What is the AI Robotics in Warehousing Market Size?

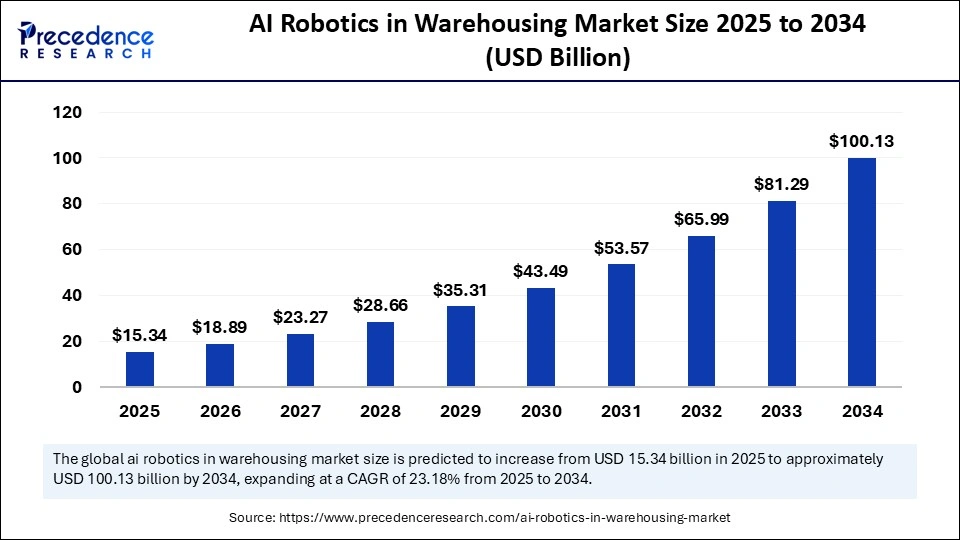

The global AI robotics in warehousing market size was calculated at USD 12.45 billion in 2024 and is predicted to increase from USD 15.34 billion in 2025 to approximately USD 100.13 billion by 2034, expanding at a CAGR of 23.18% from 2025 to 2034. The market growth is attributed to increasing demand for faster, more accurate, and cost-efficient warehouse operations driven by e-commerce expansion and labour shortages.

Market Highlights

- North America segment held a dominant presence in the market in 2024, accounting for an estimated 40% market share.

- The Asia Pacific segment is expected to grow at the fastest rate in the market during the forecast period of 2025 to 2034.

- By robot type, the automated guided vehicles (AGVs) segment accounted for a considerable share of the market in 2024 that holding a market share of about 40%.

- By robot type, the autonomous mobile robots (AMRs) segment is projected to experience the highest growth rate in the AI robotics in warehousing market between 2025 and 2034.

- By function/application, the picking & packing segment led the market, accounting for an estimated 38% market share in 2024.

- By function/application, the inventory management & tracking segment is set to experience the fastest rate of market growth.

- By AI capability, the machine learning & predictive analytics segment registered its dominance over the market in 2024, which held a market share of about 42%.

- By AI capability, the computer vision & imaging segment is anticipated to grow with the highest CAGR in the AI robotics in warehousing market during the studied years.

- By end user, the E-commerce & retail segment dominated the market, accounting for an estimated 45% market share in 2024.

- By manufacturing tech, the third-party logistics providers (3PLs) segment is projected to expand rapidly in the market in the coming years.

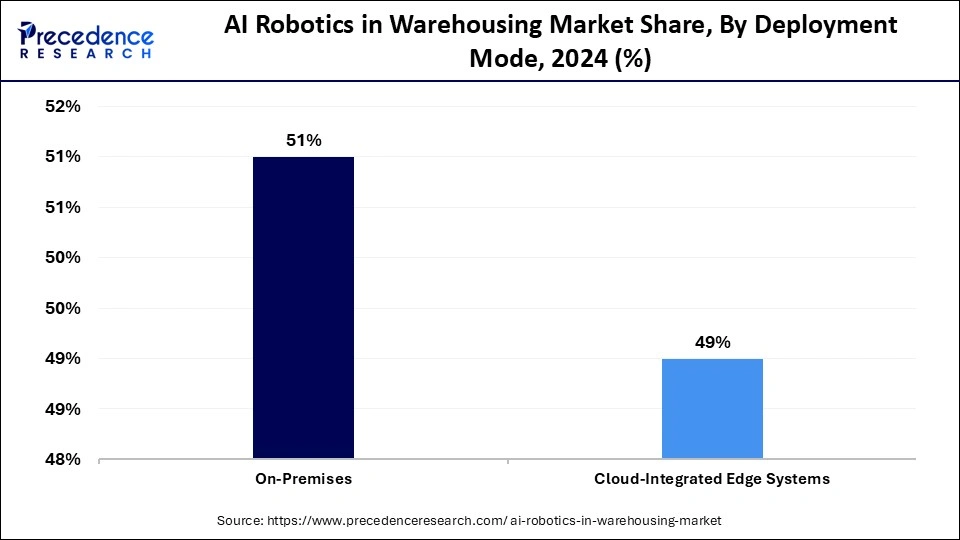

- By deployment mode, the on-premises segment maintained a leading position in the market in 2024 that holding a market share of about 51%.

- By deployment mode, the cloud-integrated edge systems segment is predicted to witness significant growth in the market over the forecast period.

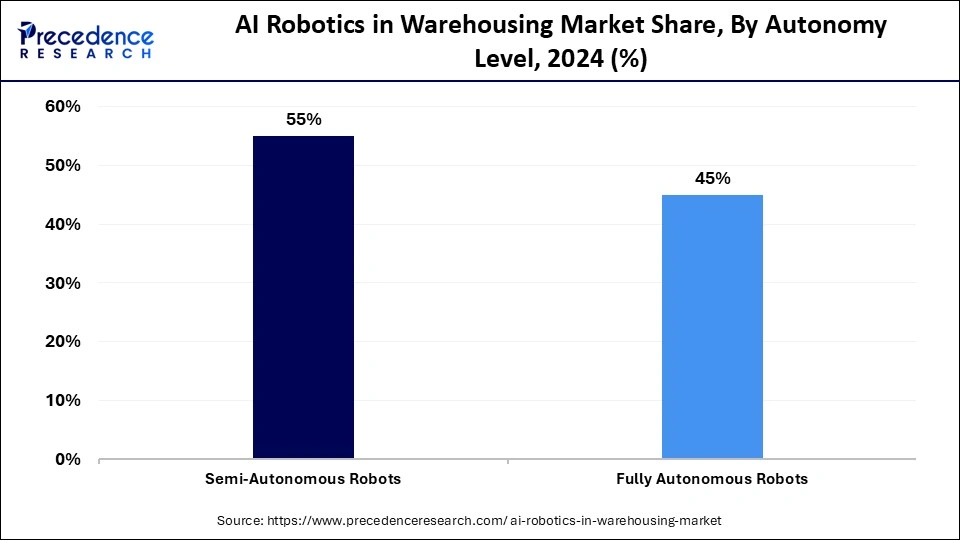

- By autonomy level, the semi-autonomous robots segment captured a significant portion of the market in 2024, accounting for an estimated 55% market share.

- By autonomy level, the fully autonomous robots segment will gain a significant share of the AI robotics in warehousing market over the studied period of 2025 to 2034.

Market Size and Forecast

- Market Size in 2024: USD 12.45 Billion

- Market Size in 2025: USD 15.34 Billion

- Forecasted Market Size by 2034: USD 100.13 Billion

- CAGR (2025-2034): 23.18%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

What Is the AI Robotics in Warehousing Market?

The fast rise of e-commerce is expected to motivate the implementation of AI-based robotics in warehousing. Companies aiming to fulfil the requirements of consumers concerning quicker delivery obligations. The AI robotics technology includes autonomous mobile robots (AMRs), autonomous guided vehicles (AGVs), and robotic arms with machine learning and computer vision to make their functioning more efficient.

In 2024, the International Federation of Robotics (IFR) estimates that AI-powered robots in the logistics sector will be used increasingly in the future. They can autonomously deliver goods and services with little human interference. Such systems make possible real-time inventory control, accurate picking of orders, and real-time routing, which reduces labour expenses and enhances throughput. Furthermore, the strategic value of robotics in improving supply chain resilience is becoming known to governments across the globe.(Source: https://ifr.org)

Key Technological Shifts in AI Robotics in Warehousing Market

The warehousing AI robotics market is undergoing a groundbreaking technological change due to the requirement for operational efficiency and scaling. One of the key trends is the rise of autonomous mobile robots (AMRs) and collaborative robotics, combining artificial intelligence. Computer vision and machine learning to provide more flexibility and accuracy in warehousing operations. Locus Robotics recently unveiled LocusINTELLIGENCE in 2025, an AI-based business intelligence layer. This allows real-time decision-making, dynamic route optimisation, and improved fleet management.

Sensor technology and perception system breakthroughs are enabling robots to work in non-structured and dynamic environments with greater precision. Such companies as ABB and Fetch Robotics are putting in place higher-level vision systems. Tactile sense to improve object recognition and picking performance. Moreover, the use of edge computing is also becoming more widespread, as the warehouse robots now process data at the edge of the system to make decisions more quickly, with less latency, and with increased autonomy.(Source: https://www.prnewswire.com)

Global Export Leaders in the AI Robotics in Warehousing Market and Import Dynamics in Key Markets

China is a dominant exporter of warehouse robotics, particularly autonomous mobile robots (AMRs) and robotic arms. In 2024, China's total export value reached 2,409.9 billion yuan, marking a 10.9% increase from the previous year. Mechanical and electrical products, including warehouse robotics, accounted for a major this total export value.

The U.S. maintains its position as a leading exporter of warehouse robotics, driven by advancements in AI and automation technologies. The export value of mechanical and electrical products, encompassing robotics, grew by 8.7% in 2024, indicating a strong market presence.

In 2024, China installed 295,000 industrial robots, accounting for 54% of global deployments. This marks the highest annual total on record for China. This surge is attributed to China's significant investment in robotics, with projections indicating an average annual growth rate.

Japan maintained its position as the second-largest market for industrial robots, with 44,500 units installed in 2024. The country's operational stock rose by 3%, totalling 450,500 units. Demand for robots is expected to grow slightly by lower single-digit rates in 2025, accelerating to medium single-digit rates in the following years.

The U.S. imported USD 707 million worth of industrial robots in 2024, with Japan, Germany, and South Korea being the top suppliers. Despite hosting leading foreign robotics firms such as ABB and Fanuc, the U.S. lacks domestic foundries for industrial robots, leading to a trade deficit in robotics. This highlights the country's reliance on imports for advanced robotics components.

In 2024, São Paulo's industrial zone reported an increase in robotic warehouse installations, supported by government incentives for Industry 4.0 adoption. Mexico's growing e-commerce sector is fuelling demand for AI-enabled logistics solutions.

(Source: https://english.www.gov.cn)

(Source: https://m.economictimes.com)

(Source: https://ifr.org)

(Source: https://oec.world)

AI Robotics in Warehousing Market – Adoption Rates & Technological Trends by Region (2024)

| Region | Current Investment Focus (2024) | Leading Technologies | Notable Deployments |

| North America | Autonomous Mobile Robots (AMRs); AI orchestration | Autonomous Mobile Robots (AMRs), AI-powered inventory management | Amazon's deployment of over 750,000 robots in fulfilment centres (Source: https://www.aboutamazon.com) |

| Europe | Cloud-integrated robotics; smart factory robotics | Collaborative Robots (Cobots), Automated Guided Vehicles (AGVs) | DHL's implementation of AMRs in Germany's logistics hubs (Source: https://group.dhl.com) |

| Asia Pacific | High-speed automated picking systems; AI vision systems | AI-driven warehouse orchestration, IoT-enabled systems | Alibaba's Cainiao Network's use of AI robotics in China |

| Latin America | Pilot projects for robotics-enabled supply chains | Mobile Picking Solutions, AI-enabled Maintenance Predictive Systems | B2W Digital's adoption of robotic picking systems in Brazil |

| Middle East & Africa | Pilot deployments of autonomous guided vehicles (AGVs) | Robotic Sortation Systems, Autonomous Vehicle Guidance Systems |

Dubai South's deployment of AMRs in logistics hubs (Source: https://www.logisticsmiddleeast.com) |

AI Robotics in Warehousing Market Growth Factors

- Growing Adoption of Autonomous Mobile Robots (AMRs): Rising demand for flexible and scalable automation solutions is driving the integration of AMRs into modern warehouse operations.

- Boosting Investment in Predictive Maintenance Technologies: Growing reliance on AI-powered diagnostics enhances equipment uptime and operational efficiency in logistics facilities.

- Propelling Development of Collaborative Robotics: Increasing demand for human-robot collaboration fosters innovation in ergonomic, safe, and adaptive robotic systems.

- Driving Expansion of Cloud-Based Robotics Platforms: Rising use of cloud robotics improves fleet coordination, remote monitoring, and software updates across multiple warehouse locations.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 12.45 Billion |

| Market Size in 2025 | USD 15.34 Billion |

| Market Size by 2034 | USD 100.13 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 23.18% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Robot Type, Function / Application, AI Capability, End User / Industry, Deployment Mode, Autonomy Level, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

How Increasing Demand for E-commerce Fulfilment Efficiency Driving the Growth of AI Robotics in Warehousing Market?

Increasing demand for e-commerce fulfilment efficiency is expected to drive the market in the coming years. As the need to make e-commerce deliveries more efficient grows, the adoption of intelligent robotics in warehousing operations is anticipated to increase, and recent industry statistics support the trend. The International Federation of Robotics identified a global population of factory robots of 4,281,585 units in 2024, indicating a significant momentum of automation in industries.

By combining machine vision and learning frameworks, companies accelerate picking cycles and decrease mispicks. Thereby enhancing accuracy in orders in high-SKU settings where throughput demands peak during peak seasons. Investment in smart automation and fleet orchestration software is increasing annually, and North American and European logistics managers invest in modular robotics. Furthermore, the growing labour shortages in logistics and warehousing are anticipated to create significant opportunities for robotic automation.(Source: https://ifr.org)

Restraint

High Initial Investment and Integration Costs Limit Robotics Adoption in Warehousing

High initial investment and integration costs are likely to hamper the market growth, particularly among small and medium operators. The cost of hardware, software, and retrofitting facilities to support robotics systems is costly in nature. Fleet integration, system customisation, and training of employees to work with robots are expensive for companies. Additionally, the restraint by lack of standardisation and interoperability is anticipated to challenge the large-scale deployment of AI-driven warehouse systems.

Opportunity

Why Is High Investment From Global Retail and Logistics Companies Accelerating the Market?

High investment from global retail and logistics companies is estimated to create favourable opportunities for the robotics warehousing market. The International Federation of Robotics claimed that the robot stock globally was at 541,000 units installed in 2024. This shows a significant expansion of hardware being tapped by retailers and integrators. (Source: https://ifr.org)

MNCs, including Amazon, DHL, Alibaba, and Walmart, increase robotic fleets at fulfilment centres to respond to changing volumes of orders and minimise manual throughput bottlenecks. DHL announced 500 million picks in 2024 using autonomous mobile robots with vendors, which proves a longer-term operational impact at scale. Moreover, the rising emphasis on workplace safety and ergonomics is expected to reinforce the deployment of AI-based robotics in warehouses.(Source:https://group.dhl.com)

Segmental Insights

Robot Type Insights

Why Are Automated Guided Vehicles (AGVs) Dominating the AI Robotics in Warehousing Market?

The automated guided vehicles (AGVs) segment dominated the AI robotics in warehousing market in 2024, accounting for an estimated 40% market share, as operators are likely to prefer high-throughput guided systems that have proven themselves. AGVs provide observable, reproducible workflows in massive, high-volume plants where stationary routing and conveyor bondages generate reliably high ROI.

Logistics integrators, including AGVs to transfer pallets and tow operations, and heavy-duty moves, due to the stability necessary and certified security interfaces. Furthermore, the extensive distribution of parks and long-run operations contributed to the maintenance of the market share of AGVs.

The autonomous mobile robots (AMRs) segment is expected to grow at the fastest rate in the coming years, as they provide versatility, quicker ROI in dynamic layouts, and superior perception to facilitate high mix fulfilment. Moreover, the retailers and third-party logistics companies, which focus on plug-and-play solutions, further boost the segment growth.

Function/Application Insights

What Makes Picking & Packing the Largest Sub-Segment in the AI Robotics in Warehousing Market?

The picking & packing segment held the largest revenue share in the AI robotics in warehousing market in 2024, accounting for 38% of the market share, due to minimizing the cycle times and cutting off mis-picks. High-velocity e-commerce fulfilment centres use pick-to-light systems.

Locus Robotics passed 5 billion picks around the world by April 2025, a goal that was reached only 24 weeks after 4 billion, which highlights the scaling of throughput, accelerated. Additionally, the automated picking and packing removed repetitive strain injuries and kept the performance at peak during peak demand, solidifying its growing demand.(Source: https://ai-techpark.com)

The inventory management & tracking segment is expected to grow at the fastest CAGR in the coming years. Owing to the growing use of real-time accuracy and constant visibility as the building blocks of operational resilience and working-capital efficiency. Furthermore, the increase in demand for inventory orchestration modules and more intensive interconnection between API and WMS/ERP platforms is expected to propel the segment.

AI Capability Insights

Why Is Machine Learning & Predictive Analytics Leading AI Capabilities in Warehouse Robotics?

The machine learning & predictive analytics segment dominated the AI robotics in warehousing market in 2024, which held a market share of about 42%, due to the demand of companies to rely on information-based forecasting to maintain high throughput and uptime. Moreover, the manufacturers and integrators optimised facility-specific telemetry to train models to alleviate yield in pilot deployments and reinforce the market dominance of machine learning.

The computer vision & imaging segment is expected to grow at the fastest rate in the coming years, owing to the benefits of perception that broaden the robotics application into high-mix picking, damage inspection, and autonomous inventory audits. Additionally, the increasing interest in the translation of computer-vision research into edge-ready warehouse solutions is expected to boost the market.

End User Insights

How Are E-Commerce & Retail Driving the Dominance of AI Robotics in Warehousing?

The e-commerce & retail segment held the largest revenue share in the AI robotics in warehousing market in 2024, accounting for 45% market share, as online retailers focus on high throughput, quick fulfilment, and processing orders without mistakes.

Direct-to-consumer (D2C) sales increased across the world, and the U.S Department of Commerce showed an increase in online retail sales by 5.3% in 2024 relative to 2023, which supports the necessity to automate warehouses. Furthermore, the Major implemented autonomous mobile robots (AMRs), robotic picking arms, and automated sortation systems to fulfil aggressive same-day and next-day delivery promises, thus facilitating the market growth.(Source: https://www.census.gov)

The third-party logistics providers segment is expected to grow at the fastest CAGR in the coming years, as they increase their use of robotics to supply scalable on-demand fulfillment services. That supports a growing range of client service level agreements (SLAs). Furthermore, the rise in e-commerce volumes and the complexity of the omnichannel logistics are boosting the segment growth.

Deployment Mode Insights

Why Is On-Premises Deployment Leading the AI Robotics in Warehousing Market?

The on-premises segment dominated the AI robotics in warehousing market in 2024, accounting for an estimated 51% market share, due to the fact that organizations require direct control, data security, and customization on their automation systems. Moreover, the other competitors, such as Walmart, are also investing in these types of technologies, changing the logistics environment with integrated robotics, sensors, and AI.

The cloud-integrated edge systems segment is expected to grow at the fastest rate in the coming years, owing to the enhance the speed of decision-making and the decrease in latency in robotic tasks. These systems are designed to merge the power of cloud computing with the real-time power of edge computing.

According to the IDC Worldwide Edge Spending Guide, the world's spending on edge computing will be 228 billion in 2024. This represents an increase of 14% over 2023. This is likely to keep on growing and edge computing powerful contributor to the development of robotics in warehousing. Furthermore, the operators of warehouses who are interested in improving the efficiency and responsiveness of their procedures are fuelling the demand for cloud-based AI robotics in warehousing technology.(Source: https://my.idc.com)

Autonomy Level Insights

What Factors Make Semi-autonomous Robots the Largest Segment in the AI Robotics in Warehousing Market?

The semi-autonomous robots segment held the largest revenue share in the AI robotics in warehousing market in 2024, accounting for 55% of the market share, as they offer a balance between human control and automation. Additionally, the increased adoption of semi-autonomous robots, which rise due to the requirement of scalable and adaptable automation in warehouses that are dynamic warehouses.

The fully autonomous robots segment is expected to grow at the fastest rate in the coming years. These are autonomous robots, which use high-level AI algorithms, sensors, and real-time data processing to complete task execution without being controlled by a human operator. Furthermore, the shift to fully autonomous systems aims to solve issues like labor shortages, 24/7 operations, as they become an essential part of future warehouse automation plans.

Regional Insights

U.S. AI Robotics in Warehousing Market Size and Growth 2025 to 2034

The U.S. AI robotics in warehousing market size was exhibited at USD 3.78 billion in 2024 and is projected to be worth around USD 31.02 billion by 2034, growing at a CAGR of 23.43% from 2025 to 2034.

Why Does North America Hold the Largest Share in the AI Robotics in Warehousing Market?

North America led the AI robotics in the warehousing market, capturing the largest revenue share in 2024, which held a market share of about 40%, due to the exponential expansion of e-commerce and more precise supply chain processes. The increasing consumer demands for the speed of delivery have led to significant investments in autonomous mobile robots and automated sortation technologies.

The Material Handling Industry (MHI) 2024 report found that warehouses that deployed robotics shortened the order fill time by as much as 30% and raised accuracy by more than 25%. Additionally, the growing demand for flexibility, manpower efficiency, and cost containment in the operations in the warehouse is expected to propel the market in this region.(Source: https://locusrobotics.com)

Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, owing to the shift of the economy towards real estate to high-technology manufacturing, and automation. Other markets that are also emerging, and utilizing robotics to enhance labor efficiency and satisfy aggressively demanding delivery timelines, include Japan and South Korea. Furthermore, the subsidies to adopt robotics and AI R&D, as government efforts are fuelling the market in the coming years.

Top Vendors in the AI Robotics in Warehousing Market

- Amazon Robotics (USA): Amazon Robotics, a subsidiary of Amazon, develops warehouse robotics systems, including the Kiva Robot, which is a mobile robot that stores and retrieves products from shelves. The company also develops other warehouse robotics systems, such as robotic arms and sorting systems.

- Symbotic (USA):Symbotic, a joint venture between SoftBank Group Corp. and Symbotic, is constructing an automated warehouse in Jackson, Georgia, set to open in late 2025.

- ABB Ltd. (Switzerland):ABB is a global leader in automation and robotics, offering advanced robotic systems widely used in manufacturing, logistics, and distribution centers.

- KUKA AG (Germany):KUKA provides industrial robots and automation solutions for various industries, including logistics. Their robots are used in tasks such as material handling, assembly, and packaging.

- Fanuc Corporation (Japan):Fanuc is a leading provider of industrial robots and automation systems. Their robots are utilized in various applications, including material handling, assembly, and packaging, to enhance efficiency in warehouse operations.

AI Robotics in Warehousing Market Companies

- 6 River Systems (Shopify)

- ABB Ltd.

- Amazon Robotics

- Boston Dynamics

- Cognex Corporation

- Dematic (KION Group)

- Elettric 80 S.p.A.

- FANUC Corporation

- Fetch Robotics

- Geek+

- GreyOrange

- Honeywell Intelligrated

- KUKA AG

- Locus Robotics

- Magazino GmbH

- Mobile Industrial Robots (MiR)

- Omron Corporation

- Swisslog (KUKA Group)

- Teradyne Inc. (Adept Technology)

- Yaskawa Electric Corporation

Recent Developments

- In September 2025, Sereact launched Cortex, a reality-trained, AI-powered robotic system offering zero shot autonomy for various robots, including robotic arms, mobile manipulators, and humanoids. Trained on thousands of hours of live logistics and manufacturing operations, Cortex delivers advanced adaptability and performance directly from the factory floor. (Source: https://www.sdcexec.com)

- In June 2025, Brightpick unveiled Autopicker 2.0, the latest iteration of its flagship AI-powered warehouse robot. Featuring next-generation Intuition software with Physical AI and picking-in-motion capabilities, along with a fully redesigned hardware platform, Autopicker 2.0 delivers an average of 70–80 picks per hour matching the productivity of an experienced warehouse associate—while offering greater reliability and continuous 24/7 operation. (Source: https://brightpick.ai)

- In September 2024, GXO Logistics, Inc., the world's largest pure-play contract logistics provider, announced a partnership with California-based robotics developer Dexterity to pilot AI-enhanced robotics in a warehouse. The collaboration aims to improve safety and efficiency for a leading beauty brand's operations. (Source: https://gxo.com)

- In March 2025, Locus Robotics introduced LocusINTELLIGENCE, a new AI-driven business intelligence software layer within its LocusONE platform. Designed for real-time decision-making, continuous optimisation, and deep operational insights, LocusINTELLIGENCE enables fulfilment operations to achieve unparalleled flexibility, throughput, and efficiency. (Source: https://www.prnewswire.com)

- In August 2025, GreyOrange partnered with Google Cloud to develop GreyMatter DeepNav, an AI-powered solution for dynamically managing and optimising autonomous robotic operations at scale. The collaboration is set to enhance automation, efficiency, and accuracy in warehouse management for retail, logistics, and supply chain companies worldwide. (Source: https://roboticsandautomationnews.com)

- In March 2025, ABB expanded its logistics and e-commerce robotics portfolio with two new AI-powered modules in its Item Picking family. Featuring ABB's proprietary AI-based vision technology, tested by leading fashion retail and logistics companies, the Fashion Inductor and Parcel Inductor deliver advanced solutions for critical logistics processes, including item picking and sorter induction.(Source:https://new.abb.com)

Segments Covered in the Report

By Robot Type

- Automated Guided Vehicles (AGVs)

- Towing AGVs

- Unit Load AGVs

- Autonomous Mobile Robots (AMRs)

- Picking AMRs

- Pallet Handling AMRs

- Robotic Arms & Pick-and-Place Robots

- Collaborative Robots (Cobots)

- Sorting & Packaging Robots

- Others

By Function / Application

- Picking & Packing

- Sorting & Distribution

- Inventory Management & Tracking

- Material Transport & Handling

- Loading & Unloading

- Quality Inspection

- Others

By AI Capability

- Machine Learning & Predictive Analytics

- Computer Vision & Imaging

- Sensor Fusion & IoT Integration

- Natural Language Processing (NLP)

- Autonomous Navigation & Path Planning

- Others

By End User / Industry

- E-Commerce & Retail

- Third-Party Logistics Providers (3PLs)

- Food & Beverage

- Pharmaceuticals & Healthcare

- Consumer Goods

- Industrial & Manufacturing

- Others

By Deployment Mode

- On-Premises

- Cloud-Integrated Edge Systems

By Autonomy Level

- Semi-Autonomous Robots

- Fully Autonomous Robots

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting