What is the Veterinary Diagnostics Market Size?

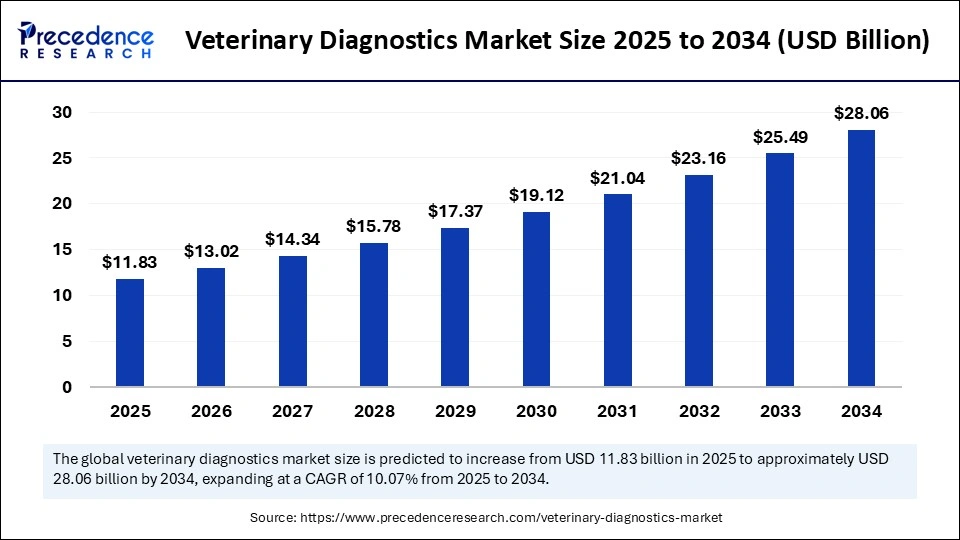

The global veterinary diagnostics market size is calculated at USD 11.83 billion in 2025 and is predicted to increase from USD 13.02 billion in 2026 to approximately USD 30.47billion by 2035, expanding at a CAGR of 9.92% from 2026 to 2035. The veterinary diagnostics market is witnessing robust growth, driven by rising pet ownership, increased awareness of animal health, and advancements in diagnostic technologies.

Veterinary Diagnostics MarketKey Takeaways

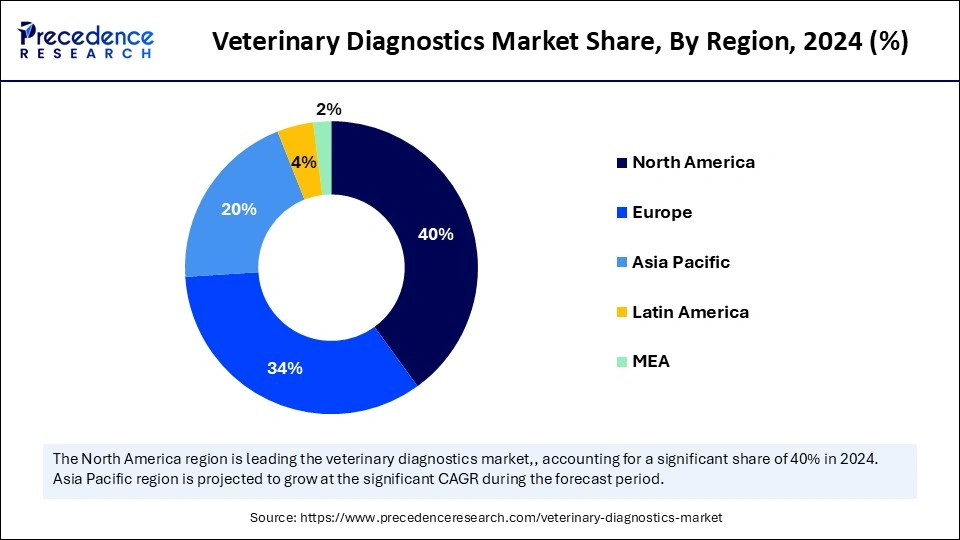

- North America dominated the global Market with the largest market share of 40% in 2025.

- Asia Pacific is expected to expand at the fastest CAGR in the market between 2026 to 2035.

- By testing category, the clinical chemistry segment held the largest market share of 24% in 2025.

- By testing category, the cytopathology segment is projected to grow at the highest during the forecast period.

- By animal type, the companion animals segment held the biggest market share of 60% in 2025.

- By animal type, the production animals segment is anticipated to grow at the fastest CAGR in the coming years.

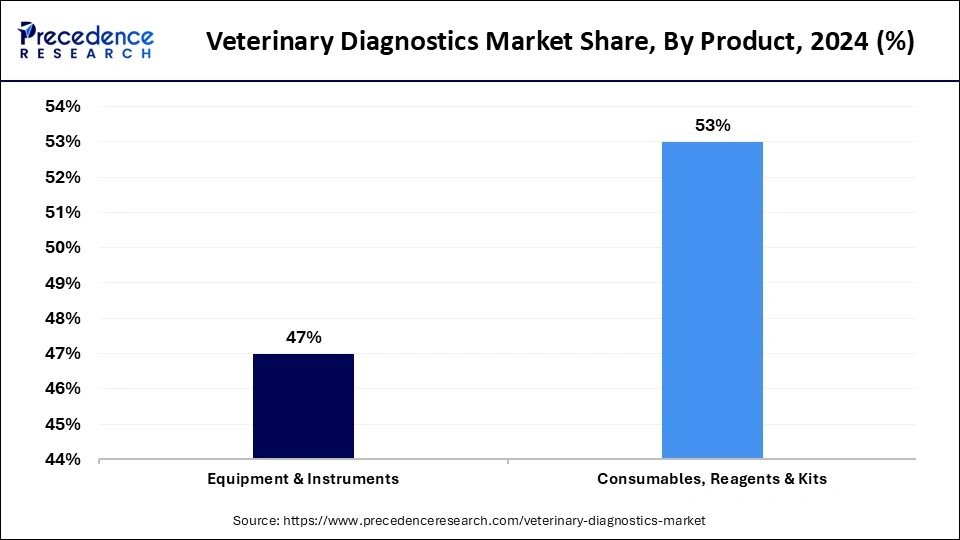

- By product type, the consumables, reagents and kits segment captured the major market share of 54% in 2025.

- By product type, the equipment and instruments segments is projected to grow at the fastest rate during the forecast period.

- By end-user, the veterinarians segment held the largest market share in 2025.

- By end-user, the animal owners/producers segment is anticipated to grow at a significant CAGR between 2026 to 2035.

Market Overview

The veterinary diagnostics market is undergoing a significant transformation, driven by increasing awareness of animal health, a surge in companion animal ownership, and heightened concerns over zoonotic diseases. As veterinary practices modernize, the demand for advanced diagnostics tools, ranging from clinical biochemistry and hematology to molecular and immunodiagnostics testing, is soaring. Rapid advancements in point-of-care testing, AI-enabled diagnostics platforms, and digital imaging are enhancing the speed and accuracy of disease detection, leading to more targeted treatments and improved animal welfare. The growing emphasis on preventive healthcare and early disease intervention is further fueling innovation and investment in diagnostic solutions across both the companion and livestock sectors. This expanding landscape is not only supporting veterinarians in delivering timely care but also positioning diagnostics as the backbone of future-ready animal healthcare.

How AI is Transforming Animal Diagnosis?

Artificial Intelligence (AI) is revolutionizing veterinary diagnostics by introducing smarter, faster, and more accurate methods of disease detection in animals. AI-powered platforms are enabling real-time data analysis, pattern recognition, and predictive diagnostics, which significantly enhance the ability of veterinarians to diagnose conditions early and with greater confidence. From analyzing radiographs and pathology slides to monitoring animal health through wearables and IoT-integrated systems, AI is reducing diagnostic errors and improving treatment outcomes. Moreover, machine learning algorithms can process vast datasets to identify emerging disease trends and resistance patterns, aiding in both individual animal care and broader epidemiological studies. This technological leap is not only streamlining veterinary workflows but also shaping a proactive healthcare model for companion animals, livestock, and even wildlife.

- In May 2025, Researchers at Kashmir University achieved a significant milestone by creating India's first gene-edited sheep. This advancement was made possible through the integration of artificial intelligence and advanced genetic biotechnology techniques. The project marks a notable achievement in the field of animal genetics and biotechnology within the country.(source: https://www.news18.com)

Recent Products Launched Around the Globe

| Country | Company | Product | Use of the Product |

| U.S. | IDEXX laboratories | Cancer DX | AI-powered canine lymphoma screening test |

| U.S. | Zoetis | Vet Scan Opticell | Cartridge-based hematology analyzer |

| China | Chengdu seamatry techno | VG2, VG1, and VI 1 | Veterinary analyzers for rapid diagnostics |

| France | Vibrac | Trilotab | Chewable trilostane tablet for canine Cushing's syndrome. |

| Germany | Eurolyser diagnostics | Smartlyse Vet | Portable hematology analyzer for the veterinary clinic |

Growth Factors of the Veterinary Diagnostics Market

- Rising companion animal ownership: with increasing emotional attachment to pets, the need for health check-ups and preventive care is rising. The growing awareness of animal well-being has significantly increased the demand for advanced diagnostic tools.

- The surge in zoonotic and livestock diseases: With a surge in zoonotic diseases and livestock-related infections, the demand for early and accurate diagnostic tools is becoming increasingly essential for both companies and farm animals. The emergence and re-emergence of zoonotic diseases such as rabies and leptospirosis have intensified the need for accurate and rapid diagnostic testing.

- Technological advancements in diagnostics: The integration of advanced tools and molecular diagnostics techniques is transforming traditional veterinary practices. Tools like PCR testing, biosensors, and portable diagnostics devices are enhancing real-time detection and improving clinical outcomes.

- Growth of pet insurance and reimbursement: As pet insurance becomes more prevalent in developed markets, pet owners are more likely to opt for higher quality, regular diagnostics tests, removing cost as a deterrent and supporting market expansion.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 30.47Billion |

| Market Size in 2025 | USD 11.83 Billion |

| Market Size in 2026 | USD 13.02 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 9.92% |

| Dominating Region | North America |

| Fastest Growing Region | Asia Pacific |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Product, Testing Category, Animal Type, End-use, and Region |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Drivers

Pet Humanization, Livestock Production, and Increased Animal Healthcare Expenditure: The Triple Force Behind Diagnostic Demand

The growing humanization of pets and the rising global livestock population are reshaping the veterinary healthcare landscape. Pet owners are increasingly willing to spend on their pets' health, boosting the demand for accurate and minimally invasive diagnostics solutions. Simultaneously, livestock farmers are under pressure to maintain herd health due to strict food safety regulations and economic risks of disease outbreaks. In addition, the rising awareness about companion animal care and livestock management is driving an upsurge in veterinary diagnostics, particularly in urban areas and agriculture-intensive regions. The increasing prevalence of zoonotic diseases, coupled with government mandates for disease surveillance, adds further momentum to the market.

Restraint

High Costs of Diagnostic Equipment and Insufficient Veterinary Healthcare Infrastructure

Despite strong growth potential, the veterinary diagnostics market faces several challenges that may hinder its full-scale adoption. High costs associated with advanced diagnostics equipment and tests can create barriers for small veterinary clinics. Moreover, the lack of standardization in diagnostics producers, limited awareness among rural farmers, and insufficient veterinary infrastructure in emerging regions restrict accessibility and trust in testing outcomes. Regulatory hurdles and the lengthy approval process for new veterinary diagnostics products also act as a brake on innovation and market expansion. To achieve widespread adoption, addressing affordability, accessibility, and awareness gaps remains critical.

Opportunity

Technological Innovation

The convergence of AI, data analytics, and portable diagnostic tools is opening unprecedented opportunities for market players. From AI-powered radiograph analysis to cloud-based veterinary diagnostics platforms, the integration of technology is revolutionizing how, when, and where diagnostics can be delivered. Emerging economies, particularly in Asia Pacific, the Middle East, and Latin America, are witnessing rapid growth in pet ownership and government investment in animal health infrastructure. These regions offer fertile ground for innovation, especially point-of-care diagnostics and mobile veterinary services. Additionally, the expanding reach of pet insurance and veterinary telemedicine is enabling broader access to diagnostics, turning niche segments into profitable ventures.

Segment Insights

Testing Category Insights

The clinical chemistry segment dominated the veterinary diagnostics market in 2024. Clinical chemistry stands as the cornerstone of veterinary diagnostics, offering critical insights into organ function, metabolic status, and disease progression in animals. It plays a dominant role due to its wide applicability in diagnosing conditions such as liver disease, renal dysfunction, and metabolic imbalances. Its high usage in routine veterinary check-ups and preventive care contributes significantly to its leadership in the market.

On the other hand, the cytopathology segment is projected to grow at the highest during the forecast period, driven by the increasing demand for minimally invasive diagnostic methods. With its ability to detect tumors, infections, and inflammatory diseases at a cellular level, cytopathology is gaining traction in oncology and dermatology within veterinary practice. Technological advancements in imaging and AI-powered analysis further support segmental growth.

Animal Type Insights

The companion animals segment dominated the veterinary diagnostics market with the largest share in 2024. This is mainly due to the increased adoption rates and humanization of pets. Pet parents are increasingly seeking early detection and personalized treatment plans, boosting demand for routine diagnostics, wellness screenings, and preventive testing. The strong presence of animal healthcare infrastructure in urban areas further supports this segment.

Meanwhile, the production animals segment is anticipated to grow at the fastest rate in the coming years. The growth of the segment can be attributed to the rising production of livestock. Due to economic losses and food safety concerns associated with livestock, governments of various nations have enforced stricter disease surveillance and animal welfare norms in the agricultural sector. This creates the need for diagnostic testing.

Product Insights

The consumables, reagents & kits segment dominated the market in 2024 owing to their recurring usage in diagnostics. Whether for ELISA tests, rapid testing strips, or PCR-based assays, consumables are essential across all types of diagnostic platforms. Their ease of use, cost-effectiveness, and compatibility with a wide range of testing systems make them indispensable in veterinary clinics and laboratories.

On the other hand, the equipment & instruments segments is projected to grow at the fastest rate during the forecast period. With the rapid shift toward automation and precision, the demand for advanced equipment like analyzers, imaging systems, and point-of-care devices is growing. Integration of AI and digital technologies into these instruments is enhancing speed, accuracy, and portability, especially valuable in remote and field settings.

End-User Insights

The veterinarians segment dominated the veterinary diagnostics market with the largest share in 2024. Veterinarians are a primary end-user of diagnostic tools, as they perform both clinical and laboratory-based testing. Their access to diagnostic facilities, technical expertise, and pivotal role in decision-making make this segment the major contributor to market growth.

On the other hand, the animal owners/producers segment is anticipated to grow at a significant CAGR in the upcoming period. Pet owners and livestock producers are increasingly participating in direct testing through at-home diagnostic kits and mobile veterinary services. The growing awareness of animal welfare and rising healthcare expenditure contribute to segmental growth. Pet owners are becoming more conscious about their pet's health, boosting the demand for early diagnostic testing.

Regional Insights

What is the U.S. Veterinary Diagnostics Market Size?

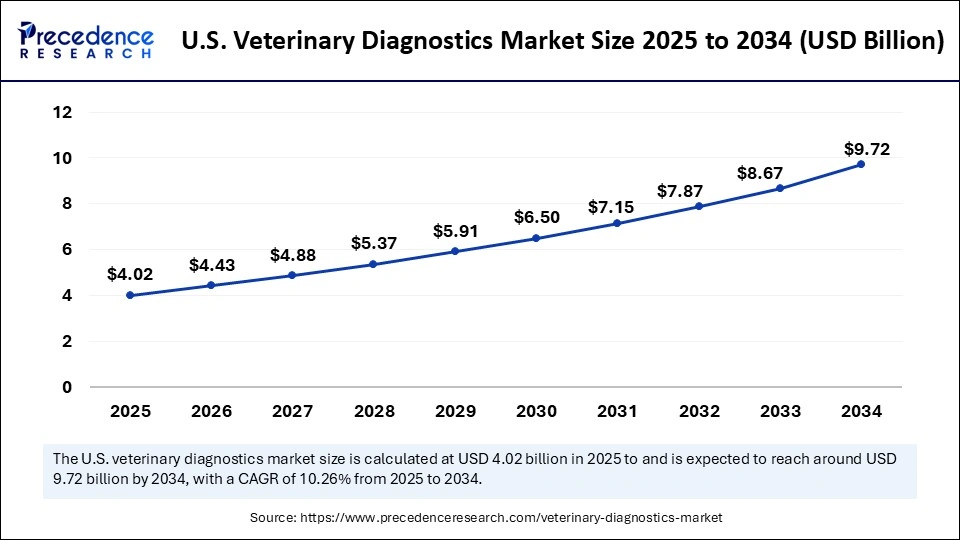

The U.S. veterinary diagnostics market size is exhibited at USD 4.02 billion in 2025 and is projected to be worth around USD 10.60 billion by 2035, growing at a CAGR of 10.18% from 2026 to 2035.

Why is North America Leading the Veterinary Diagnostics Market?

North America dominated the market by capturing the largest share in 2024, propelled by a well-established veterinary infrastructure, high pet ownership, and increased spending on animal healthcare. The U.S. boasts a mature and technologically advanced ecosystem where diagnostic testing is routine in both companion animal care and livestock management. The region is home to major industry players such as IDEXX Laboratories, Zoetis, and Thermo Fisher Scientific, consistently driving innovation through AI-integrated diagnostics, rapid test kits, and cloud-based veterinary data systems. Furthermore, widespread pet insurance adoption and strong support from regulatory bodies like the FDA and USDA have reinforced early diagnosis as a norm. The region is also witnessing a surge in mobile vet services and at-home diagnostic kits, supported by rising consumer awareness and convenience-seeking behavior.

U.S. Market Trends

The U.S. market is driven by a significant growth in pet ownership and spending on pet care. Many firms also provide favorable pet insurance, mainly for companion animals. Also, various government bodies, like the Food and Agriculture Organization, are working toward raising veterinary care awareness and even developing diagnostic infrastructure in the country.

Why is Asia Pacific Racing Ahead in Diagnostic Innovation?

Asia Pacific is expected to witness rapid growth in the veterinary diagnostics space due to the growing middle-class population, rising disposable incomes, and increasing awareness of animal health. Countries such as China, India, Australia, and Japan are rapidly expanding their veterinary services infrastructure to meet the needs of both pet owners and livestock producers. In India and Southeast Asia, government programs focusing on zoonotic disease control and livestock productivity are driving the adoption of rapid testing technologies. Australia and Japan, on the other hand, are investing in precision diagnostics and pet wellness platforms. The region's vast and varied animal population, combined with digital adoption in agriculture and healthcare, positions it as a high-potential zone for diagnostics innovation.

South Korea Market Trends

South Korea's market is driven by advancements in healthcare technology, increased need for animal healthcare, and the growing knowledge of the importance of early disease detection. South Korea stands at the forefront of innovations in animal healthcare, providing a wide range of diagnostic tools and equipment.

What Opportunities Exist in the European Veterinary Diagnostics Market?

Europe is expected to witness notable growth due to its rapid strides in digital transformation and sustainable animal health practices. Countries like Germany, France, and the UK are investing heavily in disease surveillance programs and research collaborations. The EU's emphasis on animal welfare, stricter traceability protocols in the livestock sector, and rising pet humanization is fuelling demand for faster, more accurate diagnostics. Regulatory support, combined with initiatives like the European Animal Health Law, is encouraging the development of new technologies and funding research projects. Furthermore, veterinary clinics across Europe are adopting AI-powered diagnostic platforms and telemedicine services to reach both urban and rural populations, boosting market penetration and innovation at scale.

Germany

Germany's veterinary diagnostics market is growing steadily, driven by the rising prevalence of age-associated neurological conditions in animals. Increased awareness among pet owners about cognitive decline and movement disorders is encouraging early diagnostic testing and timely intervention, boosting demand for veterinary care, supplements, and advanced treatment solutions.

How is the Opportunistic Rise of Latin America in the Veterinary Diagnostics Market?

Latin America is experiencing lucrative growth in the market, driven by increasing acceptance of rapid testing in day-to-day veterinary practice, mainly among small- and mid-scale clinics. This significantly boosts the need for faster diagnostic results without central labs. Expansion of the livestock industry, as well as food safety issues, compelled manufacturers in Brazil to implement on-site testing solutions, mainly for zoonotic diseases.

Brazil Market Trends

Brazil's veterinary diagnostics market is growing, driven by advancements in diagnostic technologies. Innovations such as molecular diagnostics, rapid immunoassays, and point-of-care testing are enhancing the accuracy, speed, and efficiency of testing, fueling demand across healthcare facilities and laboratories.

What Drives the Market in the Middle East & Africa?

The veterinary diagnostics market in the Middle East & Africa (MEA) is mainly driven by rising pet ownership, increasing awareness of animal health, and advancements in diagnostic technologies. There is a growing demand for rapid and accurate diagnostic tests, which are critical for effective disease management in both livestock and companion animals, supporting better veterinary care and livestock productivity.

UAE Market Trends

In the UAE, the market is growing, driven by increasing pet ownership, rising awareness of animal health, and government initiatives to expand veterinary healthcare infrastructure. Additionally, the country's affluent population and high per capita income support the adoption of premium veterinary services and advanced diagnostic products, further boosting market growth.

Veterinary Diagnostics Market Companies

- IDEXX Laboratories, Inc.

- Zoetis

- Antech Diagnostics, Inc. (Mars Inc.)

- Agrolabo S.p.A.

- Embark Veterinary, Inc.

- Esaote SPA

- Thermo Fisher Scientific, Inc.

- Innovative Diagnostics SAS

- Virbac

- FUJIFILM Corporation

Recent Developments

- In March 2025, Antech announced the launch of tr?Rapid FOUR, a comprehensive in-house canine vector-borne disease (CVBD) screening test. tr?Rapid FOUR is a lateral flow test used to detect canine antibodies to Anaplasma spp., Ehrlichia spp., and Lyme C6 (Borrelia burgdorferi), as well as heartworm (Dirofilaria immitis) antigen, using whole blood, serum, or plasma.

(Source: https://www.businesswire.com) - In December 2024, Zoetis Inc. announced a plan to launch its new screenless point-of-care hematology analyzer, Vetscan OptiCell, to the global market at the Veterinary Meeting & Expo (VMX) in Orlando, Florida. It is the first cartridge-based, AI-powered diagnostic tool for veterinary hematology, providing complete blood count (CBC) analysis for accurate insights.

(Source: https://www.zoetisus.com)

Segments Covered in the Report

By Product

- Consumables, Reagents & Kits

- Equipment & Instruments

By Testing Category

- Clinical Chemistry

- Microbiology

- Parasitology

- Histopathology

- Cytopathology

- Hematology

- Immunology & Serology

- Imaging

- Molecular Diagnostics

- Other Categories

By Animal Type

- Production Animals

- Cattle

- Poultry

- Swine

- Others

- Companion Animals

- Dogs

- Cats

- Horses

- Others

By End-use

- Reference Laboratories

- Veterinarians

- Animal Owners/ Producers

By Region

- North America

- APAC

- Latin America

- Europe

- MEA

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting