What is the Short-read Sequencing Market Size?

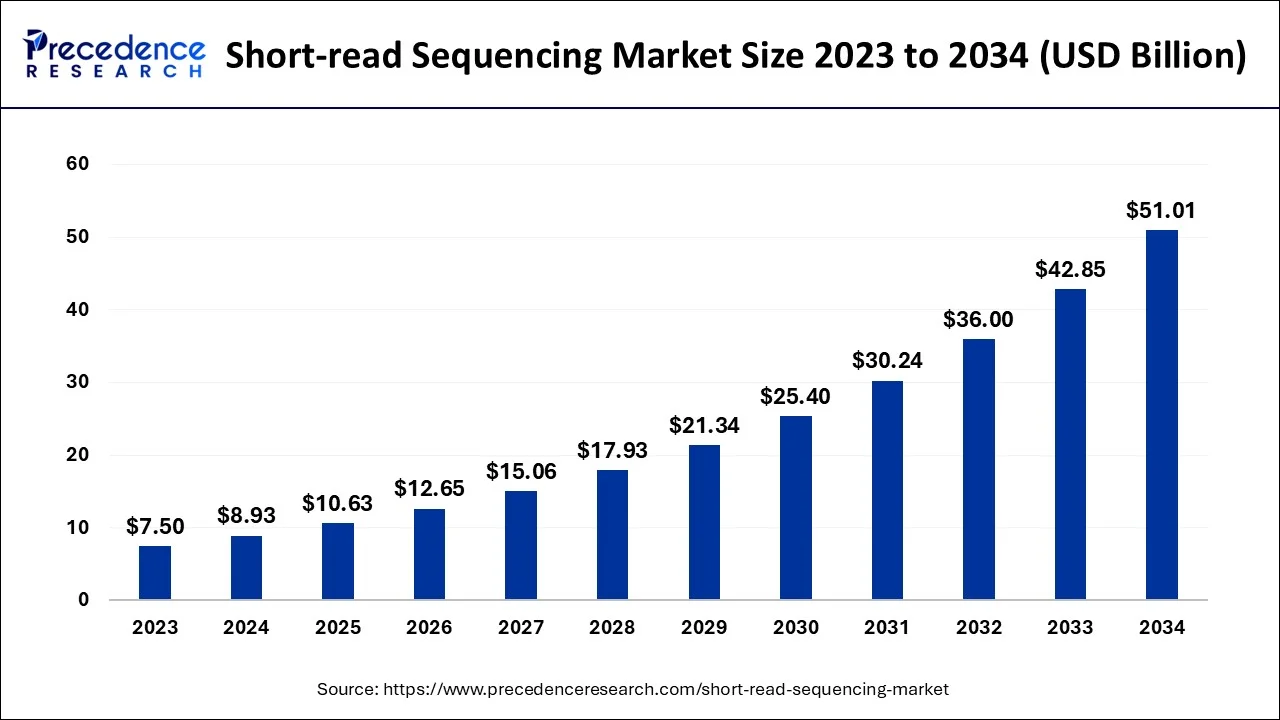

The global short-read sequencing market size is calculated at USD 10.63 billion in 2025 and is predicted to increase from USD 12.65 billion in 2026 to approximately USD 58.30 billion by 2035, expanding at a CAGR of 18.55% from 2026 to 2035.

Short-read Sequencing Market Key Takeaways:

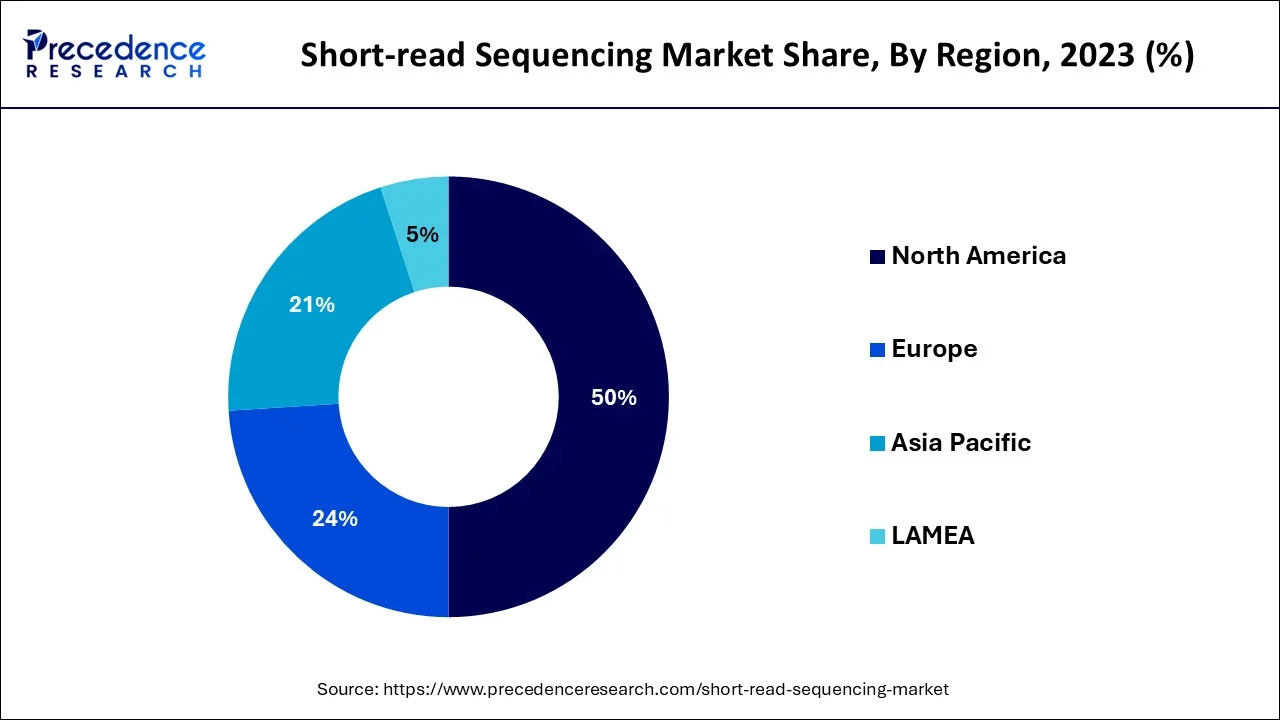

- North America has generated more than 50% of revenue share in 2025.

- Asia-Pacific market is expected to expand at the fastest CAGR between 2026 and 2035.

- By Technology, the Next-Generation Sequencing (NGS) segment is dominating the global market.

- By Product, the consumables segment has generated more than 63% of revenue share in 2025.

- By Workflow, the sequencing segment has recorded more than 57% of revenue share in 2025.

- By Workflow, the data analysis segment is predicted to grow at a remarkable CAGR of 21% between 2025 and 2035.

- By End User, the academic & research segment has generated more than 49% of revenue share in 2025.

What is Short-Read Sequencing?

The short-read sequencing market is a rapidly growing segment in the genomics industry. It is a high-throughput technique that allows researchers to sequence DNA and RNA at an unprecedented rate and with high accuracy. This technology has many applications, including genome sequencing, transcriptome analysis, and epigenetics research. This market is driven by the increasing demand for personalized medicine, drug discovery, and precision agriculture. The demand for genomic data has grown exponentially, as researchers seek to understand the molecular basis of disease, develop new therapies, and optimize crop yields, even benefiting from advances in technology, such as improvements in sequencing chemistry, library preparation, and data analysis tools.

The market is driven by academic research, clinical diagnostics, pharmaceutical and biotech companies, and agriculture and food industries. Academic research accounts for the largest share of the market, as researchers use short-read sequencing to generate new insights into the human genome and other organisms. Clinical diagnostics is the fastest-growing segment of the market, as healthcare providers adopt genomics-based precision medicine to improve patient outcomes. So, it is seen that the short-read sequencing market is dynamic and rapidly growing and is expected to continue its growth trajectory, driven by the expanding applications of short-read sequencing in healthcare, agriculture, and other industries.

Short-read Sequencing Market Growth Factors

The development of advanced technologies such as next-generation sequencing (NGS) has significantly increased the speed, accuracy, and throughput of short-read sequencing. As a result, more data can be generated at a lower cost, making sequencing accessible to a wider range of researchers and applications. The prevalence of genetic diseases is increasing globally, and short-read sequencing has become a critical tool for identifying disease causing mutations. This has led to an increase in demand for sequencing services from healthcare providers, academic institutions, and research organizations. As the volume of sequencing data generated continues to increase, there has been a significant improvement in the computational tools and algorithms used for data analysis. This has led to more accurate and efficient data analysis, making it easier to interpret and use the genomic data generated by short-read sequencing.

Market Outlook

- Industry Growth Overview:

The short-read sequencing market is experiencing significant growth, driven by its affordability, speed, and high accuracy, increasing acceptance in targeted medicine, oncology, forensics, and biodiversity research. - Global Expansion:

The short-read sequencing market is experiencing significant worldwide expansion, driven by high accuracy for small variations, and massive data output, fueling growth in personalized medicine, oncology, and infectious disease tracking. North America is dominant in the market due to increasing government support. - Major investors:

Major investors in the short-read sequencing market include Illumina, Thermo Fisher Scientific, QIAGEN, BGI/MGI, Agilent Technologies, and emerging/competing firms such as PacBio (Pacific Biosciences), Oxford Nanopore, and 10x Genomics.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 10.63Billion |

| Market Size in 2026 | USD 12.65 Billion |

| Market Size by 2035 | USD 58.30Billion |

| Growth Rate from 2026 to 2035 | CAGR of 18.55% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | By Technology, By Workflow, By Product, By Application, and By End User |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Key Market Drivers

Advancements in genomics research -Genomics research has made significant progress in recent years, and short-read sequencing is one of the key technologies that has enabled this progress. As more researchers conduct genomic studies, the demand for short-read sequencing technologies continues to increase.

Decreasing cost of sequencing -The cost of short-read sequencing has decreased significantly over the years, making it more accessible to researchers with smaller budgets. This has led to increased adoption of short-read sequencing technologies across various research fields, including agriculture, medicine, and environmental science.

Growing demand for personalized medicine -Short-read sequencing has the potential to revolutionize personalized medicine by allowing for the identification of genetic variations associated with diseases and the development of targeted therapies. As demand for personalized medicine grows, so does the demand for short-read sequencing technologies.

Key Market Restraints

- Sample preparation - The sample preparation process for short-read sequencing can be time-consuming and labor-intensive, and this can add to the overall cost and time required for the analysis.

- Accuracy - Although short-read sequencing technologies have improved over the years, they still have limitations in terms of accuracy, especially for repetitive or complex regions of the genome.

- Data analysis -The analysis of short-read sequencing data can be complex, and it requires specialized bioinformatics expertise, which can be a limiting factor for researchers or organizations without access to such expertise.

- Read length -The read length of short-read sequencing technologies is limited, and this can make it challenge the entire genome or identify structural variations.

- Regulations - Short-read sequencing technologies are subject to regulation by various national and international bodies, and compliance with these regulations can add additional costs and time to the development and commercialization of these technologies.

Key Market Opportunities

Short-read sequencing technology is advancing at a rapid pace, making it possible to sequence DNA and RNA more quickly and accurately than ever before. This is opening new avenues for research in fields such as personalized medicine, drug development, and agricultural biotechnology. The use of short-read sequencing in diagnostics is growing rapidly, particularly in the areas of cancer and infectious diseases. The ability to quickly sequence the genomes of tumors or infectious agents can help guide treatment decisions and improve patient outcomes. As short-read sequencing technology becomes more widely available and affordable, it is likely to be adopted by a broader range of researchers and clinicians. This could lead to new discoveries and applications in fields such as public health, forensics, and evolutionary biology.

Impact of COVID-19:

The COVID-19 pandemic has had a significant impact on the short-read sequencing market. While the initial impact was negative, with many research facilities and companies shutting down or reducing their operations, the market has since rebounded as demand for COVID-19 testing and research has increased. Initially, the supply chain disruptions caused by the pandemic led to a shortage of key sequencing reagents and equipment, resulting in delays and cancellations of sequencing projects. This led to a temporary decline in the short-read sequencing market.

However, with the need for COVID-19 testing and research, the demand for sequencing services and equipment quickly rebounded. Many sequencing companies pivoted their operation to focus on COVID-19 testing and research, resulting in increased revenue and market share. In addition, the pandemic has accelerated the adoption of sequencing technology in clinical settings, particularly for infectious disease diagnosis and surveillance. This has led to increased demand for sequencing equipment and services in both research and clinical settings.

Segment Insights

Technology Insights

Next-generation sequencing (NGS) is dominating the global market. NGS technologies generate large amounts of data, which can be analyzed using bioinformatics tools to gain insights into complex biological systems. They are much faster than traditional sequencing methods. They can generate millions of sequences in a single run, allowing researchers to sequence an entire genome in a matter of days.

Workflow Insights

In the workflow segment, the sequencing segment held the biggest market share. The strong market penetration in this stage of the workflow increases the income produced by the stage. DNA sequencing technologies that are new and portable have been released as a result of intense market competition. For instance, Thermo Fisher Scientific, Inc. debuted an automated NGS-sequencing Ion Torrent Genexus Dx Integrated Sequencer in March 2022 for oncology research and quick clinical diagnostics. Such programs are accelerating segment growth.

Data Analysis is projected to be the fastest-growing segment in the short-read sequencing industry and is expected to grow at a higher CAGR. Data analysis enables gene expression analysis which can be used to study disease progression and diagnosis. It has prime importance in clinical research studies. For instance, in January 2023, QIAGEN Digital Insights launched the NGS data analysis platform for conducting whole genome analysis for clinical research studies in 25 minutes. Such product launches can significantly boost segment growth in the coming years.

Product Insights

Consumables dominate the short read sequencing market for several reasons. The sequencing process itself requires many consumables, including nucleotides, enzymes, and buffers, which must be replaced for each sequencing run. Further, the cost of these consumables is often much higher than the cost of the sequencing instrument itself, making them a significant source of revenue for sequencing companies. Finally, the development of new and improved consumables can provide a competitive advantage for sequencing companies, as they can enable faster, more accurate, or less expensive sequencing.

Application Insights

The oncology segment holds the maximum share of the revenue. In recent years, there have been many advances in cancer research and development of new therapies, including targeted therapies and immunotherapies. These innovative therapies have shown promising results in treating various types of cancer, leading to an increase in their adoption and use. Moreover, the oncology segment also benefits from a large patient pool, and the increasing prevalence of cancer has led to an increase in the number of cancer patients seeking treatment. This has driven growth in the oncology market, as more pharmaceutical companies are investing in developing new cancer therapies.

End User Insights

Due to an increase in research infrastructure and a spike in the construction of healthcare facilities, the academic & research institutes segment had the biggest market share and dominated the end-use segment. For instance, the human genome sequencing research project for the study of precision medicine approaches, to improve patient care, and to develop gene therapies for the treatment of infectious diseases was launched by the Icahn School of Medicine, Mount Sinai Health System, and Regeneron Genetic Centre in August 2022.

The sector predicted to grow the fastest is the pharmaceutical and biotechnology industries. The demand for short-read technologies has grown recently because of research and development initiatives for cutting-edge therapeutics, in vitro diagnostics, and drug discovery. In the approaching years, the market is anticipated to be driven by the growing financing provided by pharmaceutical and biotechnology businesses to improve the proteomics, genomics, and biotechnology research portfolio.

Regional Insights

U.S. Short-read Sequencing Market Size and Growth 2026 to 2035

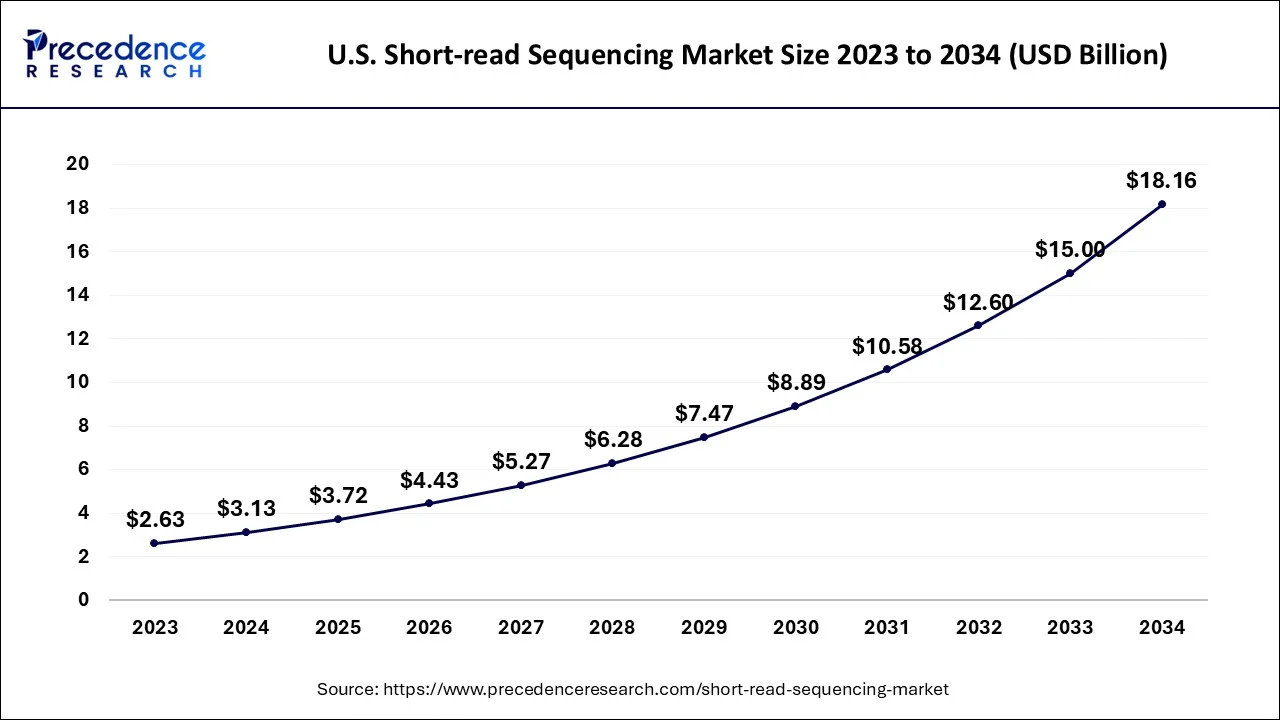

The U.S. short-read sequencing market size accounted for USD 3.72 billion in 2025 and is predicted to be worth around USD 20.81 billion by 2035, growing at a CAGR of 18.79% from 2026 to 2035.

North America: Emerging Research and Development

North America is considered the largest in the short-read sequencing market as the region has a large number of established sequencing companies and research institutions that are driving innovation in the field of genomics. These companies are investing heavily in research and development to develop new sequencing technologies and applications, which is fueling growth in the market. Further, North America has a well-established healthcare system that is driving demand for sequencing services.

The region has a large population of genetic diseases and cancer, and sequencing is increasingly being used as a diagnostic tool to identify the underlying genetic causes of these conditions. Additionally, the region has a large pharmaceutical industry that is using sequencing to develop personalized treatments and drugs.

U.S. Short-read Sequencing Market Trends

The US is a hub for major companies that essentially created and continue to dominate the short-read sequencing ecosystem. The presence of massive levels of public and private investment in genomic research. Increasing government initiatives, such as The All of Us (AoU) initiative, goal to sequence the genomes of over one million Americans from diverse ethnic backgrounds to improve personalized medical care.

Europe: Integration with Healthcare Systems

Short-read sequencing has a significant impact on agriculture and food security in Europe, as it has allowed for the identification and characterization of genetic variants that are important for crop breeding and improvement. In terms of the market, Europe has a strong presence in the short-read sequencing industry, with several major companies based in the region. These companies are involved in the development, production, and distribution of short-read sequencing instruments and reagents, as well as the provision of sequencing services to research and clinical customers.

The UK Short-read Sequencing Market Trends

The UK is strong in terms of generating and using novel processes of DNA sequencing. The UK's global-leading commercial genomics sector has been a major funder of the technological advancement that underpins current NHS genomics laboratory capabilities and remains to lead the forefront of further development in sequencing and analysis

However, there are also concerns about the impact of the short-read sequencing market on the broader biotechnology industry in Europe which could limit competition and innovation in the long term.

Asia Pacific: Increasing Government Support

Asia-Pacific region is experiencing rapid growth in the market with a significant increase in investments in genomics research by governments, academic institutions, and private companies. For instance, the Chinese government has launched several initiatives such as the National Gene Bank, which aims to build a comprehensive collection of genetic resources, and the China Precision Medicine Initiative, which focuses on the development of personalized medicine using genomic data. Also, there is a growing demand for personalized medicine in the Asia-Pacific region.

China Short-read Sequencing Market Trends

China has contributed largely to the sector of human genome research through international partnerships and strong regulatory support. China has made genetic technology broadly accessible. With the advanced infrastructure, scale, and government support, China is on a path to become the first nation to embed genomics into daily healthcare services.

Countries such as Japan and South Korea have well-established healthcare systems and aging populations, which is driving the need for more precise and personalized medical treatments. Genomic data from short-read sequencing can provide valuable insights into individual patient's genetic makeup, allowing for more targeted and effective treatment options. Finally, advancements in sequencing technologies have made short-read sequencing more affordable and accessible, leading to wider adoption of the technology in research and clinical settings.

Value Chain Analysis - Oxalic Acid Market

- R&D:

Research and Development (R&D) processes for short-read sequencing include library preparation, clonal amplification, sequencing, and data analysis.

Key Players: BGI (MGI) and QIAGEN - Clinical Trials:

Clinical trials involve sample analysis, data interpretation for diagnosis, and managerial treatment strategies in the various disease areas, specifically in oncology and genetic diseases.

Key Players: Thermo Fisher Scientific - Patient Services:

Major patient services processes for short-read sequencing, often next-generation sequencing (NGS), involve a multiple-step workflow from clinical consultation to the delivery of actionable medical output.

Key Players: Illumina

Short-read Sequencing Market Companies:

|

Company |

Headquarters |

Key Strengths |

Latest Info (2025) |

|

BGI |

Mumbai |

massive sequencing capacity, and integrated multi-omics solutions |

BGI-Research cooperated with a number of institutions to publish the first batch of animal, insect, and plant life spatio-temporal atlas in the world. |

|

Agilent Technologies |

California |

Extensive and diversified product portfolio |

In October 2025, SPT Labtech and Agilent will introduce automated target enrichment protocols for genomic workflows. |

|

Thermo Fisher Scientific, Inc. |

United States |

Provides biopharma services |

In August 2025, Thermo Fisher Scientific introduced the Applied Biosystems™ MagMAX™ HMW DNA Kit, providing a streamlined manual and automated extraction workflow to enable the reproducible isolation of High Molecular Weight (HMW) DNA suitable for long-read sequencing. |

|

ProPhase Labs, Inc. |

United States |

Diversified strategy combining Genomics & Biotech |

In September 2025, ProPhase Labs, Inc., a next-generation biotech, genomics, and consumer products company, announced that its three COVID-19 testing laboratory companies filed |

|

Illumina, Inc. |

United States |

High-throughput technology |

Illumina introduces revolutionary next-generation sequencing (NGS) and multiomics technologies. |

Other Major Key Players

- BGI

- Agilent Technologies

- Thermo Fisher Scientific, Inc.

- ProPhase Labs, Inc. (Nebula Genomics)

- Illumina, Inc.

- Psomagen

- QIAGEN

- Azenta US, Inc. (GENEWIZ)

- PerkinElmer, Inc.

- Pacific Biosciences of California, Inc.

- Cytiva

- Fasteris SA

- Genewiz

- GenScript

Recent Developments

- In November 2021, to promote human wellness, Psomagen, Inc.'s newly launched brand Kean Health is making at-home testing available.

- In July 2021, PerkinElmer to Purchase Leader in Antibody and Reagents BioLegend Transformative deals dramatically scale leading position in life science to speed up illustrious discoveries in precision medicine.

- In September 2019, the technology will be used in the American DTC market, according to Psomagen, which filed the patent jointly with Macrogen. To develop large amounts of high-quality healthcare big data fast and seize the initiative in the platform market in the United States, the company intends to encourage the voluntary participation of individual users

Segments Covered in the Report:

By Technology

- Next-Generation Sequencing

- Sanger Sequencing

By Workflow

- Pre-Sequencing

- Sequencing

- Data Analysis

By Product

- Instruments

- Consumables

- Services

By Application

- Clinical Investigation

- Oncology

- Reproductive Health

- Consumer Genomics

- Agri genomics and Forensics

- HLA Typing/ Immune System Monitoring

By End User

- Academic Research

- Hospital and Clinics

- Clinical Research

- Pharmaceutical and Biotechnology Companies

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting