What is the Skin Packaging Market Size?

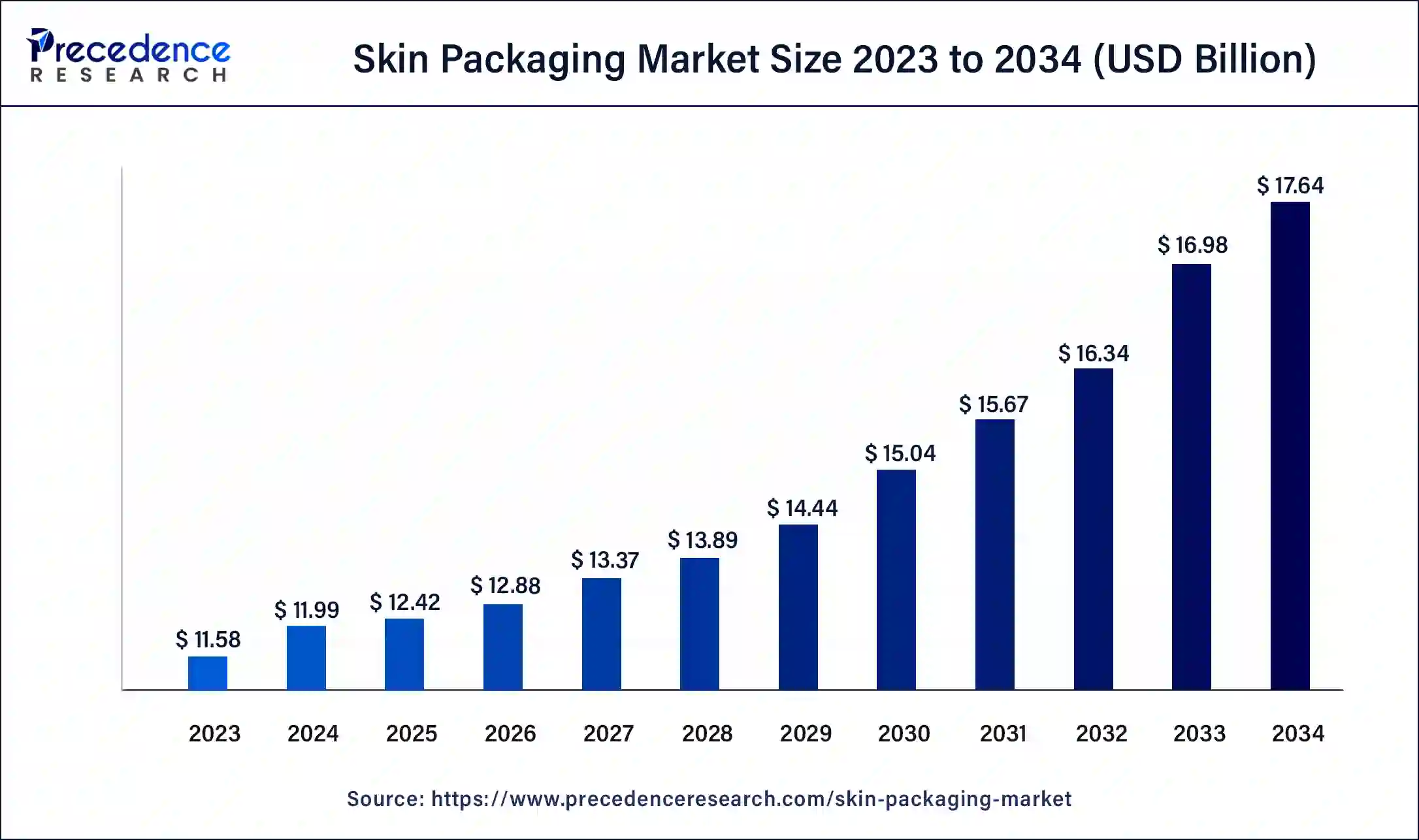

The global skin packaging market size is valued at USD 12.42 billion in 2025 and is predicted to increase from USD 12.88 billion in 2026 to approximately USD 18.29 billion by 2035, expanding at a CAGR of 3.95% from 2026 to 2035.

Skin Packaging Market Key Takeaways

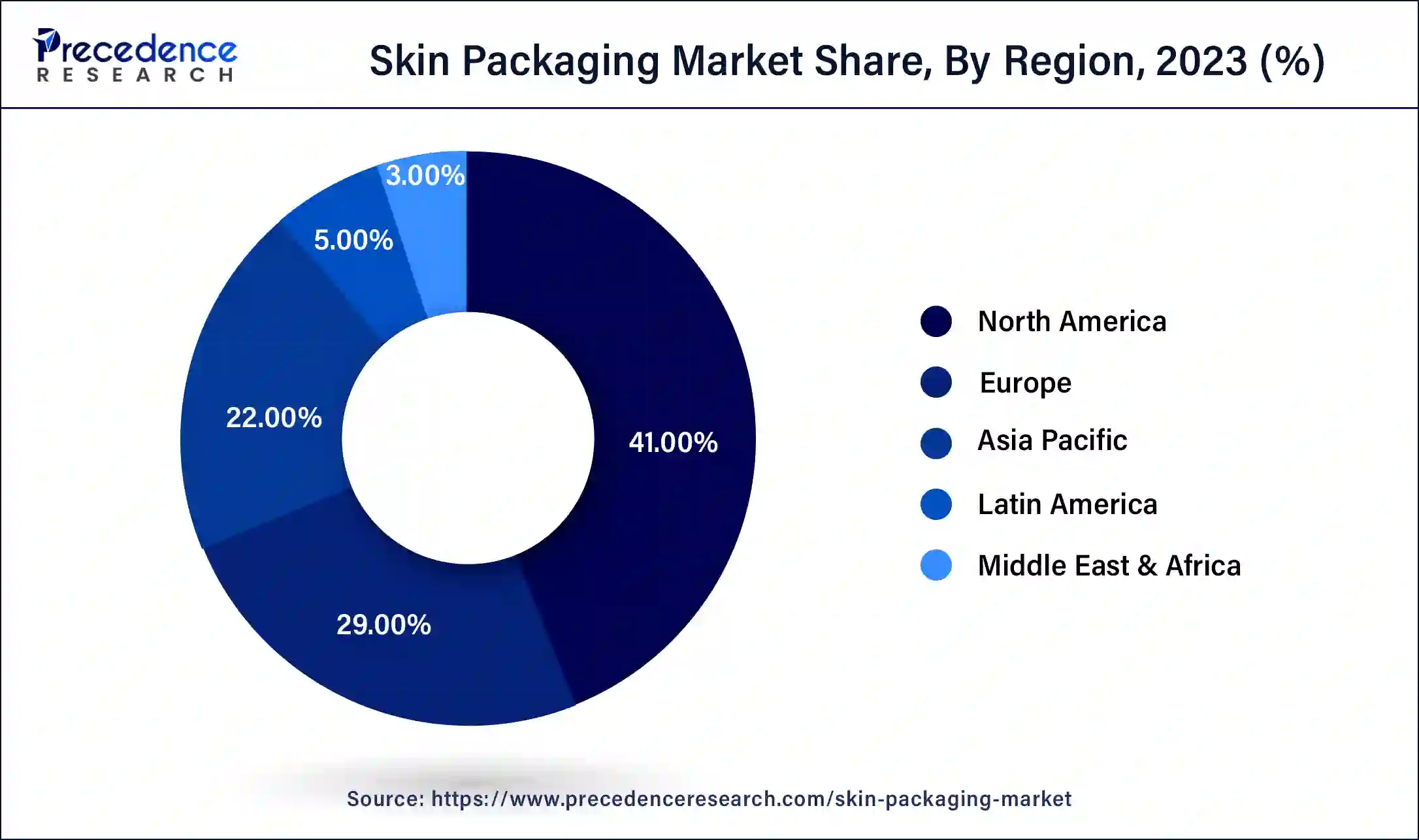

- North America contributed more than 40.14% of the revenue share in 2025.

- Asia Pacific is estimated to expand the fastest CAGR between 2026 and 2035.

- By material, the plastics segment has held the largest market share of 46% in 2025.

- By material, the others segment is anticipated to grow at a remarkable CAGR of 4.8% between 2026 and 2035.

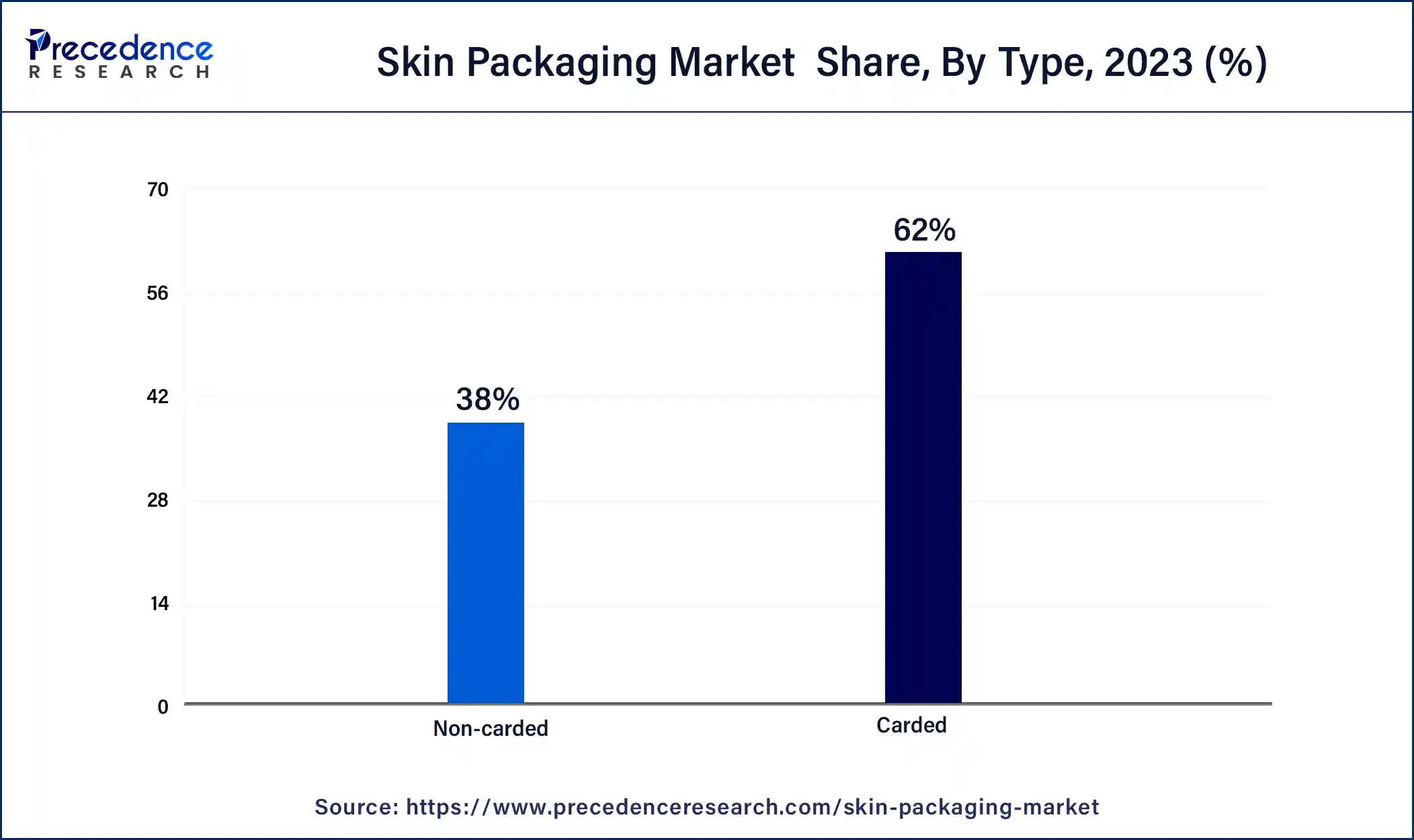

- By type, the non-carded segment generated over 61% of revenue share in 2025.

- By type, the carded segment is expected to expand at the fastest CAGR over the projected period.

- By application, the food application segment had the largest market share of 34% in 2025.

- By application, the industrial segment is expected to expand at the fastest CAGR over the projected period.

Market Overview

The skin packaging sector pertains to a niche within the packaging industry, wherein products undergo a meticulous process of hermetic enclosure within a transparent plastic film that molds closely to their contours. This technique elevates product visibility and safeguarding while concurrently mitigating packaging-related waste. Skin packaging primarily caters to items like comestibles, electronics, and consumer merchandise. The burgeoning of this market is attributed to the heightened appetite for environmentally-conscious packaging, visual allure, and product preservation. This approach offers manufacturers an economical and effective means to encase their wares, rendering it an avant-garde choice across diverse industries, especially those emphasizing sustainability and aesthetics.

How is AI Influencing the Skin Packaging Industry?

AI-driven robotic arms, as well as vision systems, inspect for and correct defects such as misaligned labels and damaged containers with high precision. Further, it also enables predictive maintenance, expecting machinery failure to decrease downtime. AI accelerates the design process, enabling the rapid creation and simulation of new, sustainable packaging structures. AI is thus integrated into packaging to track conditions such as temperature, guaranteeing the safety of cosmetic products throughout the supply chain.

Skin Packaging Market Growth Factors

The relentless surge in ecological awareness and the call for sustainable packaging practices has become a pivotal driving force behind the skin packaging market's expansion. In response to the mounting demands from both consumers and regulatory authorities, skin packaging is rapidly gaining traction. It excels in its ability to minimize superfluous packaging materials, opting for a more compact and resource-efficient approach to product protection. This reduction in waste and the incorporation of recyclable materials contribute to a substantially reduced environmental impact, rendering skin packaging the preferred choice for companies dedicated to fulfilling their corporate sustainability commitments.

In the realm of consumer allure and market attraction, skin packaging emerges as a frontrunner. It endows products with the gift of transparency, enabling consumers to intimately acquaint themselves with the items they intend to purchase. This transparency plays an instrumental role in fostering consumer trust and confidence, especially in industries like food and consumer goods. The capacity to emblazon branding and marketing messages directly onto skin packaging augments brand recognition and effectively conveys vital product information.

Skin packaging stands out as an exemplar of product preservation. The hermetically sealed plastic film acts as a formidable shield, safeguarding products against external pollutants, including dust and moisture, thus preserving their quality and extending their shelf life. This facet bears paramount importance in the food industry, where product freshness and hygiene are non-negotiable. Additionally, the capability to vacuum-seal products in skin packaging mitigates the risks of tampering and damage during transit.

Skin packaging presents itself as a financially judicious choice for manufacturers. Adhering closely to product contours, it diminishes the necessity for excessive packaging materials, thereby significantly reducing packaging expenditures. Furthermore, its streamlined design curtails the spatial requisites for warehousing and transportation, resulting in diminished logistical overheads. Such cost efficiency can be a potent motivator for enterprises aiming to optimize their packaging procedures.

The versatility of the skin packaging method extends its applicability across a myriad of industries, encompassing realms such as food, electronics, consumer goods, and pharmaceuticals. This adaptability heightens its appeal as an encompassing solution suitable for an eclectic range of products, ranging from perishable goods to fragile electronic components. Manufacturers can leverage this versatility to streamline their packaging operations and cater to diverse market segments, thus contributing to the sustained upswing of skin packaging.

The ongoing evolutionary journey of packaging technology plays an instrumental role in the flourishing trajectory of the skin packaging market. Technological innovations in machinery and materials have unlocked new horizons, making skin packaging more efficient and accessible to a broader spectrum of businesses. For instance, the advancements in skin packaging equipment have not only augmented the pace and precision of the packaging process but also rendered it a more viable option for high-volume production scenarios.

Technological Advancement

Technological advancements in the skin packaging market feature eco-friendly materials, advanced packaging techniques, automation, artificial intelligence AI andmachine learning ML, and printing and graphic design. The smart packaging integration is subdivided into RFID chips, QR codes, and NFC tags. QR codes and NFC tags help in accessing and increasing consumer engagement. This technology is highly beneficial to manufacturers supporting the tracking of products throughout the supply chain. It also verifies authenticity and helps consumers provide interactive features, mainly in areas such as health and food.

The technology also helps in enhancing innovative packaging designs. The advancement in automation contributes to packaging machinery technology, which has increased efficiency in the production of skin packaging. Printing and graphic design mostly attract consumers on a large scale. The visual appearance makes the product appealing and approachable.

Skin Packaging Market Outlook

- Industry Growth Overview: The skin packaging market is expected to grow significantly between 2025 and 2034. This increase is driven by increasing consumer demand for visually attractive and functional packaging solutions, especially for fresh foods like meat, poultry, seafood, medical devices, and consumer products. Skin packaging offers better product visibility, longer shelf life, and protection against tampering.

- Material Innovation: The main trend here, separate from sustainability, is material innovation driven by the need for better functionality, safety, and performance. The focus is on creating advanced materials with improved barrier properties and durability to extend product shelf life and ensure safety, especially for the food, beverage, and pharmaceutical sectors.

- Global Expansion:The market is expanding globally, driven by rapid industrialization, urbanization, and increasing disposable incomes, fueling demand for packaged goods. North America and Europe remain dominant markets due to well-established retail infrastructure and stringent regulations. Market players are expanding into MEA and Latin America to meet local demand and leverage growth opportunities.

- Major investors:The market is led by large, established packaging companies such as Amcor Plc, Sealed Air Corporation, Berry Global, and Klöckner Pentaplast. Investment activity mainly includes strategic mergers, acquisitions, and R&D to expand capacity, upgrade technology, and achieve sustainability objectives.

- Startup Ecosystem: While major corporations lead the core manufacturing, a developing startup scene is emerging in niche, innovation-focused areas related to sustainability and technology. This includes companies creating advanced materials (e.g., mycelium-based, water-soluble films), adding smart packaging features like QR codes for traceability, and improving production processes with AI for greater efficiency.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 18.29 Billion |

| Market Size in 2026 | USD 12.88 Billion |

| Market Size in 2025 | USD 12.42 Billion |

| Growth Rate from 2026 to 2035 | CAGR of 3.95% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Material, Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Sustainability and eco-friendly packaging

Sustainability and eco-friendly packaging represent a driving force behind the notable growth of the skin packaging market. In an era marked by heightened environmental consciousness and increasing demand for responsible business practices, skin packaging has emerged as a prominent solution. It is revered for its capacity to align with sustainability objectives in several ways.

Firstly, skin packaging minimizes environmental impact through its reduction of packaging material usage. The tight, conforming fit of the plastic film to the product significantly decreases the amount of material required, thereby reducing waste and conserving resources. This aspect resonates strongly with environmentally conscious consumers who favor products with reduced ecological footprints. Secondly, the use of recyclable and environmentally friendly materials in skin packaging adds to its eco-credentials. This aspect contributes to the circular economy by promoting the use of materials that can be recycled or reused, thus reducing the overall strain on natural resources.

Furthermore, the compact nature of skin packaging allows for efficient transportation and storage. Reduced packaging volume translates to lower carbon emissions during transportation and the optimization of storage space, which aligns with sustainability goals aimed at reducing energy consumption and emissions. In essence, sustainability and eco-friendliness are pivotal in driving the growth of the skin packaging market.

Restraint

Higher initial equipment costs

The higher initial equipment costs present a significant restraint to the growth of the skin packaging market. Skin packaging requires specialized machinery and equipment to achieve the precise sealing and vacuum-forming necessary for this packaging method. These machines can be considerably more expensive compared to equipment used for other packaging techniques. For smaller businesses or those with limited financial resources, the high upfront investment in skin packaging machinery can be a substantial barrier to adoption. It may hinder their ability to leverage the benefits of skin packaging, which includes improved product visibility, sustainability, and brand recognition.

The cost of the machinery, coupled with training and maintenance expenses, can strain budgets and delay the decision to embrace skin packaging. Furthermore, these high initial costs can deter companies from exploring the potential benefits of skin packaging, limiting market growth. To overcome this challenge, manufacturers and equipment suppliers need to find ways to make skin packaging machinery more accessible and cost-effective for a wider range of businesses, thus facilitating market expansion.

Opportunities

E-commerce packaging

E-commerce packaging is opening doors of opportunity within the skin packaging market, catering to the distinctive requirements of the digital retail realm. As the e-commerce landscape expands, there's an escalating need for packaging that simultaneously safeguards products during shipping, amplifies their visual appeal, and strengthens brand recognition. Skin packaging emerges as an ingenious solution for e-commerce entities, ensuring products remain unscathed in transit while presenting them in a crystal-clear, captivating manner. This not only elevates the unboxing experience for customers but also instills trust in the product's quality.

Skin packaging is particularly well-suited for petite items and those with unconventional shapes common occurrences in the e-commerce sector, making it an enticing choice for businesses navigating this virtual market. Its adaptability to diverse product dimensions and forms establishes it as the ideal answer to meet the evolving packaging requisites of the e-commerce industry, solidifying its role as a principal growth avenue in the skin packaging domain.

Segment Insights

Material Insights

According to the material, the plastics segment held a 46% revenue share in 2025. The plastics segment holds a major share in the skin packaging market due to its versatility, cost-effectiveness, and the ability to offer a strong protective barrier around products. Skin packaging primarily involves using a transparent plastic film to tightly encase items, providing excellent product visibility while safeguarding against environmental contaminants. Plastics are the preferred choice as they can conform to various product shapes, allowing for customization and branding. Additionally, plastic materials can be sourced sustainably, aligning with the growing emphasis on eco-friendly packaging. This combination of adaptability, protection, and sustainability has propelled plastics to dominate the skin packaging market.

The others segment is anticipated to expand at a significant CAGR of 4.8% during the projected period. The others segment holds a substantial growth in the skin packaging market due to its diverse and versatile nature. This category encompasses various packaging materials beyond traditional plastics and boards, such as recycled materials, sustainable alternatives, and specialty films. As sustainability gains prominence, businesses are increasingly exploring innovative and eco-friendly materials for skin packaging. This segment allows for customization and adaptation to specific product needs, making it a popular choice for companies seeking environmentally responsible solutions and those looking to differentiate their products with unique, specialized materials. The flexibility and adaptability of the others segment contribute to its significant market growth.

Type Insights

The type, non-carded segment is anticipated to hold the largest market share of 61.80% in 2025. The dominance of the non-carded segment in the skin packaging market can be attributed to its adaptability and economic advantages. Non-carded skin packaging stands out for its capacity to securely encase products without the requirement of a supporting card, rendering it suitable for a diverse array of product contours and dimensions. Its efficiency, affordability, and eco-friendly attributes have made it an alluring choice across a spectrum of industries, notably in the realms of food and consumer goods. Moreover, its ability to reduce material consumption aligns seamlessly with sustainability objectives, further solidifying its preeminence in the market.

The carded segment is projected to grow at the fastest rate over the projected period. The carded segment holds a major growth in the skin packaging market primarily due to its versatility and cost-effectiveness. Carded skin packaging involves sealing products to a cardboard or paperboard backing, which provides excellent product visibility and protection. This method is widely adopted because it is suitable for a diverse range of product shapes and sizes, making it appealing to various industries. The cost efficiency and customizable branding opportunities also contribute to its popularity. Moreover, carded skin packaging aligns with sustainability goals as it minimizes material waste, resonating with the increasing demand for eco-friendly packaging solutions.

Application Insights

The food segment had the highest market share of 36%in 2025 based on the sales channel. The food segment holds a significant share in the skin packaging market due to the method's effectiveness in preserving food quality and extending shelf life. Skin packaging provides a secure and airtight seal that protects perishable items, preventing contamination and spoilage. Its transparent nature enhances product visibility, fostering consumer trust. Furthermore, it minimizes food waste by reducing the risk of damage during transportation and storage. These advantages make skin packaging a preferred choice for the food industry, aligning with the sector's critical needs for food safety, freshness, and presentation, thus contributing to its major share in the market.

The industrial segment is anticipated to expand at the fastest rate over the projected period. The industrial segment holds a significant share of the skin packaging market due to its unique packaging requirements. In the industrial sector, where items can vary in size, shape, and weight, skin packaging offers a versatile and protective solution. It secures heavy machinery parts, delicate electronic components, and irregularly shaped industrial goods with ease. This protective packaging reduces the risk of damage during transit, ensuring that products reach their destinations intact. Additionally, the ability to print branding and crucial information directly on the skin packaging enhances product identification and traceability, a critical need in industrial applications.

Regional Insights

What is the U.S Skin Packaging Market Size?

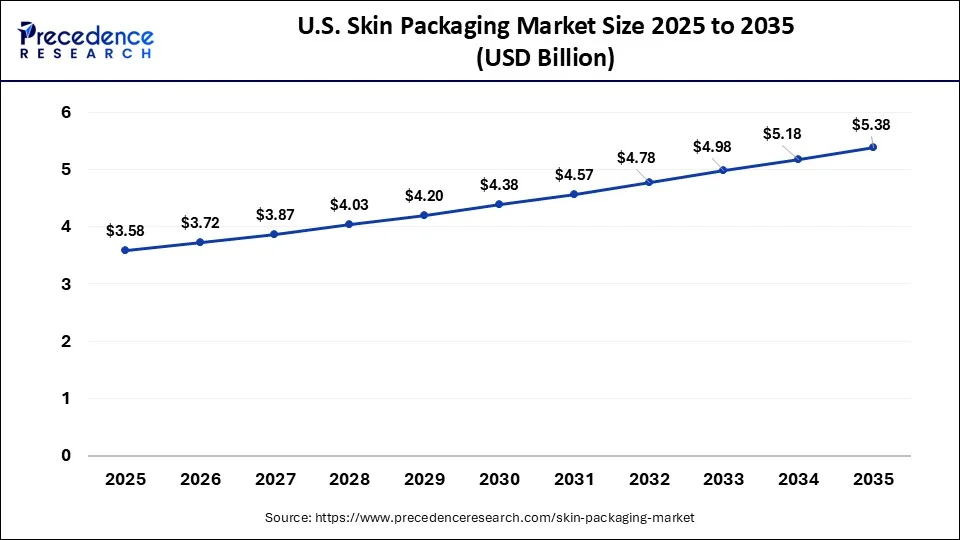

The U.S. skin packaging market size is evaluated at USD 3.58 billion in 2025 and is projected to reach USD 5.38 billion by 2035, registering a CAGR of 4.16% from 2026 to 2035.

North America held the largest revenue share of 40.14% in 2025. North America commands a substantial share of the skin packaging market due to several key factors. The region benefits from a strong consumer base with a penchant for eco-friendly and visually appealing packaging. Additionally, North American industries, such as food and electronics, rely heavily on efficient product protection and branding, areas where skin packaging excels. Regulatory compliance and quality standards in the region also favor the adoption of skin packaging. Furthermore, the well-established e-commerce sector in North America has further propelled the demand for secure and visually appealing packaging, solidifying the region's prominent position in the skin packaging market.

U.S. Skin Packaging Market Trends

The U.S. plays a key role in the global skin packaging market, fueled by a well-established packaging industry, high disposable incomes, and a strong retail sector. The U.S. leads in advanced packaging technologies and consistently complies with strict food safety regulations. There is high demand for attractive, premium-quality packaging for luxury goods, fresh meat, and medical devices. Major international packaging firms like Sealed Air Corporation, Berry Global, and Amcor help drive the growth of this market.

What Makes Asia Pacific the Fastest-Growing Area in the Skin Packaging Market?

Asia Pacific is estimated to observe the fastest expansion. The dominant growth of Asia Pacific in the skin packaging market can be attributed to various compelling factors. This robust market share is driven by the flourishing manufacturing sectors, particularly in nations like China, India, and South Korea, which exhibit a heightened demand for packaging solutions that are not only cost-effective but also versatile.

Asia Pacific dominates the skin packaging market with its largest share. Inside the Asia Pacific market, China contributes a large portion of the revenue share. The highest customer demand leads to increased manufacturer demand. China's efforts and improvements in protecting goods during shipping to avoid spoilage have pressured the skin packaging production market to deliver quality packaging.

Skin packaging aligns perfectly with this requirement, emerging as the preferred choice for a wide spectrum of products emanating from these vibrant economies. Furthermore, the thriving e-commerce landscape in the Asia-Pacific region has accentuated the necessity for packaging that combines both protective qualities and visual appeal, where skin packaging has emerged as a leader. Its remarkable adaptability to a diverse array of product shapes and dimensions further bolsters its prominence within this dynamic marketplace.

India Skin Packaging Market Trends

India is a quickly expanding market for skin packaging because of rapid industrial growth, urban development, and a rising consumer population. The country aims to meet the growing domestic demand for packaged foods, beverages, and personal care products. Moreover, government initiatives that promote sustainable and eco-friendly packaging, such as Make in India and plastic waste reduction targets, are shaping the market and fostering innovations in bio-based and recyclable materials from both local companies and international firms operating in India.

How is the Opportunistic Rise of Europe in the Skin Packaging Market?

Europe is expected to see significant growth in the market due to increasing focus on sustainability and rising environmental concerns. Strict regulations on plastic waste, along with a strong consumer preference for eco-friendly products, are encouraging manufacturers to adopt recyclable and biodegradable materials like PET and paperboard. The market is driven by major global companies that are heavily investing in research and development to improve film clarity and barrier properties, aiming to extend shelf life, especially for high-value food, consumer goods, and medical devices.

Germany Skin Packaging Market Trends

Germany is a key hub for the European skin packaging industry. The country is home to advanced technology and global industry leaders such as MULTIVAC and Klockner Pentaplast. The market is driven by high demand from the food processing and industrial goods sectors, with a focus on operational efficiency. The country emphasizes advanced production methods, such as vacuum evaporation for high-purity salts and the development of eco-friendly films, to meet both industrial needs and strict national environmental standards.

A Look at Latin America's Emerging Skin Packaging Market

The skin packaging market in Latin America is growing quickly because of the rising demand for durable packaging for products like meat, seafood, and ready-to-eat meals. However, skin packaging offers a longer shelf life and an attractive look for consumers. The region is seeing increased demand for premium and convenient packaging options, driven by urbanization and lifestyle changes. A key trend is the move toward sustainable and eco-friendly materials, prompted by growing consumer awareness and new environmental regulations in various countries.

Brazil Skin Packaging Market Trends

Brazil holds a distinctive position in the Latin American packaging market, focusing on extending the shelf life and safety of packaged food, which is a key application for skin packaging. The market benefits from a large domestic consumer base, the growth of modern retailing and e-commerce, and the demand for durable packaging that can handle complex supply chains. Although rigid plastic currently dominates the market, there is a growing shift toward flexible and sustainable options like paperboard and bio-based films.

What Potentiates the Growth of the Skin Packaging Market in the Middle East and Africa?

The MEA skin packaging market is growing, driven by a high demand for packaged food, particularly meat and seafood, to ensure freshness and hygiene. Countries in the region are investing in modern packaging technologies to enhance product appeal and meet international quality standards. The market is increasingly pushing toward sustainable solutions and materials that align with a circular economy, despite challenges such as varying regulatory frameworks and reliance on imports.

Saudi Arabia Skin Packaging Market Trends

Saudi Arabia's skin packaging market is influenced by economic diversification and the development of local industries, including packaging and food production. There is a high demand for advanced packaging solutions that can protect products in the region's harsh climate and support the growing e-commerce sector. The market is actively exploring eco-friendly materials and smart packaging technologies to improve product tracking and authentication.

Value Chain Analysis

- Raw Material Production & Supply

This involves producing plastic films (PVC, PE, PET) and paperboard backings from raw polymers, resins, and adhesives.

Key Players: DuPont, Dow Chemical, Amcor, and Sealed Air Corporation. - Packaging Design and Manufacturing

This focuses on converting raw materials into final packaging products (films, trays, carded backings) through design, printing, and forming processes.

Key Players: Amcor, Sealed Air Corporation, WestRock, and Smurfit Kappa Group. - Application and Co-Packing

This involves the actual process of placing the product on the backing and vacuum-sealing it with a plastic film.

Key Players: Tyson Foods, Buske Logistics, and Rhodius Co-Packing. - Distribution and Retail

This manages the logistics of delivering packaged products to consumers, often requiring cold chain management for food items.

Key Players: 3PL providers, supermarkets, and e-commerce platforms. - End-User Consumption and Disposal

The stage where consumers purchase and dispose of the packaging, with growing demand for sustainable disposal solutions.

Key Players: Consumers and waste management/recycling companies and firms like Corpseed and Enviro Recyclean.

Private Industry Investments for Skin Packaging

- Knox Lane's Acquisition of Elevation Labs: The private equity firm Knox Lane acquired Elevation Labs, a premium beauty product manufacturer, to expand its presence in the growing beauty and personal care market.

- Bain Capital's Acquisition of World Wide Packaging: Bain Capital Private Equity acquired World Wide Packaging LLC, a provider of cosmetic packaging and filling technologies, with plans to merge it with a Chinese manufacturer to create a fully integrated solutions provider.

- Solidus' Investment in FUTURLINE Solutions: Solidus is investing EUR 11 million into its FUTURLINE range of retail-ready packaging, which includes skin and modified atmosphere packaging solutions using at least 80% less plastic.

- Sealed Air's Development of a Paper-Based Bottom Web: Sealed Air Corporation developed a new paper-based bottom web compatible with both vacuum skin packaging (VSP) and modified atmosphere packaging (MAP) top webs, helping retailers reduce plastic usage.

Top Companies in the Skin Packaging Market and Their Offerings

- Sealed Air Corporation: High-performance Cryovac brand films and automated systems for food and protective packaging.

- Berry Global, Inc.: A wide range of films, trays, and thermoformed solutions for various skin packaging applications.

- Clondalkin Group:Customized flexible and specialty films, including barrier and lidding films, for industrial and food skin packaging.

- ProAmpac:Innovative high-barrier films and customized packaging solutions for food, medical, and industrial sectors.

- Flexopack SA:Specializes in co-extruded films and lidding films for food skin packaging, MAP, and vacuum packaging.

- Bemis Company, Inc.(now Amcor): Offers a comprehensive range of high-barrier vacuum skin packaging films, such as SkinTite™, specifically designed for applications like fresh meat and ready meals on various tray types.

- Coveris Holdings S.A.: Manufactures multi-layer co-extruded barrier VSP films with high clarity and puncture resistance that are compatible with PE, PET, PP, and even cartonboard base trays.

- LINPAC Packaging (now Klockner Pentaplast): Provides a broad range of rigid VSP trays available in materials like mono PET and barrier PP, designed for normal, protruding, and super-protruding product styles.

- Display Pack, Inc.: Specialises in custom thermoformed plastic packaging, including carded skin packaging and high-tolerance trays used for retail and industrial display.

- G. Mondini: Designs and manufactures advanced tray-sealing machinery specifically engineered to execute vacuum skin packaging for the food industry.

- Polypack, Inc.: Focuses primarily on shrink-wrapping and cardboard packaging equipment, though they offer some secondary solutions that complement primary skin packaging lines.

- Schur Flexibles Group (now Schur): Supplies high-performance flexible films, including skin films with high-barrier properties and easy-peel features for fresh food preservation.

- Shawnee Chemical: Acts as a supplier of PVC resins and plastic compounds used by manufacturers to produce the films and materials required for skin packaging.

- Universal Plastic Bag Co.: Produces various specialty plastic bags and films, often catering to industrial needs that require durable skin-like protective layering.

- Ampac Holdings LLC (now part of Coveris): Originally offered innovative flexible packaging and pouch solutions that have since been integrated into the broader Coveris VSP film portfolio.

Recent Developments

- In May 2025, Sontex announced high-performance skin packaging machines for secure and eye-catching product displays. A leading specialist in packaging machinery, Sontex, is offering the latest advancement to businesses to upskill in the technological aspects.

- In October 2024, Onion skin packaging announced its aim to lessen plastic packaging and food waste. The initiative is with its approach to eco-friendly packaging, has boosted the skin packaging market globally.

- In September 2024, Coveris introduced a new vacuum skin packaging facility in the UK. The investment at the site consists of the conversion hall and a specialist contributing to the innovative skills to empower the skin packaging market.

- In May 2022, Amcor Plc unveiled its cutting-edge innovation, PowerPostTM, which brings forth a novel technology enabling the creation of bottles that are remarkably lighter, weighing up to 30% less than conventional counterparts. These bottles can be crafted entirely from recycled materials, aligning with sustainable practices. Specifically designed for hot-fill beverages, this technology also addresses the issue of overflow spills, enhancing user experience. This breakthrough product is underpinned by the utilization of vacuum-absorption technology, known as PowerStrap.

- In April 2022, Sealed Air announced a strategic collaboration focused on an advanced recycling initiative with a primary emphasis on recycling flexible plastics sourced from the food supply chain. The goal is to transform these materials into fresh, certified, circular food-grade packaging solutions. This partnership underscores a commitment to sustainable and eco-conscious approaches in the packaging industry.

Segments Covered in the Report

By Material

- Plastics

- Paper & Paperboard

- Others

By Type

- Carded

- Non-carded

By Application

- Food

- Consumer Goods

- Industrial

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting