What is Selective Laser Sintering Market Size?

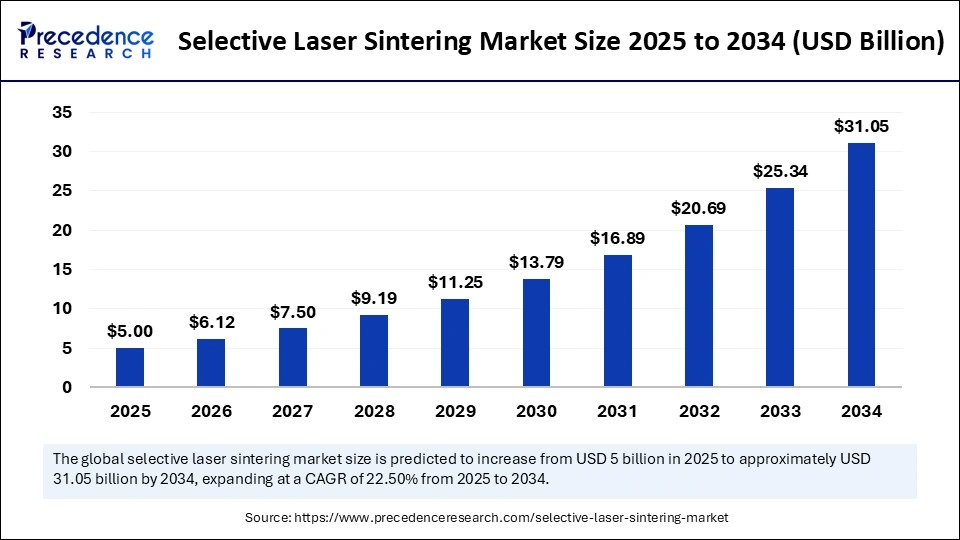

The global selective laser sintering market size accounted for USD 5.00 billion in 2025 and is predicted to increase from USD 6.12 billion in 2026 to approximately USD 31.05 billion by 2034, expanding at a CAGR of 22.50% from 2025 to 2034. The market growth is attributed to the increasing demand for rapid prototyping, customization, and cost-effective production of complex and functional parts across various industries.

Market Highllights

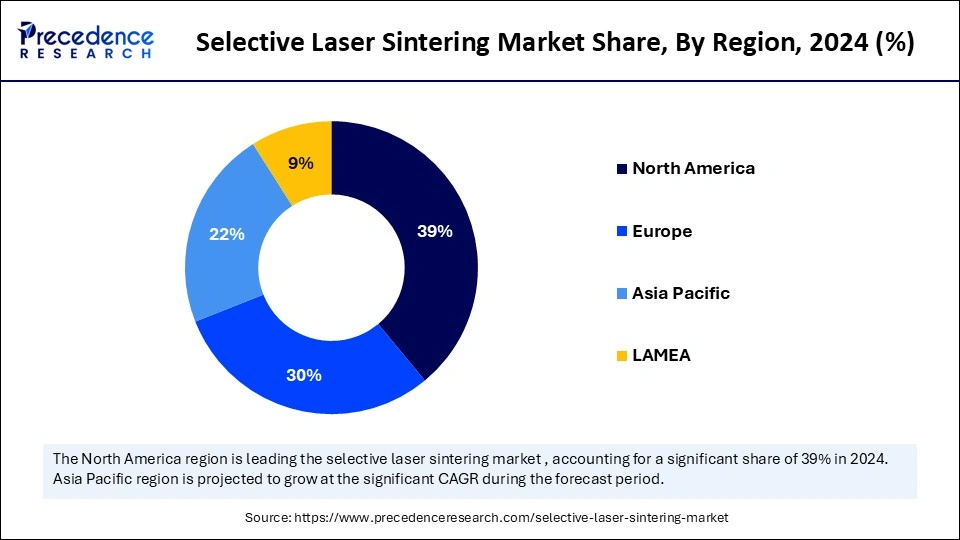

- North America dominated the market by holding more than 39% of market share in 2024.

- Asia Pacific is projected to grow at a double-digit CAGR of 25% during the forecast period.

- By process parameter, the laser power segment held a significant share of the market in 2024.

- By process parameter, the build bed temperature segment is expected to grow at a significant rate between 2025 and 2034.

- By material type, the polymers segment held a considerable share of the market in 2024.

- By material type, the biomaterials segment is projected to grow at a significant CAGR during the forecast period.

- By application, the prototyping segment led the global market in 2024.

- By application, the tooling segment is projected to expand rapidly in the market in the coming years.

- By industry, the automotive segment dominated the global market in 2024.

- By industry, the aerospace segment is projected to grow at the fastest CAGR of 23.4% in the upcoming period.

What are the Beneficial Aspects of the Selective Laser Sintering?

The increasing need for fast prototyping and personalization by different industries is boosting the growth of the selective laser sintering market. This technology has substantial benefits when it comes to producing highly complex and functionable parts. Selective laser sintering (SLS) is an additive manufacturing that requires the use of a high-powered laser to fuse powdered materials in successive thin strand to make whole 3D geometries. Furthermore, its ability to fabricate components with outstanding mechanical properties makes it suitable for aerospace, automotive, medical, and consumer electronics industries.

Impact of Artificial Intelligence on the Selective Laser Sintering Market

Artificial intelligence (AI) is a transformative element that supports selective laser sintering (SLS) development through process control enhancement and product quality improvement. Engineers apply AI algorithms to analyze enormous data generated by SLS machines to change the laser parameters in real time for greater optimal precision and repeatability. Moreover, AI also enables automation, adjusting parameters for optimal design. AI can monitor and control the SLS process in real time.

Selective Laser Sintering Market Growth Factors

- Advancements in Material Science: The development of new, high-performance materials for selective laser sintering (SLS) is expected to expand its application in producing complex, durable parts.

- Customization Demand: The growing need for highly customized products across industries, including automotive and aerospace, is projected to drive the adoption of SLS for tailored component production.

- Technological Integration: The integration of artificial intelligence (AI) and automation with SLS technology is likely to enhance production efficiency and precision, further boosting its adoption.

- Adoption in Aerospace and Defense: The increasing use of SLS in the aerospace and defense sectors for producing lightweight, high-performance parts is anticipated to fuel market growth.

- Low-Volume Production Capability: The ability of SLS to produce small batches of functional parts quickly and economically is expected to drive its growth in industries with low-volume needs.

- Cost-Effectiveness for Complex Designs: The cost savings associated with producing complex geometries without traditional tooling is expected to make SLS an attractive option for industries focused on design innovation.

- Focus on Sustainability: The automotive and manufacturing sectors' shift toward sustainability, including the production of lightweight and energy-efficient components, is expected to create new growth opportunities for SLS technology.

Selective Laser Sintering Market Outlook:

- Global Expansion: The transforming growth is driven by the increasing demand for personalized, lightweight parts from industries such as aerospace, automotive, and healthcare.

- Major Investor: Companies, like 3D Systems, EOS GmbH, and Farsoon Technologies, are heavily investing in innovation in materials.

- Startup Ecosystem: Regolo Studio, an Italian startup that develops sophisticated SLS materials, like Alumide and Carbonmide, which are high-rigidity nylon formulations.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.00 Billion |

| Market Size in 2026 | USD 6.12 Billion |

| Market Size by 2034 | USD 31.05 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 22.50% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Process Parameter, Material Type, Application, Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Rising Demand from the Aerospace Sector

The increasing demand for SLS from the aerospace and defense sector is a major factor driving the growth of the selective laser sintering market. Aerospace manufacturers work with lightweight, strong assemblies with restrictive safety regulations, and selective laser sintering (SLS) enables fabrication of pieces with complex geometry. This technology enables high-complexity, low-volume production, a strategy that accords with aerospace demand for prototyping. Aerospace manufacturers require rapid prototyping for accelerating product development cycles. Companies such as Boeing and Lockheed Martin embraced SLS for developing engine parts, including brackets and air ducts.

In 2024, NASA demonstrated the capability of successfully testing more than 100 additively manufactured parts in spacecraft, many of which were made using SLS processes for thermal and mechanical robustness. Furthermore, America Makes reported that aerospace is one of fastest growing industries in the adoption of additive manufacturing in the U.S., specifically in powder-bed fusion equipment such as SLS, as they satisfy the defense-grade material demands.

Restraint

High Costs and Scalability Challenges

SLS is expensive, especially for low-volume production runs. This limits its adoption in some industries. Parts developed from SLS often require post-processing steps like finishing and cleaning, increasing the production cost. In addition, scaling up production creates challenges and requires substantial investments in additional equipment. The layer-by-layer sintering process consumes a large amount of time for each component. The fact that the cooling time is high for each layer's solidification before proceeding to the next increases the whole process time.

Opportunity

Surging Investments in Digital Manufacturing Infrastructure

Increasing investments in digital manufacturing infrastructure is expected to create immense opportunities for key players competing in the selective laser sintering market. Smart factories and Industry 4.0 evolution continue to receive greater resource allocations from governments and the private sector. The rising demand for smart factory solutions opens up the way for additive manufacturing systems, such as SLS. In 2024, the Department of the Energy's (DOE) Advanced Materials and Manufacturing Technologies Office (AMMTO) announced an investment of USD 33 million for smart manufacturing efforts. Furthermore, such strategic investments in digital infrastructure enable manufacturers to leverage SLS for on-demand localized production.

Segment Insights

Process Parameter Insights

The laser power segment dominated the selective laser sintering market with a significant share in 2024. The melting and sintering processes of powders are crucial procedures, which are dependent on the power setting of the laser. Higher laser power enables the sintering of a variety of materials, including metals and high-performance polymers. This facilitates the production of complex parts. Furthermore, as industries pursue improved turnaround times in custom and complex parts development, the demand for increased laser power levels in SLS equipment rises.

The build bed temperature segment is expected to grow at a significant rate in the coming years. Build bed temperature is mainly used to achieve optimal quality of parts and minimize failure rates with SLS processes. The thermal dynamics of the powder bed during sintering depend significantly on the temperature of the bed and regulate the flow characteristics of the material in relation to the mechanical properties of the final product. The rising demand for high-quality parts is expected to drive segmental growth.

Material Type Insights

The polymers segment held a considerable share of the selective laser sintering market in 2024, as they are multi-purpose, cost-effective, and easy to use in many applications. Polymers are used to design intricate parts and geometry due to their excellent mechanical properties and flexibility. Polymers such as Nylon (PA 12) and Polyamide (PA 11) have been significantly gaining traction for developing complex parts. They are used to develop lightweight parts in military applications due to their durability and the ability to resist harsh environments. The increased need for lightweight, durable, and low-cost parts, especially for use in prototyping, bolstered the growth of the segment.

The biomaterials segment is projected to grow at a significant CAGR during the forecast period, owing to their growing application in the healthcare and medical device industry. Biomaterials have the capability to customize 3D-printed, patient-specific implants, prosthetics, and surgical guides. Biomaterials are used in medical applications such as implants and tissue engineering due to their biocompatibility and ability to promote cell growth.

Application Insights

The prototyping segment dominated the selective laser sintering market with the largest share in 2024. SLS has the capability of creating detailed prototypes quickly. SLS has a unique advantage in prototyping since it enables designers and engineers to make functional prototypes with complex geometries. The increased need to accelerate product development cycles further bolstered the growth of the segment. Several industries, including aerospace, consumer electronics, and medical devices, use SLS for its rapid prototyping capabilities.

The tooling segment is projected to grow at a notable rate in the coming years. SLS enable rapid creation of tooling prototypes, which reduces lead times and costs. It helps produce complex tooling design that are hard to manufacture with traditional methods. The rising demand for customized tooling is expected to drive the demand for SLS.

Industry Insights

The automotive segment held the largest share of the selective laser sintering market in 2024 due to the increased need for lightweight, strong, and customized automotive components. SLS allows manufacturing complex geometries and fine details that are impossible to make using traditional manufacturing methodologies. The demand for custom-made components has increased, boosting the need for SLS. Automakers leverage SLS to generate complex yet lightweight parts that can improve the performance and efficiency of vehicles. Furthermore, the growing production of electric vehicles is creating the need for rapid prototyping, which is likely to boost the adoption of SLS in the automotive industry.

The aerospace segment is projected to grow at the fastest rate in the upcoming period. This technology is capable of producing lightweight, high-performance parts that are conformable to the strict aerospace standards. SLS technology is heavily used in the aerospace industry to develop intricate engine components. The rising demand for rapid prototyping to accelerate development cycles is likely to contribute to segmental growth.

Regional Insights

U.S. Selective Laser Sintering Market Size and Growth 2025 to 2034

The U.S. selective laser sintering market size is exhibited at USD1.46 billion in 2025 and is projected to be worth around USD 9.26 billion by 2034, growing at a CAGR of 22.77% from 2025 to 2034.

Enhancement of Accessible & Scalable Systems: U.S. Market Trend

The U.S. market is one of the major holding countries in North America, which specifically bolsters the widespread progression of accessible and scalable solutions. Whereas, firms like Formlabs are developing SLS technology more accessible to a broader range of businesses (like SMEs) by unveiling compact, benchtop printers, especially the Fuse Series.

Why did North America Dominate the Market in 2024?

North America registered dominance in the selective laser sintering market by holding the largest share of 39% in 2024. This is mainly due to a high demand for additive manufacturing and the presence of major market players. The region is an early adopter of additive manufacturing, including SLS. In 2024, the U.S Department of Energy (DOE) featured the leadership role played by North America in the adoption of additive manufacturing technologies, particularly in the automotive, aerospace, and healthcare sectors. The region boasts robust automotive and aerospace sectors. There is a high demand for rapid prototyping and lightweight components in these sectors, boosting the need for SLS.

Immersive Initiatives by Substantial Countries are Propelling the Asia Pacific

Asia Pacific is expected to grow at the fastest CAGR of 25% in the upcoming period. This is mainly due to the rapid expansion of the manufacturing sector. The adoption of additive manufacturing, including SLS, is rising in manufacturing businesses. The rapid expansion of the automotive industry, along with the increasing production of vehicles, is likely to support regional market growth. There is a strong focus on industrial automation and smart factories, which opens up new avenues for SLS. China, Japan, and South Korea have been increasingly investing in additive manufacturing infrastructure, allowing wider use of SLS. In 2024, the Chinese government introduced additional bonuses to promote additive manufacturing as one of the goals of “Made in China 2025” initiative. Furthermore, the expansion of the aerospace industry influences the growth of the market.

Rising Demand for Tailored Approaches is Impacting Europe

Europe is considered to be a significantly growing area. The growth of the selectrive laser sintering market in the region is driven by the rising demand for SLS in the aerospace, automotive, and healthcare industries for producing lightweight, high-performance components. The region boasts some of the well-known automakers who are investing in 3D manufacturing technologies to enhance their production capabilities. The rising demand for customized components from the aerospace industry in order to enhance the efficiency of aircraft is likely to support regional market growth. Additionally, the rising demand for personalized medical implants and devices drives the growth of the market.

Developing Hybrid Manufacturing Systems: Explores the Japanese Market

In the current era, many Japanese machine tool manufacturers, specifically DMG Mori and Yamazaki Mazak, are encouraging the revolution of innovative hybrid systems that integrate additive manufacturing (like laser sintering/deposition) with conventional subtractive CNC machining in a single machine. This further simplifies workflows and accelerates dimensional accuracy and surface finish.

Boasting a Robust R&D Sector: Elevates the German Market

Germany's numerous facilities are fostering R&D activities, such as the Fraunhofer ILT (Institute for Laser Technology) is broadly known as a founder of laser-based additive manufacturing. It has the Aachen Center for Additive Manufacturing, which emphasises process improvement, material development, and knowledge transfer to assist companies in integrating AM technologies.

Transforming Centers & Academic Research Centers are Boosting Latin America

A significant progression of the selective laser sintering market is propelled by the contribution of innovation centers, such as HP Inc. opened a 3D printing innovation center in South America, for developing sustainable polymer materials and next-generation SLS platforms. However, the Centro de Pesquisas Renato Archer in Brazil uses SLS machines for R&D and a variety of projects, presenting a developed academic and research base for the technology.

Brazil's SLS Market Soars

The Selective Laser Sintering market in Brazil is experiencing robust expansion, driven by the increasing adoption of additive manufacturing across diverse industries like automotive, healthcare, and consumer goods. Government initiatives promoting innovation and sustainability are fueling investments in advanced production technologies, creating significant growth potential for SLS applications.

Selective Laser Sintering Market Companies

- GE Additive

- EOS

- HP

- Shining 3D

- Renishaw

- Materialise

- Trumpf

- Sciaky

- SLM Solutions

- Farsoon Technologies

- ExOne

- Arcam

- 3D Systems

- Voxeljet

- Prodways

Latest Announcement by Industry Leader

- In April 2025, 3D printer manufacturer Raise3D is celebrating its tenth anniversary by unveiling two new 3D printers at RAPID + TCT 2025 in Detroit, scheduled for April 8-10. The company introduced the RMS220, its first Selective Laser Sintering (SLS) 3D printer, and the DF2+, an upgraded Digital Light Processing (DLP) resin system that improves upon the previous DF2 model. Both printers are designed to address the increasing demand for reliable, end-to-end additive manufacturing (AM) workflows capable of supporting diverse production requirements. Raise3D CEO Edward Feng stated, “To meet these needs, Raise3D takes a full-process approach—from seamless integration of software, hardware, and materials to a comprehensive ecosystem encompassing FFF, DLP, and SLS technologies. We focus on balancing performance, cost, and efficiency to drive innovation and simplify production challenges.”

Recent Developments

- In January 2025, Shri H D Kumaraswamy, Hon'ble Minister of Heavy Industries and Steel, Government of India, launched the Apollo 350 SLS, India's first indigenously designed and developed Polymer Selective Laser Sintering (SLS) 3D printer. Developed by FSID-Indian Institute of Science under the Capital Goods Scheme of MHI Phase-II in collaboration with Fracktal Works Pvt Limited, the product debuted at IMTEX 2025, India's largest machine tool expo. This achievement marks a significant milestone for India's additive manufacturing (AM) ecosystem, enabling the nation to design and produce advanced high-tech machinery indigenously, meeting global standards and catering to the specific needs of the Indian market.

- In November 2024, EOS and AM solutions entered into a partnership and launched the P3 NEXT selective laser sintering (SLS) printer at Formnext 2024 in Frankfurt, Germany. The EOS P3 NEXT was created in direct response to customer feedback, making it more productive than the EOS P396 while occupying less floor space, largely due to its integrated monitor.

- In November 2024, AM Efficiency, a Swedish company specializing in post-processing solutions for additive manufacturing, introduced UNPIT, an automated machine for entry-level Selective Laser Sintering (SLS) 3D printers. Debuting at Formnext 2024 in Frankfurt this November, UNPIT automates key stages of post-processing, such as unpacking, depowdering, cleaning, and material recovery, and can reclaim up to 100% of unused powder. This innovation significantly reduces material waste and lowers operational costs for small and medium-sized enterprises (SMEs) involved in 3D printing.

Segments Covered in the Report

By Process Parameter

- Beam Profile

- Build Bed Temperature

- Hatch Spacing

- Laser Power

- Laser Scan Speed

- Layer Thickness

- Powder Flow Rate

- Scanner Type

By Material Type

- Biomaterials

- Ceramics

- Composites

- Metals

- Polymers

By Application

- Prototyping

- Tooling

- Rapid Manufacturing

By Industry

- Aerospace

- Defense

- Automotive

- Consumer Electronics

- Education & Research

- Medical

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting