Proppants Market Size and Forecast 2025 to 2034

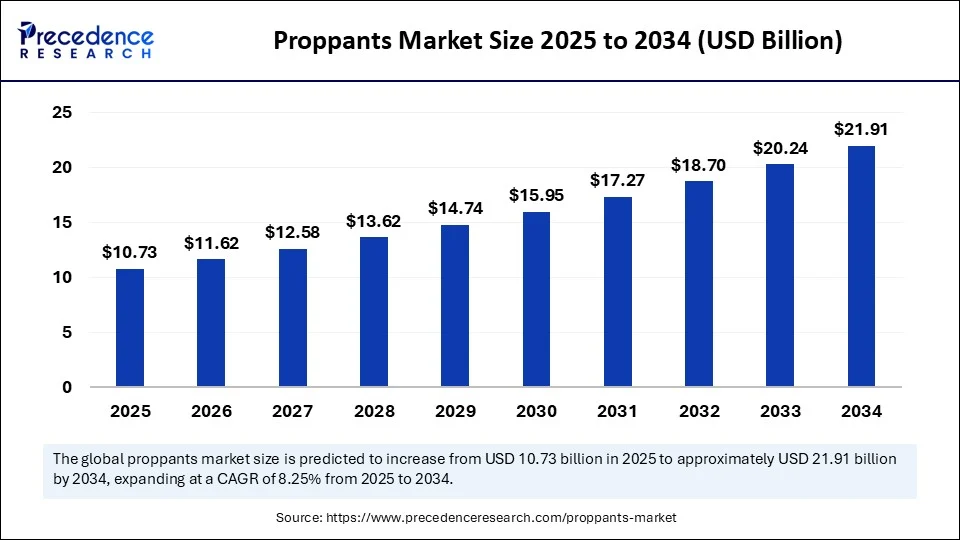

The global proppants market size was calculated at USD 9.92 billion in 2024 and is predicted to increase from USD 10.73 billion in 2025 to approximately USD 21.91 billion by 2034, expanding at a CAGR of 8.25% from 2025 to 2034. The demand for the proppants market is increasing due to cost-effectiveness. High-performance ceramic and resin-coated proppants are gaining traction for their durability and conductivity in challenging geographical formations.

Proppants Market Key Takeaways

- In terms of revenue, the global proppants market was valued at USD 9.92 billion in 2024.

- It is projected to reach USD 21.91 billion by 2034.

- The market is expected to grow at a CAGR of 8.25% from 2025 to 2034.

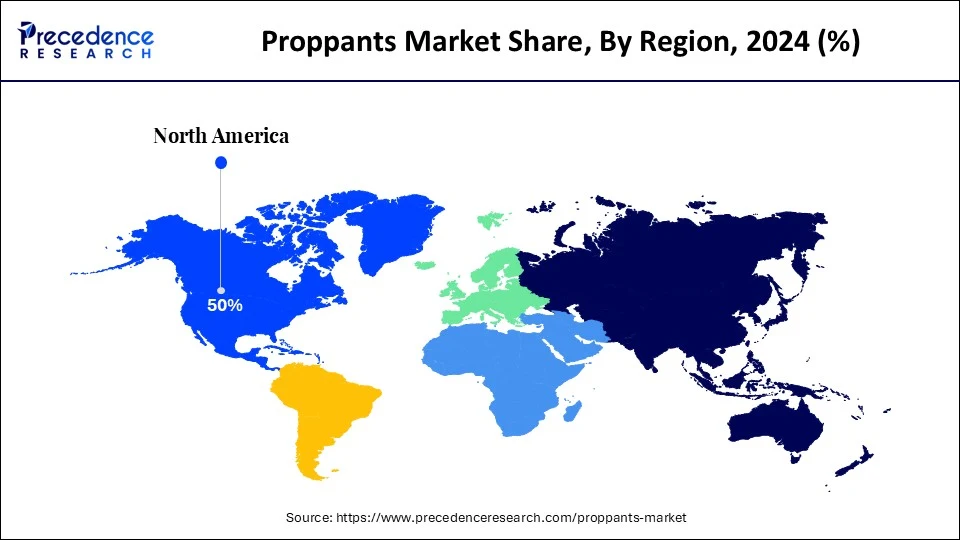

- North America dominated the global market with the largest market share of 50% in 2024.

- Asia Pacific is expected to be the fastest-growing region in the upcoming years.

- By type, the sand proppants segment held the maximum revenue share in 2024.

- By type, the ceramic proppants segment is expected to witness the fastest growth in over the forecast period.

- By application, the oilfield hydraulic fracturing segment led market in 2024.

- By application, the non-oilfield applications segment is expected to witness the fastest growth over the forecast period.

- By end-user, the oil & gas exploration & production companies segment captured the biggest market share in 2024.

- By end-user, the independent operators segment is expected to witness the fastest growth over the forecast period.

How AI Is Impacting the Proppants Market?

Artificial intelligence is emerging as a powerful enabler in the proppants market, optimizing both upstream operations and supply chain efficiency. In hydraulic fracturing, AI-driven predictive models help determine the optimal type, quantity, and placement of proppants for each well, reducing waste and improving production rates. Machine learning algorithms analyze geological data, fracture simulations, and historical performance to customize proppant selection for specific formations. On the logistics side, AI streamlines transportation planning and inventory management, ensuring timely delivery to remote drilling sites while reducing operational costs. Additionally, AI-powered quality control systems can detect inconsistencies in proppant size, shape, or coating in real time, ensuring higher performance in the field. By integrating AI insights with real-time monitoring of well performance, operators can continuously fine-tune proppant strategies to maximize output and extend well life.

U.S. Proppants Market Size and Growth 2025 to 2034

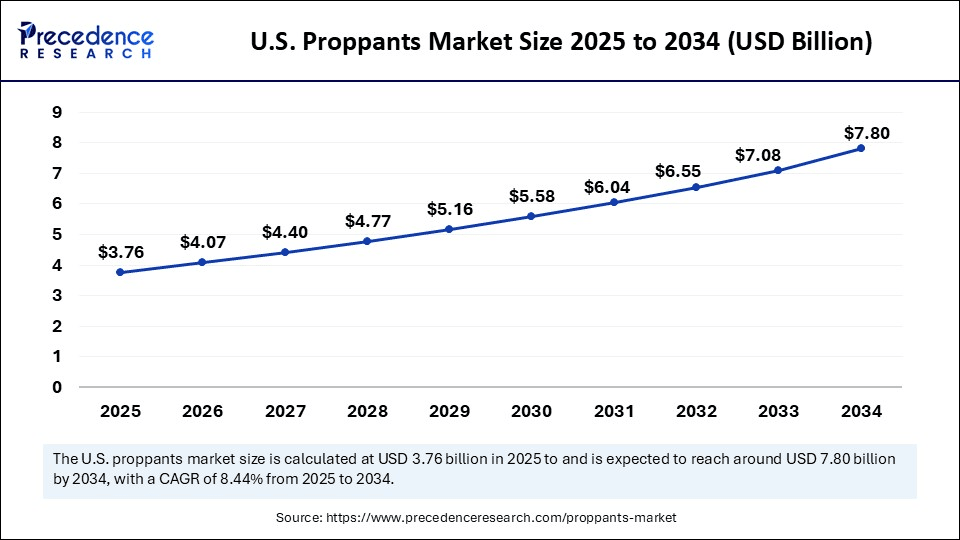

The U.S. proppants market size was evaluated at USD 3.47 billion in 2024 and is projected to be worth around USD 7.80 billion by 2034, growing at a CAGR of 8.44% from 2025 to 2034.

Why Is North America the Leader in the Proppants Market?

North America continues to dominate the proppants market, driven by rapid industrialization, increasing energy demand, and growing investments in unconventional oil and gas projects. Countries such as China and India are accelerating domestic production to reduce dependence on energy imports, creating steady demand for proppants. In India, exploration and production activities under initiatives like the Hydrocarbon Exploration and Licensing Policy (HELP) are fostering growth in hydraulic fracturing operations.

The U.S. is dominating North America. The country's expanding upstream capabilities, combined with the adoption of AI in geological assessment and drilling optimization, are improving the efficiency of proppant use. Availability of low-cost raw materials for sand proppants and proximity to key energy markets further strengthen the region's position. Moreover, India's focus on energy security and self-reliance supports long-term investment in unconventional energy development.

What Is Making Asia Pacific a Rising Star in the Proppants Market?

Asia Pacific continues to be the fastest-growing proppants market, driven by rapid industrialization, increasing energy demand, and growing investments in unconventional oil and gas projects. Countries such as China and India are accelerating domestic production to reduce dependence on energy imports, creating steady demand for proppants. In India, exploration and production activities under initiatives like the hydrocarbon exploration and licensing policy are fostering growth in hydraulic fracturing operations. The country's expanding upstream capabilities, combined with the adoption of AI in geological assessment and drilling optimization, are improving the efficiency of proppant use. Availability of low-cost raw materials for sand proppants and proximity to key energy markets further strengthen the region's position. Moreover, India's focus on energy security and self-reliance supports long-term investment in unconventional energy development.

India is the fastest-growing economy in the Asia Pacific, driven by its increasing emphasis on domestic oil and gas production to reduce energy import dependence. While the country's shale reserves are still largely untapped, exploratory activities in basins such as Cambay, Krishna-Godavari, and Damodar Valley are gaining momentum, creating a long-term pipeline for hydraulic fracturing demand. The Indian government's supportive policies, including liberalized exploration licensing and foreign investment incentives, are attracting both domestic and international players to invest in unconventional energy projects. Additionally, India's push for energy security is fostering collaborations with global technology providers, enabling the adoption of advanced drilling techniques that require higher-quality proppants. Local manufacturing of ceramic and coated proppants is also expected to rise, supported by the “Make in India” initiative, which could reduce import reliance and lower supply chain costs.

Driving Efficiency, One proppant at a Time

The proppants market involves materials used in hydraulic fracturing (fracking) to keep fractures in rock formations open, allowing oil and gas to flow freely to production wells. Proppants are typically made of sand, ceramics, or resin-coated materials that withstand high pressures underground. Their effectiveness directly impacts well productivity and efficiency. Market growth is influenced by increasing shale gas exploration, advancements in fracturing technologies, and demand for enhanced oil recovery.

Supported by the resurgence of hydraulic fracturing activities and the ongoing exploitation of unconventional energy reserves. Sand proppants remain the most widely used due to their cost-effectiveness, while resin-coated and ceramic proppants are gaining traction in high-pressure, high-temperature formations where enhanced durability and conductivity are required. The market is highly cyclical, influenced by global crude oil and natural gas prices, which dictate drilling activity levels. Environmental concerns and water management challenges in fracking are prompting the industry to explore more sustainable proppant solutions and improved recovery methods. Regional demand is shaped by the intensity of shale development, regulatory environments, and advancements in drilling technologies.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 21.91 Billion |

| Market Size in 2025 | USD 10.73 Billion |

| Market Size in 2024 | USD 9.92 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 8.25% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Application, End User, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Has Rising Shale Gas Production Driven the Proppants Market?

The rapid increase in shale gas production is a key driver for the proppants market, as hydraulic fracturing remains the primary method for extracting hydrocarbons from unconventional reservoirs. Higher drilling activity in shale formations directly translates into increased demand for proppants to maintain fracture conductivity and optimize well performance. Regions with abundant shale reserves, such as the U.S., China, and emerging basins in India and Australia, are investing heavily in exploration and production to meet growing energy needs and reduce reliance on imports. As energy security becomes a national priority, governments and private operators are expanding their unconventional resource development programs, thereby sustaining long-term proppant consumption.

Technological Advancements are booming, the Echoes of the time

Technological innovations in drilling and completion techniques are transforming proppant usage patterns, making operations more efficient and cost-effective. The adoption of horizontal drilling, multi-stage fracking, and real-time fracture monitoring has increased both the precision and scale of proppant placement. Advanced analytics, AI-driven modeling, and improved geological mapping are enabling operators to tailor proppant type, size, and quantity to the specific properties of each well, reducing waste while boosting production rates. Innovations in proppant transportation and delivery systems, such as automated handling units, are also enhancing safety and operational speed.

Restraint

Including High Dependence on Volatile Oil and Gas Prices

The proppants market faces challenges, including high dependence on volatile oil and gas prices, which directly impact drilling activity and proppant consumption. Environmental concerns over hydraulic fracturing, including water usage, seismic activity, and potential contamination, can lead to regulatory restrictions. The production of high-quality ceramic and resin-coated proppants involves significant capital investment, which may be prohibitive in periods of low demand. Logistics and supply chain constraints in remote drilling areas can add to operational costs. Additionally, overcapacity in certain regions and competition from low-cost suppliers can pressure margins for producers.

Opportunity

Development of Advanced Ceramic Proppants

The development of advanced ceramic proppants presents a significant opportunity for manufacturers seeking to serve high-performance applications. These proppants offer superior strength, sphericity, and conductivity compared to conventional sand, making them ideal for deep and high-stress wells where standard materials would fail. Innovations in lightweight ceramic formulations are reducing transportation costs while maintaining structural integrity under extreme conditions. With operators increasingly focused on maximizing well productivity and lifespan, demand for premium-grade ceramics is expected to rise, especially in regions with complex geology. Additionally, the integration of AI in proppant performance modeling can accelerate the design and deployment of next-generation ceramic solutions tailored to specific reservoir conditions. Manufacturers investing in R&D and scalable production capabilities for these advanced ceramics will be well-positioned to capture a growing share of the high-value segment of the market.

Type Insights

Why Sand Proppants is Dominating the Proppants Market?

The sand proppants segment held a dominant presence in the proppants market in 2024 due to their cost-effectiveness, availability, and proven performance in a wide range of well conditions. Their lower price point compared to ceramic proppants makes them the preferred choice for large-scale operations where cost control is critical. In many oil and gas basins, natural sand meets the strength requirements for shallow to medium-depth wells, making it a practical option. The abundance of silica sand reserves in several producing regions further supports supply stability and price competitiveness. Sand proppants are also easy to process and transport, ensuring quick deployment in high-volume projects. These factors collectively ensure that sand proppants continue to dominate the global proppants market share.

Another factor contributing to sand proppants' dominance is their adaptability to modern fracturing techniques, including multi-stage and high-volume fracking operations. While they may not match the performance of ceramic proppants in extreme pressure environments, sand proppants remain ideal for most of the shale plays. Operators often choose sand for its compatibility with various fluid systems and its predictable behavior in fracture networks. Continuous improvements in mining and processing technologies are enhancing the sphericity and purity of sand, improving its conductivity in reservoirs.

The ceramic proppants segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034 due to their superior mechanical strength, high sphericity, and ability to withstand extreme downhole pressures. These properties make them particularly well-suited for deep, high-stress reservoirs where sand would fail to maintain fracture conductivity. The increased exploration of unconventional and ultra-deep resources is fueling demand for these advanced materials. Operators aiming to maximize recovery rates and extend well life are increasingly turning to ceramic proppants despite their higher cost. The market is also benefiting from ongoing R&D in lightweight ceramics, which reduces transportation expenses while maintaining structural integrity. As global energy demand rises, the need for efficient, long-lasting proppant solutions is driving ceramic adoption.

Technological advancements are further propelling ceramic proppants into the spotlight. Enhanced manufacturing techniques allow for precise control over particle size, density, and coating, optimizing performance for specific reservoir conditions. AI-driven modeling and simulation tools are enabling customized proppant designs, improving operational efficiency. In addition, the trend toward longer lateral wells and more complex completions increases the demand for high-performance proppants capable of withstanding repeated stress cycles. The oil and gas industry's focus on total cost of ownership, rather than just upfront expenses, is also making ceramic proppants more appealing. With continued innovation and increasing recognition of their long-term productivity benefits, ceramic proppants are set to be the fastest-growing segment in the coming years.

Application Insights

Why Oilfield Hydraulic Fracturing Dominated the Proppants Market?

The oilfield hydraulic fracturing segment dominated the proppants market driven by its critical role in unlocking hydrocarbons from tight formations. The expansion of shale oil and gas production across key regions continues to fuel high demand for proppants. In most fracking operations, proppants are essential for holding fractures open, ensuring optimal hydrocarbon flow rates. Advances in drilling and completion technologies are enabling larger fracture networks, which require proportionally higher volumes of proppants. The scalability of hydraulic fracturing projects also contributes to sustained demand, as operators can adjust proppant volumes to match well design and reservoir characteristics. This consistent requirement solidifies hydraulic fracturing's position as the primary driver of the proppants market.

The preference for proppants in oilfield applications is also reinforced by the continuous rise in unconventional energy projects. With operators focusing on maximizing well productivity, proppant selection and optimization have become strategic considerations. The majority of proppant consumption occurs in oilfield operations, reflecting the scale and frequency of hydraulic fracturing activities worldwide. Innovations in fracture mapping and real-time monitoring are enabling more precise placement of proppants, further enhancing recovery efficiency. This combination of scale, necessity, and technological enhancement ensures that oilfield hydraulic fracturing will remain the largest application segment for proppants. As global energy demand grows, its dominance is expected to persist.

The non-oilfield applications segment will gain a significant share of the market over the studied period of 2025 to 2034 due to the development of geothermal energy projects, water filtration, and certain chemical processing activities, which are emerging as high-growth niches. These sectors benefit from the mechanical properties of proppants, such as high compressive strength and thermal stability, which make them suitable for demanding industrial environments. The push toward renewable energy sources, including geothermal, is creating fresh opportunities for proppant usage in well stimulation and heat exchange enhancement. Additionally, the growing emphasis on industrial water treatment is expanding the application of proppants in filtration systems. Although they currently have a smaller market share, the growth trajectory of these applications is accelerating as industries seek reliable, durable materials.

The rising adoption of proppants in non-oilfield sectors is further supported by material innovation and customization. Manufacturers are developing specialized proppants with tailored properties such as enhanced chemical resistance or optimized porosity for specific industrial uses. These advancements are making proppants more competitive against alternative materials in non-energy markets. Furthermore, sustainability initiatives are prompting the exploration of recycled and eco-friendly proppant options, appealing to environmentally conscious industries. As awareness of their versatility increases, proppants are likely to see expanded use beyond oil and gas, positioning non-oilfield applications as a significant growth frontier for the market.

End-User Insights

Why Oil & Gas Exploration & Production Companies are dominating the Market?

The oil & gas exploration & production segment is dominating the proppants market due to the scale and complexity of their operations. These companies often manage extensive portfolios of unconventional wells, each requiring significant proppant volumes. Their financial resources allow for large, continuous procurement contracts, ensuring stable demand for suppliers. The integration of advanced fracking technologies further increases proppant usage per well, reinforcing their dominant role in the market. Additionally, their global reach allows them to source and deploy proppants efficiently across multiple regions. This combination of scale, capital strength, and technological adoption ensures their continued dominance.

E&P companies also maintain strong partnerships with proppant manufacturers, enabling collaborative R&D and customized solutions for unique geological challenges. Their emphasis on operational efficiency drives innovations in proppant design, such as improved coating technologies and performance monitoring systems. Moreover, their influence over industry standards and best practices helps shape the overall demand landscape for proppants. As global energy consumption rises, these companies' expansive drilling programs will continue to generate substantial proppant requirements. Their ability to invest in both conventional and unconventional resource development ensures that they will remain the leading end-user segment in the foreseeable future.

Independent operators are the fastest growing segment in the proppants market due to their agility allows them to quickly adopt innovative drilling and completion practices, often leading to higher efficiency per well. Many independents focus on niche basins or underexplored areas, where targeted fracking programs can yield high returns. The increasing availability of contract drilling and third-party service providers enables these operators to compete effectively without the capital intensity of larger firms. Their growing share of new well completions is driving incremental demand for proppants.

The rise of independents is also linked to favorable regulatory environments and access to private equity or venture capital funding, which supports their expansion into unconventional plays. These operators often collaborate closely with technology providers to optimize proppant selection and placement for specific reservoir conditions. Their willingness to experiment with advanced materials, such as ceramic or resin-coated proppants, further contributes to market growth. As more independent operators enter the field, especially in emerging shale basins, their collective demand for proppants is expected to accelerate. This positions them as a dynamic and increasingly influential segment within the industry.

Proppants Market Companies

- CARBO Ceramics Inc.

- Covia Holdings Corporation

- Sandstorm Resources Ltd.

- U.S. Silica Holdings, Inc.

- Fairmount Santro

- Saint-Gobain Proppants

- Emerge Energy Services

- Sibelco Group

- EP Minerals

- Hi-Crush Inc.

- Adaro Energy

- BASF SE

- Trelleborg AB

- Jingxin Group

- Shandong Haihua Group

- Jinzhou Bohai Fracturing

- Angang Group

- Resfract Technologies

- Ensign Energy Services Inc.

- Nanocyl SA

Recent Developments

- In August 2025, two energy giants, Exxon Mobil and Chevron , recently caught my attention, with XOM emerging as the stronger pick in my comparison. Exxon appears more attractively valued, is delivering faster earnings growth, and benefits from a secondary business that I believe remains underappreciated by the market. That said, Chevron still stands out as the safer long-term holding, thanks to its strategy of modestly increasing production from high-return assets and maintaining a more robust dividend profile.(Source: https://seekingalpha.com)

Segments Covered in the Report

By Type

- Sand Proppants

- Ceramic Proppants

- Resin-Coated Proppants

- Other Proppants

By Application

- Oilfield Hydraulic Fracturing

- Non-Oilfield Applications

By End User

- Oil & Gas Exploration & Production Companies

- Oilfield Service Companies

- Independent Operators

By Region

- North America

- Europe

- Asia Pacific

- South America

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting