What is the Sports and Leisure Equipment Market Size?

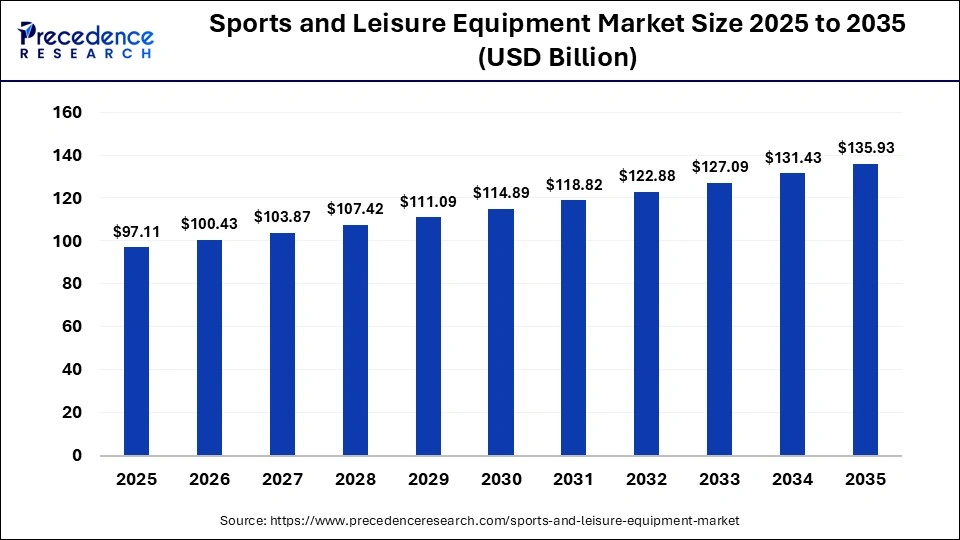

The global sports and leisure equipment market size was estimated at USD 97.11 billion in 2025 and is predicted to increase from USD 100.43 billion in 2026 to approximately USD 135.93 billion by 2035, expanding at a CAGR of 3.42% from 2026 to 2035. The market growth is attributed to rising consumer participation in sports, fitness adoption, and increasing demand for advanced equipment.

Market Highlights

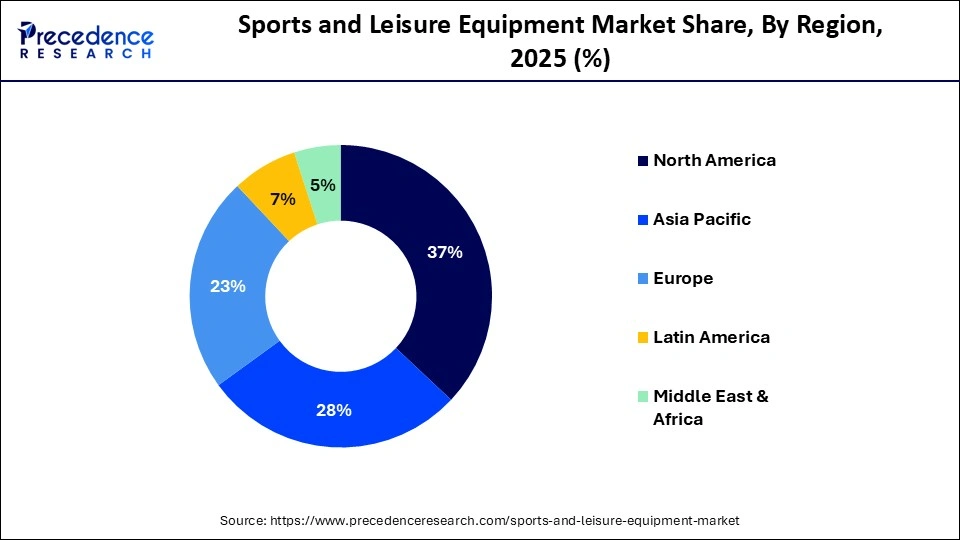

- North America dominated the market with approximately 37% of the market share in 2025.

- The Asia Pacific is expected to grow at the fastest CAGR of 7% between 2026 and 2035.

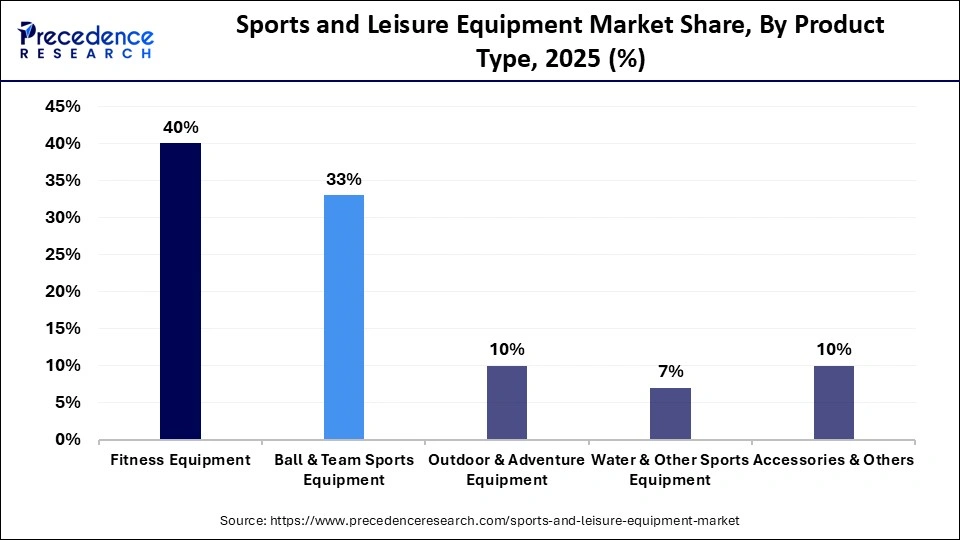

- By product type, the fitness equipment segment dominated the sports and leisure equipment market with a share of approximately 40% in 2025, and is seen to sustain its position during the forecast period with a CAGR of 5.9%.

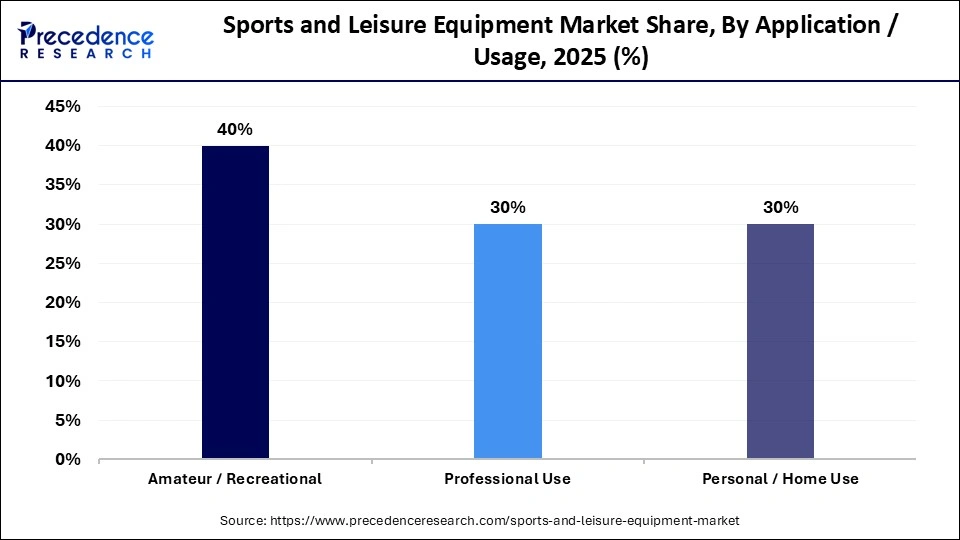

- By application/usage, the amateur/recreational segment held a major market share of approximately 40% in 2025.

- By application/usage, the personal/home use segment is expected to expand at the fastest CAGR of 6.2% from 2026 and 2035

- By distribution channel, online/e-commerce segment dominated the market with a share of approximately 40% in 2025, and is seen to sustain the position during the forecast period with a CAGR of 5.6%.

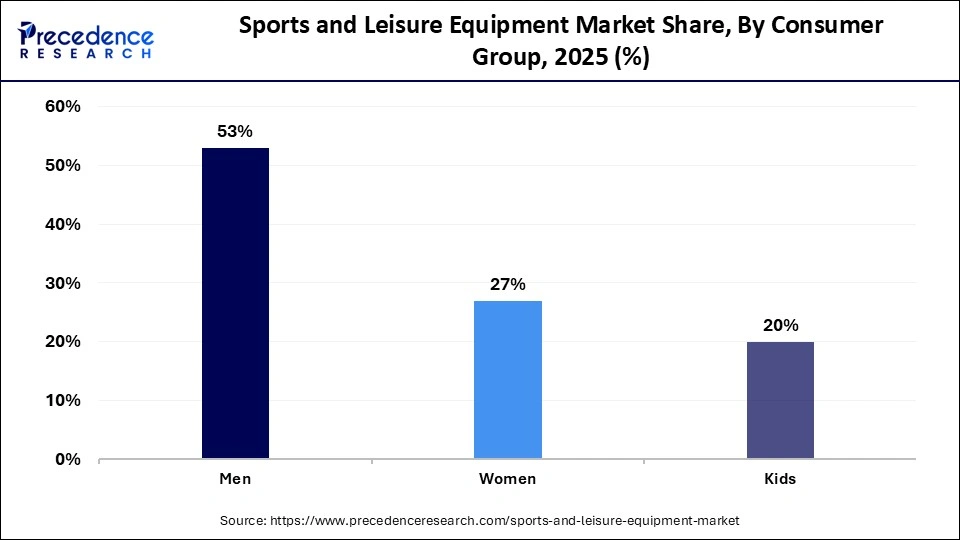

- By consumer group, the men segment generated the biggest market share of approximately 53% in 2025.

- By consumer group, the women segment is expected to expand at the fastest CAGR of 5.8% between 2026 and 2035

Market Overview

The sports and leisure equipment market comprises products designed for physical activity, fitness, outdoor recreation, and competitive sports. It includes equipment for ball sports, fitness machines, camping/outdoor gear, water, and team sports, as well as accessories, apparel, and footwear. The market is being significantly propelled by the rising global physical activity and sports participation, a key driver that also underscores broader health and public policy priorities. Sports programs in schools and communities increase youth participation, which is associated with increased consumption of equipment.

Impact of AI on the Sports and Leisure Equipment Market

Artificial intelligence (AI) and machine learning (ML) are revolutionizing the way sports equipment is designed and manufactured. They are used in altering the technology of the sports ecosystem overall and are making a tangible difference. ML and computer vision have now been used by manufacturers to simulate thousands of possible product design alternatives. Moreover, the public research and industry reports project rapid growth in sports AI applications, with markets expanding as clubs and brands adopt predictive analytics and performance tracking tools.

Sports and leisure equipment Market Growth Factors

- Rising Adoption of Connected Fitness Devices: Growing consumer preference for smart workout equipment is propelling interactive fitness engagement.

- Expansion of Virtual Training Platforms: Online and app-based coaching programs are boosting participation across home and commercial gyms.

- Integration of Gamification in Workouts: Gamified exercise experiences are fuelling user motivation and consistent engagement in interactive fitness.

Market Trends

- Hybrid Fitness & Digital Community Platforms Strengthening Equipment Demand

Integration of virtual classes, challenges, and social leader boards with physical equipment drives repeat purchases. This digital physical fusion is expected to expand the market for interactive home and commercial sports products in 2026.

- Wearable Integrated Sports Equipment Driving Precision Focused Purchases

Connected shoes, sensor-embedded balls, and smart training rigs deliver real-time performance and recovery metrics. The growing use of wearable-linked gear fuels demand for tech-enhanced sports equipment in the coming years.

- Immersive & Gamified Training Experiences Elevating Market Participation

Gamification integrated into sports gear, rewards, challenges, and virtual environments, boosts usage frequency. Interactive experiences are expanding the market for tech-enhanced sports and leisure products in 2026.

Global Sports and Leisure Equipment Market in a Phase of Accelerated Evolution

- China is a major manufacturing and export hub for sporting goods, with China's sporting goods exports totaling approximately USD 14.90 billion in the first half of 2025, driven especially by fitness equipment and treadmills, even as some categories like sportswear and footwear declined in value.

- In FY 2023-24, India's sports equipment exports were approximately USD 523.24 million, with continued shipments in FY 2024-25 suggesting ongoing export activity.

- Export shipment data (Jun 2024–May 2025) shows that globally, there were 172,305 shipments of sports goods from nearly 4,000 exporters to 5,000 buyers worldwide, marking about 31% export growth compared to the prior 12-month period, indicating expansion in manufacturing activity reaching export markets.

- Global expansion of fitness facilities continued through 2025, with the number of health and fitness clubs worldwide growing nearly 4% year-on-year, reflecting sustained infrastructure development in urban centres that boosts demand for commercial and consumer fitness equipment.

- In the U.S., urban fitness participation and facility growth remain high, with nearly 77 million Americans holding gym or studio memberships in 2024, up from previous years, underpinning increased equipment purchases for both commercial gyms and personal use in cities.

- According to the 2025 Global Fitness Industry Report, global fitness club memberships climbed by about 6% year over year in 2024, which encourages continued purchase of commercial and personal fitness equipment

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 97.11 Billion |

| Market Size in 2026 | USD 100.43 Billion |

| Market Size by 2035 | USD 135.93 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 3.42% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product Type, Application/Usage, Distribution Channel, Consumer Group, and region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segmental Insights

Product Type Insights

Which Product Type Segment Dominated the Sports and Leisure Equipment Market?

The fitness equipment segment held the largest revenue share of approximately 40% in the market in 2025, and is seen to sustain its position during the forecast period with a CAGR of 5.9%, as consumers are shifting towards personalized and connected workout solutions.

Data from the SFIA 2025 show that winter sports activities grew by 1.7%, and general fitness activities increased by 0.3%. The idea of healthier living contributes to the demand for treadmills and intelligent machines. Furthermore, the segment remains poised to lead future growth as active lifestyles and public health engagement shape equipment adoption in 2025.

Application/Usage Insights

Why Did the Amateur/Recreational Segment Dominate the Market?

The amateur/recreational segment held the largest revenue share of approximately 40% in the sports and leisure equipment market in 2025, as broad public engagement across sports and fitness activities remains strong and diverse. According to the 2025 SFIA Topline Participation Report, the overall physical activity participation reached 80% for active Americans.

This indicates high demand for the fundamental sports gear, activity equipment, and casual products, as a great number of people are involved in non-competitive walking, jogging, and team activities. Additionally, the higher rates of casual fitness and outdoor activity among adults amateur encourage purchase for sports and leisure equipment.

The personal/home use segment is expected to grow at the fastest CAGR in the coming years, with a 6.2% CAGR, due to the increasing number of people investing in a personal workout solution that meets the flexible scheduling and well-being needs. Furthermore, the home-based conditioning and exercise gym sessions to the established recreation, which is driving the demand for personal equipment.

Distribution Channel Insights

How the Online/E-commerce Segment Dominated the Market?

The online/e-commerce segment held a dominant position in the sports and leisure equipment market with a share of approximately 40% in 2025, and is seen to sustain the position in the coming years with a CAGR of 5.6%, due to the consumers' increasing preference for digital shopping. Online retail penetration is running high, as 77% of online EU customers are purchasing goods online in 2024, which is way higher than 59% in 2014.

This indicates a widespread acceptance of shopping online, including sports equipment. Additionally, the mobile and internet access growth boosts access for younger demographics, who frequently browse and buy sports products through apps and platforms.

Consumer Group Insights

Why Did the Men Segment Dominate the Sports and Leisure Equipment Market?

The men segment contributed the biggest revenue share of approximately 53% in the market in 2025, as men participate in sports and physical activity at higher rates, especially in structured and competitive contexts. Additionally, the ongoing expansion of fitness initiatives aimed at broadening male participation is expected to maintain male dominance in consumer demand over the coming years.

The women segment is expected to grow at the fastest CAGR in the coming years, accounting for 5.8% CAGR, because barriers to participation are slowly reducing and women have more opportunities in sport. Efforts, such as the UNESCO Sport and Gender Equality Game Plan, seek to lower the number of dropouts of women in sports. Additionally, social media conversations around women's sport continue to expand, amplifying female athlete influence and consumer interest in performance and lifestyle products in the coming years.

Regional Insights

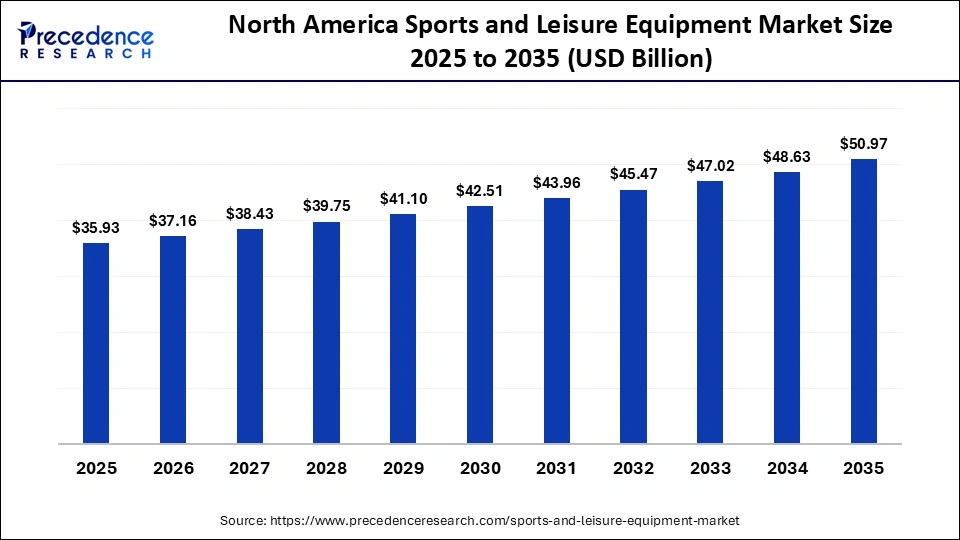

How Big is the North America Sports and Leisure EquipmentMarket Size?

The North America sports and leisure equipment market size is estimated at USD 35.93 billion in 2025 and is projected to reach approximately USD 50.97 billion by 2035, with a 3.56% CAGR from 2026 to 2035

Why Did North America Lead the Sports and Leisure Equipment Market?

North America led the market, capturing the largest revenue share of approximately 37% in 2025, due to high participation levels that continued to remain high, and consumers were engaged widely across demographics.

In the 2023-24 school year, sports participation in the U.S. was at record levels, including more than 8.2 million high school athletes in the country. This represents high involvement of youth in sports, which is a demand driver for fitness equipment. Furthermore, participation in diverse activities, including lacrosse, volleyball, and tennis, broadens the range of equipment purchased, sustaining strong equipment demand in this region.

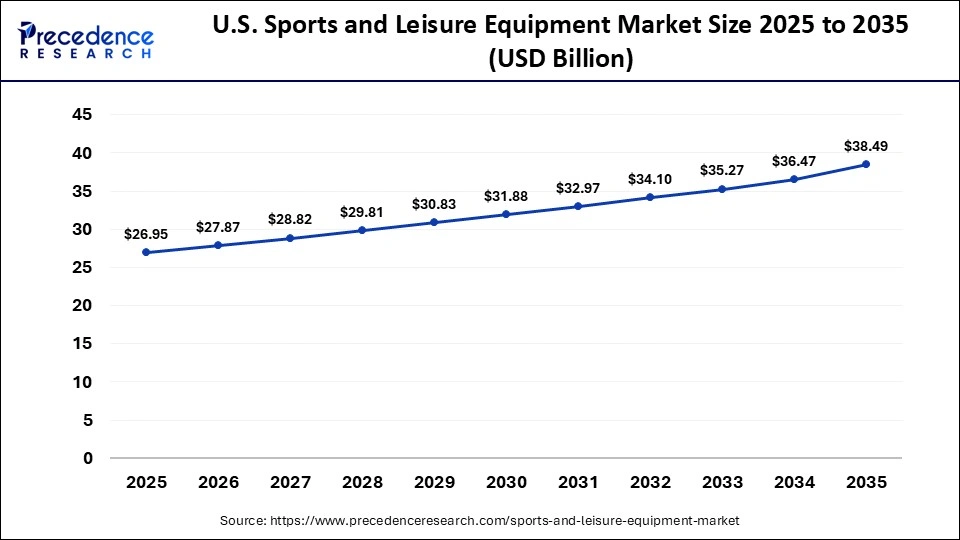

What is the Size of the U.S. Sports and Leisure EquipmentMarket?

The U.S. sports and leisure equipment market size is calculated at USD 26.95 billion in 2025 and is expected to reach nearly USD 38.49 billion in 2035, accelerating at a strong CAGR of 3.63% between 2026 and 2035.

U.S. – Driving Regional Demand in North America

U.S. leads the regional North America, as sports participation is still exceptionally high in the youth, adult, and recreational segments. National statistics indicate that there were 8.26 million high school athletes in organized sports during the 2024-25 season, a record of high school sports activity in the U.S. Moreover, the expansive sports culture and robust engagement across age groups show that the U.S. is expected to sustain strong equipment demand growth into 2026.

Which Factors Propel Equipment Demand Across Asia Pacific Sports Consumers?

Asia Pacific is expected to grow at the fastest CAGR of 7.0% in the sports and leisure equipment market during the forecast period, owing to the participation expansion and public engagement rising swiftly across multiple countries, supported by large population bases and government sports policies.

According to the official statistics, China had a sports and fitness participation rate of approximately 49.6% in December 2024. This is a high percentage when compared with the past years, and it indicates an even further involvement of consumers in active lifestyles. Additionally, demographic growth, rising incomes, and participation momentum persist across Asia-Pacific, and demand is projected to grow faster than in many mature regions in the coming years.

China – Accelerating Growth in Asia Pacific

China is leading the charge in the Asia Pacific market, as it is evidenced by the general population's involvement and government policy that highly encourages the consumption of sports and other related sporting equipment. The participation in outdoor sports increased higher than the projected values as of 2025.

Over 400 million individuals are involved in outdoor sports, which highlights the popularity of gear in hiking, biking, water sports, and snow sports. Furthermore, the urban and suburban growth in sports participation further drives demand for performance and recreational products, making China a core growth engine.

Sports and Leisure Equipment Market – Value Chain Analysis

- Product Concept & Design

Conceptualization of sports gear and equipment with a focus on performance, comfort, and safety.

Key Players: Nike, Adidas, Under Armour, Puma

- Manufacturing & Assembly

Transformation of design specifications into finished products through cutting, molding, and stitching.

Key Players: Contract Manufacturers, In-house Manufacturing Units of Nike/Adidas, Decathlon

- Quality Testing & Certification

Rigorous performance, durability, and safety assessments to meet sport federation standards.

Key Players: Independent Testing Labs, ISO/Sport Standards Bodies, Brand Quality Divisions

- Logistics & Distribution

Transportation of finished equipment to regional warehouses and retail channels.

Key Players: Logistics Providers, Decathlon Distribution Hubs, Nike/Adidas Fulfillment Networks

- Retail & Omni Channel Sales

Delivery of products to consumers via stores, e-commerce, and specialty retailers.

Key Players: Decathlon, Dick's Sporting Goods, Intersport, Academy Sports + Outdoors

Who are the Major Players in the Global Sports and Leisure Equipment Market?

The major players in the sports and leisure equipment market includeAdidas AG, Amer Sports Corporation, ASICS Corporation, Bauer Hockey LLC, Callaway Golf Company, Columbia Sportswear Company, Decathlon S.A., Mizuno Corporation, New Balance Athletics Inc., Nike, Inc., Puma SE, Skechers USA Inc., Under Armour, Inc., Wilson Sporting Goods, and Yonex Co. Ltd.

Recent Developments in the Sports and Leisure Equipment Market

- In January 2026, Bluestone Equity Partners made a major investment in Selkirk Sport, a leading pickleball equipment manufacturer. This underscores the increasing popularity of niche and emerging sports, driving innovation and participation in equipment segments across the market.(Source: https://www.businesswire.com)

- In September 2025, Lehar Footwear Limited entered the performance footwear segment with its new sports and athleisure brand, RANNR. Targeting young professionals, fitness enthusiasts, and lifestyle-conscious consumers, the brand combines durability, comfort, and style, meeting growing demand for versatile, value-driven sports footwear.(Source:https://www.indianretailer.com)

- In August 2025,Eleiko, a leader in premium strength equipment, launched interactive online configurator tools to simplify gym design and equipment planning. The platform, developed with London Dynamics, uses 3D modeling and augmented reality, enabling gyms and fitness centers to customize and visualize setups efficiently. This innovation reflects the rising demand for tech-enabled, flexible fitness solutions in the market.(Source:https://www.leisureopportunities.co.uk)

Segments Covered in the Report

By Product Type

- Fitness Equipment

- Ball & Team Sports Equipment

- Outdoor & Adventure Equipment

- Water & Other Sports Equipment

- Accessories & Others

By Application/Usage

- Professional Use

- Amateur/Recreational

- Personal/Home Use

By Distribution Channel

- Online/E-commerce

- Specialty Sport Stores

- Supermarkets/Hypermarkets

- Others (Dept. Stores, Direct)

By Consumer Group

- Men

- Women

- Kids

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content