What is the Shore to Ship Power Supply Market Size in 2026?

The global shore to ship power supply market size was calculated at USD 2.40 billion in 2025 and is predicted to increase from USD 2.56 billion in 2026 to approximately USD 4.53 billion by 2035, expanding at a CAGR of 6.55% from 2026 to 2035.The market growth is attributed to increasing global port electrification initiatives and stricter maritime emission regulations targeting vessel-related air pollution.

Key Takeaways

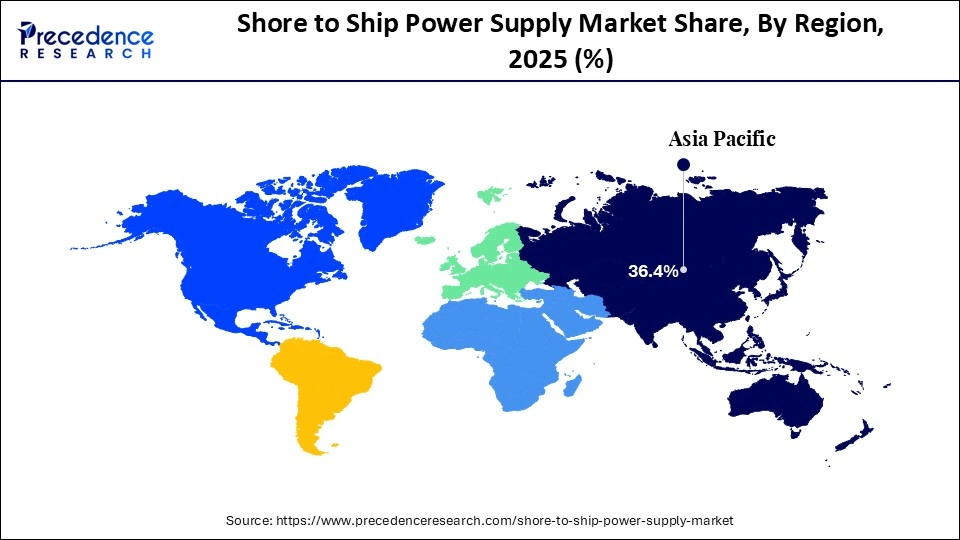

- Asia-Pacific dominated the market with approximately 36.4% of the market share in 2025.

- North America is expected to grow at the fastest CAGR between 2026 and 2035.

- By installation type, the shoreside (port infrastructure) segment contributed the highest shore to ship power supply market share of approximately 89% in 2025.

- By installation type, the shipside (onboard equipment) segment is expected to grow at a strong CAGR of approximately 13.9% between 2026 and 2035.

- By connection type, the retrofit (existing fleet/ports) segment held a major market share of approximately 74% in 2025.

- By connection type, the new installation (newbuilds) segment is expected to expand at the fastest CAGR from 2026 to 2035.

- By component, the frequency converters segment captured the highest market share of approximately 34% in 2025.

- By component, the switchgear devices segment is poised to grow at a healthy CAGR between 2026 and 2035.

- By power rating, the up to 30 MVA segment generated the biggest market share of approximately 58% in 2025.

- By power rating, the above 60 MVA segment is expected to expand at the fastest CAGR between 2026 and 2035.

What is the Shore to Ship Power Supply Market?

The increasing enforcement of global maritime decarbonization regulations is a major driver accelerating the adoption of shore-to-ship power supply systems worldwide. Shore-to-ship power, also known as shore power or cold ironing, is an advanced port electrification technology. It permits docked ships to close the onboard diesel auxiliary engines and be tied to landside electric grids. This connection provides onboard lighting, ventilation, cargo handling equipment, and hoteling operations with electricity during berthing periods. Furthermore, the growing regulatory pressure and urgent need to reduce port emissions continue to strongly drive shore-to-ship power supply market expansion worldwide.

Impact of Artificial Intelligence on the Shore to Ship Power Supply Market

Artificial intelligence (AI) is transforming the market by optimizing connection efficiency and infrastructure utilization. Control systems with AI are used to analyze the timetable of vessel arrival and the electrical load demand in real-time. Such systems assist ports in providing consistent onshore power, excluding overloading risks and the avoidance of idle energy wastage. Moreover, AI is also useful in intelligent load forecasting to assist ports in balancing grid demand as various vessels are connected simultaneously.

Global Port Electrification and Shore Power Infrastructure Expansion Trends in the Shore to Ship Power Supply Market

- European countries collectively operate at least 51 ports with shore power installations across 15 coastal nations, highlighting expanding infrastructure deployment driven by regulatory mandates requiring port electrification compliance by 2030.

- In 2025, the Netherlands ranks among the most advanced individual country deployments, with the Port of Rotterdam alone operating over 100 shore power installations totaling more than 43 MW of installed capacity, supporting extensive vessel electrification at berth.

- Norway has emerged as one of the global leaders in HVSC system deployment, with Oslo Port installing at least 12 high-voltage shore power units in 2024 to support ferries and cruise vessels, driven by national emissions taxation policies and government-supported decarbonization programs.

- The European Commission continues financing port electrification through the Connecting Europe Facility, which allocated more than €1.5 billion toward alternative fuels and shore power infrastructure between 2021 and 2027, with multiple shore connection projects approved or expanded during 2024–2026 across Germany, Spain, and the Netherlands.

- The Port of Los Angeles reported that shore power usage has reduced at-berth diesel particulate matter emissions by approximately 95% and nitrogen oxides by about 80% per vessel call, contributing significantly to the port's overall emissions reduction achievements under its Clean Air Action Plan as of 2024.

Shore to Ship Power Supply Market Growth Factors

- Integration of Smart Port Digitalization Technologies: Growing adoption of automated and connected port systems is propelling the installation of advanced shore power solutions.

- Increase in Cruise Tourism and Passenger Vessel Traffic: Rising cruise ship deployments worldwide are fuelling investment in shore-based electrical connection systems.

- Strengthening Maritime Decarbonization Targets: Global net zero shipping commitments are boosting electrification adoption across major commercial and passenger ports.

Shore to Ship Power Supply Market Market Trends

- Smart Grid Integration Enhancing Shore Power Efficiency and Reliability.

- The introduction of smart grid management technologies into shore power systems is being integrated by utilities and port operators.

- These platforms enable real-time monitoring, load balancing, and predictive maintenance for electrified port infrastructure. This transformation is driving smarter and more reliable ship-to-shore electrical connections globally.

- Expansion of High Voltage Shore Power for Ultra-Large and Next-Generation VesselsPorts are installing high-capacity shore connection systems to support ultra-large container ships and cruise vessels.

- Large technology vendors like ABB and Siemens are implementing high-voltage systems in the maritime sector. This trend is accelerating the deployment of more powerful shore-to-ship energy supply infrastructure globally.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 2.40 Billion |

| Market Size in 2026 | USD 2.56 Billion |

| Market Size by 2035 | USD 4.53 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.55% |

| Dominating Region | Asia Pacific |

| Fastest Growing Region | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Installation Type, Connection Type, Component, Power Rating, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Installation Type Insights

Which Installation Type Segment Dominated the Shore to Ship Power Supply Market?

The shoreside (port infrastructure) segment dominated the market in 2025, accounting for an estimated 89% market share, as ports invest heavily in grid connection systems, frequency converters, transformers, and cable management infrastructure for electrified berths. Strict emission requirements for ports to have shore power facilities are established by governments in Europe and Asia. Furthermore, the European Union introduced the FuelEU Maritime and AFIR laws to accelerate investments in port electrification, thus facilitating the segment.

The shipside (onboard equipment) segment is expected to show the fastest growth with a CAGR of approximately 13.9% over the forecast period. Shipowners are equipping ships with onboard transformers, switchboards, and automated shore connection interfaces at an alarming rate. South Korea, Japan, and Europe had fleet modernization schemes that encouraged high shipside technology. This increasing compliance mandate likely leads to continuous growth in demand for onboard installations globally.

Connection Type Insights

Why Did the Retrofit (Existing Fleet/Ports) Segment Dominate the Market?

The retrofit (existing fleet/ports) segment held the largest revenue share of approximately 74% in the shore to ship power supply market in 2025, due to the rapid electrification of existing global commercial vessel fleets and port terminals. The ports of California, Northern Europe, and China required that visiting ships have shore power compatibility. Additionally, retrofitting also has quicker benefits of emission reduction, which aid in government decarbonization timelines and environmental targets, fostering the segment's growth.

The new installation (newbuilds) segment is expected to gain the highest market share between 2026 and 2035, owing to the rise in the number of newbuild vessels being fitted with in-built shore power compatibility. Newbuild shore power integration is becoming a priority in shipping companies to meet the emission reduction obligations and fuel efficiency requirements. Furthermore, this strong shift toward integrated electrification is likely to drive rapid growth of the new installation segment worldwide.

Component Insights

How the Frequency Converters Segment Dominated the Market?

The frequency converters segment contributed the biggest market share of approximately 34% in the shore to ship power supply market in 2025, due to the critical requirement to match the vessel's electrical frequency with the port grid supply. Frequency converters allow the smooth transfer of power by transforming grid electricity into onboard electrical compatible formats. Moreover, the proportion of converter systems in port electrification projects is growing, as a large part of the investment being allocated towards converter systems is based on the functional significance.

The switchgear devices segment is expected to witness the fastest growth in the market over the forecast period, owing to the growing need of safe power supply and electrical fault prevention. Switchgear is used to have a regulated power flow between the port grid infrastructure and associated vessels.

Digital monitoring systems are built into modern switchgear and have enhanced operational visibility and a high level of reliability in the system. Moreover, the developments are expected to enhance the growth of the switchgear segment in all systems of shore power infrastructure worldwide.

Power Rating Insights

Which Power Rating Segment Led the Shore to Ship Power Supply Market?

The up to 30 MVA segment accounted for the highest revenue share of approximately 58% in the market in 2025, due to the widespread electrification of container ships, ferries, and medium-sized cruise vessels. This growth is supported by the fact that most of the container ships, ferries, and mid-sized cruise vessels have been electrified. Port electrification programs across Europe and China are projected to continue deploying these systems extensively. This strong operational suitability is likely to sustain the dominance of up to 30 MVA installations globally.

The above 60 MVA segment is expected to grow at the fastest CAGR in the coming years, owing to the increase in the electrification of mega cruise ships and ultra-large container ships. The growth of the cruise industry in Europe, North America, and Asia is expected to drive demand for such systems. Moreover, this trend towards increased electrification of vessels will lead to vigorous growth for over 60 MVA systems in the world.

Regional Insights

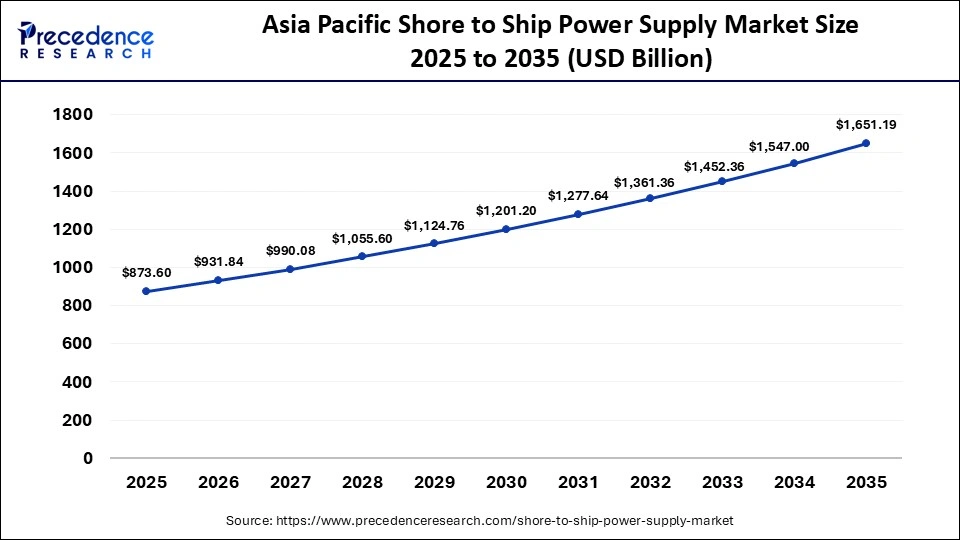

Asia Pacific Shore to Ship Power Supply Market Size and Growth 2026 to 2035

The Asia Pacific shore to ship power supply market size is expected to be worth USD 1,651.185 billion by 2035, increasing from USD 873.6 billion by 2025, growing at a CAGR of 6.57% from 2026 to 2035.

Why Did Asia-Pacific Establish Dominance in the Shore to Ship Power Supply Market?

Asia-Pacific held a major revenue share of approximately 36.4% in the market in 2025, owing to the massive presence of commercial ports and high vessel traffic volume. The United Nations Conference on Trade and Development in 2024 reported that Asia handled 63% of global container port throughput, confirming its dominant maritime activity concentration.

China, South Korea, and Japan spent a lot of money on programs to modernize the electrified port infrastructures. Additionally, the strong infrastructure expansion is expected to maintain Asia-Pacific's leading market growth.

China Leading Shore Power Expansion Across Asia-Pacific

China leads the market in Asia-Pacific due to its aggressive national port decarbonization and electrification implementation strategy. The Port of Shanghai expanded shore power infrastructure across container terminals to reduce port emissions significantly. China Classification Society strengthened electrical standards supporting safe high-voltage shore power system integration. Such tight regulatory, infrastructure, and industrial strengths are expected to fuel China's regional market in the coming years.

How is North America Growing in the Shore to Ship Power Supply Market?

North America is expected to grow at the fastest CAGR in the market during the forecast period, owing to the strict emission control regulations implemented across major coastal states. In 2025, the U.S. Maritime Administration declared that federal port electrification programs facilitated various large-scale shore power initiatives.

- In 2025, the American Association of Port Authorities added that investment in port electrification has increased at a faster rate among coastal terminals of North America. Such regulatory and infrastructure drive will likely drive robust expansion in the regional market.

United States Driving Rapid Shore Power Growth Across North America

The U.S. is leading the charge in North America due to its strict environmental regulations and strong infrastructure investment commitments. California Air Resources Board implemented shore power regulations on container, cruise, and refrigerated cargo ships on a compulsory basis.

Ports, such as Long Beach and Seattle, increased the presence of electrified berths to aid in meeting emission reduction goals. There were federal funding schemes that assisted in the electrification of ports under the maritime decarbonization infrastructure programs.

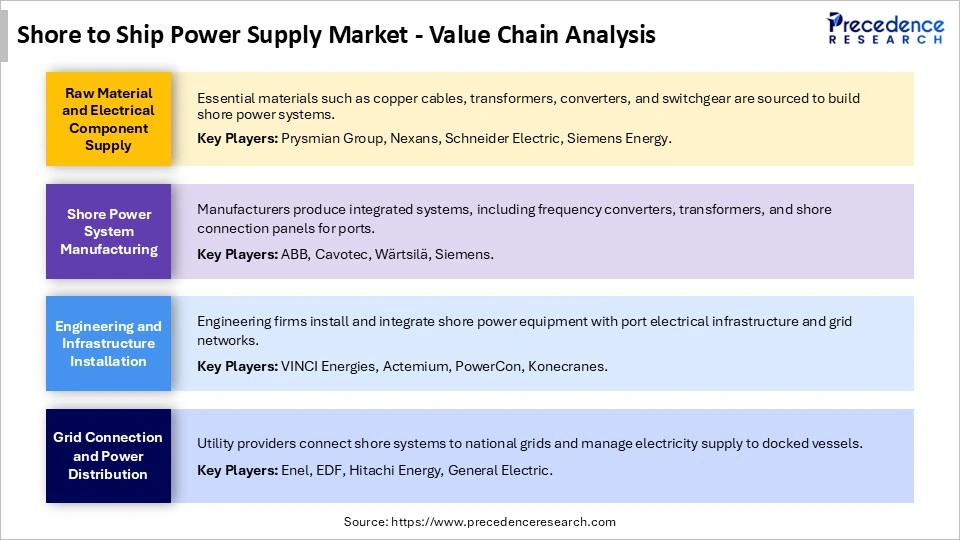

Shore to Ship Power Supply Market Value Chain Analysis

Shore to Ship Power Supply Market Companies

- ABB Ltd.

- Siemens AG

- Schneider Electric SE

- Wärtsilä Corporation

- Cavotec SA

- GE Vernova

- Hitachi Energy Ltd.

- Danfoss A/S

- Eaton Corporation

- Wabtec Corporation

- Cochran Marine

- Blueday Technology AS

- Nidec ASI S.p.A.

- Vinci Energies

- PowerCon A/S

Recent Developments

- In January 2026, Paradip Port Authority reached a major operational milestone by commissioning its Shore-to-Ship Power Supply system successfully. The port delivered full electrical load to the vessel MV APJ INDRANI at CB-1 Berth, owned by Apeejay Shipping. This deployment allows vessels to shut down onboard auxiliary engines while berthed, improving energy efficiency and significantly lowering port-related emissions. (Source: https://indiaseatradenews.com)

- In January 2026, ABB secured contracts from Rotterdam Shore Power, a joint venture between the Port of Rotterdam and Eneco, to design and install multiple shore power systems. The combined installations will exceed 100 MVA capacity, making them the world's largest shore power system deployment. The project will help the port reduce emissions and comply with the European Union's FuelEU Maritime Regulation. (Source: https://new.abb.com)

Segments covered in the report

By Installation Type

- Shoreside (Port Infrastructure)

- Shipside (Onboard Equipment)

By Connection Type

- Retrofit (Existing Fleet/Ports)

- New Installation (Newbuilds)

By Component

- Frequency Converters

- Transformers

- Switchgear Devices

- Cables & Accessories

- Others (Control Panels/Meters)

By Power Rating

- Up to 30 MVA

- 30-60 MVA

- Above 60 MVA

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting