What is the On-Demand Warehousing Market Size?

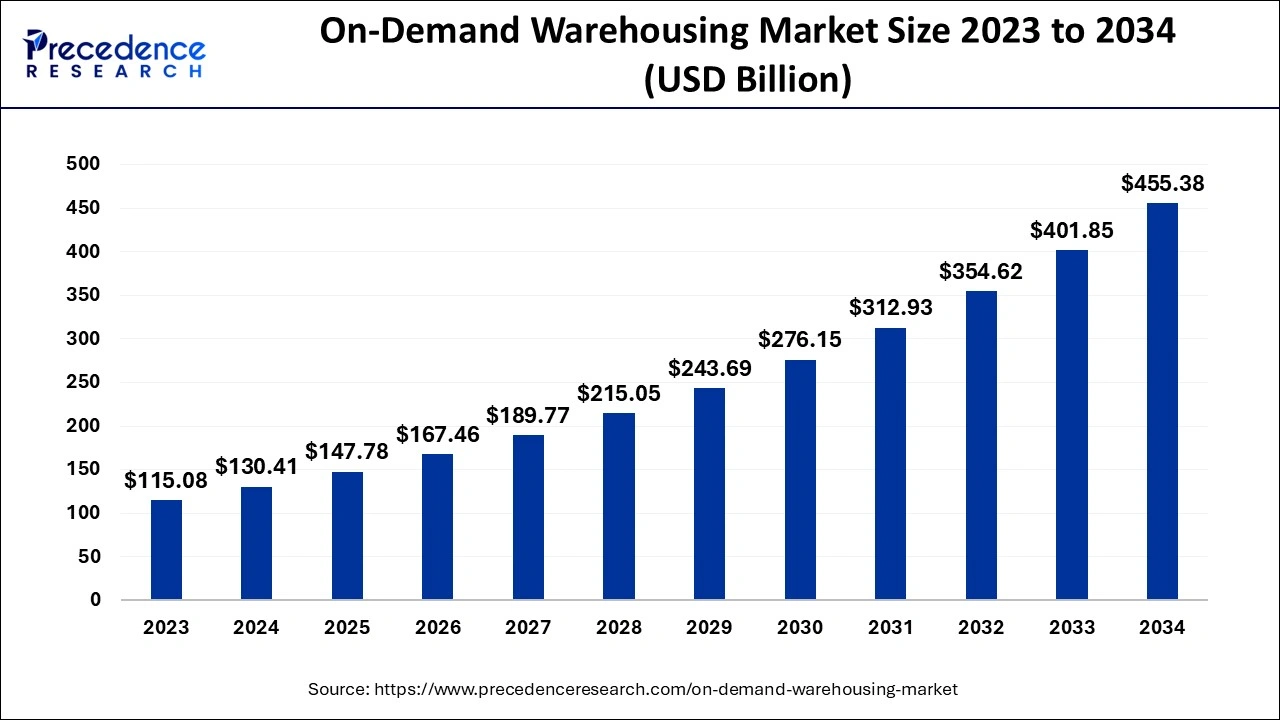

The global on-demand warehousing market size is accounted at USD 147.78 billion in 2025 and predicted to increase from USD 167.46 billion in 2026 to approximately USD 455.38 billion by 2034, expanding at a CAGR of 13.32% from 2025 to 2034. The on-demand warehousing market growth is attributed to the increasing demand for flexible and efficient logistics solutions driven by the rise of e-commerce and changing consumer preferences.

On-Demand Warehousing Market Key Takeaways

- The global on-demand warehousing market was valued at USD 130.41 billion in 2024.

- It is projected to reach USD 455.38 billion by 2034.

- The on-demand warehousing market is expected to grow at a CAGR of 13.32% from 2025 to 2034.

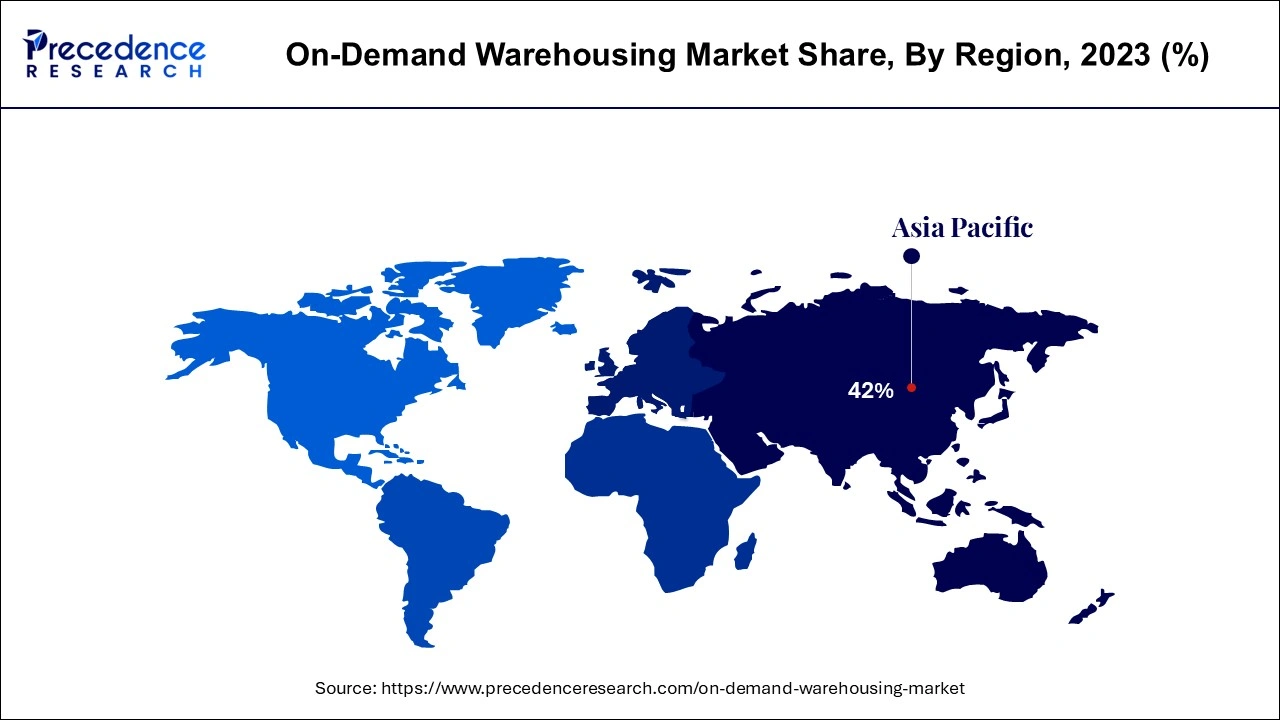

- Asia Pacific dominated the on-demand warehousing market with the largest market share of 42% in 2024.

- North America is projected to host the fastest-growing market in the coming years.

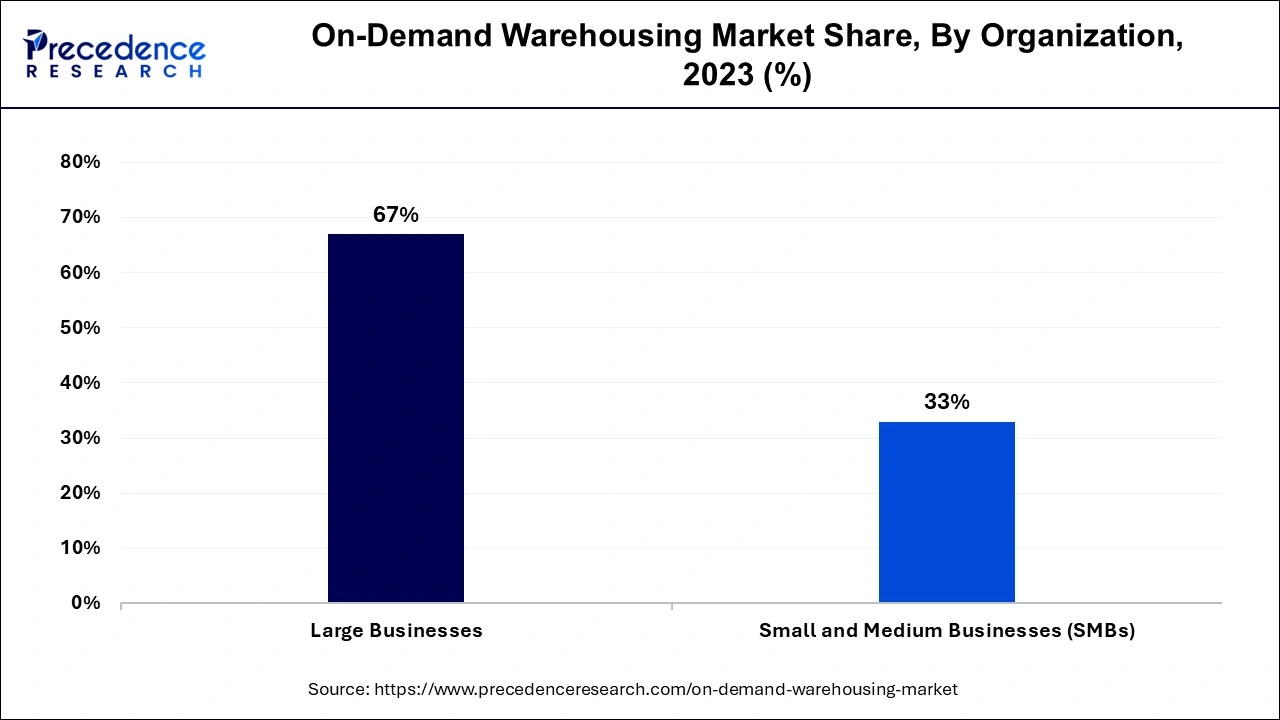

- By organization size, the large segment accounted for the highest market share of 67% in 2024.

- By organizations, the small & medium businesses segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By industry vertical, the manufacturing segment accounted for a considerable share of the market in 2024.

- By industry vertical, the retail & E-commerce segment is anticipated to grow with the highest CAGR in the market during the studied years.

Impact of Artificial Intelligence on the On-demand Warehousing Market

In the on-demand warehousing market, AI helps companies minimize inventories, predict customer demand, and decrease costs. AI predicts the requisites of inventory accurately, so stock out or overstocking rarely. High-technology solutions, such as robots and self-driving automobiles, enhance the control of the material flow and enable minimum dependence on manual operations. This increased automation optimizes order deliverability, blend accuracy, and flow from storage to distribution. Furthermore, this technology improves customer satisfaction, as the status can be monitored in real-time, and delivery estimates are usually accurate to meet the transparency requirement of modern society.

On-Demand Warehousing Market Booms with E-Commerce and Sustainable Logistics Trends

Growing needs for dynamic and specifically tailored logistic services lead to a strong and consistent development of the on-demand warehousing market. The increasing trend in online selling has subsequently made organizations look for flexible and versatile solutions for their warehouses. This changing inventory demand and the need to provide swift delivery for customer orders creates demand for these on-demand warehousing solutions.

- The U.S. Department of Commerce reported in 2023 that e-commerce sales recorded a 15.5% rise due to consumer behavioral changes that need flexibility in warehousing methods.

The on-demand warehousing market provides critical solutions that businesses need to leverage to target modern consumers' demands enabled by these technologies. Additionally, the growing shift to sustainability improves the popularity of the flexible warehousing models since companies and logistic providers want to have sustainable storage operations while minimizing their impacts on the environment.

On-Demand Warehousing Market Growth Factors

- Rapid urbanization: Increasing urban population is driving demand for efficient logistics and warehousing solutions to support local consumption trends.

- Evolving consumer expectations: The growing expectation for fast and flexible delivery options is prompting businesses to adopt on-demand warehousing for improved service levels.

- Global supply chain disruptions: Recent global disruptions, such as pandemics and geopolitical tensions, are pushing companies to diversify their supply chains and incorporate flexible warehousing strategies.

- Rising labor costs: Increasing labor costs are driving companies to automate their warehousing processes, making on-demand solutions more attractive.

- Technological advancements: Innovations in warehouse management systems (WMS) and robotics are enhancing the efficiency and scalability of on-demand warehousing operations.

- Sustainability initiatives: The growing focus on sustainability and carbon footprint reduction is encouraging companies to invest in flexible warehousing solutions that align with eco-friendly practices.

- Increased investment in e-commerce: The surge in investment in e-commerce platforms and infrastructure is creating a higher demand for adaptable warehousing solutions to support the expanding online retail sector.

Market Outlook

- Industry Growth Overview- The market is growing rapidly due to rising e-commerce, fluctuating inventory demands, and the need for flexible, technology-driven storage solutions, enabling businesses to optimize space, reduce costs, and ensure faster order fulfillment.

- Major Investors- Major investors in the market include private equity, real estate funds, and logistics venture capital, collectively investing billions to support scalability and flexible storage platforms.

- Global Expansion- The global on-demand warehousing market is rapidly expanding as e-commerce, supply chain flexibility, and pay-as-you-go storage models take off worldwide.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 455.38 Billion |

| Market Size in 2026 | USD 167.46 Billion |

| Market Size in 2025 | USD 147.78 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 13.32% |

| Largest Market | North America |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Organization, Industry Vertical, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East, & Africa |

Market Dynamics

Driver

Increasing e-commerce demand

Increasing e-commerce demand is expected to drive the growth of the on-demand warehousing market. The rise of digitalization in trade agreements and the use of sophisticated technology solution tools that support trade compliance further boost the market. About 64% of manufacturers, retailers, and logistics firms are either using cross-border e-commerce or are eager to join this market within the upcoming year, facilitating the demand for on-demand warehousing solutions.

- The International Trade Administration reports that global B2C e-commerce revenue is projected to reach USD 5.5 trillion by 2027, driven by a robust compound annual growth rate of 14.4%.

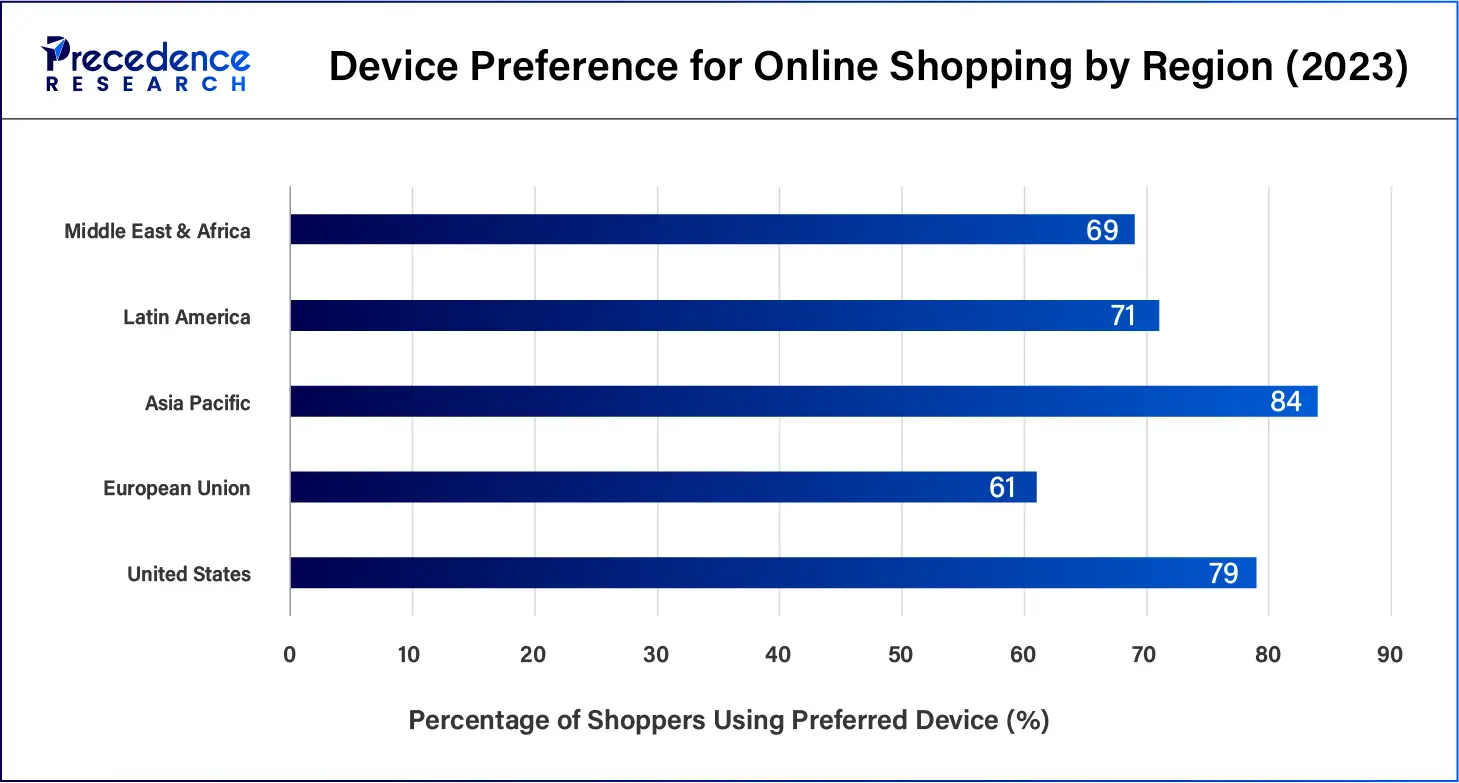

- Data published by Avalara in collaboration with Reuters Events suggests that the cross-border expansion continues with the top growth regions, including the Asia Pacific, Latin America, and the Middle East and Africa, already dominating the global market outside regions like North America and Europe.

| Region | Preferred Shopping Device | % of Online Shoppers Using Device | Popular Product Category |

| United States | Mobile | 79% | Electronics, Apparel |

| European Union | Desktop | 61% | Fashion, Personal Care |

| Asia Pacific | Mobile | 84% | Electronics, Beauty |

| Latin America | Mobile | 71% | Apparel, Electronics |

| Middle East & Africa | Mobile | 69% | Electronics, Groceries |

Restraint

Impede limited accessibility to remote locations

The limited reach of the on-demand warehousing market in remote or rural areas is expected to hamper market growth. Most on-demand warehousing service providers exist in urban areas where demand for their services is high while leaving rural areas, which experience both a challenge and high storage costs. This model is inclined to the urban markets, thus leaving the businesses that sell products to the rural markets with limited options in terms of managing flexibility in storage. Furthermore, the lack of centers in rural areas for companies in agriculture or manufacturing requires the service for distributing products.

Opportunity

Increasing adoption of advanced technologies

Increasing adoption of automation, artificial intelligence (AI), and Internet of Things (IoT) technologies presents a significant opportunity for the on-demand warehousing market. Technologies increase inventories, operations, and order fulfillment through the latest technologies in the supply chain. Integration of robotics minimizes human intervention, hence cutting on errors, while smart technologies enable efficient use of space. The IoT technology grants real-time data on the state of stocks, hence efficient control of the same. Furthermore, a large number of businesses are shifting to accurate, efficient, and competitive warehousing services.

- The World Economic Forum estimated that automation of logistics will increase by 50% in the next three years due to high demand for efficiency and reduced cost.

- The U.S. Department of Commerce pointed out that about 60% of logistics companies are already using AI in their operations and decision-making.

Organizations Insights

The large segment held a dominant presence in the on-demand warehousing market in 2024, owing to their rising dependence on sophisticated warehousing solutions wed to strategic imperatives. Through this investment, they are in a position to work efficiently, eliminate the long cycle of production, and experience an efficient reduction in large fluctuations of inventory during their busy season.

- A report from the U.S. Department of Commerce points out that 80% of big companies are investing in automation and AI technologies for warehouses.

- The Council of Supply Chain Management Professionals predicted that by the end of 2024, about 75% of large enterprises use on-demand warehousing to respond adequately to the increasing complexities of international supply chains.

The small & medium businesses segment is expected to grow at the fastest rate in the on-demand warehousing market during the forecast period of 2024 to 2034, as they require quality customization and flexibility at a relatively cheaper and affordable rate compared to large, established businesses. SMBs require a system enabling them to address the issue of the dynamic volume of inventory without signing contracts for the space for years.

- The U.S. Small Business Administration survey revealed that about 72% of small businesses struggled with fulfilling the demand during specific seasons hence the criticality of flexible warehousing solutions.

- The National Federation of Independent Business estimated that 62% of SMBs intended to boost their investment in logistics solutions.

Industry Vertical Insights

The manufacturing segment accounted for a considerable share of the on-demand warehousing market in 2024, owing to the demands for efficient stock storage and elastic logistics services. Companies are looking for flexible warehousing solutions for the changing demand schedule in production. Furthermore, this trend boosts the demand for technologies that are efficient in the use of space and supply chain logistics.

- The National Association of Manufacturers surveyed 110 firms and noted that 70% of those that manufactured reported concerns relating to quick shifts in demand, which forced them to rely on on-demand warehousing.

The retail & E-commerce segment is anticipated to grow with the highest CAGR in the on-demand warehousing market during the studied years, as the market primarily focuses on digital platforms and quick delivery. Technology has advanced dramatically in the last few years, and e-shopping has increased exponentially over the same period. Retailers are now incorporating demand warehousing to make improvements to their stock handling to meet consumer demands for speed of delivery. Additionally, the retailers aim to adopt flexible warehousing solutions.

- According to the U.S. Department of Commerce, there has been a 15% increase in e-shopping sales in 2023.

Regional Insights

Asia Pacific On-Demand Warehousing Market Size and Growth 2025 to 2034

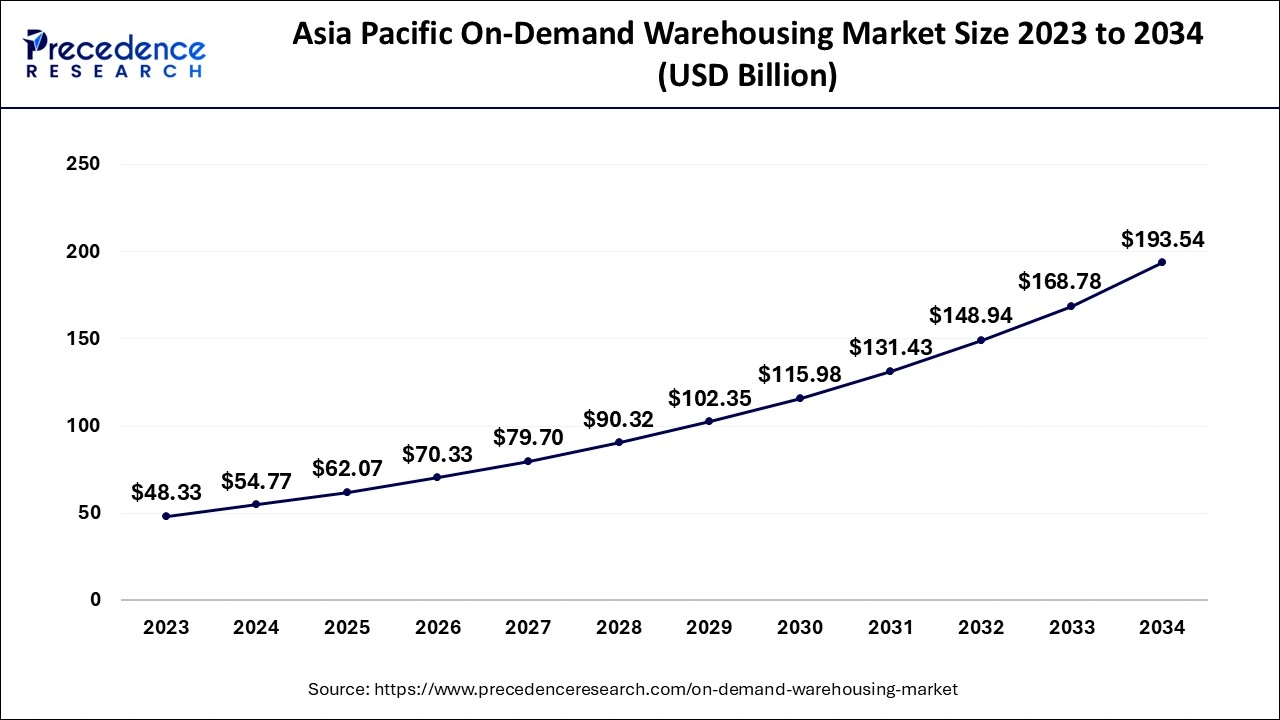

The Asia Pacific on-demand warehousing market size is evaluated at USD 62.07 billion in 2025 and is projected to be worth around USD 193.54 billion by 2034, growing at a CAGR of 13.45% from 2025 to 2034.

Asia Pacific held the largest share of the on-demand warehousing market in 2024, owing to the rapidly growing e-commerce industry and more logistics investments. The newly emergent middle-income population is projected to drive online shopping, thus creating incremental demand for more flexibility in warehousing facilities in the region. Logistics and transportation, being critical in fulfilling requirements of on-demand warehousing, have witnessed a rise.

North America is projected to host the fastest-growing on-demand warehousing market in the coming years, due to the growing number of e-commerce companies, and fast-evolving logistics requirements. This trend is expected to sustain, as several businesses seek on-demand warehousing services since consumers require better time to deliver and prompt supply chain transformation.

- According to the National Retail Federation consumer forecast, e-commerce sales are set to grow at a rate of around 10% a year up to 2024, thus fuelling the market in the coming years.

E-Commerce Growth and Flexibility Drive China's Market

The China market is increasing due to rapid e-commerce growth, rising consumer demand for faster delivery, and the need for flexible storage solutions. Businesses are adopting on-demand models to efficiently manage fluctuating inventory and reduce operational costs. Additionally, advancements in warehouse management technologies and the government's focus on modern logistics infrastructure are further driving the expansion of on-demand warehousing across China.

U.S. On-Demand Warehousing Soars with E-Commerce and Agile Logistics Needs

The U.S. market is increasing due to the rapid expansion of e-commerce and growing consumer expectations for faster, flexible deliveries. Companies are leveraging on-demand warehouses to optimize space, manage seasonal inventory fluctuations, and reduce operational costs. Additionally, advancements in warehouse management systems, automation, and the rising trend of sustainable logistics solutions are further driving the adoption of on-demand warehousing across the U.S.

Europe Embraces Flexible Warehousing to Meet Rising E-Commerce Demand

The Europe on-demand warehousing market is growing due to increasing e-commerce penetration, rising consumer demand for fast and flexible delivery, and the need for cost-efficient storage solutions. Businesses are adopting on-demand models to manage seasonal inventory fluctuations and optimize warehouse space. Additionally, advancements in warehouse management technologies, automation, and a focus on sustainable logistics practices are further driving the adoption of on-demand warehousing across Europe.

Flexibility and speed Drive Growth in the UK

The UK market is increasing due to rapid e-commerce growth, rising consumer expectations for fast delivery, and the need for flexible storage solutions. Businesses are adopting on-demand models to efficiently manage seasonal inventory, optimize warehouse space, and reduce operational costs. Additionally, advancements in warehouse management technologies, automation, and sustainable logistics practices are further boosting the adoption of on-demand warehousing across the UK.

Value Chain Analysis

- Infrastructure Development

On-demand warehousing infrastructure emphasizes flexible, tech-enabled facilities in strategic locations to efficiently handle changing inventory demands.

Key Players: Prologis, Flexe, Ware2Go, Flowspace, and Stord. - Warehousing and Inventory Management

On-demand warehousing uses a flexible, pay-as-you-go model with technology to manage inventory and connect businesses to shared warehouse networks.

Key Players: Flexe, Flowspace, Stord, Ware2Go, and Prologis. - Regulatory Compliance and Customs Clearance

On-demand warehousing follows all relevant customs, safety, and security regulations to ensure compliant operations.

Key Players: XPO Logistics, DB Schenker, CEVA Logistics, Ryder, and Kuehne + Nagel.

Top Vendors and their Offerings

- Extensive: Provides flexible warehousing and distribution solutions with scalable storage and inventory management services.

- Flexe: Offers on-demand warehousing, fulfillment, and logistics network solutions for flexible inventory management.

- Flowspace: Delivers cloud-based warehouse management, fulfillment, and storage solutions for e-commerce and retail businesses.

- Red Stag Fulfillment: Specializes in e-commerce fulfillment, including warehousing, shipping, and returns management with a focus on accuracy and speed.

- ShipBob, Inc.: Provides tech-enabled fulfillment and distributed warehousing services for fast and reliable order delivery.

On-Demand Warehousing Market Companies

- Stord, Inc.

- Ware2Go Inc.

- Waredock Estonia LLC

- Wareflex

- ZhenHub Technologies Ltd.

Recent Developments

- In October 2024, Amazon announced the launch of two new robotic systems named Sequoia and Digit, designed to enhance efficiency and safety in their fulfillment centers. Sequoia can identify and store inventory 75% faster, significantly improving order processing times by up to 25%. Digit, a bipedal robot, is expected to assist in tasks such as tote recycling within warehouse operations, marking a substantial step in automating the workforce and enhancing employee safety.

- In April 2024, Zebra Technologies launched a suite of advanced warehousing technologies, including a new AI-driven inventory management system. This technology integrates real-time data analytics to streamline operations and improve inventory accuracy.

- In June 2024, Kinaxia Logistics introduced a new on-demand warehousing service aimed at providing greater flexibility for businesses facing seasonal demand fluctuations. This service allows customers to store and dispatch goods without long-term contracts, enhancing their supply chain agility.

Latest Announcements by Industry Leaders

- June 05, 2024 – LTS Global Solutions

- Managing Director - Dave Hands

- Announcement- LTS Global Solutions, a leading provider in logistics and supply chain management, has introduced its Warehouse as a Service (WaaS) offering in response to the growing demand for flexible warehousing options. Dave remarked, “Our decision to launch the Warehouse as a Service was directly influenced by our commitment to understanding the evolving needs of our customers and adapting to the dynamic shifts within the marketplace.”

Segments Covered in the Report

By Organization

- Large Businesses

- Small and Medium Businesses (Smbs)

By Industry Vertical

- Retail and E-Commerce

- Healthcare

- Manufacturing

- Food and Beverage

- Automotive

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content