Rehabilitation Equipment Market Size and Forecast 2025 to 2034

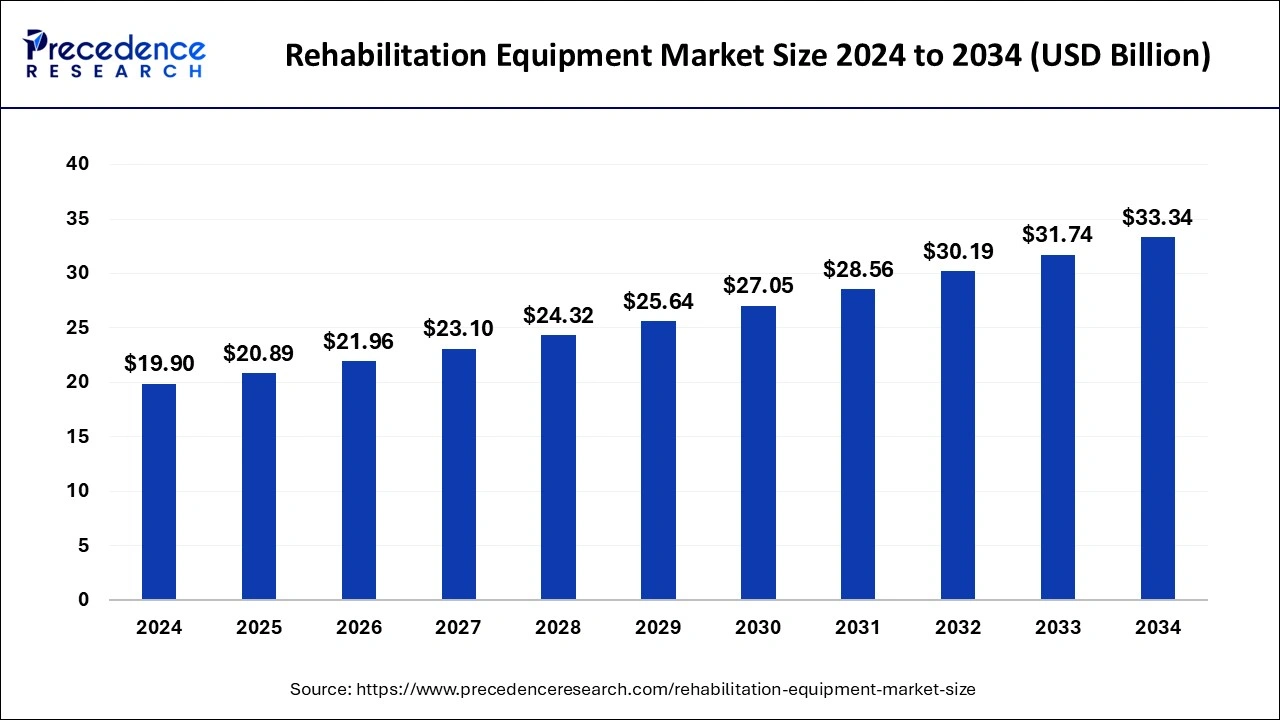

The global rehabilitation equipment market size accounted for USD 19.90 billion in 2024 and is expected to exceed around USD 33.34 billion by 2034, growing at a CAGR of 5.30% from 2025 to 2034.

Rehabilitation Equipment Market Key Takeaways

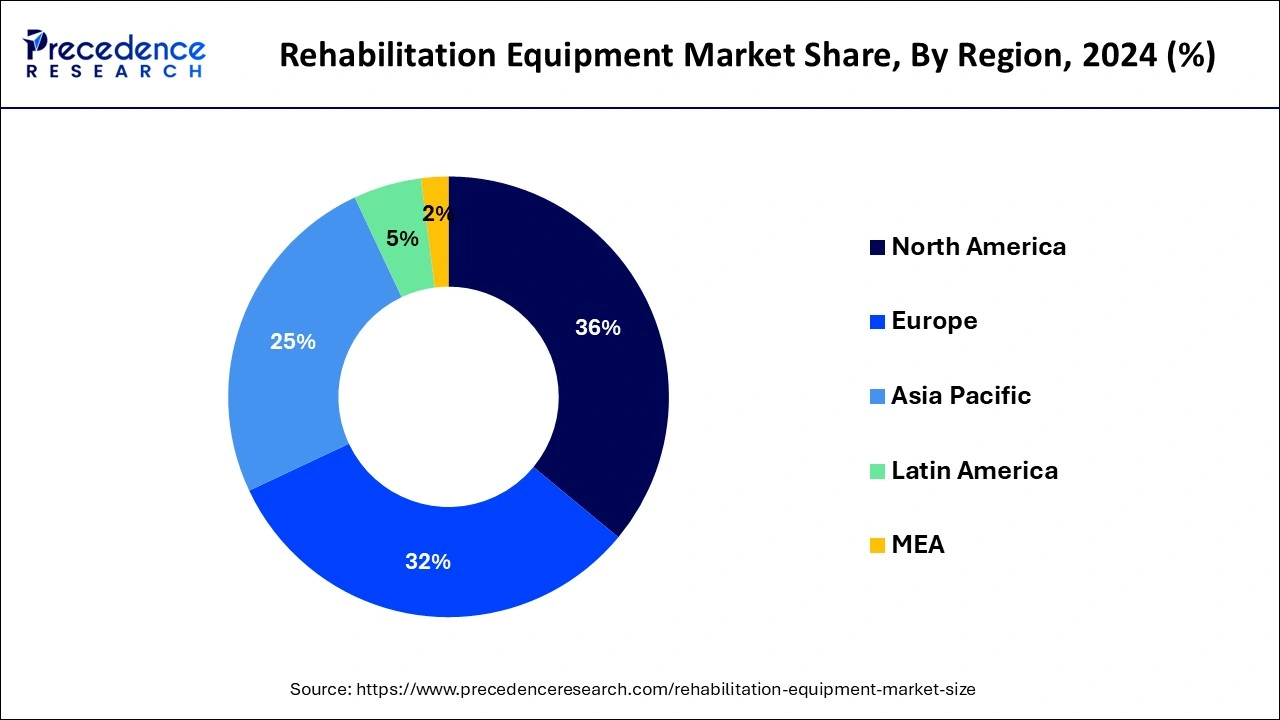

- North America led the global market with the highest market share of 35.11% in 2024.

- Asia Pacific region is estimated to expand the fastest CAGR between 2025 and 2034.

- By Product, the mobility equipment segment has held the largest market share of 38% in 2024.

- By End-User, the hospitals segment captured the biggest revenue share of 35% in 2024.

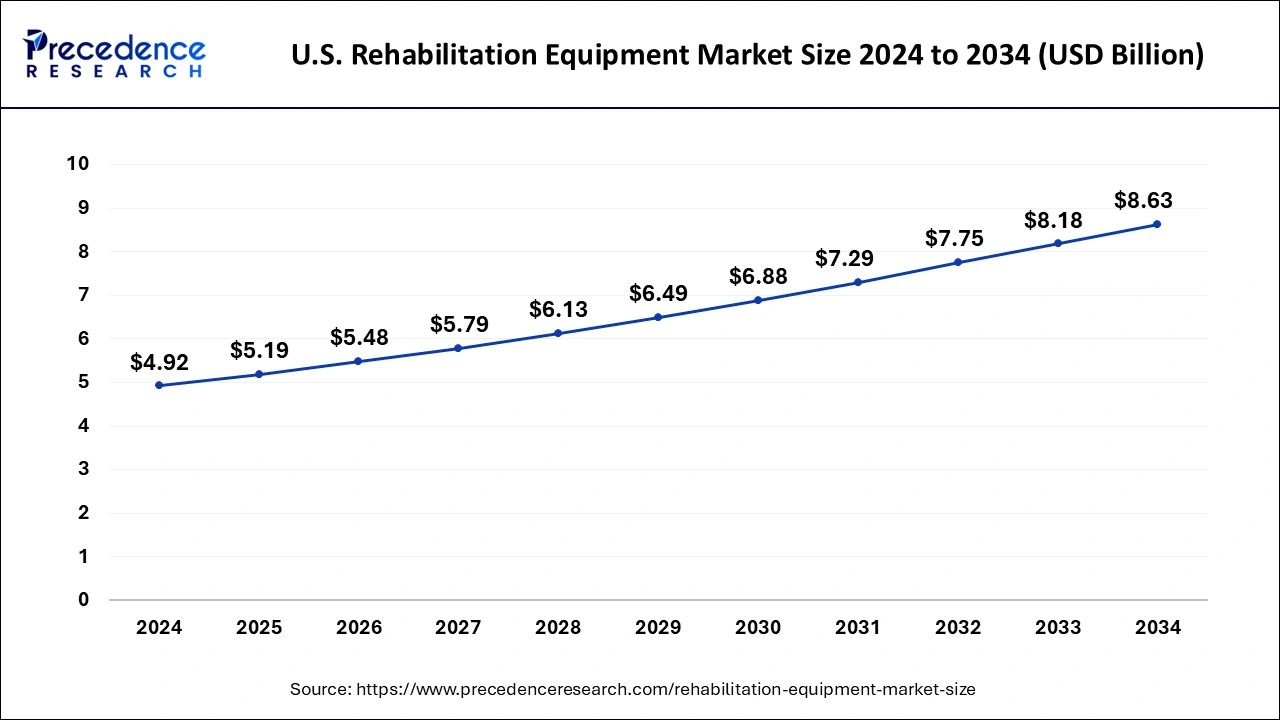

U.S. Rehabilitation Equipment Market Size and Growth 2025 to 2034

The U.S. rehabilitation equipment market size was exhibited at USD 4.92 billion in 2024 and is projected to be worth around USD 8.63 billion by 2034, growing at a CAGR of 5.78% from 2025 to 2034.

With a share of 35.11%, North America led the field and is predicted to hold that position throughout the forecast period.The elderly make up a sizable portion of the population in North America. In this area, the prevalence of non-communicable illnesses including Parkinson's, diabetes, arthritis, and cardiovascular disease is rising. Access to rehabilitative items is being improved by reimbursement systems like Medicare.

The fastest-growing regional market is anticipated to be Asia Pacific, with a promising CAGR of 8.9% over the course of the projected period.A growing patient base, better public and private reimbursement systems, and ongoing healthcare facility construction make emerging nations like India and China the most profitable markets. Growth in this area is anticipated to be boosted by rising medical awareness, an increase in doctors, and supporting government initiatives and regulations. The market for rehabilitation equipment is expanding as a result of patients' quick acceptance of innovative items. In 2016, Europe had the second-largest share. Due to the slowing economy and the healthcare sector, the market for rehabilitation equipment in Europe is predicted to develop slowly. Additionally, it is anticipated that changes in the regulatory environment would impede the expansion of the market for rehabilitation equipment in Europe.

How Is the European Rehabilitation Equipment Market Growing?

The European rehabilitation equipment market is advancing rapidly because of constant technological advancements and further investment in the areas of health care. The innovations are facilitating the creation of advanced rehabilitation equipment and treatments that aim at better patient outcomes and healthcare delivery facilitation throughout the continent. Rising use of digital platforms like robotics, virtual reality, and AI-based rehabilitation devices is changing traditional care to make the therapies more personalized and effective.

The rehabilitation equipment market is showing good growth in the U.K., and this is a result of more investments being made in startup research activities. Co-operation between the UK government and the private sector is the driver of innovation in rehabilitation technologies to enhance patient outcomes.

What Are the Key Trends in the MEA Rehabilitation Equipment Market?

The rehabilitation equipment market in the Middle East and Africa (MEA) is witnessing steady growth. The growing population of rehabilitation centers and the growing awareness about the benefits of rehabilitation. The population in the area is facing an increased prevalence of chronic diseases, disabilities, and injuries necessitating full rehabilitation services, which increases the need for advanced equipment. Health initiatives to increase access to rehabilitation services, combined with the effects of public-private partnerships, are also growing the market. Urbanization is facilitating the availability and high quality of rehabilitation services, owing to increased government funds to modernize the health sector.

Market Overview

The widespread use of rehabilitation equipment in clinics, hospitals, home care settings, and rehabilitation and physiotherapy centers is currently made possible by the rising prevalence of many chronic and non-communicable diseases, such as cancer, arthritis, and Parkinson's, especially among the growing geriatric population. Accordingly, the deployment of virtual or remote healthcare programs on various internet platforms has been prompted by the rapid emergence of the coronavirus illness (COVID-19) pandemic and the ensuing adoption of lockdowns.

Another significant growth-inducing feature is the ability of this trend to allow patients to acquire individualized training drugs and share the diagnostics record with rehab specialists. Additionally, major competitors are heavily working with other businesses to offer affordable, enduring, and high-performance rehabilitation equipment, which is aiding in the market expansion and meeting the growing need for improved equipment and clinical outcomes. Other factors, such as rising consumer healthcare spending, increased investment in research and development (R&D), and numerous beneficial initiatives taken by governments and non-governmental organizations (NGOs) of different countries to strengthen the current healthcare infrastructure are fostering a positive outlook for the market.

Worldwide demand for everyday assistance equipment for the disabled population is rising quickly. The use of new communication channels by manufacturers has increased consumer awareness of newly released items. Patients are therefore kept up to date on new products entering the market. Local governments in a number of nations have made it simple to finance, offered subsidies, and given other financing choices for rehabilitation equipment, which is anticipated to increase demand for assistive goods and spur growth. Favorable reimbursement practices in major markets like the U.S. are anticipated to give manufacturers considerable sales prospects. Medicare reimbursements make it possible for patients to use assistive technology for rehabilitation. Hospital beds, walkers, wheelchairs, canes, crutches, commode chairs, patient lifts, and other durable medical equipment needed for rehabilitation are all covered under Medicare. Additionally, in order to enhance access to high-quality and reasonably priced assistive technologies, the WHO created the Priority Assistive Products List (APL) in support of the Global Cooperation on Assistive Technology (GATE). These approaches should boost manufacturing companies' growth prospects.

Rehabilitation Equipment Market Growth Factors

Other factors influencing the worldwide market for rehabilitation goods include rising disposable income, which makes it easier to obtain better treatment, and expanding healthcare infrastructure, particularly in highly populated emerging nations like China and India. The rehabilitation goods market is expected to have generally positive growth. This is mostly relevant to developed economies, where access to cutting-edge medical facilities and contemporary medications is greater than in underdeveloped nations. A substantially larger patient population that can access and afford medical rehabilitation treatments has been able to emerge in emerging nations because of the expansion of healthcare facilities. Consequently, it is anticipated that the market for rehabilitation goods in emerging nations would expand quickly over the prediction period.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 20.89 Billion |

| Market Size by 2034 | USD 33.34 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 5.30% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product, Application, and End-Use |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Growing prevalence of musculoskeletal disorders

- Musculoskeletal disorders are common, and they have a wide-ranging effect. They are the main reason why millions of individuals all over the world suffer from severe, ongoing physical incapacity and agony. Approximately 20% to 30% of individuals worldwide are now coping with a painful musculoskeletal ailment, according to the World Health Organization (WHO). Due to the high number of patients being hospitalized in musculoskeletal rehabilitation centers across the world, there is a growth in the need for equipment in these facilities.

Growing prevalence of neurological disorders

- The market for equipment used in neurological rehabilitation is projected to develop at a CAGR of 15% through 2032, driven by rising rates of neurological illnesses, robotic rehabilitation, and an aging population with increasing rates of neurocognitive disorders. Neurorehabilitation is frequently required for patients with neurological conditions such as stroke, cerebral palsy, multiple sclerosis, and brain operations. The elderly patient group is more likely to experience visual and hearing loss and prefers to receive rehabilitation therapy. As a result, the market is experiencing a sharp increase in demand due to the growing elderly population. Additionally, the increased use of neurorehabilitation technology is being influenced by the public's growing knowledge of these services. The need for neurological rehabilitation equipment is also increasing as a result of technological developments like wearable technology, nanotechnology, and robots.

Key Market Challenges

- High cost of treatment and lack of healthcare infrastructure - Over a quarter of a billion people will be forced into poverty by 2022, according to figures provided by Oxfam, a global network of charity organizations, despite the fact that the majority of the world's population lives in middle-income countries. Additionally, at least 50% of the world's population lacks access to basic health care, according to a recent World Bank (WB) and World Health Organization (WHO) study. Currently, around 800 million individuals spend at least 10% of their household incomes on health-related expenses, and for about 100 million people, these costs are so exorbitant that they force them to survive on less than USD 1.90 per day. These problems prevented the majority of the population from using healthcare services, which might impede the expansion of the rehabilitation products industry throughout the anticipated time period.

Key Market Opportunities

Increasing technological advancements

- The creation of cutting-edge medical equipment, including robots and anti-gravity treadmills, has been facilitated by the emergence of the most recent technology. With activities that aid patients recovering from neurological impairments, strokes, or other traumatic brain injuries, rehabilitation robots assist therapists. Robotic assistance enables patients to accomplish up to ten times as many repetitions as they would in a conventional one-hour session. With the help of these developments, patients may walk effortlessly and independently, aiding in their recuperation.

- Additionally, anti-gravity robotic treadmills enable people with neurological disorders to regain or enhance their capacity to move or walk. Patients may exercise and improve their gait while experiencing less discomfort and pressure on their joints and bones thanks to anti-gravity robotic treadmill technology. The use of cutting-edge technology in rehabilitation services has proven extremely beneficial for patients all over the world. Robotics and software developments help treatment professionals reach more patients, provide more accurate diagnoses, and improve clinical proficiency.

Increasing geriatric population and rise in surgical procedures

- The worldwide population's increased life expectancy as a result of scientific developments has increased the number of elderly people. This will increase the market size for rehabilitative items overall. The majority of chronic medical illnesses that geriatric individuals experience require rehabilitation goods in order to preserve their health and quality of life.

- Additionally, an increase in healthcare spending and the number of operations performed globally are projected to support the development of general rehabilitation goods. According to the National Center for Health Statistics, inpatient surgical operations totaled almost 48 million in only the United States in 2009. Products for rehabilitation are crucial for both a quick recovery and preserving good health after surgery. This will contribute favorably to the market's overall growth.

Product Insights

With a share of 38%, the mobility equipment category led the market as a whole in 2024. Because of the increasing number of elderly and disabled people throughout the world, this market segment is anticipated to retain its dominance over the forecast period. The wheelchairs and scooters section and the walking assistance devices segment make up the mobile devices segment. Due to their low cost and ease of use, walking assistance devices the most basic type of mobility equipment are favored by the target group.

Application Insights

The exercise equipment used in the rehabilitation of patients following trauma or the start of degenerative illnesses is included in the physiotherapy sector. The method in occupational therapy is more all-encompassing. The market is expected to be driven by an aging population, changing lifestyles, an increase in physiotherapy clinics, and supportive healthcare reforms during the course of the forecast period. Exoskeletons, robotics, implanted technology for pain treatment, and other technical developments are also major drivers of the rehabilitation equipment market in physiotherapy, as is growing demand in emerging nations. After an injury, surgery, or sickness, physiotherapy employs a number of approaches to enhance, maintain, and restore a person's physical strength and mobility. In order to help the patient, execute everyday tasks effortlessly, occupational therapy is utilized to conduct a thorough assessment of the patient, the patient's family, and the environment. The goal of occupational therapy is to motivate patients to carry out routine tasks. Between 2023 and 2032, this market is projected to develop at a CAGR of 7%.

The market is expected to be driven by an aging population, changing lifestyles, an increase in physiotherapy clinics, and supportive healthcare reforms during the course of the forecast period. Exoskeletons, robotics, implanted technology for pain treatment, and other technical developments are also major drivers of the rehabilitation equipment market in physiotherapy, as is growing demand in emerging nations. After an injury, surgery, or sickness, physiotherapy employs a number of approaches to enhance, maintain, and restore a person's physical strength and mobility.

End-User Insights

The rehabilitation equipment market is divided into hospitals & clinics, rehabilitation facilities, home care settings, and physiotherapy centers based on end-use. In 2024, hospitals held the greatest percentage with around 35%. Due to hospitals' huge patient populations, this market sector is anticipated to increase significantly over the next years.

Due to increased public awareness of physiotherapy, technical developments in physiotherapy facilities, and an increase in the frequency of non-communicable illnesses including Parkinson's and arthritis, revenue for rehab centres is anticipated to increase throughout the projection period. During the projected period, it is anticipated that the penetration of rehab centres in emerging economies would expand, leading to a large increase in the number of rehab facilities. In 2023, the market for rehabilitation equipment was worth roughly USD 2.8 billion across home care settings and physiotherapy facilities. Because home care is more affordable than hospital care, there has been a movement in long-term care from hospitals to homes.

Recent Developments

- In February 2024, Addverb launched three robots suited for a variety of applications. Entering into healthcare robotics, the automation solutions provider revealed Healan, a cutting-edge medical cobot designed for rehabilitation and imaging.

(Source: https://addverb.com) - In November 2023, Syrebo personally in addition to taking part in the exhibition, launched two newly created products- Hand Rehabilitation Robot(BCI) and Upper Limb Rehabilitation Robot at the exhibition, the leading rehabilitation solutions provider.

(Source: https://www.syrebo.com) - In August 2023, ReWalk Robotics Ltd., a provider of advanced technologies for mobility in rehabilitation and daily life for neurological conditions, announced it had completed its acquisition of AlterG, Inc., an innovator and provider of Anti-Gravity systems for neurological rehabilitation.

(Source: https://www.globenewswire.com) - Invacare Corp. has acquired Altimate Medical, a manufacturer of standing frames and mobility aids for the rehab market.

Rehabilitation Equipment Market Companies

- Baxter International (US)

- Invacare Corporation (US)

- Medline Industries, LP (US)

- Arjo (Sweden), Colfax Corp. (US)

- Dynatronics Corp. (US)

- Handicare Group AB (Sweden)

- Drive DeVilbiss International (Germany)

- Etac AB (Sweden)

- GF Health Products Inc. (US)

- Joerns Healthcare LLC (US)

- Prism Medical UK Ltd. (UK)

- Guldmann (Denmark)

- EZ Way Inc. (US)

- LINET (Czech Republic)

- Carex Health Brands (US)

- Roma Medical (UK)

- Caremax Rehabilitation Equipment Co. Ltd. (China)

- Antano Group (Italy)

- Ossenberg GmbH (Germany)

- WINNCARE (UK)

- Sunrise Medical LLC (Germany)

- TecnoBody (Italy)

- Enraf-Nonius (Netherlands)

- Proxomed (Germany)

Segments Covered in the Report

By Product

- Therapy Devices

- Daily Living Aids

- Medical Beds

- Bathroom & Toilet Assist Devices

- Reading Writing & Computer Aids

- Mobility Equipment

- Wheelchairs & Scooters

- Powered

- Mobility

- Manual

- Walking Assist Devices

- Canes

- Crutches

- Walker

- Wheelchairs & Scooters

- Exercise Equipment

- Lower Body Exercise Equipment

- Upper Body Exercise Equipment

- Body Support Devices

- Patient Lifts

- Medical Lifting Slings

- Others

By Application

- Physiotherapy

- Occupational Therapy

- Strength, Endurance

- Pain Reduction

By End-Use

- Hospitals & Clinics

- Rehab Centers

- Home Care Settings

- Physiotherapy Centers

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting