What is the Psoriasis Treatment Market Size?

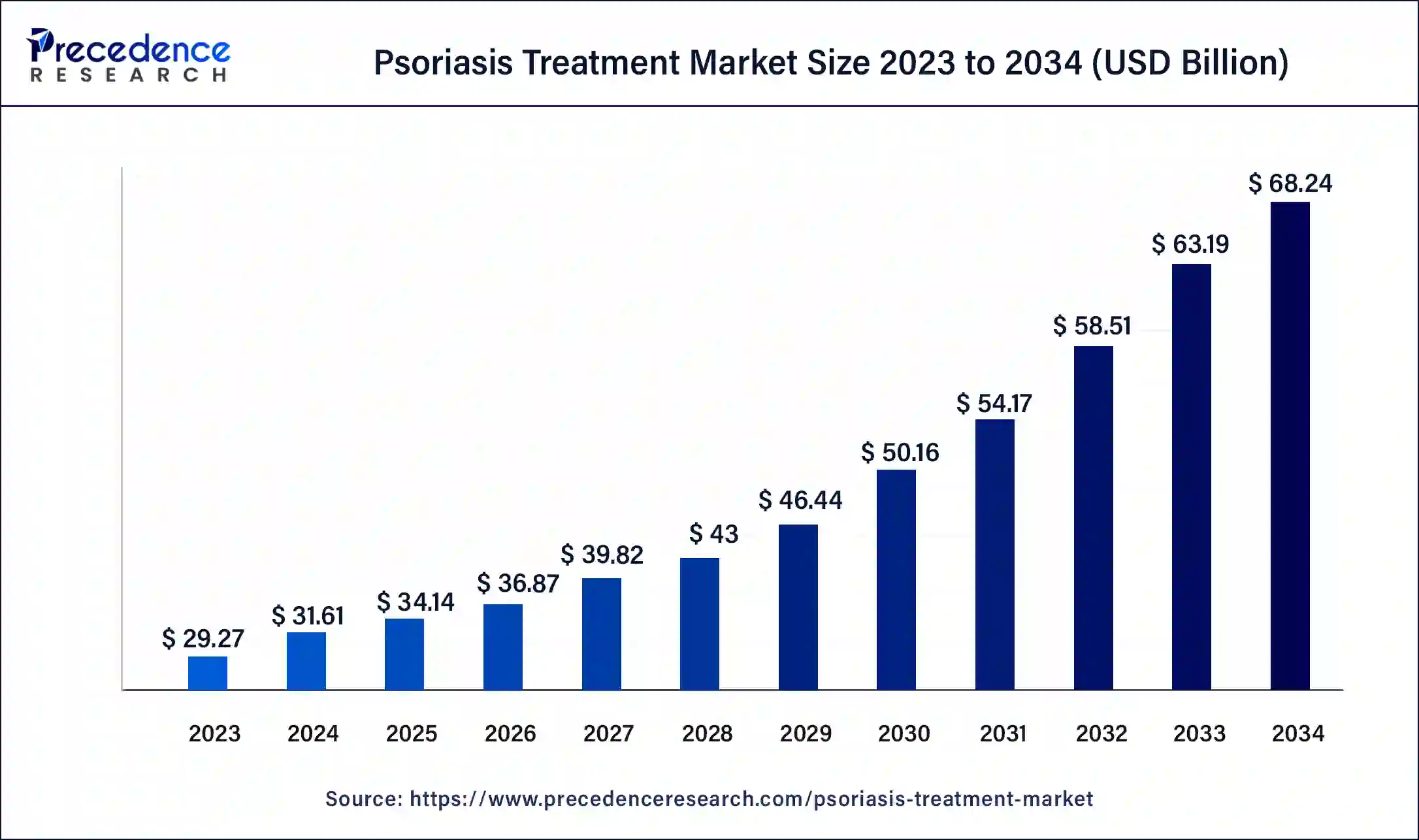

The global psoriasis treatment market size is accounted at USD 34.14 billion in 2025 and is predicted to increase from USD 36.87 billion in 2026 to approximately USD 73.04 billion by 2035, expanding at a CAGR of 7.9% from 2026 to 2035

Market Highlights

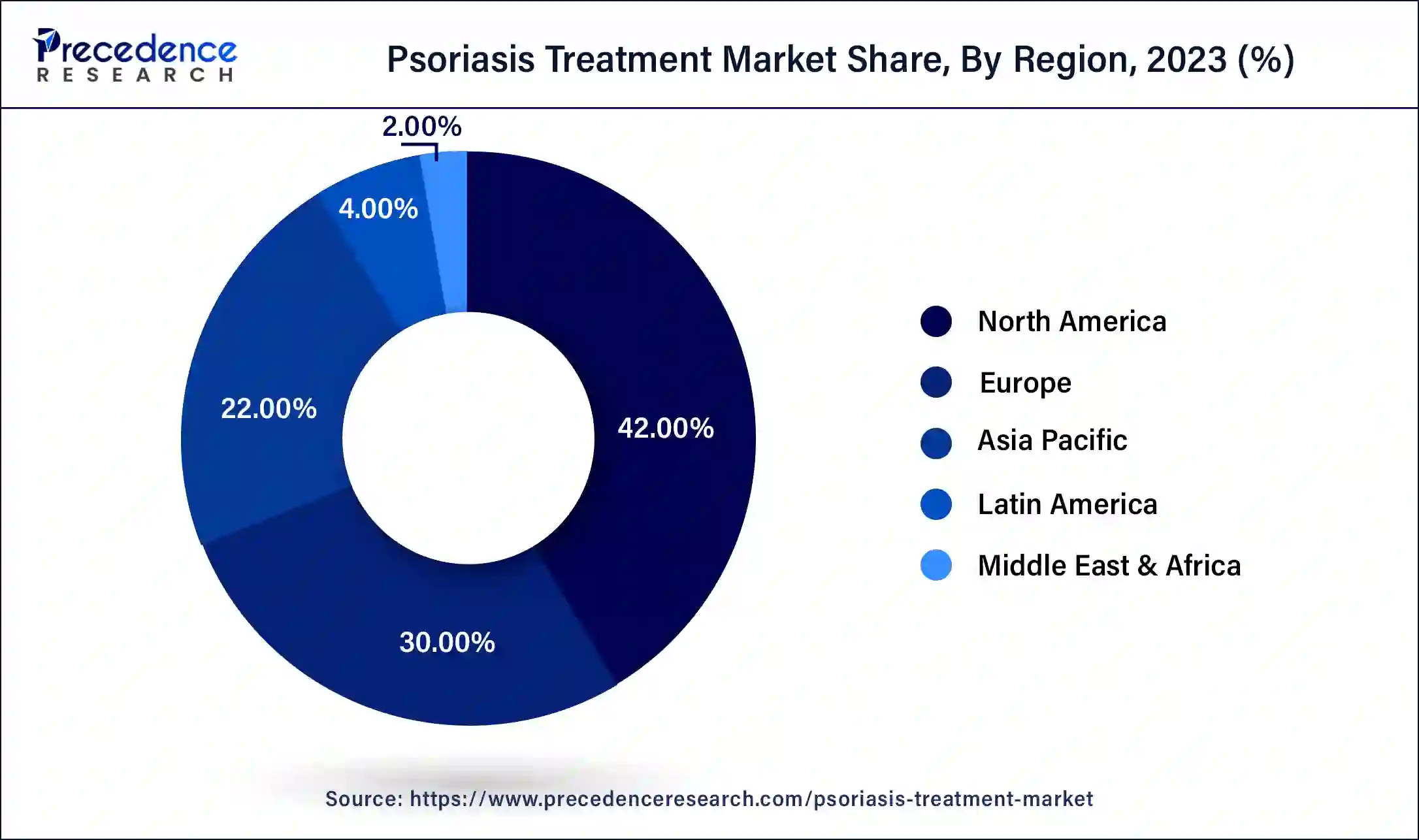

- North America region generated a revenue share of around 42% in 2025.

- The Asia Pacific market is expected to exhibit the strongest CAGR between 2026 to 2035

- In 2023, the TNF inhibitors drug class segment accounted for 47.5% revenue share.

- By type, the plaque psoriasis segment is estimated to hold the largest market share between 2026 to 2035

- By route of administration, the parenteral route segment is estimated to hold the highest market share in 2025.

- By distribution channel, the retail pharmacies segment registered the maximum market share in 2025.

Rising Psoriasis Burden and Market Transformation Amid Modern Therapies

Psoriasis is a skin condition which is an autoimmune inflammatory type of disorder which is caused as a result of overproduction of tissue cells over the skin. Symptoms such as excessive dryness, itching, bleeding and local irritation are experienced by the patient over the period of time. Pricking pain and inflammation is experienced by the patient over the skin in severe conditions. the disease is categorized under two types of psoriatic arthritis and plaque psoriasis. The patients suffering with psoriatic arthritis usually present with skin conditions along with joint complaints and pain.

On the other hand, plaque psoriasis is commonly observed among the people with prominent skin conditions. The huge number of people belonging to the geriatric population has also increased the number of cases belonging to psoriasis. The extensive use of biosimilar products I have helped to boost the market to a great extent. They lucrative offers and schemes which have been provided by the insurance companies in the form of reimbursement facilities have helped to boost the size of the market to a great extent during the forecast period.

The rapid prescriptions made by the clinics and the hospitals in order to treat these skin conditions how increased the sales of biologic products into the market which facilitates the growth of the market to a great extent. The high cost of the modern medicines and procedures hampered the growth of the market tremendously. The lack of disposable income available with the people hampered the sales and demand of the medicines. The long-term treatment which is associated with these skin disorders amounts to a huge amount over the period of time which proves to be a challenge for the growth of the market.

The outbreak of the pandemic had a significant impact on the psoriasis treatment market. On one hand, the follow ups and regular visit to the hospitals were restricted due to the transportation facilities and movements being hampered due to the lockdowns. On the other hand, the online retail stores showed a rising demand and supply on account of the increasing trend of online shopping among the consumers. The patients showed greater response to this system as compared to the earlier ones. Better self-care provided better results during the occurrence of the pandemic.

The impact of environmental factors on the health of the consumers were minimum which helped the market to grow significantly. The expenditure which was associated with the occurrence of the pandemic reduced the disposable income available with the people which had a direct impact on the growth of the market. The covid infection had shown its negative effects on a certain group of individuals by aggravating their skin disorders. The retail pharmacies also showed a great demand and supply during the course of the pandemic as a result all of the high-risk factors in the hospitals and clinics.

Major Psoriasis Treatment Market Trends

• Convenient Oral Therapies Are Gaining Favor with Patients: Due to increased concern with patient compliance, many pharmaceutical companies are actively pursuing oral therapies, including the next generation of small molecule inhibitors, as an alternative therapy option for patients reluctant to use injectable biologic therapies.

• Continuing increase in Treatment Personalization: A growing focus on developing new types of diagnostic tools and using biomarkers to guide therapy selection has allowed dermatologists to personalize their treatment plans and provide better patient outcomes by decreasing the need for trial and error in therapy selection for patients with moderate to severe psoriasis.

• Increasing Penetration of Biosimilars: Many biosimilars are coming onto the market with the expiration of many key biologic drugs' patents, particularly in lower-cost markets, providing a wider range of options for patients without limiting the clinical activity of the products.

• Tele-dermatology and Digital Disease Tracking Technology: The availability of virtual dermatology consultations and digital disease tracking applications is expanding the options available for the treatment of chronic psoriasis, especially in regions with a limited number of dermatology specialists.

Psoriasis Treatment Market Trade Analysis

• The psoriasis therapeutic market exhibits substantial differences in differences between the developed and developing markets due to the high price of biologics exported to North American and European markets vs. the higher use of generics and biosimilars by markets that have more sensitivity to pricing.

• Governments provide reimbursement frameworks and other tender-based procurement, as well as insurance company reimbursement, that govern import volumes and how quickly the therapy is adopted, and how that might affect cross-border pharmaceutical trade flow.

• While Centralized Biologics Manufacturing and complex cold chain logistics continue to impact the efficiency of trade and logistics, affecting timelines and product market availability in remote regions.

Market Outlook

- Industry Growth Offerings- The market is growing due to the rising prevalence of chronic skin disorders, increasing adoption of biologics and biosimilars, expanding healthcare infrastructure, and supportive insurance coverage. Innovations in targeted therapies and tele-dermatology services further accelerate market growth.

- Global Expansion-The global market is expanding as healthcare access improves in emerging economies, biologics and biosimilars gain wider adoption, and international pharmaceutical companies strengthen distribution networks. Rising awareness, digital health platforms, and telemedicine also drive worldwide market growth.

- Startup ecosystem- The startup ecosystem is growing with companies developing novel biologics, biosimilars, and digital health solutions. Focus on personalized therapies, tele-dermatology, and home-based treatment delivery, supported by venture funding and healthcare partnerships, is driving innovation and market entry.

Psoriasis Treatment Market Growth Factors

The high prevalence of skin disorders in the developed nations like North America has helped the psoriasis treatment market to show a considerable growth in this region. The rate at which the disease of psoriasis is developing in the people belonging to this region has given rise to various drives and campaigns organized by the government in order to spread awareness regarding the management and treatment of this disease. The lucrative offers and schemes which are provided by the insurance companies in the form of reimbursements has also helped to boost the economy for the psoriasis treatment market. Advanced psoriatic conditions which involved other complications such as severe hair loss and joint pains also proved to be a driving factor for the growth of the market.

With the increasing research and development carried out by the key market players in the field of therapeutics has help to boost the market to a great extent. The advancements made by the key market players has helped reduce the number of side effects which are faced by the patient after the treatment by modern medicine. This has proved to be a great driving factor for the growing market. The huge number of people belonging to the geriatric population has also proved to be a blessing for the market growth as a result of the high prevalence of skin diseases among these people. The treatment of this disease requires a very long period of time which helps the market to record a high revenue return over the period of time as a result of the constant supply and demand which is seen as a part of the ongoing treatment. In many cases this disease has followed genetic inheritance which has also proved to be a driving force for the market.

The advanced applications which have been introduced into the market have successfully provided faster results over a shorter period of time which has supported the market growth significantly. This disease has now started occurring even in the people belonging to the younger age group as a result of the modern lifestyle practices which do not include healthy food habits. As far as treatment is concerned the parental route of administration has considered to be the fastest growing segment as a result of its ease of access. This route of administration has been seen effective for treating the people belonging to the younger age groups and children. These multiple reasons prove to be the growth factors for the psoriasis treatment market during the forecast period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 34.14 Billion |

| Market Size in 2026 | USD 36.87 Billion |

| Market Size by 2035 | USD 73.04 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.9% |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Drug Class, Treatment Type, Type, Route of Administration, Distribution Channel, and Region |

| Regions Covered | North America, Asia Pacific,Europe, Latin America, Middle East and Africa |

Segments Insights

Drug Class Insights

TNF inhibitors have shown the maximum growth in the market by holding the largest share during the forecast period. The segment of interleukins is seen to record the fastest growth in the forecast period as a result off the growing prescriptions which is facilitated by its similarity in biological constitution.

As the prices of the inhibitors are reducing rapidly because of the competition provided by the interleukins the market is expected to show a transition.

Type Insights

Plaque psoriasis recorded the fastest growth as a result of its rapid prevalence in the market. A huge number of people are seen suffering with this type of skin disorder and hence it records the highest return during the forecast period. The rapid advancements which are taking place in order to treat such skin disorders have helped the market to record a tremendous growth.

Psoriatic arthritis forms the next segment under this heading which is commonly found in the people. The new products which are launched by the key market players in order to treat these diseases have proved to be the driving forces for the growth of the market during the forecast period.

Route of Administration Insights

The parenteral route has recorded the highest share in the market as a result of its high level of convenience. It is the easiest way of application which is considered by the people all over the world. A rapid sales and supply are observed over the counter which helps the market to record a considerable revenue. The rapid development seen in the medical industry has enhanced the confidence people have over these applications.

The oral route of administration has seen a secondary place in the market as a result of the rapid prescriptions. The rapid research and development performed by the key market players regarding these applications as boosted the size of the market considerably.

Distribution Channel Insights

The retail pharmacies have dominated the segment as a result of the huge sales and supply which is recorded by the high demand of the market. Increasing awareness regarding the available medicines and products in order to treat these skin disorders has boosted the demand and supply in the market.

On the other hand, the next segment which has shown a considerable growth is of online pharmacies which has formed the recent trend. Rapidly increasing fashion of online shopping has boosted the demand and sales of the online pharmacies. Hospitals and clinic from the next segment which shows a steady rise with the increasing number of patients in the market.

Regional Insights

U.S. Psoriasis Treatment Market Size and Growth 2026 to 2035

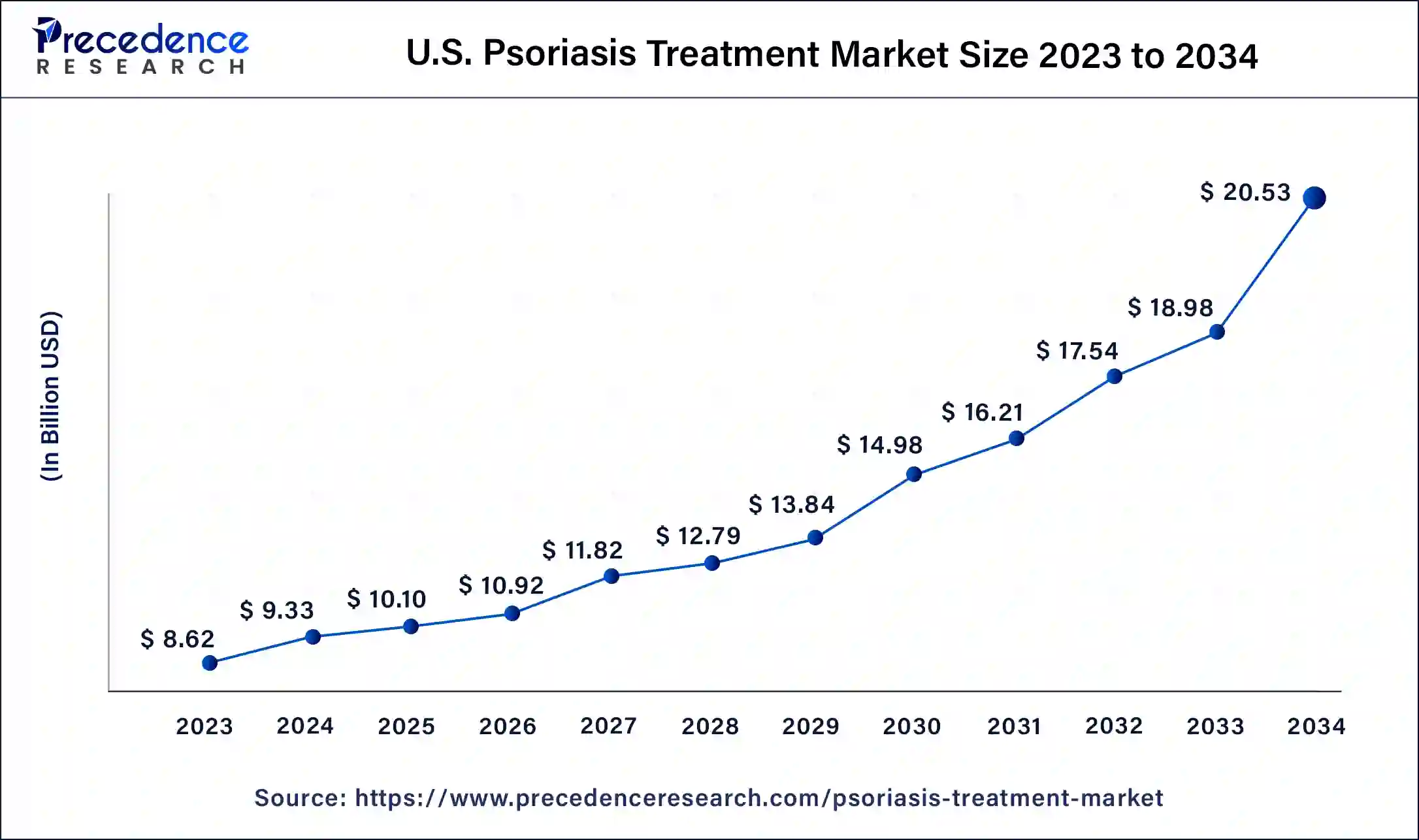

The U.S. psoriasis treatment market size is estimated at USD 10.10 billion in 2025 and is predicted to be worth around USD 22.00 billion by 2035, at a CAGR of 8.1% from 2026 to 2035

The largest market shared is held by the North American region as a result of the huge number of people suffering with skin disorders. The increasing prevalence of psoriasis among the people residing in this region has helped the market to record a significant growth. Psoriasis awareness month is a special initiative which is taken up by the government in the month of August every year in order to spread awareness regarding this skin condition and help them with the therapeutic options available in the market. With the recent advancements that have been observed in the market regarding the treatment of this skin condition rapid growth in the market size has been experienced.

North America: Market Leader Enriched by Biologic Uptake and FDA Approval

North America remains the leading region in the global psoriasis treatment market, benefitted from its established healthcare system and willingness to accept biologics. The U.S. represents the largest population of affected individuals, with over 7.5 million people currently living with psoriasis. FDA approvals continue to strengthen North America as the region of therapeutic advancement, as seen with UCB's bimekizumab (BIMZELX) for the treatment of patients with moderate to severe plaque psoriasis.

Advanced Therapies Drive Growth in the U.S. Psoriasis Market

The U.S. market is growing due to strong adoption of advanced biologics, rising disease awareness, and increasing diagnosis rates supported by improved healthcare access. A large patient pool with chronic and severe psoriasis continues to drive demand for long-term therapies. Favorable reimbursement policies, expanding dermatology clinics, and continuous R&D investments by major pharmaceutical companies further accelerate market expansion. Additionally, the shift toward tele-dermatology and specialty pharmacies strengthens treatment accessibility and boosts overall market growth.

Europe has proved to be the next largest market under this category and is expected to show or significant growth during the forecast period.

Innovative Treatments and Infrastructure Expand Europe's Psoriasis Market

The Europe market is expanding due to the increasing prevalence of chronic skin disorders, growing awareness of advanced biologic and targeted therapies, and widespread healthcare infrastructure. Government initiatives and reimbursement policies support patient access to costly treatments. Rising adoption of biosimilars, coupled with ongoing clinical research and innovation in dermatology, is driving market growth. Additionally, the shift toward outpatient care, telemedicine, and specialty pharmacies enhances treatment accessibility, fueling steady expansion across European countries.

Personalized Care and New Therapies Fuel Growth in the UK Psoriasis Market

The UK market is rising as patients increasingly seek faster relief and effective long-term management options. Growth is driven by the introduction of innovative therapies, including oral small molecules and next-generation biologics. Private healthcare providers and specialty clinics are expanding treatment availability, while digital health platforms and home-delivery pharmacy services are improving accessibility. Rising focus on personalized treatment plans, patient education, and early diagnosis programs is further fueling demand, supporting steady market expansion across the country.

Asia-Pacific: Fastest Growth with Emerging Awareness and Innovation

Asia Pacific is on a rapid increase in demand for psoriasis treatment, aided by a better understanding of the disease, improvements in accessibility to diagnostic testing, and growing healthcare expenditures. Countries historically with lower visibility of this condition are beginning to show awareness and understanding of psoriasis. The areas of India and China are seeing a shift towards modern therapies. Treatments like Tinefcon from Lords Mark Biotech, which contain herbal and biotech-based elements, demonstrate this region's ability to combine tradition and innovation in treatments that appear to be embraced by patients and other professionals.

Rising Awareness and Healthcare Access Boost China's

China's market is expanding due to a rising patient population, increased urban pollution triggering flare-ups, and growing awareness of dermatological care. Government efforts to improve healthcare access and insurance coverage for chronic conditions have boosted treatment adoption. Rapid expansion of hospitals, dermatology centers, and online pharmacies enhances availability of advanced therapies. Additionally, rising income levels and the entry of global biologic manufacturers, along with local biosimilar development, are accelerating market growth across the country.

Value Chain Analysis

Formulation and Final Dosage Preparation

- Psoriasis treatment formulations range from topical creams, ointments, and gels to injectable biologics and systemic therapies.

- Dosage preparation is tailored to the medication type and patient condition, ensuring optimal efficacy and safety.

- Administration and compounding are supervised by healthcare professionals, including doctors and pharmacists.

Key Players: AbbVie, Novartis, Johnson & Johnson, Eli Lilly, Amgen, Pfizer.

Packaging and Serialization

- Psoriasis medications must follow general pharmaceutical packaging and serialization regulations.

- Requirements focus on traceability, anti-counterfeiting measures, and patient safety.

- Compliance ensures secure distribution and helps prevent counterfeit drugs from entering the market.

Key Players: Johnson & Johnson, Novartis, AbbVie, Eli Lilly, Pfizer, Amgen.

Distribution to Hospitals, Pharmacies

- Psoriasis treatments are distributed via hospital pharmacies, retail pharmacies, and online platforms.

- Hospital pharmacies handle complex and high-cost biologics, managing severe cases, and account for the largest market share.

- Retail pharmacies offer a wide range of treatments, including topical creams and self-administered biologics, experiencing rapid growth.

- Online channels are expanding due to convenience and increasing home-use treatment adoption.

Key Players: AbbVie, Novartis, Johnson & Johnson, Eli Lilly, Pfizer, Amgen.

Top Vendors and their Offerings

- Pfizer: Offers biologics and oral therapies targeting moderate-to-severe psoriasis, focusing on inflammation control and immune modulation.

- Amgen Inc.: Provides biologic treatments for plaque psoriasis and psoriatic arthritis, emphasizing long-term efficacy and patient support programs.

- AbbVie Inc.: Supplies advanced biologics like Humira and Skyrizi for chronic psoriasis and psoriatic arthritis, targeting immune system pathways.

- Novartis: Develops innovative biologics and small-molecule therapies for psoriasis, including topical and systemic treatments for diverse patient needs.

- UCB S.A.: Focuses on immunology-based therapies for psoriasis and related inflammatory conditions, offering targeted and personalized treatment solutions.

Other Major Key Players

- Johnson & Johnson Services, Inc. (U.S.)

- LEO Pharma A/S (Denmark)

- Merck & Co., Inc. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Eli Lilly and Company (U.S.)

- Evelo Biosciences, Inc. (U.S.)

Recent updates

Innovative biologics redefine psoriasis care

- On 12 March 2025, Improvements in biologic therapies were a major factor in the notable expansion of the psoriasis treatment market. Patients now have better options for managing their psoriasis thanks to these treatments' improved efficacy and safety profiles. The need for such creative solutions has been fueled by the rising prevalence worldwide, signaling a turning point in the treatment of psoriasis.

Recent Breakthroughs in Psoriasis Treatment:

- By April 2025, Numerous medications in mid and late-stage development have been added to the psoriasis treatment pipeline. Notable among these are treatments that are expected to provide a variety of treatment options, such as senczelokimab, TAK-279, and imsidolimab. With more individualized and efficient treatment options for patients, the market is predicted to benefit from the anticipated approval and introduction of these therapies.

Recent Developments

- On December 1, 2025, Sun Pharmaceutical Industries Ltd. introduced ILUMYA (tildrakizumab) in India as a treatment for moderate-to-severe plaque psoriasis, bringing a globally endorsed IL-23 inhibitor biologic to the Indian market after years of international use. The launch follows strong clinical responses and long-term efficacy in skin clearance. (Source- https://www.bigmoleculewatch.com)

- On 21 February 2025, Teva Pharmaceuticals and Alvotech announced the U.S. launch of SELARSDI (ustekinumab-aekn), a biosimilar to Stelara, for the treatment of plaque psoriasis, psoriatic arthritis, Crohn's disease, and ulcerative colitis in adults and pediatric patients. This launch follows FDA approval and a settlement agreement with Johnson & Johnson, the manufacturer of Stelara

- In March 2025, Affibody AB regained full rights to izokibep, an investigational small protein therapeutic designed to selectively inhibit interleukin-17A (IL-17A), after the termination of licensing agreements with Acelyrin and Inmagene. Affibody is continuing development, with ongoing and planned trials in psoriatic arthritis, hidradenitis suppurativa, uveitis, and axial spondyloarthritis.

- In March 2025, Arcutis Biotherapeutics experienced a remarkable stock rally in 2024, increasing from under $4 to around $14, driven by its focus on dermatology treatments. The company introduced three FDA-approved drugs within two years and aims for two more approvals in 2025. Their flagship product, Zoryve, addresses plaque psoriasis and seborrheic dermatitis and boasts a foam version for eczema.

- In July 2024, Sandoz, a key player in generic and biosimilar medicines, announced the launch of Pyzchiva (ustekinumab) across Europe. Pyzchiva is approved for the treatment of adults with plaque psoriasis, psoriatic arthritis, Crohn's disease, and pediatric plaque psoriasis for patients six years and older weighing over 60 kg.

- In August 2024, Amgen announced Otezla (apremilast) is now available in the U.S. for pediatric use. Earlier this year, the U.S. Food and Drug Administration (FDA) approved Otezla for the treatment of moderate to severe plaque psoriasis in children and adolescents ages six and older who weigh at least 20 kg (44 lb) and are candidates for phototherapy or systemic therapy.

- In October 2023, the U.S. Food and Drug Administration (FDA) approved BIMZELX (bimekizumab-bkzx) for the treatment of moderate-to-severe plaque psoriasis in adults who are candidates for systemic therapy or phototherapy. Bimekizumab is the first and only approved biologic treatment for psoriasis.

Segments covered in the report

By Drug Class

- Interleukins

- TNF Inhibitors

- Others

By Treatment Type

- Biologic Drugs

- Small Molecule Systemic Drugs

- Tropical Therapies

By Type

- Psoriatic Arthritis

- Plaque Psoriasis

- Others

By Route of Administration

- Oral

- Parenteral

- Topical

By Distribution Channel

- Hospital Pharmacies

- Online pharmacies

- Retail Pharmacies

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content