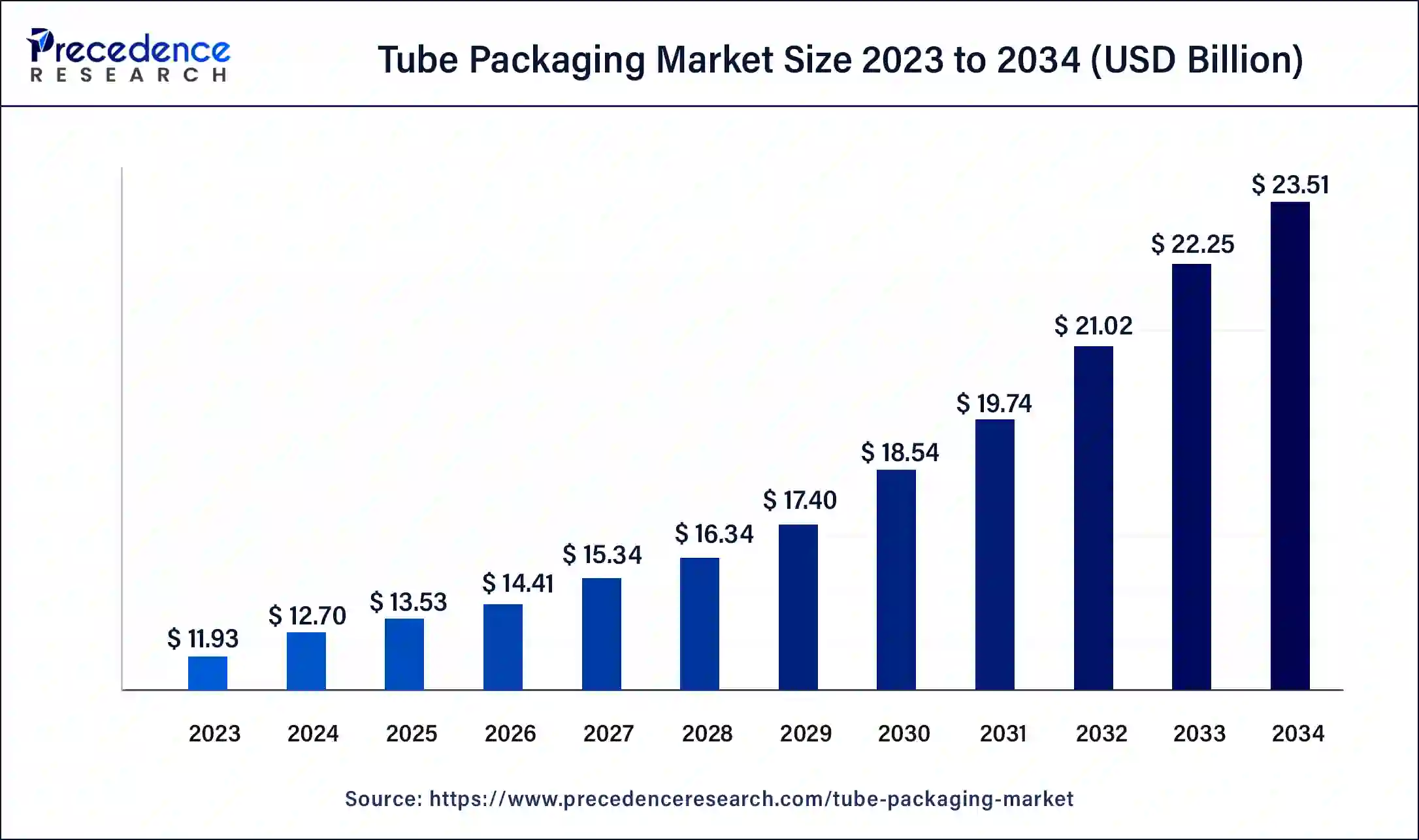

What is the Tube Packaging Market Size?

The global tube packaging market size is calculated at USD 13.53 billion in 2025 and is predicted to increase from USD 14.41 billion in 2026 to approximately USD 23.51 billion by 2034, expanding at a CAGR of 6.35% from 2025 to 2034.

Tube Packaging Market Key Takeaways

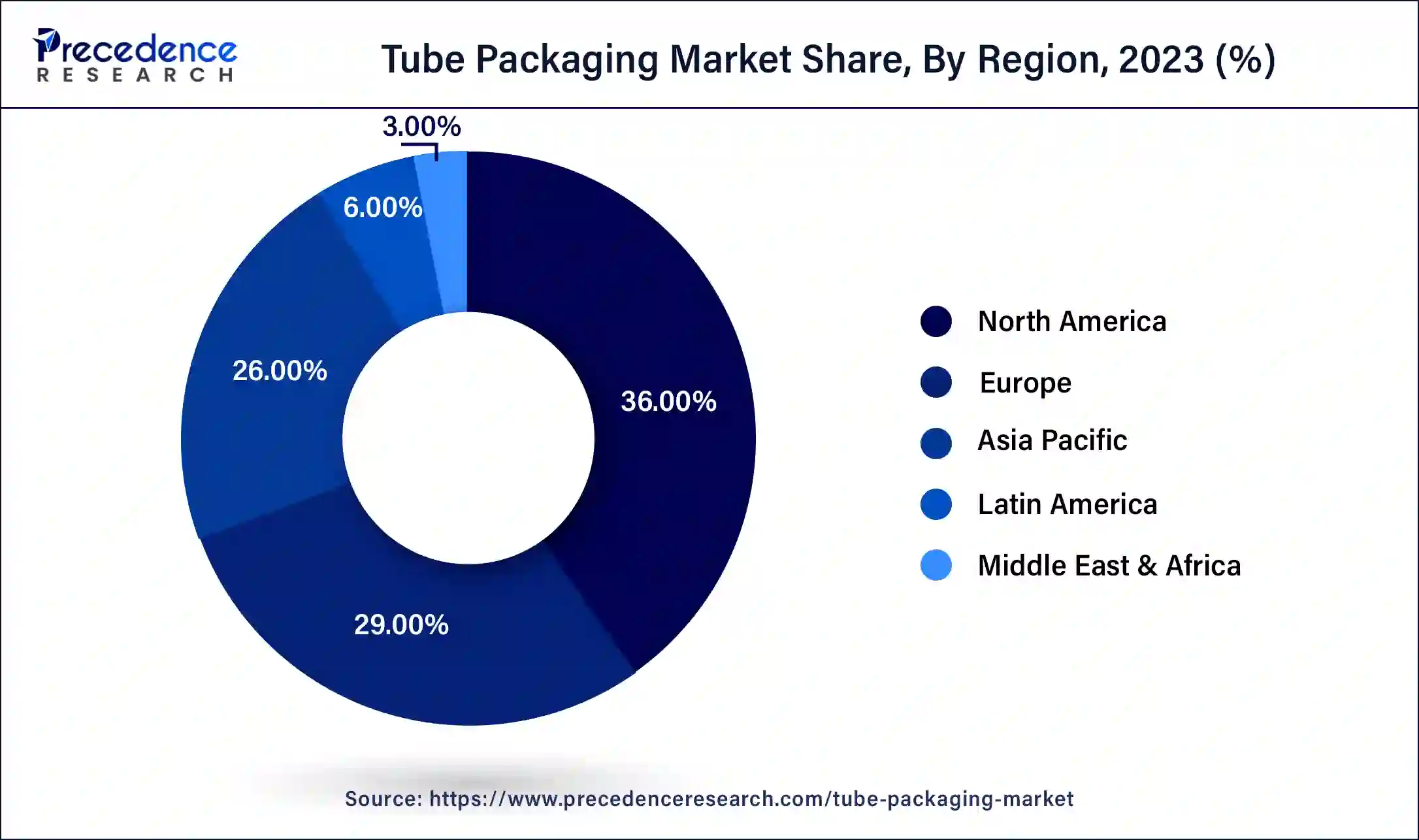

- North America contributed more than 36% of revenue share in 2024.

- Asia-Pacific is expected to expand at the fastest CAGR during the forecast period.

- By Tube Type, the squeeze and collapsible segment accounted for over 73% of revenue share in 2024.

- By Tube Type, the twist tubes segment is anticipated to grow at a notable CAGR of 7.8% during the projected period.

- By Product, the laminated tubes segment led the market with a major market share of 46% in 2024.

- By Product, the aluminum product segment is estimated to expand at the fastest CAGR over the projected period.

- By Application, the personal care and oral care segment had the largest market share of 67% in 2024.

- By Application, the healthcare segment is anticipated to grow at the fastest CAGR over the projected period.

Market Overview

Tube packaging refers to cylindrical containers typically made of materials like plastic, aluminum, or paperboard. These containers are sealed at one end and often feature a flip-top cap or nozzle for dispensing the product. Tube packaging is widely used across various industries, including cosmetics, pharmaceuticals, food, and personal care, for packaging products like creams, lotions, ointments, toothpaste, and more.

It offers several advantages, including ease of dispensing, portability, and product protection. Tube packaging is versatile, allowing for various sizes and shapes, and it can be customized with branding and labeling to enhance product visibility and appeal to consumers.

Tube Packaging Market Growth Factors

Tube packaging refers to cylindrical containers typically crafted from materials such as plastic, aluminum, or paperboard. These versatile containers are sealed at one end and feature a flip-top cap or nozzle for easy product dispensing. Tube packaging finds extensive use across diverse sectors, including cosmetics, pharmaceuticals, food, and personal care, serving as an ideal vessel for products like creams, lotions, ointments, toothpaste, and more. Its appeal lies in its convenience, portability, and ability to safeguard products.

Several key drivers propel the tube packaging market's growth including the packaging's user-friendliness and product protection capabilities make it highly sought after by consumers. The cosmetic and personal care industry's expansion, fueled by rising beauty consciousness, contributes to increased tube packaging demand. Additionally, innovations in sustainable and eco-friendly materials are driving the adoption of green tube packaging.

The COVID-19 pandemic further underscored the importance of hygienic and tamper-evident packaging, making tube packaging materials crucial for healthcare and pharmaceutical sectors. Current industry trends center around sustainability, with a growing focus on recyclable and biodegradable tube packaging materials. Customization and personalization of tube packaging designs are on the rise, enabling brands to differentiate and connect with consumers.

The market also witnesses advancements in tube sealing and dispensing technologies to enhance user experience. Challenges in the tube packaging market include rising competition, fluctuating raw material costs, and the need to balance sustainability with packaging performance. Opportunities in the market include innovating sustainable tube packaging solutions, exploring collaborations for recycling initiatives, and expanding into emerging markets with growing consumer demand for eco-friendly packaging. Meeting the demand for hygienic and tamper-evident packaging remains a valuable opportunity in the current market landscape.

What is Driving the Growth of the Global Tube Packaging Market?

The global tube packaging market is rapidly expanding as brands in the cosmetics, pharmaceuticals, and food categories turn to compact, user-friendly, and sustainable packaging formats. Users are gravitating toward hygienic, travel-ready tube packaging that allows precise dispensing, quality protection, and ease of transport.

Simultaneously, manufacturers are innovating with sustainable materials and advanced barriers, as well as a capacity for digital customization. The trends of high-performance packaging and appealing visual attributes are positioning tube packaging as the format of choice for mass-market and premium products alike.

Market Outlook:

- Industry Growth Overview: The tube packaging market is anticipated to grow steadily, particularly as brands seek portable, contaminant-free, and high-barrier packaging. Demand in applications for cosmetics, over-the-counter products, and food products will continue to stimulate both production improvements and global growth and penetration.

- Sustainable Trends: Sustainable packaging will encompass the highest level of innovation in the future, especially as companies will adopt more and more post-consumer recycled plastics, bio-based plastics, and aluminum recycling. Manufacturers have already prioritized single-material tubes and refillable tubes.

- Global Expansion: While companies enter new markets and expand regional production facilities, companies are also engaging in strategic partnerships to solidify their supply chains. Global tube consumption is forecasted to increase with counter growth in the Asia-Pacific, Latin America, and Africa.

- Start-Up Ecosystem: The startup ecosystem is changing, with young companies leveraging the need for biodegradable tubes, bio-based polymers, and digital tooling, allowing for consumer customizability. All of these companies are attracting investment from established brands in the FMCG and beauty spaces, looking to drive their sustainable purpose through next-generation packaging.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 6.35% |

| Market Size in 2025 | USD 13.53 Billion |

| Market Size in 2026 | USD 14.41 Billion |

| Market Size by 2034 | USD 23.51 Billion |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2034 |

| Segments Covered | By Tube Type, By Product, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Product protection and demand from cosmetic and personal care industry

The demand for tube packaging is significantly boosted by its exceptional product protection capabilities. The cylindrical design, often equipped with a sealed flip-top cap or nozzle, creates a robust barrier against external factors like air, moisture, and contaminants. This ensures the product's integrity and extends its shelf life, which is crucial for items such as cosmetics, pharmaceuticals, and food products. Consumers and manufacturers alike value packaging that guarantees the preservation of product quality and freshness. Tube packaging excels in this regard, offering a reliable solution that aligns with consumers' expectations for uncompromised product protection.

Moreover, The tube packaging market experiences a substantial surge in demand, primarily driven by the thriving cosmetic and personal care industry. As beauty consciousness continues to rise globally, consumers seek skincare, haircare, and grooming products that are not only effective but also aesthetically pleasing. Tube packaging offers an ideal vessel for these products, facilitating easy dispensing and precise application.

Additionally, the ability to customize tube packaging with attractive designs and branding elements enhances the visual appeal, aligning with the industry's focus on product presentation. Consequently, the cosmetic and personal care industry's growth further fuels the demand for tube packaging, making it a preferred choice for packaging solutions in this sector.

Restraints

Environmental concerns and raw material price fluctuations

The rising emphasis on sustainability by consumers and regulatory authorities exerts mounting pressure on manufacturers to embrace environmentally friendly materials and adopt sustainable practices. The use of plastic tubes, for example, has faced criticism due to their impact on the environment. Manufacturers face the challenge of balancing sustainability with cost-effectiveness, as sustainable materials can be pricier than traditional options.

Additionally, achieving consistent sustainability standards across the supply chain requires investments in research and development. Moreover, the tube packaging market is susceptible to fluctuations in the prices of raw materials, particularly petroleum-based materials used in plastic tubes. Rapid price changes can affect production costs and profit margins for tube manufacturers. To mitigate these fluctuations, companies may need to explore alternative materials or diversify their supply sources, which can be time-consuming and costly. These challenges can impact the affordability of tube packaging solutions for both manufacturers and consumers, potentially affecting market demand.

Opportunities

Collaboration for recycling initiatives, customization and personalization

Increasing environmental awareness has led to collaborative efforts between packaging manufacturers, brands, and recycling organizations. This synergy aims to develop and promote recycling solutions for tube packaging materials, making them more sustainable and eco-friendly. Consumers are increasingly looking for products packaged in materials that can be easily recycled or upcycled. Brands that actively engage in recycling initiatives gain favor among environmentally conscious consumers, boosting the demand for tube packaging solutions designed with recyclability in mind.

Moreover, the trend of customization and personalization has swept across the packaging landscape. Tube packaging offers ample opportunities for brands to tailor their packaging designs, colors, and branding elements to resonate with their target audience. Personalized packaging not only enhances the visual appeal but also fosters a deeper connection with consumers. Whether it's unique packaging for limited-edition products or packaging that reflects a consumer's name or preferences, customization and personalization create a sense of exclusivity and relevance.

As consumers increasingly seek products that align with their individuality, these features surge the demand for tube packaging, making it a versatile canvas for branding and consumer engagement.

Tube Type Insights

According to the tube type, the squeeze and collapsible segment has held a 73% revenue share in 2024. Squeeze tubes are cylindrical containers typically made of flexible materials like plastic or laminate. They are designed for easy dispensing of products like creams, gels, and liquids. Trends in squeeze tube packaging include a growing preference for sustainable materials, such as recyclable plastics, to align with eco-friendly initiatives.

Additionally, manufacturers are incorporating user-friendly features like flip-top caps and nozzle designs for precise product application, enhancing consumer convenience and product differentiation. Collapsible tubes are commonly used for packaging creams, ointments, and adhesives. They are made from materials like aluminum or plastic laminate.

A prominent trend in collapsible tube packaging is the adoption of innovative dispensing mechanisms to minimize product wastage and ensure precise application. Brands are also focusing on enhancing tube aesthetics through vibrant colors and appealing graphics to attract consumers. Sustainability remains a key trend, with an emphasis on recyclability and materials sourced from renewable sources to reduce environmental impact.

The Twist tubes segment is anticipated to expand at a significant CAGR of 7.8% during the projected period. Twist tubes are cylindrical packaging containers that feature a twisting mechanism to dispense the product. These tubes are commonly used for products like lip balm, solid perfumes, and stick deodorants. They are typically made of materials like plastic or paperboard. In the tube packaging market, twist-type packaging is witnessing trends such as eco-friendly materials to align with sustainability goals. Brands are also focusing on innovative designs and ergonomic twists for ease of use. Additionally, customization options, including branding and labeling, are becoming popular to enhance product visibility and consumer engagement.

Product Insights

Based on the product, the laminated tubes segment is anticipated to hold the largest market share of 46% in2024. Laminated tubes are versatile packaging solutions constructed by combining multiple layers of materials, typically plastic and aluminum, for enhanced product protection and barrier properties. These tubes are widely used in cosmetics, pharmaceuticals, and food industries.

A prominent trend in the tube packaging market is the growing preference for laminated tubes due to their durability, barrier protection, and visual appeal. Brands are increasingly choosing laminated tubes to showcase their products, and advancements in printing technologies allow for vibrant and intricate designs, enhancing their aesthetic appeal.

On the other hand, the aluminum product segment is projected to grow at the fastest rate over the projected period. Aluminum tubes are lightweight yet robust packaging solutions that offer excellent product protection. They are commonly used in pharmaceuticals, oral care, and industrial applications. In the tube packaging market, aluminum tubes are witnessing a resurgence due to their recyclability and sustainability credentials. Aluminum is highly recyclable, making it an eco-friendly choice.

Additionally, the premium appearance of aluminum tubes and their tamper-evident properties make them suitable for pharmaceutical and cosmetic products, aligning with the demand for secure and sustainable packaging options.

Application Insights

In2023, the personal care and oral care segment had the highest market share of 67% on the basis of the installation. In the tube packaging market, personal care and oral care applications involve the packaging of products such as lotions, creams, serums, and cosmetics. A significant trend in personal care tube packaging is the increasing demand for sustainable and eco-friendly materials. Brands are opting for recyclable and biodegradable tube packaging to align with consumer preferences.

Additionally, customization and personalization are gaining traction, with brands using tube packaging as a canvas for unique branding and design, enhancing the overall product experience and attracting consumers seeking personalized beauty solutions.

The healthcare segment is anticipated to expand at the fastest rate over the projected period. In the tube packaging market, healthcare applications encompass packaging solutions for toothpaste, ointments, gels, and pharmaceutical products. A notable trend is the emphasis on hygienic and tamper-evident packaging, which has gained prominence, especially in the wake of the COVID-19 pandemic. Tube packaging with features that ensure product integrity and user safety is in high demand. Moreover, the healthcare sector is witnessing the adoption of sustainable materials in tube packaging, reflecting the broader trend of eco-consciousness in the industry.

Regional Insights

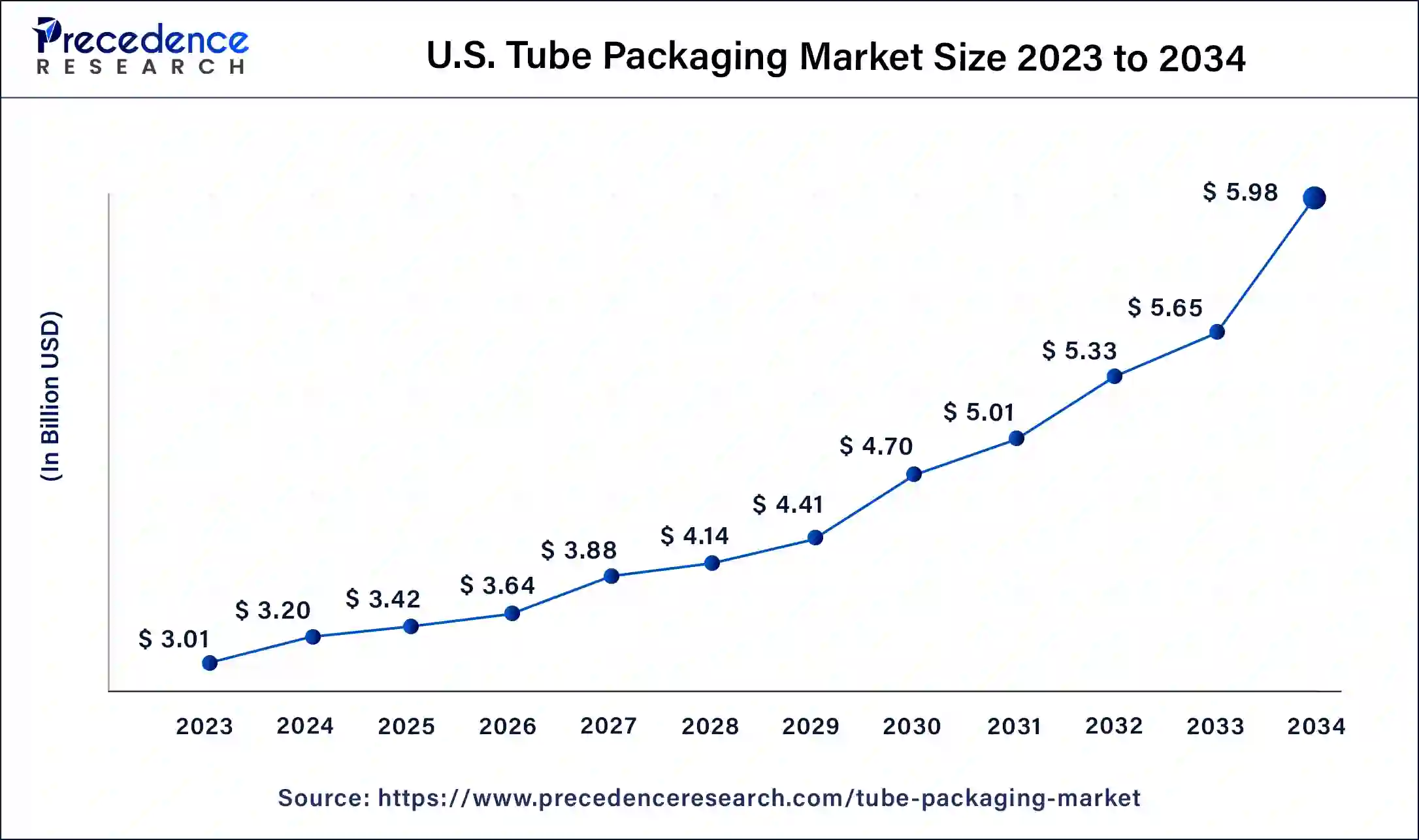

U.S. Tube Packaging Market Size and Growth 2025 to 2034

The U.S. tube packaging market size is estimated at USD 3.42 billion in 2025 and is predicted to be worth around USD 5.98 billion by 2034, at a CAGR of 6.43% from 2025 to 2034.

North America has held the largest revenue share 36% in 2024.In North America, the tube packaging market witnesses a growing preference for sustainable and eco-friendly packaging solutions. Consumers' environmental awareness drives demand for recyclable and biodegradable tube packaging materials. The cosmetic and personal care industry in the region is thriving, boosting the need for visually appealing and convenient tube packaging. Additionally, collaborations for recycling initiatives and innovative designs contribute to the market's growth.

North America: U.S. Tube Packaging Market Trends

In the U.S., the market is seeing growing demand for sustainable and recyclable tubes, with brands increasingly shifting toward mono-material, paper-based, and bio-based options. Eco-conscious regulation and consumer pressure are pushing manufacturers to innovate with lightweight, low-waste tube designs. Personal care and cosmetics remain dominant applications, particularly for squeeze tubes, while smart closures and packaging shapes are gaining traction for differentiation.

Asia-Pacific is estimated to observe the fastest expansion.The Asia-Pacific tube packaging market is marked by rapid expansion, driven by the region's burgeoning e-commerce sector. The demand for secure and convenient packaging suitable for online retail has surged. Furthermore, a focus on customization and personalization in packaging designs is gaining traction in this region, allowing brands to establish stronger connections with consumers. Sustainable packaging solutions are also a prominent trend, aligning with the environmental concerns of the Asia-Pacific market.

Asia Pacific: China Tube Packaging Market Trends

In China, the market is rapidly expanding thanks to booming demand from the cosmetics and personal care sectors, especially with the growth of online retail. Government regulations and sustainability goals are pushing manufacturers toward recyclable and single material tubes, including bio based options. Advanced production techniques like multi-layer co-extrusion are increasingly used to improve performance and barrier properties for premium products.

In Europe, the tube packaging market is witnessing notable trends driven by sustainability and consumer preferences. There's a growing demand for eco-friendly tube packaging materials, including recyclable plastics and paper-based options, as environmental concerns continue to rise. Customization and personalization of tube packaging designs are on the upswing, allowing brands to connect with consumers on a more individual level.

Additionally, the pandemic has underscored the importance of temper-evident and hygienic packaging, further driving the adoption of tube packaging in healthcare and personal care sectors across the European region.

What are the Reasons that Europe is Leading the Global Tube Packaging Market in Sustainability and Innovation?

Europe continues to be at the forefront of tube packaging, thanks to the strong trend towards sustainable packaging, recycling regulations, and high consumer preference for premium personal care products. Germany, France, Italy, and the U.K. are advancing mono-material tube and post-consumer recycled (PCR) plastic and aluminum recovery technology.

Some of the major players in Europe, Huhtamaki, Amcor, and Hoffmann Neopac, are making huge capital investments into circular packaging systems for major CPG brands. Furthermore, the growing demand for oral care and premium cosmetics keeps driving Europe's confidence in tube packaging.

What are the Reasons that Latin America is Becoming a Major Growth Center of Tube Packaging?

Latin America is starting to see more adoption of tube packaging driven by urbanization, increasing consumption of personal care products, and a developing pharmaceutical market. In Brazil, Mexico, and Argentina, we can see increased demand for inexpensive and flexible packaging for mass brand cosmetics and OTC medicines.

Local producers are using this time as an opportunity to make flexible tubes that add eco-friendliness and offer more functional supply chains. With increasing distribution networks by global brands, we will see a steady increase in tube packaging demand for the next ten years across the region.

In what Ways does the Tube Packaging Market Value Chain Increase Global Supply Efficiency?

The tube packaging market value chain included sourcing raw materials, designing and making tubes, filling, logistics and distribution, and post-use recycling. Top companies such as Amcor, Essel Pro-pack, and Huhtamaki work collaboratively with resin suppliers and brand-owners to promote material efficiency and sustainability. Manufacturers have launched high-accuracy extrusion, lamination, and digital printing technologies to help reduce costs.

- Raw Material Optimization: Manufacturers are working in conjunction with polymer suppliers to develop lightweight and recyclable materials that provide enhanced flexibility to the tubes while improving product protection and meeting brand sustainability goals.

- Advanced Manufacturing and Printing: Innovation in companies like Amcor and Huhtamaki is seen in the use of high-speed extrusion, lamination, and decorative digital printing technology that creates aesthetic and resilient tubes.

- Efficient Distribution and Recycling Networks: Logistics systems are improved to facilitate a more seamless flow of products. Strong collaborations supporting recycling programs and initiatives are addressing the growing interest in post-consumer-recycled content and mono-material tubes.

Tube Packaging MarketCompanies

- Essel Propack Ltd.

- Huhtamaki Oyj

- CCL Industries Inc.

- Albea S.A.

- Amcor plc

- Montebello Packaging Inc.

- Sonoco Products Company

- VisiPak

- Berry Global Group, Inc.

- World Wide Packaging LLC

- CTL Packaging USA

- Hoffmann Neopac AG

- Neopac US, Inc.

- Intrapac International Corporation

- Montebello Packaging, Ltd.

Recent Developments

- In 2019, Stora Enso introduced biodegradable and renewable paperboard tube packaging for cosmetics, offering an eco-friendly alternative to conventional plastic packaging solutions. This innovation aligns with sustainability goals, emphasizing environmental responsibility in the cosmetic industry.

- In 2019, Amcor successfully concluded its acquisition of Bemis, a move aimed at bolstering its position as a provider of responsible packaging solutions for various consumer products, including food, beverages, pharmaceuticals, and more. This strategic acquisition enhances Amcor's scale, capabilities, and global footprint.

- In 2019, Berry Global Group, Inc. finalized its acquisition of RPC Group Plc, forming a prominent global supplier of value-added protective solutions and becoming one of the world's largest plastic packaging companies.

Segments Covered in the Report

By Tube Type

- Squeeze and Collapsible

- Twist

By Product

- Laminated

- Plastic

- Aluminum

- Others

By Application

- Personal Care & Oral Care

- Healthcare

- Food

- Consumer Goods

- Others

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting