Whart is the Smart Pneumatics Market Size?

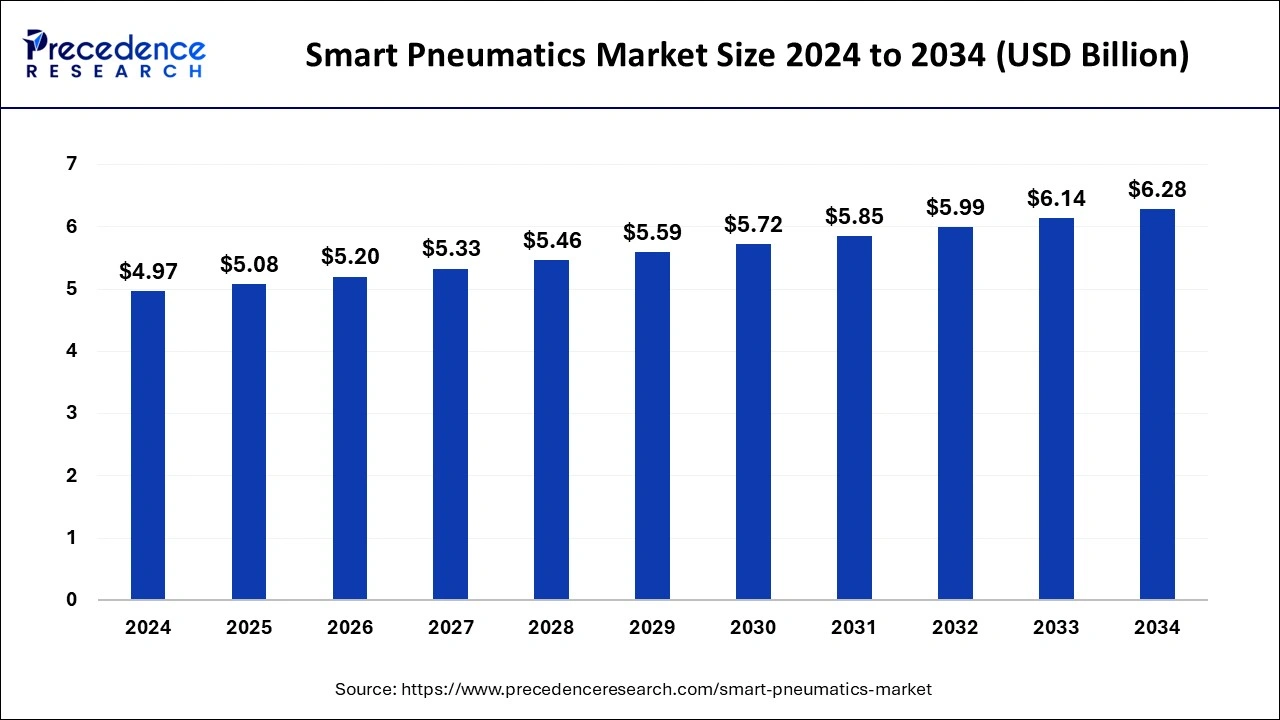

The global smart pneumatics market size was estimated at USD 5.08 billion in 2025 and is predicted to increase from USD 5.20 billion in 2026 to approximately USD 6.43 billion by 2035, expanding at a CAGR of 2.38% from 2026 to 2035.

Smart Pneumatics MarketKey Takeaways

- In terms of revenue, the global smart pneumatics market was valued at USD 5.08billion in 2025.

- It is projected to reach USD 6.43billion by 2035.

- The market is expected to grow at a CAGR of 2.38% from 2026 to 2035.

- Asia Pacific held the dominant share of the smart pneumatics market in 2025.

- By component, the hardware segment accounted for the dominating share in 2025.

- By component, the software segment is expected to witness a significant share during the forecast period.

- By type, the smart pneumatic valves segment held the largest share of the market in 2025.

- By type, the smart pneumatic actuators segment is expected to grow fastest during the forecast period.

- By end-use industry, the automotive segment held the dominating share of the market in 2025.

- By end-use industry, the oil & gas segment is expected to grow at a notable rate.

Market Overview

With the rapid pace of digitalization, pneumatics boost productivity and efficiency at a higher level. Industrial Internet of Things (IIoT) and digitization offer substantial growth opportunities to improve business performance. Gradually, smart pneumatics are replacing traditional pneumatic devices owing to their capacity to maintain data and keep records, which assists operators in finding the exact problem and saves time as well as maintenance costs. Smart pneumatic systems are designed to improve operational efficiency, enhance automation, and reduce maintenance costs in a wide range of industries, including food & beverage, automotive, semiconductor, pharmaceutical, and others.

Smart pneumatics are widely used to control multiple machines and processes, including the movement of robots, the operation of valves, and the flow of liquids and air. This advanced system is powered by sensors that detect pressure and temperature in real-time. The data that is being collected by these sensors can be used to adjust the system's settings to boost performance. Smart pneumatics are extensively utilized to lessen energy usage to a certain extent by monitoring air pressure and adjusting it accordingly. Companies can save on energy costs and optimize efficiency.

Artificial Intelligence: The Next Growth Catalyst in the Smart Pneumatics Market

AI is transforming the smart pneumatic industry by transitioning systems from simple automated tools into intelligent, self-optimizing agents that significantly enhance productivity. By integrating machine learning algorithms with smart sensors, these systems can now perform real-time data analysis to predict maintenance needs, reducing unexpected downtime.

AI enables advanced energy management by detecting leaks and optimizing air pressure based on demand, which can result in a reduction in air consumption in certain applications.

Smart Pneumatics MarketGrowth Factors

- The growing focus on the expansion of Industrial IoT is observed to promote the growth of the smart pneumatics market in the upcoming years. The expansion of the IIoT creates a demand for enhanced connectivity and integration of smart pneumatics systems with other industrial devices.

- The expansion of the market is majorly driven by the growing demand for automation in multiple industries and the increasing need for efficient and cost-effective pneumatic solutions.

- The increasing acceptance of smart pneumatic systems leads to improved performance and enhance the overall efficiency of industrial processes.

- The rapid technological innovations in control systems, sensors, and connectivity offer significant growth opportunities for the development of more advanced smart pneumatics solutions.

- Companies worldwide are embracing automation across various sectors to boost productivity and efficiency and reduce labor costs, fueling the growth of the smart pneumatics market.

- The rising demand for energy-efficient solutions is expected to boost the growth of the market during the forecast period. With the increase in energy costs, companies are actively looking for innovative ways to enhance energy efficiency and reduce consumption.

- Emerging markets around the world continue to adopt automation technologies, which increases the penetration of the smart pneumatics market during the forecast period.

Market Outlook

- Market Growth Overview: The smart pneumatics market is expected to grow significantly between 2025 and 2034, driven by the integration of industrial IoT and connectivity, growing smart predictive maintenance and efficiency, and increasing demand for sustainable, energy-efficient manufacturing, significantly reducing downtime.

- Sustainability Trends: Sustainability trends involve energy efficiency and consumption reduction, leak detection and monitoring, and eco-friendly manufacturing.

- Major Investors: Major investors in the market include Emerson Electric Co., Festo SE & Co. KG, Parker Hannifin Corporation, SMC Corporation, and Bosch Rexroth AG.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 5.08 Billion |

| Market Size by 2035 | USD 6.43Billion |

| Growth Rate from 2026 to 2035 | CAGR of 2.38% |

| Largest Market | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Type, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Integration with the industrial Internet of Things

The smooth assimilation of smart pneumatic approaches with Industrial IoT is expected to boost the growth of the smart pneumatics market during the forecast period. Industrial IoT facilitates the seamless communication of detectors, gadgets, and other systems, which assists in data-driven insights in reducing downtime through various predictive maintenance and timely interventions and real-time monitoring and control of pneumatic operations. Smart pneumatics systems can generate real-time data while in use, which also helps engineers and device operators understand how each component of equipment performs under different situations.

Smart pneumatic systems are revolutionizing production by enabling intense and detailed scrutiny of industrial systems through continuous monitoring and receiving feedback. Several companies are opting for smart pneumatics for its various benefits in manufacturing. Moreover, companies are adopting automation to reduce labor costs and optimize productivity. Smart pneumatic systems play an important role in automation by offering reliable control of pneumatic components, contributing to streamlined processes. Such supportive factors are expected to drive the growth of the smart pneumatics market during the forecast period.

Restraint

High initial investment

The high initial investment is anticipated to hamper the growth of the market. The implementation of smart pneumatics systems requires significant investment in purchasing equipment, technology integration, and proper training of the workforce. Due to budget constraints, the high capital requirement discourages smaller enterprises from adopting these advanced technologies. Many industry players lack awareness of the benefits and capabilities of smart pneumatics. Integration of smart pneumatics with existing systems can be complex in older industrial facilities due to the lack of skilled technicians to handle integration. Such factors may limit the adoption and expansion of the global smart pneumatics market.

Opportunity

Rising focus on energy efficiency

The increasing focus on the energy efficiency industry is projected to offer a lucrative opportunity for the growth of the smart pneumatics market during the forecast period. Operators of pneumatic systems of all sizes extensively install smart pneumatic components to realize significant energy savings and boost productivity. The rapidly increasing demand for energy-efficient solutions has compelled manufacturers to seek ways to reduce energy consumption and minimize expenses. Smart pneumatic systems offer significant savings by providing control and monitoring of energy usage in mainly large-scale manufacturing processes. Additionally, manufacturers are emphasizing energy efficiency and reducing carbon footprint. Companies understand the need to create smart pneumatic components to earn profit from the customer desire for energy-efficient goods. Thereby driving the market's growth.

Segment Insights

Component Insights

The hardware segment accounted for the dominant share in 2025. Hardware components are the physical elements of smart pneumatic systems, which include valves, sensors, controllers, and actuators. These components work generously for precise control and automation in industrial processes.

Besides the dominance of the hardware segment, the software segment has shown a noteworthy presence in the smart pneumatics market. This segment is expected to witness significant growth during the forecast period. The raw data extracted through hardware components is collected, processed, and analyzed by software. Software plays an indispensable role in smart pneumatic systems. It provides the algorithms and programming for monitoring and automation as well as assists operators in decision-making via data-driven insights.

Type Insights

The smart pneumatic valves segment held the dominating share of the smart pneumatics market in 2025. Valves are often employed to help control the flow of fluids or gases in a system. Smart pneumatic valves incorporate innovative technologies for automating control and enhancing efficiency in industries. Smart valves have several applications in the food and beverage, semiconductor, oil & gas, automotive, water, and wastewater industries, all of which are adopted to lessen energy costs. Smart valves help to accelerate industrial processes by permitting constant monitoring and detection of problems to ensure that the facility works at its best. Several end-user companies are deploying them into their systems to enhance their plant efficiency, equipment monitoring, and process control.

The combodian Government signed an agreement with the Japanese International Cooperation Agency to build a wastewater treatment plant in Dangkor district. The project is aimed at improving the drainage system in the district so that wastewater flows directly to the plant rather than the river by investing USD 25 million.

The smart pneumatic actuators segment is observed to grow at the fastest rate during the forecast period of 2024-2033. Actuators are referred to as devices that convert energy into mechanical motion, often used to control valves in pneumatic systems. Actuators facilitate improved automation capabilities with more control. In addition, the rapid adoption of IoT-enabled actuators for predictive maintenance is anticipated to propel the segment's growth during the forecast period.

End-user Insights

The automotive segment held the dominating share of the smart pneumatics market in 2025. In the automotive industry, smart pneumatic systems are widely used for automation and control in manufacturing processes, including assembly and material handling. Automotive manufacturers are investing in R&D and also revising their production decisions. Factors such as technological upgrades, stringent emission regulations, and increasing production andsales of passenger cars are bolstering the growth of the automotive segment. Moreover, the rise in demand for automotive components and accessories is also projected to accelerate the growth of the segment during the forecast period.

The oil & gas segment is observed to grow at the fastest rate during the forecast period. The oil and gas industries adopt smart pneumatic systems for various tasks, including pipeline monitoring, process automation, and valve control. Such systems improve safety, reliability, and efficiency in oil and gas operations.

Regional Insights

Asia Pacific held a dominant position in the smart pneumatics market and is expected to lead the global market throughout the forecast period. The growth of the region is attributed to the presence of prominent market leaders, rising adoption of smart manufacturing and Industry 4.0, the rapid progress of industrialization, stringent regulatory rules for the workplace, rapid urbanization, increasing penetration of IIoT across various sectors, rising acceptance of safety standards and procedures, and increasing awareness of innovative technology which results in creating a substantial demand for smart pneumatics in the region.

Developing countries of Asia Pacific, such as India, Japan, and China, are experiencing an increasing demand for smart pneumatic solutions in the energy, automotive, oil and gas, and manufacturing sectors. These systems are widely employed by companies to improve production processes and enhance operational efficiency and safety. The increasing industrialization, rapid urbanization, and rising population in the Asia-Pacific region have led to the growing demand for agricultural products, food, and chemicals that use smart pneumatic technology in their industrial plants.

China Smart Pneumatics Market Trends

China integrates IoT-enabled actuators and smart valves, and manufacturers are shifting from reactive repairs to data-driven predictive maintenance, significantly minimizing operational downtime and energy waste. The digital transformation is repositioning pneumatics as a cornerstone of sustainable, smart manufacturing, ensuring China remains at the forefront of global industrial productivity.

The smart pneumatics market has also witnessed increasing investment in new facilities in industries such as automotive, oil and gas, chemicals, semiconductor, and food & beverage sectors. Moreover, while applying the power of digitalization and Industrial IoT across various sectors, several key players have initiated experimenting with the potential of smart pneumatics in recent years. Thus, this is expected to propel the smart pneumatics market growth in the region during the forecast period.

- In April 2022, GAIL announced that its joint venture company, Bengal Gas Co. and Hindustan Petroleum Corporation Ltd., aims to invest more than INR 17,000 in various CNG projects in West Bengal over the next five years.

How is North America Growing Fastest in the Smart Pneumatics Industry?

North America is embedding IIoT-enabled architectures and smart air-management systems into the core of its manufacturing infrastructure. The stringent sustainability mandates and the push for reshoring, high-precision sectors like automotive and healthcare, are adopting intelligent valve terminals and sensors to facilitate seamless predictive maintenance.

U.S. Smart Pneumatics Market Trends

The U.S. shift toward IoT-integrated pneumatic architectures, where real-time monitoring of pressure and cylinder positioning facilitates a transition from reactive repairs to high-precision predictive maintenance. The critical demand for miniaturised, energy-efficient components that allow for seamless integration into the compact environments of robotics and pharmaceutical assembly.

Value Chain Analysis of the Smart Pneumatics Market

- Raw Material & Component Suppliers (Upstream)

This initial stage involves supplying raw materials such as high-grade steel, aluminum, polymers, and electronic components necessary to manufacture smart pneumatic hardware.

Key Players: SICK AG - Manufacturing and Assembly of Smart Components

This stage includes the design, manufacturing, and assembly of smart pneumatic valves, actuators, sensors, and modules that allow for real-time monitoring, data collection, and predictive maintenance.

Key Players: Festo SE & Co. KG, Emerson Electric Co., SMC Corporation, Parker Hannifin Corporation, Bosch Rexroth AG, IMI Precision Engineering Ltd., and AirTAC International Group. - Software and IoT Solution Providers

This critical layer provides the software, analytics, and cloud dashboards that process the raw data generated by the smart hardware into actionable insights.

Key Players: Siemens AG, Rockwell Automation Inc., Schneider Electric SE, Honeywell International Inc., and Cypress Envirosystems Inc.

Smart Pneumatics Market Companies

- Rotork: Rotork advances smart pneumatics by incorporating intelligent, IoT-enabled positioners and actuators that provide real-time diagnostics and predictive maintenance for flow control systems.

- Festo AG & Co.KG: Festo is a pioneer in digitization, offering the Festo Motion Terminal, a cyber-physical system that combines pneumatics with integrated, software-controlled functional sensors.

- Thomson Industries: Thomson contributes by integrating smart sensing and control technology into linear motion systems, which are essential components of modern, automated pneumatic machinery.

- Bimba Manufacturing: Bimba offers a wide portfolio of, often customized, smart actuators and pneumatic control components that utilize sensors to provide, for example, position sensing and diagnostics.

- Metso: Metso specializes in smart, automated valve solutions for process industries, utilizing intelligent positioners that allow for self-diagnostics and predictive maintenance.

Other Major Key Players

- Parker Hannifin Corporation

- Bimba Manufacturing Co.

- Rotork PLC

- Thomson Industries Inc.

- Cypress EnviroSystems Corp

- Ningbo Smart Pneumatic Co. Ltd

- Emerson Electric Co.

- Stanley Black & Decker, Inc.

- Advanced Pneumatics

- Aventics GmbH

- Basso Industry Corp.

- Bosch Rexroth

- Chicago Pneumatic

- Delton Pneumatics

- Gardner Denver

- Ham-Let Group

- Hitachi Koki

- Ingersoll Rand Inc.

- Jiffy Air Tool

- Kramer Air Tools Inc.

Recent Developments

- In May 2022, Massachusetts Institute of Technology (MIT) researchers created a new manufacturing technique that could be more cost-effective for soft pneumatic actuators. Researchers from MIT have come up with a new way to manufacture soft pneumatic actuators.

- In October 2023, Toyota Material Handling launched a new line of electric, pneumatic forklifts with 48V and 80V models. This durable line is built to withstand outdoor terrain and work in various weather conditions. The forklifts are designed for retail applications like lumberyards, home centers, landscaping, and store support.

Segments Covered in the Report

By Component

- Hardware

- Software

- Services

By Type

- Smart Pneumatic Valves

- Smart Pneumatic Actuators

- Smart Pneumatic Modules

By End-use

- Oil & Gas

- Energy & Power

- Water & Wastewater

- Automotive

- Semiconductor

- Food & Beverage

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Tags

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting