What is the Walking Assist Devices Market Size?

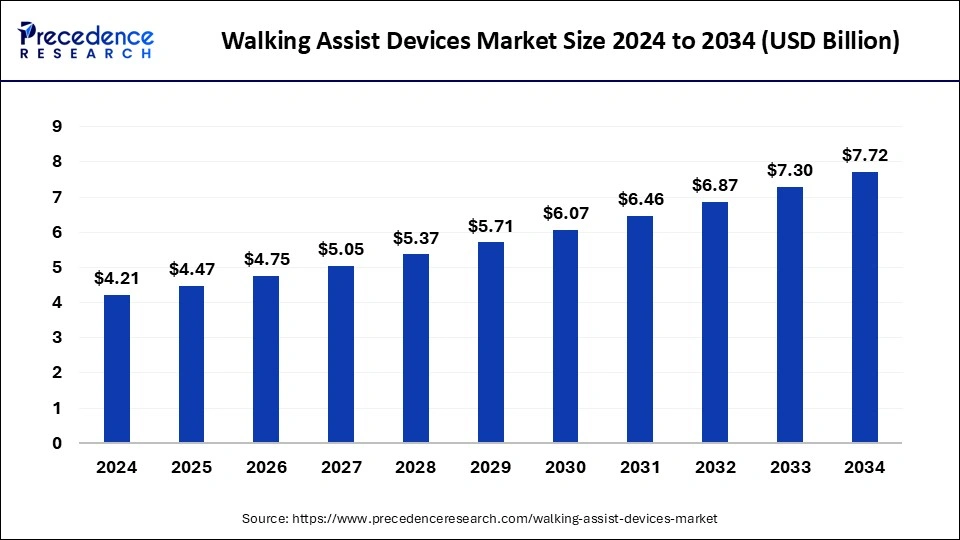

The global walking assist devices market size is calculated at USD 4.47 billion in 2025 and is predicted to increase from USD 4.75 billion in 2026 to approximately USD 8.15 billion by 2035, expanding at a CAGR of 6.12% from 2026 to 2035.

Walking Assist Devices Market Key Takeaways

- The global walking assist devices market was valued at USD 4.47 billion in 2025.

- It is projected to reach USD 8.15 billion by 2035.

- The market is expected to grow at a CAGR of 6.12% from 2025 to 2035.

- The North America walking assist devices market reached USD 4.47billion in 2025 and is expected to expand around USD 8.15 billion by 2035, at a CAGR of 6.12% from 2026 to 2035.

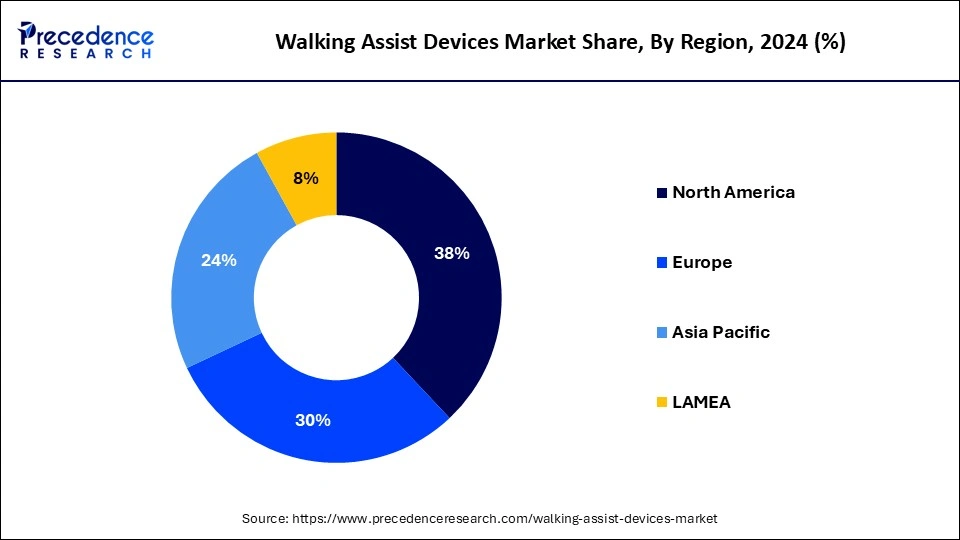

- North America dominated the walking assist devices market with the largest revenue share of 36% in 2025.

