What is the Travel Insurance Market Size?

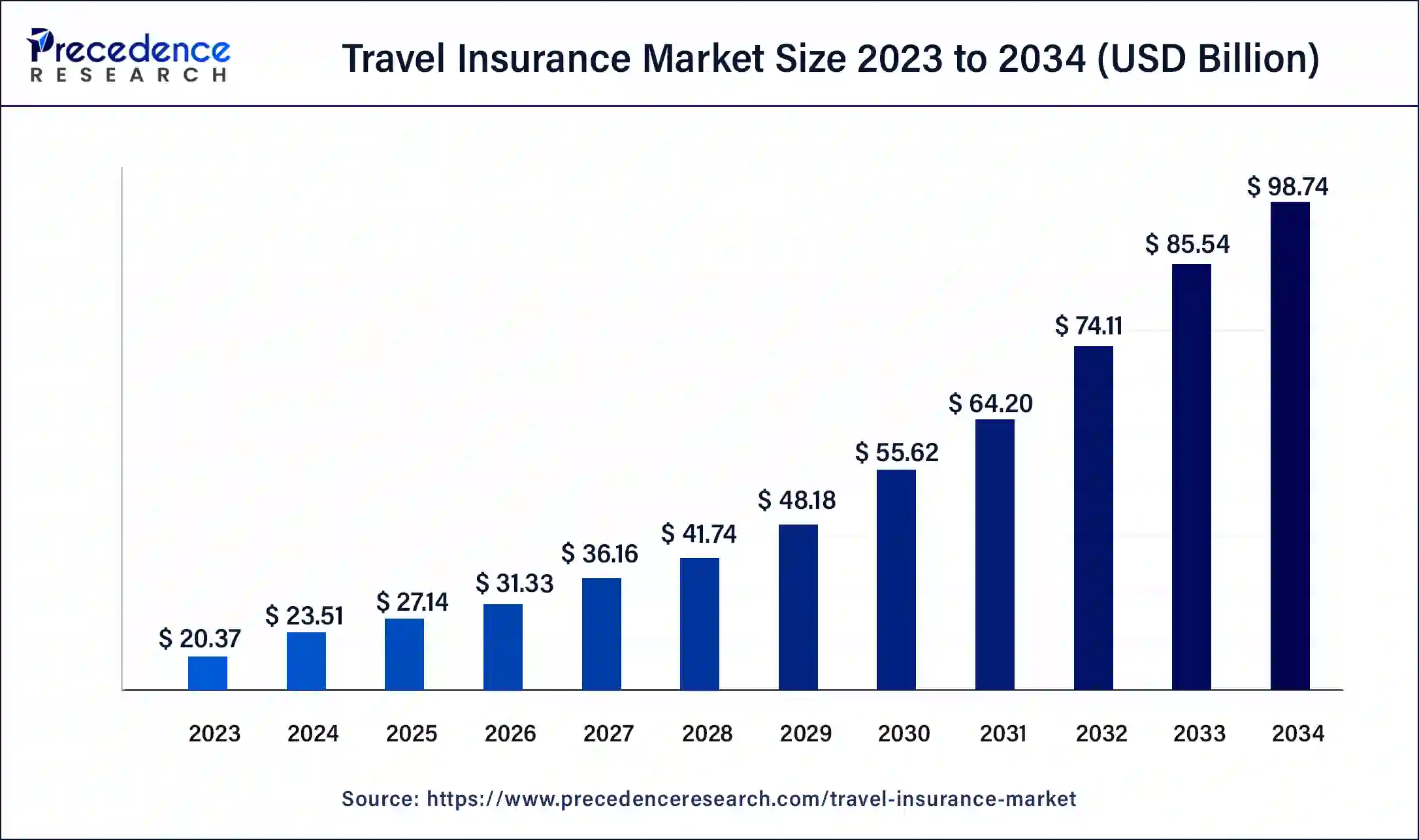

The global travel insurance market size is accounted at USD 27.14 billion in 2025 and predicted to increase from USD 31.33 billion in 2026 to approximately USD 98.74 billion by 2034, expanding at a CAGR of 15.43% from 2025 to 2034. The benefits of travel insurance include emergency travel assistance, car rental coverage, baggage coverage, trip delay coverage, etc., contributing to the growth of the market.

Travel Insurance Market Key Takeaways

- The global travel insurance market was valued at USD 27.14 billion in 2025.

- It is projected to reach USD 98.74 billion by 2034.

- The market is expected to grow at a CAGR of 15.43% from 2025 to 2034.

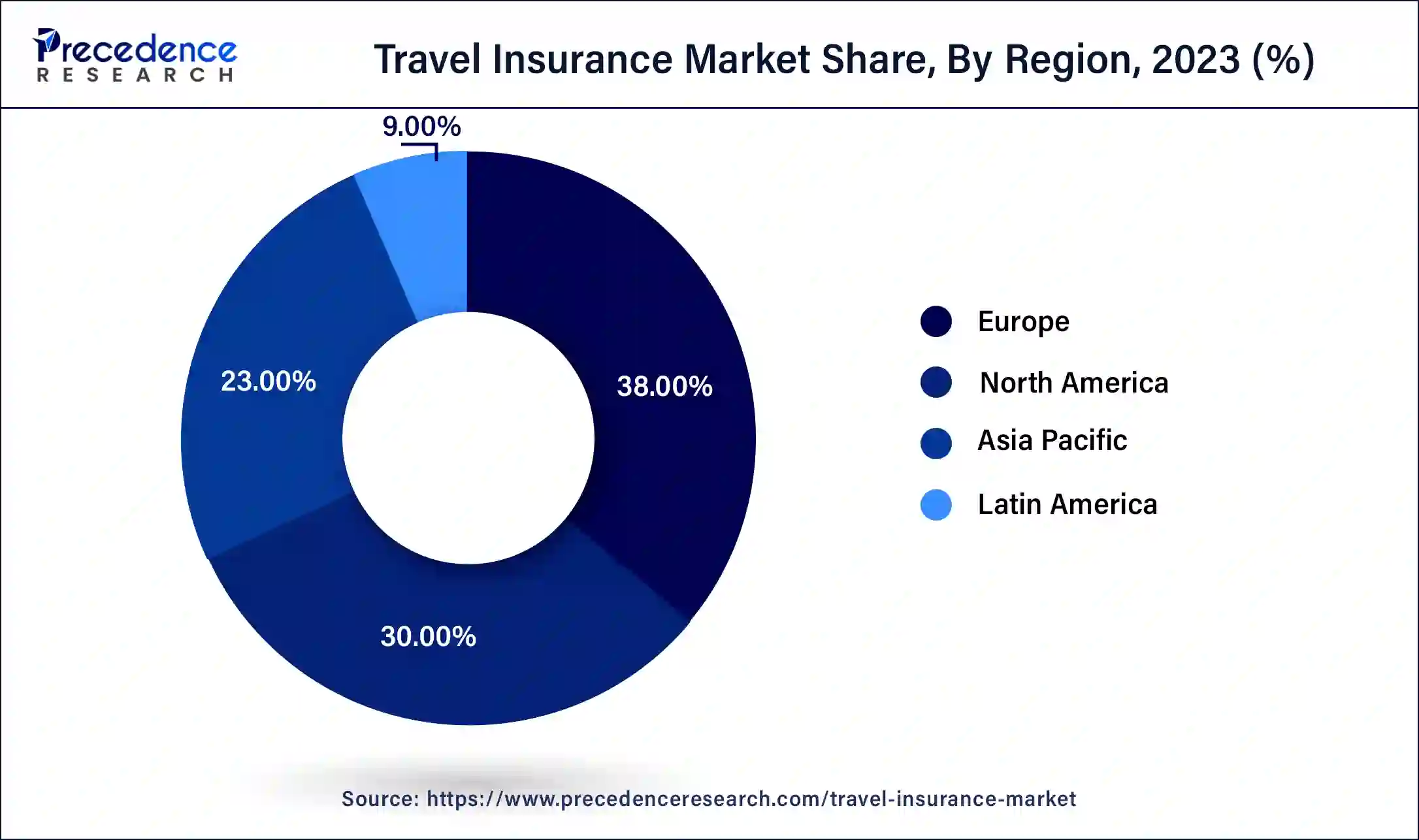

- Europe dominated the travel insurance market with the largest market share of 38% in 2024.

- Asia Pacific is estimated to grow at a fastest CAGR of 16.73% during the forecast period of 2025-2034.

- By insurance coverage, the single-trip travel insurance segment contributed more than 63% in 2024.

- By insurance coverage, the annual multi-trip travel insurance segment is expected to grow at a CAGR of 15.32% during the forecast period.

- By distribution channel, the insurance companies segment recorded the largest market share of 38% in 2024.

- By distribution channel, the banks segment is estimated to grow at a notable CAGR of 18.03% during the forecast period.

- By end-users, the senior citizens segment dominated the travel insurance market in 2024.

- By end-users, the business travelers segment is anticipated to expand at a double-digit CAGR of 17.62% during the forecast period.

How can AI help travel insurance?

The benefits of artificial intelligence in travel insurance include fraud prevention and detection, improved customer experience, customers enjoying a more personalized experience, and personalized coverage options. AI is changing the travel insurance industry by providing travelers with personalized coverage options.

- In May 2024, Insuretech Company Qover collaborated with Bunq, which is the second-largest Neobank in Europe and launched travel insurance across seven markets. Together, the company provides an exceptional user experience for ‘Eva,' a bunk's model user. This helps to expand insurance products with excellent AI-based customer care and an efficient stream process.

Market Overview

The travel insurance market includes the selling and buying of insurance products developed to reduce financial risks related to travel, including lost baggage, medical emergencies, and cancellations. Travel insurance is a type of insurance that covers financial losses linked with traveling; it may be useful for the protection of international or domestic travel. The benefits of travel insurance include reimbursement for disability, lost baggage, and accidental death. Coverage for trip delays, cancellations, and interruptions. Translation services and assistance with stolen or lost documents help to the growth of the market.

The Travel insurance coverage amount has increased in 2025 as 62% of travels now adopting policies with a sum insured of $250,000 or more, up from the earlier norm of $100,000.

Travel Insurance Market Growth Factors

- The benefits of the travel insurance market include reimbursement for disability, accidental death, and lost baggage.

- It also includes coverage for trip delays, interruptions, and cancellations. Translation services, assistance with stolen or lost documents.

- Emergency medical care includes dental care, ambulance, and hospital. For surprise circumstances, financial coverage may ruin a trip, such as flight delays, accidents, injury, illness, and other issues.

- Travel insurance covers hospital, doctor, medicines, lab work, X-ray, ambulance services bills, and other medical expenses at the time of the trip.

Market Scope

| Report Coverage | Details |

| Market Size by 2034 | USD 98.74 Billion |

| Market Size in 2025 | USD 27.14 Billion |

| Market Size in 2026 | USD 31.33 Billion |

| Market Growth Rate from 2025 to 2034 | CAGR of 15.43% |

| Largest Market | Europe |

| Base Year | 2025 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Insurance Coverage, Distribution Channel, End-users, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Overseas business expansion and international trade development

Overseas business expansion and international trade development contribute to the growth of the travel insurance market. It includes reimbursement for disability, lost baggage, or accidental death and coverage for trip delays, interruptions, and cancellations. Translation services, assistance with stolen or lost documents. This helps the expansion of business and the development of international trade.

Restraint

Downsides of travel insurance

The downsides of the travel insurance market include some policies may have waiting periods, benefits from the insurance policies may overlap, not all activities or limited activities are covered, each travel insurance policy has its loopholes, and travel insurance claims may get rejected. Some policies cannot cover pre-existing conditions, and comprehensive travel insurance may be costly. It also includes waiting periods, which can hamper the growth of the market. Lack of experience in terms of premium rates and coverage rates also restrict the market's growth.

Opportunity

Social responsibility and sustainability

The initiatives related to social responsibility and sustainability are gaining prominence in the travel industry. Insurers are focusing on security-related coverage, emergency assistance, and safety protocols to address traveler's problems. Increasing collaboration between insurers and Insurtech companies to cutting-edge and streamline processes, which makes travel insurance more efficient and accessible, contributes to the growth of the travel insurance market.

- In May 2024, Ratan Tata and Tiger Global-backed wealth management platform Upstox entered into the business of insurance distribution, onboarding HDFC Life as its first partner. Upstox offers term life insurance on its platforms and is planning to begin travel, health, and motor insurance in the future.

Insurance Coverage Insights

The single-trip travel insurance segment dominated the travel insurance market in 2024. Single-trip insurance covers start-to-end trip travel investments. The benefits of single-trip travel insurance include only paying for the time we need to be covered, permanent disability and death, theft or damage of personal possessions, trip cancellations, rental car access, medical evacuation and repatriation, and medical expenses. Single-trip travel insurance covers emergency travel assistance, cancellation for any reason, lodging expenses, car rental coverage, baggage coverage, trip delay coverage, trip interruption or cancellation coverage, and medical expense coverage. These factors help to the growth of the market.

- In August 2024, a new travel insurance personalization option was launched by an insurance provider, Gigasure. They provide Boost and Add-on benefits to its policies. Boost benefits to the customers it may update their plans at a moment's notice and tailor policies to suit their individual budgets and itineraries.

The annual multi-trip travel insurance segment is expected to grow significantly during the forecast period. The benefits of annual multi-trip travel insurance include coverage for trip shortening and cancellation because of COVID-19 diagnosis, emergency overseas dental treatment coverage, emergency overseas medical expenses coverage, affordable coverage for multiple domestic trips, medical expenses, medical evacuation, and streamlined coverage that contributes to the growth of the travel insurance market. It includes baggage insurance, covers COVID under medical insurance, and the highest levels of medical and medical education coverage in the policies in analysis.

- GeoBlue's Trekker Choice Plan is best for annual travel insurance plans and offers a combination of strong medical coverage and competitive costs. This policy's medical coverage is $1 million, and medical evacuation coverage is $500,000.

- In July 2024, a new annual multi-trip (AMT) product was launched by the global travel insurance provider World Nomads. The key benefit of the product is Air Doctor, which helps connect travelers to medical advice and private doctors in destinations where public health services cannot treat international travelers.

Distribution Channel Insights

The insurance companies segment dominated the travel insurance market in 2024. Travel insurance companies' benefits include customization options and preexisting medical condition coverage in situations like political unrest, natural disasters, etc. Travel insurance may cover and arrange emergency evacuation, missed connections, travel delay reimbursement, baggage and personal items protection, emergency medical coverage, and trip cancellation and interruption coverage, contributing to the growth of the market.

- In July 2024, an AI-powered health insurance plan, ‘Elevate,' was launched by a leading private general insurer in India, ICICI Lombard. Elevate comes with power-packed 15 in-build coverage and many personalization options, including 20 critical illness coverage accommodations, maternity & newborn coverage, personal accidents, and personalized home care, air ambulance, inflation protector, preventive care, travel benefits, and many more.

Some Travel Insurance Companies

- HTH Insurance

- HTH Worldwide Travel Insurance

- Travelex

- Generali Global Assistance

- AXA Assistance USA

- Seven Corners

- AIG

- Nationwide

- Travel Insured International

- PrimeCover

The banks' segment is estimated to be the fastest-growing during the forecast period. The benefits of travel insurance banks include credit card travel insurance like car rental insurance, trip delay reimbursement, lost or stolen baggage insurance, emergency medical coverage, trip cancellation, and interruption insurance. Bank-specific travel insurance provides credit cards or premium bank accounts that help the growth of the travel insurance market. This also includes lost baggage, trip cancellations, medical emergencies, and sometimes worldwide emergency assistance services.

- In June 2024, an accidental insurance policy goal to provide affordable coverage to those who were unable to pay higher amounts was launched by a division of India that is under the ownership of the Department of Post, India Post Payment Bank (IPPB).

End Users Insights

The senior citizens segment dominated the travel insurance market in 2024. The benefits of travel insurance for senior citizens include providing extension policy, personal accident coverage, coverage for medical expenses, loss of passport coverage, coverage for missed connecting flights, trip delays coverage, coverage for trip interruptions, trip cancellations coverage, and coverage for loss of luggage, etc. contribute to the growth of the market. Senior citizen travel insurance covers acute anesthetic treatment of teeth because of injury, accidental injury while on the trip, etc. can help the growth of the market.

- In June 2024, the ‘KBL WISE Senior Citizens Saving Bank Account' was launched by Karnataka Bank, it is designed to provide wellness, banking, and healthcare needs for senior citizens.

The business travelers segment is anticipated to be the fastest-growing during the forecast period. The benefits of travel insurance for business travelers include the fact that it offers 24/7 assistance services for business travelers, coverage of lost or stolen business equipment, and reimbursement of non-refundable prepaid costs because of travel cancellations, delays, and interruptions. Financial protection against unforeseen events. These factors help the growth of the travel insurance market. Most comprehensive travel insurance policies are suitable for a business traveler.

- In September 2023, a comprehensive business travel accident insurance was launched by the insurance division of Everest Group, Ltd, Everest Insurance. This innovative addition improves its Health and Accident portfolio, providing an extensive solution that combines insurance protection with an array of important security, travel, and medical assistance services.

Regional Insights

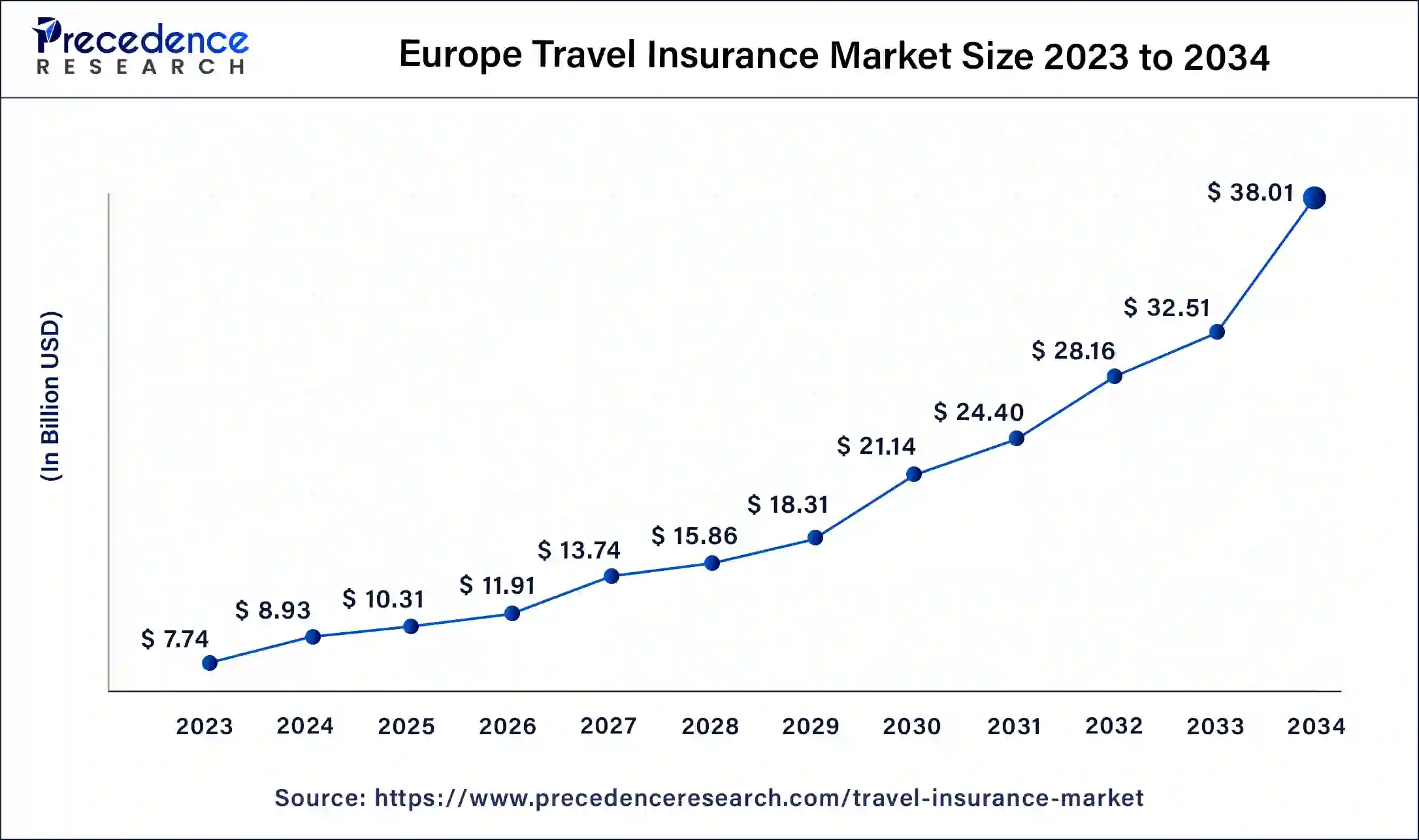

Europe Travel Insurance Market Size and Growth 2025 to 2034

The Europe travel insurance market size is exhibited at USD 10.31 billion in 2025 and is projected to be worth around USD 38.01 billion by 2034, poised to grow at a CAGR of 15.56% from 2025 to 2034.

Europe dominated the travel insurance market in 2024. Factors like rising travel and tourism lead to modern communication, growth of wealth, and peace in the neighborhood, contributing to the growth of the market in the Asia Pacific region. Well-organized travel infrastructure, awareness of travel insurance's importance, and strong regulatory support contribute to the growth of the market.

- In June 2024, a global leader in the travel experience and loyalty programs, Collinson, announced a strategic collaboration with the global travel insurance provider World Nomads to launch a new AMT (Annual Multi-Trip) product in the UK and Ireland.

UK Travel Insurance Statistics 2024:

- According to the 2024 Forbes Advisor poll, 42% don't buy travel insurance, 40% of Brits buy travel insurance when they book a holiday, 14% buy a policy before they leave, and 5% get travel cover as a part of a packaged bank account.

Asia Pacific is estimated to be the fastest-growing during the forecast period of 2025-2034. Rising agility, security, and advancement in travel medical insurance policies contribute to the growth of the market. Increasing awareness of travel insurance advantages, increasing expenditure, and increasing disposable incomes contribute to the growth of the travel insurance market in the Asia Pacific region.

- In April 2024, according to a survey report, 82% of Indian travelers were attracted to travel to Europe with increasing travel insurance policies. According to a survey report, the number of people booking travel insurance policies increased.

Growing Travel Industry: Attracting Indian Travellers

India is a significant player in the Asian travel insurance market, with growth driven by the rapid growth of the travel industry, due to the increased number of international travellers. Indian citizens are becoming aware of the importance of travel insurance coverage, driving demand for travel insurance products. The rising availability of disposable income, allowing people to spend on travelling, has led to a surge in the travel insurance market.

- The increased focus of Indian travellers on medical protection and visa security fosters travel insurance at 18.95% in Q1 2025.

Schengen Destination: The Major Plot in Travel Insurance Coverage, 2025

Schengen is becoming the prime choice of destination in 2025. Countries are seeing a significant increase in visas for the destination.

- Germany accounted for 20% of total Schengen visits.

- For instance, according to the Policybazaar report of April 2025, India has jumped 18.95% in Q1 2025, and 62% of Indian travelers opted for travel insurance coverage of $250,000 or more.

- France followed at 17.57%

- Switzerland at 10.67%

- The Netherlands, at 9.37%, is the most visited Schengen destination

and Italy at 7.78% in Q1 2025.

Travel Insurance Market Companies

- Ping An Insurance (Group) Company of China, Limited

- Delphi Financial Group, Inc.

- Zurich Insurance Group AG

- Travel Insured International

- Seven Corners, Inc.

- Battleface

- USI Insurance Services, LLC.

- ASSICURAZIONI GENERALI S.P.A.

- AXA Travel Insurance

- American International Group, Inc. (AIG)

- Allianz Partners

- China Pacific Insurance (Group) Co. Ltd

- Arch Capital Group Limited

- American Express Company

- ERGO Group AG

- Aviva PLC

- PassportCard

- Staysure

- Trailfinders Ltd.

- Just Travel Cover

- Insurefor.com

Recent Developments

- In April 2025, OneBefore, the MGA specialising in consumer insurance with a focus on accident, absence, health, and travel insurance, partners with Pulse Insurance, the specialist insurance provider, for the launch of their ‘Travel Well' product.

- In February 2025, Trawick International, a leader in global insurance, expanded into Canada with the launch of three new travel insurance plans designed exclusively for Canadian residents, including TrueNorth Trip Protection Plus, TrueNorth Travel Medical, and TrueNorth Trip Protection Lite. This place has a 10-day free look period.

- In January 2025, Berkshire Hathaway Travel Protection (BHTP), a leading travel insurance provider, published its 2025 State of Travel Insurance Report (SOTI), stating that the Intent to purchase travel insurance among Gen Z rose by 24% from 2023. Reports demonstrate Gen Z as an emerging key growth area for both travel suppliers and travel insurance providers in 2025 and beyond.

Segments Covered in the Report

By Insurance Coverage

- Single Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

- Long Stay Travel Insurance

By Distribution Channel

- Insurance Intermediaries

- Insurance Companies

- Banks

- Insurance Brokers

- Insurance Aggregators

By End-users

- Education Travelers

- Business Travelers

- Senior Citizens

- Family Travelers

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting