanical stress. Many authorities and manufacturers are increasing their spending on R&D activities, with a high focus on development and technology, to fuel the VFD market's growth. The growing industrialization, urbanization, and increasing prevalence of process optimization will further drive the growth and demand of the market.

Several advantages fuel the variable frequency drive market growth

Energy efficiency is the major advantage of variable frequency drives. Electrifying motors generally account for a significant portion of energy consumption, especially within industrial setups. Variable frequency drives help to save by skillfully controlling the motor speed. Given the non-linear relationship between energy consumption and motor speed, the energy savings are magnificent. The variable frequency drives effectively monitor the startup current. They have taken control of the capacity to initiate motors at zero frequency and voltage, which reduces the corrosion on motors and extends their functional life duration, decreasing the demand for continuous repair and maintenance.

The variable frequency drives prove crucial for optimizing manufacturing procedures by offering adjustable control over the motor speeds. These optimized functions assisted in the maintenance of strict quality standards and ensured constant product quality. The variable frequency drives can be generated to run the motors at absolute speed. The many variable frequency drives can be controlled remotely and provide enhanced flexibility. These are major driving factors of the variable frequency drive market.

However, the high installation cost of variable-frequency drive systems may restrain the growth of the variable-frequency drive market. VFDs offer a high range of energy efficiency advantages, but the cost related to installing VFD equipment may challenge VFD market growth. The use of these VFDs in any application and industry boosts to better impacts of the procedure, but, during the upgradation and expansion of any project, the power need is also changed, which may result in the development of the VFD as per users' demand for the distribution system, which will raise the total prize of installation. In addition, VFDs for devices such as functional noise, harmonics, and HVAC factors also impact the distribution capability, resulting in a rise in overhead costs.

Variable Frequency Drive Market Report Scope

| Report Coverage | Details |

| Market Revenue in 2023 | USD 21.5 Billion |

| Projected Forecast Revenue by 2032 | USD 30.61 Billion |

| Growth Rate from 2023 to 2032 | CAGR of 4% |

| Largest Market | Asia Pacific |

| Base Year | 2022 |

| Forecast Period | 2023 to 2032 |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Variable Frequency Drive Market Top Companies

- Hitachi Ltd

- Carlo Gavazzi

- Eaton PLC

- Johnson Controls Inc.

- Invertek Drives Ltd.

- Fuji Electric Co. Ltd

- Emerson Industrial Automation

- Honeywell International Inc.

- Mitsubishi Electric Corporation

- Schneider Electric

- Toshiba International Corporation

- GE Energy Power Conversion

- Rockwell Automation

- Danfoss A/S

- Siemens AG

- ABB Ltd.

Recent Development by Invertek Drives Ltd

- In October 2023, to redefine the elevator motor control, a new product variable frequency drive launched by Invertel Drives Company. Invertek is a leading innovator and manufacturer of electric motor control technology. This advanced company provided motor control technology, power, functionality and unprecedented size.

Recent Development by Carlo Gavazzi

- In August 2023, Carlo Gavazzi launched the RVBS variable frequency drive for speed control applications such as HVAC systems, compressors, conveyors, fans, and pumps. The open drives are available in 0.75 kW and 0.55 kW versions. Carlo Gavazzi is an automation and controls specialist company.

Regional Insights

Asia Pacific dominated the variable frequency drive market in 2023. The increasing building activities, market liberalization, and rapid industrialization in emerging countries are anticipated to drive the growth of the market in Asia Pacific. The presence of food and beverages and large automotive and water treatment manufacturers in countries such as Japan, China, and India are anticipated to drive the market growth in Asia Pacific.

The largest number of variable frequency drive products are made in China and are very cheap. Foreign brands have controlled the Chinese high-end VFD market. With the improved stability of products, coupled with the benefits of price and services, continuous development of technology, and competition of domestic producers due to these factors, China will become a stronger country.

In Japan, AC manufacturing is a major hub and has the largest sale in the ACs variable frequency drives market. The variable frequency drive industry in India entered a growth space with drives and functional-efficient motor control systems, leading to essential energy and growing energy prices. End-user drive advantages include reduced maintenance needs, enhanced procedure control performance, and VFD adoption in India. These are the major factors in India and Japan that are responsible for driving the variable frequency drive market growth.

Latin America is forecasted to grow at a significant growth over the projection period. The urbanization and privatization in countries such as Mexico and Brazil. Latin America covers the VFD market by end-user, application, power range, voltage, and type. AC drive manufacturers in Latin America are the major players. Mexico is the major country that has the maximum sales of VFDs. Latin America is expected to be the commercial hub and advanced development in manufacturing over the country.

Market Potential and Growth Opportunity

ML and AL for better control

In modern days, artificial intelligence and machine learning will play an important role in variable frequency drives. Many of the variable frequency drive commissioning procedures are constant, and the issues around the commissioning are related to a lack of understanding or product knowledge of the application. Once the VFDs device database is built, the application of machine learning into VFDs decreases this. Artificial intelligence will also carry system development as it will permit innovative reactions under a controlled industrial atmosphere that will be beneficial to the procedure. This major opportunity may drive the growth of the variable frequency drive market.

Variable Frequency Drive Market News

- In January 2024, in Chicago, ABB launched the ACH580 4X variable frequency drive. This was a new addition to the company's compatible drive portfolio. The aim behind this launch was for extreme environments and outdoor installation in the HVACR industry.

- In November 2023, Franklin Electric launched new DrivE-Tech COMPACT and CERUS X-Drive variable frequency drives. The Drive-Tech COMPACT and CERUS X-Drive are the new achievements in fully compact, reliable, and featured compact drive solutions for various applications and industries. Both drive models merge complicated designs, which are essential for the most demanding devices in the HVAC, pump, and industrial markets.

- In October 2023, at Dubai’s World Trade Center, WEG launched solar-powered variable-frequency drives for pumping applications. The company presented its technology in hall eight, stand 8-D16.

Key Market Players

- ABB Ltd

- Siemens AG

- Danfoss A/S

- Rockwell Automation

- GE Energy Power Conversion

- Toshiba International Corporation

- Schneider Electric

- Mitsubishi Electric Corporation

- Honeywell International Inc.

- Emerson Industrial Automation

- Fuji Electric Co. Ltd

- Johnson Controls Inc.,

- Eaton PLC

- Hitachi Ltd

Market Segmentation

By Product

- AC Drives

- DC Drives

- Servo Drives

By Power Range

- Micro

- Low

- Medium

- High

By Voltage Type

- Low Voltage

- Medium Voltage

By Application

- Pumps

- Electric Fan

- HVAC

- Conveyors

- Extruders

- Others

By End User

- Oil & gas

- Industrial

- Power

- Infrastructure

Buy this Research Report@ https://www.precedenceresearch.com/checkout/1848

You can place an order or ask any questions, please feel free to contact at sales@precedenceresearch.com | +1 650 460 3308