What is the Air Compressor Market Size?

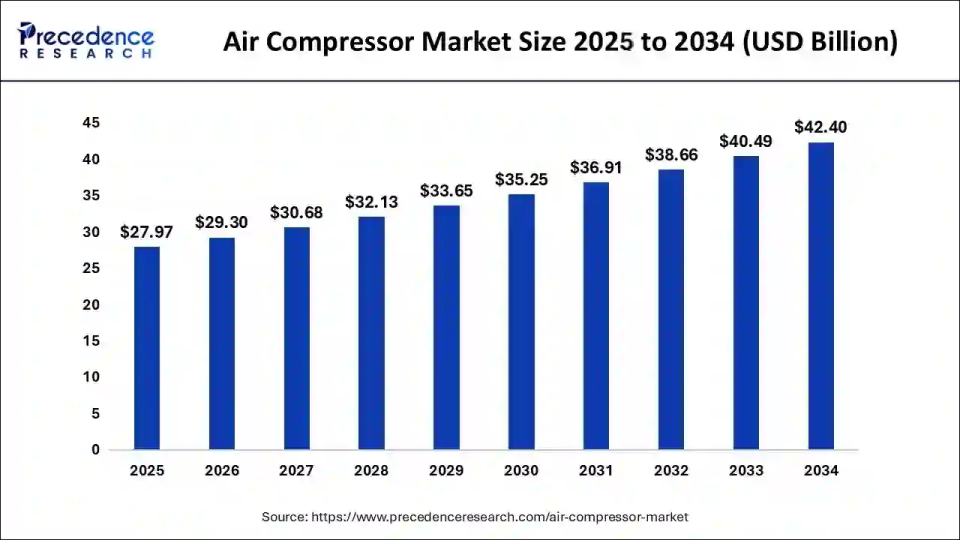

The global air compressor market size is calculated at USD 27.97 billion in 2025 and is predicted to increase from USD 29.30 billion in 2026 to approximately USD 44.25billion by 2035, expanding at a CAGR of 4.69% from 2026 to 2035.

Market Highlights

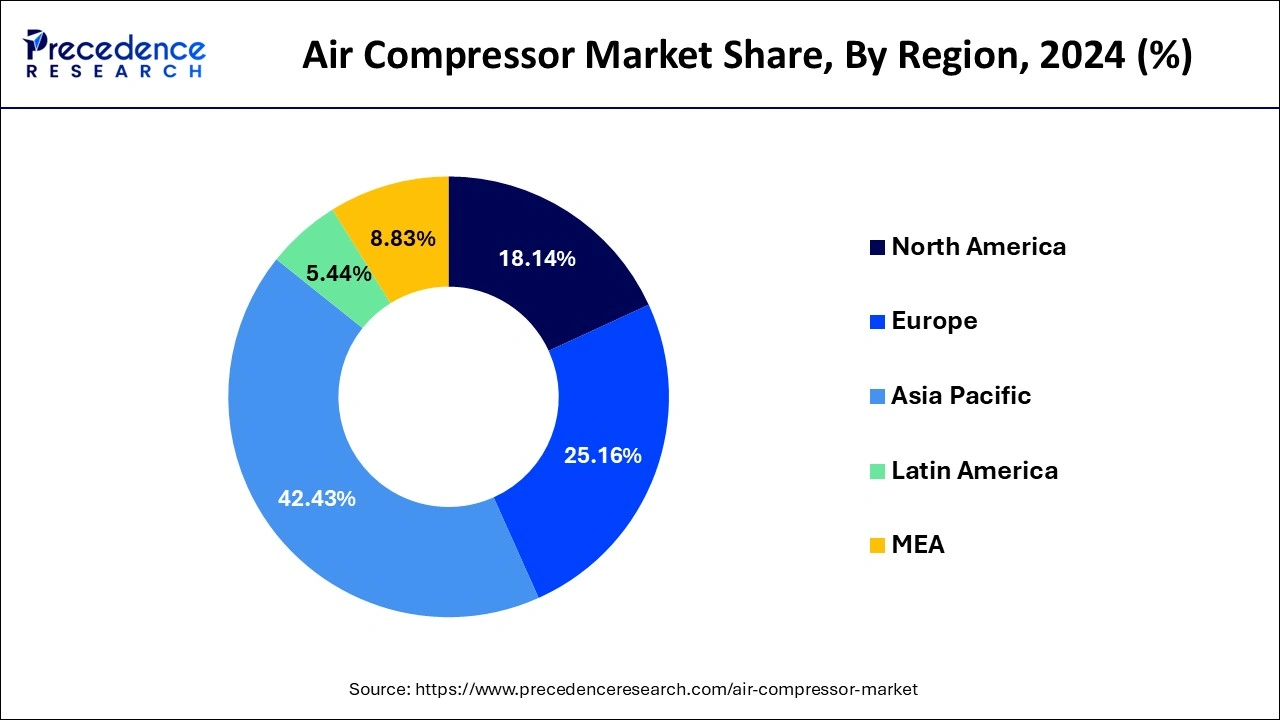

- Asia Pacific dominated the global air compressor market with the largest market share of 42.43% in 2025.

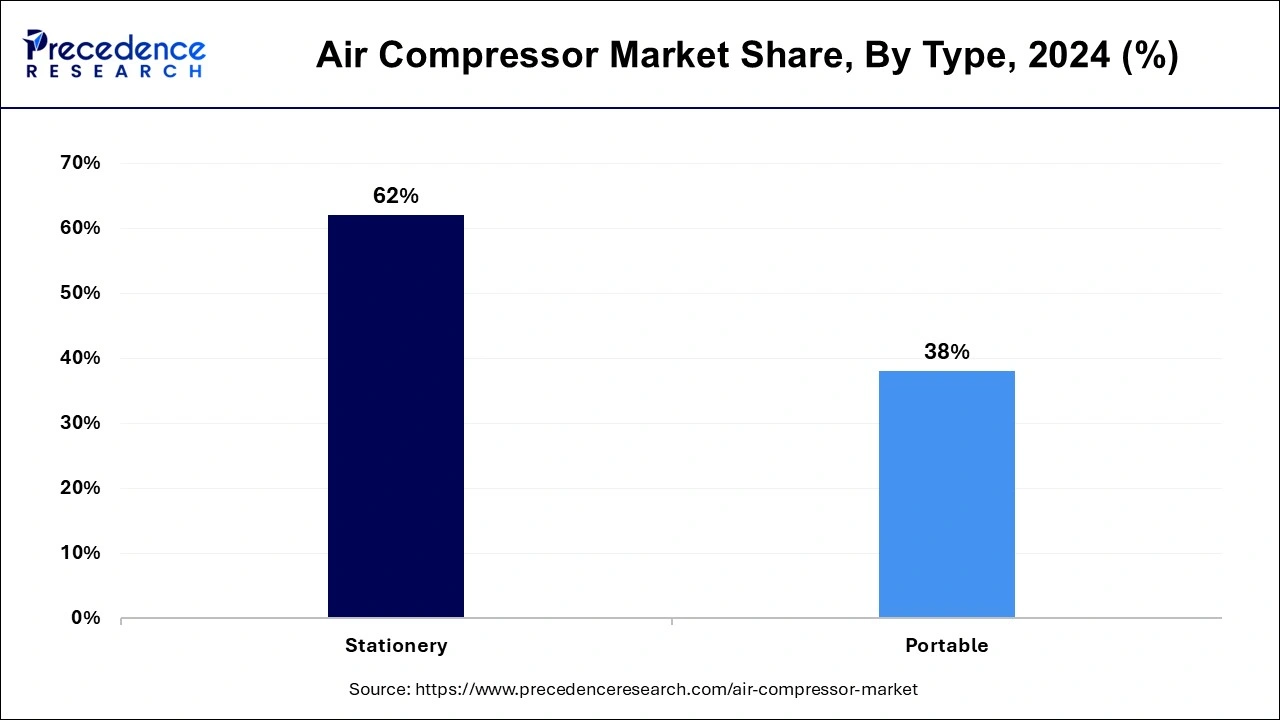

- By type, the stationery segment contributed the highest market share of 62% in 2025.

- By product, the rotary segment led the market in 2025.

- By product, the centrifugal segment is projected to grow at a significant CAGR during the forecast period.

- By application, the manufacturing segment contributed the biggest market share in 2025.

- By application, the oil and gas segment is expanding at a solid CAGR during the forecast period.

How is AI-driven technology revolutionizing the air compressor market?

The Artificial Intelligenceis revolutionizing the air compressor market in terms of operational efficiency and reliability. Major focuses are maintenance prediction, when using real-time data to predict failures, and adaptive energy optimization to prevent energy wastage. Automation promotes load balancing and increases wear life, also introducing remote monitoring for a higher level of operational control. AI also helps reduce carbon emissions and opens new business avenues in the form of performance-based services. In general, AI facilitates a huge scope for enhancing compressor performance to make industries cost-efficient and sustainable.

Market Outlook

- Industry Growth Overview: The air compressor market is growing due to rising demand for energy-efficient models, technical advancements such as IoT integration for remote monitoring, and growing automation in different sectors. Increased industrial activity, construction projects drive the growth of the market.

- Global Expansion:The air compressor market is experiencing global expansion, as it plays a significant role in production, construction, and the energy sector, a tendency supported by factors such as increasing worldwide manufacturing activity, industrial computerization, and infrastructure advancement in emerging economies. Asia Pacific is dominated in the market due to increasing urbanization and industrialization.

- Major investors:The major players and investors in the air compressor market are mainly the established worldwide manufacturing conglomerates and specialized industrial tools companies, like Atlas Copco, Ingersoll Rand, and Hitachi

Air Compressor Market Growth Factors

The growing oil and gas industry is a major factor that drives the growth of the global air compressor market. The rising consumption of energy in developing countries like China, India, and South Korea is driving the market growth. The rapid industrialization and growing investments to enhance the oil and gas pipeline networks is expected to have a positive and significant impact on the demand for the air compressors across the globe. The air compressors have wide applications in the industries such as freezing, cooling, cutting, welding, and packaging. The rapid growth of the industries across the developed and the developing regions is augmenting the growth of the air compressor market. Furthermore, the surging growth of the various industries such as chemicals & petrochemicals, manufacturing, power generation, paper and pulp, pharmaceuticals, and food & beverages industries is expected to provide lucrative growth opportunities to the market players in the forthcoming years. The surging adoption of the variable speed systems, retrofitting for the available systems, low cost of maintenance, and operational effectiveness are the major factors that are significantly boosting the demand for the air compressors across various key industries around the globe.

The growing demand for the energy-efficient air compressors to minimize the operational costs is driving the global market growth. The rising initiatives by the prominent market players to develop low cost and eco-friendly air compressors are expected to positively impact the market growth. Various companies have already developed next-generation systems that offer high performance capabilities at affordable costs. The demand for the innovative air compressors is significantly rising owing to the enhanced cost-saving features. The presence of several top manufacturers and the new product launches by them significantly drives the growth of the market. Furthermore, the increased demand for the compressed air in the various industries for the power tools is significantly driving the market growth. Furthermore, the rising demand for the air compressors in the construction and mining industry is fueling the demand for the innovative air compressors for achieving cost efficiency.

- Expanding Oil & Gas Sector: New exploration and pipeline projects are intensifying the demand for dependable compressed air solutions, resulting in the overall market growth.

- Industrial Expansion: Development in manufacturing, chemical, construction, and mining applications of air compressors aids in their steady adoption.

- Energy-Efficient Systems: Demand for variable speed drive type compressors and environmentally friendly designs, under cost-saving and sustainability fronts, support market growth.

- Technological Innovation: Further development of advanced, next-generation air compressors, offering high performance and easy maintenance, has provided a competitive edge to the market.

- Construction and Mining Applications: On the heavy side, the rise in demand for compressed air for tools and machinery is driving the demand for infrastructure and resource extraction operations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 27.97 Billion |

| Market Size in 2026 | USD 29.30 Billion |

| Market Size by 2035 | USD 44.25 Billion |

| Growth Rate from 2026 to 2035 | AGR of 4.69% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Product, Application, Lubrication, Power Rating, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type Insights

The stationery segment contributed the highest market share of 62% in 2025. The increased demand for the stationery air compressor in the manufacturing industry across the globe has fueled the growth of this segment. Moreover, the rapid industrialization in the developing countries like Saudi Arabia, UAE, India, Brazil, and China is expected to spur the demand for the stationery air compressors in the upcoming future.

The portable is estimated to be the most opportunistic segment during the forecast period. The portable air compressors serves as a reliable power source to various tools and equipment in the construction, mining, and other industries, which is a major factors that is expected to drive the growth of this segment in the upcoming years.

Product Insights

The rotary segment dominated the global air compressor market in 2025, owing to the huge demand and higher adoption of the rotary air compressors in the big industries such as pulp and paper, mechanical and electrical machinery, mining and metallurgy, and electric power industries across the globe.

On the other hand, the centrifugal is expected to be the fastest-growing segment during the forecast period. The energy efficiency, fewer components, and higher airflow are the major features of the centrifugal air compressors that is fueling its adoption across various end use verticals.

Application Insights

The manufacturing segment dominated the global air compressor market in 2025. The rising investments in the industrialization of the developing and the underdeveloped region is fueling the growth of the segment. The air compressor have extensive utilization in the manufacturing industry. The high demand for the air compressors in the manufacturing sectors of the developed countries has significantly fueled the growth of the manufacturing segment in the past decades.

The oil and gas is estimated to be the most opportunistic segment during the forecast period. The surging adoption of the portable air compressors in oil and gas industry is fueling the market growth. The rising investments in the development of effective pipeline networks is expected to drive the growth of the segment.

The air compressor market is moderately fragmented with the presence of several local companies. These market players are striving to gain higher market share by adopting strategies, such as investments, partnerships, and acquisitions & mergers. Companies are also spending on the development of improved products. Moreover, they are also focusing on maintaining competitive pricing.

Regional Insights

Asia Pacific Air Compressor Market Size and Growth 2026 to 2035

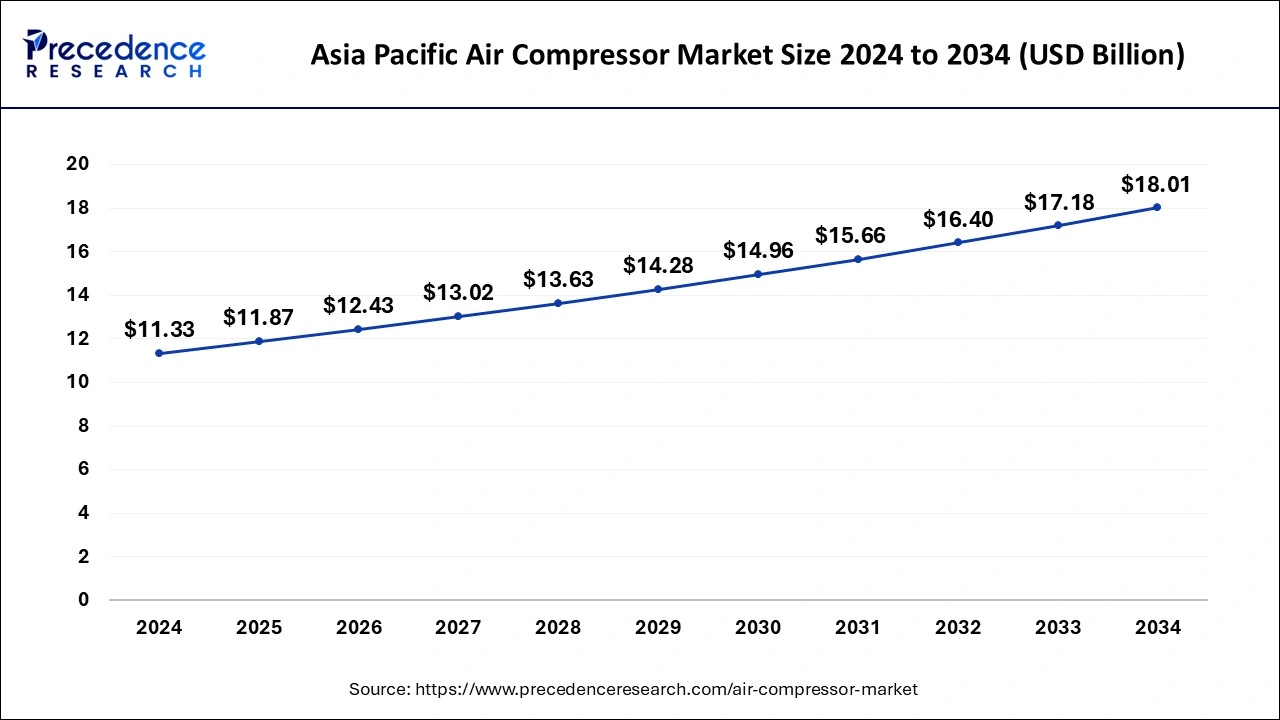

The Asia Pacific air compressor market size is evaluated at USD 11.87 billion in 2025 and is predicted to be worth around USD 18.8 billion by 2035, rising at a CAGR of 4.71% from 2026 to 2035

Asia Pacific: Favorable government policies

Asia Pacific accounted for a market share of over 42.43% and dominated the global air compressor market in 2025. This is majorly attributed to the huge presence of manufacturing sectors in the region. The favorable government policies has attracted huge FDIs in the region and the cheap availability of factors of production in the region has resulted in the concentration of the industries. The countries like China and India are becoming the manufacturing hub of the globe. Therefore, the higher presence of industries has boosted the demand for the air compressors in the region. The rapidly growing applications of the air compressors in the various industries such as food & beverages, mining, pulp & paper, and construction industries is expected to further fuel the Asia Pacific air compressor market.

Dominating the air compressor market, the Asia-Pacific region benefits from rapid industrialization, especially in powerhouse nations like China and India, which possess strong manufacturing capabilities. The demand for air compressors spans various industries manufacturing, construction, and automotive fueled by the increasing application of automation technologies. The significant industrial expansion, particularly in electronics manufacturing, such as semiconductors and microchips, acts as a primary driver for the elevated requirement for air compression systems within the region.

India: Manufacturing and industrial growth

In India, increasing demand from rapidly growing areas such as construction and manufacturing, growing regulatory spending in infrastructure, and growing domestic manufacturing capabilities, particularly for smaller-capacity compressors. India has a vigorous production sector that relies heavily on compressed air for driving tools on assembly lines, like drills and impact wrenches.

North America:Surging investments in the development of oil and gas distribution

North America is expected to witness a steady growth rate during the forecast period. The surging investments in the development of oil and gas distribution networks and increased adoption of the eco-friendly air compressors in the industrial units of US is expected to drive the market growth during the forecast period.

North America's air compressor market is also on an upward trajectory, characterized by a mature industrial framework and high adoption rates across diverse sectors. The presence of major players in the market, coupled with a shift towards industrial automation and energy efficiency, is propelling the demand for advanced air compressor solutions. Compliance with stringent environmental regulations is further incentivizing the adoption of innovative air compression technologies across manufacturing, oil and gas, and power generation industries.

U.S.: Technological advancement and innovation

The U.S. heavily invests in research and development (R&D). This has led to novelties like variable speed drive (VSD) compressors, oil-free technologies, and the incorporation of IoT for remote monitoring and prognostic maintenance, all of which enhance efficiency and reliability. The U.S. Department of Energy (DOE) has implemented strict energy efficiency standards for manufacturing tools, pushing production and industries to accept more effective services.

Europe: Increasing government initiatives

Europe is experiencing substantial growth in the market due to Europe has a robust and technologically advanced industrial base, especially in countries like Germany, France, and Italy, which drives high demand for air compressors in sectors such as manufacturing, automotive, and food and beverage.

UK: Industry Collaboration and R&D

The UK has a well-established production sector that spans numerous industries, including aerospace, automotive, pharmaceuticals, food and beverage, and construction. Strict environmental regulations, such as the EU's Ecodesign Directive and the UK's own net-zero targets, encourage industries to adopt advanced, energy-efficient air compressor technologies.

How is the Opportunistic Rise of Latin America in the Air Compressor Market?

Latin America is experiencing significant market growth because it is the world's leading copper mining region, which greatly increases the demand for air compressors. These compressors are crucial for key operations such as drilling, rock blasting, and material handling in mines. The ongoing expansion of mining activities across the region boosts the need for reliable and efficient air compressor systems to support the demanding tasks of extraction and processing. Increasing industrialization and urbanization in the region's economies are also driving the demand for advanced air compression solutions.

Additionally, the region is seeing a rise in the adoption of energy-efficient and smart compressor technologies, spurred by regulatory changes and environmental commitments. Furthermore, the growth of manufacturing sectors such as chemicals, pharmaceuticals, and food and beverages continues to drive the market forward.

Brazil Air Compressor Market Trends

The market in Brazil is expanding due to increasing industrialization and demand from sectors like manufacturing, construction, and automotive that depend on compressed air for operations. Moreover, infrastructure development projects, the adoption of energy-efficient and advanced compressor technologies, and growing oil and gas activities are further fueling market growth in the country.

What Potentiates the Market in the Middle East & Africa?

The air compressor market in the Middle East & Africa is fueled by the growing demand for compressed air across various industries such as oil and gas, manufacturing, and construction. The region is experiencing increased industrial activity, infrastructure development, and expansion of the mining sector, which has contributed to the overall growth of the market. Countries like Saudi Arabia, the United Arab Emirates, and South Africa are leading players in the region due to their strong industrial sectors and ongoing infrastructure projects.

UAE Air Compressor Market Trends

The market in the UAE is growing due to rapid industrialization, construction activities, and expansion of oil and gas, power, and manufacturing sectors that rely on compressed air systems. Additionally, increasing adoption of energy-efficient and advanced compressor technologies, along with government initiatives supporting industrial infrastructure, is fueling market growth in the region.

Value Chain Analysis – Drive by Wire Market

1.Raw Material:

The raw materials for an air compressor involve cast iron, steel, and aluminum for the main body and tanks, which are selected for durability and resistance to wear.

- Key Players: Creatio and Innovaccer

2.Chemical Synthesis and Processing:

The chemical synthesis and processing of an air compressor significantly concern the raw materials and the manufacturing technology used for its machinery, as well as the specialized lubricants and coatings used for durability and performance.

- Key Players:Oracle (Cerner) and SAP

3.Compound Formulation and Blending:

The compound formulation and blending of air compressor oil involves combining a major proportion of base oils with a minor proportion of various performance-improving additives.

- Key Players: Salesforce and Microsoft

Air Compressor Market Companies

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

Sweden |

Decentralized business model |

Atlas Copco's new factory in Pune will manufacture air and gas compressor systems for the local and export markets. It encompasses a manufacturing plant and office building of approximately 25,000 m2.

|

|

|

Kobe Steel Ltd. |

Japan |

Integrated technological capabilities |

Kobe Steel to establish a new service base for non-standard compressors and plastic mixing and pelletizing systems in Saudi Arabia. |

|

Coimbatore, Tamil Nadu |

Strong financial metric |

Elgi Equipment aims to be a top air compressor supplier globally by 2035 with new cost-effective technology. |

|

|

Ingersoll-Rand PLC |

United States |

Strong financial position and cash flow |

Ingersoll Rand presented the client with a superior air separation compression solution that met all of their stringent project requirements. |

|

Kirloskar Pneumatic Company Limited |

Maharashtra |

Efficient capital management |

In 2024, Kirloskar Pneumatic (KPCL) acquires a 51% stake in S&C, expanding into industrial refrigeration. |

Other Major Key Players

- Mitsubishi Heavy Industries Ltd.

- Suzler Ltd.

- Ebara Corporations

- Porter Cable

- VMAC Global Technology Inc.

Recent Developments

ZF

- In April 2025, ZF launched a state-of-the-art Quiet Compressor tailored specifically for electric trucks, designed to enhance performance while minimizing noise pollution.

ELGi

- In February 2025, ELGi unveiled a transformative innovation in industrial air compression technology that aims to optimize efficiency and reduce costs.

Hitachi Industrial Equipment Systems

- In June 2024, Hitachi Industrial Equipment Systems introduced a "Predictive Diagnosis Service" for air compressors, harnessing machine learning techniques to provide proactive maintenance solutions.

Segments Covered in the Report

By Type

- Stationery

- Portable

By Product

- Rotary

- Screw

- Scroll

- Others

- Centrifugal

- Reciprocating

By Application

- Electronics

- Manufacturing

- Oil and Gas

- Healthcare

- Food & Beverages

- Home Appliances

- Energy

- Others

By Lubrication

- Oil free

- Oil filled

By Power Rating

- 0-100 kW

- 101-300 kW

- 301-500 kW

- 501 kW & above

By Region

- North America

- Latin America

- Europe

- Asia-pacific

- Middle and East Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting