Sports Broadcasting Technology Market Size and Forecast 2025 to 2034

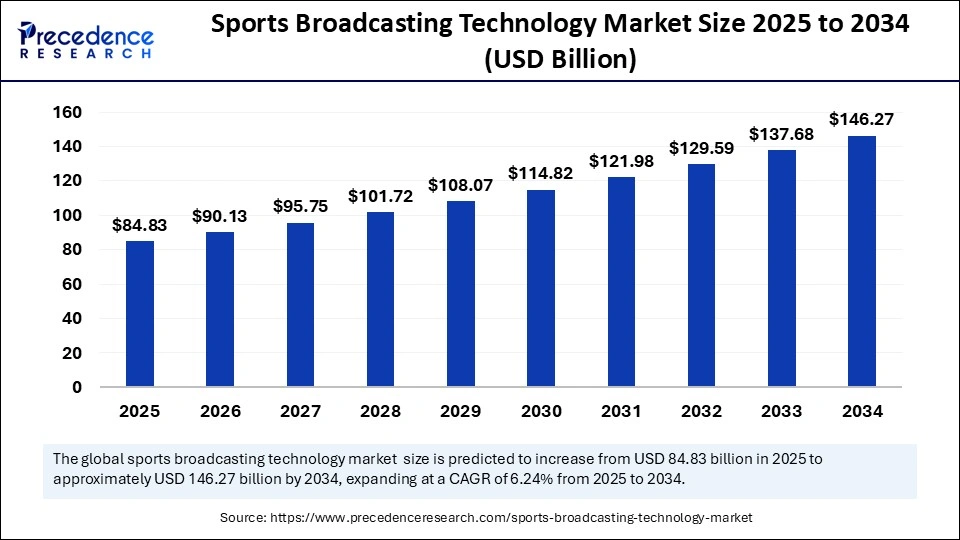

The global sports broadcasting technology market size was calculated at USD 79.85 billion in 2024 and is predicted to increase from USD 84.83 billion in 2025 to approximately USD 146.27 billion by 2034, expanding at a CAGR of 6.24% from 2025 to 2034. The demand for advanced camera technologies is driving the global market. The demand for live sports content and the expansion of sports broadcasting channels are driving the need for advanced sports broadcasting technologies, driving the market expansion.

Sports Broadcasting Technology Market Key Takeaways

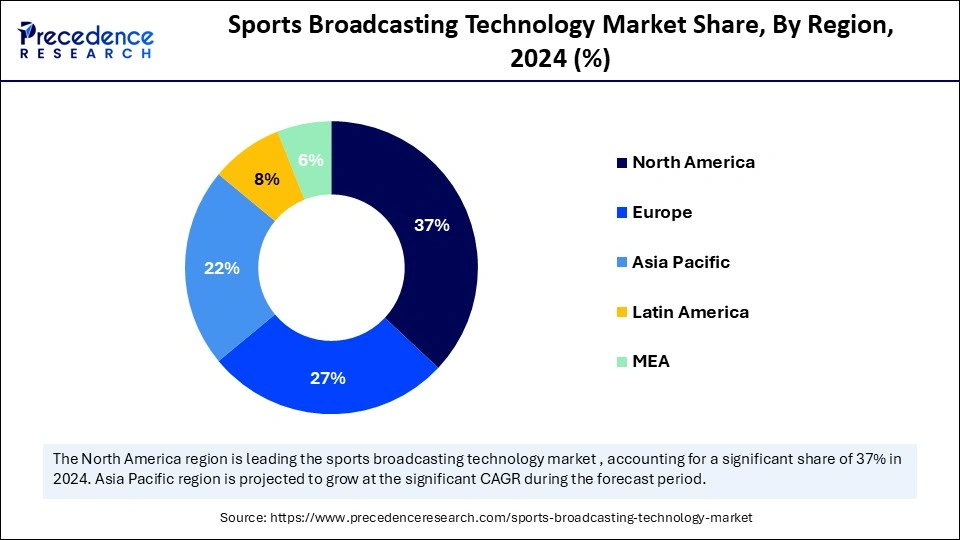

- North America dominated the sports broadcasting technology market with the largest share of 37% in 2024.

- Asia Pacific is projected to host the fastest-growing market in the coming years.

- Europe is anticipated to witness notable growth in the global market.

- By component, the solutions segment led the global market in 2024.

- By component, the services segment is projected to expand rapidly in the coming years.

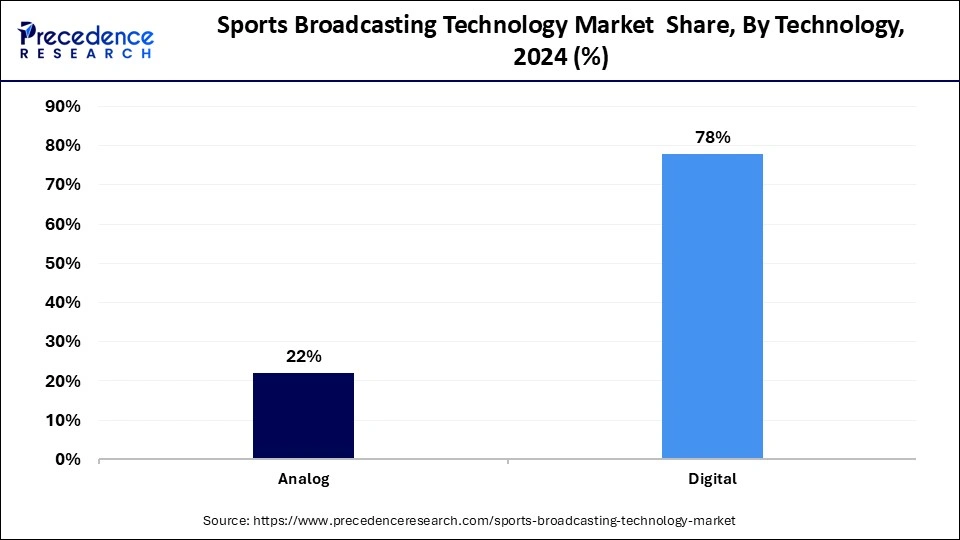

- By technology, the digital segment held a biggest market share of 78% in 2024.

- By technology, the analog segment is expected to grow rapidly during the forecast period of 2025 to 2034.

- By platform, the television segment dominated the global market in 2024.

- By platform, the OTT platform segment is projected to grow at the fastest CAGR in the future years.

- By end-use, the broadcasters segment led the global market in 2024.

Artificial Intelligence (AI) Transformative Approaches in Sports Broadcasting Technologies

Artificial Intelligence has gained popularity for its significant applications like personalized content recommendations, real-time analysis, and automated highlight generation. It is improving broadcasting efficiency by providing automated camera control, content creation, editing, and predictive maintenance applications in the sports broadcasting technology market. AI is a spectacular tool for improving visibility and streamlining operations. Stadiums are implementing AI-based cameras for seamless observations. The camera allows teams, players, and coaches to analyze detailed player clips and game events.

- In April 2024, Spiideo equipped AI cameras at every single National Women's Soccer League (NWSL) stadium to provide automated multi-angle broadcasts.

U.S. Sports Broadcasting Technology Market Size and Growth 2025 to 2034

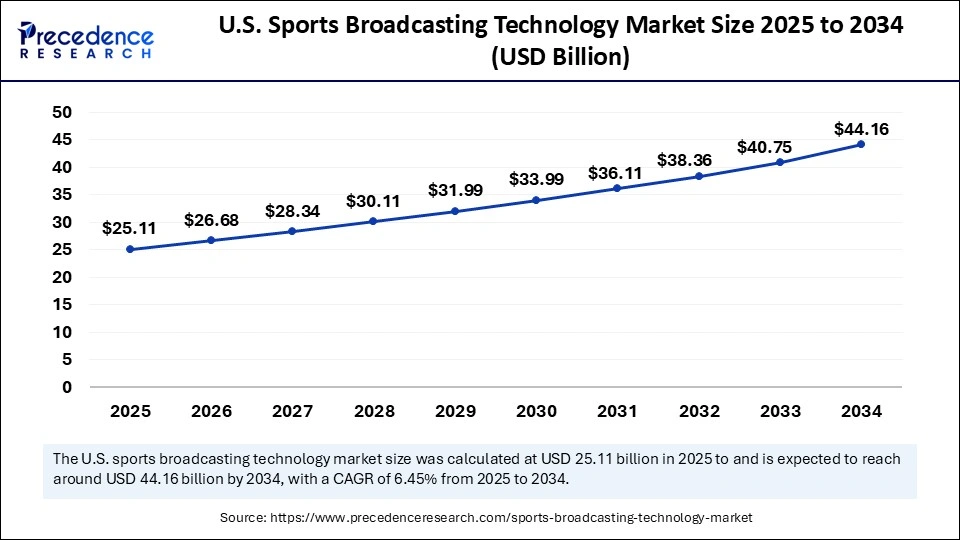

The U.S. sports broadcasting technology market size was exhibited at USD 23.64 billion in 2024 and is projected to be worth around USD 44.16 billion by 2034, growing at a CAGR of 6.45% from 2025 to 2034.

Advanced Infrastructure Leading North American Market

North America dominated the sports broadcasting technology market with the largest share in 2024, driven by advanced infrastructure and the presence of major sports leagues. North America is home to well-established infrastructures such as high-speed networks and advanced broadcasting equipment. Early and high adoption of AI, augmented reality, andInternet of Things devices is trending in the North American market. Additionally, the region has witnessed significant demand for sports content, driving the development of a strong sports culture and audience base.

The United States is leading the regional market due to the country's strong sports culture and large sports fan base. The existence of major sports leagues is driving demand for advanced sports broadcasting technologies in the country. Key market vendors are collaborative with other companies and institutes to advance technological innovation and developments.

- In February 2025, Boomtown Innovation powered Comcast NBCUniversal SportsTech, an R&D program to drive, identify, and cultivate emerging companies' growth and shape the sports industry while creating a space for Comcast and its partners to test and pilot new solutions.

Digital Transformation: Increasing Adoption of Advanced Technologies in Asia

Asia Pacific is projected to host the fastest-growing sports broadcasting technology market in the coming years., leading the global sports broadcasting technology market due to various factors like digital transformation, demand for sports content, and technological advancements. Asia Pacific is a hub for sports events. The increasing investments, innovations, and social changes are driving significant improvements in sports events, leagues, and corporations. Investors are surging for significant growth and opportunities, driving focus on the adoption of advanced technologies like 5G technology, AI, and VR. The increased investments in sports infrastructure and a high audience base are driving the adoption of advanced sports broadcasting technologies.

Countries like China, Japan, India, and South Korea are contributing a significant market share. Japan's strong focus on technology and innovation is driving sports broadcasting technological advancements. The Chinese government is increasing investments in sports infrastructure and broadcasting technologies. India, with the highest sports audience, has witnessed increased demand for sports content and events. Vendors' collaborations and investments in sports broadcasting contribute to market expansion.

- In February 2025, Kudan Inc., a global leader in Simultaneous Localization and Mapping (SLAM) technology, collaborated with FOX Sports to redefine augmented reality (AR) experiences in live sports broadcasting to debut at the upcoming Super Bowl LIX, where Kudan's patent-pending high-frequency 3D LiDAR SLAM tracking software will power next-generation AR enhancements, delivering an unprecedented viewing experience for immersive sports entertainment.

Strong Sports Culture Contributing to the European Market

Europe is anticipated to witness notable growth in the global sports broadcasting technology market, driven by the region's strong sports culture, well-established sports leagues, and digital transformation. European sports broadcasting has increased the adoption of cutting-edge technologies such as Augmented Reality and Virtual Reality, and AI. European streaming platforms are allowing sports broadcasters to experiment with new technologies, driving audience attraction and demand.

- In April 2025, Warner Bros. Discovery (WBD) Sports Europe and its partner Amazon Web Services (AWS) launched Cycling Central Intelligence (CCI), an innovative generative AI-powered platform that transforms how mountain biking events are brought to viewers worldwide.

Italy is a significant player in the European market, driving expansion in sports broadcasting technology due to high-quality television platforms and telecom services. The existence of major sports leagues and infrastructure advancements, including high-speed internet and advanced equipment, is driving Italy's position in the sports broadcasting technology market.

Market Overview

The sports broadcasting technology market is witnessing transformative growth, driven by increased demand for live sports content and technological advancements. The rise in sports audiences and the increased popularity of live sports has driven emphasis on the need for advanced technologies. Broadcasters are adopting cutting-edge technologies like 4K, 8K, and HDR broadcasting, enabling high visual quality.

The sports are gaining popularity on OTT platforms and witnessing demand for personalized content. Expanded sports broadcasting channels are available on mobile devices and are contributing to market expansion. Additionally, the growing adoption of high-definition and 4K television is projected to fuel sports broadcasting technological advancements. The surge of broadcasters to satisfy consumer demands is a trend of innovations and developments in technologies.

Sports Broadcasting Technology Market Growth Factors

- Demand for live sports: Live sports content is gaining popularity, driving demand for advanced sports broadcasting technologies.

- Expansion of sports broadcasting channels: The sports broadcasting channel has expanded due to the increased audience of various sports. Additionally, the adoption of multi-channel broadcasting is an emerging opportunity for advanced technologies.

- Growth of streaming platforms: The rise of OTT services and online streaming platforms requires cutting-edge sports broadcasting technologies.

- Virtual and augmented reality: audience driving demand for high-experience-based sports broadcasting.

Sustainability: Broadcasters are focusing on adopting green technologies to reduce environmental impact, creating novel opportunities for innovation and development. - Advancements in camera technology: The adoption of advanced cameras like high-resolution cameras, 4K and 8K lenses, and AI-powered cameras has increased to improve viewing experiences, driving the sports broadcasting technology market.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 146.27 Billion |

| Market Size in 2025 | USD 84.83 Billion |

| Market Size in 2024 | USD 79.85 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 6.24% |

| Dominated Region | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Component, Technology, Platform, End-User, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America and Middle East & Africa |

Market Dynamics

Drivers

Rise of streamlined platforms

The sports broadcasting technology market has witnessed significant growth and tension growth of streamlined platforms. Streamline platforms enable sports broadcasters to distribute efficient content and improve quality. Audiences are driving demand for seamless viewing experiences with personalized content recommendations and live streaming, enhancing the popularity of streaming platforms. The need for sports broadcasters for content management for more effectiveness in live events highlights the analysis driving the growth of streamlined platforms.

Restraint

High implementation cost

The high upfront investments in analytics platforms, VR equipment, and wearable devices are increasing the implementation cost of sports broadcasting technology. High infrastructure costs associated with building and maintaining are further causing challenges for technological implementations. Upgrading stadiums to smart stadiums involves heavy investments in digital infrastructure. Additionally, expensive technology upgrades like 4K and 8K broadcasting increase the implementation cost of sports broadcasting technologies.

Opportunity

Rise in demand for immersive experiences

The increased popularity of sports and the rise of streamlined platforms have increased the demand for immersive experiences. Sports broadcasters are investing in innovation and advancements in cutting-edge technologies like camera technology, live streaming, and the adoption of AI, AR, and VR to enhance viewing experiences. AI, AR, and VR technologies revolutionizing live broadcasting provide immersive views and interactive experiences. 4K, 8K, and HDR broadcasting enable high picture quality and provide more immersive viewing. The rising OTT platform popularity is contributing to the increasing need for immersive experiences to drive significant impact on innovation and development of sports broadcasting technologies.

Component Insights

The solutions segment led the global sports broadcasting technology market in 2024. Solution components include hardware and software. The increased demand for high-quality content and the popularity of OTT platforms are driving the adoption of advanced broadcasting solutions. Technological advancements like AI-powered cameras and cloud-based solutions enable high-quality and efficiency sports broadcasting. The demand for solutions like camera systems, broadcasting software, amplifiers, encoders, transmitters, repeaters, and modulators is increasing in sports broadcasting events.

The services segment is projected to expand rapidly in the coming years, driven by increased demand for personalized experiences. The growth of streamlined services like maintenance, managed services, implementation, and consulting services is contributing to the segment's growth. Adoption of AI, AR, and VR-based technologies and the popularity of OTT platforms are expanding the adoption of advanced sports broadcasting services.

Technology Insights

The digital segment held a dominant presence in the sports broadcasting technology market in 2024, driven by the rising demand for online sports content. Digital, streamlined platforms are becoming popular in sports content. Advances in digital broadcasting technology, like 4K and 8K, enable improved quality and efficiency of sports broadcasting. ESPN+, Amazon Prime Video, and DAZN are the major platforms driving digital sports broadcasting popularity and audience engagement.

The analog segment is expected to grow rapidly during the forecast period of 2025 to 2034 due to its cost-effectiveness and reliability. Analog technology is cost-effective compared to digital technology, making it an ideal solution for limited-budget events. Small sports events, such as local sports and areas with limited digital infrastructure developments, drive the adoption of analog technology.

Platform Insights

The television segment dominated the global sports broadcasting technology market in 2024 due to the demand for high-quality broadcasts on television. Television is the primary platform for sports watching due to the major popularity of sports channels and live event broadcasting. The wide reach and accessibility of television make it a prime platform for sports broadcasting. Additionally, technological advancements like 4K television and the adoption of high-definition are increasing its preference among audiences.

However, the OTT platform segment is projected to grow at the fastest rate in the future years. The increased demand for personalized content, recommendations, and interactive experiences is shifting audience preference toward OTT platforms. OTT platforms are flexible and have a high reach toward the audience. The increased online sports consumption is driving the popularity of OTT platforms.

End-Use Insights

The broadcasters segment led the global sports broadcasting technology market in 2024 and is expected to continue its dominance over the forecast period. The demand for advanced technologies for sports broadcasting has increased due to the rising audience range and rising sports popularity. The demand for high-quality broadcasting has surged, and broadcasters' investments in technologies like 4K, 8K displays, HDR, and high-speed cameras have enhanced the viewing experience. The expansion of sports broadcasting channels and the popularity of OTT platforms are driving the need for advanced sports broadcasting technologies. Digital broadcasting enables sports broadcasters to reach a wider audience.

Sports Broadcasting Technology Market Companies

- Broadcast Electronics (Elenos S.r.L.),

- IBM Corporation

- Staige GmbH

- Rohde and Schwarz

- AvL Technologies

- OMB Broadcast

- Global Invacom

- Hangzhou HAOXUN Technologies Co., Ltd.

- ETL System Ltd.

- NEC Corporation

- VSN Video Stream Networks S.L.

- Sportradar AG

Recent Developments

- In November 2024, Pixotope Technologies launched the Pixotope Reveal, an AI-powered background segmentation tool that transforms how broadcasters integrate real-time graphics into live productions.

- In July 2024, Alibaba Cloud collaborated with Olympic Broadcasting Services (OBS) and unveiled OBS Cloud 3.0, an innovative AI-enhanced platform designed for the primary method of content distribution for the Paris Games.

- In April 2024, MediaKind, the global change leader in media technology services and solutions, launched several new scalable solutions, including enhanced cloud capabilities, edge cloud devices, and AI innovations for sports rights holders, content owners, broadcasters, vMVPDs, and pay-TV providers at NAB Show 2024 in Las Vegas, NV.

Segments Covered in the Report

By Component

- Solutions

- Software

- Hardware

- Dish Antennas

- Amplifiers

- Switches

- Encoders

- Video Servers

- Transmitters/Repeaters

- Modulators

- Others

- Services

By Technology

- Analog

- Digital

By Platform

- OTT

- Radio

- Television

- Satellite Direct-to-Home

- Digital Terrestrial Television (DTT)

- Cable Television

- IPTV

By End-User

- Broadcaster

- Studios and Content Developer

- Distributors

By Region

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Get a Sample

Get a Sample

Table Of Content

Table Of Content