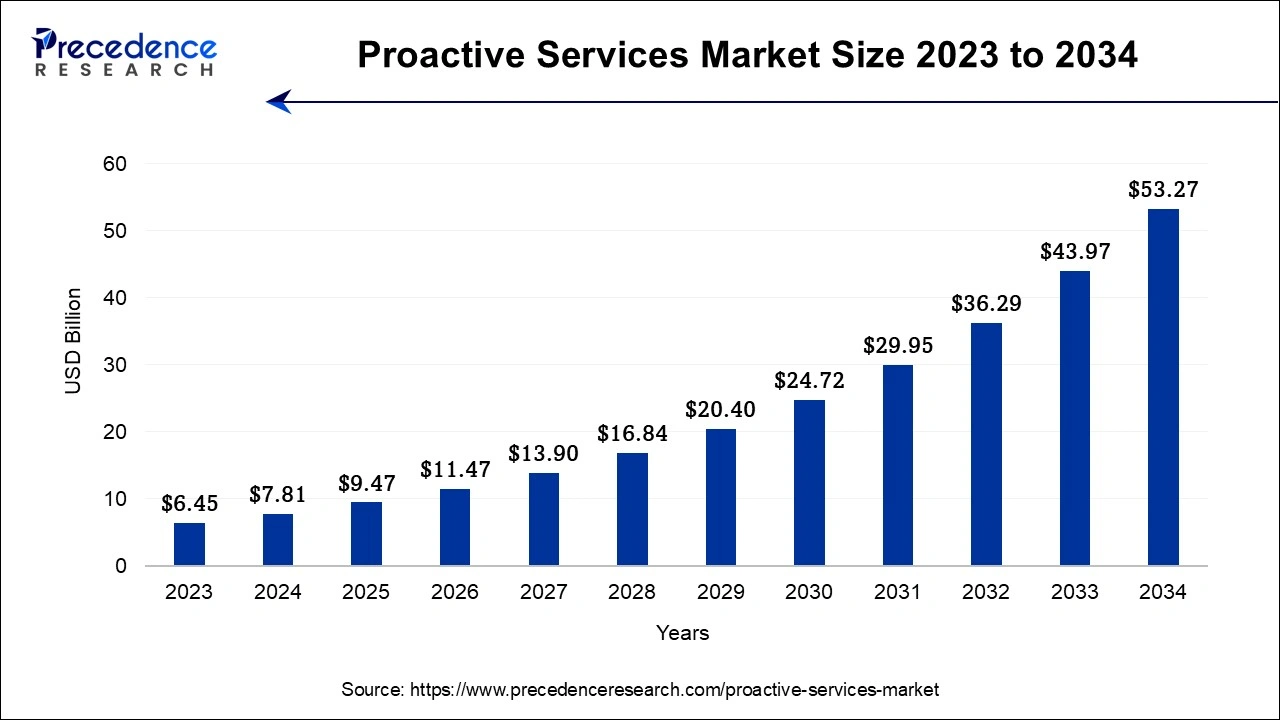

What is the Proactive Services Market Size?

The global proactive services market size is calculated at USD 9.47 billion in 2025 and is predicted to increase from USD 11.47 billion in 2026 to approximately USD 61.49 billion by 2035, expanding at a CAGR of 20.57% from 2026 to 2035.

Proactive Services Market Key Takeaways

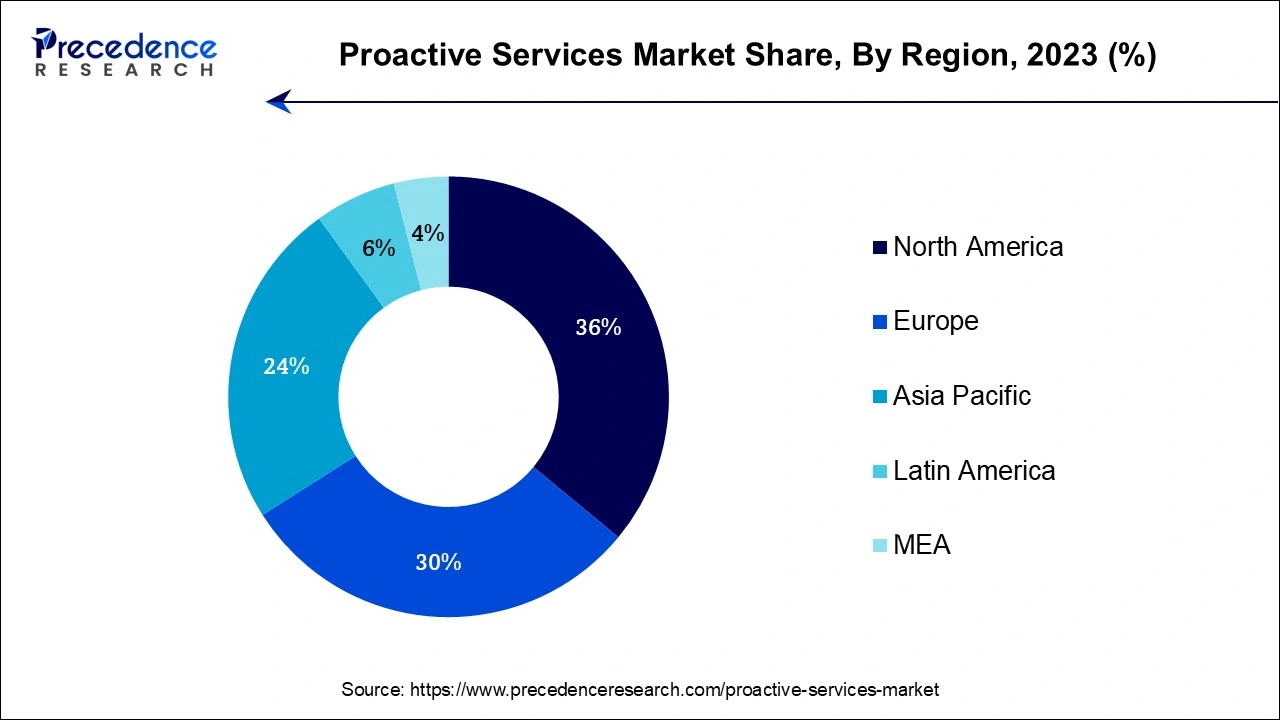

- North America contributed more than 36% of the market share in 2025.

- By Service, the managed services segment captured over 40% of the market share in 2025.

- By Technology, the analytics segment registered more than 53% of the revenue market in 2025.

- By Enterprise, the large enterprise segment captured more than 60% of the market share in 2025.

- By Industry, the BFSI segment led the global market with the highest market share of 22% in 2025.

- By Application, the customer experience management segment held the largest market share of 27% in 2025.

Proactive Services Market: Driving Customer Satisfaction, Value, and Preventive Solutions.

Proactive services are processes and procedures that are used to avert customer problems and generate recurrent or higher-volume purchases. Meeting and surpassing client expectations, enhancing customer relationships, and boosting customer value are all aided by proactive services. The proactive services market comprises revenues produced by organizations by providing solutions and services developed for clients that address problems that the customer may not have been aware of previously. The value associated to the items sold by the service provider or included in the service providing is included in the market value. Included are only commodities and services transferred between companies or sold to end users. These services provide consumers with information and ideas regarding any difficulties that may arise throughout the treatment.

Artificial intelligence (AI) and data analytics advancements

The fast advancement of AI and data analytics technology has revolutionized the proactive services sector. AI systems can analyze massive amounts of data in real-time, discovering patterns, trends, and anomalies that humans would overlook. Businesses may use AI-powered solutions to monitor consumer interactions, social media attitudes, and online behaviors to spot possible concerns or opportunities ahead of time. Companies that use predictive analytics may anticipate client demands, automate operations, and provide proactive services like personalized product suggestions or preventive maintenance.

Proactive Services Market Growth Factors

Rapid technological breakthroughs, such as artificial intelligence, machine learning, the Internet of Things (IoT), and data analytics, will support the expansion of proactive services. These technologies help organizations collect, analyze, and understand massive amounts of data in real time, allowing them to discover consumer demands, foresee challenges, and provide personalized suggestions. Proactive services offer enormous potential in a variety of sectors. In healthcare, for example, proactive services can improve patient monitoring, increase preventive care, and enable remote consultations. Similarly, in manufacturing it can improve equipment performance, reduce interruptions, and increase productivity. As companies recognize the advantages of proactive services, the market is likely to expand across many industries.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 61.49 Billion |

| Market Size in 2026 | USD 11.47 Billion |

| Market Size in 2025 | USD 9.47 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 20.57% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Service, Technology, Enterprise, Industry, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing need for personalized customer experiences

Customers have increased expectations for personalized experiences in today's competitive business market. They expect proactive services that are tailored to their requirements and preferences. Businesses that can foresee client needs and offer proactive solutions have a huge competitive edge. Businesses may obtain insights into individual preferences, purchasing history, and behavior trends by exploiting consumer data. This data enables them to provide personalized suggestions, targeted discounts, and proactive assistance, therefore improving the entire client experience. Accordingly, it helps to enhance the growth of the provocative services market during the forecast period.

Restrains

Issues with scalability and increasing complexity

As the number of data and client interactions grows, proactive services must expand efficiently. It can be difficult to manage massive volumes of real-time data, integrate many systems and touchpoints, and ensure flawless operations across multiple channels. To address the rising needs and complexity of proactive services, businesses must develop scalable architectures, install powerful analytics platforms, and have the requisite infrastructure.

Challenges

Organizational transformation and adoption

Positioning proactive services in place sometimes necessitates considerable organizational changes. To accommodate proactive methods, this may entail educating staff, clarifying roles and responsibilities, and realigning procedures. Change resistance and the necessity for organizational buy-in might stymie the deployment of proactive services. Shifting the mentality, culture, and processes to accept a proactive approach is also part of the changes. It entails overcoming resistance to change, cultivating a culture that encourages proactive problem-solving and customer-centricity, realigning processes to integrate proactive aspects, and putting effective change management practices in place. To effectively implement proactive services, leadership commitment, cultural transformation, process realignment, and a focus on continuous improvement are required.

Opportunities

Differentiation and competitive advantage

Businesses can differentiate themselves and gain a competitive advantage by providing proactive services. Businesses that provide unique and creative solutions that go beyond reactive help may attract customers who seek proactive and personalized services. By anticipating requirements, making personalized recommendations, and providing great assistance, proactive services improve the customer experience. This increases customer loyalty and happiness while also establishing a favorable brand reputation. Furthermore, through data analytics, automation, and optimized procedures, it enhances operational efficiency, resulting in cost savings and faster reaction times. Businesses can differentiate themselves in a competitive industry, seize a greater market share, and position themselves as trusted advisors and partners to their consumers by investing in proactive services. Overall, adopting proactive services allows organizations to stand out, strengthen customer connections, and generate long-term growth.

Segment Insights

Service Insights

The proactive service market is classified into technological support, managed services, design, and consulting. In 2025, the managed services sector held the largest market share. Managed services enable the outsourcing of IT duties to improve job productivity. The benefits of implementing managed services include lower operating costs, improved functional efficacy, and less strain on the in-house IT staff. The requirement for optimal resource allocation, remote monitoring and administration of hardware, security services, and communication assistance will drive this segment's expansion even further. Furthermore, cloud computing and big data analytics are projected to fuel development. Managed services provide advantages such as reduced downtime, scalability, data compliance, and faster response time.

Technological Insights

The proactive service market is classified into artificial intelligence, machine learning and analytics. In 2025, the analytics segment held the largest market share. Analytics technology can manage massive volumes of data and assists organizations in providing proactive customer service. Organizations may utilize advanced analytics to identify fundamental causes by measuring multiple factors, understanding customer purchase habits, analyzing probabilities, and measuring anomalies. Increased data gathering leads to improved analytical skills; also, predictive analytics technology allows for synchronous and real-time action, which is why organizations use analytics tools. Organizations that make extensive use of IoT devices have heterogeneous streams of data that analytical tools may employ to create consistency throughout the organization. The artificial intelligence market is likely to expand in the coming years. Due to the AI's ability to effectively grasp data and offer custom product and service suggestions, an increasing number of organizations are using it. It would also help in cross-selling and upselling. Customers save time by using artificial intelligence to help them navigate through multiple web portals and applications.

Enterprise Insights

The enterprise segment is segregated into small and medium-sized enterprises and large enterprises in the proactive services market. Large corporations have the financial means to utilize preventative services on-site. As a result, organizations are migrating to cloud deployment to take advantage of benefits such as high flexibility, extensive availability, and low deployment costs. Because of their strong financial capacities, large organizations may also implement digital strategy across businesses and expedite digital transformation across varied industries. A rising number of financial organizations, such as banks and other financial businesses, are utilizing these services to reduce operating expenditures and event notifications. The SME segment is likely to witness the fastest growth in the coming years. Due to financial limits, SMEs confront several issues, including a shortage of trained labor, domain-specific specialists, scalability, and managerial control. However, with the support of cloud deployment, SMEs may increase the reliability and management of their company processes while simultaneously lowering device costs.

Industry Insights

The BFSI segment dominated the market in 2025. The growing interest of banks and other financial institutions in improving customer engagement and interaction procedures to leave a lasting impression on clients is likely to fuel the expansion of this industry. The surge in mobile banking services has been noted, pushing banks to adopt proactive services in the rapidly increasing industry. Over the projection period, the healthcare category is predicted to grow at the fastest pace. The healthcare industry is highly reactive, but a trend toward value-based care with improved population health and reduced costs is predicted to underpin the industry's development. Healthcare departments can predict future hazards by employing pattern recognition with known results and by using sophisticated technology and algorithms to analyze multiple data streams. Proactive services assist healthcare staff in addressing the problem before it worsens, and it also assists patients in avoiding the costs associated with high-risk diseases, such as the need for emergency surgery or the number of days spent in the intensive care unit.

Application Insights

The proactive service market is segmented into cloud management, data center management and customer experience management. In 2025, the customer experience management category held the largest proportion of the market. Customer experience management benefits organizations in a variety of ways, including word-of-mouth marketing, maintaining existing customers, recruiting new customers, boosting customer happiness, greater customer lifetime value, and brand loyalty. Organizations may boost brand preference by providing distinct experiences while also cutting expenses by lowering churn rates. Thus, the demand for customer experience management is likely to grow within the estimated timeframe Furthermore, factors such as decreasing marketing and acquisition costs, operational innovation, technology developments, and increased consumer expectations are also likely to contribute to the segment's growth in the years to come.

Regional Insights

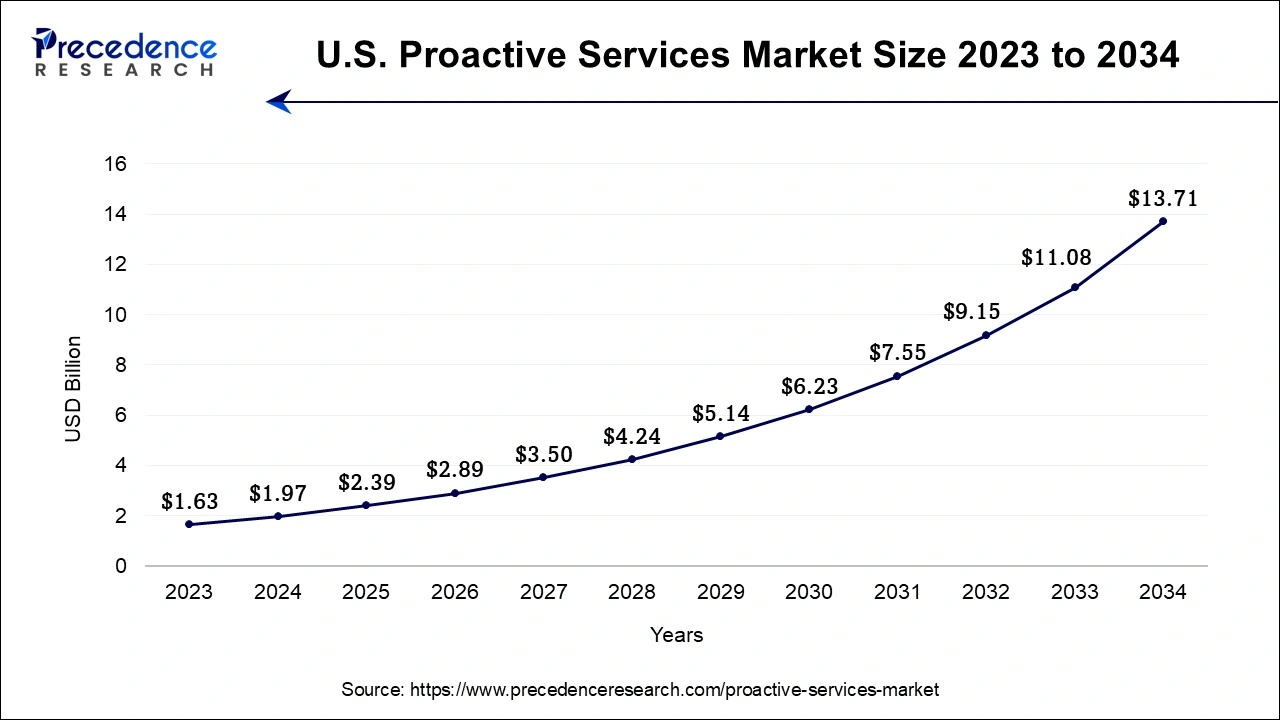

U.S. Proactive Services Market Size and Growth 2026 to 2035

The U.S. proactive services market size is exhibited at USD 2.39 billion in 2025 and is projected to be worth around USD 15.87 billion by 2035, poised to grow at a CAGR of 20.84% from 2026 to 2035.

North America held the largest share of the global proactive services market in 2025. A stable economy and significant government investment in numerous technologies such as AI, sophisticated data analytics, and machine learning make North America one of the most advanced regions.

Furthermore, North America has a significant retail business that focuses on providing proactive services, which is one of the major drivers for regional market growth.

U.S. Market Trends

The U.S. proactive services market is expanding due to growing demand for preventive solutions that enhance customer experience, satisfaction, and loyalty. Businesses are increasingly adopting advanced analytics and service platforms to anticipate client needs, resolve potential issues, and drive recurring purchases, while technological advancements and strong enterprise adoption further accelerate market growth in the country.

What Makes Asia Pacific the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the fastest rate in the proactive services market over the projection period. This is mainly due to rapid digital transformation, rising adoption of advanced customer service technologies, and increasing enterprise focus on customer retention. The rapid expansion of the e-commerce, telecom, and IT sectors, along with growing investments in analytics-driven proactive solutions, is also accelerating market growth across the region.

India Market Trends

India is a major contributor to the market in Asia Pacific. This is mainly due to the rising adoption of digital customer service solutions, AI-driven analytics, and preventive support systems across IT, telecom, and e-commerce sectors. Growing focus on enhancing customer experience, improving retention, and reducing service disruptions, coupled with increasing enterprise investments in advanced service platforms, is fueling market growth in India.

Why is the Market in Europe Growing?

The European proactive services market is expected to grow at a significant CAGR during the forecast period due to increasing adoption of advanced customer service technologies, AI-based analytics, and predictive support solutions. Rising focus on enhancing customer experience, reducing operational costs, and ensuring service continuity, along with investments by enterprises across IT, telecom, and manufacturing sectors, is driving market growth in the region.

UK Proactive Services Market Trends

In the UK, the market is expanding due to growing demand for customer support services, AI-driven service platforms, and preventive maintenance solutions. Enterprises across IT, telecom, and e-commerce sectors are investing in advanced technologies to anticipate customer needs, enhance satisfaction, and reduce service disruptions, contributing to the market growth.

Proactive Services Market Top Companies & Their Offerings

- Cisco Systems, Inc: Provides networking, unified communications, and AI-driven customer experience solutions, including proactive service platforms for enterprises to enhance support and operational efficiency.

- International Business Machines Corporation (IBM): Offers AI-powered analytics, cloud-based customer service platforms, and proactive IT support solutions for businesses across industries to improve service delivery and customer satisfaction.

- DXC Technology: Delivers IT services, cloud solutions, and proactive support systems that help organizations anticipate issues, optimize operations, and enhance customer experience.

- Avaya Inc.: Specializes in unified communications, contact center solutions, and AI-driven proactive service technologies for enhanced customer engagement and operational efficiency.

- Genesys: Provides cloud-based customer experience and contact center platforms, including proactive engagement tools and AI-driven solutions to improve customer satisfaction and service automation.

- Hewlett Packard Enterprise Company: Offers IT infrastructure, AI-driven monitoring, and proactive support services to optimize enterprise operations and ensure continuous system performance.

Other Major Companies

- Amazon Web Services, Inc.

- NICE

- Juniper Network, Inc.

- Microsoft Corporation

- Symantec Corporation

- Huawei Technologies Co., Ltd

Recent Developments

- In February 2025, Honeywell International Inc. introduced a new range of proactive service solutions for the healthcare industry, designed to enhance patient outcomes through advanced monitoring and proactive management. (Source: honeywell.com)

- In January 2024,Siemens AG teamed up with a major manufacturing firm to deploy a proactive service model aimed at improving operational efficiency and lowering maintenance costs by using IoT technologies to monitor equipment and predict potential failures. (Source: press.siemens.com)

- In May 2023, SAP announced a new product called SAP Customer Data Cloud. The product helps businesses to collect, store, and analyze customer data. SAP Customer Data Cloud can be used to identify potential problems, predict customer churn, and personalize marketing campaigns.

- In March 2023, Microsoft launched a new suite of proactive services called Microsoft 365 Customer Insights. This suite of services uses AI and machine learning to help businesses understand their customers better. This can help businesses to personalize marketing campaigns, improve customer support, and increase customer retention.

- In October 2022, Cisco Systems launched a new solution that helps to predict IT infrastructure failures proactively. This solution uses AI and machine learning to analyze data from IT systems and identify potential problems before they occur. This can help businesses to avoid costly outages and downtime.

Segments Covered in the Report

By Service

- Technical Support

- Design and Consulting

- Managed Services

By Technology

- Artificial Intelligence

- Machine Learning

- Analytics

By Enterprise

- Small and Medium Size Enterprise

- Large Enterprise

By Industry

- Banking, Financial Services and Insurance (BFSI)

- Healthcare

- Retail

- Telecommunication

- Government and Defense

- Others

By Application

- Cloud Management

- Data Center Management

- Customer Experience Management

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting