What is the Special Purpose Vehicle (SPV) Services Market Size?

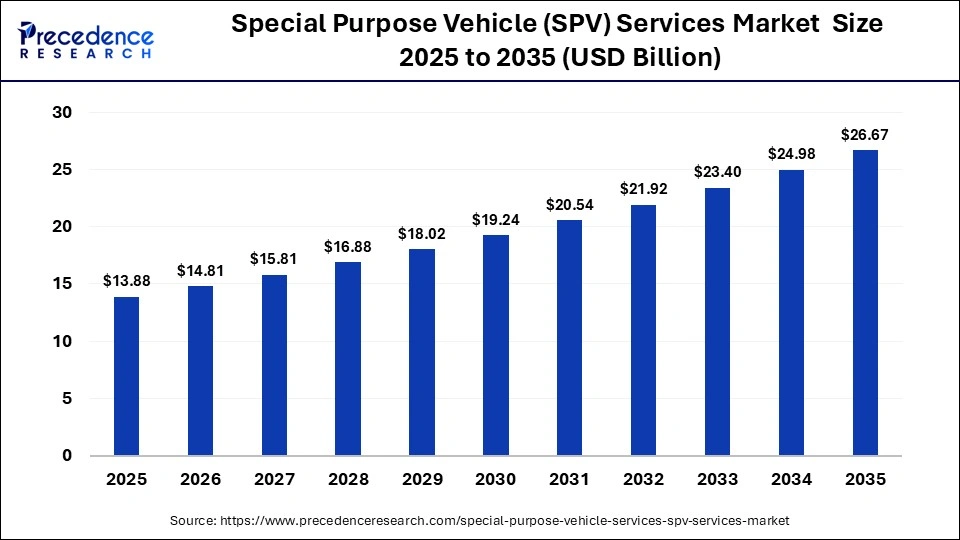

The global global special purpose vehicle (SPV) services market size was calculated at USD 13.88 billion in 2025 and is predicted to increase from USD 14.81billion in 2026 to approximately USD 26.67 billion by 2035, expanding at a CAGR of 6.75% from 2026 to 2035.The market is driven by the increasing adoption of special-purpose vehicle (SPV) services by insurance companies to secure assets and manage specific projects. Additionally, rising infrastructure projects, expanding investment in real estate, and the need for regulatory compliance are further driving the market.

Market Highlights

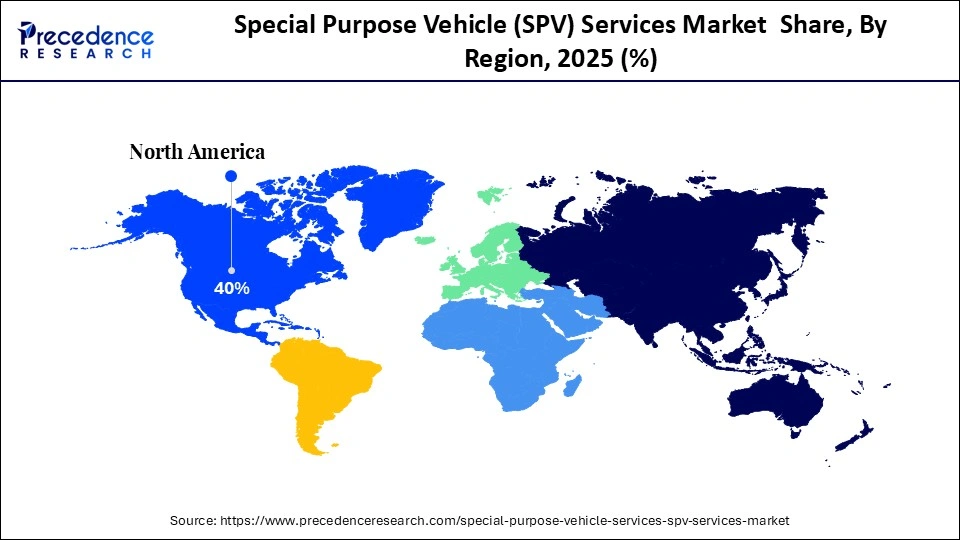

- North America led the special purpose vehicle (SPV) services market with a share of 40% in 2025.

- Asia Pacific is expected to grow at the fastest CAGR of 7.0% during the forecast period.

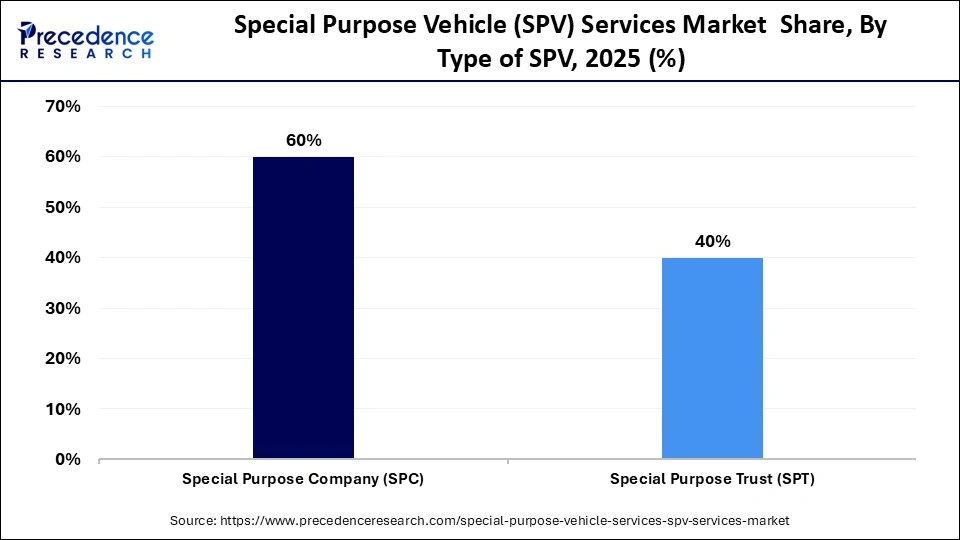

- By type of SPV, the special purpose company (SPC) segment held the largest market share of 60% in 2025.

- By type of SPV, the special purpose trust (SPT) segment is expected to grow at the highest CAGR of 5.5% between 2026 and 2035.

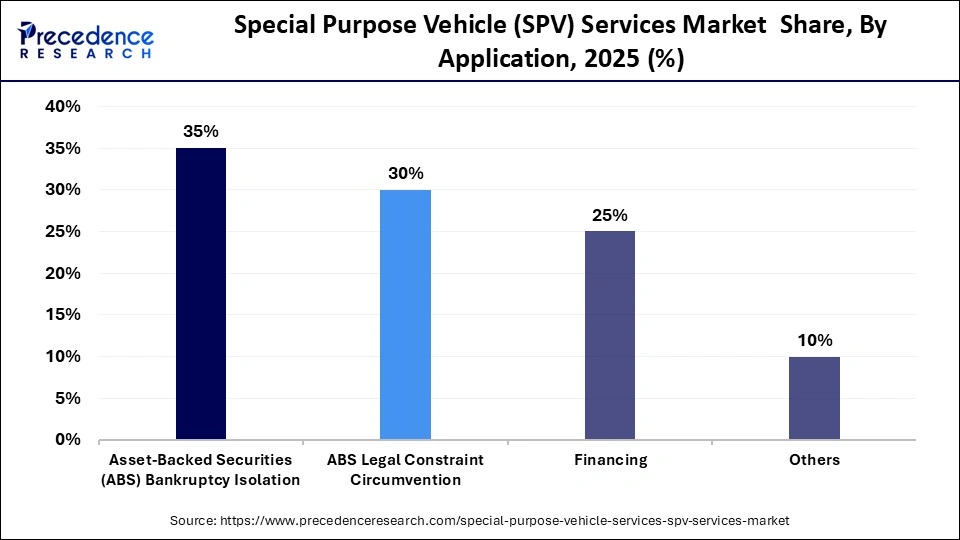

- By application, the asset-backed securities (ABS) bankruptcy isolation segment held the largest market share of 35% in 2025.

- By application, the financing segment is expected to expand at the fastest CAGR of 5.9% during the forecast period.

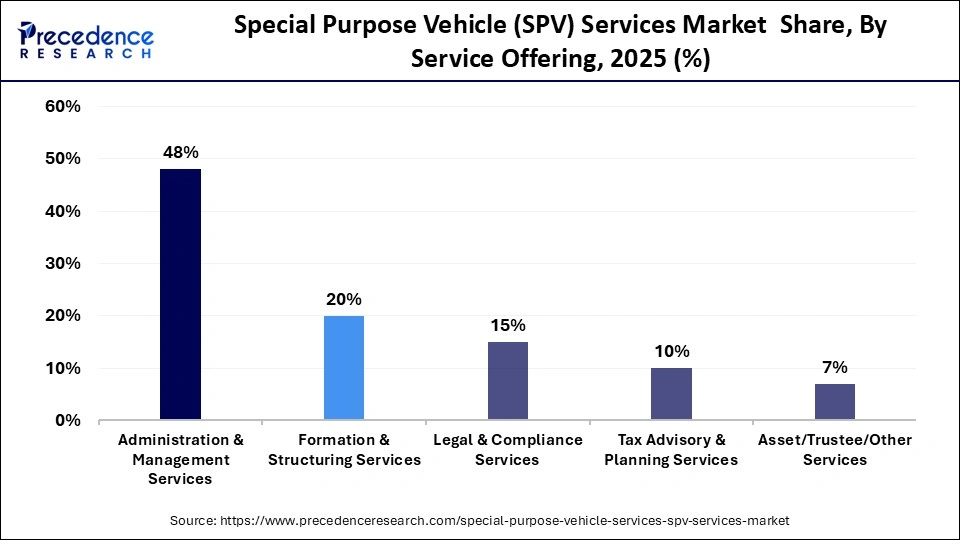

- By service offering, the administration & management services segment held the highest market share of 48% in 2025.

- By service offering, the asset/trustee/other services segment is expected to grow at the highest CAGR of 5.6% during the forecast period.

- By industry focus/end-user, the banking & financial institutions segment dominated the market with a share of 40% in 2025.

- By industry focus/end-user, the real estate & infrastructure segment is expected to expand with a considerable CAGR during the forecast period.

Market Overview

The special purpose vehicle (SPV) services market is a crucial segment of the finance sector. The market includes professional services that support the creation, administration, compliance, and management of special-purpose vehicles, legally distinct entities used to isolate financial risk, facilitate securitization, project finance, structured investments, and regulatory optimization. These services encompass structuring, governance, accounting, reporting, and advisory functions that help corporations, financial institutions, and investors manage complex transactions, mitigate risk, and meet regulatory requirements across global jurisdictions, driven by growth in structured finance and cross-border investments.

The increasing adoption of SPVs by investment firms for managing credit flow and numerous government initiatives aimed at strengthening the BFSI sector are driving the market expansion. Moreover, the growth of the banking industry across the world is expected to have a positive impact on the market.

How Does AI Influence the Special Purpose Vehicle (SPV) Services Industry?

Artificial intelligence has made a significant impact on the finance sector by reducing costs, enhancing operational efficiency, and improving decision-making through advanced data analysis and automation. Nowadays, SPV providers have started integrating AI into their platforms to enhance risk management & fraud detection, along with increasing operational efficiency. This adoption of AI has not only improved the efficiency and reliability of SPV services but has also contributed substantially to the overall growth and development of the market.

- In September 2025, Apex Group launched an AI-driven WealthTech platform. This platform is designed to help wealth managers, private banks, distributors, and fund managers efficiently serve the next generation of investors with advanced investment opportunities in private equity, private credit, and alternative assets.

Special Purpose Vehicle (SPV) Services Market Trends

- Increased Adoption for Risk Mitigation: Companies are increasingly using SPVs to isolate financial and legal risks, especially in project finance and large-scale investments.

- Growth in Infrastructure and Real Estate Projects: Expanding infrastructure and real estate developments are driving demand for SPV services to manage project financing and ensure compliance.

- Integration of Digital Platforms and Automation: Automation and fintech solutions are streamlining SPV setup, reporting, and governance, reducing operational costs and enhancing transparency.

- Collaborations: Numerous finance companies are collaborating with SPV providers to enhance their operational efficiency.

- Service Launches: Numerous market players are launching different types of SPV services for end-user industries.

- Government Investment: The governments of several nations, including China, India, the UK, Canada, and the U.S., are investing rapidly in strengthening the BFSI infrastructure.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 13.88Billion |

| Market Size in 2026 | USD 14.81 Billion |

| Market Size by 2035 | USD 26.67 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.75% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Type of SPV, Application, Service Offering , Industry Focus/ End-User, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Type of SPV Insights

Why Did the Special Purpose Company (SPC) Segment Dominate the Market?

The special purpose company (SPC) segment dominated the special purpose vehicle (SPV) services market with the largest share of 60% in 2025. This is mainly due to the increased use of special purpose companies (SPC) in parent companies to secure assets, isolate financial risk, facilitate specific, and narrow transactions. SPCs provide a legally separate entity that limits liability and isolates financial risk, making them a preferred choice for investors and financial institutions. Additionally, numerous functions of SPCs, including securitization of assets, risk isolation and management, project financing, and regulatory compliance, are driving its adoption.

The special purpose trust (SPT) segment is expected to grow at the highest CAGR of 5.5% between 2026 and 2035. The growth of the segment is driven by the rapid adoption of special purpose trust (SPT) by financial institutions and originators to hold assets for specific, non-charitable, or charitable purposes. SPTs offer enhanced legal and tax efficiency, as well as greater flexibility in managing and segregating assets for investors. Also, several benefits of SPT, such as risk isolation, asset protection, tax optimization, and enhanced confidentiality, are expected to boost its adoption.

Application Insights

What Made Asset-Backed Securities (ABS) Bankruptcy Isolation the Leading Segment in the Market?

The asset-backed securities (ABS) bankruptcy isolation segment led the special purpose vehicle (SPV) services market with a major share of 35% in 2025. The segment's dominance is driven by the growing adoption of SPV services to provide additional security during bankruptcy situations. Additionally, the rising application of SPVs in bankruptcy isolation, such as legal separation, investor security, and protection from substantive consolidation, is expected to sustain the segment's growth trajectory in the coming years.

The financing segment is expected to expand at a strong CAGR of 5.9% during the forecast period. The growth of the segment is driven by the increasing use of SPVs in the financial sector to protect the parent firm from liabilities. Also, numerous applications of SPVs in the finance industry, including asset securitization, off-balance sheet financing, and investment pooling & startup funding, are expected to drive the growth of the segment.

Service Offering Insights

Why Did the Administration & Management Services Segment Dominate the Market?

The administration & management services segment dominated the special purpose vehicle (SPV) services market with a share of 48% in 2025. This is primarily due to the increased demand for administration & management services by real-estate companies to manage their daily activities. These services provide essential functions such as regulatory compliance, accounting, reporting, and day-to-day management of SPVs. Financial institutions, investment funds, and corporates rely heavily on these services to ensure smooth operations, transparency, and risk mitigation.

The asset/trustee/other services segment is expected to expand at the fastest CAGR of 5.6% in the upcoming period. This is mainly due to the rising adoption of asset management solutions by finance companies for preventing fraud. As investors and financial institutions seek transparency, risk mitigation, and compliance with regulatory frameworks, the demand for trustee, custodial, and other specialized services rises. Additionally, the growth of complex structured finance, securitizations, and cross-border transactions is driving the adoption of these services to ensure proper governance and efficient management of SPVs.

Industry Focus/End-user Insights

How Does the Banking & Financial Institutions Segment Lead the Market?

The banking & financial institutions segment led the special purpose vehicle (SPV) services market by holding a major revenue share of 40% in 2025. This is mainly due to the heightened adoption of legal and compliance services by these institutions to enhance their working efficiency. Their reliance on SPVs for managing complex financial transactions, regulatory compliance, and asset isolation drives consistent demand for SPV services. Additionally, the increasing adoption of SPVs in banks for asset securitization and risk isolation is expected to foster segmental growth.

The real estate & infrastructure segment is expected to grow at a considerable CAGR during the forecast period due to the increasing use of SPVs for project financing, risk isolation, and efficient management of large-scale developments. Special Purpose Vehicles (SPVs) are used in the real estate sector to ring-fence liabilities, isolate project-specific risks, and facilitate joint ventures. Moreover, its application in enhancing tax efficiency, structuring investments, and enabling asset securitization is expected to boost the growth of the segment.

Regional Insights

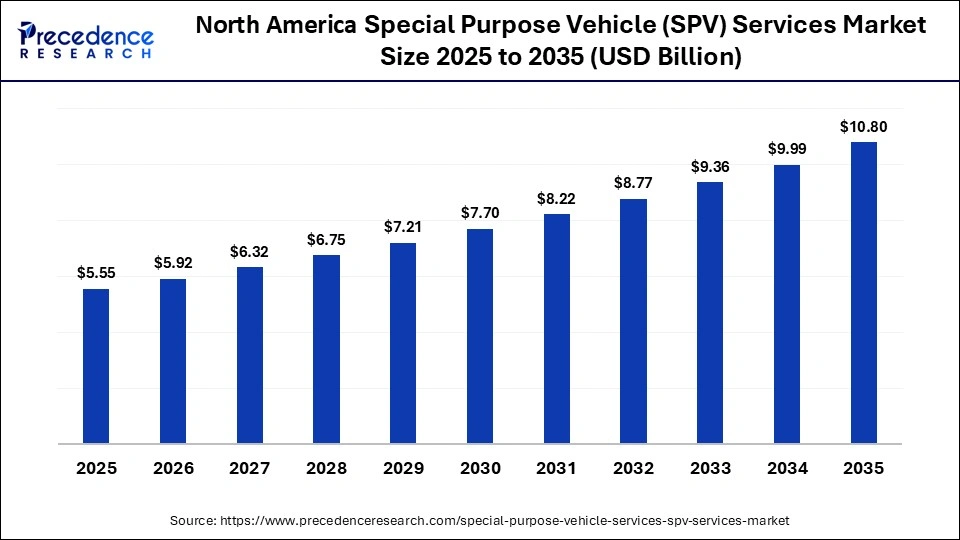

How Big is the North America Special Purpose Vehicle (SPV) Services Market Size?

The North America special purpose vehicle (SPV) services market size is estimated at USD 5.55 billion in 2025 and is projected to reach approximately USD 10.80 billion by 2035, with a 6.88% CAGR from 2026 to 2035.

What Made North America the Dominant Region in the Special Purpose Vehicle (SPV) Services Market?

North America dominated the special purpose vehicle (SPV) services market by capturing the largest share of 40% in 2025. This is mainly due to the increased popularity of assetsecuritization and structured finance activities in the U.S., Canada, and Mexico. There is a high level of legal & compliance services from the insurance firms, which positively contributed to the market. Moreover, the presence of various market players, including BNY Mellon, Vistra, Intertrust Group, and JPMorgan Chase, and advanced technological adoption, including AI-driven risk management and automation, are expected to sustain the region's dominance in the market.

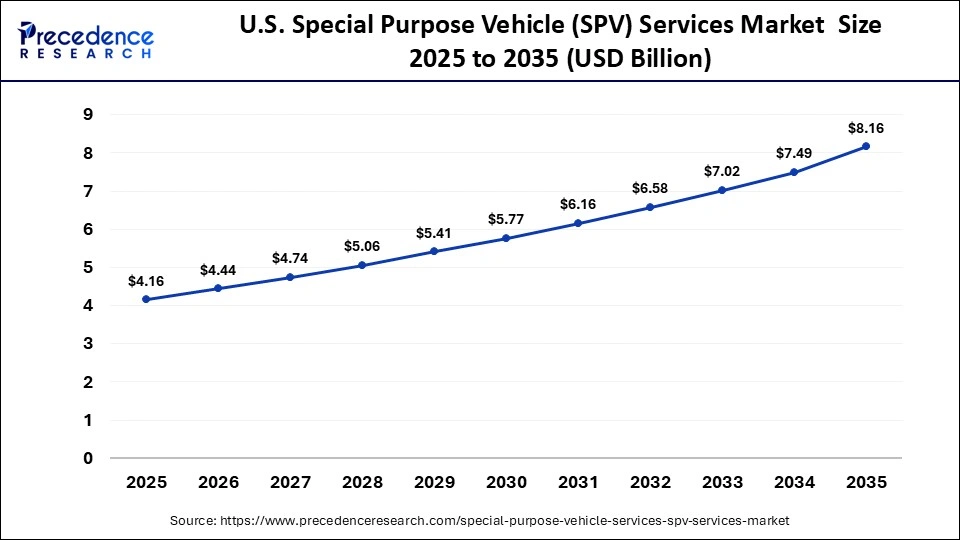

What is the Size of the U.S. Special Purpose Vehicle (SPV) Services Market?

The U.S. special purpose vehicle (SPV) services market size is calculated at USD 4.16 billion in 2025 and is expected to reach nearly USD 8.16 billion in 2035, accelerating at a strong CAGR of 6.97% between 2026 and 2035.

U.S. Special Purpose Vehicle (SPV) Services Market Trends

The market in the U.S. is expanding due to the widespread use of special-purpose vehicles in real estate, infrastructure, and structured finance transactions, supported by well-established legal and regulatory frameworks. High investment activity, strong capital markets, and the adoption of advanced technologies like AI and automation for risk management and operational efficiency are also driving growth. Additionally, the increasing use of management and administration services by investment firms, as well as rapid infrastructural development, is contributing to market growth.

Why is Asia Pacific Considered the Fastest-Growing Region in the Market?

Asia Pacific is expected to grow at the highest CAGR of 7% during the forecast period. This is mainly due to the rising adoption of trust SPVs in the real estate sector across various nations, such as South Africa, Japan, China, and India. The rise in the number of financial institutions, along with the surging adoption of SPVs by the banking and finance companies, is also driving the market. Moreover, the presence of several market players, including Kyokuto Kaihatsu Kogyo Co., Ltd., TMF Group, Carta Asia, and IQ-EQ, is expected to contribute to the growth of the special purpose vehicle (SPV) services market in this region.

China Special Purpose Vehicle (SPV) Services Market Analysis

The surging adoption of accounting and reporting services by the real estate sector, along with the increasing proliferation of corporate companies, is driving the market in China. Additionally, technological advancements in the banking sector, as well as a surging focus on cross-border governance, are playing a vital role in shaping the industrial landscape.

Who are the Major Players in the Global Special Purpose Vehicle (SPV) Services Market?

The major players in the global special purpose vehicle (SPV) services market include Citi, HSBC, JPMorgan Chase UBS, Wilmington Trust, JTC Group, Maples Group, IQ-EQ, Citco Group, Vistra, BNY Mellon, Northern Trust, Sanne Group, Aztec Group, Apex Group

Recent Developments

- In November 2025, Sap Taulia launched an AI-based Supply Chain Finance SPV in Italy. This AI-enabled platform is designed for the fintech sector across this country.

- In September 2025, NUCFDC partners with CSC SPV. This partnership aims at transforming urban cooperative banks of India with modern infrastructure.

- In August 2025, Structum launched a SPV-as-a-Service platform. This service platform is designed for venture capital firms, global investors, and enterprises.

- In August 2025, DMCC launched SPV and holding company licenses. These licences are designed to offer businesses, investors, and family offices enhanced flexibility in asset protection, investment structuring, and others.

- In May 2025, Shore Capital partnered with Sweetmore Bakeries. This partnership aims at recapitalization of the Sweetmore Bakeries through a special purpose vehicle.

- In March 2025, SPV. Co launched an advanced automation software. This software is designed for the creation and compliance of special purpose vehicles (SPVs) to cater to the needs of private equity, venture capital, and real estate investments.

Segments Covered in the Report

By Type of SPV

- Special Purpose Company (SPC)

- Special Purpose Trust (SPT)

By Application

- Asset-Backed Securities (ABS) Bankruptcy Isolation

- ABS Legal Constraint Circumvention

- Financing

- Others

By Service Offering

- Administration & Management Services

- Formation & Structuring Services

- Legal & Compliance Services

- Tax Advisory & Planning Services

- Asset/Trustee/Other Services

By Industry Focus/ End-User

- Banking & Financial Institutions

- Real Estate & Infrastructure

- Private Equity & Venture Capital

- Others (Insurance, Corporates, Gov't)

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content