What is the Tertiary Packaging Market Size?

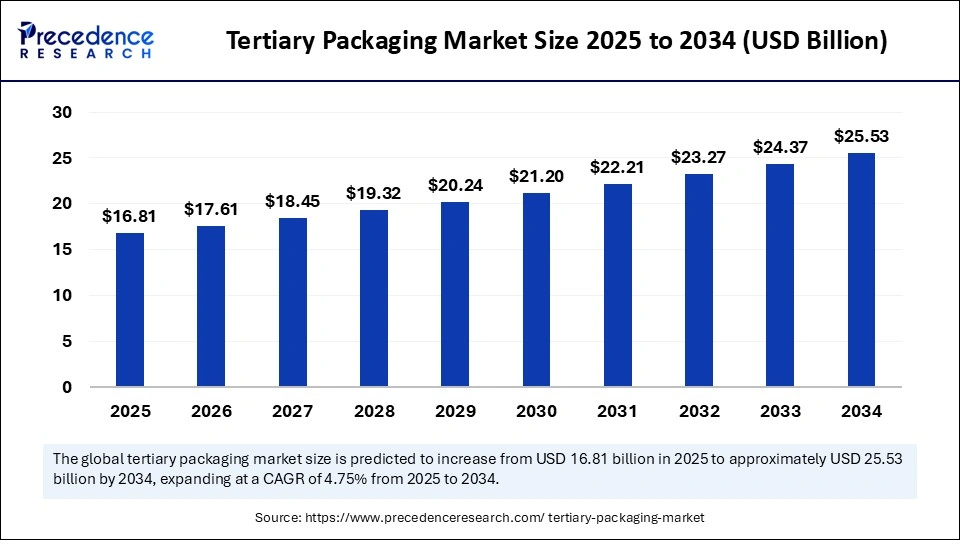

The global tertiary packaging market size accounted for USD 16.05 billion in 2024 and is predicted to increase from USD 16.81 billion in 2025 to approximately USD 25.53 billion by 2034, expanding at a CAGR of 4.75% from 2025 to 2034. The market growth is attributed to rising global trade volumes and increasing demand for durable and sustainable packaging solutions in high-intensity logistics networks.

Market Highlights

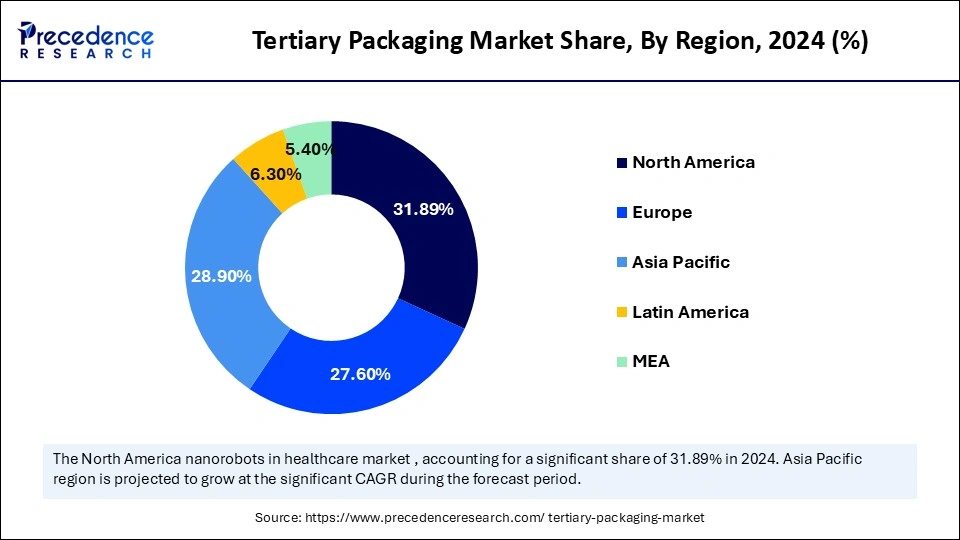

- North America segment dominated the global market with the largest market share of 31.8% in 2024.

- By region, the Asia Pacific segment is expected to grow at the fastest CAGR of 8.5% during the forecast period.

- By product type, the stretch film segment accounted for a considerable share of 32.4% in 2024.

- By product type, the pallet wrap film segment is projected to experience the highest growth CAGR of 7.9% during the forecast period.

- By material type, the polyethylene (PE) segment contributed the highest market share of 48.6% in 2024.

- By material type, the biodegradable & compostable materials segment is set to experience the fastest CAGR 9.6% from 2025 to 2034.

- By thickness/gauge, the 21.5 microns segment held the largest market share of 37.2% in 2024.

- By thickness/gauge, the above 100 microns segment is anticipated to grow at the highest CAGR of 7.5% during the forecast period.

- By manufacturing tech, the blown film extrusion segment accounted for the significant market share of 42.1% in 2024.

- By manufacturing technology, the cast film extrusion segment is projected to expand rapidly with CAGR of 7.3% during the forecast period.

- By transparency level, the high-transparency film segment led the market with maximum market share of 44.5% in 2024.

- By transparency level, the hazy/matte clear film segment is expected to experience significant CAGR of 6.9% during the forecast period.

- By application, the pallet unitization segment captured the significant market share of 33.7% in 2024.

- By application, the export wrapping segment is expected to gain a significant share of 7.7% study period of 2025 to 2034.

- By end-use industry, the logistics & warehousing segment generate the major market share of 29.5% in 2024.

- By end-use industry, the e-commerce & retail fulfillment centers segment is projected to be the fastest-growing CAGR of 8.4% during the forecast period.

Market Size and Forecast

- Market Size in 2024: USD 16.05 Billion

- Market Size in 2025: USD 16.81 Billion

- Forecasted Market Size by 2034: USD 25.53 Billion

- CAGR (2025-2034): 4.75%

- Largest Market in 2024: North America

- Fastest Growing Market: Asia Pacific

WhatIs Tertiary Packaging and Its Applications?

The increase in air cargo demand can be viewed as a significant force behind tertiary packaging, and recent statistics prove its relevance in the market. According to IATA, Global Cargo Tonne-Kilometers (CTK) increased by 11.3% in 2024 compared to 2023 and produced new record volumes. There was also an increase in global trade volumes.

This further puts increased strain on the logistics and packaging systems to ensure the safety of goods during transit. Air cargo demand has been growing for four consecutive quarters, prompting logistics operators to increase the specifications of protective tertiary packaging to safeguard against damage during handling.

High-speed transportation increased the transparency of stretch films, more robust pallet wraps, and moisture-resistant bulk covers. The expansion of e-commerce in 2024 further exacerbated the pressure on the last-mile and the frequency of palletization. This drives the joints between packaging design, automation, and materials technology to tighter tolerances and greater durability. Furthermore, the increasing industrial production, particularly in manufacturing centres in the Asia-Pacific in 2024, enhanced the need for export wrapping and high levels of tertiary protection of goods shipped over long distances.(Source: https://www.iata.org)

Impact of Artificial Intelligence on the Tertiary Packaging Market

Artificial Intelligence (AI) is transforming the tertiary packaging industry by redefining the processes of designing, manufacturing, and controlling bulk packaging solutions. Manufacturers incorporate AI-driven analytics to predict shipping volumes, anticipate demand changes, and optimize material usage. This reduces overall expenditures and enhances efficiency. Furthermore, the sustainability objectives are also furthered as AI algorithms test the material's performance and suggest recyclable or biodegradable options that do not compromise its strength.

Tertiary Packaging MarketGrowth Factors

- Rising Adoption of Connected Fitness Equipment: Growing demand for smart treadmills, bikes, and rowers integrated with real-time performance tracking is driving interactive engagement.

- Boosting Demand for Immersive Training Content: Expanding libraries of live and on-demand classes are fuelling user retention and enhancing subscription-based revenue models.

- Growing Popularity of Gamified Workouts: Integration of gaming elements and virtual competitions is propelling user participation across younger demographics.

- Expanding Corporate Wellness Programs: The increasing adoption of employer-led wellness initiatives is driving the growth of interactive fitness platforms in workplace health strategies.

Market Scope

| Report Coverage | Details |

| Market Size in 2024 | USD 16.05 Billion |

| Market Size in 2025 | USD 16.81 Billion |

| Market Size by 2034 | USD 25.53 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 4.75% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Film Type, Material Type, Thickness / Gauge, Manufacturing Technology, Transparency Level, Application, End-Use Industry, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Why Is the Growing Focus on Supply Chain Efficiency Driving Adoption in the Tertiary Packaging Market?

Growing focus on supply chain efficiency is projected to drive the tertiary packaging solutions market in the coming years. The increasing attention to supply chain efficiencies is expected to stimulate the demand for high-tech tertiary package engineering that improves handling, storage, and transportation capacity. Manufacturers are focused on minimizing the handling costs and prefer to work with lightweight but durable materials designed to serve the purpose of large-scale logistics. (Source: https://www.wto.org)

The introduction of speed-of-trade metrics in 139 countries by the World Bank's LPI 2023 has prompted companies to reduce turnaround times in their docks and accelerate cross-docking processes. OECD policy work on supply-chain resilience in 2024 emphasizes digitalization and the convergence of regulations.

Thus, companies are adopting RFID tracking systems, warehouse execution systems, and digital twins to enhance inventory accuracy and dwell time of multimodal hubs. Furthermore, the increasing demand from the e-commerce industry is expected to accelerate the adoption of tertiary packaging as online retailers rely heavily on pallets, containers, and bulk packaging solutions for safe and efficient product handling. (Source:https://www.desolutions.com)

Restraint

High Material Costs Limiting the Scalability of Tertiary Packaging Solutions

High material costs are anticipated to limit the scalability of tertiary packaging solutions, thereby hindering market growth. Such cost variances increase the cost of manufacturers and distributors who use bulk packaging as a logistics strategy. Furthermore, the restrained growth through stringent environmental regulations, which are expected to challenge conventional packaging adoption

Opportunity

How Is Surging Emphasis on Sustainability Fuelling Innovation in the Tertiary Packaging Market?

Surging emphasis on sustainability is likely to create immense opportunities for the tertiary packaging market in the coming years. Focusing on sustainability is strengthening innovation in tertiary packaging as businesses adopt eco-friendly and recyclable bulk packaging solutions. Major industry coalitions made significant progress in 2024, with major signatories reducing their use of virgin plastics by 9.6 million tonnes since 2018. This has driven suppliers to offer more recycled-content options for pallets, crates, and bulk trays. (Source: https://content.ellenmacarthurfoundation.org)

The latest statistics from Eurostat on packaging waste indicate that approximately 41% of EU packaging waste consists of paper and cardboard, while plastic accounts for around 19% of packaging waste. Designers use that as the motivation to replace single-use plastics with paper-based and reusable systems. Additionally, the rising demand from pharmaceutical logistics is expected to drive market expansion as healthcare providers and distributors prioritize safe, compliant, and damage-resistant shipment solutions.(Source:https://ec.europa.eu)

Segment Insights

Product Type Insights

Which Product Type Dominated the Tertiary Packaging Market in 2024?

The stretch film segment dominated the tertiary packaging market in 2024, accounting for an estimated 32.40% market share, due to its flexibility, affordability, and capacity for uniform load containment across various industry verticals. In 2024, global trade activity was characterized by a rise in the volume of merchandise trade. This is reported by the World Trade Organization (WTO), which notes that merchandise trade volume increased by 1% following the stagnation in 2023.

This creates additional pressure on the need for reliable secondary and tertiary load protection. Food, beverage, and pharmaceutical companies favored tertiary packaging for its lightweight reduced shipping expenditures at the same time. This has increased the supply of stretch film vendors that conform to more rigorous requirements of transit simulation, thus further boosting the segment. (Source: https://www.wto.org)

The pallet wrap film segment is expected to grow at the fastest rate in the coming years, accounting for 7.9% of the market share, due to the increasing demand for load stability and effective bulk operations within regional and international logistics systems. Moreover, the combination of operational efficiency, durability, and regulatory conformity will boost the emergence of pallet wrap film as the fastest-growing sub-section of tertiary packaging solutions.

Material Type Insights

Which Material Type Emerged as the Leading Choice in the Tertiary Packaging Market in 2024?

The polyethylene (PE) segment held the largest revenue share in the tertiary packaging market, accounting for approximately 48.6% of the market, due to its durability, flexibility, and cost-effectiveness. Additionally, the current efforts towards achieving material circularity and regulatory compliance are expected to drive the demand for polyethylene (PE) tertiary packaging solutions.

The biodegradable & compostable materials segment is expected to grow at the fastest CAGR in the coming years, accounting for a 9.6% market share. Long-term producer responsibility (EPR) policies are factors that lead to the shift to renewable, plant-based materials. Environmental regulations, such as the EU Packaging and Packaging Waste Regulation which seek to make all packaging fully recyclable by 2030.

There are organizations, including the Ellen MacArthur Foundation and the WBCSD, that advocate the practice of the circular economy. This urges businesses to use materials that decompose naturally and minimise the use of fossil fuels. Additionally, the mechanical properties of biodegradable materials are verified in accordance with ISTA testing protocols, which contributes to the use of biodegradable materials in large-scale logistics networks.(Source: https://environment.ec.europa.eu)

Thickness/Gauge Insights

Which Thickness/Gauge Range Accounted for the Largest Share of the Tertiary Packaging Market in 2024?

The 21–50 micron segment dominated the tertiary packaging market in 2024, accounting for an estimated 37.2% market share, primarily due to its extensive use in logistics and warehousing operations. This segment offers the perfect balance of material strength and flexibility, making it suitable for stretch films, shrink wraps, and pallet wrapping. Furthermore, the gauge is widely used by manufacturers in the food and beverage, pharmaceutical, and consumer electronics industries to maintain the stability of the load while using lightweight packaging.

The above 100 micron segment is expected to grow at the fastest rate in the coming years, accounting for 7.5% of market share, owing to the increasing demand for heavy-duty and industrial-grade packaging equipment. Moreover, the above 100 microns segment is likely to be the fastest-growing thickness segment in the next decade, due to the combination of heavy-duty protection and sustainable material design.

Manufacturing Tech Insights

Which Manufacturing Technology Led the Tertiary Packaging Market in 2024?

The blown film extrusion segment held the largest revenue share in the tertiary packaging market in 2024, accounting for approximately 42.1% of the market, as this method is widely used in tertiary packaging where high strength, uniformity, and versatility are required. Additionally, the sustainability initiatives also increased the adoption of multi-layer blown films, thus facilitating the segment growth.

The cast film extrusion segment is expected to grow at the fastest CAGR in the coming years, accounting for 7.3% market share, owing to its barrier properties and homogeneous surface. Film innovations, such as co-extrusion and nano-layering, enhance the tensile strength. Furthermore, Companies are involved in the active development of cast film to increase their capabilities and market-driven sustainability demands.

Transparency Level Insights

Which Transparency Level Held the Dominant Share in the Tertiary Packaging Market in 2024?

The high-transparency film segment dominated the tertiary packaging market in 2024, accounting for an estimated 44.5% market share, as it offers clear and consistent visual inspection to aid in inventory control and quality control, thereby enhancing consumer confidence in the areas of food and drinks, pharmaceuticals, and consumer electronics. Automated packaging system manufacturers are moving more towards high-transparency films.

Their films remain clear even during the high-speed wrapping and stretching processes, eliminating errors in operations. Furthermore, top logistics companies such as DHL, UPS, and Maersk incorporate high-clarity films to facilitate bulk operations, which guarantee the safety of products during cross-border deliveries and long-haul carriage.

The hazy/matte clear film segment is expected to grow at the fastest rate in the coming years, accounting for 6.9% of the market share, owing to increasing demand for product differentiation, anti-glare characteristics, and improved appearance in packaging. Moreover, the high level of technological development in the matte and semi-transparent film extrusion is further driving the segment growth in the coming years.

Application Insights

Which Application Segment Drove the Tertiary Packaging Market in 2024?

The pallet unitization segment held the largest revenue share in the tertiary packaging market in 2024, with a market share of approximately 33.7%, due to its importance in streamlining logistics and warehouse processes. They have the capacity to hold several products in one pallet, making storage more efficient, handling easier, and minimizing damage during shipment transit.

Pallet unitization is increasingly being used in industries that require a high degree of product integrity over complicated supply chains. According to the International Safe Transit Association (ISTA), damage during transit is estimated to decrease by 25% when properly palletized unitization is observed. This also lowers the replacement cost and the operational costs to a considerable extent in 2024, thus further fuelling the segment in the coming years. (Source: https://www.tuvsud.com)

The export wrapping segment is expected to grow at the fastest CAGR in the coming years, accounting for a 7.7% market share, driven by the increasing globalization of trade and the need to ensure the security of long-distance cargo. Furthermore, sustainability trends are also reflected in growth, as exporters are more likely to use recyclable and biodegradable products to meet regional environmental policies, thereby increasing the segment's popularity.

End-Use Industry Insights

Which End-Use Industry Dominated the Tertiary Packaging Market in 2024?

The logistics and warehousing segment dominated the tertiary packaging market in 2024, accounting for an estimated 29.5% market share, due to the increasing demand to execute bulky deliveries effectively on both local and global supply chains. This division is the leading one, as distribution centers and 3PLs require standardized tertiary solutions. This takes the form of stretch films, pallet wraps, and bulk trays, which save time and minimize damage rates during storage and transit.

The dynamism of trade activities around the world increased in 2024, with global trade reaching approximately USD 33 trillion. This results in an increase in palletized movements and necessitates a strong bulk packaging that can survive multimodal transfer points. Moreover, large contract logistics companies, including DHL Supply Chain, DB Schenker, and FedEx Logistics, expanded pilot programs to standardize tertiary specifications among customers, enhance pallet throughput, and reduce the number of return/inspection cycles.(Source: https://unctad.org)

The e-commerce and retail fulfillment centers segment is expected to grow at the fastest rate in the coming years, accounting for 8.4% of the market share, owing to the increasing volumes of online shopping. The need for consumers to see faster delivery times, which would put high demands on bulk handling and protection.According to the International Trade Administration (ITA), global B2C e-commerce revenue is projected to reach USD 5.5 trillion by 2027, advancing at a steady CAGR of 14.4%.

Fulfillment operators will use more modular bulk cartons and lightweight pallet wraps, as well as moisture-resistant films, more often to preserve mixed SKU pallets. That is loaded on regional sortation hubs and last-mile carriers, as these solutions are expected to mitigate damages and returns during peak-season spikes. Furthermore, major e-commerce merchants, such as Amazon, Walmart, and Alibaba, have taken their optimization programs to the next level with fulfillment-level packaging, further facilitating the tertiary packaging market in the coming years.(Source: https://www.trade.gov)

Regional Insights

U.S. Tertiary Packaging Market Size and Growth 2025 to 2034

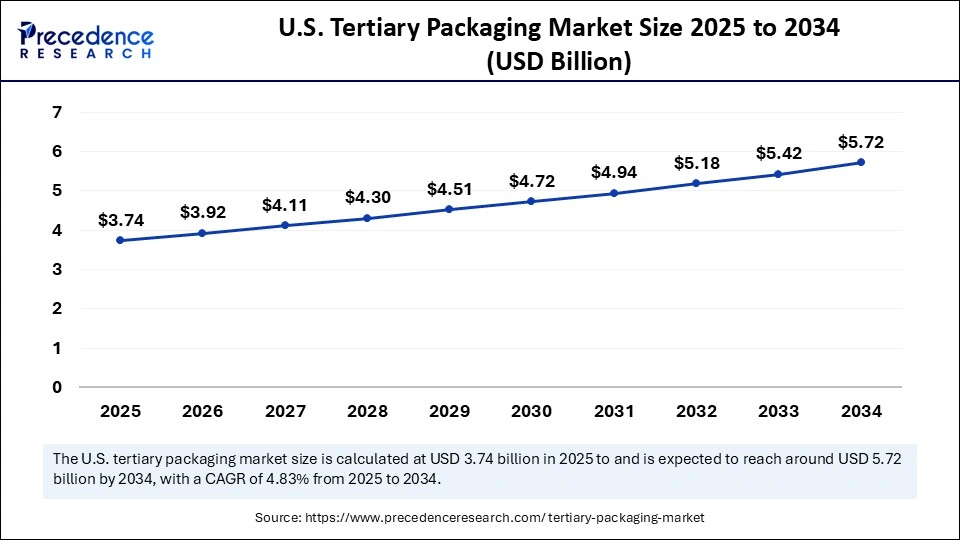

The U.S. tertiary packaging market size was exhibited at USD 3.57 billion in 2024 and is projected to be worth around USD 5.72 billion by 2034, growing at a CAGR of 4.83% from 2025 to 2034.

Why did North America Lead the Tertiary Packaging Market in 2024?

North America led the tertiary packaging market, capturing the largest revenue share in 2024, which accounted for approximately 31.8%. This dominance was attributed to the region's intensive logistics system, the development of 3PL systems, and the elevated industrial throughput that requires uniform tertiary formats. The number of large distribution centers and automated fulfillment centers increased pallet build-and-break cycles in 2024. This highlighted the demand for stretch films, pallet wraps, and bulk trays that facilitate faster handling and minimize damage. (Source: https://www.digitalcommerce360.com)

The highly developed e-commerce penetration, with U.S. e-commerce consuming about 15-16% of retail sales in 2024, led to an increase in fulfillment throughput and palletized flows, enhancing tertiary consumption at peak nodes. The demand for air cargo grew by 11.3% growth. This put pressure on shippers to opt for high-performance films and demand palletization to make faster and more efficient routes. Additionally, they introduced a range of sustainability-linked reporting requirements, which hastened the growing need to adopt certified recyclable tertiary packaging formats.(Source:https://www.ctfreight.com)

What Factors Are Expected to Help the Market Expand in Asia Pacific During the Coming Years?

The Asia Pacific is anticipated to grow at the fastest rate in the market during the forecast period, accounting for an 8.5% market share, driven by the industrialization pace, increase in manufacturing capacity, and the prevailing volumes of e-commerce throughout the region. In Asia and Oceania, manufacturing activity was the most significant contributor to growth in the fourth quarter of 2024. (Source: https://stat.unido.org)

As the world has an increased demand for heavy-duty palletization operations and high-gauge film operations on intra-regional and export cargo operations. The Asia-Pacific region contributed the largest share of the world's e-commerce revenue in 2024, which challenged fulfillment networks to implement scalable tertiary formats for mixed-SKU pallets and cross-border movements. Furthermore, regional packaging manufacturers such as Uflex, Toyo Seikan, and Nippon Paper Industries invested in new plant installations to increase their capacity and provide heavy-duty, sustainable tertiary packaging to the Asian-Pacific markets.(Source:https://www.euromonitor.com)

Tertiary Packaging Market Companies

- International Paper

- WestRock Company

- Berry Global Group Inc.

- Amcor Plc

- Rengo Co.

- Ltd.

- Brambles Ltd.

- PECO Pallet Inc.

- Sonoco Products Company

- Mondi Group

- Novolex.

Recent Developments

- In August 2025, Kao Corporation inaugurated a new tertiary amine production facility in Pasadena, Texas, with an annual capacity of 20,000 tons. The plant is expected to strengthen stable supply for the growing U.S. market and enhance operational efficiency through local production, while also reducing transportation-related COâ‚‚ emissions. (Source: https://www.kao.com)

- In February 2025, Tetra Pak introduced carton packaging incorporating certified recycled polymers in India, becoming the first company in the country's food and beverage packaging sector to achieve this milestone. Certified under ISCC PLUS, the packaging contains 5% certified recycled polymers, supporting compliance with India's Plastic Waste Management (Amendment) Rules 2022.(Source:https://www.towardspackaging.com)

Latest Announcements by Industry Leaders

- In September 2025, Avery Dennison Corporation announced a range of product innovations set to debut at Labelexpo 2025, booth 3E61, starting September 16 in Barcelona. With packaging and labels playing a pivotal role in advancing connectivity and circularity, the company has developed solutions that strengthen packaging reuse and recycling, improve functionality and performance, enhance shelf appeal, and deliver greater supply chain transparency.

Mariana Rodriguez, the newly appointed Vice President and General Manager, Materials Group EMENA, stated: “Labelexpo 2025 represents a landmark showcase of innovation, and we are eager for customers to experience it firsthand. For 90 years, Avery Dennison has led the labeling and packaging industry. In Barcelona, we will highlight how we are tackling critical challenges across sectors such as retail, consumer packaged goods, automotive, and pharmaceuticals. This event underscores our vision of Making Possible™, and we look forward to welcoming visitors to our booth.”(Source: https://spnews.com)

Segments Covered in the Report

By Film Type

- Stretch Film

- Hand Stretch Film

- Machine Stretch Film

- Pre-stretched Film

- Shrink Film

- Heat Shrink Film

- Cold Shrink Film

- Pallet Wrap Film

- Bundling Film

- Protective Film

- Overwrap Film

By Material Type

- Polyethylene (PE)

- LDPE (Low-Density Polyethylene)

- LLDPE (Linear Low-Density Polyethylene)

- HDPE (High-Density Polyethylene)

- Polypropylene (PP)

- BOPP (Biaxially Oriented Polypropylene)

- Polyvinyl Chloride (PVC)

- Ethylene Vinyl Acetate (EVA)

- Biodegradable & Compostable Materials

- Polylactic Acid (PLA)

- Polyhydroxyalkanoates (PHA)

- PBAT (Polybutylene Adipate Terephthalate)

- Others

- PET Films

- Nylon Films

By Thickness / Gauge

- Up to 20 Microns

- 21–50 Microns

- 51–100 Microns

- Above 100 Microns

By Manufacturing Technology

- Blown Film Extrusion

- Cast Film Extrusion

- Biaxial Orientation

By Transparency Level

- High-Transparency Film

- Semi-Transparent Film

- Hazy/Matte Clear Film

By Application

- Pallet Unitization

- Bulk Load Stabilization

- Warehouse & Distribution Wrapping

- Temporary Load Protection

- Export Wrapping

- Multi-size Load Compatibility

- Others

By End-Use Industry

- Logistics & Warehousing

- Food & Beverage Manufacturing & Distribution

- FMCG (Consumer Goods)

- Pharmaceuticals & Healthcare Logistics

- Pharmaceutical Manufacturers

- Medical Device Manufacturers

- Wound Care & Disposable Supplies

- Cold Chain Pharma Logistics

- Hospital & Clinical Distribution

- Contract Manufacturing & Packaging (CMOs/CPOs)

- Pharmaceutical Wholesalers & Distributors

- Clinical Trial Logistics

- Others

- E-commerce & Retail Fulfilment Centers

- Automotive & Industrial Parts Distribution

- Cold Chain & Perishables

- Contract Packaging Services

By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting