Self-adhesive Labels Market Size and Forecast 2025 to 2034

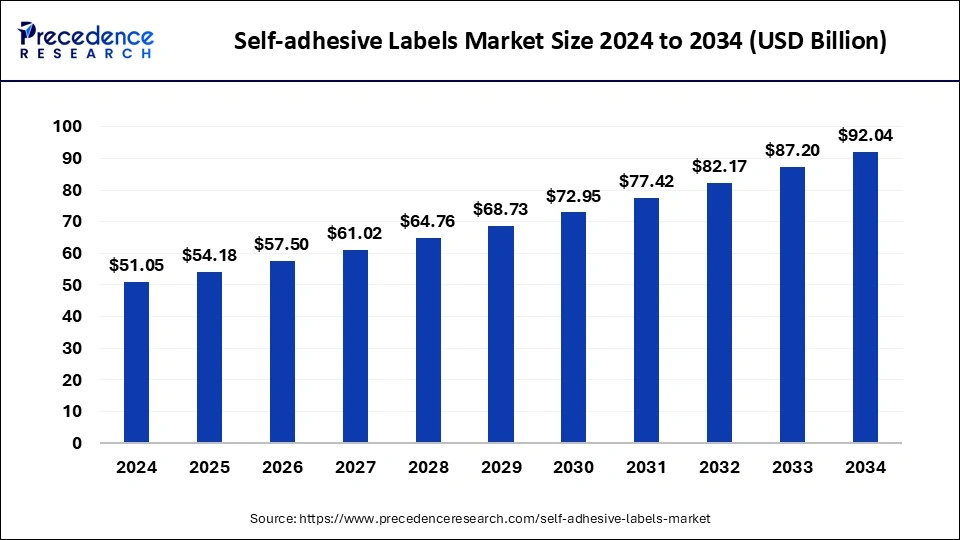

The global self-adhesive labels market size was estimated at USD 51.05 billion in 2024 and is predicted to increase from USD 54.18 billion in 2025 to approximately USD 92.04 billion by 2034, expanding at a CAGR of 6.07% from 2025 to 2034. The increasing industrial and manufacturing development is driving the growth of the market.

Self-adhesive Labels Market Key Takeaways

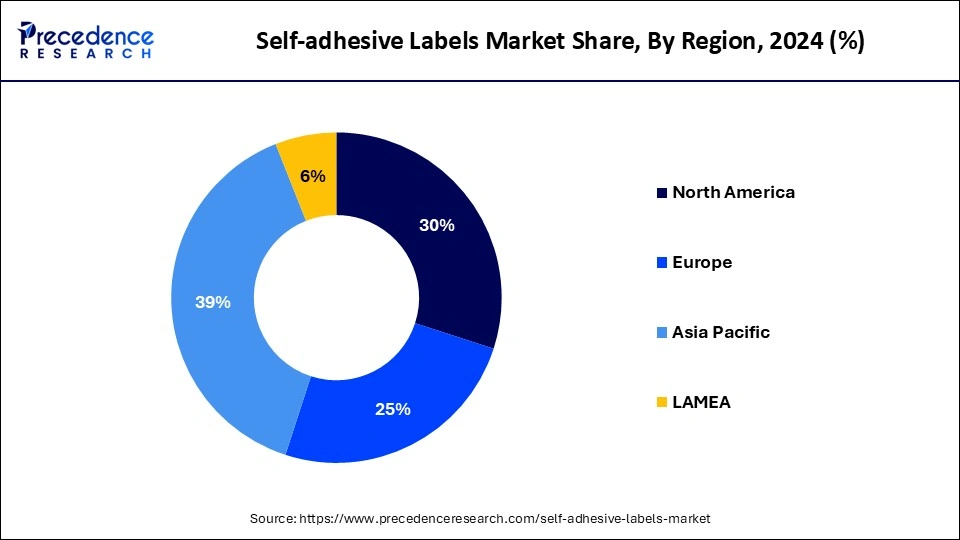

- Asia Pacific led the market with the largest revenue share of 39% in 2024.

- North America is expected to grow significantly during the forecast period.

- By type, the release liner segment dominated the market with the highest market share in 2024.

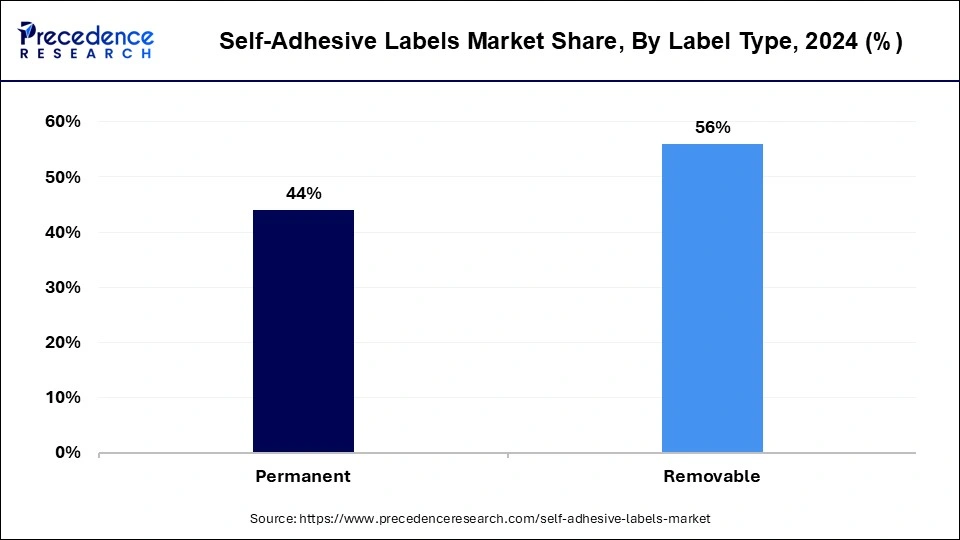

- By label type, the permanent label segment has held a major revenue share of 56% in 2024.

- By application, the food and beverages segment dominated the market in 2024.

Asia Pacific Self-adhesive Labels Market Size and Growth 2025 to 2034

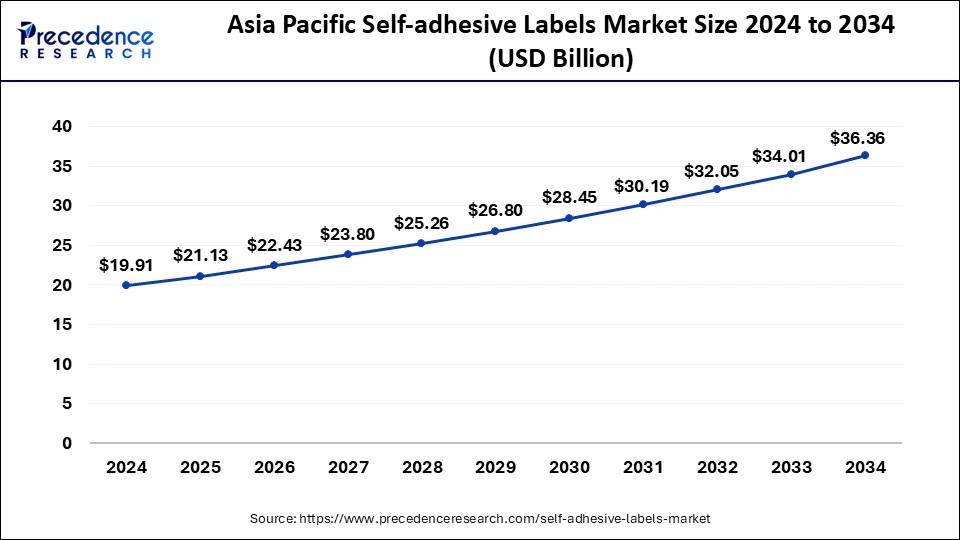

The Asia Pacific self-adhesive labels market size was estimated at USD 19.91 billion in 2024 and is predicted to be worth around USD 36.36 billion by 2034 with a CAGR of 21.13% from 2025 to 2034.

Asia Pacific led the self-adhesive labels market with the largest share in 2024. The growth of the market in the region is expected to sustain its dominance due to the rising population, urbanization, and industrial development in the regional countries driving the growth of the market. Due to the rising consumer base and disposable income in the population, the increasing consumer goods industry drives the demand for personal consumer goods to pharmaceuticals, which accelerated the demand for self-adhesive labels for providing information, pricing, and regularity standards on products. Thus, the rising industries are driving the growth of the self-adhesive labels market in the region.

- For instance, Labelexpo Asia 2023, the biggest package and label printing technology event in Asia, celebrated its 20th anniversary on the opening of the Shanghai New International Expo Center (SNIEC). Labelexpo was originally founded in Singapore and moved to Shanghai, China. The label group is expanded its database over the time that includes nearly 200,000 suppliers, printers, and end-users.

In the Asia Pacific, China led the market owing to the strong manufacturing sector, growing consumer demand, and expanding e-commerce industry. Also, ongoing advancements in labelling technologies, such as smart labels with RFID and QR codes, are improving product security, tracking, and overall consumer engagement.

North America is expected to witness significant growth during the forecast period. The market's growth is attributed to the higher demand for consumer goods due to higher per capita income in the population and the higher presence of economically stable countries, resulting in the increased industries and manufacturing sectors in the region. Thus, the increased presence of the major industries and manufacturing companies is contributing to the growth of the self-adhesive labels market in the region.

In North America, the U.S dominated the market in 2024 by holding the largest market share. The dominance of the country is due to the expanding food & beverage, pharmaceutical, and e-commerce sectors in the country. Moreover, stringent regulations and the need for informative and clear labels on medications fuel demand for specialized self-adhesive labels. The surge in online shopping has raised the need for reliable and effective product labelling for shipping and inventory management.

Europe is expected to grow at a notable CAGR over the forecast period. The growth of the region can be attributed to the growing popularity of durable and convenient labelling solutions, the burgeoning e-commerce industry, and the increasing emphasis on sustainability. Furthermore, RFID integration, digital printing, and other technological advancements are improving the efficiency and capabilities of self-adhesive labels in the country.

Market Overview

Self-adhesive labels are pressure-sensitive labels. It can easily be versatile and can stick on various surfaces like materials, including plastics, glass, cardboard, and metals. It sticks when the pressure is applied to the label. There are two types of self-adhesive: permanent and removable. Removable labels are more commonly used in a wide range of applications, such as temporary company systems, promotional stickers, pricing labels, and others. Permanent labels are durable and last longer; they are commonly used in product labeling, branding, and identification. Self-adhesive labels come in a number of variants, small and large. The large self-adhesive labels enable more information and are an excellent tool for promotional and branding activities. The rising consumer segment and the increasing product marketplace are driving the demand for the self-adhesive labels market.

Self-adhesive Labels Market Growth Factors

- The rising demand for self-adhesive labels from the various end-use industries such as retail, manufacturing, logistics and supply chain, consumer goods, and others is driving the growth of the self-adhesive labels market.

- Self-adhesive labels are made with paper, which makes them biodegradable in nature, and though they are recyclable, the rising adaptation of biodegradable products due to environmental concerns is driving the growth of the market.

- The rising demand for the self-adhesive in the retail industry for identification of product, promotional activities, and price marketing, it provide the internal information about the product is driving the growth of the market.

- Self-adhesive label is used to provide information about the product, usage instructions, safety warnings, and ingredient lists on the various consumer goods products that driving the growth of the market.

- Rising industrialization and manufacturing industries in economically developing countries are contributing to the growth of the self-adhesive labels market.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 54.18 Billion |

| Market Size by 2034 | USD 92.04 Billion |

| Growth Rate from 2025 to 2034 | CAGR of 6.07% |

| Largest Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Type, Label Type, Application, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Increasing consumer goods industry

The rising global population drives the demand for the consumer goods industry, and the demand for FMCG is highly contributing to the growth of the market. Self-adhesive labels are used to label and provide accurate information about the ingredients, quality, quantity, pricing, and others. The increasing demand for clothing, packaged foods, consumer durables, electronics, and goods in the population due to rising disposable income in economically developed countries is driving the demand for self-adhesive labels. Additionally, the rising demand for self-adhesive labels in manufacturing, agriculture, consumer goods, pharmaceuticals, and others is further driving the growth of the self-adhesive labels market.

Restraint

Availability of alternative products

Some labelling alternatives can be integrated more seamlessly into existing production lines, potentially improving operational efficiency. For example, the use of in-mold labelling can streamline the manufacturing process by combining labelling and moulding into a single step. Some alternative labelling technologies allow for greater customization and versatility. Sleeve labels, for example, can cover the entire surface of a container, providing more space for branding and information, and can be applied to complex shapes that self-adhesive labels might not adhere to effectively. Thereby, the availability of alternative products is a major restraint for the self-adhesive labels market.

Opportunities

Rising urbanization and growing marketplaces

The rising urbanization and consumer market base in economically developing nations due to the people's rising per capita income and demand for packaged goods are driving the demand for the self-adhesive labels market. Self-adhesive provides clear product branding, identification, and other information. The population's rising demand for aesthetically appealing products also boosts the growth of a wide range of industries. The rising investment in the industrialization and manufacturing and packaging industry is driving the demand for self-adhesive labels. Additionally, rising e-commerce marketplaces are also boosting the growth of the market.

Technological advancements

Technological progress in adhesive formulations can result in labels that adhere more effectively to a wider variety of surfaces, including challenging materials and conditions (e.g., extreme temperatures, moisture). Advances in materials science have led to the development of biodegradable and recyclable self-adhesive labels. These eco-friendly options appeal to environmentally conscious consumers and help companies meet sustainability goals. Improvements in printing speeds without compromising quality can increase production efficiency and reduce turnaround times, making self-adhesive labels more competitive.

Type Insights

The release liner segment dominated the self-adhesive labels market with the largest market share in 2024. The release liners are also called the backing or carrier. It is used to protect the labels, act as protective layers, and keep them safe until the label is ready to use. The release liner is made of poly-coated paper, paper, and other materials like films and metalized paper. Two major types of release liners are paper and PET film. PET liners are highly used in the manufacturing industries due to their higher capacity for fast labeling.

PET liners are also used in the wet condition. PET liners are made of polyester film, though they are thinner in density than paper liners, so they can roll more labels on each roll. This saves more time and cost due to the less damage or breakage in the machine roll as compared to paper rolls. Thus, the increased consumption of release liners for several product labeling drives the expansion of the segment in the self-adhesive labels market.

Label Type Insights

The permanent label segment dominated the self-adhesive labels market in 2024. There is a rising use of permanent labels in various industrial labeling such as pharmaceutical, construction, and shipping. Permanent labels are stronger than removable labels; they are durable and highly temperature resistant. Permanent labels are water resistant, though they can be used in the food and beverages industry.

The medical industry is highly using high-quality permanent labels. Products like medical equipment, laboratory specimens, and pharmaceutical safety labels are used for permanent labeling. The construction industry is further using permanent labels due to the equipment handled in extreme situations and harsh weather; the labeling on construction equipment advertises safety and usage standards that cannot fall off. Thus, permanent labels are preferred in the construction industry.

Application Insights

The food and beverages segment dominated the self-adhesive labels market in 2024. The rising global population and the population diverting to ready-to-use food products, packaged food products, and beverages due to the faster lifestyle and rising growth in economic wealth are driving the demand for self-adhesive labels in the food and beverages industry. There are strict regulations from the various regional governments to show content on the food labeling or packaging. Labels consist of information regarding the food products, such as nutritional content, shelf-life, manufacturing and expiry dates, manufacturer, and others. That drives the demand for high-quality labeling for the product.

The rising adoption of convenience food and average products in the market is further driving the growth of the market. Thus, the increasing market competition and food delivery partners are highly contributing to the demand for self-adhesive labels in the food and beverages industry.

Self-adhesive Labels Market Companies

- Mondi

- Fuji Seal International, Inc

- Asteria Group

- optimum Group

- Avery Dennison Corporation

- CCL Industries, Inc

- Multi-Color Corporation

Recent Developments

- In June 2025, Palantir Technologies Inc. announced a multi-year partnership with Fedrigoni, a global reference manufacturer of specialty papers for packaging and other creative applications, self-adhesive labels, graphic supports for visual communication, and RFID. This strategic alliance aims to accelerate Fedrigoni's digital transformation by leveraging advanced AI capabilities.

(Source: https://www.businesswire.com) - In September 2024, Schades Group, has acquired UK-based Hamilton Adhesive Labels to further diversify its product offering and strengthen its market position. With multiple locations across Europe, Schades Group's core business is the production, sales, marketing, and distribution of plain and printed sustainable paper rolls, self-adhesive labels, and food wrap.

(Source: https://www.labelsandlabeling.com - In March 2023, Rotolabel, a manufacturer of self-adhesive labels for the FMCG market segment, including wine, installed an 8-color FA-17 flexo press from Nilpeter. The company has a longstanding partnership with Nilpeter, with whom it has done business from the older generation of letter presses to several FB- and FA-Lines.

(Source: https://www.labelsandlabeling.com) - In May 2024, ID Images announced the launch of sustainable direct thermal labels for different industrial packaging to enhance their identification and packaging process. These labels do not use traditional ink, toner, or other consumables; they rely on heat-sensitive materials to produce sharp and crisp prints, resource-efficient, simple, and cost-effective solutions for texts and barcodes.

- In 2023, HERMA, the specialist in self-adhesive technology in Germany, launched 71N, versatile self-adhesive materials for labeling, in collaboration with BASF, a chemical company.

- In 2024, Xpress Labels, self-adhesive label manufacturers in Aylesbury, Buckinghamshire, invested in the PicoColour UV Inkjet Digital Label Press, produced and supplied by Dantex Group.

Segments Covered in the Report

By Type

- Release Liners

- Linerless

By Label Type

- Permanent

- Removable

By Application

- Food and Beverages

- Pharmaceuticals

- Household and Personal Care

- Consumer Goods

- Others

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting