What is the Refurbished Medical Imaging Devices Market Size?

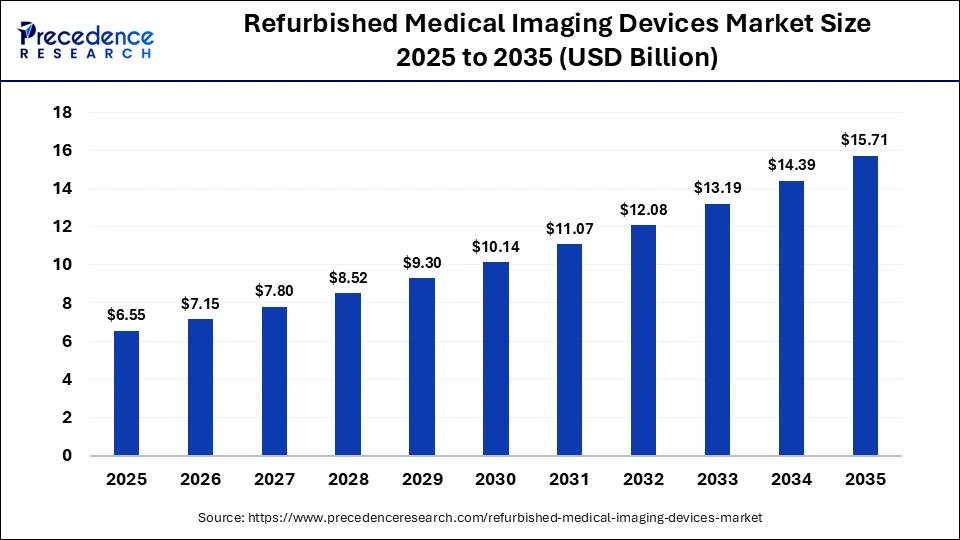

The global refurbished medical imaging devices market size was calculated at USD 6.55 billion in 2025 and is predicted to increase from USD 7.15 billion in 2026 to approximately USD 15.71 billion by 2035, expanding at a CAGR of 9.14% from 2026 to 2035.The market growth is attributed to increasing demand for cost-effective, high-quality imaging solutions to expand clinical capacity while managing capital expenditures efficiently.

Market Highlight

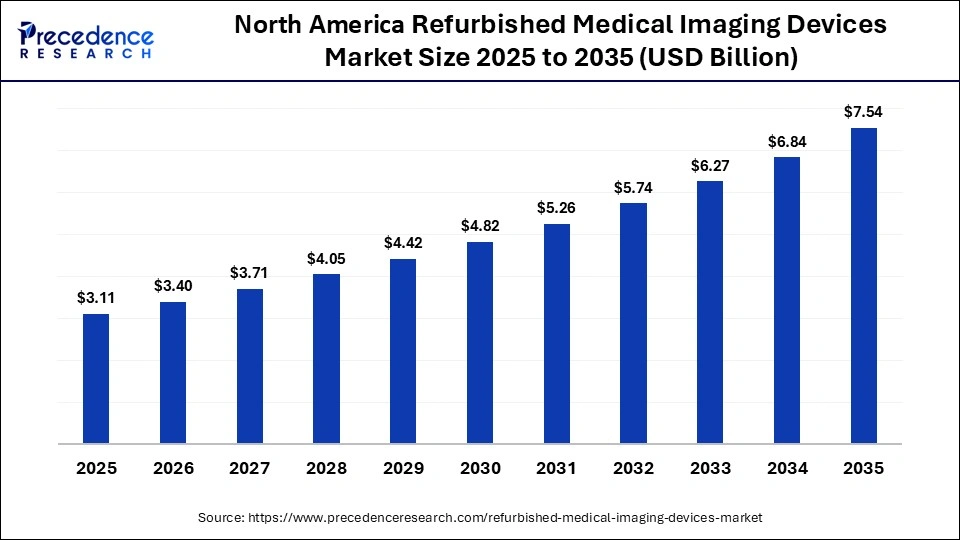

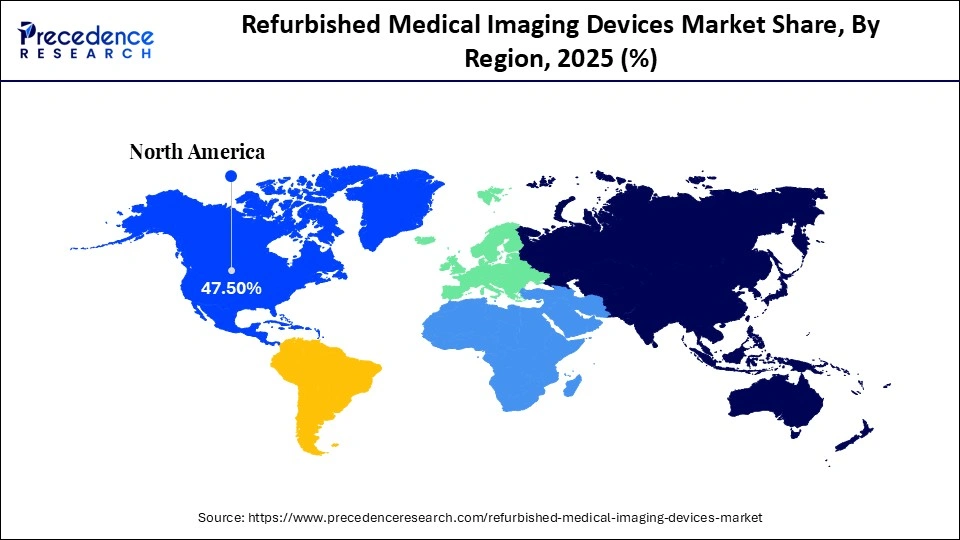

- North America dominated the market with 47.5% of the market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 9.5% between 2026 and 2035.

- By modality/device type, the X-ray/MRI segment contributed the highest market share of 44.8% in 2025.

- By modality/device type, the CT/ultrasound segment is growing at a strong CAGR of 8.6% in the refurbished medical imaging devices market between 2026 and 2035.

- By application, the diagnostic imaging segment held a major market share of 43.1% in 2025.

- By application, the interventional/therapeutic imaging segment is expected to expand at a notable CAGR of 8.8% from 2026 to 2035.

- By end-use, the hospitals segment captured the highest share of 43.6% in the refurbished medical imaging devices market during 2025.

- By end-use, the diagnostic imaging centers/ambulatory surgical centers segment is poised to grow at a healthy CAGR of 9% between 2026 and 2035.

Refurbished Medical Imaging Devices Market Overview

Rising global healthcare cost pressures are significantly driving the adoption of refurbished medical imaging devices, making cost containment a key market driver in 2025. Hospitals and diagnostic centers are looking for an affordable alternative to a new system that does not compromise the quality of the diagnostic result. Refurbishment of the old MRI, CT, ultrasound, and X-ray equipment reconditioned by certified methods with the ability to achieve OEM-like performance. This enables facilities to achieve high clinical throughput with reduced capital expenditure and a longer equipment life.

The technology facilitates interoperable digital processes that adhere to the Digital Imaging and Communications in Medicine (DICOM) standards. This enables the device to integrate well with PACS, RIS, and reporting platforms that are being implemented in contemporary radiology departments. Furthermore, the capacity of healthcare to provide proper diagnostics in large quantities continues to be an attractive long-term motivation behind the further adoption of refurbished medical imaging equipment.

Impact of Artificial Intelligence on the Refurbished Medical Imaging Devices Market

The remodeling of the renewed medical imaging ecosystem is done through artificial intelligence that enhances the reliability of the diagnostic process and lifecycle of the imaging equipment in healthcare facilities. The diagnostic accuracy of refurbished MRI, CT, and X-ray systems using AI-based image reconstruction and noise-reduction algorithms is equal to that of newer systems. Predictive analytics applications can be used to aid proactive maintenance, including component degradation trend forecasting, minimizing unexpected downtime, and maximizing usable system life of refurbished assets.

Refurbished Medical Imaging Devices Market Growth Factors

- Rising Demand for Affordable Healthcare Solutions: Growing cost pressures in hospitals and clinics are boosting the adoption of high-quality refurbished imaging devices.

- Advancements in Imaging Software Integration: New AI-enabled and cloud-compatible platforms are propelling the performance and utility of refurbished MRI, CT, and ultrasound systems.

- Growing Emphasis on Sustainable Healthcare Practices: Increasing environmental awareness and circular economy initiatives are driving hospitals to adopt refurbished medical imaging equipment.

- Expansion of Rural and Tier-2 Healthcare Infrastructure: Rising healthcare access programs in underserved regions are fueling demand for cost-effective imaging solutions.

Refurbished Medical Imaging Devices Market Key Indicators Driving Industry Evolution

- According to OECD Health Statistics and national radiology registries cited by the Radiological Society of North America (RSNA), more than 35-40% of MRI and CT systems operating in public hospitals across middle-income countries were over 8 years old as of 2024, creating a substantial installed base suitable for certified refurbishment rather than replacement.

- In its 2024 Form 10-K and sustainability disclosures, GE Healthcare stated that tens of thousands of imaging systems remain in active clinical use beyond first ownership, with refurbished and redeployed systems forming a core component of hospital installed bases in North America, Europe, India, and Latin America.

- Hospital asset audits summarized in UK NHS imaging infrastructure reports (2024-2025) show that refurbished CT and X-ray systems remain integral to installed diagnostic capacity, particularly for emergency, orthopedic, and general radiology workloads.

- UK NHS England and National Audit Office (NAO) imaging infrastructure reports (2024) indicate that refurbished CT, X-ray, and fluoroscopy systems enabled hospitals to expand imaging capacity using 2.3 billion pounds capital allocation per room, allowing funds to be redirected toward workforce hiring and digital infrastructure.

- Siemens Healthineers, through its Lifecycle & Circular Economy reporting (2024), highlighted that refurbished MRI and CT solutions are increasingly funded through operational budgets rather than capital-heavy replacement programs, supporting long-term asset utilization without triggering full equipment write-offs.

- OEM disclosures from GE Healthcare and Canon Medical Systems (2024) confirm that software and hardware retrofits during refurbishment (e.g., detector replacement, PACS integration) significantly extend device service life, allowing older models to perform comparably with newer releases.

- FDA 2024 guidance updates on refurbished medical devices indicate that all refurbished imaging systems (MRI, CT, X-ray, ultrasound) imported or sold in the U.S. must meet 510(k) premarket notification standards or equivalent quality certifications before clinical use.

- According to COCIR 2024 lifecycle management reports, the Netherlands and Germany serve as major refurbishment and redistribution hubs for imaging systems in Europe, where certified refurbished MRI, CT, and X-ray systems are re-exported to secondary hospitals and smaller clinics across the EU.

Refurbished Medical Imaging Devices Market Outlook

- Industry Growth Overview: The refurbished medical imaging devices market has strengthened as healthcare providers worldwide grapple with budget limitations and rising demand for diagnostic imaging. In 2024, MRI, CT, and X-ray devices were the most adopted refurbished devices, as hospitals strive to upgrade aging fleets without necessarily spending too much on the acquisition of new devices. The second-hand imaging devices still offer a cheap, viable alternative to the current strain on the budgets of the health sector, especially in developing countries.

- Sustainability Trends: Sustainability considerations are pushing refurbished imaging adoption beyond cost savings. The healthcare system is finding refurbished equipment as a viable approach to decrease medical electronic waste and to encourage the objectives of a circular economy. By 2024, refurbishing will help achieve major resource savings and reduce e-waste generation. Refurbished imaging devices can provide reliable performance without causing as much harm to the environment as the production of new devices.

- Global Expansion: Geographic coverage of the market grew greatly in 2024-2025, with North America having a powerful presence of installations of refurbished devices owing to strong healthcare delivery and quality benchmarks. The Asia Pacific region, with its booming growth, is driven by the growth of healthcare expenditures and an increase in the number of diagnostic units in India, Southeast Asia, and China. Moreover, the OEMs and independent refurbishers are scaling distribution and service capabilities to meet localized needs while navigating region-specific regulatory requirements.

- Major Investors: Investment interest in the refurbished medical imaging sector strengthened in 2025. Strategic healthcare investors and corporate players sought to enlarge refurbishment capabilities, support service networks, and standardize quality assurance frameworks. Investments made in capital are geared towards any extension of refurbishment facilities, upgrading technology, and checking mechanisms that strengthen buyer trust and institutional uptake.

- Startup Ecosystem: Emerging companies are innovating around refurbishment technologies and clinical integration solutions that improve the quality, performance, and usability of second-life imaging devices. By 2024-2025, advanced testing platforms, modular component upgrades, and digital performance monitoring tools were the startups that had led to increased confidence in refurbished systems' reliability. This changing ecosystem is indicative of a greater transformation towards technology-enabled refurbishment of imaging equipment.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.55 Billion |

| Market Size in 2026 | USD 7.15 Billion |

| Market Size by 2035 | USD 15.71 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.14% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Modality/Device Type, Application, End-Use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Modality/Device Type Insights

Why Are X-ray and MRI Dominating Strongly in the Refurbished Imaging Devices Market?

X-ray/MRI segment dominated the refurbished medical imaging devices market in 2025, accounting for an estimated 44.8% market share, due to these modalities having become an essential part of a broad range of clinical settings. They are well-integrated with standardized refurbishment and quality assurance systems. The popularity of the refurbished X-ray systems remains strong as far as basic diagnostic imaging requirements are concerned, including bone and chest scanning. The MRI systems command a large portion of the refurbished mix due to the complex soft tissue diagnostic requirements in neurology, oncology, and musculoskeletal care. Furthermore, the refurbished mid-field MRI scanners affordable investment opportunity for facilities with advanced imaging requirements needing to incur high costs to acquire new units

The CT/ultrasound segment is expected to grow at the fastest rate in the coming years, accounting for 8.6% of CAGR, owing to the growing demand for refurbed CT systems for cross-sectional imaging needed to diagnose trauma, vascular, and cancer. The use of refurbished CT systems increased in popularity in mid-tier hospitals and outpatient clinics. This has been further propelled by the growing clinical imperative to use CT imaging in urgent care and nontraditional care. They offer a better balance between performance and the total cost of ownership than many new acquisitions with limited budgets.

Application Insights

Why Is Diagnostic Imaging Dominating the Refurbished Medical Imaging Devices Market?

The diagnostic imaging segment held the largest revenue share in the refurbished medical imaging devices market in 2025, due to its fundamental role in early disease detection, screening, and ongoing patient monitoring. According to official data on NHS England, plain radiography (X-ray) achieved the highest number of imaging tests, with 1.69 million tests reported in August 2025. This indicates that core diagnostic modalities represented the largest volumes of performed procedures in clinical practice. These utilization rates highlight the importance of facilities focusing on refurbished diagnostic systems. They assist with basic and advanced imaging systems efficiently and cost-effectively, given the capital restrictions. Furthermore, the growing need for imaging services in the community and emergency services, where the refurbished devices provide continuity in care as the equipment changes its lifespan.

The interventional/therapeutic imaging segment is expected to grow at the fastest CAGR in the coming years, accounting for 8.8% market share. Driven by the ongoing expansion of minimally invasive, image-guided procedures that require precise visualization and real-time guidance. Moreover, the evidence from interventional radiology market analyses highlights strong adoption of image-guided therapies in oncology, vascular, and neurology applications.

End-use Insights

Why Are Hospitals Dominating While Imaging Centers in the Refurbished Medical Imaging Devices Market?

Hospitals segment dominated the refurbished medical imaging devices market in 2025, accounting for an estimated 43.6% market share, due to their comprehensive care responsibilities and high imaging volumes. Hospitals carry out comprehensive diagnostic and interventional services with a wide range of applications across various departments, and as such, the use of X-ray, MRI, CT, and ultrasound is required. This is necessary in emergency care, inpatient diagnostics, surgical planning, and monitoring of chronic diseases, solidifying long-term needs of reliable equipment. The professional management institutions, such as AHRA, highlight the constant incorporation of new technology and quality processes by the hospital imaging departments. This support care delivery to boost the attraction of refurbished systems that uphold high-quality performance and often interoperability. Furthermore, the robust hospital infrastructure and established reimbursement mechanisms allow health systems to strategically deploy refurbished equipment where it best supports clinical throughput and cost management.

Diagnostic imaging centers/ambulatory surgical centers segment is expected to grow at the fastest rate in the coming years, accounting for 9% of CAGR, owing to the shifting care patterns and increasing decentralization of imaging services. The delivery of healthcare is shifting to outpatient and community-based care. Patients are getting more diagnostic imaging services outside of the traditional hospital setting for its convenience and reduced cost of the procedure. Furthermore, the rise of value-based care initiatives and patient preference for convenient, affordable imaging also incentivizes investment in refurbished devices at ambulatory sites.

Regional Insights

How Big is the North America Refurbished Medical Imaging Devices Market Size?

The North America refurbished medical imaging devices market size is estimated at USD 3.11 billion in 2025 and is projected to reach approximately USD 7.54 billion by 2035, with a 9.26% CAGR from 2026 to 2035.

Why Is North America Leading the Refurbished Medical Imaging Devices Market in 2025?

North America led the refurbished medical imaging devices market, capturing the largest revenue share in 2025, accounting for 47.5% of the market share, supported by its extremely high procedural imaging volumes and deep integration of advanced clinical workflows. In the United States and Canada, diagnostic imaging has become a pillar of clinical practice. They have been performed globally in 2024 in CT, MRI, ultrasound, and X-ray, with many of these procedures being conducted in North America because of its well-established healthcare systems.

Healthcare facilities in the U.S. depend on the first life and certified refurbished imaging equipment to keep up with the service throughputs and manage capital expenditures. More than 39,000 imaging facilities are accredited by organizations, including the American College of Radiology (ACR). Furthermore, the U.S. market of diagnostic imaging services is expected to increase the demand for neurological and cardiological imaging in this region.

What is the Size of the U.S. Refurbished Medical Imaging Devices Market?

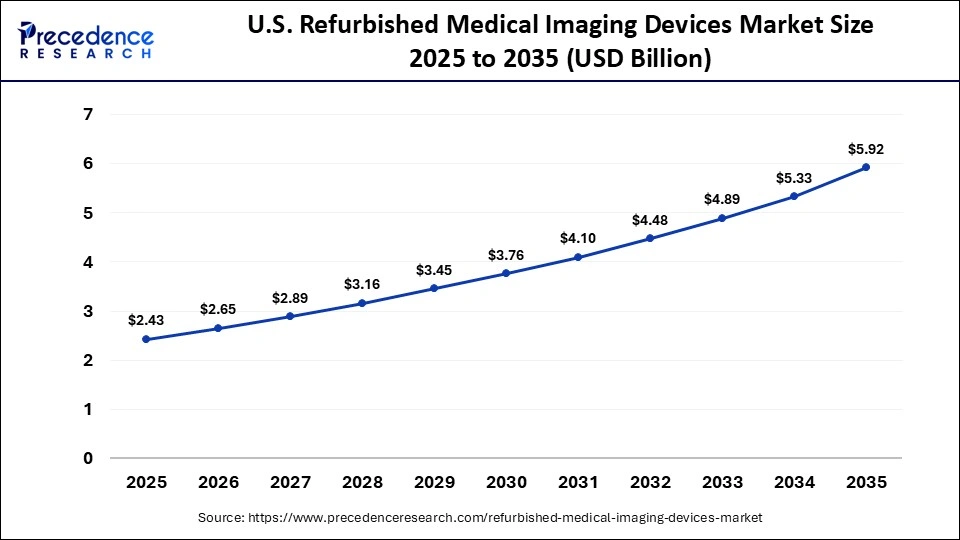

The U.S. refurbished medical imaging devices market size is calculated at USD 2.43 billion in 2025 and is expected to reach nearly USD 5.92 billion in 2035, accelerating at a strong CAGR of 9.31% between 2026 and 2035.

United States Powering North America's Imaging Revolution

U.S. is a major player in the North America regional refurbished medical imaging devices market, due to its exceptionally high procedural volumes and deep clinical integration. Imaging procedures like CT are over 80 million scans per year, and tens of millions of CT and MRI scans are done annually in the U.S. This indicates a predominant use of high-technology diagnostics in oncology, cardiology, and neurology. The rise in the importance of preventive and early detection of diseases is supported by an increase in reimbursement for diagnostic services.

What Factors Are Driving the Rapid Growth of Refurbished Medical Imaging Devices in Asia Pacific?

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, accounting for an estimated 9.5% market share. Driven by the rapid expansion of healthcare services, large underserved populations, and significant public and private investments in diagnostic infrastructure. The demographic changes, such as aging in China, India, and Southeast Asia, are increasing demand both in routine and advanced imaging services. This forces the facilities to consider the cost-effective refurbished systems that are expanding the diagnostic accessibility in both urban, semi-urban, and rural areas.

India's Rapid Expansion in Refurbished Medical Imaging Devices

India is leading the charge in the Asia Pacific market, supported by a combination of expanding healthcare infrastructure, public health programs, and rising patient demand for affordable diagnostics. The larger diagnostic imaging market in India is expected to see further high growth as the investments in CT, MRI, and ultrasound capacity in both urban and rural areas remain strong. Moreover, the programs of the government, like Ayushman Bharat, focus on the expansion of access to imaging services in the underserved locations, thus facilitating the market growth.

How Is Europe Maintaining a Strong Presence in the Refurbished Medical Imaging Devices Market Despite Slower Growth?

The Europe region is expected to hold a notable revenue share of the refurbished medical imaging devices market, driven by mature healthcare systems and an emphasis on quality and safety in imaging practices. European suppliers are assimilating the use of refurbished imaging systems as part of cost management initiatives.

This has been more apparent in the public hospital system, where sustainable procurement is becoming a major issue. Moreover, the national priorities on health that focus on early detection and prevention further create immense demand for medical imaging devices.

Germany, Europe's Technological Hub for Refurbished Imaging

Germany is a major contributor to the market in Europe, with hospital infrastructure, strong compliance with medical device regulations, and a culture of technology renewal that supports refurbished systems. Strict compliance with EU-wide quality frameworks, such as the harmonized safety and interoperability standards, provides hospitals with assurance to adopt refurbished systems. This fits well in their performance expectations and maximizes the capital allocation, thus making Germany a center of the imaging ecosystem of Europe.

Refurbished Medical Imaging Devices Market Value Chain Analysis

- Equipment Deinstallation & Recovery

This stage involves safely dismantling pre-owned imaging systems (MRI, CT, X-ray, ultrasound) from healthcare facilities and assessing their suitability for refurbishment, including functionality checks and service history analysis.

Key Players: GE Healthcare, Siemens Healthineers, Philips Healthcare, Block Imaging International Inc., Soma Technology Inc.

- Refurbishment & Reconditioning

Core refurbishment activities include cleaning, disassembly, replacement of worn or outdated components, software updates, performance calibration, and cosmetic restoration to meet original manufacturer standards before reassembly.

Key Players: GE Healthcare, Siemens Healthineers, Canon Medical Systems, Philips Healthcare, Hitachi Healthcare

- Re installation & Training

Following QA sign off, refurbished systems are transported to end user sites, professionally installed, calibrated, and configured, with operator training and documentation provided to ensure safe and effective clinical use.

Key Players: Hitachi Healthcare, Konica Minolta Inc., Carestream Health Inc., Siemens Healthineers, GE Healthcare

- After Sales Service & Lifecycle Support

Once deployed, refurbished devices are supported with post-installation services including warranty coverage, preventive maintenance contracts, parts supply, and technical support throughout their extended operational life.

Key Players: Fujifilm Holdings Corporation, Mindray Medical International Limited, Block Imaging International Inc., Soma Technology Inc., DRGEM Corporation

Who are the Major Players in the Global Refurbished Medical Imaging Devices Market?

The major players in the refurbished medical imaging devices market include GE Healthcare, Siemens Healthineers, Philips Healthcare, Canon Medical Systems, Fujifilm Holdings Corporation, Hitachi Healthcare, Hologic, Inc., Agfa-Gevaert Group, Shimadzu Corporation, Konica Minolta, Inc., Carestream Health, Inc., Mindray Medical International Limited, Block Imaging International, Inc., Soma Technology, Inc., and DRGEM Corporation.

Recent Developments

- In September 2025, Novartis announced plans to launch a direct-to-patient (DTP) platform in the US, effective November 1, 2025, allowing cash-paying patients prescribed Cosentyx (secukinumab) to purchase it at a 55% discount off the list price. Cosentyx, Novartis' top-selling product in the US, is a biologic approved by the FDA for the treatment of multiple immune-mediated inflammatory diseases, including psoriasis, hidradenitis suppurativa, and psoriatic arthritis. The therapy has been clinically studied for more than 17 years and has been used to treat over 1.8 million patients globally since its launch in 2015.

- In December 2025, Platinum Equity announced the completion of its acquisition of the Owens & Minor Products & Healthcare Services business. The acquired business will continue to operate as Owens & Minor P&HS as a privately held, standalone company within Platinum Equity's portfolio. The seller, retaining a five percent stake, announced that its remaining operations will be rebranded as Accendra Health, Inc., effective.

- In July 2025, Samsung Electronics announced it had signed an agreement to acquire Xealth, a healthcare integration platform that connects diverse digital health tools and care programs to improve outcomes for patients and providers. The acquisition will leverage Samsung's expertise in wearable technology to advance its vision of a connected care platform, bridging wellness and medical care to deliver a seamless and holistic approach to preventive health for a broader population.

- In December 2025, Private equity firm Arcline Investment Management initiated the sale of its portfolio company, Medical Manufacturing Technologies (MMT), to Perimeter Solutions for $685 million. MMT specializes in medical device manufacturing solutions and serves as a single-source partner for automated, process-driven medical production. The company supports leading medical technology OEMs and CDMOs in the production of complex interventional devices, including catheters, guidewires, stents, microcoils, and related components.

Segments Covered in the Report

By Modality/Device Type

- X-ray

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Ultrasound

- Nuclear Imaging

By Application

- Diagnostic Imaging

- Interventional Imaging

- Therapeutic Imaging

- Others

By End-Use

- Hospitals

- Diagnostic Imaging Centers

- Ambulatory Surgical Centers

- Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting