What is the Virtual Sports Market Size?

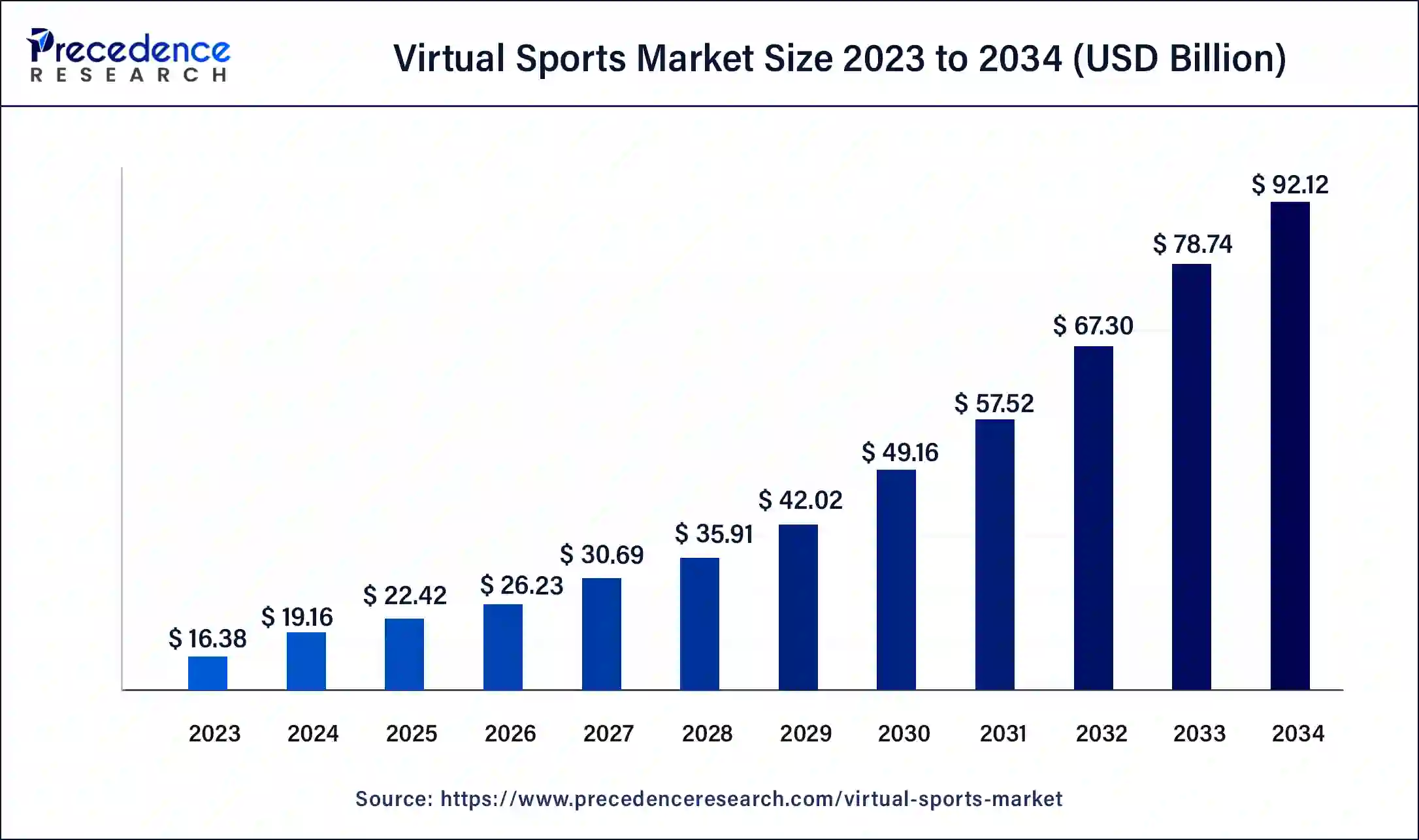

The global Virtual Sports Market size is calculated at USD 22.42 billion in 2025 and is predicted to increase from USD 26.23 billion in 2026 to approximately USD 105.50 billion by 2035, expanding at a CAGR of 16.75% from 2026 to 2035.

Virtual Sports Market Key Takeaways

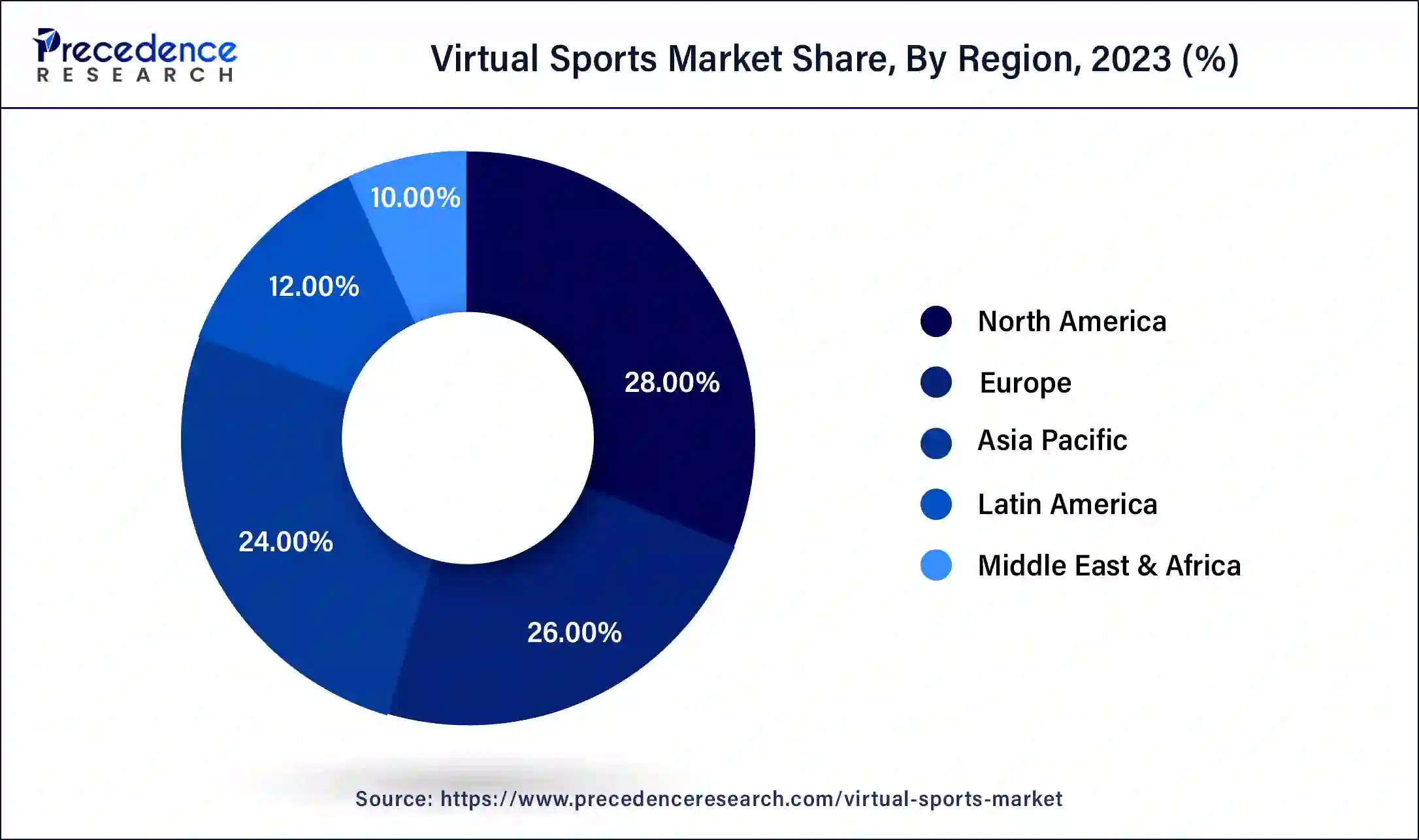

- North America led the global market with the highest market share of 28% in 2025.

- Asia Pacific is expected to witness the fastest CAGR of 19.07% during the forecast period.

- By component, the solution segment held the largest segment of 86% in 2025.

- By component, the services segment is expected to grow at a significant rate during the forecast period.

- By game, the football virtual sports segment held the largest market share of 30% in 2025.

- By game, the basketball virtual sports segment is expected to grow at a notable rate.

- By demographic, the 21 to 35 years segment has contributed more than 42% of revenue share in 2025.

- By demographic, the below 21 years segment is expected to grow at a notable CAGR of 17.05% during the forecast period.

Market Overview

The virtual sports market refers to a sector within the broader sports and entertainment industry that involves the creation and simulation of sports events through computer-generated graphics and technology. Unlike traditional sports that are played in physical arenas, virtual sports take place in virtual environments, often facilitated by advanced computer software and simulations. Virtual sports events are created using advanced simulation technologies, incorporating realistic graphics, physics, and artificial intelligence to mimic the dynamics of real-world sports.

The virtual sports market often overlaps with the online gaming and betting industry. Users can place bets on virtual sports events, and virtual sports simulations may serve as the basis for various sports-themed video games. It also provide entertainment for both participants and spectators. Gamers can compete against each other, and fans can watch virtual sports events as a form of entertainment, often featuring commentary and analysis similar to traditional sports broadcasts.

- In March 2023, Aristocrat Gaming announced its partnership with Inspired Entertainment to launch new virtual sports capability to football fans globally through Aristocrat Gaming's multiyear global licensing agreement with the NFL (National Football League). The virtual sports simulations will offer fans with the capability to wager on teams as they go head-to-head in ultra-realistic, fast-paced, and simulated matchups.

Virtual Sports Market Growth Factors

- Ongoing advancements in technology, such as improvements in graphics, artificial intelligence, and virtual reality, enhance the realism and immersive nature of virtual sports. As technology continues to evolve, it attracts more users seeking a high-quality and engaging virtual sports experience.

- The widespread availability of high-speed internet and the increasing global connectivity enable users from different parts of the world to participate in and spectate virtual sports events. This accessibility contributes to the expansion of the virtual sports market on a global scale.

- The prevalence of smartphones and mobile devices allows users to access virtual sports platforms easily. Mobile gaming and apps dedicated to virtual sports provide a convenient and on-the-go experience, contributing to the market's growth.

- Collaborations between the virtual sports industry and other sectors, such as gaming, betting, and entertainment, create synergies that attract a diverse audience. Integration with online gaming platforms and betting services adds new dimensions to the virtual sports market, appealing to a broader user base.

- Evolving consumer preferences, especially among younger demographics, favor digital and interactive experiences. Virtual sports cater to this demand by offering an alternative and technologically-driven form of entertainment, attracting users who may not be as interested in traditional sports.

- The COVID-19 pandemic highlighted the importance of virtual experiences when physical gatherings were restricted. Virtual sports provided a viable alternative for sports enthusiasts and offered a means of entertainment during lockdowns and social distancing measures, contributing to increased adoption.

- The growth of e-sports, which involves competitive gaming, has positively influenced the market. E-sports enthusiasts may find virtual sports appealing due to shared characteristics, such as competitive gameplay and online engagement.

- Continuous innovation in virtual sports content, including the introduction of new sports simulations, game modes, and interactive features, keeps users engaged. Regular updates and fresh content contribute to user retention and attract new participants.

- Increased marketing efforts and sponsorships in the virtual sports sector contribute to its visibility and legitimacy. As the market gains recognition, more companies are likely to invest in virtual sports events, further fueling its growth.

- Supportive regulatory frameworks in various regions can encourage the growth of the virtual sports market by providing a conducive environment for businesses, fostering innovation, and ensuring consumer protection.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 105.50 Billion |

| Market Size in 2025 | USD 22.42 Billion |

| Market Size in 2026 | USD 26.23 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 16.75% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Component, Game, Demographic, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Rise of mobile gaming

The rise of mobile gaming has emerged as a powerful driver for the increasing demand in the virtual sports market. With the widespread penetration of smartphones and the continuous evolution of mobile gaming technology, users now have the convenience of accessing virtual sports experiences at their fingertips. The portability and accessibility of mobile devices have democratized participation in virtual sports, enabling a diverse and global user base. Mobile gaming's influence extends beyond accessibility, as smartphones provide an immersive platform for engaging virtual sports content.

The integration of advanced graphics, responsive touch controls, and augmented reality features on mobile devices enhances the overall user experience, bridging the gap between virtual and real-world environments. This trend aligns with evolving consumer preferences, especially among younger demographics, who seek interactive and on-the-go entertainment experiences.

Furthermore, mobile platforms serve as a catalyst for social interaction and community building within the virtual sports realm. Multiplayer modes, real-time competitions, and in-app communication features create a dynamic and connected virtual sports ecosystem. As the mobile gaming landscape continues to thrive, its symbiotic relationship with the virtual sports market not only propels the demand but also establishes a transformative paradigm in the way audiences engage with sports and entertainment on a global scale.

Restraint

Limited physical interaction

The limited physical interaction inherent in virtual sports poses a potential constraint on the demand for this burgeoning market. Unlike traditional sports that thrive on the tangible, real-world engagement of players and fans, virtual sports lack the physicality and hands-on experiences that have long characterized sports culture. This absence of direct physical interaction may hinder the widespread adoption of virtual sports among individuals who cherish the visceral aspects of traditional sports events.

Human beings are inherently social creatures, and the camaraderie and shared experiences in a physical sporting arena contribute significantly to the allure of sports. Virtual sports, existing in the digital realm, may struggle to replicate the emotional intensity and genuine connection that fans experience when witnessing live events. The tactile elements of cheering for a favorite team, the adrenaline of live competition, and the collective energy of a crowd are difficult to replicate in a virtual environment.

Moreover, the limited physical interaction may impact the perceived authenticity of virtual sports, potentially deterring traditional sports enthusiasts who find fulfillment in the raw, unscripted moments of real-world competitions. Overcoming this restraint will require innovative approaches to enhance the virtual sports experience, such as integrating augmented reality or creating immersive, socially interactive virtual environments that offer users a sense of physical presence and shared participation.

Opportunity

Continued advancements in virtual reality (VR) and augmented reality (AR) technologies

- In December 2023, MeetKai partnered with Meta-Stadiums to launch a world-first football, FIFA Sports Metaverse platform that willl allow fans to attend real-time virtual games from FIFA footballers. The platform will also provide 137 FIFA teams for 150 live virtual football matches.

Continued advancements in virtual reality (VR) and augmented reality (AR) technologies present unprecedented opportunities for the virtual sports market. As augmented reality and virtual reality capabilities progress, the potential for creating highly immersive and lifelike virtual sports experiences becomes increasingly tangible. VR headsets, in particular, allow users to step into virtual stadiums, interact with 3D simulations, and experience sports events as if they were physically present. Augmented reality introduces exciting possibilities for merging virtual elements with the real world, enhancing the viewing experience for users.

AR applications could overlay real-time statistics, player profiles, or interactive graphics onto a user's physical surroundings during virtual sports events, providing a dynamic and engaging experience. These technologies have the potential to transcend the limitations of traditional 2D screens, offering users a more compelling and interactive means of engaging with virtual sports content.

Furthermore, VR and AR advancements open doors to innovative training and educational applications within the virtual sports realm. Athletes could use VR simulations for skill development, tactical training, and strategic analysis. Fans might participate in immersive virtual sports experiences, bringing them closer to the action and deepening their connection to their favorite teams and players. As VR and AR technologies continue to evolve, the virtual sports market stands at the forefront of a transformative era, poised to redefine how sports enthusiasts engage with and experience their favorite games.

Component Insights

The kits segment dominated the virtual sports market in 2025; the segment is observed to continue the trend throughout the forecast period. The solutions segment encompasses the technological products and software applications that form the core offerings of the virtual sports market. This includes the development and deployment of virtual sports simulations, gaming platforms, and content creation tools. Solutions within this category focus on providing realistic and engaging virtual sports experiences, incorporating advancements in graphics, artificial intelligence, and simulation technologies.

Virtual sports solutions cater to a variety of sports simulations, ranging from traditional sports like soccer and basketball to innovative and futuristic game concepts. The development of cutting-edge solutions is crucial for capturing user interest and ensuring the immersive quality of virtual sports experiences.

The services segment is expected to grow at a significant rate throughout the forecast period. The services segment of the virtual sports market encompasses a range of offerings that support the implementation, customization, and maintenance of virtual sports solutions. These services may include consulting, system integration, training, and ongoing technical support. Consulting services assist clients in understanding the potential of virtual sports, defining strategies, and selecting suitable solutions based on their specific needs.

System integration services focus on seamlessly incorporating virtual sports solutions into existing infrastructure. Training services aim to educate users on how to maximize their virtual sports experience, while ongoing support ensures the smooth operation and troubleshooting of virtual sports platforms. The services component is instrumental in enhancing the overall value proposition of virtual sports, ensuring that clients can effectively leverage and optimize their virtual sports solutions.

Game Insights

The football virtual sports segment held the dominating share of the virtual sports market in 2025. Virtual football simulations replicate the dynamics of traditional football (soccer) matches. These games offer users the experience of playing or spectating football matches in a virtual environment, complete with realistic graphics, player movements, and strategic gameplay.

The basketball virtual sports segment is expected to generate a notable revenue share in the market. Virtual basketball games replicate the fast-paced and dynamic nature of basketball matches. Users can enjoy playing or watching virtual basketball games that capture the essence of the sport, including team coordination, scoring, and strategic gameplay.

- In September 2023, 2K launched top-rated NBA video game simulation series, the NBA 24. This will feature in new In NBA 2024 Season, unified Seasonal progressions and Pass options track that combines MyTEAM and MyCAREER into linear rewards system.

Demographic Insights

The 21 to 35 years segment is observed to hold the dominating share of the virtual sports market during the forecast period. Individuals in the 21 to 35 years age group represent a key demographic for virtual sports platforms. This age range typically includes a tech-savvy audience with a strong interest in sports and gaming. Virtual sports experiences designed for this segment may focus on providing a balance between realism, interactivity, and social features to cater to the preferences of users in their prime gaming years.

The below 21-year segment is expected to generate a notable revenue share in the market. This demographic segment comprises individuals who are younger than 21 years old. Younger users often embrace technology and digital experiences more readily, making them a significant target audience for virtual sports platforms. Virtual sports can cater to the preferences and gaming habits of this age group, offering engaging and innovative experiences.

Regional Insights

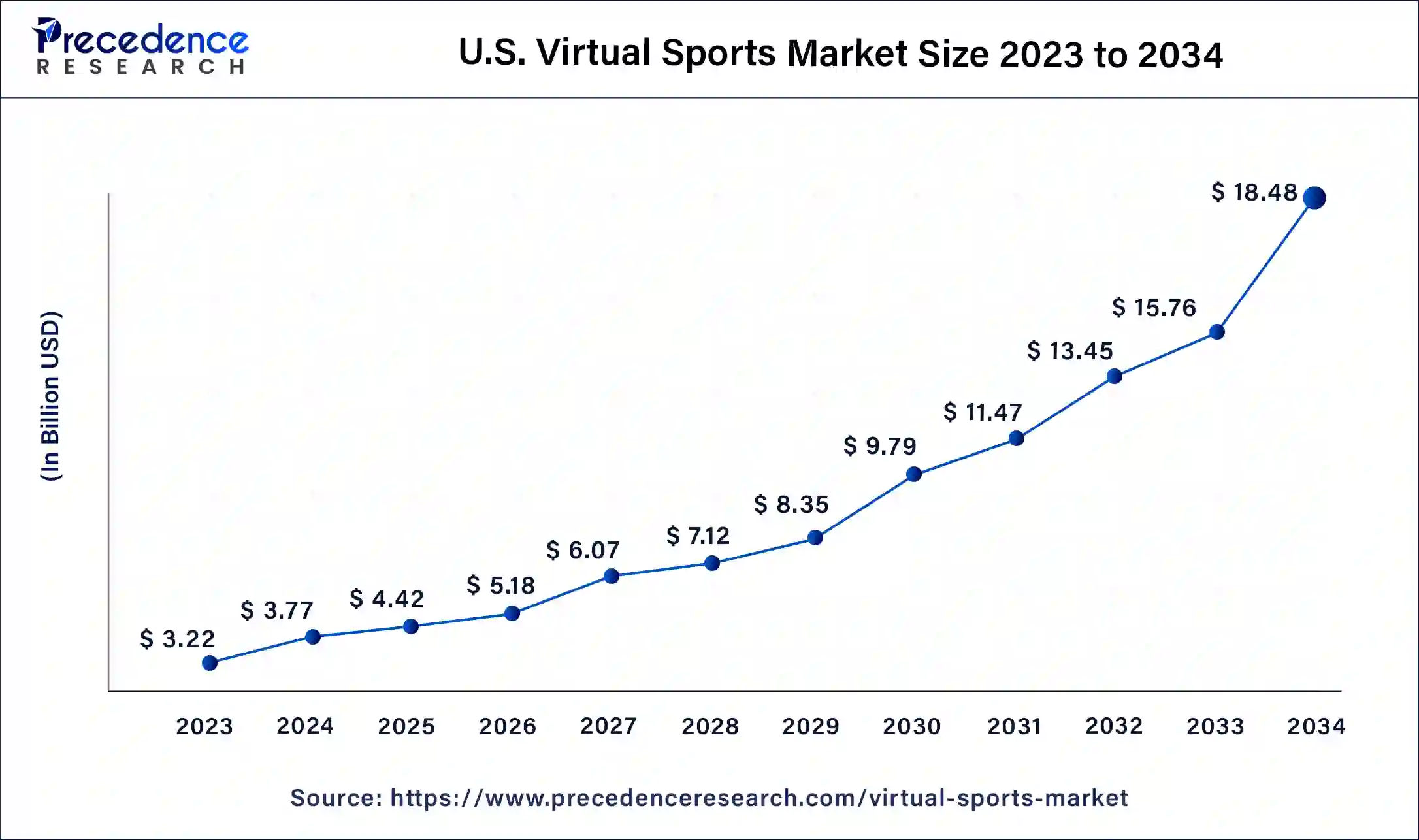

U.S. Virtual Sports Market Size and Growth 2026 to 2035

The U.S. Virtual Sports Market size is estimated at USD 4.42 billion in 2025 and is predicted to be worth around USD 21.20 billion by 2035, at a CAGR of 16.97% from 2026 to 2035.

In 2025, North America dominated the virtual sports market due various factors including technological advancements, a robust gaming culture, and increasing interest in virtual experiences. North America has been at the forefront of technological innovation, and this trend extends to the virtual sports market. Ongoing advancements in graphics, artificial intelligence, and virtual reality technologies have enhanced the realism and immersive nature of virtual sports experiences.

U.S. Market Trends

The U.S. virtual sports market is driven by technological advancements such as VR/AR, AI, the rising popularity of online sports betting, and the growth of esports. The increasing culture and even massive viewership of eSports, mainly among younger demographics, are also driving the market.

Additionally, the prevalence of mobile gaming has played a significant role in the virtual sports market in North America. The accessibility and convenience of mobile devices have made virtual sports experiences more accessible to a wide range of users, contributing to increased engagement. With a deep-rooted passion for traditional sports, North America has seen a seamless integration of virtual sports into its sports culture. Virtual sports platforms often offer simulations of popular sports like football, basketball, and baseball, catering to the interests of sports enthusiasts.

What Makes Asia Pacific the Rapidly Growing Region in the Market?

Asia-Pacific is poised for rapid growth in the virtual sports market due to various factors such as increasing internet penetration, rising smartphone adoption, and a growing interest in gaming and sports-related content. The Asia-Pacific region has been a global hub for gaming culture, with countries like China, Japan, and South Korea leading in terms of both gaming consumption and production. The popularity of esports and online gaming has contributed to a receptive environment for virtual sports. In addition, the prevalence of mobile gaming in Asia-Pacific has played a significant role in the growth of the virtual sports market.

China Market Trends

China's virtual sports market is being driven by a massive gamer population, widespread adoption of advanced technologies, and a booming esports industry. Key trends fueling growth include rapid expansion in mobile gaming, football simulation games, and the integration of VR/AR technologies to deliver more immersive and interactive gaming experiences.

How is the Opportunistic Rise of Europe in the Market?

Meanwhile, Europe is growing at a notable rate in the virtual sports driven by factors such as technological advancements, the popularity of gaming culture, and a growing interest in virtual experiences. Europe has a strong gaming culture, with a significant number of gamers and esports enthusiasts. The popularity of esports events and competitive gaming has fostered an environment where virtual sports are well-received, especially among the tech-savvy demographic. Europe has a rich sports culture, and virtual sports platforms often offer simulations of popular sports such as football (soccer), basketball, and racing. The region's existing passion for traditional sports contributes to the acceptance and adoption of virtual sports experiences.

Germany

Germany's market is driven by the rising popularity of online gaming, along with betting, and technological advancements. There is increasing adoption and exploration of cutting-edge technologies, which include augmented reality (AR) as well as virtual reality (VR), to create more interactive gaming experiences, contributing to the market.

What Potentiates the Market in Latin America?

Latin America's virtual sports market is expected to grow notably during the forecast period, driven by mobile-first engagement, increasing regulation, football's popularity, and the demand for hyper-localized content. In Brazil, strong mobile penetration, a deep passion for football, and emerging market regulations are boosting the virtual sports segment. Growth is further fueled by high-spending users seeking immersive digital sports experiences, particularly in virtual football, as new licensing frameworks provide opportunities for operators.

What Opportunities Exist in the Middle East & Africa for the Market?

The Middle East & Africa (MEA) offers significant opportunities in the virtual sports market. These opportunities arise from the increasing digital penetration, widespread smartphone usage, and a young, tech-savvy population. Expanding internet access, including 5G networks, is enabling seamless mobile gaming experiences, while evolving regulatory frameworks in select countries are creating a more structured and secure market. The region's large youth demographic, comfortable with digital platforms, is further boosting demand for mobile-focused virtual sports and immersive digital gaming experiences.

Oman Market Trends

Oman's virtual sports market is experiencing strong growth, driven by high smartphone penetration, a young and digitally engaged population, and increasing government support for eSports. Mobile gaming serves as the leading platform, generating the majority of revenue in the country's gaming industry. The widespread availability of affordable smartphones and data plans makes virtual sports accessible to a broader audience, further boosting market growth.

Virtual Sports Market Companies

- 2K Sports

- Activision Blizzard

- Big Ant Studios

- Codemasters

- Cyanide Studio

- Dovetail Games

- EA Sports

- HB Studios

- Konami

- Milestone S.r.l.

- Netmarble

- Nintendo

- Square Enix

- SEGA

- Sports Interactive

- Red Entertainment

- Ubisoft

- Visual Concepts

Recent Developments

- In June 2023, One Future Football (1FF) launched its virtual worldwide soccer league to attract soccer fans. It has more than 250 CGI generated players and 12 founding member teams around the world.

- In June 2023, Big Ant Studios announced its partnership with NACON to launch date of Cricket 24 for Xbox Series X|S, PS4, PS5, Xbox One, and PC. It will feature the biggest rivalry in cricke, The Ashes. The game will also include nations and teams globally.

- In June 2023, Nike partnered with EA Sports to unravel unparalleled levels of customisation within the EA Sports ecosystem and provide immersive experiences.

- In April 2023,SEGA Corporation announced the acquisition of Rovio Entertainment Oyj. With the help of acquisition the company help to quicken the growth in the gaming market and rise its corporate value by creating synergies between Rovio's strengths and SEGA's current businesses, such as its live-operated mobile game and global IPs development capabilities.

Segments Covered in the Report

By Component

- Solutions

- Services

By Game

- Football

- Racing

- Golf

- Basketball

- Cricket

- Skiing

- Tennis

- MMA

- Others

By Demographic

- Below 21 Years

- 21 to 35 Years

- 35 to 54 Years

- 54 Years and Above

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting