Vitamin K Market Size and Forecast 2025 to 2034

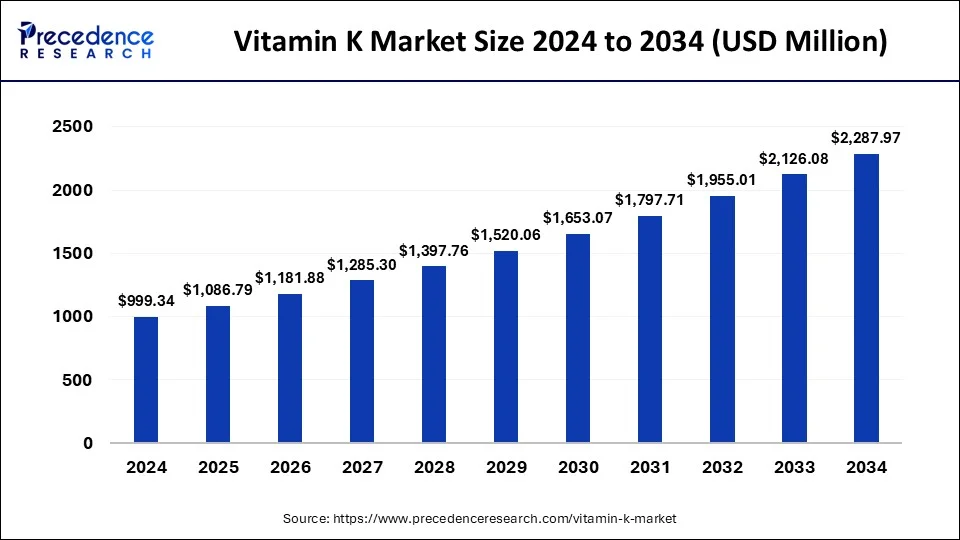

The global vitamin K market size was estimated at USD 999.34 million in 2024 and is predicted to increase from USD 1,086.79 million in 2025 to approximately USD 2,287.97 million by 2034, expanding at a CAGR of 8.64% from 2025 to 2034.

Vitamin K Market Key Takeaways

- The global vitamin K market was valued at USD 999.34 million in 2024.

- It is projected to reach USD 2,287.97 million by 2034.

- The vitamin K market is expected to grow at a CAGR of 8.64% from 2025 to 2034.

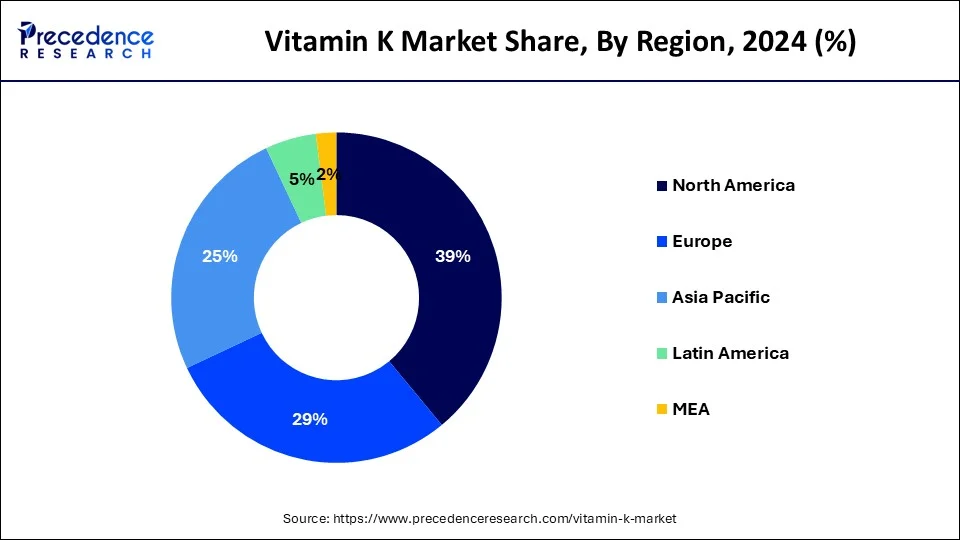

- North America held the largest market share of 39% in 2024.

- Asia Pacific is anticipated to witness the fastest CAGR during the forecast period.

- By product type, the Vitamin K2 segment accounted for a considerable share and is observed to contribute a significant share in the upcoming period.

- By application, the osteoporosis segment held a significant share of the market in 2024.

- By application, the Vitamin K Deficiency Bleeding (VKDB) segment is expected to grow significantly during the forecast period.

- By route of administration, the oral segment led the market with the largest share in 2024.

U.S. Vitamin K Market Size and Growth 2025 to 2034

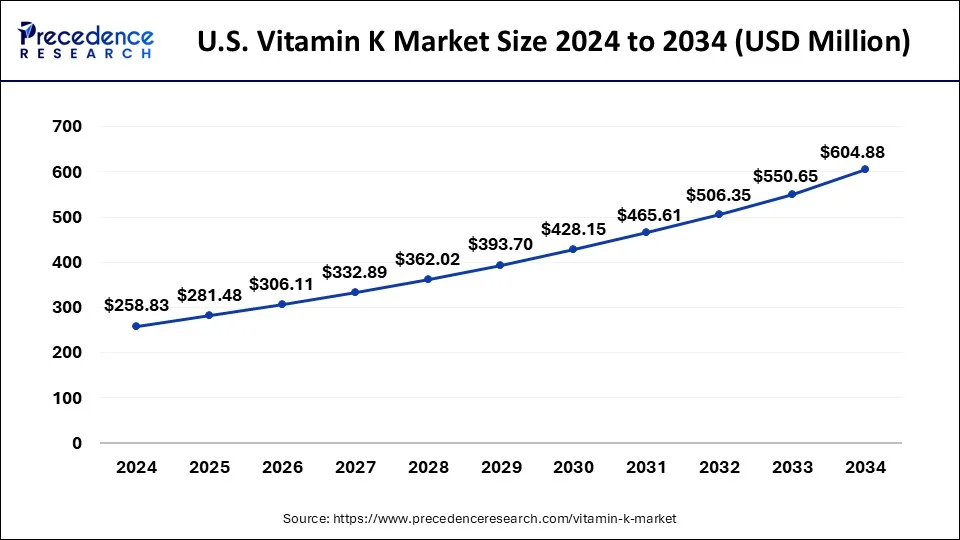

The U.S. vitamin K market size reached USD 258.83 million in 2024 and is anticipated to be worth around USD 604.88 million by 2034, poised to grow at a CAGR of 8.86% from 2025 to 2034.

North America held the dominating market share of 39% in 2024. The growth of the North American region is attributed to the presence of prominent vitamin K product manufacturers, the increasing geriatric population, rising awareness of the significance of nutritional benefits, rising investments in the research and development activities of Vitamin K supplements, significant demand for vitamin K1 injectables and rising prevalence of chronic disorders such as neonatal bleeding, arthritis, cancer diabetes, vascular calcification, regulate blood sugar and osteoporosis. Thus, this is expected to fuel market growth in the region during the forecast period.

- Osteoporosis is a bone disease that makes bones weak and more likely to break. According to the data published by the Bone Health and Osteoporosis Foundation in 2023, Osteoporosis affects nearly 10 million Americans, while another 44 million suffer from low bone density and are at a higher risk of bone fractures. 54 million Americans, half of all adults age 50 and above are at higher risk of breaking a bone and should be concerned about bone health. 1 in 2 women and up to 1 in 4 men will break a bone in their lifetime due to osteoporosis.

The U.S. market has undergone substantial expansion due to rising demand for nutritional products, the presence of sophisticated healthcare infrastructure, increasing focus on wellness, increasing incidence of vitamin K-related disorders, and rising innovation in product development.

- In July 2024, Octapharma USA disclosed that Balfaxar had obtained FDA approval for promptly reversing acquired coagulation factor deficiency caused by vitamin K antagonist therapy in adult patients requiring urgent surgery or invasive procedures. Balfaxar aids in restoring blood coagulation by replenishing deficient clotting factors resulting from warfarin therapy.

The Asia Pacific vitamin K market is expected to grow at the fastest rate in the coming years due to several factors including increasing cases of Vitamin K Deficiency disorder, rising demand for vitamin K2 supplements, rising health concerns, increasing need for vitamin K1 injectables to save infants from any complexities, and growing demand for nutritional food & drinks.

- In September, Abbott launched PediaSure to support catch-up growth and unlock growth potential in children. The PediaSure is enhanced with arginine and natural vitamin K2, two important nutrients to help further support catch-up growth.

Market Overview

The vitamin K market refers to the global industry involved in the production, distribution, and sale of vitamin K supplements, pharmaceuticals, and other related products. Vitamin K is a fat-soluble vitamin essential for blood clotting, bone metabolism, and cardiovascular health. It is available in various forms, including vitamin K1 (phylloquinone) and vitamin K2 (menaquinone), and is commonly found in leafy greens, dairy products, and certain animal products. The market for vitamin K products encompasses dietary supplements, fortified foods, pharmaceutical formulations, and medical applications.

Vitamin K Market Growth Factors

- The rapidly increasing awareness about the significance of Vitamin K in maintaining overall bone health is anticipated to fuel the market's expansion during the forecast period.

- The increasing prevalence of chronic diseases, such as osteoporosis, blood coagulation, arthritis, diabetes, cardiovascular disease, skin-related diseases, and others is expected to fuel the market growth revenue in the coming years. Consumption of Vitamin K in sufficient helps in preventing several diseases.

- The rise in the geriatric population along with the emerging trend of preventive healthcare is projected to create significant growth opportunities for the Vitamin K market.

- Several factors such as growing health consciousness, changing dietary patterns, and a sedentary lifestyle increase the importance of Vitamin K supplements.

- The rising demand for functional beverages and infant nutrition in emerging economies is expected to contribute to the growth of the vitamin K market during the forecast period.

Market Scope

| Report Coverage | Details |

| Growth Rate from 2025 to 2034 | CAGR of 8.64% |

| Market Size in 2025 | USD 1,086.79 Million |

| Market Size by 2033 | USD 2,287.97 Million |

| Largest Market | North America |

| Base Year | 2023 |

| Forecast Period | 2024 to 2033 |

| Segments Covered | By Product Type, By Route of Administration, and By Application |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing prevalence of chronic disorders

The rapidly rising prevalence of chronic disorders is expected to boost the growth of the vitamin K market during the forecast period. The rapidly rising prevalence of vitamin K-associated diseases including hemorrhagic disease in newborn babies, neonatal bleeding, osteoporosis, arthritis, diabetes, cardiovascular disease, and others led to a spurring of the demand for vitamin K tablets, supplements, or injections. Infants or newborns are more susceptible to vitamin K deficiencies. VKDB commonly occurs when babies are unable to stop bleeding as their blood does not have enough Vitamin K to form a clot.

- According to the data published by the CDC in July 2023, as babies can be affected until they are 6 months old, healthcare providers divide Vitamin K deficiency bleeding (VKDB) into three types such as early, classical, and late. Early and classical VKDB are quite common, occurring in 1 in 60 to 1 in 250 newborns, the risk is much higher for early VKDB among those infants whose mothers used certain medications during the pregnancy. Late VKDB is very rarer, occurring in 1 in 14,000 to 1 in 25,000 infants.

Infants who do not receive a vitamin K shot at birth are 81 times more likely to develop late VKDB than infants who do receive a vitamin K shot at birth. As a result, the rising prevalence of chronic disorders is accelerating the growth of the market during the forecast period.

Restraint

Lack of awareness

The lack of awareness is anticipated to restrain the market's expansion during the forecast period. Vitamin K is an essential nutrient that the body needs in sufficient amounts and plays a significant role in blood clotting and overall bone health. Less awareness among people regarding the benefits of Vitamin K, particularly in underdeveloped countries, may result in restricting the expansion of the global vitamin K market.

Opportunities

Rising health awareness

The rising health awareness is projected to offer a lucrative opportunity for the growth of the vitamin K market during the forecast period. The market has experienced health consciousness which increases the demand for vitamin supplements. Vitamin K is gaining significant attention due to its multiple medical benefits in treating diseases and promoting better well-being. The emerging benefits of preventive healthcare solutions are encouraging people to intake sufficient amounts of nutrients.

In addition, Sedentary lifestyles or hectic lifestyles and dietary changes cause vitamin K deficiency. An individual who leads a sedentary lifestyle and intakes junk food is likely to develop chronic diseases and may also suffer from vitamin deficiencies. Thus, the rising health consciousness is contributing to the market's revenue.

Product Type Insights

The Vitamin K2 segment accounted for a significant share of the vitamin K market in 2024. and is also anticipated to continue its dominance over the forecast period owing to the rising use of vitamin k2 in bone development, vascular protection, and blood coagulation. Vitamin K2 is more effective in bone metabolism than vitamin K1. Vitamin K2 is widely known as menaquinone and can be found in fermented foods, dairy, and animal products. It is beneficial for bone health, regulating blood sugar, preventing heart-related diseases, promoting proper brain function, and boosting the overall metabolism of the body.

- In October 2022, Kappa Bioscience, a leading manufacturer of vitamin K2 under the brand name K2Vital announced the launch of its first organic-grade vitamin K2-MK7.

- On the other hand, the Vitamin K1 segment is observed to witness a notable growth rate. Vitamin K1 is mostly found in plant foods. Vitamin K1 is a fat-soluble vitamin that helps in the treatment of hemorrhagic conditions in infants and coumarin overdoses.

- In June 2019, Dr Reddy announced the therapeutic equivalent of Vitamin K1 in the United States.Phytonadione Injectable Emulsion USP is a therapeutic equivalent generic version of Vitamin K1 approved by the U.S. Food and Drug Administration.

Application Insights

The osteoporosis segment held a significant share of the vitamin K market in 2024. Vitamin K plays a crucial role in bone metabolism and mineralization, making it essential for maintaining bone strength and density. Individuals with osteoporosis, a condition characterized by weakened and porous bones, often have insufficient levels of vitamin K. Therefore, healthcare professionals frequently recommend vitamin K supplementation to support bone health and reduce the risk of fractures in osteoporotic patients.

Osteoporosis primarily affects older adults, particularly postmenopausal women and elderly individuals, who are at higher risk of bone-related complications such as fractures. With the global population aging rapidly, the prevalence of osteoporosis is expected to rise, driving the demand for interventions that support bone health, including vitamin K supplements. As a result, the osteoporosis segment represents a significant portion of the vitamin K market's consumer base.

The dermal application segment held a notable share of the vitamin K market in 2024, the segment is expected to sustain the position throughout the forecast period. Vitamin K has numerous skin applications including resolving bruising, suppressing pigmentation, prophylactically limiting the occurrence of acneiform side effects, and helping in wound healing. Vitamin K is non-irritating and safe for use with all skin types. Vitamin K improves wound healing by increasing wound contraction and assisting in the formation of collagen and blood vessels. Vitamin K has redox properties which means the skin's ability to detoxify reactive oxygen species that are formed when an individual is exposed to UV rays and pollution.

The Vitamin K Deficiency Bleeding (VKDB) segment is expected to grow significantly during the forecast period. Vitamin K deficiency bleeding (VKDB) often occurs in newborn babies during the first few days and weeks of life up to 6 months of age. This health condition is referred to as hemorrhagic disease of the newborn. The bleeding can occur anywhere on the inside or outside of the infant's body. Thereby driving the segment's growth.

Route of Administration Insights

The oral segment held the largest share of the vitamin K market in 2024. The segment is observed to sustain dominance over the forecast period. Vitamin K can be taken in various forms, including powders, liquids, and pills. It also makes it easier for patients to consume. Due to the increase in chronic illnesses, the usage of oral administration will rise.

Vitamin K Market Companies

- BASF SE

- Lonza Group

- Glanbia Plc

- ADM

- Farbest Brands

- SternVitamin GmbH & Co. K.G.

- Adisseo

- Rabar Pty Ltd

- DSM

- Kappa Bioscience

- Livealth Biopharma

- NattoPharma

- Amphastar Pharmaceuticals Inc.

- NOW Foods

- Pfizer Inc

- Solgar Inc

- Nexeo Solutions

- Kyowa Hakko USA

- Stason Pharmaceuticals

- Asiamerica Ingredients

- Amway

- Bluestar Adisseo Co.

- Atlantic Essential Products Inc.

- Bactolac Pharmaceutical Inc.

Recent Developments

- In October 2023, Smidge Small Batch Supplements announced the launch of grass-fed, Australian Emu Oil for real food vitamin K2. The company unveiled a new small-batch supplement to their premium, clean line product line that offers essential nutrients lacking in even the best whole foods diet.

- In November 2023, Abbott announced the launch of the new PediaSure with Nutri-Pull System. The Nutri-Pull system is a unique combination of ingredients like vitamin K2, vitamin D, vitamin C, and casein phosphopeptides (CPPs), which help support catch-up growth amongst children through the absorption of key nutrients.

- In June 2022, Balchem Corporation announced the acquisition of vitamin K2 player Kappa Bioscience. Balchem Corporation has signed a definitive agreement to acquire Norwegian Vitamin K2 supplier Kappa Bioscience AS for approximately US$340 million.

Segments Covered in the Report

By Product Type

- Vitamin K1

- Vitamin K2

By Route of Administration

- Oral

- Topical

- Parenteral

By Application

- Osteoporosis

- Vitamin K Dependent Clotting Factor Deficiency (VKCFD)

- Prothrombin deficiency

- Vitamin K Deficiency Bleeding (VKDB)

- Dermal Application

By Geography

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting