What is Restorative Dentistry Market Size?

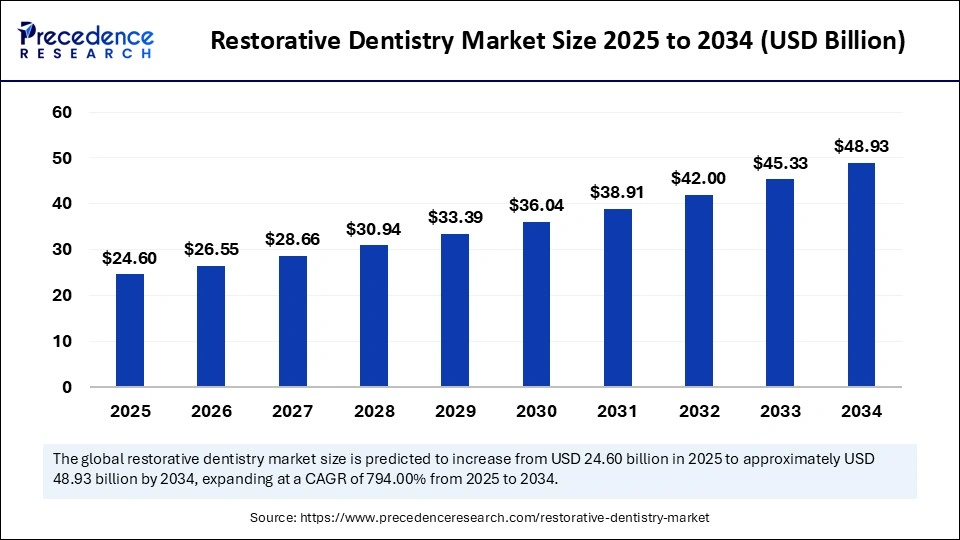

The global restorative dentistry market size is calculated at USD 24.60 billion in 2025 and is predicted to increase from USD 26.55 billion in 2026 to approximately USD 48.93 billion by 2034, expanding at a CAGR of 7.94% from 2025 to 2034. Restorative dentistry focuses on repairing and restoring damaged teeth to improve oral health and functionality. It encompasses various treatments aimed at restoring the natural appearance and strength of teeth, contributing to overall dental wellness.

Market Highlights

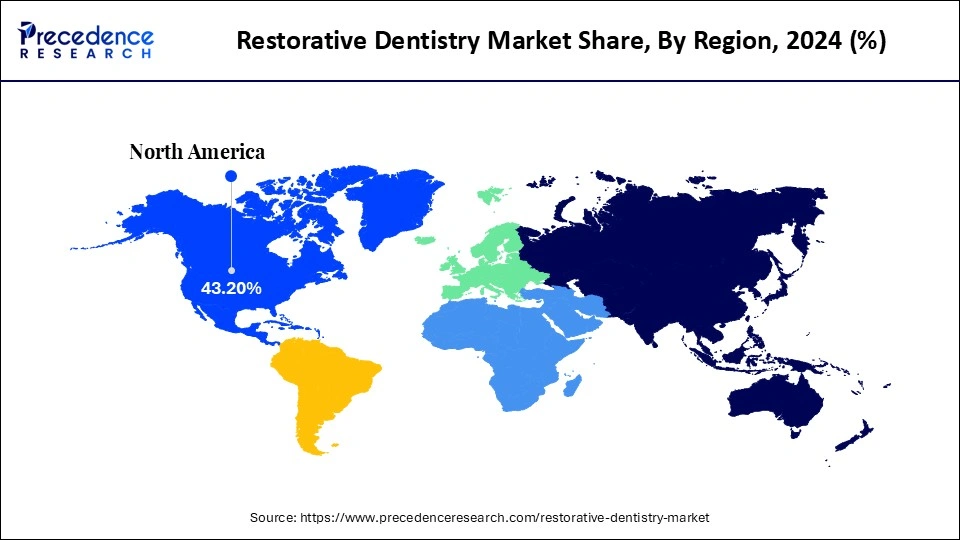

- By region, North America dominated the market, holding the largest market share of 43.2% in 2024.

- By region, Asia Pacific is expected to expand at the highest CAGR of 7.7% in the market between 2025 and 2034.

- By product, the restorative materials segment held the largest share of the restorative dentistry market, accounting for 44.2% in 2024.

- By product, restorative equipment is expected to grow at a remarkable CAGR between 2025 and 2034.

- By material type, the ceramics/all-ceramic segment held the largest market share of 34.5% in the restorative dentistry market during 2024.

- By material type, the services segment is expected to grow at a remarkable CAGR of 7.2% between 2025 and 2034.

- By application/treatment type, the implantology segment held the largest market share of 41.8% in 2024.

- By application/treatment type, the prosthodontics segment grows at a remarkable CAGR of 7.3% between 2025 and 2034.

- By end-user, the dental hospitals & clinics segment held the largest share of 53.5% in the restorative dentistry market during 2024.

- By end-user, the patients segment is set to grow at a remarkable CAGR of 7.3% between 2025 and 2034.

Market Size and Forecast

- Market Size in 2025: USD 24.60 Billion

- Market Size in 2026: USD 10.55 Billion

- Forecasted Market Size by 2034: USD 48.93 Billion

- CAGR (2025-2034): 7.94%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What is the Restorative Dentistry Market?

The restorative dentistry market includes materials, instruments, and technologies used to repair, replace, or restore damaged and missing teeth. It covers restorative materials, prosthetics, implants, and related equipment applied in conservative dentistry, endodontics, implantology, and prosthodontics. Market growth is driven by the increasing prevalence of dental disorders, aging populations, dental tourism, and advancements in CAD/CAM and 3D printing technologies. The market primarily serves dental clinics, hospitals, laboratories, and academic institutions worldwide.

Market growth in the restoration dentistry market is being propelled by rising oral-health awareness, demographic aging, and the proliferation of minimally invasive restorative techniques that prioritize both function and esthetics. Patients increasingly demand durable, tooth-colored restorations, leading clinicians to favor advanced composites, ceramic onlays, and adhesive protocols over traditional metallic materials. Innovations in chairside digital workflows, such as CAD/CAM, intraoral scanning, and rapid milling, have compressed turnaround times and elevated restorative precision, reducing reliance on off-site labs. Concurrently, preventive care and early-intervention philosophies are expanding the addressable market by converting once-extractive cases into restoratively salvageable ones. Reimbursement dynamics and increasing dental insurance penetration in some markets are further enabling the uptake of higher-value restorative procedures. In sum, restoration dentistry now sits at the confluence of material science, digital integration, and patient-centric aesthetics.

Restorative Dentistry Market Outlook

- Industry Growth Overview: Industry growth is underwritten by convergence: academic research translating new ceramic and composite chemistries into clinically viable products, dental labs investing in digital asset production, and OEMs bundling hardware and software ecosystems for practitioners. Consolidation among dental manufacturers and lab networks is creating vertically integrated supply chains that shorten lead times and improve quality control. Training academies and certification programs proliferate, reducing clinician variability and accelerating adoption of complex restorative protocols. Investment in chairside technologies and service models that offer pay-per-use or subscription financing is broadening clinic affordability. As procedures shift toward preservation and aesthetics, service mixes evolve to include interdisciplinary care, prosthodontics, endodontics, and periodontics, further expanding market depth. Hence, growth is both product-led and systemically enabled

- Sustainability Trends: Sustainability narratives are gaining traction as manufacturers reduce solvent-intensive processes, switch to greener packaging, and explore recyclable ceramic substructures and biodegradable consumables. Dental labs and clinics are adopting energy-efficient milling machines, solvent recovery systems, and waste-segregation practices to reduce environmental impact. Suppliers increasingly disclose lifecycle analyses for restorative materials, and purchasers are beginning to factor environmental credentials into procurement decisions. Such trends are nascent but growing, particularly among corporate clinic chains and hospital-affiliated dental centers. Over time, sustainability will become a brand differentiator rather than a marginal compliance checkbox

- Major Investors: Capital flows into restorative dentistry come from strategic medical-device investors, dental-focused venture funds, and private equity groups consolidating clinic chains and lab networks. Investors favor companies that offer integrated digital-restorative platforms, proprietary biomaterials, or scalable chairside solutions that shorten treatment cycles. Growth capital also targets lab automation and AI-driven design tools that promise margin expansion through efficiency. Public and private co-investments often pair with go-to-market support to scale clinical adoption. The investor mix reflects both deep sector specialization and broader healthcare investment appetite

- Startup Economy: A vibrant startup cohort is innovating across bioactive restorative materials, intraoral scanning software, AI-driven margin detection, and automated milling workflows. Many ventures originate from dental schools and materials science labs, rapidly partnering with labs or clinic chains for real-world validation. Startups that bundle hardware, software, and consumables into recurring revenue models attract premium valuations. Exit pathways include acquisition by established dental OEMs or strategic roll-ups by lab consolidators. This entrepreneurial energy continually injects new modalities and business models into the market.

Key Technological Shifts in the Restorative Dentistry Market

The pivotal shift is the seamless integration of digital workflows with biomimetic restorative materials, enabling predictable, fast, and esthetic outcomes that rival natural dentition. Intraoral scanning and AI-assisted design produce restorations with superior marginal fit, while high-performance zirconia and hybrid ceramics deliver lifelike optics and strength. Chairside CAD/CAM systems now offer true single-visit dentistry without compromising on performance, reducing patient attrition and logistical overhead. Additive manufacturing and advanced milling strategies allow for micro-texturing and custom translucency that mimic enamel dentin gradients. Simultaneously, bioactive sealants and ion-releasing composites enhance longevity by promoting remineralization and reducing secondary caries. This confluence of digital precision and smart materials is reshaping clinical expectations and practice economics.

Market Key Trends in Restorative Dentistry Market

- Migration to single-visit, chairside restorations enabled by CAD/CAM and in-office milling.

- Proliferation of high-strength, aesthetic ceramics and adhesive composite systems.

- Adoption of AI tools for margin detection, shade matching, and quality assurance.

- Lab consolidation and vertical integration with digital design-to-manufacture pipelines.

- Increasing clinician demand for turnkey service models that include training and maintenance.

Market scope

| Report Coverage | Details |

| Market Size in 2025 | USD 24.60 Billion |

| Market Size in 2026 | USD 10.55 Billion |

| Market Size by 2034 | USD 48.93 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 7.94% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Product Type,Material Type,End User,Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Market Drivers

Aesthetics Meets Durability: Patient Preferences Reframe Practice

Patients increasingly seek restorative solutions that marry natural aesthetics with long-term durability, creating demand for advanced materials and digital precision. This shift compels practitioners to adopt technologies that deliver predictable, visually pleasing outcomes with fewer visits. The willingness to pay for premium, same-day restorations supports higher-margin services and incentivizes clinic investment in digital equipment. Manufacturers that offer validated clinical protocols and training find faster adoption as clinicians seek risk mitigation. The interplay of patient expectations and clinician capability thus drives market expansion and innovation. Ultimately, the consumer's desire for natural, enduring smiles is the market's most potent accelerant.

Market Restraint

Cost and Competency: Barriers to Universal Adoption

High capital expenditure for chairside milling, scanners, and lab automation deters smaller practices from rapid adoption, creating a two-tier service sector in the restorative dentistry market. Moreover, effective use of advanced restorative systems demands clinician training and lab collaboration, and upskilling represents both time and financial investments. Reimbursement constraints in many jurisdictions mean patients often shoulder costs, limiting uptake in price-sensitive cohorts. Supply-chain variability for high-purity ceramics and specialized milling burs can disrupt workflows. Collectively, these economic and competency hurdles temper the speed at which innovation permeates the entire dental community.

Market Opportunity

Democratizing Precision Restorations

The prime opportunity lies in modular business models that lower entry barriers to financing for chairside systems, cloud-based CAD subscriptions, and pay-per-use milling services, enabling smaller clinics to offer premium restorations. Expanding service partnerships between clinics and centralized digital labs can scale access while preserving quality. The development of lower-cost, clinically robust biomaterials will open markets in emerging economies where demand for aesthetic dentistry is increasing. Adjacent opportunities include outcome-based service contracts and tele-pathways for remote design consultation. By making precision restorative care affordable and scalable, stakeholders can unlock substantial latent demand.

Restorative Dentistry Market Value Chain Analysis

- Raw Material Sources: Primary inputs include high-purity zirconia blanks, lithium disilicate glass ceramics, resin composites, and adhesive luting agents; secure sourcing of these materials is essential for consistent optical and mechanical properties. Supply stability depends on specialized ceramic manufacturers and refined polymer chemistry suppliers with GMP capabilities.

- Investment by Investors: Investors favor vertically integrated players and software platforms that lock clinics into recurring revenue through consumables and subscription models. Growth capital is also flowing into lab automation and AI companies that promise margin uplift via efficiency gains.

Segment Insights

Product Type Insights

Why Are Restorative Materials Dominating the Restorative Dentistry Market?

The restorative materials are dominating the restorative dentistry market, holding a 44.2% share and representing the bedrock of modern dental reconstruction. Their versatility in applications such as fillings, crowns, and veneers ensures their sustained preference among practitioners. The evolution of advanced composites and biocompatible resins has further elevated their performance and aesthetic appeal. Market growth is driven by the surge in cosmetic dentistry and the rising incidence of dental decay globally. Furthermore, innovations in nanotechnology are refining the strength, polishing ability, and longevity of these materials. As patient expectations lean toward natural-looking restorations, restorative materials remain the industry's irreplaceable cornerstone.

The restorative equipment is the fastest-growing segment in the restorative dentistry market, holding a 7.4% share, driven by product category and catalyzed by the integration of precision-based technologies. The proliferation of CAD/CAM systems, 3D scanners, and digital milling machines has revolutionized chairside restorations. These innovations enable dentists to deliver same-day crowns and bridges with impeccable accuracy, significantly reducing treatment time. Additionally, the push toward minimally invasive procedures fuels demand for ergonomic and digitally compatible tools. This trend is particularly strong in technologically progressive practices emphasizing workflow automation. With continual advances in digital dentistry, restorative equipment is rapidly transforming from a supporting asset into a strategic enabler of clinical excellence.

Material Type Insights

Why Are Ceramics Dominating the Restorative Dentistry Market?

The ceramics are dominating the restorative dentistry market, holding a 34.5% share, driven by the convergence of technology and personalized patient care. The growing popularity of smile design consultations, 3D imaging-based treatment planning, and customized dental restoration packages has redefined patient experience. Dental service providers are adopting subscription and digital follow-up models to ensure long-term restoration maintenance. Additionally, clinics offering AI-assisted diagnostics and tele-dentistry consultations are creating new service paradigms. The emphasis on holistic oral wellness, rather than mere correction, further propels this segment's expansion. As patient-centric dentistry becomes the norm, service-based models are rapidly becoming the industry's most dynamic frontier.

The service is the fastest-growing in the restorative dentistry market, holding a share of 7.2%. Implantology stands as the cornerstone of restorative dental applications, commanding a substantial market share due to its long-term effectiveness and aesthetic outcomes. Dental implants are increasingly preferred for their ability to restore function, preserve jawbone integrity, and deliver natural-looking results. The rising geriatric population and escalating cases of tooth loss have further intensified this demand. Technological advancements, such as computer-guided implant surgery and 3D bone mapping, have elevated procedural precision. Furthermore, innovations in bioactive coatings and titanium alloys enhance osseointegration and longevity. Implantology not only restores smiles but also symbolizes the fusion of surgical artistry with biomedical engineering.

Application Insights

Why Is Implantology Leading the Restorative Dentistry Market?

Implantology is dominating the restorative dentistry market, holding a 41.8% share. It stands as the cornerstone of restorative dental applications, commanding a substantial market share due to its long-term effectiveness and aesthetic outcomes. Dental implants are increasingly preferred for their ability to restore function, preserve jawbone integrity, and deliver natural-looking results. The rising geriatric population and escalating cases of tooth loss have further intensified this demand. Technological advancements, such as computer-guided implant surgery and 3D bone mapping, have elevated procedural precision. Furthermore, innovations in bioactive coatings and titanium alloys enhance osseointegration and longevity. Implantology not only restores smiles but also symbolizes the fusion of surgical artistry with biomedical engineering.

Prosthodontics is the fastest-growing segment in the restorative dentistry market, holding a share of 7.3%, fueled by increasing aesthetic aspirations and advancements in digital fabrication. The integration of CAD/CAM, intraoral scanning, and AI-based bite analysis is revolutionizing crown, bridge, and denture design. This growth is also reinforced by the surge in full-mouth rehabilitation and cosmetic enhancements among middle-aged populations. Moreover, the use of lightweight, durable, and biocompatible materials has significantly enhanced prosthetic comfort and function. Dental laboratories and clinics are embracing digital workflows to improve precision and reduce turnaround times. As personalized smile restoration becomes a lifestyle demand, prosthodontics is ascending as the new frontier of restorative art.

End User Insights

Why Are Dental Hospitals & Clinics Leading the Restorative Dentistry Market?

The dental hospitals & clinics are dominating the restorative dentistry market, holding a 53.5% share, owing to their comprehensive infrastructure and skilled professionals. Their dominance is sustained by the wide range of treatments offered, from fillings and crowns to full-mouth rehabilitation. The growing preference for multi-specialty dental centers equipped with digital imaging and chairside CAD/CAM systems reinforces their leadership. Furthermore, partnerships with material manufacturers and implant brands enhance their clinical efficiency and cost-effectiveness. Patients continue to trust clinics for personalized consultation and high-quality outcomes. As technology integrates seamlessly into clinical practice, dental hospitals and clinics will continue to anchor the restorative ecosystem.

Patients are the fastest-growing segment in the restorative dentistry market, holding a 7.3% share, as individuals increasingly take an active role in their dental restoration journeys. Growing health awareness and the democratization of aesthetic dentistry have empowered patients to seek advanced treatment options directly. Digital engagement platforms, virtual smile simulations, and AI-assisted consultations are making dental care more accessible and participatory. The rise of dental tourism and flexible financing options has also broadened treatment affordability. Additionally, self-education through online channels is reshaping how patients choose materials and procedures. This paradigm shift from passive care receivers to informed decision-makers marks a new era of patient-driven restoration dentistry.

Regional Insights

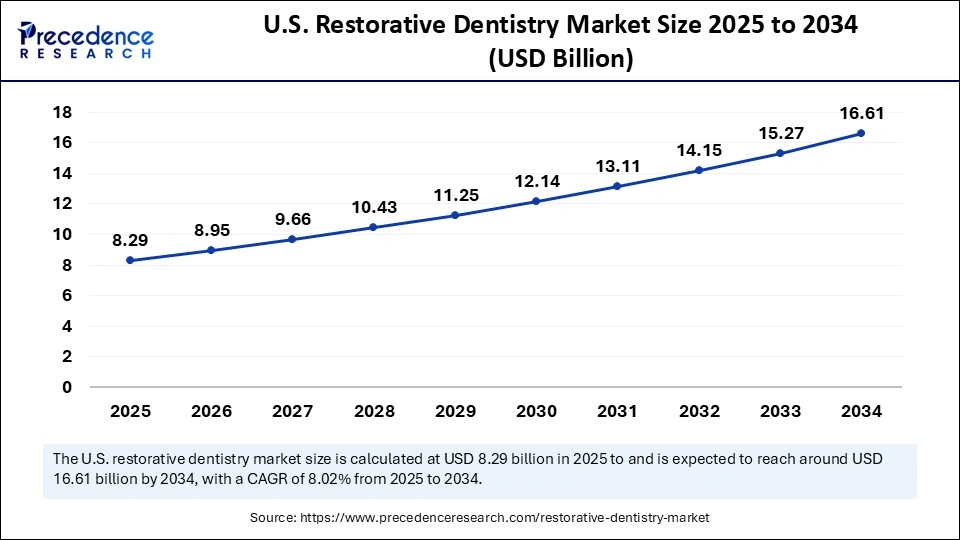

U.S. Restorative Dentistry Market Size and Growth 2025 to 2034

The U.S. restorative dentistry market size was exhibited at USD 8.29 billion in 2025 and is projected to be worth around USD 16.61 billion by 2034, growing at a CAGR of 8.02% from 2025 to 2034.

How North America Is Dominating the Restorative Dentistry Market?

North America dominates the restorative dentistry market, holding a 43.2% share due to high per-capita dental expenditure, widespread insurance penetration, and a strong culture of cosmetic dentistry. The region's dense network of specialty practices and dental schools accelerates the adoption of advanced materials and digital workflows. Robust private investment and supplier presence make equipment acquisition and training readily accessible to clinicians. Corporate dental chains and multi-practice groups further scale technology diffusion by centralizing digital labs and purchasing power. Regulatory clarity in product approvals and a vibrant continuing-education ecosystem underpin clinical confidence in new restorative modalities. Consequently, North America continues to set clinical standards and commercial benchmarks for restorative innovation.

United States

The U.S. market leads the global landscape for restoratives and dental technology due to its mature, innovation-driven ecosystem and strong integration between clinical practice, research, and industry. A dense network of private dental clinics fosters rapid adoption of new restorative materials and digital workflows. In contrast, robust venture capital and private equity investment continue to fund startups developing AI-driven diagnostics, CAD/CAM systems, and biomimetic materials. The presence of major regulatory bodies and streamlined FDA pathways, coupled with widespread CE marking for imported and domestic devices, enhances product credibility and accelerates market entry.

Additionally, influential dental associations, such as the American Dental Association (ADA) and the American Academy of Cosmetic Dentistry (AACD), along with leading academic centers, play a pivotal role in clinical validation and guideline development, effectively transforming emerging innovations into standard practice. As patient expectations evolve toward aesthetics and minimally invasive procedures, the U.S. market remains both a testbed for innovation and a benchmark for global clinical standards.

Can Asia Pacific Translate Scale Into Clinical Sophistication in Restorative Dentistry?

Asia Pacific is the fastest-growing region in the restorative dentistry industry, holding a 7.7% market share. This growth is driven by rising disposable incomes, expanding dental access, and a cultural premium on esthetics in major urban centers. The rapid expansion of private clinic networks and growing medical tourism creates demand for high-quality restorative services at competitive pricing. Investments in digital labs and local manufacturing of ceramic blanks are lowering costs and improving supply chain resilience. Governments and insurers in some markets are beginning to broaden basic dental cover, indirectly supporting uptake of higher-value restorative procedures. Training programs and international partnerships accelerate skills transfer, allowing regional clinicians to adopt advanced workflows more rapidly. Consequently, the Asia Pacific is both a volume engine and a fertile ground for the diffusion of innovation.

Country Level Analysis

China's large, urbanizing population and rapidly modernizing healthcare infrastructure position it as a pivotal growth market for restoratives. The country's expanding middle class is driving heightened demand for advanced dental care, aesthetic treatments, and high-quality restorative materials that align with global standards. Meanwhile, significant investments in local manufacturing, R&D hubs, and digital laboratory capacity are accelerating technology transfer and enabling faster adoption of CAD/CAM, 3D printing, and AI-assisted design tools.

These advancements are reducing costs and improving access across both public and private sectors. If clinician training programs continue to strengthen, supported by partnerships between universities, international manufacturers, and professional associations, and if reimbursement models evolve to better support restorative procedures, China could emerge not only as a key consumer market but also as a major center for innovation, clinical research, and large-scale deployment within the global dental ecosystem.

Recent Developments

- In October 2025, A prominent Glasgow clinician praised Scotland's move to introduce regulations for non-surgical cosmetic procedures, while cautioning that the proposed legislation must go further to ensure comprehensive patient protection. Dr. Andrew Culbard, Clinical Director of Aesthetic & Restorative Dentistry, Orthodontics, and Facial Aesthetics at the Scottish Dental Care Group, described the new proposals as a crucial advancement for public safety. In his remarks to The Herald, Dr. Culbard emphasized that Scotland's decision to regulate non-surgical cosmetic treatments is not merely a legislative milestone; it represents an essential step toward safeguarding the public from potential harm.(Source: https://www.heraldscotland.com)

- In October 2025, Dentistry today transcends the traditional realm of filling cavities and repairing damaged teeth; it has evolved into a refined confluence of medical science, engineering precision, and digital innovation, capable of profoundly transforming lives. At the forefront of this revolution stands Dr. Jasdeep Kaur Cheema, an accomplished implant restorative dentist whose inspiring journey from Punjab to global acclaim mirrors both her unwavering determination and the remarkable evolution of modern dentistry itself.(Source: https://www.businesstoday.in)

Top Restorative Dentistry Market Companies

- Dentsply Sirona Inc.: Dentsply Sirona leads the global restorative dentistry market with an extensive portfolio that includes CAD/CAM systems, composites, cements, and digital imaging technologies. The company's flagship CEREC system revolutionized chairside restorative workflows, offering same-day crowns and inlays, while its ongoing innovation emphasizes digital integration and minimally invasive restoration.

- 3M Company: 3M is a pioneer in restorative materials and adhesive science, providing advanced composites like Filtek™, cements such as RelyX™, and bonding systems trusted worldwide. The company continues to push boundaries in nanotechnology-based materials, enhancing esthetics, strength, and longevity in restorative dental applications.

- Envista Holdings Corporation: Envista, through its leading brands KaVo Kerr and Nobel Biocare, offers a full suite of restorative and prosthetic solutions, including CAD/CAM, implants, and digital diagnostics. Its integrated approach combines hardware, materials, and digital platforms, supporting precision-driven, patient-centered restorative workflows.

- Ivoclar Vivadent AG: Ivoclar Vivadent is synonymous with esthetic restorative excellence, producing globally acclaimed systems such as IPS e.max, Tetric EvoCeram, and Variolink Esthetic. The company's innovations bridge materials science and digital dentistry, enabling lifelike restorations and efficient workflows for both chairside and laboratory environments.

- Zimmer Biomet Holdings Inc.: Zimmer Biomet brings expertise from implantology into restorative dentistry, offering bone grafting materials, abutments, and restorative implant components. With a focus on regenerative and biologically integrated restorations, the company aims to improve long-term dental health outcomes through precision implant-restorative solutions.

Other Companies in the Market

- GC Corporation: Develops high-quality dental materials such as glass ionomers, composites, and cements, with a strong focus on bioactive and minimally invasive restorative solutions.

- Mitsui Chemicals Inc.: Provides advanced dental materials through its Sun Medical and Shofu subsidiaries, focusing on hybrid ceramics, adhesives, and biomimetic restorative products.

- Septodont Holding: Renowned for dental anesthetics and restorative materials, Septodont integrates pain management and biocompatible cements into comprehensive restorative workflows.

- COLTENE Holding AG: Offers a broad portfolio of restorative and prosthetic materials, including impression compounds, composites, and adhesives for clinical and laboratory use.

- VOCO GmbH: Specializes in restorative dental materials such as nano-hybrid composites and bonding systems, emphasizing innovation in handling, polishability, and longevity.

- Nobel Biocare Services AG: A subsidiary of Envista, Nobel Biocare is a pioneer in implant-based restorations and digital workflows, offering integrated prosthetic and restorative solutions.

- Bisco Inc.: Focuses on adhesive dentistry and restorative bonding solutions, producing innovative resins and cements that improve adhesion and long-term restoration stability.

- Ultradent Products Inc.: Manufactures dental materials such as whitening gels, bonding agents, and restorative resins, with a strong presence in esthetic and conservative dentistry.

- Danaher Corporation: Former parent of Envista Holdings, Danaher remains a major player through its portfolio of dental technology and diagnostic subsidiaries, enhancing restorative care efficiency.

- Insync Healthcare Solutions: Provides digital dental software and workflow solutions that integrate imaging, treatment planning, and restorative design within cloud-based platforms.

- IBM Corporation: Supports the dental industry with AI-driven diagnostics and data analytics, enabling predictive treatment planning and digital workflow optimization in restorative care.

Segments Covered in the Report

By Product Type

- Restorative Materials (Direct & Indirect)

- Implants

- Prosthetic Materials

- Restorative Equipment

By material type

- Metal / Metal Alloys

- Ceramics / All-Ceramic

- Composite Resins

- Biomaterials

- Bonding Agents / Adhesives

- Impression Materials

By Application / Treatment Type

- Conservative & Endodontics

- Implantology

- Prosthodontics

- Other Restorative Treatments

By End-User

- Dental Hospitals & Clinics

- Dental Laboratories

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content