- Asia Pacific is expected to witness significant growth in the market during the forecast period.

- By product, the walkers segment held the largest market share in 2025.

- By age group, the geriatric population segment dominated the market in 2025.

- By end-user, the homecare segment led the global market in 2025.

What are Walking Assist Devices?

Walking devices are also known as ambulatory-assisted devices that are used by patients suffering from walking issues post-surgery to help support patients in ambulating independently. The assisted walking devices aim to enhance the walking pattern and improve balance and safety while moving independently. There are several types of assisted walking devices, such as walkers, canes, wheelchairs, and communication aids. The increasing geriatric population and the rising incidents like accidental cases, post-surgical operations, and falls are some of the causes that lead to the challenge in mobility and drive the demand for the walking assist devices market.

Walking Assist Devices Market Growth Factors

- The increasing demand for assisted walking devices due to the rise in the geriatric population and the increasing prevalence of diseases such as Parkinson's disease, arthritis, and other diseases that drive the demand for assisted walking devices.

- The increasing demand for innovative solutions for increased mobility solutions and ensuring independence in lifestyle for the aged population is driving the demand for the walking assist devices market.

- The increases accidental cases, sports injuries, and incidents like falls are severally damage the musculoskeletal system that leads to decrease the ability to ambulate independently that drives the growth of the walking assist devices market.

- The rising demand for assisted walking devices after severe spine and knee surgeries for rehabilitation, the patients are experiencing severe pain after the surgeries, difficulties in walking, and weakness in muscles that causes challenges in waking or ambulating independently is further driving the demand for the independent mobility solutions that are driving the growth of the walking assist devices market.

- The rising advancements in healthcare devices and the integration of smart technologies such as artificial intelligence, IoT, machine learning, and sensors are driving the innovations, and the new launch in assisted walking devices is further driving the growth of the walking assist devices market.

Walking Assist Devices Market Outlook

Between 2025 and 2030, this market is expected to rise significantly due to the growing demand for AI-integrated walkers, coupled with rapid investment by market players for opening new research and development centres in different parts of the world.

Numerous market players are actively entering this market, drawn by partnerships, R&D, and business expansions. Several walking assist devices brands, such as Benmor Medical, Briggs Healthcare, Carex Health Brands, and some others have started investing rapidly for developing high-quality walking assist devices for handicapped people.

Various startup brands are engaged in manufacturing walking assist devices in different regions. The prominent startup companies dealing in walking assist devices consist of Astrek Innovations, ABLE Human Motion, NeoMotion, and some others.

Market Scope

| Report Coverage | Details |

| Market Size by 2035 | USD 8.15 Billion |

| Market Size in 2025 | USD 4.47 Billion |

| Market Size in 2026 | USD 4.75 Billion |

| Market Growth Rate from 2026 to 2035 | CAGR of 6.12% |

| Largest Market | North America |

| Base Year | 2025 |

| Forecast Period | 2026 to 2035 |

| Segments Covered | Products, Age Group, End-user, and Regions |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

Market Dynamics

Driver

Increasing geriatric population

The rising global population and the rising aging population are mostly affected by some types of physical diseases, such as arthritis and other orthopedic conditions, due to the aging effects that lead to the difficulties in walking that drive the demand for assisted walking devices. Additionally, the increasing number of surgical operations in the targeted diseases drives the demand for assisted walking devices. The rise in traumatic injuries, such as the risk of falls, road accidents, spinal cord injuries, and brain injuries that may cause physical disabilities in patients, also boosts the growth of the walking assist devices market.

Restraint

High cost

The higher cost associated with assisted walking devices limits the growth of the market. The increased cost of devices is not afforded by the fixed and limited-income seniors or geriatric population with low monthly incomes. Thus, the higher cost of the devices is restraining the growth of the walking assist devices market.

- The cost of knee replacements in India starts from USD3,900 for a single knee and $7,500 for both knees and further depends upon the technique of surgery, implant, medical history and condition, hospital and the city, and the surgeons.

Opportunity

Integration of advanced technologies

The integration of smart technologies such as artificial intelligence and robotics into assisted walking devices is used as the mobility solution for patients with some kind of challenges in walking independently. The expansion of artificial intelligence and robotics are driving the opportunities in the advancements in assisted walking devices. AI helps in enhancing assisting technologies and helps people make their lives easier. Many of the major players in the walking assist devices market are researching the advancements in assisted walking devices like wheelchairs.

- The researchers from Deakin University and the Control Bionics Applied AI Institute (A2I2) designed the world-first autonomous driving wheelchair module known as DROVE. The devices use wheelchair-mounted cameras, sensors, and the NeuroNode interface to achieve centimeter accuracy.

Walking Assist Devices Market Segment Insights

Product insights

The walker's segment held the largest walking assist devices market share in 2025. The growth of the segment is attributed to the rising adaptation of the walkers by the patients with the post-surgical operations that are driving the demand for the walkers. The higher adoption of walkers is due to their advanced safety, which is used to stabilize patients with poor balance. The walker provides more balance and a base of support than other walking devices like walking sticks. It comes with three sides and a side closet. Walker has several benefits, such as promoting independent mobility, increasing metabolic and musculoskeletal demands, optimizing activity levels, and reducing the risk of falls. There are various types of walkers available on the market, depending on the user or patient's requirements. Rollators, knee walkers, and walker cane hybrids. The Rollators are one of the common types of walkers that come with handlebars, four-wheels, and comforting space for seating; they are also equipped with handbrakes for safety concerns.

Age Group Insights

The geriatric population segment dominated the walking assist devices market in 2025. The rising geriatric population around the world, which comes under the age group of 60 and above, is more likely to get affected by incidents like the risk of falls and misbalance, weakness in muscles, and pain in joints that may lead to difficulty in mobility independently that may drive the demand for the walking assist devices market. Additionally, the increasing prevalence of chronic diseases in the geriatric population, such as Parkinson's disease and arthritis, is one of the major reasons for the rising demand for assisted walking devices by the geriatric population.

End-user Insights

The homecare segment led the global walking assist devices market in 2025. The increasing demand for home healthcare facilities due to the higher comfort and home healthcare reduces the extra time for traveling. The rising adoption of advanced technologies in healthcare, such as the rise of telehealth, is driving the growth of the home healthcare segment in the healthcare industry. The increasing demand for assisted walking devices is due to the geriatric population's preference for home treatment for comfort, which is also driving the growth of the walking assist devices market.

Walking Assist Devices Market Regional Insights

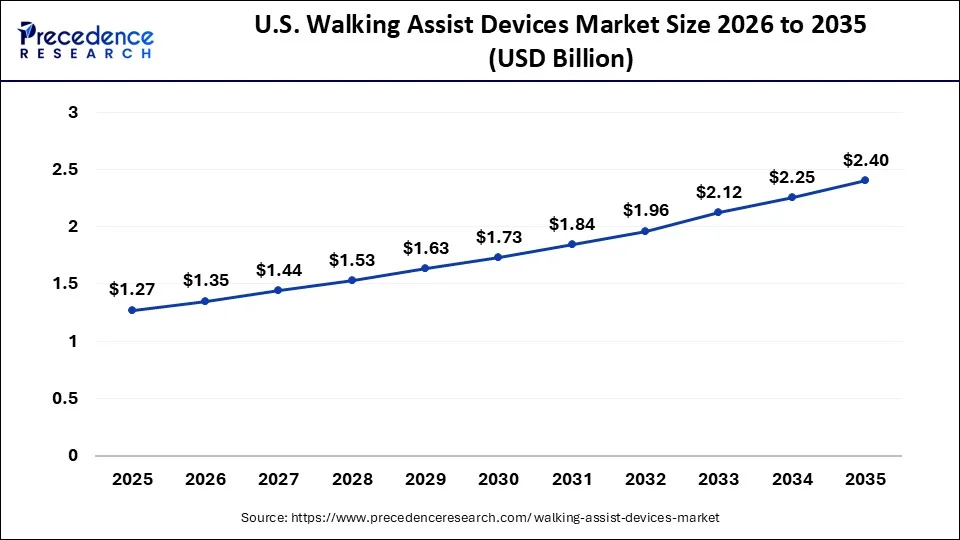

The U.S. walking assist devices market is exhibited at USD 1.27 billion in 2025 and is projected to be worth around USD 2.40 billion by 2035, growing at a CAGR of 6.57% from 2026 to 2035.

North America dominated the assist devices market in 2025. The growth of the walking assist devices market is attributed to the increasing availability of well-developed healthcare infrastructure and the availability of major market players that support the trend of assisted walking devices. The region has recorded significant growth in surgeries like knee and hip replacement, which is driving the demand for assisted walking devices by patients and hospitals.

The increasing demand for assisted walking devices by patients ' surgeries is due to difficulties due to surgical operations and extreme pain in walking. The assisted walking devices help patients with independent mobility. Additionally, the technological integration in healthcare devices and the ongoing investment in the further launch and innovations in new healthcare devices are contributing to the expansion of the walking assist devices market in the region.

- As per the reports by the American Academy of Orthopedic Surgeons, there are more than 300,000 hip replacement surgeries performed in the United States each year.

- The annual expenditure on orthopedic healthcare by the U.S. totals $350 billion to $400 billion or 10% of the total U.S. healthcare expenditure.

Asia Pacific is expected to witness significant growth in the walking assist devices market during the forecast period. The growth of the market is attributed to the rising population and the rising number of geriatric population suffering from some kind of physical pain and challenges in walking due to the aging effect or some kind of disease that drives the demand for assisted walking devices. The rising number of road accidents and surgical treatment is further contributing to the demand for assisted walking devices. The growing disposable income in the population and the surging expenditure on healthcare are also boosting the growth of the market in the region.

- In India, almost 20 lakh people need knee replacement surgery each year, but 2.5 to 3 lakh people undergo it due to several factors like fear of operation, cost, possible revision in the future, and durability of the implants.

Europe held a significant share of the market. The increasing demand for canes and crutches across different nations such as France, the UK, Germany, the Netherlands, and some others has boosted the industrial expansion. Moreover, the presence of numerous market players, coupled with rapid investment by the government for modernizing the hospitals, is expected to accelerate the growth of the walking assist devices market in this region.

Latin America held a considerable share of the industry. The surging number of orthopedic patients in various countries such as Argentina, Brazil, Peru, and some others has bolstered the market growth. Also, numerous government initiatives aimed at providing walking assist devices to physically disabled people are expected to drive the growth of the walking assist devices market in this region.

The Middle East and Africa held a notable share of the market. The growing sales of walkers in several nations, including Saudi Arabia, South Africa, the UAE, Qatar, and others, have boosted the market expansion. Additionally, rapid investment by market players for opening new production centers is expected to propel the growth of the walking assist devices market in this region.

Walking Assist Devices Market Value Chain Analysis

Walking assist devices, including canes, crutches, and walkers, are primarily made from lightweight and durable materials such as aluminum alloys, steel, carbon fiber, and various plastics and rubbers.

Key Companies: Carbonex India Pvt Ltd, Aeron Composite Pvt. Ltd., Hindustan Engineers, and others.

Testing and Quality Control (QC) of walking assist devices involves a multi-faceted approach to ensure safety, effectiveness, durability, comfort, and compliance with national and international standards.

Key Companies: SGS, Bureau Veritas, Intertek, and others.

The distribution channels for walking assist devices are primarily offline (through retail pharmacies, medical supply stores, and hospitals) and online (via e-commerce platforms).

Key Companies: Amazon, Ebay, Alibaba, and others.

Walking Assist Devices Market Companies

TOPRO Mobility is a UK-based manufacturer of mobility aids like rollators and walkers, founded in 1997.TOPRO is well-known for its high-quality, durable, and user-friendly rollators (walkers) such as the TOPRO Troja, Olympos, Odyssé, and the carbon fiber Pegasus models. These products focus on safety, comfort, and ease of use, with features like reliable braking systems and stable maneuvering.

Invacare Corporation is a global manufacturer and distributor of home medical products, including power and manual wheelchairs, beds, respiratory products, and seating and positioning systems. Invacare's product lines include power and manual wheelchairs, seating and positioning systems, home care beds, pressure-relieving mattresses, and respiratory products like oxygen concentrators. It also offers repair and rental services.

Drive Medical is a global manufacturer of durable medical equipment known for its wide range of products, from mobility aids like wheelchairs and walkers to respiratory care and bath safety products. The company emphasizes innovation, functionality, and value to improve quality of life and promote independence, with a mission to provide world-class products to a broad customer base across North America, Europe, Asia, and other regions.

Eurovema AB is a Swedish company that develops, manufactures, and markets technical aids for people with special needs, including work chairs, electric wheelchairs, rollators, and strollers. Its wheelchairs are designed for indoor use with features like enhanced seating comfort and freedom of movement.

Human Care HC AB, a Swedish company that develops and markets medical technology products for the elderly, such as lifting systems and mobility aids. This develops AI-enhanced support programs for healthcare providers and patients, using behavioral science to improve treatment adherence and health outcomes.

Medline Industries, LP, headquartered in Northfield, Illinois, is the largest privately held manufacturer and distributor of medical supplies and solutions in the United States. The company offers over 550,000 medical products and serves the entire continuum of care, including hospitals, surgical centers, long-term care facilities, and physician offices.

Benmor Medical is a UK-based manufacturer and supplier of bariatric medical equipment, such as beds, hoists, and wheelchairs, for the NHS and community settings. The company provides a comprehensive service that includes product design, rental services, installation, training, and support to improve patient care and safety.

Other Major Key Players

- Briggs Healthcare

- Carex Health Brands

Recent Developments

- In November 2025, ELFIGO launched a new range of mobility scooters and electric wheelchairs. These mobility aids are designed for the physically disabled people of Singapore.

(Source: fox59.com) - In July 2025, NAU launched a new range of wearable robots. These robots help people to walk on any surface.

(Source: disabilityinsider.com) - In June 2025, Sunrise Medical launched a new range of walking assist products. These products are designed for the consumers of the UK.

(Source: attoday.co.uk)

Segments Covered in the Report

By Products

- Canes

- Crutches

- Walkers

- Gait trainers

By Age Group

- Geriatric

- Adults

By End-user

- Hospitals

- Homecare

- Others

By Geography

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East & Africa

For inquiries regarding discounts, bulk purchases, or customization requests, please contact us at sales@precedenceresearch.com

Frequently Asked Questions

Ask For Sample

No cookie-cutter, only authentic analysis – take the 1st step to become a Precedence Research client

Get a Sample

Get a Sample

Table Of Content

Table Of Content

sales@precedenceresearch.com

sales@precedenceresearch.com

+1 804-441-9344

+1 804-441-9344

Schedule a Meeting

Schedule a Meeting