Vehicle Subscription Market Size and Forecast 2025 to 2034

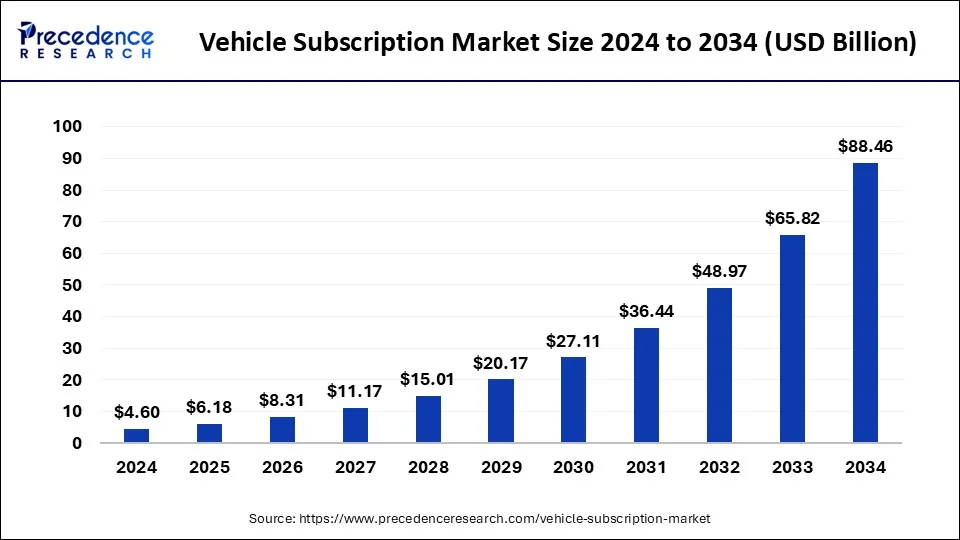

The globalvehicle subscription market size was estimated at USD4.60 billion in 2024 and is predicted to increase from USD 6.18 billion in 2025 to approximately USD 88.46 billion by 2034, expanding at a CAGR of 34.4% from 2025 to 2034.

Vehicle Subscription Market Key Takeaways

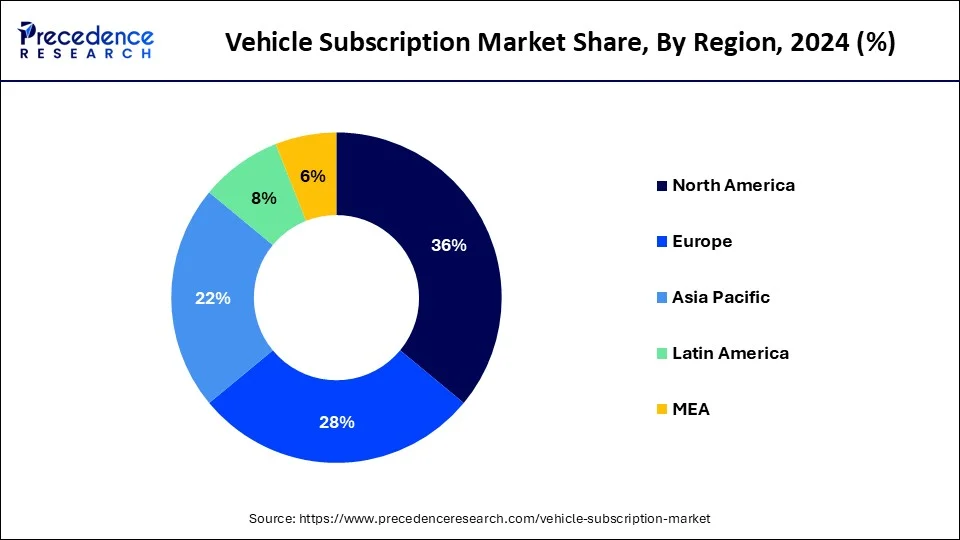

- North America led the global market with the highest market share of 36% in 2024.

- By vehicle type, the IC powered vehicle segment has hold the largest market share of 71% in 2024.

- By subscription period, the 1 to 6 months segment captured the biggest revenue share in 2024.

- By service providers, the Independent/third-party service provider segment registered the maximum market share in 2024.

- By end use, the corporate segment is estimated to hold the highest market share in 2024.

U.S. Vehicle Subscription Market Size and Growth 2025 to 2034

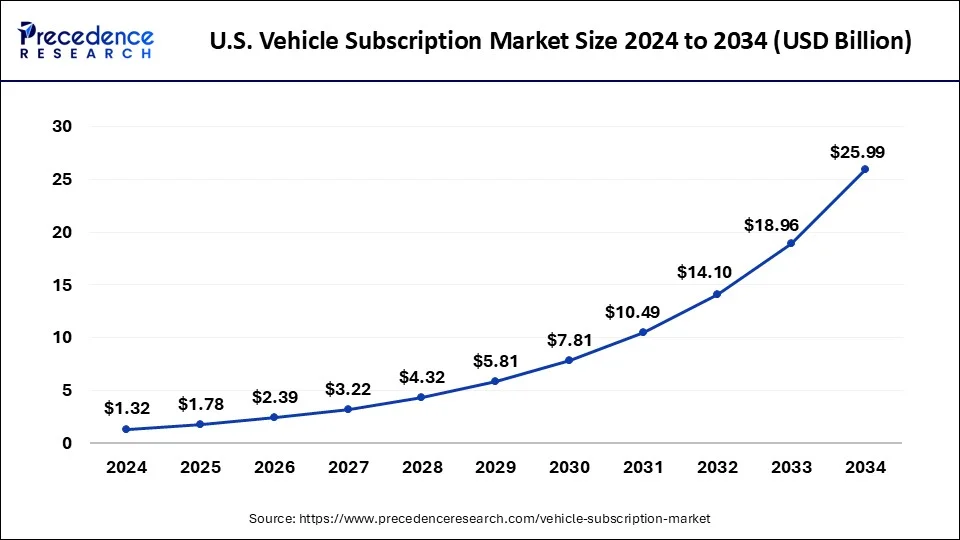

The U.S. vehicle subscription market size was estimated at USD 1.32 billion in 2024 and is predicted to be worth around USD 25.99 billion by 2034, at a CAGR of 34.72% from 2025 to 2034.

North America contributed more than 36% of the total revenue share in 2024. This is because of the high living standards of people in these regions and high disposable incomes. For instance, On 28th CarNext, a pan-European marketplace for high-quality used cars, announced that it is partnering with the leading tech company ProovStation and DEKRA to pilot virtual car inspections using AI technology. The scanner provided by ProovStation will facilitate CarNext to enhance its inspection and remarketing processes by using innovative AI technology and to automate the scanning and damage detection portion of the reconditioning process. The scanner will make sure holistic checks for all the cars supplied by CarNext in Netherlands before they are reconditioned at 228 checkpoints.

Asia Pacific is expected to grow remarkably during the forecast period witnessing a CAGR of more than 28% owing to the rapid surge in urbanization, industrialization and the massive population in this region. Also, the growth of disposable incomes due to industrialization is fostering the market growth in the Asia Pacific region.

Vehicle Subscription MarketGrowth Factors

The surge in the adoption of vehicle subscription model across the world owing to its cost-effectiveness and offering easy user access to vehicles is expected to drive the growth of the market. For instance, On 29th September 2021, General Motors announced the development of "Ultifi" software platform for its cars. This new software will facilitate in-car subscription services, over-the-air (OTA) updates and “new opportunities to increase customer loyalty. The automaker conceptualizes the new software powering everything starting from the mundane, such asweather apps, to potentially disputable features like the use of in-car cameras for facial recognition or to detect children to automatically activate the car's child locks. The third partydevelopers will also be able to use this Linux-based system, who wishes to create apps and other features for GM customers.

Also, the increase in penetration of vehicle subscription service providers due to increased demand for vehicle leasing services by consumers and the strict regulations by governments in order to control emissions from vehicles are some of the factors that is accelerating the growth of the vehicle subscription market.

The rapid increase in the consumers disposable income in the developing countries are fostering the market growth. Furthermore, the factors such as the increase in population, rapid urbanization and industrialization are anticipated to fuel the market growth.

The benefits of subscription over leasing is fueling the market growth. Some of the benefits of the subscriptions compared with leasing includes the subscription services covers maintenance cost, repair cost, insurance cost, license fees, and taxes which the leasing service do not. Also, the agreement duration is longer in subscription when compared with the leasing service. Therefore, this attribute is estimated to drive the growth of the vehicle subscription market.

The strategic partnership between the automakers and the subscription service providers are fostering the market growth. This partnership helps in catering the untapped markets. Owing to the Change in consumer sentiments toward vehicle subscription the vehicle subscription providers need to undergo strategic partnership with the auto manufacturers to attain the long-term business opportunities. These factors boost the market growth. For instance, On 6th July 2021, CarNext, one of Europe's leading online B2C and B2B used car marketplaces, announced that it has entered into an exclusive Long-Term Service Agreement with LeasePlan, a largest car leasing companies in the world with over 1.8 million vehicles under management in 30 countries. This ensures CarNext a supply of close to 300,000 high-quality used cars annually to sell through its B2C and B2B marketplaces across Europe, giving the company an excellent base for future growth.

Market Scope

| Report Highlights | Details |

| Market Size in 2024 | USD 4.60 Billion |

| Market Size in 2025 | USD 6.18 Billion |

| Market Sizeby 2034 | USD 88.46 Billion |

| Growth Rate From 2025 to 2034 | CAGR of 34.4% |

| Largest Market | North America |

| Fastest Growing Market | Asia Pacific |

| Base Year | 2024 |

| Forecast Period | 2025 to 2034 |

| Segments Covered | Vehicle, Subscription Period,Service Providers,End Use,Region |

| Regions Covered | North America, Asia Pacific, Europe, Latin America, Middle East and Africa |

Vehicle Type Insights

Based on the vehicle type, the vehicle subscription market is divided into IC Powered Vehicle and Electric Vehicle. The IC powered vehicle segment leads the vehicle subscription market in terms of revenue share contributing more than 71% in 2024 and is expected to grow significantly during the forecast period. It is because of the large scale availability of fuel stations across the world to power the IC powered vehicles.

The electric vehicles segment is also estimated to grow at a CAGR of 27% in the upcoming years owing to the increased penetration of the electric vehicle sales and the traction towards electric mobility. Also, the Government investment in promoting the electric vehicles will contribute positively towards the growth of the vehicle subscription market.

Subscription Period Insights

Based on the subscription period, the vehicle subscription market is divided into 1 to 6 Months, 6 to 12 Months and More than 12 Months. In this segment, the 1 to 6 months segment holds a significant market share because usually it is observed that the employer segment hires the vehicle during their vacations. This factors the drives the demand for subscription segment of 1 to 6 months period.

Service Providers Insights

Based on the service providers, the vehicle subscription market is divided into OEMs & Captives and Independent/Third Party Service Provider. In this segment, the Independent/ third party service provider dominates the Vehicle Subscription Market owing to the availability of providing the customers a wide range of vehicles models that the customers can switch during their subscription period.

End Use Insights

Based on the end use, the corporate end-use segment dominated the vehicle subscription market contributing more than 60% in terms of revenue share in 2024 and is estimated to grow significantly during the forecast period owing to the increase in business tours, transportation service to employees and optimum durational contract period.

The private end use segment is also anticipated to witness highest growth with a CAGR of 24% over the forecast period due to change in customer preference in obtaining a vehicle subscription service.

Vehicle Subscription Market Companies

- Fair Financial Corp.

- Clutch Technologies, LLC

- CarNext

- FlexDrive

- Cluno GmbH

- DriveMyCar Rentals Pty Ltd

- BMW AG

- Daimler AG

- General Motors

- Hyundai Motor India

- Tata Motors

- Tesla

- Volkswagen

- Volvo Car Corporation

- ZoomCar

- Cox Automotive

- Wagonex Limited

- LeasePlan

- Drover Limited

- Lyft Inc.

Segments Covered in the Report

By Vehicle Type

- IC Powered Vehicle

- Electric Vehicle

By Subscription Period

- 1 to 6 Months

- 6 to 12 Months

- More than 12 Months

By Service providers

- OEMs & Captives

- Independent/Third Party Service Provider

By End Use

- Private

- Corporate

By Geography

- North America

- U.S.

- Canada

- Mexico

- Europe

- U.K.

- Germany

- France

- Russia

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- LAMEA

- Latin America

- Middle East

- Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting