What is the Therapeutic Neurotoxin Market Size?

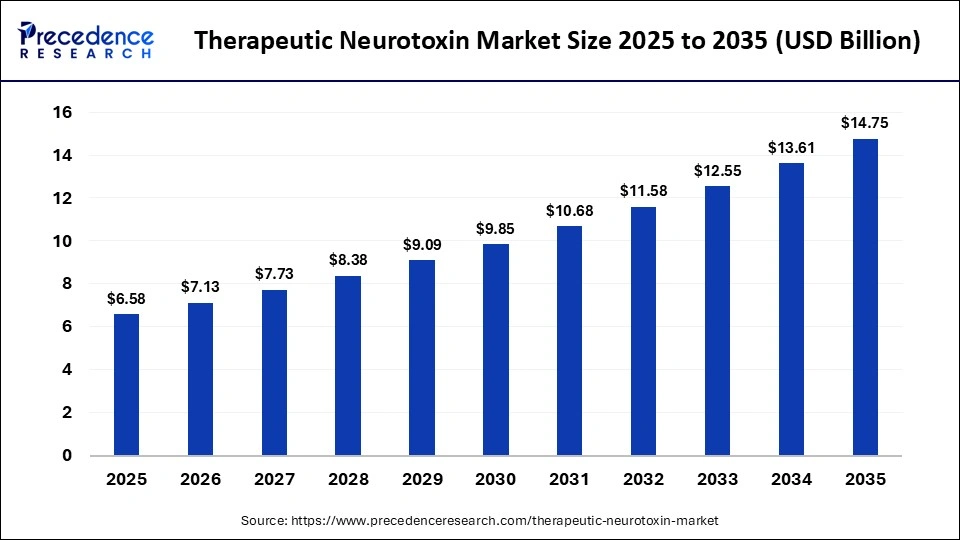

The global therapeutic neurotoxin market size was calculated at USD 6.58 billion in 2025 and is predicted to increase from USD 7.13 billion in 2026 to approximately USD 14.75 billion by 2035, expanding at a CAGR of 8.41% from 2026 to 2035. The market is driven by growing demand for minimally invasive therapies and expanding medical applications of neurotoxins.

Market Highlights

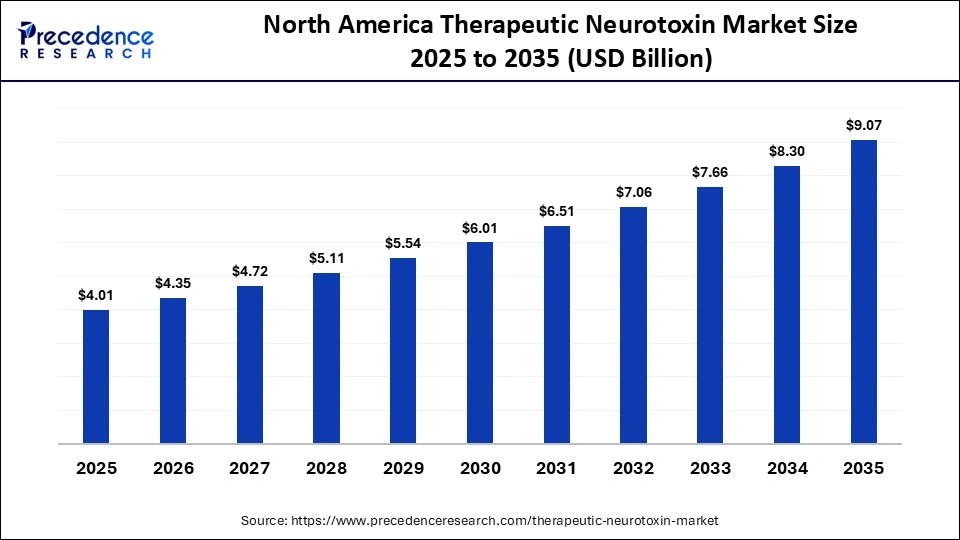

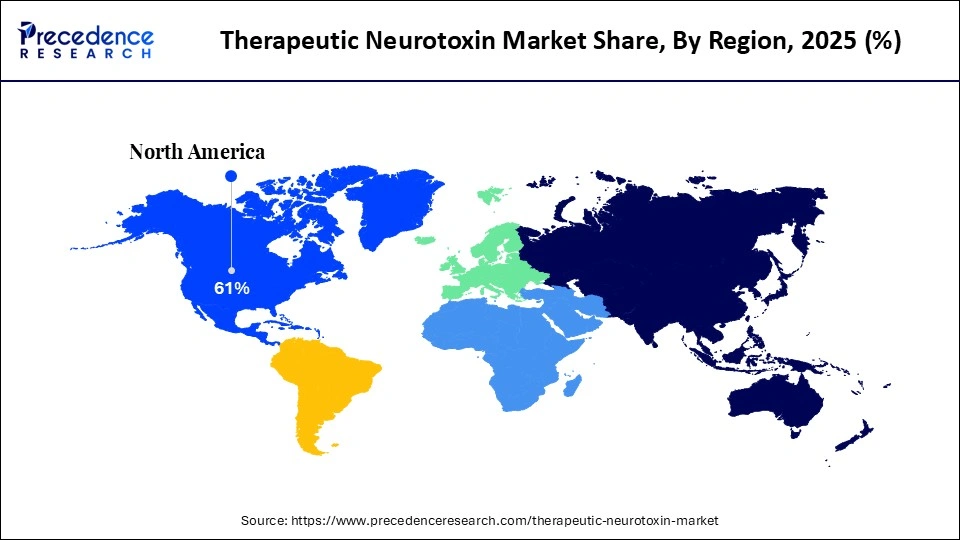

- North America accounted for the largest market share of 61% in 2025.

- Asia Pacific is expected to experience the fastest CAGR during the forecasted years.

- By neurotoxin type, the botulinum toxin type A segment held the largest share of the market in 2025.

- By neurotoxin type, the botulinum toxin type B segment is expected to grow at a notable rate in the market over the forecast period.

- By end user, the hospitals segment dominated the market in 2025.

- By end user, the specialty neurology clinics segment is expected to grow at the fastest CAGR in the market over the forecast period.

- By route of administration type, the intramuscular segment held a major market share in 2025.

- By route of administration type, the intradermal segment is expected to grow at the fastest rate in the upcoming period.

Market Overview

The therapeutic neurotoxin market is driven by the expanding use of neurotoxins beyond aesthetics into various medical specialties, including neurology, psychiatry, and urology. These drugs, including botulinum toxin A and B, are widely used in the therapy of chronic migraine, spasticity, dystonia, cervical dystonia, blepharospasm, hyperhidrosis, and overactive bladder. There is a growing prevalence of neurological and neuromuscular diseases around the world, along with the growing geriatric population, thereby boosting the demand for these types of therapies. Moreover, expanding healthcare infrastructure in the emerging and developed markets and favorable government initiatives aimed at improving access to neurological care are driving the growth of the market.

How is AI Integration Impacting the Therapeutic Neurotoxin Market?

Artificial intelligence is transforming the therapeutic neurotoxins market by accelerating the development and formulation of drugs and optimizing clinical outcomes. New neurotoxin formulas are being developed and optimized with AI models that allow researchers to increase efficacy, stability, and duration of action and decrease development times. In clinical trials, AI is used to stratify patients, design trials to improve its effectiveness, and analyze data to predict how patients will respond to treatment and enhance success. With this predictive ability, clinicians can customize dosing and treatment regimens to help lead the trend toward individualized therapeutic neurotoxin treatments. The monitoring and analysis of real-world patient data are also done using AI to detect side effects at their earliest stage, improve safety profiles, and facilitate post-marketing surveillance.

Therapeutic Neurotoxin Market Trends

- There is a rising use of therapeutic neurotoxins across neurology, urology, and pain management, expanding well beyond aesthetic applications to address chronic and complex medical conditions worldwide.

- Growing clinical evidence and rising patient awareness are driving the adoption of botulinum toxin therapies as effective prophylactic treatments for chronic migraine.

- Manufacturers are advancing neurotoxin formulations with longer duration of action, improved targeted delivery, and reduced injection frequency to enhance treatment outcomes and patient convenience.

- The integration of artificial intelligence is accelerating neurotoxin research by optimizing clinical trials, personalizing dosing regimens, and improving overall drug development efficiency.

- Rapid growth of the global geriatric population is increasing the prevalence of neurological and neuromuscular disorders, fueling long-term demand for therapeutic neurotoxin treatments.

- Favorable regulatory approvals, expanded therapeutic indications, and supportive government healthcare initiatives are strengthening market growth and encouraging innovation in therapeutic neurotoxin development.

Market Scope

| Report Coverage | Details |

| Market Size in 2025 | USD 6.58 Billion |

| Market Size in 2026 | USD 7.13 Billion |

| Market Size by 2035 | USD 14.75 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 8.41% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Neurotoxin Type, End User, Route of Administration, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Segment Insights

Neurotoxin Type Insights

Why Did the Botulinum Toxin Type A Segment Lead the Therapeutic Neurotoxin Market?

The botulinum toxin type A segment led the market by holding the largest revenue share in 2025. This is because of its broad range of therapeutic indications, including chronic migraine, cervical dystonia, spasticity, blepharospasm, hyperhidrosis, and overactive bladder. Its prolonged effect relative to other types of toxins decreases the number of injections per patient, enhancing treatment adherence and overall satisfaction with treatment. The formulations involving botulinum toxin type A have become the preferred choice of physicians for their predictable outcomes, standardized dosing, and well-established safety and efficacy profile. Adoption has been further enhanced by continuous product innovation, such as better formulations and increased accuracy in delivery.

The botulinum toxin type B segment is expected to grow at the fastest CAGR over the forecast period. The growth of the segment is driven by its role in patients who develop resistance or reduced responsiveness to type A. Its faster onset of action in certain neuromuscular disorders has increased physician interest, while ongoing R&D is improving safety, dosing accuracy, and therapeutic consistency. Greater awareness among neurologists about personalized treatment options is further supporting the adoption of type B formulations.

End User Insights

How Do Hospitals Contribute the Most Revenue Share in 2025?

The hospitals segment held the largest share of the market in 2025. This is because hospitals serve as primary centers for diagnosing and treating severe neurological, neuromuscular, and urologic conditions requiring neurotoxin administration. Availability of trained neurologists, specialized departments, and multidisciplinary care teams ensures safe and closely supervised treatment. Frequent management of conditions such as chronic migraine, spasticity, and dystonia, combined with favorable reimbursement policies and insurance coverage, further supports hospital-based adoption.

The specialty neurology clinics segment is expected to grow at the fastest rate in the market in the coming years, as these clinics specialize in the treatment of neurological disorders that include migraines, dystonia, spasticity, and movement disorders; therefore, they are very effective in providing neurotoxin therapy. The number of trained neurologists and the rising outpatient volumes are augmenting the adoption of treatment in such settings. The growing preference of patients to specialty clinics is characterized by shorter waiting times, a personal approach to treatment, and relatively affordable prices in contrast to hospitals. The development of diagnostic instruments and standard injection procedures is helping clinics to administer therapeutic toxins to the brain through injection methods with high levels of success.

Route of Administration Type Insights

Why Did the Intramuscular Segment Lead the Therapeutic Neurotoxin Market in 2025?

The intramuscular segment led the market with a major revenue share in 2025. This is because of the increased usage of IM injections in treating neurological and neuromuscular conditions such as spasticity, dystonia, chronic migraine, and muscle stiffness. IM injections allow precise targeting of affected muscles, offering predictable absorption, reliable onset of action, and consistent dosing, making them the preferred route in hospitals, specialty clinics, and rehabilitation centers. Additionally, trained physicians can safely administer repeat doses, supporting long-term management of chronic conditions.

The intradermal segment is expected to grow at a significant CAGR over the forecast period due to its reduced dose and increasing applications. Intradermal injection allows precise placement of neurotoxins and enables maximum safety and comfort of the patient, as it is administered in a limited amount and is localized. It is a pathway that is progressively utilized in pain treatment, management of local muscular weakness, and some therapeutic-aesthetic indications. There is a tendency toward the use of minimally invasive procedures and precision-based treatments, all of which are being encouraged by the increased levels of interest among physicians. The effectiveness of intradermal delivery is also being improved by the appearance of new formulation compatibility, injection methods, and clinical guidelines.

Regional Insights

How Big is the North America Therapeutic Neurotoxin Market Size?

The North America therapeutic neurotoxin market size is estimated at USD 4.01 billion in 2025 and is projected to reach approximately USD 9.07 billion by 2035, with a 8.50% CAGR from 2026 to 2035.

What Made North America the Leading Region in the Therapeutic Neurotoxin Market?

North America led the therapeutic neurotoxin market by holding the largest share in 2025. This is mainly due to a steady increase in regulatory approvals of therapeutic neurotoxins across multiple indications, which has boosted clinical adoption. Rising prevalence of chronic migraine, neurological, and neuromuscular disorders, combined with well-established healthcare systems, trained specialists, and advanced diagnostic and treatment facilities, has further fueled demand. Strong R&D investment by major pharmaceutical and biotech companies, along with favorable reimbursement policies and insurance coverage, has enhanced patient access and supported market growth.

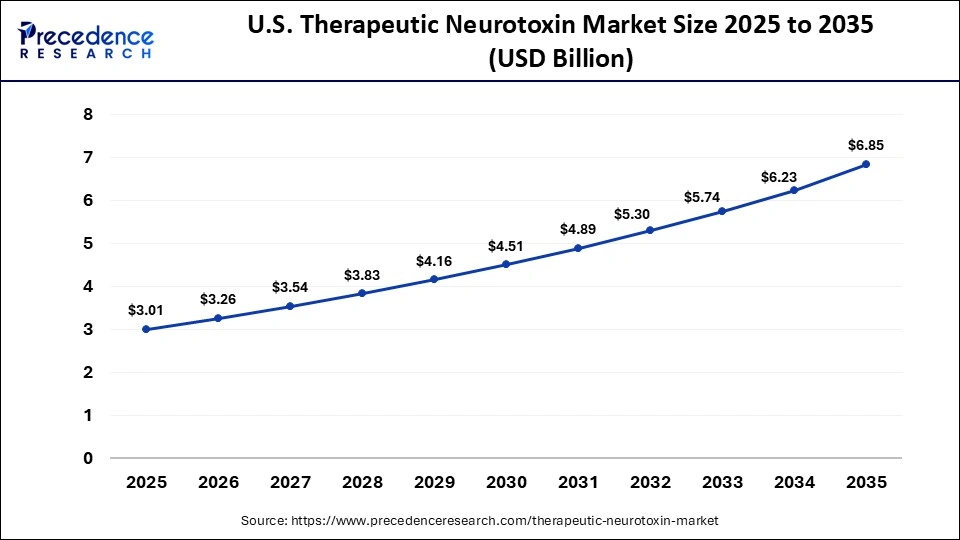

What is the Size of the U.S. Therapeutic Neurotoxin Market?

The U.S. therapeutic neurotoxin market size is calculated at USD 3.01 billion in 2025 and is expected to reach nearly USD 6.85 billion in 2035, accelerating at a strong CAGR of 8.57% between 2026 and 2035.

U.S. Market Analysis

The therapeutic neurotoxin market in the U.S. is expanding due to the rising prevalence of neurological and neuromuscular disorders, strong adoption of botulinum toxin therapies across multiple indications, and advanced healthcare infrastructure with trained specialists. Favorable regulatory approvals, robust R&D investment by leading pharmaceutical and biotech firms, and supportive reimbursement and insurance coverage further drive market growth and patient accessibility.

Why is Asia Pacific Undergoing the Fastest Growth in the Therapeutic Neurotoxin Market?

Asia Pacific is expected to grow at the fastest CAGR during the forecast period, driven by a large and aging population, which is increasing the prevalence of neurological and neuromuscular disorders. Governments in countries such as China, Japan, India, and South Korea are investing in healthcare infrastructure, specialist training, and neurological care programs, while growing awareness among patients and physicians is boosting neurotoxin adoption. Additionally, the region's expanding medical tourism industry is attracting international patients seeking cost-effective neurotoxin treatments.

China Market Analysis

China is the major contributor to the therapeutic neurotoxin market in Asia Pacific. This is due to its large and aging population, rising prevalence of neurological and neuromuscular disorders, and strong government investment in healthcare infrastructure, specialist training, and neurological care programs. Additionally, increasing awareness among physicians and patients, coupled with the growth of medical tourism, has further accelerated the adoption of therapeutic neurotoxins in the country.

Why is the European Therapeutic Neurotoxin Market Experiencing Notable Growth?

The market in Europe is expected to grow at a notable rate. Germany, France, and the UK are the countries where the public healthcare infrastructures are well developed and help to ensure that the therapeutic neurotoxin treatments are provided to a great number of people. This has been enhanced by the existence of good reimbursement policies and healthcare coverage that is supported by the government, and has increased affordability and uptake by patients. Demand is growing due to clinical applications of neurotoxins that are used more frequently in several indications, such as migraines, spasticity, and movement disorders.

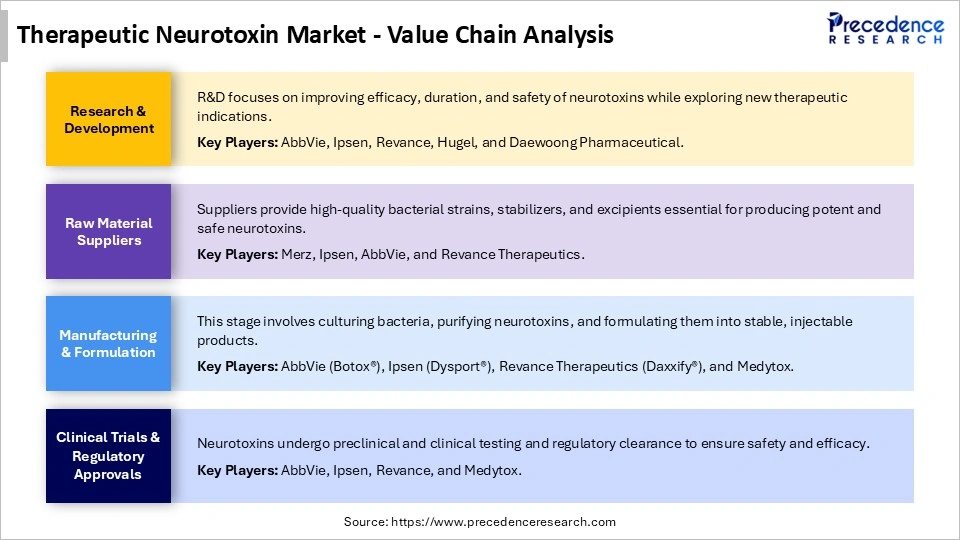

Therapeutic Neurotoxin Market Value Chain Analysis

Who are the Major Players in the Global Therapeutic Neurotoxin Market?

The major players in the therapeutic neurotoxin market include AbbVie/Allergan, Ipsen, Merz Therapeutics, Revance Therapeutics, Galderma S.A., Hugel, Daewoong Pharmaceutical, Medytox, Evolus, Lanzhou Institute of Biological Products, US WorldMeds, Eisai, and Supernus Pharmaceuticals.

Recent Developments

- In August 2025, Merz Therapeutics reported the enrolment of the first patient in its 2 international Phase III clinical trials, MINT-E and MINT-C. These are trials comparing the effectiveness and safety of XEOMIN(r) (incobotulinumtoxinA) as a treatment of episodic and chronic migraine in adults.(Source: https://merztherapeutics.com)

- In April 2025, AbbVie filed a Biologics License Application (BLA) with the U.S. FDA for the trenibotulinumtoxinE (TrenibotE). The product will be used in the management of moderate to severe glabellar lines, which will increase the aesthetic and therapeutic range of neurotoxins offered by AbbVie.(Source: https://news.abbvie.com)

- In February 2024, Revance Therapeutics announced that the U.S. Centers for Medicare & Medicaid Services (CMS) had assigned a permanent J-code (J0589) for DAXXIFY.

- In February 2024, approved for the treatment of cervical dystonia in adults, simplifying reimbursement and expanding patient access. The company also reported the publication of results from its ASPEN-1 Phase 3 pivotal study in Neurology, the journal of the American Academy of Neurology.(Source: https://www.biospace.com)

Segments Covered in the Report

By Neurotoxin Type

- Botulinum toxin type A

- Botulinum toxin type B

By End User

- Hospitals

- Specialty neurology clinics

- Rehabilitation centers

By Route of Administration

- Intramuscular

- Intradermal

- Intravesical

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting