What is the Small-Scale LNG Market Size?

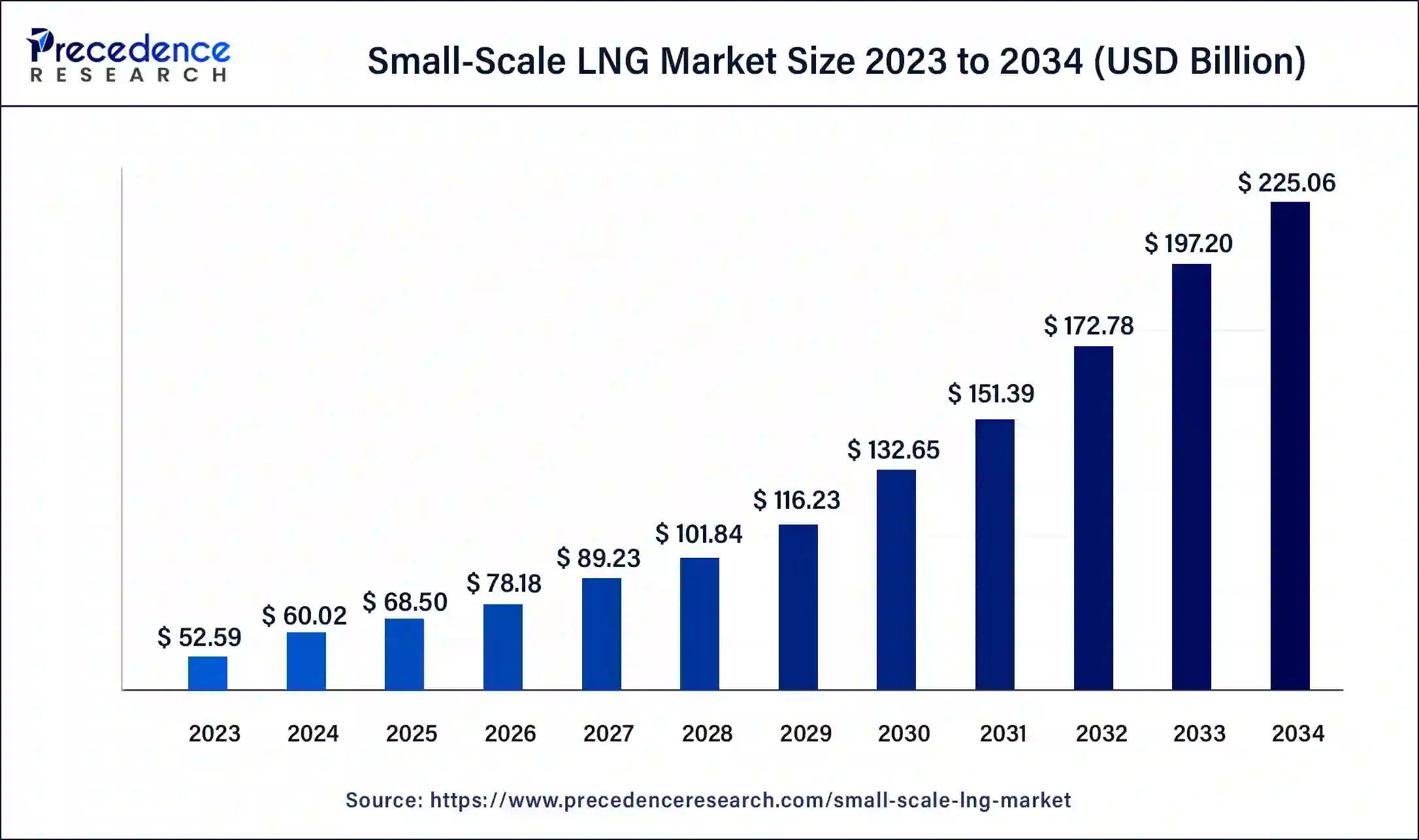

The global small-scale LNG market size is calculated at USD 68.50 billion in 2025 and is predicted to increase from USD 78.18 billion in 2026 to approximately USD 250.63 billion by 2035, expanding at a CAGR of 13.85% from 2026 to 2035.

Small-Scale LNG Market Key Takeaways

- The global small-scale LNG market was valued at USD 68.50billion in 2025.

- It is projected to reach USD 250.63billion by 2035.

- The small-scale LNG market is expected to grow at a CAGR of 13.85% from 2025 to 2035.

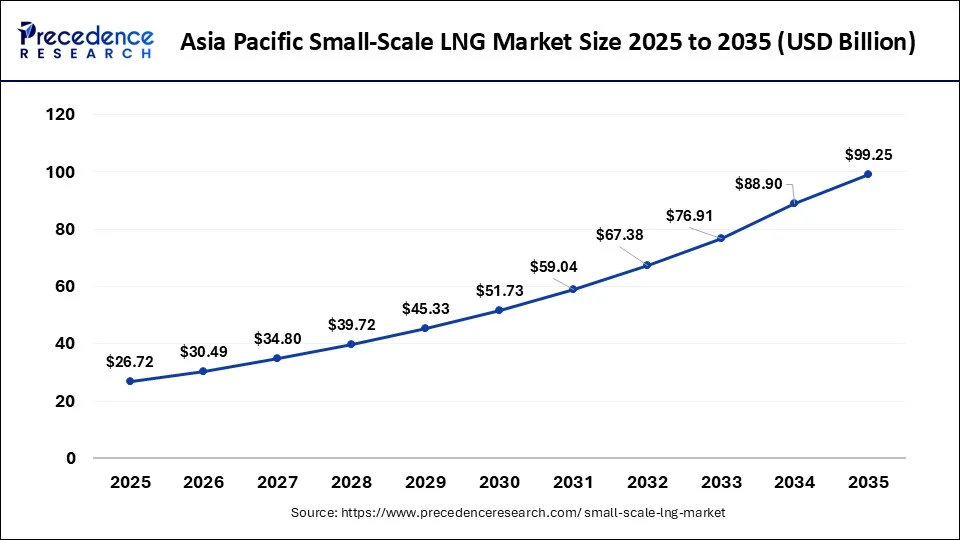

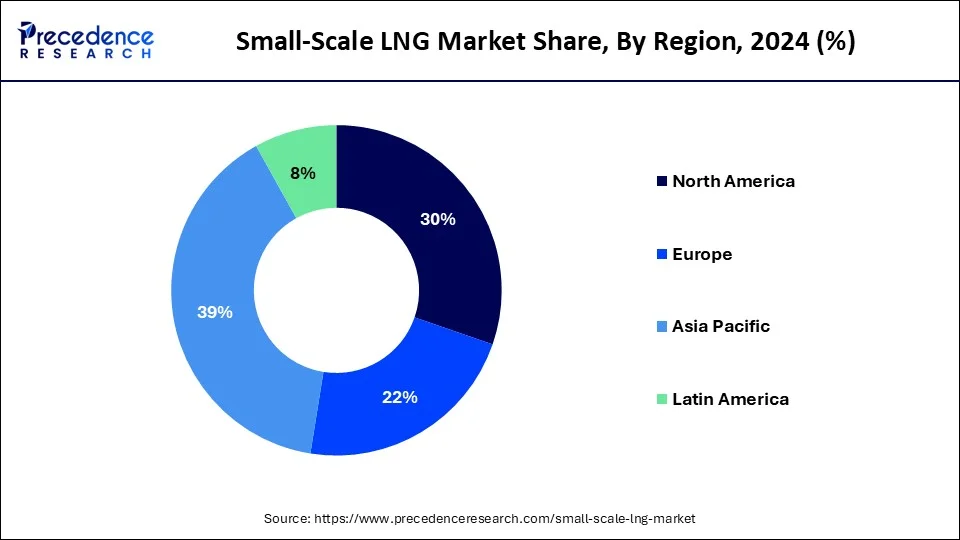

- Asia Pacific dominated the global small-scale LNG market with the largest market share of 39% in 2025.

- North America will show the fastest growth in the market over the forecast period.

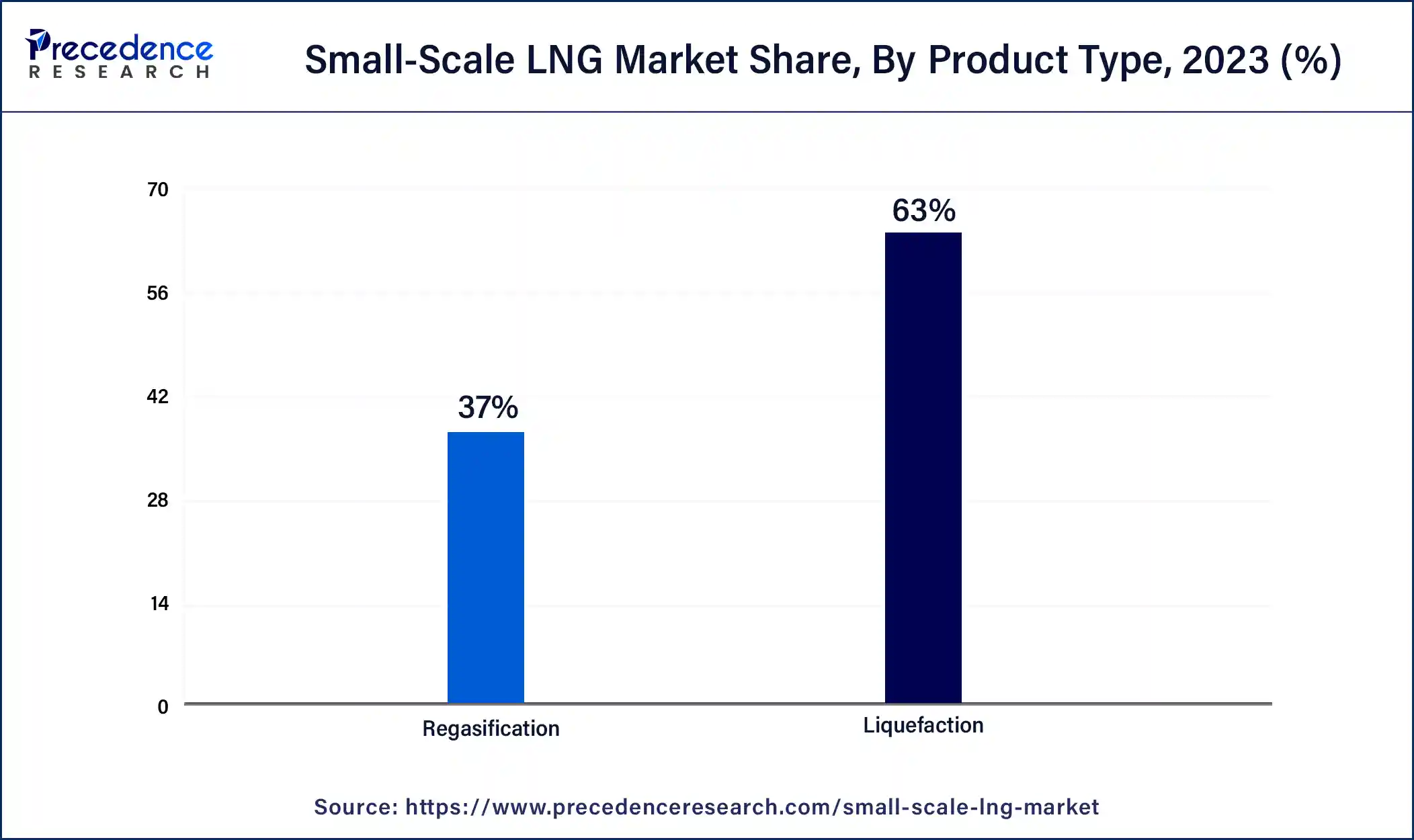

- By product type, the liquefaction segment contributed the biggest market share of 63% in 2025.

- By application, the heavy-duty segment led the market and is anticipated to grow further during the projected period.

- By mode of supply, the truck segment led the global market in 2025.

Market Overview

Small-scale liquefied natural gas is one processed in limited industrial capacity. The gas is converted into a colorless and odorless liquid that can be re-gasified for various uses after being stabilized to very low temperatures. Small-scale LNG is more environmentally friendly than diesel and oil and is generally used to fulfill off-grid power generation needs. Increasing the utilization of LNG fuel in the marine industry can drive the small-scale LNG market growth further.

Gas is widely used in the commercial, industrial, and residential sectors as a career fuel and for heating. There is an increasing global demand for LNG-powered ships and vehicles compared to diesel - or gasoline-powered vehicles. Furthermore, LNG-powered vehicles are eco-friendly and have reduced operating expenses because they don't emit hazardous emissions.

How AI is Transforming the Small-Scale LNG Market

AI, along with domain knowledge, offers a revolutionary solution in the small-scale LNG market. By using machine learning algorithms, AI optimizes the complex, non-linear connection between inputs and increased outputs of the production, lowers emissions, and also reduces variability. Furthermore, Predictive Maintenance Models can minimize downtime and stimulate maintenance schedules. AI algorithms can facilitate the smooth working of the overall production process, enabling AI to thrive in production.

- In July 2025, Honeywell acquired Air Products' LNG tech and business for USD 1.81 billion. The acquisition will build on Honeywell's energy transition capabilities by creating an end-to-end offering for customers worldwide. Due to the acquisition, Honeywell will offer customers a comprehensive, top-tier solution for managing their energy transformation journey.

Small-Scale LNG Market Growth Factors

- A collaborative approach among all departments in the production facilities is expected to propel the small-scale LNG market growth soon.

- LNG is viewed as a cleaner fossil energy than coal or oil, which can contribute to its market expansion.

- Growing innovation in the liquefication process of LNG.

- The rising energy transition and environmental concerns are the key factors driving market growth.

Small-Scale LNG Market Outlook

- Industry Growth Overview: The small-scale LNG market is on a steady rise as the need to find more clean fuel options in the power generation, marine transport, and industrial use increases. Market growth is also being caused by growth in regulations on emissions and access to remote areas that require energy.

- Global Expansion: It is being implemented more internationally in Europe and Asia-Pacific, and LNG bunkering, off-grid power, and fuel switching programs are the driving forces. The Southeast Asian, African, and Latin American market growth is rampant as investments in the infrastructure of LNG and distributed energy systems are taking place.

- Major Investors: Some of the major investors are Shell, TotalEnergies, BP, and ExxonMobil companies, among other energy giants, and they are busy building small-scale LNG portfolios. Brookfield Asset Management and BlackRock, which are infrastructure-oriented investors, are also investing in LNG terminals and logistics projects.

- Startup Ecosystem: There are such companies in the startup ecosystem as Gasfin, Cool Company, and Skangas, whose area of activity is modular LNG solutions and small-scale liquefaction. Such start-ups focus on flexible distribution, cost effectiveness, and LNG deployment in marine and remote industries.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 250.63 Billion |

| Market Size in 2025 | USD 68.50 Billion |

| Market Size in 2026 | USD 78.18 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 13.85% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application, Mode of Supply, and Regions. |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

High demand for small-scale liquefied natural gas

Increasing demand for energy-efficient and cheap energy sources is the primary factor driving the small-scale LNG market growth along with the growing acceptance in the transportation industry. Additionally, the increasing need for liquefied natural gas has raised the demand for it, which ultimately results in growing LNG output. Various remote regions lack electricity, and government initiatives to enhance rural electrification have raised the demand for liquefied natural gas in future endeavors.

- In April 2025, TotalEnergies announced the final investment decision (FID) of the Marsa LNG project in Oman, combining upstream gas production, downstream gas liquefaction, and renewable power generation to position the Sultanate as a hub for low-carbon LNG bunkering operations. The Marsa LNG plant will be 100% electrically driven and supplied with solar power, positioning the site as one of the lowest GHG emissions intensity LNG plants ever built worldwide, with a GHG intensity below 3 kg CO2e/boe.

Restraints

Supply chain disruptions

The disruption in supply change management due to various economic or environmental reasons is expected to hamper market growth during the forecast period. Moreover, the per KG operating cost for the small-scale LNG market is high compared to mid- and large-size liquefied natural gas.

Opportunity

Increased modular solutions and rising LNG bunkering facilities

The small-scale LNG market is experiencing a growth in portable LNG solutions and modular liquefaction plants. These module units provide scalability and flexibility, enabling rapid deployment and cheap expansion of LNG infrastructure in remote regions. Furthermore, the growing utilization of Small-scale LNG bunkering facilities catering to the increasing need for LNG as a marine fuel can further strengthen the market presence. These facilities also enable convenient refueling of LNG-powered vessels.

- In April 2025, Seaspan Energy launched the second of its three 7600m3 LNG bunkering vessels, the Seaspan Lions, named after the twin peaks of the North Shore, known as Ch'ich'iyúy Elxwíkn. to the Squamish Nation. The Seaspan Lions will provide LNG fuelling services for vessels on the West Coast of North America, becoming the first company to provide LNG bunkering in the Pacific Northwest.

Segment Insights

Product Type Insights

The liquefaction segment dominated the small-scale LNG market in 2024 and is expected to grow rapidly over the forecast period. The growth of the segment can be attributed to the increasing production of LNG from various places like from the deep in the gas basins. The growth of liquefaction infrastructure, along with the expanding export opportunities, drives the segmental growth. Additionally, there has been an upsurge in the establishment of liquefaction terminals across the globe to meet the growing demand for liquidation.

- In April 2025, the Petroleum and Natural Gas Regulatory Board (PNGRB) and the Indian Gas Exchange (IGX) launched contracts for small-scale liquefied natural gas on its platform in a bid to address the demand for fuel in areas not connected to the national gas grid. The introduction of LNG contracts on IGX aims to address the growing gas demand from industries and CGD (City Gas Distribution) companies that do not have access to pipeline networks.

Application Insights

The heavy-duty segment led the small-scale LNG market in 2024 and is anticipated to grow further during the projected period. The dominance and growth of the segment can be attributed to the growing use of long-haul LNG-fueled trucks across the globe, along with the versatility and sustainable options offered by LNG in heavy-duty vehicles, showing its potential to fuel positive environmental impact to fulfill the demands of the transportation sector. Furthermore, the rising adoption of LNG as an alternative fuel in heavy-duty vehicles, especially in European countries and China, boosts segmental growth further.

- In January 2025, JD Logistics, the logistics division of JD.com, announced its large-scale implementation of hydrogen-powered heavy-duty trucks, marking a first in China's logistics sector. This initiative aligns with the company's long-standing commitment to clean energy usage and environmental stewardship. The new fleet consists of 9.6-meter heavy-duty logistics trucks, each with an 18-ton carrying capacity.

- In April 2025, the Cargo handling system order for the LNG bunkering vessel reinforces Wärtsilä's leading position in small-scale LNG applications. The vessel is co-financed by the Support for Sustainable and Digital Transport Programme, part of the Recovery, Transformation and Resilience Plan from the Spanish Ministry of Transport, Mobility and Urban Agenda.

Mode of Supply Insights

The truck segment led the global small-scale LNG market in 2025. This is because trucks can navigate different paths and deliver LNG to challenging and remote locations that are out of reach of pipelines and other infrastructure. Moreover, the mobility and flexibility of trucks make them sophisticated tools for transporting LNG to various locations. Developments in tracking technologies like enhanced LNG storage and fueling systems have made it more effective to transport and distribute LNG via trucks.

- In December 2025, French LNG terminal operator Elengy, a unit of Engie's GRTgaz, increased the truck loading capacity at its Fos Cavaou terminal on France's Mediterranean coast. The new loading bays at Fos Cavaou join the two existing ones, thus doubling the terminal's loading capacity to 22,000 slots per year. According to Elengy, the firm invested 10 million euros in these two new facilities.

- In May 2025, Commercial vehicle manufacturer MAN Truck & Bus plans to launch its first trucks with hydrogen combustion engines in 2025. The small series is set to comprise around 200 units. The new MAN hTGX is to be delivered to customers in Germany, the Netherlands, Norway, Iceland, and selected non-European countries.

Regional Insights

What is the Asia Pacific Small-Scale LNG Market Size?

The Asia Pacific small-scale LNG market size was exhibited at USD 26.72 billion in 2025 and is projected to be worth around USD 99.25 billion by 2035, poised to grow at a CAGR of 14.02% from 2026 to 2035.

Asia Pacific dominated the small-scale LNG market in 2025. The dominance of the region can be linked to the growing utilization of LNG in power generation and production industries. Furthermore, Asia Pacific has stringent environmental regulations which are meant to reduce greenhouse gas emissions. LNG offers an opportunity for businesses to meet energy demands while disparaging environmental regulations. Furthermore, the region is also witnessing infrastructural and technological developments.

- In April 2025, The Union Minister for Petroleum and Natural Gas recently inaugurated India's first small-scale liquefied natural gas (SSLNG) unit at GAIL (India) Ltd's Vijaipur complex in Madhya Pradesh. This development is part of the government's broader initiative to promote the use of natural gas in various sectors and increase its share in the country's primary energy mix to 15% by 2030.

- In June 2022, two small-scale liquefaction skids that can produce LNG on a pilot basis were ordered by the Gas Authority of India Limited (GAIL). These facilitate the construction of LNG fuel stations and bunkering facilities and will liquefy natural gas for distribution through the new city gas distribution (CGD) network.

North America will show the fastest growth in the small-scale LNG market over the forecast period. The growth of the segment can be credited to the rising demand for fiber cement small-scale liquefied natural gas in the region. The high demand for LNG in the region is propelled by the abundance of shale gas deposits in nations like the United States. Moreover, there is a rise in government focus on growing renewable energy sources in the region.

Why Is the European Small-Scale LNG Market Experiencing Notable Growth?

The European market is experiencing a high growth rate due to the high concentration of the region with energy security, decarbonization, and investment in fuel diversification. Since disruptions of supply and loss of reliance on pipeline gas, European nations are switching to using small-scale LNG in generating distributed power, heating industries, and transportation. Also, the government subsidies, international LNG trade, and investments in modular liquefaction and regasification facilities are speeding up the small-scale LNG deployment spread in Europe.

The UK Small-Scale LNG Market Trend

The UK's market is experiencing a stable development due to growing industrial, marine, and transportation demand for cleaner fuels. LNG is also becoming popular as a transition fuel to help the UK achieve its net-zero goals and to be able to maintain a consistent energy supply. The market trends are the growth of LNG bunkering services at large ports, the increased use of LNG-powered trucks and vessels, and the increased number of satellite LNG terminals.

Why Is the MEA Small-Scale LNG Market Gaining Momentum?

The Middle East and Africa market is becoming a trend with the growing energy demands, fuel diversification requirements, and growing attention to cleaner energy sources. The increasing industrialization in many countries in the region results in many countries having gaps in power supply, and as a result, small-scale LNG is an effective solution to distributed generation of power and the use of industrial fuels.

The demand is also increasing as a result of expanded LNG bunkering, mining activities, and off-grid power developments.

UAE Small-Scale LNG Market Trend

The UAE is the leader of the MEA small-scale LNG market, which is supported by good gas reserves and developed energy infrastructure. Such nations are investing in LNG to industrialize, transport, and marine bunkers to facilitate sustainability measures. South Africa is an important player in Africa due to power shortages and rising dependency on LNG as a source of gas-to-power initiatives. Egypt is also becoming one of the regional centres owing to its LNG exports and its increasing domestic demand.

Why Is the Latin American Small-Scale LNG Market Emerging Rapidly?

The Latin American market is driven by the growing need to have some reliable energy sources that are cleaner in production and use in the power generation, transportation, and industrial fields. The use of LNG is gradually substituting the use of diesel in power plants, mining activities, and heavy transportation, as the substance has fewer emissions and enhanced cost efficiency.

Governments and other players are being forced to invest in LNG infrastructure by the increasing environmental regulations and energy security concerns.

Brazil Small-Scale LNG Market Trend

Brazil is in charge of the market, and its demand is high in the industry and power generation segments. The significant energy market and increased LNG imports in Brazil provide a market-wide support, and Chile has used LNG extensively to improve energy security. Another major contributing factor is Mexico, due to the industrial development and the cross-border trade of LNG with the United States. Argentina is developing quickly, which is facilitated by the development of shale gas and the growing LNG infrastructure.

Top Ten Natural Gas Consumption Countries

| Rank | Country | Annual gas consumption (MMcf) |

| 1 | United States | 27,243,858,000 |

| 2 | Russia | 15,538,246,850 |

| 3 | China | 6,738,151,620 |

| 4 | Iran | 6,567,636,495 |

| 5 | Japan | 4,364,157,070 |

| 6 | Canada | 4,053,420,385 |

| 7 | Saudi Arabia | 3,614,137,100 |

| 8 | Germany | 2,872,839,935 |

| 9 | Mexico | 2,756,000,000 |

| 10 | United Arab Emirates | 2,621,818,538 |

Value Chain Analysis-Small-Scale LNG Market

- Infrastructure Development: The development of ports, roads, railways, warehouses, and logistics parks to provide free transit of cargo, expansion of storage facilities, and multimodal transport networks.

Key players: DP World, PSA International, Adani Ports, Hutchison Ports, Brookfield Infrastructure - Warehousing and Inventory Management: Modern warehouses use automation, cold storage, and inventory software to be able to accomplish good stock management, real-time tracking, and space optimization.

Key players: Prologis, DHL Supply Chain, GXO Logistics, Lineage Logistics, Kuehne+Nagel - Logistics Technology and Platform Development: The digital platforms are a combination of AI, IoT, route optimization, and real-time visibility, which enhance the efficiency and experience of the logistics network systems.

Key players: SAP, Oracle, Manhattan Associates, Project44, FourKites

Small-Scale LNG Market Companies

- Engie

- Linde plc

- Wärtsilä

- Gazprom

- Royal Dutch Shell plc

- Chart Industries, Inc.

- Honeywell International Inc.

- Gasum Oy

- Skangas AS

- Total SE

- Eni S.p.A.

- Stabilis Energy

- Novatek

- Air Products and Chemicals, Inc.

- China National Offshore Oil Corporation (CNOOC)

- Petronas

- Sempra Energy

- Mitsubishi Corporation

- ConocoPhillips Company

- BP plc

Recent Developments

- In July 2024, DESFA reported the opening of a new small-scale LNG station in Aspro Skydras to enhance LNG supply to transportation and industrial use. The initiative helps Greece to move towards clean energy and increase its strategic presence in the regional energy market.

(Source: https://www.lngindustry.com ) - In July 2024, New Fortress Energy sold its Miami small-scale liquefaction and storage facility and is supposed to close it in Q3 2024. The divestment is in line with the NFE strategy of cutting its debts and reinvesting in higher-yielding downstream activities.

(Source: https://ir.newfortressenergy.com ) - In November 2023,a subsidiary of Engie's GRTgaz, Elengy, inaugurated a novel small-scale LNG carrier loading operation at its Fos Tonkin terminal situated along the Mediterranean coast of France.

- In March 2022, Avenir LNG Limited acquired HIGAS Srl, an Italian firm that administers and owns LNG terminals on a small scale. For this acquisition, fortifying the organization's position in the European market was the primary objective.

- In March 2022, MAN Energy Solutions and Woodside Energy inked a partnership agreement to commercialize Factory LNG, a method for small—to medium-scale LNG production.

Segments Covered in the Report

By Product Type

- Liquefaction

- Regasification

By Application

- Heavy-duty vehicles

- Marine transport

- Industrial & power

- Other applications

By Mode of Supply

- Trucks

- Trans-shipment & Bunkering

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting