Proton Pump Inhibitors (PPIs) Market Size and Forecast 2025 to 2034

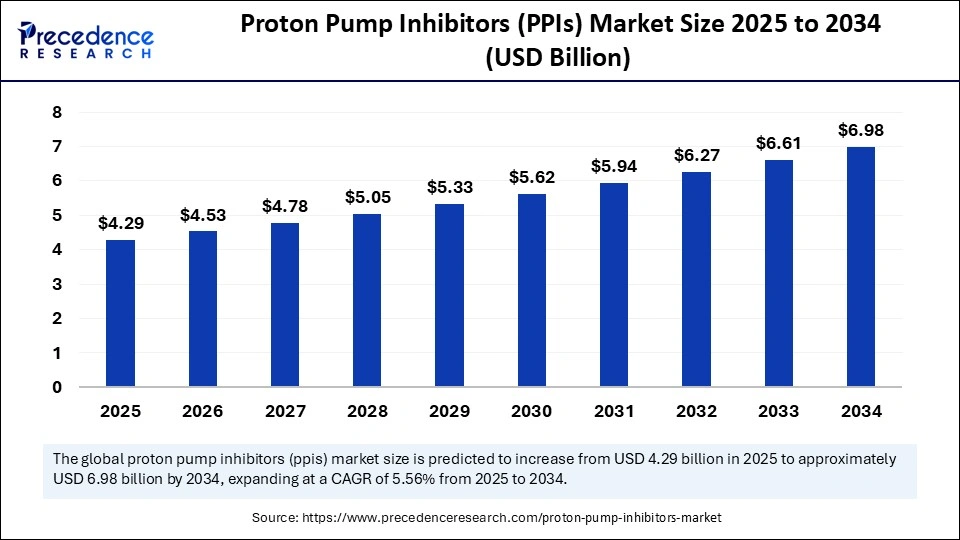

The global proton pump inhibitors (PPIs) market size accounted for USD 4.06 billion in 2024 and is predicted to increase from USD 4.29 billion in 2025 to approximately USD 6.98 billion by 2034, expanding at a CAGR of 5.56% from 2025 to 2034.The market is witnessing significant growth due to greater focus on personalized treatment approaches and the rising prevalence of gastrointestinal disorders and related chronic conditions, leading to an increased demand for early diagnosis and effective therapies. Additionally, the growing preference for minimally invasive and long-lasting therapeutic options is expected to propel market growth in the future.

Proton Pump Inhibitors (PPIs) MarketKey Takeaways

- In terms of revenue, the global proton pump inhibitors (PPIs) market was valued at USD 4.06 billion in 2024.

- It is projected to reach USD 6.98 billion by 2034.

- The market is expected to grow at a CAGR of 5.56% from 2025 to 2034.

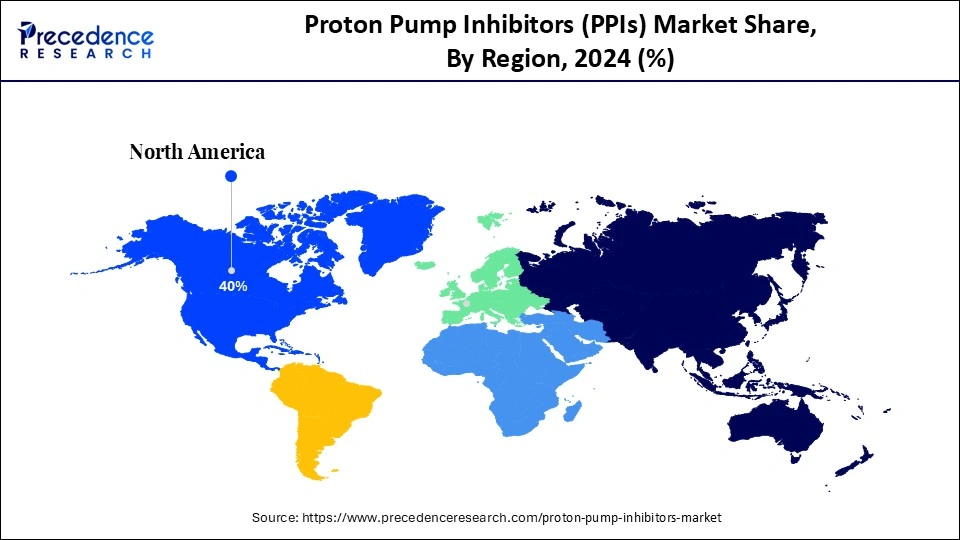

- North America dominated the proton pump inhibitors (PPIs) market with the largest share of 40% in 2024.

- Asia Pacific is expected to grow at the fastest CAGR from 2025 to 2034.

- By drug type, the Omeprazole segment led the market in 2024.

- By drug type, the Pantoprazole segment is expected to grow at a significant CAGR over the projected period.

- By route of administration, the oral segment held the biggest market share in 2024.

- By route of administration, the injectable segment is expanding at a significant CAGR from 2025 to 2034.

- By indication, the gastroesophageal reflux disease segment contributed the highest market share in 2024.

- By indication, the heartburn segment is expected to witness a significant CAGR during the forecast period.

- By distribution channel, the hospital pharmacies segment generated the major market share in 2024.

- By distribution channel, the online pharmacies segment is projected to grow at a CAGR between 2025 and 2034.

How is AI Transforming the Proton Pump Inhibitors (PPIs) Market?

Artificial intelligenceis revolutionizing the market for proton pump inhibitors (PPIs) by enhancing drug discovery and development and promoting rational drug use. AI-powered tools are employed to analyze protein structures, predict drug interactions, and optimize formulations, resulting in more targeted and effective therapies. Furthermore, AI is also used in clinical settings to improve the rational use of PPIs, particularly in hospitals, by identifying inappropriate prescriptions and ensuring adherence to guidelines. It can also analyze the 3D structures of PPIs bound to their target, the gastric proton pump, and suggest modifications to improve drug potency and selectivity, potentially enhancing patient outcomes and reducing side effects.

U.S. Proton Pump Inhibitors (PPIs) Market Size and Growth 2025 to 2034

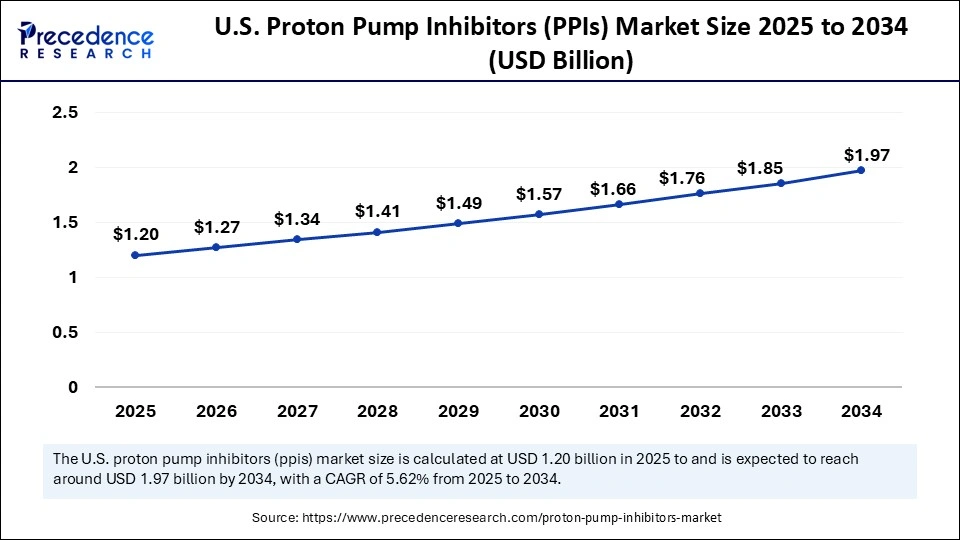

The U.S. proton pump inhibitors (PPIs) market size was exhibited at USD 1.14 billion in 2024 and is projected to be worth around USD 1.97 billion by 2034, growing at a CAGR of 5.62% from 2025 to 2034.

What Factors Contributed to North America's Dominance in the Proton Pump Inhibitors (PPIs) Market in 2024?

North America dominated the market by capturing the largest revenue share in 2024. This is due to the high prevalence of gastrointestinal disorders like GERD and peptic ulcers, a well-established healthcare infrastructure, and strong patient demand, including a significant over-the-counter market. The region also benefits from major pharmaceutical companies such as AstraZeneca, Pfizer, Takeda, Teva, and Sun Pharmaceutical Industries, along with research institutions, which drive innovation and advancements in PPI development and treatment protocols. Moreover, significant healthcare investments facilitate the adoption of advanced PPI solutions, supported by a robust healthcare system with good access to medications and treatments.

The U.S. Proton Pump Inhibitors (PPIs) Market Trends

The U.S. holds a dominant position in the global market, largely due to its high prevalence of gastrointestinal disorders and well-established healthcare infrastructure. Major pharmaceutical companies in the U.S. are actively engaged in research and development of new PPI formulations and treatment strategies. Increased healthcare expenditure, well-established healthcare facilities, and high patient demand contribute to market growth in the country.

What are the Major Factors Supporting the Growth of the Proton Pump Inhibitors (PPIs) Market Within Asia Pacific?

Asia Pacific is expected to experience the fastest growth in the market. The growth of the market within the region is driven by the increasing prevalence of gastrointestinal disorders, rising healthcare expenditure, and expanding healthcare infrastructure, which improve access and affordability of medications like PPIs. The growing middle-class population and better healthcare access in countries like China, India, and Japan also contribute. Prominent pharmaceutical companies such as Cadila Pharmaceuticals, Eisai, Dr. Reddy's Laboratories Ltd., and Lupin are actively focusing on developing novel drugs, supporting market growth. Government initiatives and national healthcare programs are also promoting access to essential medicines, and the availability of cost-effective generic PPIs in countries like China and India makes these medications more accessible to a broader population.

In April 2022, Daewon Pharmaceutical launched Escorten, its first proton-pump inhibitor drug. Escorten Tablet, containing esomeprazole magnesium trihydrate as the main ingredient, is a low-dose PPI that significantly improves access to PPIs in various treatment settings, from hospitals to university hospitals. It offers excellent therapeutic effects and affordable prices as a satisfactory treatment option.

(Source: https://www.koreabiomed.com)

China Proton Pump Inhibitors (PPIs) Market Trends

China plays a major role in the global market. This is mainly due to advances in healthcare infrastructure, increased awareness of gastrointestinal disorders, and a rising aging population. China's pharmaceutical industry is robust, with numerous domestic manufacturers and distributors ensuring the availability of PPIs. The future of the Chinese PPI market will likely be influenced by market dynamics, government regulations, and ongoing efforts to promote rational drug use.

What Opportunities Exist in the Proton Pump Inhibitors (PPIs) Market Within Europe?

Europe is expected to grow at a significant rate in the upcoming period, driven by a robust healthcare infrastructure, well-established prescription practices, and a high prevalence of gastrointestinal disorders. Germany is notable for its strong healthcare system and high rates of PPI prescriptions, making it a leading market due to its well-regulated public health insurance system, which provides patients with easy access to treatment. Additionally, various government initiatives, such as the Critical Medicines Act in the European Union, emphasize the region's commitment to ensuring access to essential medications like PPIs while addressing potential supply chain challenges and shortages.

In March 2025, the European Commission introduced the Critical Medicines Act, a legislative proposal aimed at addressing drug shortages among member states. This act aims to enhance the availability and supply of essential medicines within the European Union, tackling recurring challenges in pharmaceutical supply chains to reduce dependency on external suppliers and bolster resilience within Europe's healthcare systems.

(Source: https://www.geneonline.com)

Latin America Proton Pump Inhibitors (PPIs) Market Trends

The growth of the market within Latin America is expected to be driven by the rising incidence of gastrointestinal issues, increased awareness of treatment options, and growing healthcare investments. Brazil and Mexico are witnessing promising growth due to the improvements in healthcare infrastructure and an aging population. For example, M8 Pharmaceuticals has partnered with Daewoong Pharmaceuticals to introduce an innovative solution for GERD treatment in Mexico, reflecting a growing focus on providing advanced PPIs in the region.

Middle East and Africa Proton Pump Inhibitors (PPIs) Market Trends

The proton pump inhibitors (PPIs) within the Middle East and Africa is growing due to the changing dietary habits, sedentary lifestyles, and increased stress, contributing to a rise in conditions like GERD, peptic ulcers, and other gastrointestinal issues. While specific government initiatives targeting PPIs are not widely publicized, the overall increase in healthcare spending and infrastructure development across the region is fostering a favorable environment for market expansion.

Market Overview

Proton Pump Inhibitors (PPIs) are a specific type of medication leveraged to manage and treat conditions caused by excessive stomach acid, primarily acid reflux, peptic ulcers, and Gastroesophageal Reflux Disease. These drugs work by irreversibly inhibiting the H+/K+-ATPase enzyme, also known as the proton pump in the stomach lining, which is responsible for acid secretion. The market is characterized by intense competition, with major pharmaceutical companies actively involved in researching and developing new PPIs and formulations. While PPIs are generally considered safe for short-term use, the market for PPIs is experiencing growth due to factors like the increasing prevalence of gastrointestinal disorders, new product launches, and the effectiveness of PPIs in treating various acid-related conditions.

What are the Key Trends in the Proton Pump Inhibitors (PPIs) Market?

- Demand for Effective Acid-Related Conditions Treatment:PPIs are highly effective in reducing stomach acid and providing relief from symptoms like heartburn and acid indigestion, making them a preferred selection for managing various gastrointestinal issues.

- Growing Awareness and Diagnosis:Growing awareness of gastrointestinal disorders and improved diagnostic capabilities are leading to more diagnoses and treatment with PPIs, which is contributing to market growth.

- Development of New Products:Pharmaceutical companies are continuously developing and launching new and improved PPI formulations, often with enhanced efficacy, longer duration of action, improved safety profiles, and better tolerability, expanding the market.

- OTC and Accessibility: Increased awareness about the benefits of PPIs, together with their availability in both prescription and over-the-counter forms, at lower dosages, is increasing accessibility and contributing to market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 6.98 Billion |

| Market Size in 2025 | USD 4.29 Billion |

| Market Size in 2024 | USD 4.06 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.56% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Drug Type, Route of Administration, Indication, Distribution Channel, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing Prevalence of Gastrointestinal Disorders

The primary factor driving the growth of the proton pump inhibitors (PPIs) market is the increasing prevalence of gastrointestinal disorders, especially gastroesophageal reflux disease (GERD). Conditions like peptic ulcers and Zollinger-Ellison syndrome also contribute to the demand for PPIs. Growing awareness about gastrointestinal disorders and improvements in healthcare infrastructure, particularly in emerging markets, also support market growth. This surge in gastrointestinal issues, coupled with an aging population and changing lifestyles, is increasing the demand for PPIs, which are a common treatment for these conditions.

Restraint

Concerns About Side Effects Related to Prolonged Use

The main restraint in the proton pump inhibitors (PPIs) market is concerns about side effects related to prolonged use, which have led to increased scrutiny from healthcare professionals and potential market limitations. While effective for treating acid-related disorders, PPIs have been linked to various side effects, including increased risk of fractures, kidney disease, and infections like C. difficile. The FDA has issued warnings regarding these risks, especially concerning fractures with long-term use. These concerns can make doctors more cautious when prescribing PPIs, particularly for long-term treatment, potentially limiting market growth.

Opportunity

Development of Novel Dual Therapy Drugs

The key future opportunity in the proton pump inhibitors (PPIs) market lies in the development of novel dual therapy drugs that combine acid suppression with mucosal protection. This strategy aims to provide more effective and sustained relief from gastrointestinal disorders by addressing both acid secretion and the protective mechanisms of the stomach lining. Such approaches could lead to better symptom relief and help mitigate some long-term concerns related to PPIs.

In June 2024, Akums Drugs & Pharmaceuticals Ltd announced the launch of Rabeprazole + Levosulpiride SR capsules. Approved by the Drug Controller General of India, this new formulation improves relief for patients suffering from gastrointestinal tract (GIT) disorders by offering a more effective remedy, alleviating symptoms, enhancing gastrointestinal function, and boosting overall well-being.

(Source: https://health.economictimes.indiatimes.com)

Drug Type Insights

Why Did the Omeprazole Segment Dominate the Proton Pump Inhibitors (PPIs) Market in 2024?

The Omeprazole segment dominated the market with the largest share in 2024. This is due to its established efficacy, high brand recognition, and wide availability in both prescription and over-the-counter markets, making it a preferred choice for treating various acid-related disorders. Additionally, it is mainly used in the treatment of GERD, peptic ulcers, Zollinger-Ellison syndrome, and as part of triple therapy for Helicobacter pylori infections. Its versatility in managing different gastrointestinal conditions, along with a generally well-tolerated safety profile, contributes to its leading position.

The Pantoprazole segment is expected to grow at the fastest rate in the upcoming period. This is mainly due to its favorable pharmacokinetic properties, including a lower potential for drug interactions and a longer duration of action compared to other PPIs. Pantoprazole is generally well-tolerated, with a low incidence of adverse effects, and can inhibit the cytochrome P450 enzyme system. This makes it a safer choice for patients taking multiple medications. Nowadays, there is growing awareness and usage of pantoprazole due to its efficacy and safety profile, particularly in treating GERD and related conditions.

Route of Administration Insights

What Made Oral the Dominant Segment in the Market in 2024?

The oral segment dominated the proton pump inhibitors (PPIs) market with a major revenue share in 2024. This is owing to its proven efficacy, widespread availability, and relatively lower cost compared to other administration routes, such as intravenous (IV). High-dose oral PPIs are as effective as IV PPIs in managing certain conditions, like bleeding peptic ulcers, after endoscopic treatment. Oral administration is generally more convenient for patients, requiring less specialized medical supervision, which is often preferred in hospital settings. Furthermore, patients often prefer the ease and comfort of oral medications, leading to better adherence to treatment.

The injectable segment is expected to grow at the fastest CAGR during the forecast period. This is primarily because of its ability to offer rapid and effective acid suppression, especially in acute situations like peptic ulcer bleeding. Intravenous administration allows for faster absorption and a quicker onset of action in suppressing gastric acid production compared to oral formulations. This is crucial in situations where rapid acid control is needed, such as acute upper gastrointestinal bleeding. Therefore, it is mainly used in treatments where immediate and effective acid suppression is essential for preventing further complications and promoting healing.

Indication Insights

How Does the Gastroesophageal Reflux Disease Segment Dominate the Proton Pump Inhibitors (PPIs) Market in 2024?

The gastroesophageal reflux disease segment maintained a dominant position in the market in 2024. This is due to the high prevalence of GERD, which significantly impacts the quality of life, the effectiveness of PPIs in treating it, and the widespread use of PPIs for long-term management and maintenance therapy, as they are considered the gold standard for treating various GERD-related conditions, including erosive esophagitis and Barrett's esophagus. Thus, the consistent demand for PPIs contributes to the large market share held by the GERD segment for both acute and long-term management.

The heartburn segment is expected to expand at the fastest rate in the coming years. The growth of the segment is driven by the increasing prevalence of gastroesophageal reflux disease, characterized by heartburn and regurgitation, which is becoming more common globally. This, coupled with other acid-related disorders and the widespread use of PPIs for symptom relief, has fueled demand. Additionally, unhealthy eating habits, increased stress, alcohol consumption, and smoking are known to worsen acid reflux and heartburn, increasing demand for PPIs and making treatment more accessible and convenient for those seeking relief from occasional heartburn.

Distribution Channel Insights

Why Did the Hospital Pharmacies Dominate the Proton Pump Inhibitors (PPIs) Market in 2024?

The hospital pharmacies segment led the market in 2024. This is because of specialized treatment needs and established supply agreements that ensure a steady, reliable supply. Hospital pharmacies handle complex PPI cases, often requiring high doses or long-term therapy, and have contracts with pharmaceutical companies. This dominance is further explained by the rising number of patients with gastrointestinal disorders seeking treatment in hospital settings, which are well-equipped to manage these conditions.

The online pharmacies segment is expected to grow at the fastest CAGR during the projection period. The growth of the segment is attributed to the increased accessibility, convenience, and competitive pricing offered by online platforms. These platforms provide 24/7 availability, doorstep delivery, and features like prescription management and reminders, making it easier for consumers. Online pharmacies also tend to offer lower prices due to reduced overhead costs compared to traditional stores, attracting price-sensitive customers and fueling the growth of online sales.

Proton Pump Inhibitors Market Companies

- AstraZeneca

- Bayer AG

- Cadila Pharmaceuticals

- Eisai Inc.

- GlaxoSmithKline PLC

- Pfizer Inc.

- Takeda Pharmaceuticals

- Sanofi SA

- Dr. Reddy's Laboratories

- Redhill Pharma Limited

- Cipla Limited

Recent Developments

- In June 2025, Eisai Co., Ltd. announced the launch of Pariet S, a highly effective new over-the-counter medication designed to alleviate severe heartburn and stomach pain caused by gastric acid reflux. The medicine is available in small, easy-to-swallow tablets with a once-daily dosage that provides 24-hour relief.

(Source: https://www.eisai.com) - In July 2024, Dr. Reddy's Laboratories signed a non-exclusive patent licensing agreement with Takeda Pharmaceutical Company. This collaboration aims to introduce Vonoprazan tablets, a novel treatment for gastrointestinal disorders, to patients across India. These tablets serve as orally active potassium competitive acid blockers (PCABs) and are used to treat reflux esophagitis and other acid peptic disorders under the brand name Vono.

(Source: https://www.business-standard.com) - In June 2024, Torrent Pharmaceuticals Limited announced a collaboration with Takeda Pharmaceuticals to commercialize its gastrointestinal drug portfolio. Torrent has entered into a non-exclusive patent licensing agreement to bring Takeda's novel GI drug, Vonoprazan, to market as an effective alternative for GERD treatment, which has predominantly relied on proton pump inhibitors such as Pantoprazole.

(Source: https://timesofindia.indiatimes.com)

Segments Covered in the Report

By Drug Type

- Esomeprazole

- Omeprazole

- Dexlansoprazole

- Pantoprazole

- Others

By Route of Administration

- Oral

- Injectable

By Indication

- Gastroesophageal Reflux Disease

- Heartburn

- Peptic Ulcers

- Others

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Drug Stores

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting