What is the Secure Logistics Market Size?

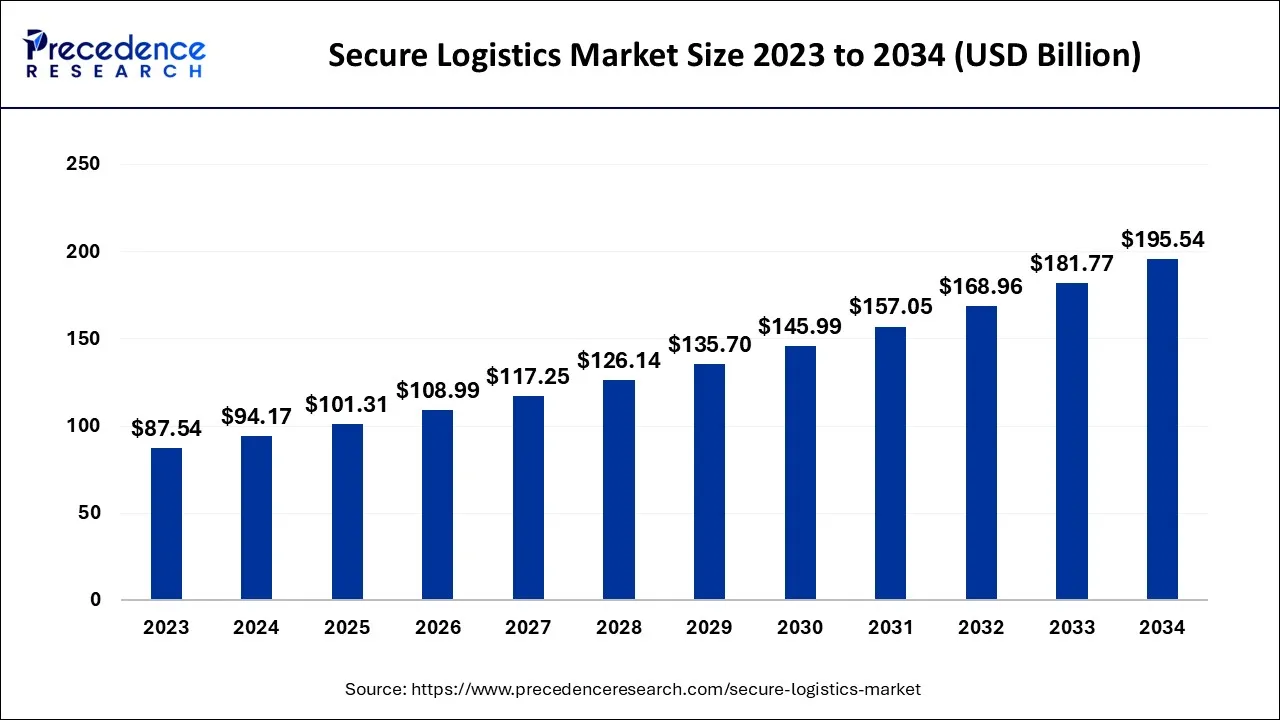

The global secure logistics market size was valued at USD 101.31 billion in 2025 and is predicted to increase from USD 108.99 billion in 2026 to approximately USD 208.67 billion by 2035, expanding at a CAGR of 7.49% over the forecast period from 2026 to 2035.

Market Highlights

- Europe region has accounted revenue share of 43% in 2025.

- The Asia Pacific market is poised to grow at a CAGR of 12.2% over the forecast period.

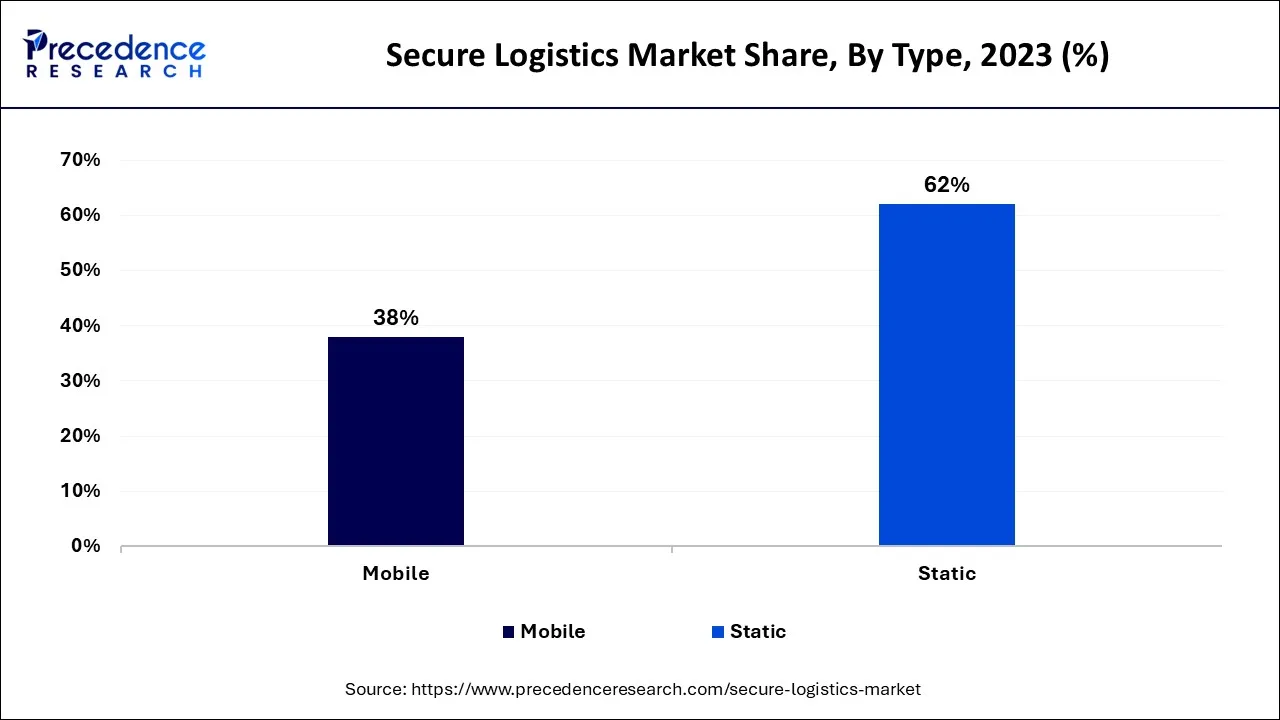

- By type, the static type segment has registered the highest market share of over 62% in 2025.

- The mobile type segment has generated 38% revenue share in 2025.

- By application, the cash management segment accounted highest revenue share in 2025 which was 55.8%.

Market Size and Forecast

- Market Size in 2025: USD 101.31 Billion

- Market Size in 2026: USD 108.99 Billion

- Forecasted Market Size by 2035: USD 208.67 Billion

- CAGR (2026 to 2035): 7.49%

- Largest Market in 2025: Europe

- Fastest Growing Market: Asia Pacific

How is the integration of artificial intelligence (AI) impacting the growth of the secure logistics market?

In recent years, the landscape of the logistics industry has undergone a remarkable transformation. Artificial Intelligence (AI) can be a game-changer, providing innovative solutions to the challenges faced by the logistics industry. Artificial Intelligence (AI) in secure logistics is revolutionizing the industry by enhancing automation across various operations, from warehousing to transportation. Automated systems powered by Artificial Intelligence (AI) can optimize inventory management and route optimization to ensure timely deliveries. AI-powered predictive maintenance assists in keeping logistics equipment running smoothly and prevents costly breakdowns. By integrating Artificial Intelligence (AI) into logistics, firms can achieve greater efficiency, improve customer satisfaction, and boost cost savings. Additionally, Artificial Intelligence (AI) in e-commerce logistics also provides real-time tracking and monitoring of parcels, which enhances the overall customer experience.

Secure Logistics Market Growth Factors

Secure logistics includes secure storage, transportation, and handling measures that are implemented to minimize the risks associated with transportation such as theft, damage, loss, or unauthorized access. As a result of the increasing security concerns among corporations and banks, there is a growing demand for security management services for currency movement.

To overcome the constraints and facilitate the mobility of production factors including labor, land, and capital, the European Union has established a structure. This structure aims to provide a secure and safe environment for the transportation of goods and currency across the region. The banking industry globally is undergoing a transformation due to the changes in technical innovation and the deregulation of financial services.

The banking industry in emerging economies has traditionally been a highly protected industry with regulated deposits and restrictions for domestic and foreign entry. However, due to technological advancements and macroeconomic pressures, the banking industry is opening up the market to foreign competition. BRICS countries and other emerging economies are expected to experience a large inflow of Foreign Direct Investments (FDIs).

The growth of the skilled labor force, rapid globalization, and a rise in the number of young consumers in these regions has been the driving factor in the banking sector's growth. Furthermore, the increasing number of High Net-worth Individuals (HNIs) and the growing need for wealth management services are expected to influence the growth of the banking sector in emerging markets.

HNIs will invest in cash deposits, real estate, debt portfolios, and equities. As an example, the State Bank of India (SBI) is focusing on providing wealth management, retail banking, and personal banking services to cater to the needs of its HNI clients.

- Factors driving the market for safe transportation include an increase in the amount of money moving around the world, warehouse technology, and the explosive growth of e-commerce.

- The development of the safe logistics sector is hampered by the increasing use of mobile payments and online banking, bad logistics management, cybersecurity problems, and rising fuel prices.

- The demand for digital solutions from businesses, changes in business operations, self-driving cars, and technological advancements with a trained workforce all present development possibility in the secure logistics market.

Market Outlook

- Industry Growth Overview: The growing e-commerce platforms and increasing demand for cash management solutions are increasing the use of secure logistics, promoting industry growth.

- Major Investors: Massive institutional asset managers and private equity firms are the major investors in the market. The Vanguard Group and Carlyle Group are some of the major investors.

- Startup Ecosystem: The startup ecosystems focus on the integration of AI, blockchain, and IoT solutions to enhance the applications of secure logistics, where SecureDApp, Indemni, and Taabi Mobility are showing active participation.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 101.31 Billion |

| Market Size in 2026 | USD 108.99 Billion |

| Market Size by 2035 | USD 208.67 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 7.49% |

| Largest Market | Europe |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type, Application, Mode of Tranport and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Emerging economies expansion of banking and financial institutions

In recent decades, the global banking sector has undergone significant changes due to the deregulation of financial services and technological advancements. Banking was traditionally a highly protected industry in emerging economies, with regulated deposits and strict entry requirements for domestic and foreign investors. However, with the rise of macroeconomic pressures and technological innovations in the banking industry, regional players have been forced to open up their markets to foreign competition.

The BRICS nations, including Brazil, Russia, India, China, and South Africa, are expected to receive substantial foreign direct investment (FDI). This expansion of the BFSI sector in emerging economies is driven by several factors, such as a growing skilled labor force, increasing globalization, and a rise in the number of young consumers.

Key Market Challenges

Increasing usage of payments from mobile

Technological advancements such as NFC, EMV chips, and other contactless devices are transforming the payment process. This shift presents a substantial opportunity for mobile commerce due to the availability of improved data and payment infrastructure. With a growing consumer base, online mobile commerce is gaining popularity.

The emergence of mobile wallets, including Apple Pay, Google Pay, and Samsung Pay, is expected to drive the market for mobile payments. To attract new users, point-of-sale systems that accept mobile payments and incentives such as loyalty programs and promotions are being widely adopted.

Consequently, people are increasingly turning away from cash payments in favor of digital ones. However, this trend is expected to restrain market growth over the forecast period.

Opportunities

Increasing cash-in-transit heists as well as theft of freight

Global logistics thefts and heists have been on a steady rise over the past decade. For example, South Africa has experienced at least one Cash-In-Transit (CIT) heist until February 2020, with 35 such heists reported nationwide, and 21 in Gauteng alone. Cities like Cape Town and Boksburg are witnessing a surge in on-road robberies, causing a rise in theft-related concerns for customers from various industries, such as banking, retail, and precious metals, while traveling.

Despite conducting their logistics operations, these companies are experiencing losses due to theft, often because of inadequate security personnel and outdated technology. Thus, there is a growing demand for reliable logistics services to address these security issues. Secure logistics firms offer a range of outsourcing services, including armored vehicles, cross-border transport, staffed security, ATM management, secure storage, cash-in-transit, and replenishment, among others.

Therefore, businesses are increasingly focusing on secure logistics services to minimize the risks of theft and other security breaches during the transportation and handling of goods and assets.

Segments Insights

Type Insights

The global market has been categorized into two types: static and mobile. In 2024, the static type segment recorded the highest market share and is expected to continue dominating the market throughout the forecast period. Manned guards are typically utilized in the static type for security purposes, with security guards stationed at various points to ensure secure logistics transportation.

Many players offer guarding services in the market and provide specialized logistics security solutions aimed at preventing theft, reducing shipment loss and damage, and exposing security breaches.

Meanwhile, the mobile type segment is expected to register the fastest growth rate during the forecast period, primarily due to the increasing advancements in secure journey management services. Service providers offer vehicles equipped with electronic countermeasures, radio, and satellite communication systems. Financial institutions primarily use electronic safes to reduce management downtime, and service providers partner with several safe manufacturers to provide a wide range of electronic safe services of various sizes.

Application Insights

The cash management segment held the largest market share in 2024 and is expected to remain dominant during the forecast period. This growth is attributed to the increasing penetration of ATMs in emerging countries. The cash management segment comprises cash-in-transit, cash processing, and ATM services.

Cash-in-transit involves the collection of money from banks and delivering it to designated cash points like ATMs, utilizing armored trucks that reduce risks and enhance security by reducing opportunities for theft. Service providers offer Automated Teller Machine (ATM) services alongside traditional cash-in-transit services, which are governed by regional, national, and local legislation, with the Ministry of Justice, the Ministry of Interior, and the Police being responsible authorities in the industry.

Market players focus on developing innovative and efficient goods, forming alliances, and entering into collaborations and partnerships to gain a competitive advantage. For instance, to hasten the shift to a sustainable model, Prosegur and Forética, a Spanish group in corporate social responsibility and sustainability, established an alliance in 2022.

Brink's Inc. also collaborated with Courtyard, a physically-backed NFT platform, in February 2022, and its Canadian subsidiary signed a multi-year agreement with Canopy Growth Corp. in 2018. These partnerships enabled Brink's to create a cross-selling program that would enable it to offer solutions to Canopy Growth's connected cultivators and retail clients.

Mode of Transport Insights

The roadways segment held the largest market share in 2024. The growth of the segment is majorly driven by the increasing flexibility and accessibility provided by roadways for the transit of shipments safely and timely. In addition, with the rapid adoption of advanced technologies such as vehicle tracking systems, GPS technologies, and safe convoy protocols, road transport has emerged as a secure logistics provider. The increasing demand for secure door-to-door transportation. The security of road transport for sensitive and high-value items is enhanced by increasing investments in advanced surveillance systems, armored trucks, and others.

On the other hand, the airways segment is expected to grow at the fastest CAGR over the studied period. The segment's growth is primarily attributed to the rising globalization and increasing requirement for expensive goods to be shipped rapidly and safely. The Airways segment offers high efficiency and speed, one of the vital modes of transportation for various industries such as pharmaceuticals, banking, fresh food, and others that require cold chain technology to control temperatures throughout the supply chain. Moreover, the stringent security requirements of air cargo, secure logistics providers invest in state-of-the-art screening technologies, secure cargo facilities, and compliance with international standards for air transport security. Therefore, rapid ongoing advancements in aviation security significantly increase the need for swift and safe transportation solutions.

- According to the IBEF report on Jul 2024, India's ambitious plan to expand its airport infrastructure by 2047 aims to increase the number of airports to 300, driven by expectations of a significant surge in passenger traffic, according to a draft plan by the Airports Authority of India (AAI).

Regional Insights

What is the Europe Secure Logistics Market Size?

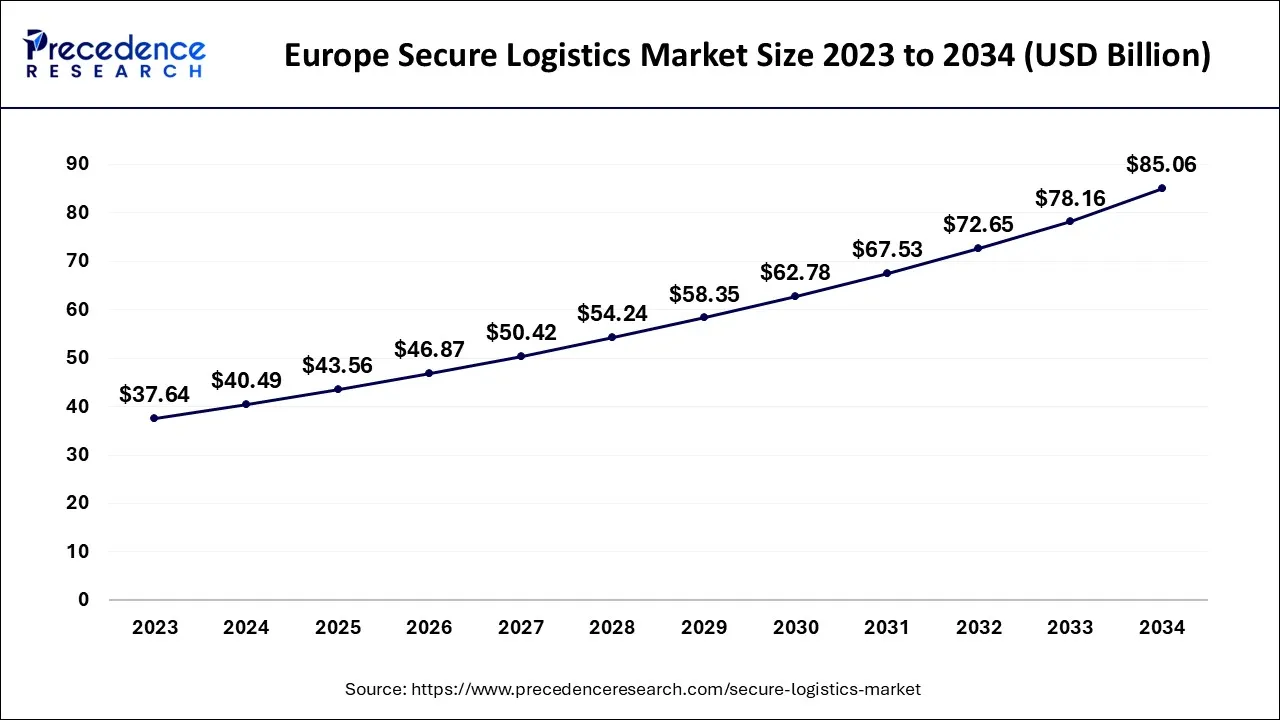

The Europe secure logistics market size was exhibited at USD 43.56 billion in 2025 and is projected to be worth around USD 91.03 billion by 2035, growing at a CAGR of 7.65% from 2026 to 2035.

Growth in ATMs Drives European Secure Logistics Industry

The Europe market has emerged as the most dominant market in 2025. The growth of ATMs in emerging economies and their increasing penetration is expected to drive regional growth, along with the rise in cash circulation and trade investments between European countries, which presents a range of secure logistics opportunities.

Future market shares will be impacted by trade policies and Brexit-related issues. Emerging markets like Brazil, Nigeria, and Iran are expected to exhibit high demand for new ATMs due to the development of financial institutions in these regions. In the European Union, the theft of high-risk, high-value products is estimated to cost over 8.2 billion Euros annually.

- In April 2024, The Norwegian government unveiled an NKr 435bn ($US 40.13bn) proposed budget for investment in railway infrastructure under the latest 12-year National Transport Plan 2025-2036.

The UK Secure Logistics Market Trends

The UK consists of a well-developed banking hub, which increases the use of secure logistics. At the same time, the growth in e-commerce platforms is also increasing their demand for secure transportation. Additionally, the expanding advanced therapies are also increasing their use.

Expanding Financial Institutes Propel Asia Pacific Secure Logistics Market

The Asia Pacific market is growing at the fastest CAGR during the forecast period. The factors driving growth in the region include the increasing demand for ATMs, expansion of financial institutions, and rising freight theft.

- According to the IBEF, As of FY22, the Indian Railway network spans over 68,103 kilometers, up from 65,810 km in FY14. Indian Railways is the largest rail network in Asia and the world's second-largest network managed by a single administration. The Interim Budget 2024-25 allocated US$ 30.8 billion (Rs. 2.55 lakh crore) to Indian Railways with a focus on investing in the modernization of the railways.

- Chinese construction sector to grow by 4%. China is one of the world's largest construction markets.

- The Chinese government announced its 2024 Budget in March 2024. The budget includes an expenditure of CNY28.6tn ($4tn) in 2024, which is an increase of 3.8% compared with the 2023 Budget. Additionally in March, the government announced it plans to invest CNY1.2tn ($173bn) in transport infrastructure projects by the end of this year.

- In March 2024, the Yangtze River Delta region government announced an investment of CNY140bn ($19.6bn) to develop 32 railway infrastructure projects in the region in 2024.

- In February 2024, the Shanghai government announced it plans to start work on 24 projects with a combined investment of CNY42.1bn ($5.8bn) in 2024.

China Secure Logistics Market Trends

The growth in the ATM networks across China is increasing the use of secure logistics. Moreover, the growing use of smartphones luxury goods are also increasing their demand. Furthermore, the growing adoption of various advanced therapies and medical devices is also increasing their demand.

Adoption of Cash Transactions Boosts North American Secure Logistics Industry

The North American market is expected to have a considerable market share in 2023 due to the preference for cash transactions and payment modes among consumers. However, the North American market incurred significant economic losses in the first two quarters of 2020 due to the high number of COVID-19 cases, particularly in the US, which impacted the logistics supply chain.

- In December 2023, the U.S. Department of Transportation's Federal Railroad Administration (FRA) announced that it has awarded $8.2 billion for 10 passenger rail projects across the country while announcing corridor planning activities that will impact every region nationwide. This unprecedented investment in America's nationwide intercity passenger rail network builds on a $16.4 billion investment announced last month for 25 projects of national significance along America's busiest rail corridor. To date, the Biden-Harris Administration has announced nearly $30 billion in investments for the nation's rail system.

- In June 2022, The Federal Railroad Administration (FRA) announced over $368 million in Consolidated Rail Infrastructure and Safety Improvements (CRISI) grant program funds to 46 projects in 32 states and the District of Columbia. These investments will play a crucial role in modernizing our country's rail infrastructure and strengthening supply chains, helping to reduce congestion and get people and goods where they need to go quickly and more affordably. The program will create good-paying jobs and benefit urban and rural communities across the country.

Logistics and supply chain industry participants are focusing on digital technologies to mitigate losses and maintain commercial operations. Several logistics firms are investing in digital technologies and concentrating on recruitment opportunities.

U.S. Secure Logistics Market Trends

The U.S. consists of large assets value that drives the demand for secure logistics to prevent the risk of theft. The presence of large banking systems also promotes their use. Additionally, the increasing online platforms, growing healthcare products, and their clinical trials are also increasing the use of secure logistics.

Rising Cash Usage Promotes MEA

MEA is expected to grow significantly in the secure logistics market during the forecast period, due to growing cash usage. The growing ATM network is promoting its use, where the increasing high-value assets are also increasing their demand. Furthermore, growing e-commerce platforms and healthcare solutions are also increasing their use, which is backed by government support, promoting the market growth.

Value Chain Analysis of the Secure Logistics Market

- Raw Material Sourcing (Steel, Plastics, Electronics)

The raw material sourcing of the secure logistics involves the procurement of high-strength polymers, galvanized steel, and aluminum.

Key players: RAIBEX, LeghornGroup, General Dynamics. - Testing and Quality Control

Material integrity and tamper resistance are evaluated in the testing and quality control of secure logistics.

Key players: SGS, BSI, Intertek. - Aftermarket Services and Spare Parts

Rapid component replacement and AI-driven predictive maintenance are provided in the aftermarket services and spare parts of secure logistics.

Key players: GardaWorlds, Loomis, INKAS.

Secure Logistics Market Companies

- Brinks: The company provides Brink's Complete platform.

- Loomis: Loomis SafePoint is provided by the company.

- Garda World: The company delivers the GardaWorld Online platform.

- Prosegur: Prosegur Cash Today is offered by the company.

- Allied Universal: The HELIOS platform is offered by the company.

Other Major Key Players

- G4S

- Securitas

- CMS

- Knoxshield Security Logistics

- Zegmax Logistics

- Cash Logistik Security

- Rodoban

- Armaguard

- Global Security Logistics

Recent Developments

- In July 2024, DP World received the AEO-LO program accreditation administered by CBIC. The certification, under the aegis of the WCO SAFE Framework of Standards, is awarded to companies whose operations strengthen global supply chain security and facilitate the movement of legitimate goods. The AEO-LO certification will streamline clearance procedures for DP World at all customs stations across India for five years.

- In November 2024, Matrixdock, a leading platform for tokenized real-world assets (RWA), is pleased to announce a strategic partnership with Brink's, a global leader in secure logistics and asset protection. This partnership ensures the secure transportation and vaulting of LBMA-certified gold, which underpins Matrixdock's recently launched XAUm token, with a focus on vaults located in Singapore and Hong Kong, two of Asia's premier financial hubs.

- In September 2024, Maersk West and Central Asia Limited (Maersk), a global shipping, transport, and logistics services company, appointed Pakistan's Secure Logistics Group Limited (SLGL) as its onshore logistics partner. This strategic partnership aligns with SLGL's continued commitment to expanding its logistics services portfolio.

- In order to create a tangible catastrophe recovery option for protecting private cryptocurrency keys, Brink's Incorporated teamed up with Metaco, a cryptocurrency custody company with headquarters in Switzerland, in May 2022. The customers are provided with smartcards that are physical copies.

- METACO confirmed a collaboration with Brink's in May 2022. Brink's utilizes its internationally renowned secure transportation knowledge and global network of vault sites to introduce METACO's institutional digital asset custody services into the real world.

Segments Covered in the Report

By Type

- Static

- Mobile

By Application

- Cash Management

- Diamonds, Jewelry & Precious Metals

- Manufacturing

- Others

By Mode of Transport

- Roadways

- Railways

- Airways

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- The Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting