What is the Smart Personal Safety and Security Device Market Size?

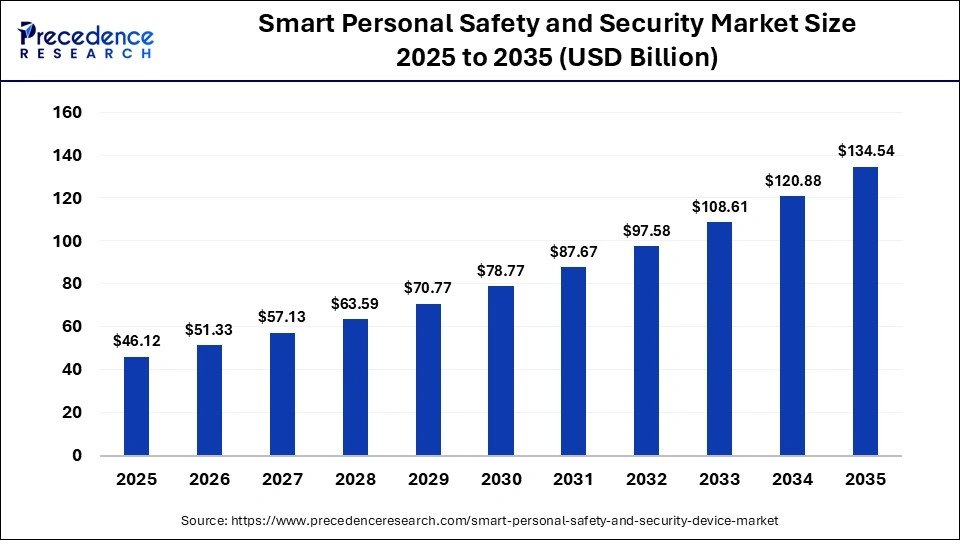

The global smart personal safety and security device market size accounted for USD 46.12 billion in 2025 and is predicted to increase from USD 51.33 billion in 2026 to approximately USD 134.54 billion by 2035, expanding at a CAGR of 11.30% from 2026 to 2035. The market is booming at a rapid pace, due to an increase in crime rate, urbanization, and technological advancements. Moreover, a rise in personal safety awareness and the availability of smart and more accessible technology facilitate the market growth.

Market Highlights

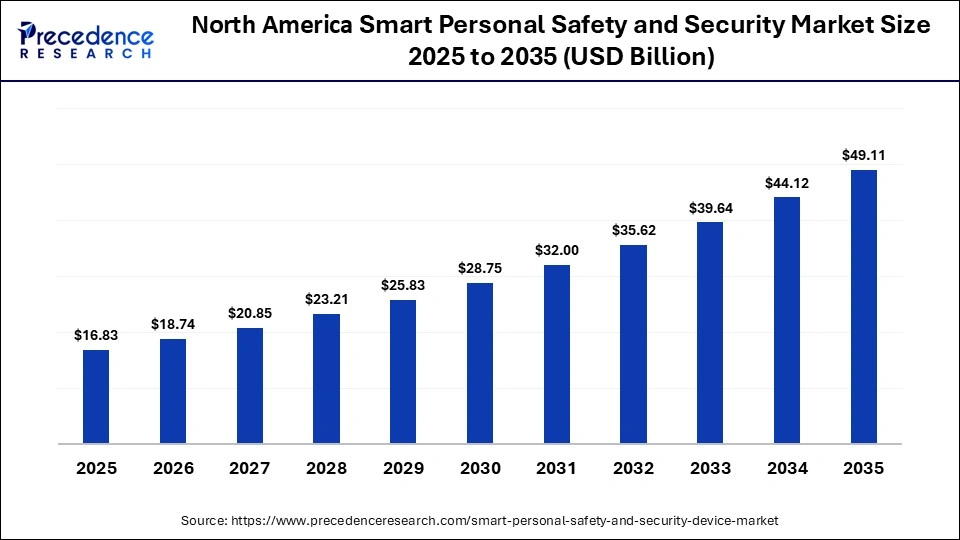

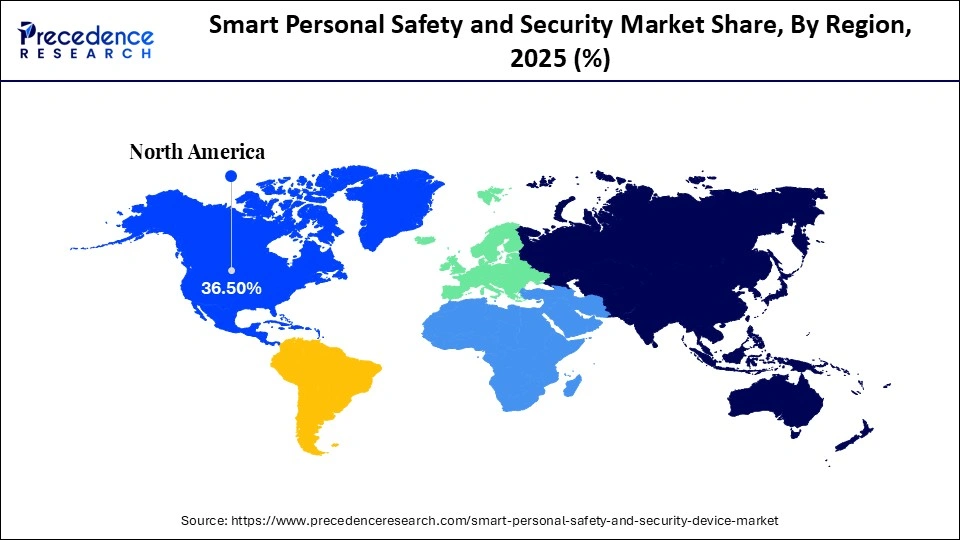

- North America dominated the smart personal safety and security device market, holding a share of 36.5% in 2025.

- Asia-Pacific is expected to expand with the highest CAGR during the forecast period.

- By product type, the smart wearables segment held the largest market share of approximately 52% in 2025.

- By product type, the smart jewelry/finger wear segment is expected to grow at a remarkable CAGR of approximately 17.8% between 2026 and 2035.

- By technology, the positioning technology segment dominated the market with a share of approximately 40% in 2025.

- By technology, the sensor technology segment is expected to rise with a considerable CAGR of approximately 14% during the forecast period.

- By application, the individual consumers segment held the largest share of approximately 59.5% of the market in 2025.

- By application, the healthcare/elderly care segment is expected to grow at the highest CAGR of approximately 15.3% between 2026 and 2035.

What are Smart Personal Safety and Security Devices?

The smart personal safety and security device market encompasses the development of suitable technology and smart devices to protect individuals against theft. The market growth is propelled by the increase in the incidence of theft, assault, and harassment, amplifying the need for self-protection tools. Technological advancements like IoT and wearables offer real-time tracking, SOS alerts, and health monitoring, which enable one's safety and peace of mind. Various government initiatives, like adoption, emergency response, and urbanization, have further led to an increase in personal safety tools.

Corporate companies are increasingly adopting personal safety devices for their employees' safety, especially in high-risk sectors like healthcare and call centers. Such devices offer dual functionality, along with security; it offers health monitoring, therefore broadening their appeal. This market flourishes due to a unique blend of fear, innovation, and the demand for smart safety solutions, making them essential tools for personal security.

How is AI Transforming the Smart Personal Safety and Security Device Market?

Artificial intelligenceis transitioning this sector by transforming this tool from a passive, reactive device to a more proactive tool. It acts predictively by analyzing behavioral activity and differentiating between harmless behavior and real threats, hence minimizing false alarms. Smart surveillance, wherein AI-equipped cameras can perform real-time analysis to reduce threats and crime rates. Advanced facial recognition and smart personal safety apps enable safe travel and alerts when there is unusual activity. AI-powered wearables can detect falls, and GPS tracking is gaining popularity.

Smart Personal Safety and Security Device Market Trends

- Wearable Dominance: This device offers constant contact with safety as it is wearable and removes the need to carry the device. It is making safety convenient for a larger population. It has transformed safety from a niche concern to a trendy lifestyle, making its market stronger.

- Biometric & Advanced Authentication: This technology is replacing traditional, easily compromised security methods with unique, secure, and convenient devices. Traditional methods like PIN can easily be hacked or stolen, whereas biometrics like fingerprint or facial recognition are unattainable to replicate, reducing financial fraud.

- Health & Wellness Convergence: It is shifting smart personal tools from reactive to preventive and proactive helpers. It creates a multifunctional device that monitors physical as well as environmental safety, hence broadening the user base.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 46.12 Billion |

| Market Size in 2026 | USD 51.33 Billion |

| Market Size by 2035 | USD 134.54 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 11.30% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Technology Type, Application, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Why Did the Smart Wearables Segment Dominate the Market?

The smart wearables segment dominated the smart personal safety and security device market with a share of approximately 52% in 2025, due to their versatility in combining health with safety, ease of use, AI integration, and customer awareness regarding personal safety. These devices offer alarm systems, real-time tracking, and health monitoring, making them popular among a huge demographic, especially youngsters and teenagers.

They are disguised as fashionable day-to-day products with hidden alarms, making it a discreet wearable. Wearables enhance personal security while capitalizing on current tech and the rise in safety concerns, making them a leading force in the market. They offer high accuracy and are more affordable compared to other safety devices.

The smart jewelry/finger wear segment is expected to rise at a remarkable CAGR of approximately 17.8% between 2026 and 2035, due to consumers' desire for discreet, appealing safety devices that blend into daily life, which offer functionality and design without the bulk of smart wearables. They come in various designs and are embedded with multiple features, such as immediate SOS signalling using GPS location.

Technology Insights

How the Positioning Technology Segment Dominated the Market?

The positioning technology segment contributed the biggest revenue share of approximately 40% in the smart personal safety and security device market in 2025, due to the growing demand for real-time location tracking, location sharing, emergency alerts, and safety monitoring. With smartphone and wearable integration, the existing user base of positioning technology has made the safety measure more accessible and convenient. This technology tackles the rise in urban crime and violence against vulnerable populations, providing a solution amidst fear and anxiety.

The sensor technology segment is expected to grow with the highest CAGR of approximately 14% in the market during the studied years. Sensors are a pivotal technology that has enabled a passive alarm to become an intelligent, proactive safety ecosystem. This technology is driven by consumer demand and technological advances. A small and more efficient sensor enables a feature of location tracking, fall detection, and behavioral analysis.

Application Insights

Which Application Segment Led the Market?

The individual consumers segment led the global smart personal safety and security device market with a share of approximately 59.5% in 2025, due to an increase in personal safety concerns driving the demand for smart personal safety devices. Aesthetic smart wearables, with their integration into day-to-day life, appeal to a huge consumer base. These smart devices provide relief and freedom, allowing users to receive alerts during an emergency service. The amalgamation of smart and smart home ecosystems, which further enhances personal safety and security, leading to an increase in demand for such tools and devices.

The healthcare/elderly care segment is expected to witness the fastest growth in the market with a CAGR of approximately 15.3% over the forecast period, due to the huge demand for patient/worker safety, especially post-COVID-19 pandemic. With the rise in the geriatric population, there is a need for smart personal devices to detect falls, monitor vital signs, provide medication reminders, and send SOS alerts. The growing demand for smart safety solutions, ranging from protective gear for frontline workers to monitoring devices for patients, boosts the segment's growth.

Regional Insights

How Big is the North America Smart Personal Safety and Security Device Market Size?

The North America smart personal safety and security device market size is estimated at USD 16.83 billion in 2025 and is projected to reach approximately USD 49.11 billion by 2035, with a 11.30% CAGR from 2026 to 2035.

Which Factors Drive the Market in North America?

North America held a major revenue share of approximately 36.5% in the smart personal safety and security device market in 2025, mainly due to its advanced infrastructure, people's awareness, robust R&D, established tech companies, and an increase in safety concerns. North America's demographics rapidly adapt to new tech tools. This region is rapidly expanding in biometric authentication, improving security in both the public and private sectors. This region has undertaken various government initiatives, like smart cities, wherein smart video surveillance is done. OSHA policy in Canada supports the adoption of smart PPE, focusing on worker safety in high-risk environments.

What is the Size of the U.S. Smart Personal Safety and Security Device Market?

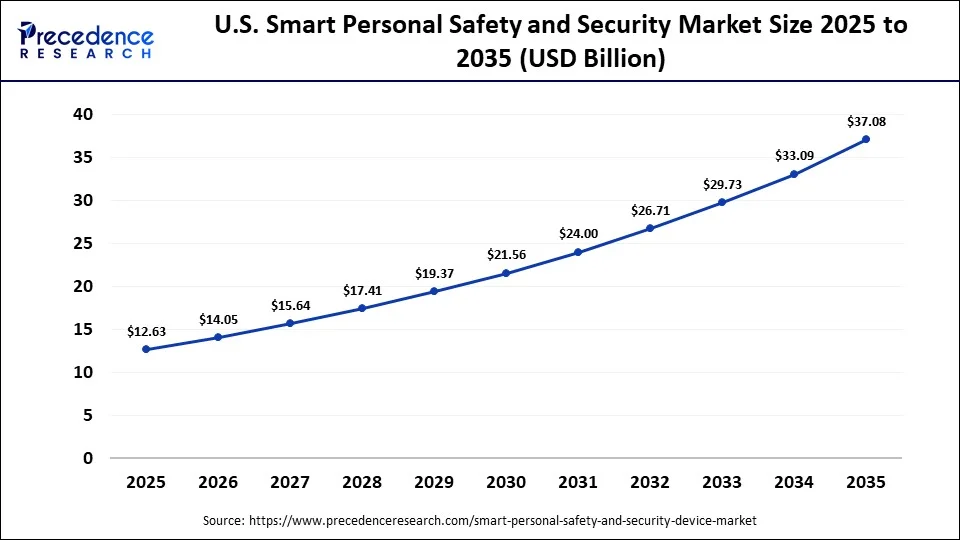

The U.S. smart personal safety and security device market size is calculated at USD 12.63 billion in 2025 and is expected to reach nearly USD 37.08 billion in 2035, accelerating at a strong CAGR of 11.37% between 2026 and 2035.

U.S. Smart Personal Safety and Security Device Market Trends

The U.S. is dominating this market due to high-tech adoption, strong infrastructure, and the presence of major tech companies. Due to its robust R&D ecosystem, a major trend seen in this sector is utilizing drones for surveillance, using augmented reality to improve situational awareness and training, and AI-driven biometric secure personal and facility access.

Government initiatives like the National AI Initiative and Smart Cities Initiatives, wherein the government is investing in IoT and AI for enhancing public safety by using smart surveillance. U.S. government agencies are also collaborating with private tech firms to accelerate innovation in safety tech.

How is Asia-Pacific Growing in the Market?

Asia-Pacific is expected to witness the fastest growth in the smart personal safety and security device market during the predicted timeframe, due to rapid urbanization, an increase in the incidence of crime, and economic stability, which has propelled the demand for IoT-enabled wearables and smart cities. Government bodies are investing heavily in smart city projects and public safety infrastructure. With the rise in urbanization, it has been observed that individual safety awareness has improved, leading to an increase in demand for smart personal safety devices. A growing online platform and local manufacturing have enhanced the accessibility and affordability of these devices.

China Smart Personal Safety and Security Device Market Trends

China dominates in the region, driven by its tech adoption, local manufacturing power, and urbanization, with a significant rise in smart home security growth. China has massive local manufacturing and supply chains, so it can mass-produce this smart safety device, and they are cost-effective as they are locally manufactured. The Chinese Government invests in the “Safe City” initiative and digital surveillance. They have a strong domestic tech industry that enables them to innovate new smart devices. China provides cost-effective, innovative products that meet consumer and national security needs.

Will Europe Grow in the Smart Personal Safety and Security Device Market?

Europe is expected to grow at a notable CAGR in the foreseeable future, due to high consumer awareness, strict safety regulations, an increase in the prevalence of crime, and government-supported initiatives. In the Horizon Europe initiative, 141 million euro was allocated for improving border security and fighting crimes, and programs like SAFE that boost the EU defence industry and influence smart security technologies. Growth in online platforms and bans on traditional self-defence items further boost the demand for smart and user-friendly alternatives.

Germany Market Trends

Germany is growing rapidly in the market due to its robust industrial base, huge investment in the R&D ecosystem, skilled workforce, and strict safety regulations. The rise in demand for IoT-enabled solutions and strong cybersecurity frameworks has further led to the growth of this market. Germany's manufacturing sector boosts the demand for smart PPE and personal safety devices. The highly skilled IT sector provides a core foundation for a secure and reliable smart security system.

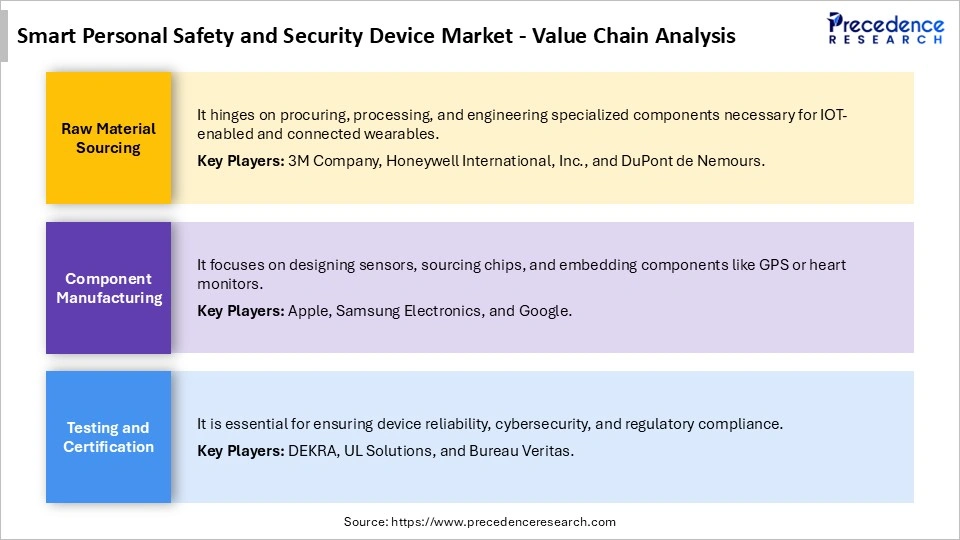

Smart Personal Safety and Security Device MarketValue Chain Analysis

Who are the Major Players in the Global Smart Personal Safety and Security Device Market?

The major players in the smart personal safety and security device market include Apple Inc., Samsung Electronics Co., Ltd., Honeywell International Inc., Garmin Ltd., Alphabet Inc., Huawei Technologies Co., Ltd, ADT Inc., Arlo Technologies, Inc, Safelet B.V., Stadler Rail AG, UnaliWear, Inc., Zembro, Silent Beacon LLC, KORE Wireless Group Inc., and Tile Inc.

Recent Developments

- In January 2026, Smart Home Protection LLC launched Timeli, the first patented portable smart personal safety system that combines flashlight, video, alarm, GPS, and instant two-way communication with emergency dispatch in one device. The device can deter threats, document danger, and deliver help faster.(Source: https://www.prnewswire.com)

- In June 2025, Samsung introduced a new security update, One UI 7. With its existing security, it has new anti-theft features such as identity check, biometric authentication, and security delay. The feature was made available in the Galaxy S25 series and other Galaxy series. (Source: https://news.samsung.com)

- In September 2025, Garmin launched Fenix 8 Pro, a smartwatch that can handle texts and calls without pairing it with a phone. It also has GPS tracking and weather forecast features through satellite communication. (Source: https://www.garmin.com)

- In July 2025, Keotech announces the Keocam personal dashcam or bodycam that provides video evidence of assaults, threats, and attacks to help track down and prosecute criminals. The device magnetically attaches to clothing and uses a 160° camera lens to capture a view in front of the user.(Source: https://www.notebookcheck.net)

Segments Covered in the Report

By Product Type

- Smart Wearables (Smartwatches, Smart Jewelry, Pendants)

- Smart Safety Devices (Personal Alarms, Panic Buttons)

- Smart Security Devices (GPS Trackers, Body-worn Cameras)

- Phone-tethered Companions

By Technology Type

- Positioning Technology (GPS/GNSS)

- Networking Technology (Bluetooth/Cellular/LPWAN)

- Sensor Technology (Accelerometer/Fall Detection)

- Speech & Voice Recognition

By Application

- Individual Consumers (Women, Children, Outdoor Enthusiasts)

- Healthcare/Elderly Care

- Corporate & Lone Workers

- Defense & Public Safety

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content