What is the Reciprocating Hydrogen Compressor Market Size?

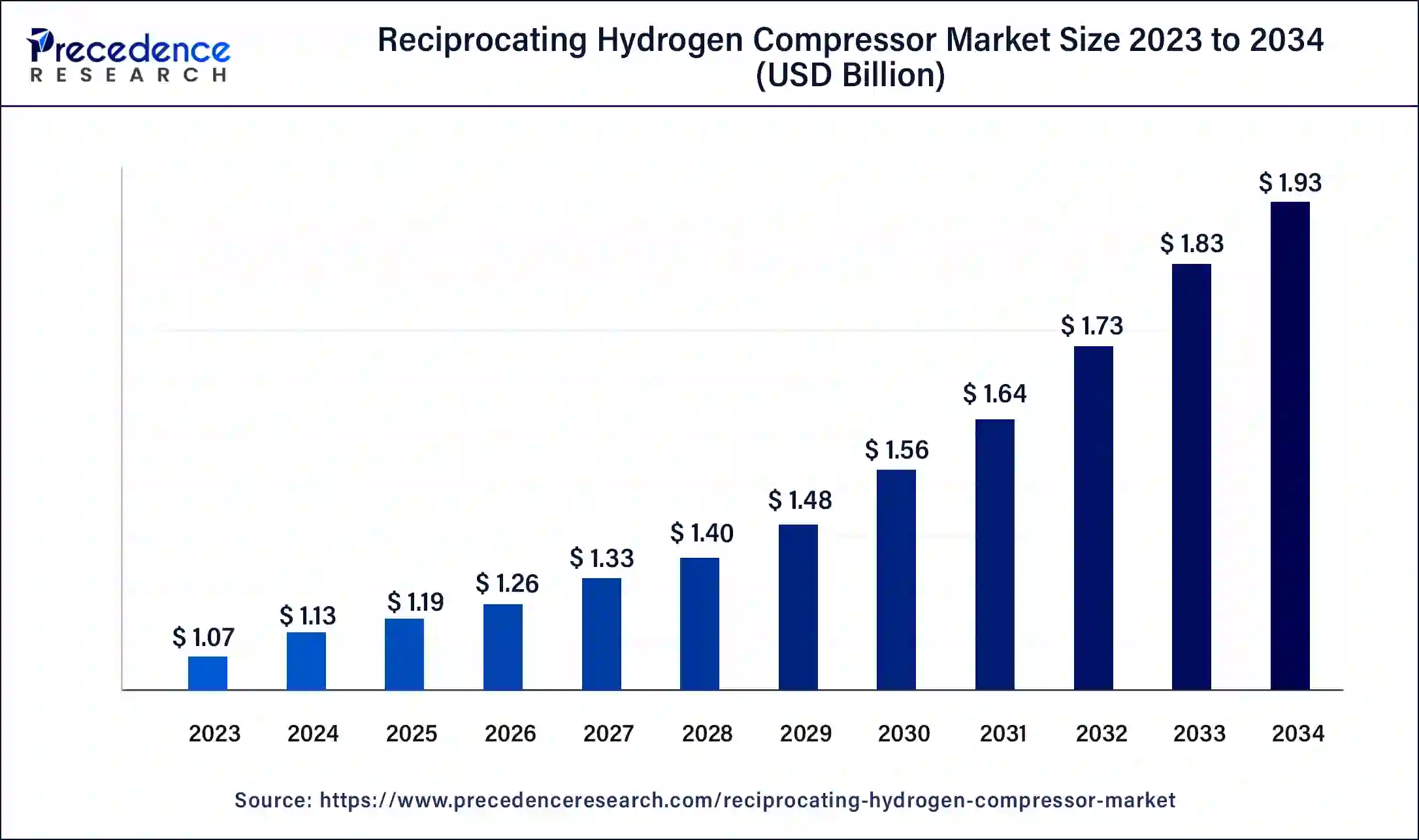

The global reciprocating hydrogen compressor market size is calculated at USD 1.19 billion in 2025 and is predicted to increase from USD 1.26 billion in 2026 to approximately USD 2.03 billion by 2035, expanding at a CAGR of 5.49% from 2026 to 2035.

Reciprocating Hydrogen Compressor Market Key Takeaways

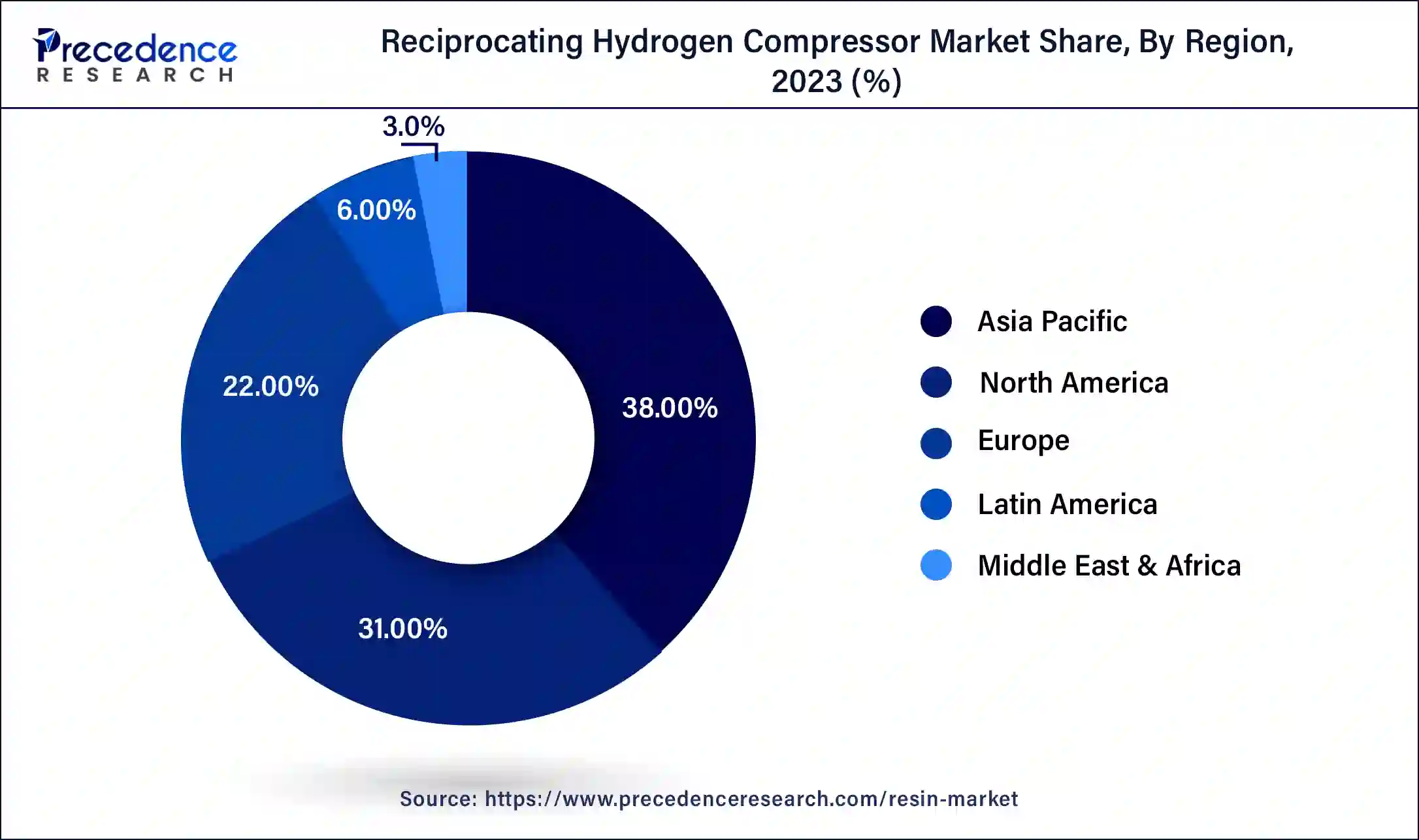

- Asia Pacific contributed the highest revenue of 38% share in 2025.

- LAMEA is estimated to expand the fastest CAGR between 2026 and 2035.

- By lubrication type, the oil-free segment has held the largest market share of 47% in 2025.

- By lubrication type, the oil-based segment is anticipated to grow at a remarkable CAGR between 2026 and 2035.

- By pressure, the 401-700 bar segment generated the highest market share of 45% in 2025.

- By pressure, the more than 700 bar segment is expected to expand at the fastest CAGR over the projected period.

- By compressor type, the double acting segment generated the highest market share of 39% in 2025.

- By compressor type, the diaphragm segment is expected to expand at the fastest CAGR over the projected period.

- By end user industry, the oil and gas segment generated the highest market share of 45% in 2025.

- By end user industry, the automotive segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The reciprocating hydrogen compressor market refers to the industry involved in the manufacturing, distribution, and sales of reciprocating compressors specifically designed for compressing and handling hydrogen gas. Reciprocating compressors are a type of mechanical device used to increase the pressure of gases by reducing their volume, and they operate through a piston-cylinder arrangement. These compressors play a crucial role in various applications such as hydrogen refueling stations, industrial processes, hydrogen storage, and transportation.

The growth of the reciprocating hydrogen compressor market is closely tied to the increasing interest in hydrogen as a clean energy carrier. Hydrogen has expanded significant attention as a probable solution to address environmental distresses, decrease greenhouse gas emissions, and support sustainable energy sources. Thus, the demand for hydrogen compressors has been on the rise to support the compression, storage, and distribution of hydrogen for applications like fuel cell vehicles, industrial hydrogen processes, and energy storage.

Reciprocating Hydrogen Compressor Market Growth Factors

- Increasing demand for hydrogen as a clean energy carrier: As countries and industries look for cleaner energy alternatives to reduce greenhouse gas emissions, hydrogen is gaining prominence as a clean energy carrier. This growing demand for hydrogen in sectors such as transportation (fuel cell vehicles), industry (hydrogen-based processes), and energy storage (hydrogen as a renewable energy storage medium) drives the need for hydrogen compression, boosting the reciprocating hydrogen compressor market.

- Development of hydrogen infrastructure: The establishment and expansion of hydrogen infrastructure, including hydrogen refueling stations and hydrogen production facilities, requires efficient and reliable hydrogen compression systems. As governments and private enterprises invest in building this infrastructure, the demand for reciprocating hydrogen compressors increases.

- Government initiatives and policies: Many governments are implementing policies and financial incentives to promote the use of hydrogen as a clean energy source. These initiatives can include subsidies, tax credits, and regulations that support hydrogen infrastructure development, which indirectly stimulates the reciprocating hydrogen compressor market.

- Environmental regulations: Stricter environmental regulations and emissions reduction targets encourage industries to adopt cleaner technologies, such as hydrogen. This drives the demand for hydrogen compression equipment, as hydrogen is considered an environmentally friendly energy carrier.

- Increasing hydrogen production: The growth of hydrogen production from various sources, including electrolysis using renewable energy, natural gas reforming, and biomass conversion, generates a higher volume of hydrogen that needs to be compressed for various applications, contributing to market growth.

- Investment in research and development: Continued investments in research and development by manufacturers and technology providers lead to the development of more advanced and reliable reciprocating hydrogen compressors, making them more attractive to potential customers.

- Growing awareness and acceptance: Increasing awareness of the benefits of hydrogen as an energy carrier and its potential for addressing sustainability and climate change concerns prompts industries and consumers to consider hydrogen-based solutions, increasing the demand for reciprocating hydrogen compressors.

- Expansion of fuel cell technology: The adoption of fuel cell technology in various sectors, including transportation, stationary power, and backup power systems, drives the need for compressed hydrogen as a fuel source, further boosting the market.

- Global transition to green hydrogen: The shift toward green hydrogen production, which involves using renewable energy sources for electrolysis, is expected to drive the need for hydrogen compression solutions, as green hydrogen is particularly valued for its minimal environmental impact.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2026 to 2035 | CAGR of 5.49% |

| Market Size in 2025 | USD 1.19 Billion |

| Market Size in 2026 | USD 1.26 Billion |

| Market Size by 2035 | USD 2.03 Billion |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Lubrication Type, By End User Industry, By Compressor Type, and By Pressure |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Growing hydrogen economy

Hydrogen is increasingly accepted as a versatile and clean energy carrier with the likely to address environmental problems and decrease greenhouse gas emissions. As industries, governments, and consumers search for sustainable energy solutions, the demand for hydrogen in various sectors such as transportation, industry, and energy storage, has been on the rise. Rapid development and adoption of hydrogen fuel cell vehicles (FCVs) is one of the key drivers of this growth. These vehicles require efficient hydrogen compression technology to store and dispense hydrogen safely, driving the need for reciprocating hydrogen compressors. The expansion of hydrogen refueling infrastructure to support FCVs further fuels this demand.

Furthermore, industrial applications also rely on hydrogen for various processes, and reciprocating compressors are crucial for compressing and transporting hydrogen in these sectors. Additionally, the growth of the hydrogen economy is bolstered by the increasing production of green hydrogen using renewable energy sources, which necessitates hydrogen compression for storage and distribution. Environmental regulations, investments in hydrogen infrastructure, technological advancements, and international collaborations further propel the reciprocating hydrogen compressor market. As the hydrogen economy continues to gain momentum, reciprocating hydrogen compressors play a vital role in enabling the safe and efficient use of hydrogen across diverse applications, making them an integral component of the clean energy landscape.

Restraint

High initial costs

High initial costs represent a significant barrier to the growth of the reciprocating hydrogen compressor market. These compressors are essential components of the hydrogen infrastructure, serving critical roles in hydrogen compression, storage, and distribution for various applications. However, their substantial upfront investment requirements pose challenges for potential users and market expansion. The capital costs associated with reciprocating hydrogen compressors can be a deterrent for businesses, governments, and organizations looking to adopt hydrogen technologies, particularly in regions with limited financial resources. These costs encompass the purchase and installation of the compressor equipment, which may involve custom engineering and infrastructure modifications, further increasing the expenditure. Moreover, ongoing maintenance, safety measures, and compliance with hydrogen-related regulations contribute to the total cost of ownership.

For industries considering a transition to hydrogen, the high initial costs of reciprocating hydrogen compressors can be a limiting factor, especially when compared to conventional energy sources. Small and medium-sized enterprises may find it particularly challenging to make this upfront investment. To overcome this barrier, continued efforts are needed to drive down the cost of reciprocating hydrogen compressor technology through research, development, and economies of scale. Additionally, government incentives, subsidies, and public-private partnerships can play a pivotal role in making hydrogen infrastructure more financially accessible, thereby unlocking the potential of the reciprocating hydrogen compressor market and facilitating the broader adoption of hydrogen as a clean energy carrier.

Opportunity

Growth of hydrogen refueling infrastructure

As hydrogen gains prominence as a clean and versatile energy carrier, particularly in the transportation sector, the growth of refueling stations is crucial to support the adoption of hydrogen fuel cell vehicles (FCVs). Reciprocating hydrogen compressors are the basis of these refueling stations, playing a pivotal role in compressing hydrogen gas for safe and efficient vehicle fueling.

With an increasing global emphasis on reducing greenhouse gas emissions and transitioning to more sustainable transportation options, FCVs have garnered attention for their potential to offer zero-emission mobility. However, the success of FCVs is intrinsically linked to the availability of a reliable and accessible hydrogen refueling infrastructure. This creates a direct demand for reciprocating hydrogen compressors, as these high-pressure compressors are the core technology required for refueling station operations.

The expansion of hydrogen refueling infrastructure is not limited to any one region; it is a global phenomenon. Countries across North America, Europe, Asia, and beyond are investing in the development of refueling networks to facilitate the growth of FCVs. This creates a substantial and enduring market opportunity for reciprocating hydrogen compressor manufacturers, as the need for these compressors extends beyond the present to meet the growing demand for clean and sustainable transportation solutions in the years to come. Furthermore, the ongoing commitment of governments and industry stakeholders to bolster this infrastructure adds to the resilience and potential for growth in the reciprocating hydrogen compressor market, making it a key player in the hydrogen economy.

Lubrication Type Insights

In 2025, the oil-free segment had the highest market share of 47% on the basis of the lubrication type. This is due to oil-free compressors being preferred in applications where absolute purity of the compressed hydrogen is crucial, such as in the electronics and semiconductor industries and eliminate the risk of oil contamination and are more environmentally friendly.

The oil-based segment is anticipated to expand fastest rate of 8.2% over the projected period. This is due to the oil-based compressors tending to be robust, durable, and can handle heavy-duty operations. They provide effective sealing and reduce wear and tear on moving parts. They are often preferred in industrial applications where high-pressure compression and continuous operation are required.

Pressure Insights

In2025, the 401-700 bar segment had the highest market share of 45% on the basis of the pressure. Compressors in this range are capable of compressing hydrogen to pressures between 401 bar and 700 bar (approximately 5,800 psi to 10,150 psi). This segment is suitable for applications requiring higher pressure levels, such as medium-sized hydrogen refueling stations, industrial processes, and some hydrogen storage and transportation systems.

The more than 700 bar segment is anticipated to expand fastest over the projected period. Compressors in this category are engineered to compress hydrogen to pressures exceeding 700 bar (approximately 10,150 psi). These high-pressure compressors are used in applications demanding very high-pressure levels, including large hydrogen refueling stations, heavy-duty industrial processes, and certain advanced research and aerospace applications.

Compressor Type Insights

In2025, the double acting compressors segment had the highest market share of 39% on the basis of the compressor type. This is due to double acting compressors providing more efficient and higher compression ratio than single-acting compressors. Double-acting reciprocating compressors use pistons that compress gas during both the forward and backward strokes of their movement. It is preferred in applications requiring higher pressure levels, such as medium to large-scale hydrogen refueling stations, industrial processes, and some hydrogen storage and transportation systems.

The diaphragm segment is anticipated to expand fastest over the projected period. This is due to diaphragm compressors suitable for applications that require high gas purity and where the risk of contamination from lubricating oil is unacceptable. Diaphragm compressors use a flexible diaphragm to separate the gas from the compression mechanism, making them oil-free and highly resistant to contamination. It is used in industries like electronics, semiconductor manufacturing, and food processing, where strict purity requirements are essential.

End User Industry Insights

In 2025, the oil & gas segment had the highest market share of 45% on the basis of the end-user industry. In the oil and gas sector, reciprocating hydrogen compressors are used for various applications, such as enhanced oil recovery (EOR) through hydrogen injection, hydrocracking processes, and hydrogen storage.

The automotive segment is anticipated to expand fastest over the projected period. reciprocating hydrogen compressors are primarily used in the development and operation of hydrogen refuelling stations to support fuel cell vehicles (FCVs) in the automotive sector.

Regional Insights

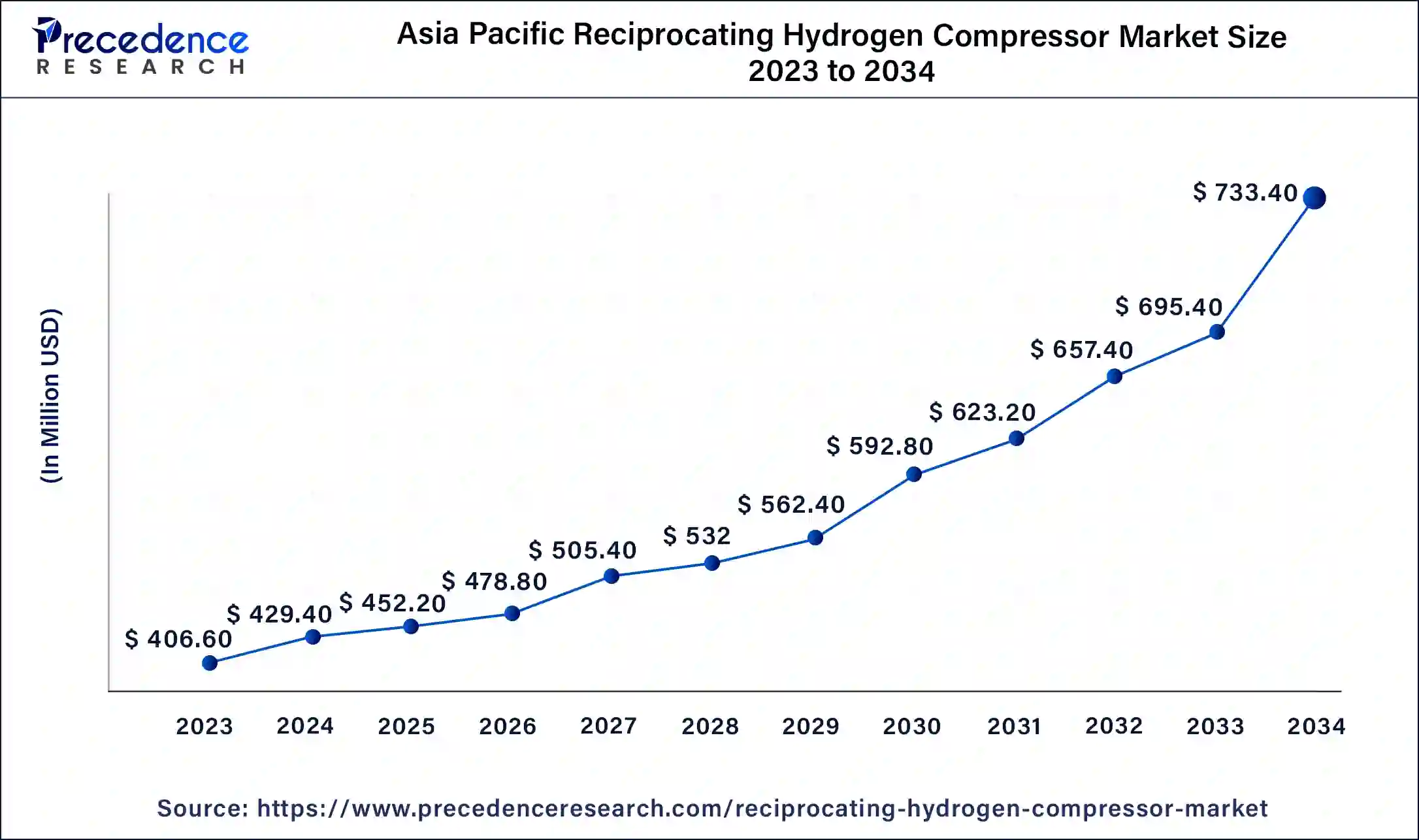

Asia Pacific Reciprocating Hydrogen Compressor Market Size and Growth 2026 to 2035

The Asia Pacific reciprocating hydrogen compressor market size is estimated at USD 452.20 million in 2025 and is predicted to be worth around USD 771.40 million by 2035, at a CAGR of 5.4% from 2026 to 2035.

Asia Pacific has held the largest revenue share in 2025. Countries in Asia Pacific is actively promoting the use of hydrogen as a clean energy carrier. Governments and industries are investing in hydrogen infrastructure, which includes the development of hydrogen refueling stations and industrial hydrogen applications. This growth fuels the demand for reciprocating hydrogen compressors.

Japan Market Trends

Japan's strong aim for carbon neutrality and hydrogen-based energy transition fuels need for compression technology. Moreover, integrating hydrogen with renewables for energy storage and grid balancing is creating new opportunities in the market.

China Market Trends

China's reciprocating hydrogen compressor market is driven by massive industrial demand along with strong government funding for the hydrogen economy. Integration with renewables, together with decentralized production methods, is a major trend, rising demand for compressors across numerous production and storage needs.

What Drives the Market in Latin America?

The reciprocating hydrogen compressor market in Latin America is expected to grow at a significant rate during the forecast period. The regional market growth is driven by massive investments in green as well as blue hydrogen projects. Several countries in the region are building export-focused hydrogen hubs, thus necessitating solid pipeline and terminal compression for global supply.

What Potentiates the Market in the Middle East & Africa?

The Middle East & Africa reciprocating hydrogen compressor market is growing at a notable rate. This growth is driven by increasing adoption of fuel cell vehicles, the push toward a hydrogen-based economy, and substantial investments in hydrogen infrastructure. Government support and funding for hydrogen initiatives, particularly in the Middle East, through national strategies and strategic investments, are further accelerating market development in the region.

What Makes North America a Significant Region in the Market?

North America is a significant region for the reciprocating hydrogen compressor market. This is mainly due to the increasing fuel cell adoption, clean energy initiatives, and growing hydrogen infrastructure in the U.S. and Canada. Rising acceptance of hydrogen as a clean energy source fuels the need for compression at fueling stations, in power generation, and in industrial applications.

LAMEA is estimated to observe the fastest expansion. Several countries in the LAMEA region are increasingly recognizing the potential of hydrogen as a clean and sustainable energy carrier. Governments and industries are exploring hydrogen production, storage, and distribution, leading to greater demand for reciprocating hydrogen compressors.

The North America reciprocating hydrogen compressor market is a dynamic and rapidly evolving segment within the broader hydrogen economy. North America, particularly the United States and Canada, has shown a strong commitment to promoting hydrogen as a clean and sustainable energy carrier. Federal and state governments are providing support, funding, and incentives for hydrogen infrastructure development, driving the demand for reciprocating hydrogen compressors across the region.

Value Chain Analysis

- Raw Material Sourcing (Metals, Electronics)

This stage involves sourcing high-durability metals, alloys, and robust electronic control systems programmed to manage the unique physical properties of hydrogen, mainly its small molecular size and also potential for material embrittlement.

Key Players: Ariel Corporation, Atlas Copco AB, Burckhardt Compression AG - Component Fabrication and Machining

It is a specialized process driven by the demand for material compatibility with hydrogen, extreme leak tightness, and resistance to hydrogen embrittlement.

Key Players: Kobe Steel, Ltd., PDC Machines Inc., NEUMAN & ESSER GROUP - Testing and Certification

It includes rigorous adherence to specific national and international safety standards along with international safety and a formal inspection process, performance standards, and even a series of mandatory physical tests to guarantee safety, reliability, and regulatory compliance.

Key Players: Ariel Corporation, Atlas Copco AB, Burckhardt Compression AG

Reciprocating Hydrogen Compressor Market Companies

- Chart Industries, Inc. (Howden Group)

- CET Engineering srl

- SIAD Macchine Impianti S.p.A.

- IHI Corporation

- Burckhardt Compression Holding AG

- PDC Machines, Inc.

- Atlas Copco AB

- NEUMAN & ESSER GROUP

- HAUG Sauer Kompressoren AG

- IDEX Corporation

- Hitachi, Ltd.

- Kobe Steel, Ltd.

- Ariel Corporation

- Ingersoll Rand Inc.

- Siemens Energy AG

- Nel ASA

- Mikuni Group

- Minnuo Group

- Kwangshin Machinery Co., Ltd.

- Indian Compressors Ltd.

Recent Developments

- June 2023: Ariel Corporation partnered with Hoerbiger to provide non-lube compressor solutions proficient of achieving the hydrogen compression requirements of the future hydrogen mobility market such as boats/ships, private trucking companies, trains, public transportation, large fleet vehicles, and other high volume, high pressure, vehicle-fueling applications.

- March 2023:Southwest Research Institute (SwRI) developed a new hydrogen compressor that can increase the reliability and efficiency of hydrogen compression used in the refueling of fuel cell electric vehicles (FCEVs).

Segments Covered in the Report

By Lubrication Type

- Oil-free

- Oil-based

By End User Industry

- Oil and Gas

- Automotive

- Others

- Chemical

By Compressor Type

- Diaphragm

- Single Acting

- Double Acting

By Pressure

- Less than 400 bar

- 401-700 bar

- More than 700 bar

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content