Self-storage Market Size and Forecast 2025 to 2034

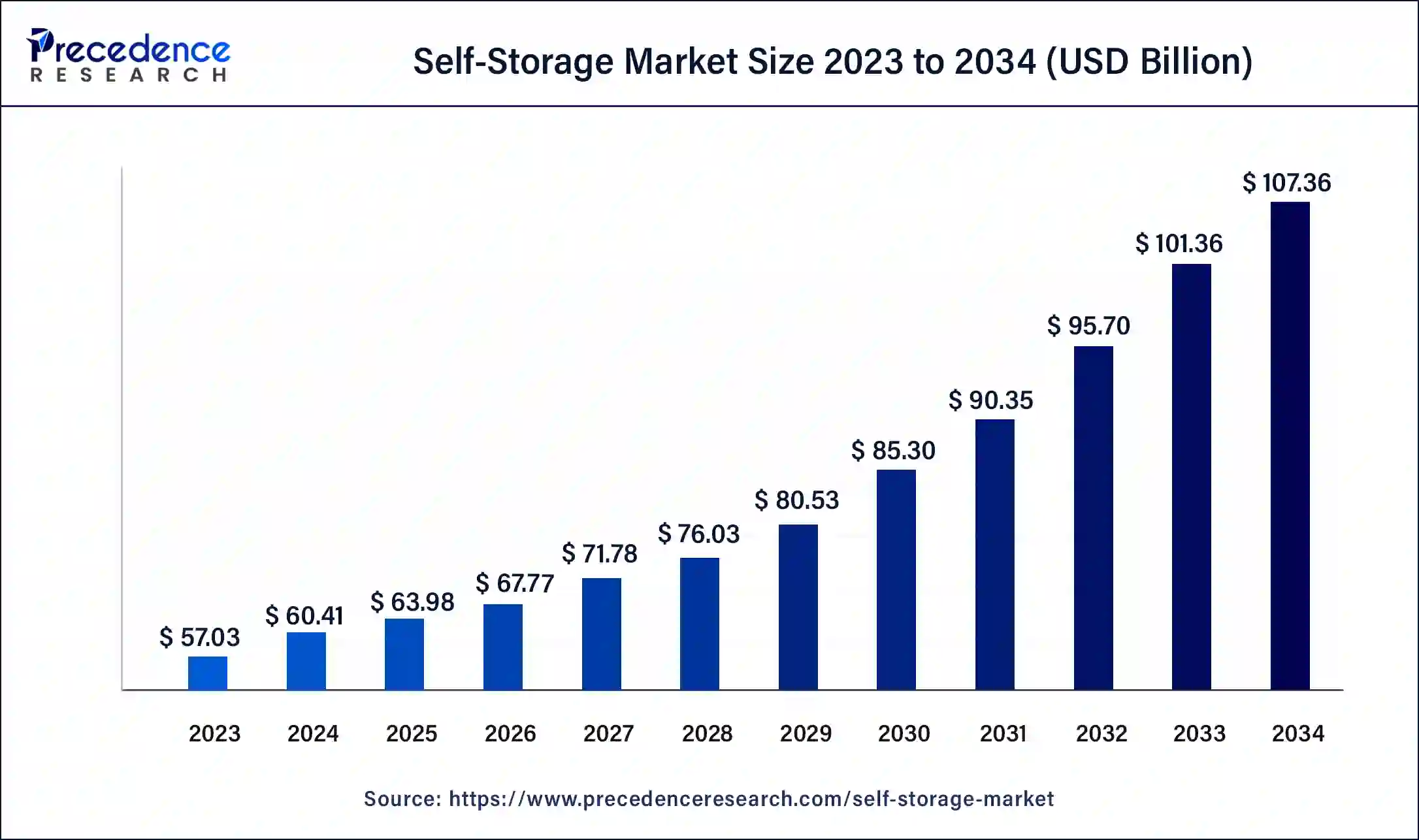

The global self-storage market size is estimated to be worth around USD 107.36 billion by 2034 from USD 60.41 billion in 2024, at a CAGR of 5.92% from 2025 to 2034. Growth factor of the self-storage market include urbanization, growing incomes, new and diverse customers' lifestyles, shift in economic performance, and technological innovation create expanded business prospects for supply.

Self-Storage Market Key Takeaways

- In terms of revenue, the self-storage market is valued at $63.98 billion in 2025.

- It is projected to reach $107.36 billion by 2034.

- The self-storage market is expected to grow at a CAGR of 5.92% from 2025 to 2034.

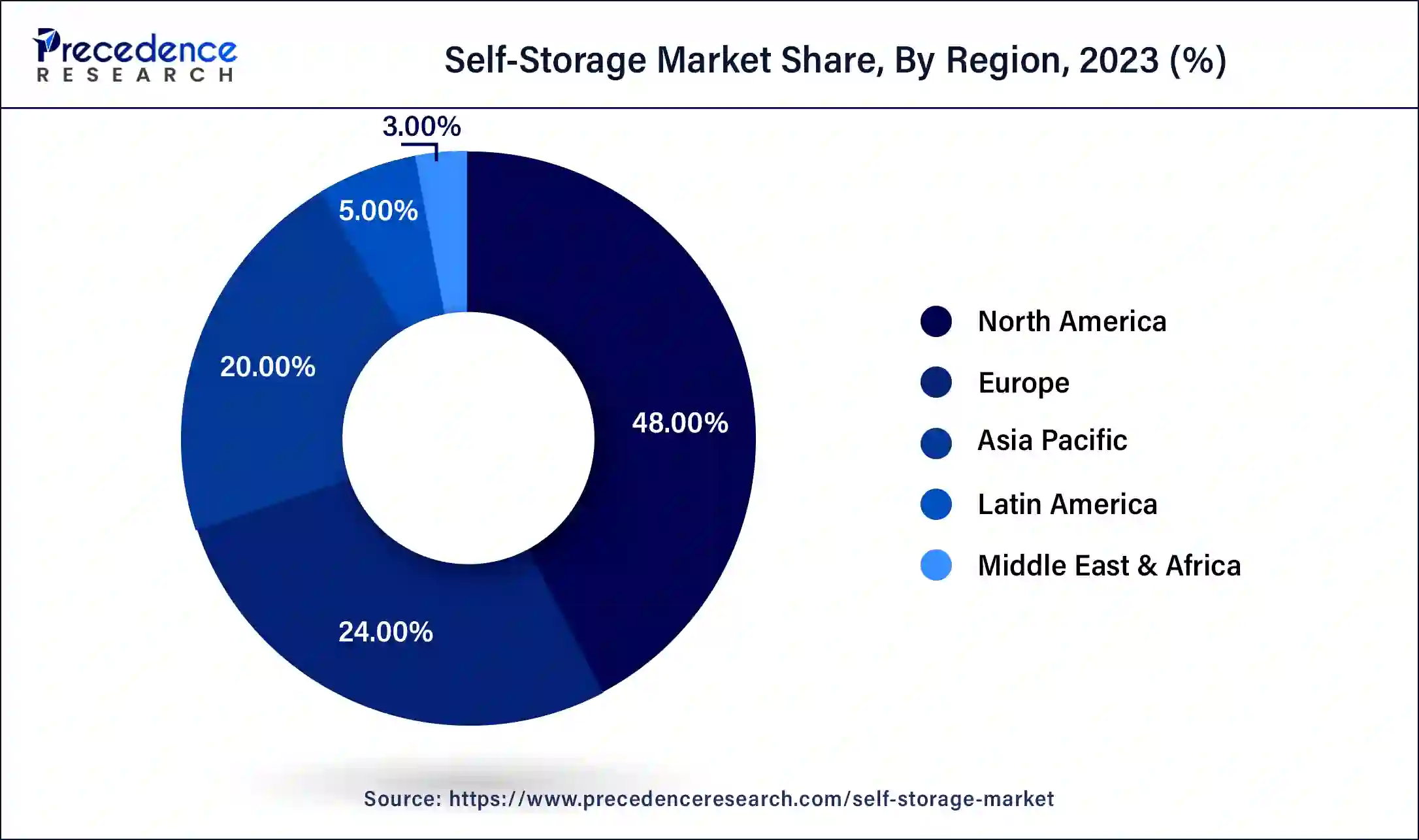

- North America led the global self-storage market with the largest market share of 48% in 2024.

- Asia Pacific is anticipated to grow at a notable CAGR of 7.11% during the forecast period.

- By unit size, the medium segment accounted for the biggest market share of 46% in 2024.

- By unit size, the large segment is expected to grow at a notable CAGR of 6.62% during the forecast period.

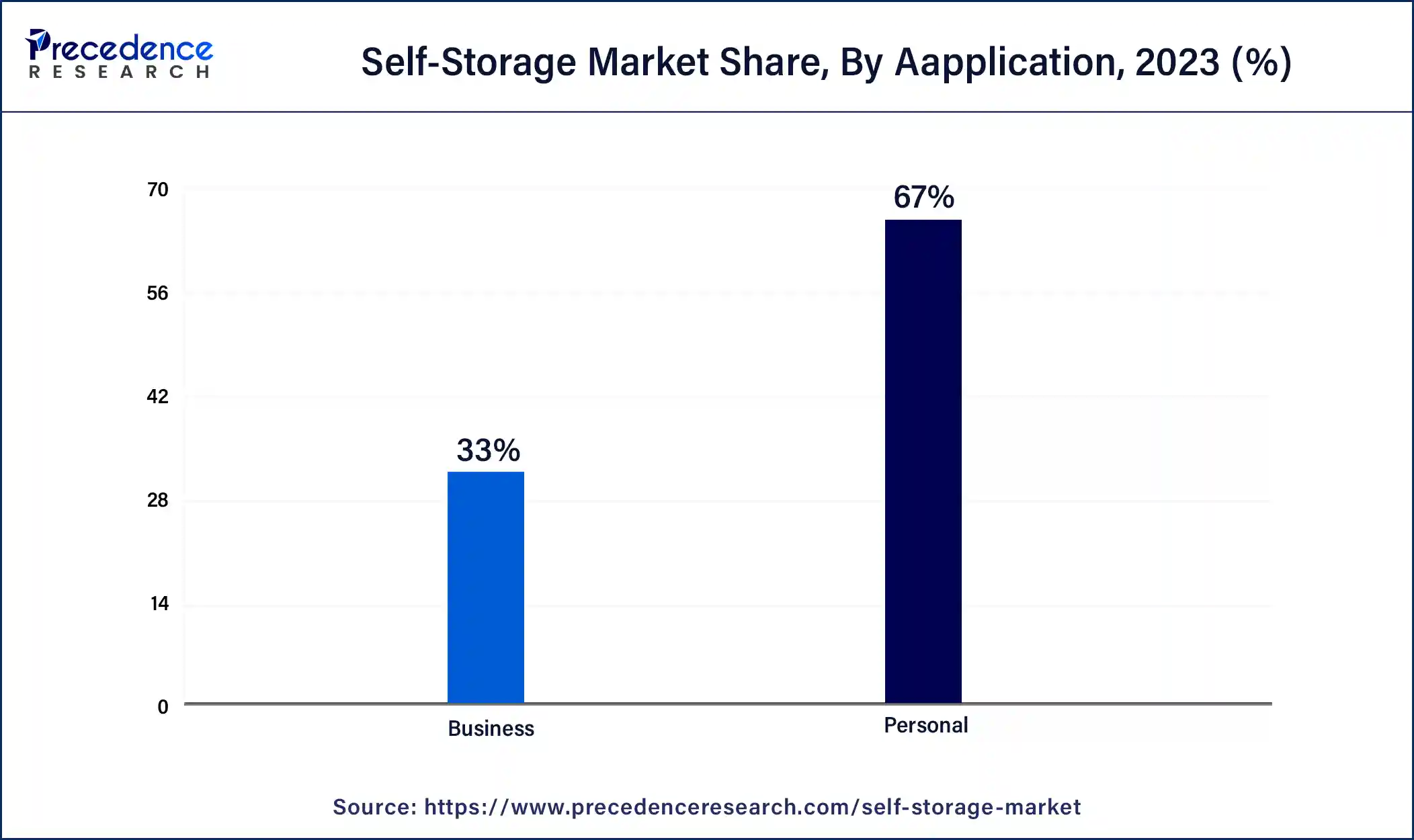

- By application, the personal segment generated the highest market share of 67% in 2024.

- By application, the business segment is expected to grow at a highest CAGR of 6.53% during the forecast period.

How is AI Changing the Self-storage Market?

The most relevant and practical use of AI in the self-storage market is indeed in the use of chatbots. AI-enabled chatbots can deal with customers, respond to customer queries, and perform other regular operations. They are launched with customer support available for 24/7 booking & reservation. Some of how AI smart security cameras and related access control systems are still developing might enhance self-storage security and the customer experience. Such systems can incorporate AI to alert security officials of any suspicious activities as they occur, hence minimizing cases of theft and unauthorized access. Another possible use could be using AI to connect to the access control systems and have the capabilities to recognize either the face or the license plate and open a certain access control point.

- In September 2024, Self Storage Manager (SSM) announced the launch of the SSM Web Platform, which is designed exclusively for the use of SSM Cloud. This new platform has been created by Absolute's team in cooperation with Adverank, the digital marketing agency and it brings a brand-new level of website management to self-storage companies while offering more options as well as better tools for controlling and marketing their online presence.

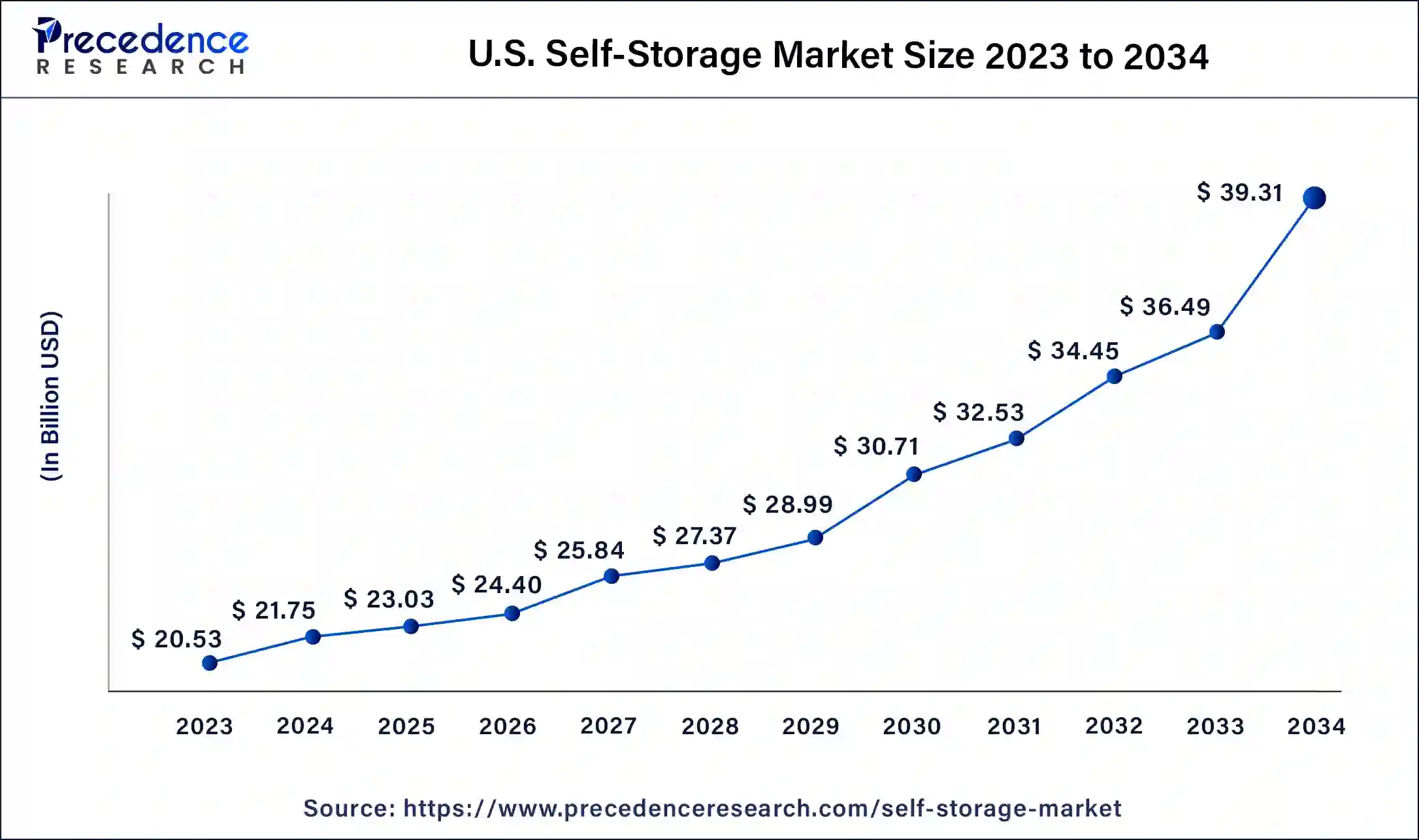

U.S. Self-storage Market Size and Growth 2025 to 2034

The U.S. self-storage market size was exhibited at USD 21.75 billion in 2024 and is projected to be worth around USD 39.31 billion by 2034, poised to grow at a CAGR of 6.10% from 2025 to 2034.

North America led the global self-storage market in 2024. The United States and Canada have a well-developed network of self-storage facilities ranging from personal to business storage. Noticeable drivers driving the market demand for self-storage include the rising need for storage, mobility, and congestion. They use the latest technologies, including online bookings and electronic gate access. Moreover, the availability of variants is also increasing in the market, including climate control for the units.

The United States dominates the North American self-storage market due to high consumer awareness and maturity within the industry, as well as lifestyle changes such as downsizing and moving. The U.S. has a strong culture of personal storage combined with fairly consistent business demand that continues to drive growth in the U.S. region.

- London's population will increase to USD 9.7 million in 2024, which is projected to reach the USD 10 million mark by 2030.

- In December 2023, VanWest revealed plans for a project in Denver, Colorado. The project, to be managed by their subsidiary, ClearHome Self Storage, will feature a 5-story, 93,000-square-foot building of Class A, climate-controlled self-storage units.

Asia Pacific is anticipated to grow notably in the self-storage market during the forecast period due to factors such as a fast-growing urbanization rate, growing disposable income, and a growing middle-class population. Currently, this growth is being driven by countries such as China, Japan, and India. This is because the demand for storage solutions is higher in urban areas due to factors such as the high-density population and the rate at which people are adapting to new lifestyles. The market is shifting from traditional storage facilities to some centralized storage with security enhancement and technological features such as climate control and digital access.

Recently, Asia Pacific has become the fastest-growing self-storage market. Rapid urbanization, decreasing living space, and increasing awareness of storage solutions in countries such as China, India, and Southeast Asia are all contributing factors. In addition, rising e-commerce, business activity, and mobility trends throughout the region are increasing demand for secure, flexible storage facilities.

China stands out as a major player in the broader Asia Pacific self-storage market due to its quickly urbanizing population, emerging middle class, and limited amount of space in many major cities. Rising consumer awareness and the expansion of e-commerce also contribute to the urgent need for convenient and safe storage.

- In December 2022, StarHub Hong Kong opened its sixth storage facility in San Po Kong, providing safe and reliable high-quality storage solutions to residents in the area.

Hong Kong is one of the most densely populated territories in the world. The limited land is quickly being occupied by its residents, leading to a shortage of living and storage space. As a result, many individuals opt to rent a self-storage unit to store items such as infrequently used belongings, home appliances, furniture, as well as company documents and merchandise in a conveniently accessible storage facility.

Market Overview

Self-storage or self-service storage popularly known as ‘device storage' is an industry that provides renting of storage space or rooms lockers or containers and open area storage units to customers on a short-term basis mostly every month. Self-storage renters include businesses and individuals.

The self-storage market is of growing aspects rapidly as it provides confidence to individual as well as commercial clients about their equipment or personal belongings storage. A self-storage provider will have several choices for you from one-room storage, and warehouse storage, to box storage. The factors include factors like urbanization, economic recovery, and increased disposable income.

Self-Storage Market Growth Factors

- Rising Urbanization's need for storage space as the living and working areas are becoming limited has driven the growth of the self-storage market.

- Emerging trends of mobility, which imply the increasing cases of people moving from one region to another and trends that embrace organizing less space and moving more, means that there is a need for easy access to storage services.

- Economic development and expansion, especially in emerging markets, are generating various business activities that result in the need for more space for the storage of goods, documents, and other tools.

- The use of technologies in self-storage facilities including features like automated access, climate control, and other security features are making storage solutions more attractive and useful.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 107.36 Billion |

| Market Size in 2025 | USD 63.98 Billion |

| Market Size in 2024 | USD 60.41 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 5.92% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Unit Size, Applicatio, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Driver

Increasing urbanization

Higher population density in urban areas largely results in individuals living in small residences and, hence, the need the self-storage market. With the growth of cities and population, density space is more of a scarcity. People live in crowded cities where there are limited accommodation spaces and or working spaces to accommodate all the items. This is why self-storage is a perfect solution when one is limited with space.

Self-storage markets are necessary for extra and unsuitable items that cannot be stored at home or in business places. This means that the requirements for storage space will only continue to grow as urbanization and population density, as well as lifestyles, expand. It is for this reason that those involved in the provision of self-storage businesses need to understand these drivers to be able to offer their services in response to customers' needs.

- According to the World Bank Group, around 56% of the world's population, 4.4 billion inhabitants, will live in cities in 2023. This trend is expected to continue, with the urban population more than doubling its current size by 2050, at which point nearly 7 of 10 people will live in cities.

Restraint

Increase in the property and maintenance costs

The challenge that affects self-storage owners is an increase in property and maintenance costs that hinder the self-storage market. There is a direct relationship between the demand for storage and the price that is paid by self-storage firms for properties to use as storage space. Further, running these facilities may also prove expensive because these infrastructures may need frequent repairs and security, among other costs.

These costs of the self-storage market are gradually increasing, and for self-storage owners to keep running their businesses and keep making profits, they have to be very keen on managing costs. It can range from securing more attractive lease terms, using strategies and measures to minimize the cost of utilities, or else hiring maintenance services from outside. With tight management, the self-storage owners have a way of making sure that the facilities are financially sustainable.

Opportunity

E-commerce growth

Digital technology also offers an opportunity, especially for the self-storage business unit, because of the growth of e-commerce. With the progression of online retail, there is a growing need for spaces to store inventory for e-tailers and third-party logistics providers. Through the association of these businesses with self-storage facilities, the warehousing and distribution industry is offered, making it easier for the self-storage facility to penetrate deeper markets and achieve higher occupancy. This integration not only responds to the increase in storage demand from e-commerce but also increases the self-storage operators' income opportunities and expands the company's development prospects.

Tech-Driven Transformation: The New Era of Self-Storage

Self-storage is changing at an accelerating pace with a wide range of applications regarding urban living, business inventory, and e-commerce fulfillment. Notable recent advancements are AI-based inventory systems, IoT-based climate controls, and completely automated access through mobile applications. In 2025, BlackRock's investment in StoreLocal—an operator of unmanned storage sites using technology—shows the industry's movement toward greater automation, advanced security, and digital experiences that focus on customers.

Unit Size Insights

The medium segment accounted for the biggest share of the self-storage market in 2024 since they offered a reasonable quantity of space while not being too expensive to attract both small business and residential customers. This segment is expected to continue dominating the market and expand its growth rates in the outlook period based on the growing interest in multi-purpose storage that easily suits residential and commercial requirements.

The large segment is expected to witness significant growth in the self-storage market during the forecast period. The size options range from 10×20 to 10×30, which provides enough room for the storage of entire household goods, vehicles, small RV, or boats. The intended use of this segment is to address the demand for larger and more flexible space that is required for moving, car storage, and other house occupancy needs.

Application Insights

The personal segment accounted for the biggest share of the self-storage market in 2024. Personal storage relates to facilities that are confined and generally necessitate customers, who are availed of individual stalls or lockers for storage. This segment has the highest market share mostly because of its versatility for individual use, offering secure, highly accessible storage options for various applications.

The business segment is expected to grow significantly in the self-storage market during the forecast period. Whether it is for warehousing stocks, merchandised goods, storing raw materials, or simply running the business entirely from within a self-storage unit, it is just perfect for all business needs. The understanding of or ability to purchase a self-storage unit offers a more practical and relatively cheaper solution than opting to lease or buy an industrial or a commercial building such as a large warehouse. There is also an availability of storage warehouses for rent, so companies do not necessarily have to invest lots of cash, but they will nonetheless get adequate space for their merchandise.

- In September 2022, the Indian Packer and Movers brand Agarwal Packers and Movers Ltd entered into an independent venture of self-storage by introducing its company, Storekar. Com. The self-storage facility occupies a prestigious position in the market for residential & commercial clients.

Self-Storage Market Companies

- CubeSmart

- Metro Storage LLC

- SmartStop Self Storage

- Life Storage Inc.

- Safestore

- W. P. Carey Inc.

- Public Storage

- Prime Storage

- Shurgard Self Storage

- Storage Giant

- Big Yellow Self Storage Company

Recent Developments

- In February 2025, SmartStop Self Storage REIT, Inc., announced an exciting art contest inviting artists from across North America to create unique, city- or region-themed designs. SmartStop Self Storage REIT, Inc. is a self-managed REIT with a fully integrated operations team of approximately 560 self-storage professionals focused on growing the SmartStop Self Storage brand. Source: businesswire.com

- In August 2023, Storable, the leading provider of technology solutions for the self-storage industry, announced its agreement to acquire CallPotential, a prominent provider of tenant engagement and performance management solutions for self-storage operators. Source: prnewswire.com

- In July 2024, Pacific Investments launches a self-storage platform.

- In May 2024, SecureSpace Self Storage announced the grand opening of a new self-storage facility, SecureSpace Los Angeles Avalon, located in and serving the city of Los Angeles, CA.

- In May 2024, Vantiva Launches the Self-Storage Industry's First Unified Operations Management Platform.

- In January 2024, SpareBox Technologies launched to offer a suite of tech-forward solutions to self-storage facility operators and property managers nationwide. These solutions were first developed and utilized internally at SpareBox Storage, the leading remote-managed operator in the self-storage industry.

- In January 2024, Etude Capital, a company of self-storage facilities in the United States, and San Felipe Financing LLC, a private real estate entity, announced the launch of a Joint Venture, Etude Storage Partners, which would invest across the North American self-storage market.

- In February 2023, Storage Giant launched a New High-Security Storage Facility in Bridgend.

Segments Covered in the Report

By Unit Size

- Small

- Medium

- Large

By Application

- Personal

- Business

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting